|

|

Post by sd on Nov 16, 2017 20:52:15 GMT -5

Haven't kept up with this thread very well-I stopped out for losses on RSX, VDE, and several other positions this week- RD sent me a nice spreadsheet I need to get

disciplined to enter into to keep track of trades- Even with the raised stops, I got lucky as the market turned higher today.

I was filled this am on SQ and AAOI, and placing orders for Friday in JD and EXAS- Got a nice pop in RHT today, hadn't checked the rest- somewhat satisfied if i don't get a notification e-mail telling me i've stopped out of XYZ .....I had also stopped out of URI- and it's now back higher as well as the 2 emerging mkt positions- I'll go back into EEMO tomorrow as it made a new high today. The momentum strategy is still where i want to be- but it may become unprofitable if volatility and the market gets choppy - Stops would get hit more frequently- or have to be even wider- double edged sword there- and I'm prone to allow a stock to run - but weakness prompts me to tighten- I don't mind reentering- and the strategy has worked this year for me--

Still largely viewing the SCTR for most trades- JD is not my preferred trade-R>O.T seeking a 3 month trend reversal- It's a smaller position .I'm also diversified with positions across

a number of market segments, primarily focusing on going long with those that are in uptrends- DBLing position in Robo, BOTZ. orders txn,lrcx,amat

|

|

|

|

Post by sd on Nov 21, 2017 14:07:37 GMT -5

11.21.17 Across the board Market rally! Home for Tues and Wed- and it's nice to drink coffee, Watch CNBC, put in some orders and everything filled and mostly all green in even the Vanguard ETF's/Investment funds. I also jumped back in at the open where i had some free cash from positions recently stopping out.

I read Blygh's thread this am , and it prompted me to put some free cash into orders- All of my free cash is now invested. Market futures also looked very good premarket- I copied some of Blygh's positions- IHI, and a smaller position in NAIL-Also added in Vanguard SKYY, VGT, and added into the QQQ's. And lest i forget- My 11 shares of RIOT filled at $10.38 - Riot was up over 15% today from the open at one point.... FUN>

I have been shifting into a larger % of individual Stocks and sector/industry group ETFS-for momentum, and also hold an Investment Theme with some broad world market exposures-

While I am holding a wide mix of positions, that can be dilutive to be that widely diversified- but that also allows me to be willing to take some potential RISK for what hopefully translates into a better overall return- Using trailing stops is the justification for that exposure being warranted - nothing is considered to be a forever investment and will be sold- either on a stop being hit or an excessive momentum run up. Issue is to allow some wiggle room- but not too much- Recent market volatility tapped me out of half a dozen positions-

Each of those is now higher today, and i had neglected to try to reenter . Stops are both to lock in some gains- as well as protect the downside from loss- I will likely continue to be aggressive in tightening on signs of a trend change.

Part of the advantage of being diversified is that it lessens Risk- Up to the point that it's not a market sell-off due to some event. Fed policy-Conflict, threat of War etc. In this extended-but continuing Bull market- you have to stay the course, just gradually adjust stops and see where it takes us. At the point that the market puts in a correction- I have no idea of whether that correction is just a minor blip -3% or something more feared- 10-15% .

Days like today have to make one optimistic- Seasonal rally seems to be here to give Thanks for- Until it gets cold feet!

I no longer have the separation I had once had with the investment account and trading accts. And i've also put stops in place for the investment Segment- Core Vanguard ETF's...

Stock positions vary greatly in position size and market exposure-- both in my account and my wife's - since I have oversight of BOTH OF them..ALL listed. Not as well thought out as they could be- Some were selected from the SCTR list at Stockcharts- so while it's a lot of names/exposure- Most are not large positions- but some are "overweight". If i could only determine -in advance- to select the right stock/etf, I would just overweight the winners!

Stock exposure- DLTR,FMC;PYPL,RHT,AAOI;SQ;JD;EXAS;AMP;RIOT,AMAT,LRCX,TXN;MA,MSFT,AMZN,FB,GOOG,CRM; Some of these are quite small positions- just to get exposure- 1 share Goog, AMZN,

and just 11 RIOT ($150.00) etc- Smaller positions are generally done in IB due to the low $1 commission charged

INDEX/ETF EXPOSURE NAIL,ROBO,BOTZ,IBB,IHI,SKYY,QQQ,WOOD,CBOE, NOTE THE OVERCONCENTRATION IN TECH GROUPS

; SPLV,VGMLX;VNQI,VUG;VIS;VGT,VIGI,VYMI,VCLT,VAW,VTEB,BND,VHT,VUG These represented a 1st run to develop a CORE seeking also diversification using Vanguard ETFs, mutual funds.

This year is an on going process of discovery for myself, as i have expanded my reach into controlling some of the IRA accounts-

The ultimate benchmark of managing this aspect of the account will be determined by my net performance over a longer term period.

|

|

|

|

Post by sd on Nov 21, 2017 15:22:10 GMT -5

RD sent me a preliminary trading spreadsheet, and I've started to add some particular elements that i think are worth including- depending on the interests of the trader.

Position sizing is a major factor in every trade decision, as well as where the stop-loss is actually placed. That = the RISK % to the trade itself and the portfolio- One could include a factor of a "TYPICAL Position Size" allowed as -perhaps - 1/10th of the portfolio value- or 1/20th , 1/5th etc.

Thought I'd include that criteria in the spreadsheet , and also some columns that could define different types of trades based on various TA . also sector and Industry group - One could put in such information that -over a longer period of time could prove valuable in determining one's overall success. I've taken a lot of trades over this year-since Feb , and don't recall the particulars of most. Taking notice of both winners and losers that had a major impact on the portfolio is worth noting.

This is just a tenative lay-out - I haven't proofed or copied the formulas down the rows, and it's certainly not finished- Still in the "Good Intentions" stage. I'll get a more refined and workable version -

Ideally it can be linked to automatically update closing prices automatically .

The initial starting lay-out :

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Nov 21, 2017 18:06:07 GMT -5

I've been watching 3 of your stocks for awhile. I especially like PYPL. The six month chart shows it rising very consistently, like its riding the 25 day EMA. Just a slight acceleration recently. But SQ's rise has accelerated dramatically in the past couple of months. It's opened a wide gap above it's moving averages. I don't know the mathematical definition of parabolic, but I think SQ is going there. It looks vulnerable to me. But by passing it up in the horse race I've missed out on some nice pretend games. I never invest based on the horse race. Maybe sometime in the future.

And a couple of months ago I rode AAOI in the horse race. But I've given up on it. It's had a couple of big gap down days and kept going down after the gaps. The moving averages are all falling. Seems like a downward primary trend on the one and two year charts. Seems like it had a sharp, steep ascent in July then rolled over to the downside big time. I don't know much about trading but I think this might be like trying to catch a falling knife.

(I know I can Google parabolic. And I did.) Good luck with these 3 -ira

|

|

|

|

Post by sd on Nov 22, 2017 9:59:10 GMT -5

I've been watching 3 of your stocks for awhile. I especially like PYPL. The six month chart shows it rising very consistently, like its riding the 25 day EMA. Just a slight acceleration recently. But SQ's rise has accelerated dramatically in the past couple of months. It's opened a wide gap above it's moving averages. I don't know the mathematical definition of parabolic, but I think SQ is going there. It looks vulnerable to me. But by passing it up in the horse race I've missed out on some nice pretend games. I never invest based on the horse race. Maybe sometime in the future.

And a couple of months ago I rode AAOI in the horse race. But I've given up on it. It's had a couple of big gap down days and kept going down after the gaps. The moving averages are all falling. Seems like a downward primary trend on the one and two year charts. Seems like it had a sharp, steep ascent in July then rolled over to the downside big time. I don't know much about trading but I think this might be like trying to catch a falling knife.

(I know I can Google parabolic. And I did.) Good luck with these 3 -ira

I agree with Your assessments IRA-

SQ just discussed adding digital currency into it's transaction capabilities -and that may explain the recent rush into it's shares- (Digital currency is the present day Tulip Mania!) it's possibly disrupting the payment sector- I also agree that it appears to be going parabolic-Hope it does! I just entered last week- and was fortunate to be on board as it jumped higher-

My approach here will be to adjust a stop-loss higher- daily- and i will also set a limit sell for 1/2 the shares above each day's close 20% or so- Just in case of a blow-off spike top. By adjusting the stop daily- possibly using the 4 ema below the closing bar- or -on strong pull-aways from the ema- the low of the bar - The price action of the bar is often a tell- tall push, shooting star-lower close- or a bar that opens high and closes low- etc.may prompt a quicker response- I try not to react intraday-

In the past, I often applied 'conventional ' investment wisdom -in my trading approach- That is to wait for a pullback and reenter-

Well, I altered that thinking this past year- and it's proved beneficial overall- Go long WITH the momentum-.

Realized this year that many stocks in momentum moves don't bother giving a pullback to massage one's ego-on getting it cheaper-and they keep on truckin'higher- So - "You've missed it" -

That type of linear thinking assumes that stocks or ETF's may have already peaked when they're up 10-20-30% and they can't have much upside left.

That investor mindset also makes the investor/trader more inclined to take the smaller gain- potentially limiting the profit potential, and not capturing the potential for a parabolic move-or another run higher-

The Caveat to this also requires being willing to set a stop-loss and - if stopped out- for gain or loss- does not mean you cannot reenter-once it looks to be appropriate- I like the saucer/cup shaped pullback lower, and the initial move higher for a reentry- Defined P.O.F for the new stop-loss.

PYPL is just a steady gainer- periodic basing- I failed to stay in the trade when I owned it earlier-and neglected to track it -Just reentered recently- As you noticed, it has been a great performer - started the year at $40 -today in the upper 70's- will be a dbl by 1-18

AAOI I think that AAOI was one of those 1st momentum names I started actually trading in the spring- It was a -Your?- Horse race pick and i traded it several times- and trailed stops and -made some timely exits- I haven't looked back at AAOI since it rolled over with the ema's declining-

This most recent entry back into AAOI- is a R.O.T. trade- and perhaps the acronym is appropriate- Reversal of Trend- to me are lower probability trades- ODDS favor the direction of the declining 50 ema will continue lower- WHY bother to take any of these types of trades that are counter to the predominant trend?

Academic interest in TA put into action-Pullbacks such as these can go Way oversold - and then the market may seek 'value' and buyers step-in- A lower price does not necessarily equate to it being a 'Value' worth buying at this level- (Look at GE as an example) Potentially, this present attempt to reverse the price direction could gain traction, and a stronger counter move could continue higher- That's what most traders look for when they get in on this type of move- I have no idea -if there is any fundamental reason for this to reverse course here-

I approached this with Clear eyes and low expectations- So, I gave it a minimal $ investment- about a .25 basic position size - $400 or so, and gave it a $42.00 stop-loss from my entry- Risking about 10%-

I similarly modify my position size in my trades in the more volatile or Risky positions-and heavier in "safer" trades I own MSFT with a 2.5x position size , and EXAS

30 shares is a 1x position size- with a 6% stop-loss priced just under the saucer low-I'd prefer an entry Risk less than 5%.

I exceeded that RISK% with AAOI, but greatly reduced the position size (just 10 shares) so the impact of being stopped out will not be as significant in Portfolio impact.

SQ position is just 25 shares-($41.04 incl comm) so it's a 2/3 position- but it already has reached over a 10% return in a few days

We get some good potential horses in the Race- Your comment about not taking an actual trade based on the Horse race- but might- Well, only select that which you are comfortable with- You can scroll back through the horse race charts to see that one week's winner may not have continued to win- but that is what stops are for-

I also find that it's instructive to view the stockcharts (or any other website list) momentum SCTR list holds many of the same names week after week after week-

I know i'm long winded in these explanations- Hope to give some fodder for your own style of trading. It's an on-going learning process for me.

Thanks for Posting~!

I see that SQ gapped open but has since declined- I'll be tightening the stop- might split the position

PM Edit- AAOI declined to my $42 stop and sold $41.90

|

|

|

|

Post by sd on Nov 22, 2017 21:01:49 GMT -5

AAOI Stopped out for a 10% Loss. Abnormally wide loss- and I intentionally did not raise my stop when the red bars showed up this week-

It was a small position- explained in the prior post-

Chart is to illustrate the WHY this could have been a viable Reversal of Trend- All of the elements were there. I could not go with the base swing low for my stop-

Since my entry was a week after the 1st reversal green bar- Price was already well beyond that low .

It also reinforces to me that my best results come from staying WITH Trend trades.

One other comment about reversal trades- The earlier one gets in, the closer to the Point of Failure one is- which means the stop-loss can be narrowed considerably-

This is also similar to what one sees on a minor pullback in an uptrend- In that instance, a price decline may be shallow or deeper- saucer or cup formation, and the common factor is price is declining and the fast ema is pointing lower- with price beneath it. The 1st thing Price has to do is to slow the fast ema's decline by making a potential halt in the decline, and then to try to move back higher- If price continues up,or sideways , the fast ema will be crossing the declining slower ema- and a "Swing Low" has then been put in with the declining Low . That swing low may be the initial stop for a long trade if taken early enough in the entry.

Since the definition of an uptrend is a higher high and a higher low- Each pullback that drops back through the fast ema can be considered a higher swing low- and if price moves higher- I would consider a stop-loss should not be violated if set below that swing low.

|

|

|

|

Post by sd on Nov 24, 2017 13:12:00 GMT -5

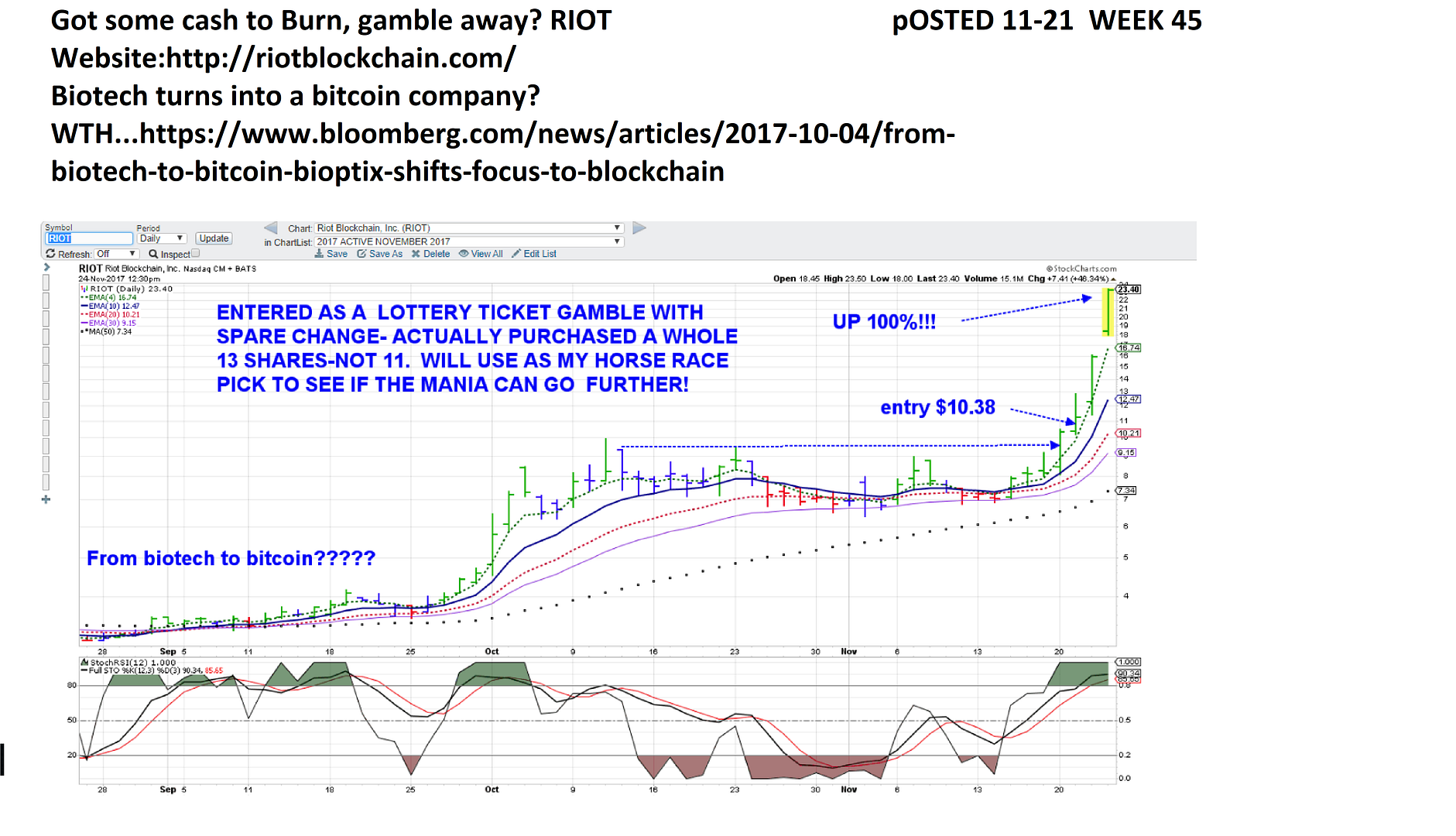

Copying the RIOT - cryptocurrency trade -copied from the Horse Race thread

It could have just as easily gone in the other direction!

Cyber Currency mania is so reminiscent of the Tech Bubble!

I had posted this as a total gamble/bubble- in week 45 thread-

My little spec gamble is a dbl , very strong today even right into the close- Possibly bodes well to go higher on Monday?

Fast as it goes up, it can come back quicker! Just for the Heck of it, I'm simply moving the stop to cover my entry cost- $10.38-

|

|

|

|

Post by sd on Nov 24, 2017 20:43:19 GMT -5

I had sold a couple of Bond positions in the Vanguard investment segment- Kept just 1 - corporate Bond fund- that's up a modest 8% on the year-

I purchased VOOG - a Vanguard growth fund- - at no trade commission cost.Has outperformed SPY at a very modest .15% Exp Ratio

I also realized i am now underweight the foreign markets- so i purchased GMF- one of the SPDR State Street Funds-

Moderating a swing Investment approach and a more Active approach holds some challenges-for me -

Had some cash clear in the trading account, so I spent some time today 'shopping' and decided I would take 4 ea .25 positions approx- intentionally took about 2k and divided it into:

XOMA, IBKR, XIV, TQQQ (LEVERAGED tECH) . Why divide it so? Odds are better- assume a 50-50 chance- with the distinction that these are already trending- should improve the potential that one can overachieve to the upside if i allow it room to do so.

What's interesting is the potential for greater loss/gain -even in small positions using leveraged ETF's -And Biotechs-

There are substantial merits to stay with a winning trade, and to not just take a small gain- Even Knowing that to be true, I stopped out as i raised my stop in DLTR following it's earnings bounce-.

DLTR- Hit my raised stop as it pulled back from the gain of it's good earnings pop- It had an exceptional Price- pull away from the Fast ema- see that wide bulge between the 4 & 10 ema- While price had gapped higher and closed high on earnings, it failed to go immediately higher- with a slightly lower close the following day. I tightened my stop Wed and it stopped out on today's pullback @ $98.30- Trend has been steadily Up 30% from the JULY lows- so it's got a lot of momentum and it gives some diversity away from the Tech sector- I would expect to see only a minor pullback from here-but one that would allow a reentry on a pullback.

SO, Why sell ? - The momentum pull-away was considerably wider than the "norm" for this stock- and I could anticipate price simply sliding back to my entry as holders took the quicker gain- and then they would reenter as price declines 2-3% lower- Essentially getting the 2-3% unexpected jump to the upside and the better value buying the 2-3-4 % pullback and getting back onto the trend- But If I fail to reenter the trade at a lower price, it is simply a short term trade that will fail to gain excess Alpha by a higher sell and a lower repurchase.

|

|

|

|

Post by sd on Nov 25, 2017 9:44:24 GMT -5

CRM was a position I took a few weeks ago, and it has trended well. This week it has paused, got a couple of bars closing below the fast ema, and the temptation is to simply raise the stop as I did with DLTR- Attaching a chart- ideally this will rebound to be a longer term hold- so I'm not tightening the stop to directly under the pullback lows - Also, it's only 20 shares, so the $7 in and out commission charged by Vanguard for non-Vanguard sponsored trades really would eat into the small net profit-

If it was in the IB account - I would be tempted to tighten the stop to the low made on Wednesday- because the commission in IB would be $2 total cost vs $14.

Also, if the share price was lower-and i had 50 shares - potentially I would split the position with one stop tight - take a small gain-

The last thing I want to do is to take a substantial loss on a trade that was headed in the right direction- like the 6% decline seen in the chart earlier this year.

|

|

|

|

Post by sd on Nov 26, 2017 20:35:46 GMT -5

Adjusting stops- Since i activated Vanguard late summer, I'm trying to blend possible longer term Investments vs short term gains- Both BOTZ, ROBO positions have been added to since I took some positions in Vanguard-in Sept. and they're pulling away-and would be candidates to just tighten directly under at the fast ema to lock in- But -and, I may regret this- I'm setting the stop-loss at the 50 ema and will see how much momentum they can muster- Verdict is that I'm overweight these individually, and though the daily share price moves are incremental, the cumulative is a nice gain- I traded both of these earlier in IB, but there was not enough downside volatility to make it worth while- and missing the turn around move higher-and chasing..... These move in unison, both essentially same market, overlapping segments- Robo I think is the more Global exposure. I've also set the 50 ema as the trailing stop in some of the other ETF/stock positions in Van. - Trying to practice both shooting for longer term gains as well as short term swings in the different accts. All of this is fine as long as volatility is relatively benign-, and the market keeps supporting higher prices-

I don't want to get caught being overly complacent about what may disrupt this Bull - and December - well - Don't look for end of year buying to prop up the market-in the final 2 weeks of December- JMHO

|

|

|

|

Post by sd on Nov 28, 2017 21:01:12 GMT -5

Don't think I made mention- took small positions last week XIV,TQQQ,IBKR,XOMA-

Stopped out on Exas today 11.28.17- small loss -$13.00 I think-

i stopped out on SQ @ $45.71 Monday for a decent gain- It was a raised stop on the momentum move- that really has been the bread and butter this year of taking profits with a trailing stop raised on excess momentum-

Market apparently rallied today- but large Tech not so much- Goog, FB, AAPL all lower on the day- wife owns a little of each and I raised stops -

BOTZ and ROBO also lackluster- May consider the aggressive stop as the position size warrants . Both are extended pull-aways from the 10 ema.

Financials gained today- Sector rotation/

CBOE up 2% today!

Nail up +5% - Thank You Blygh!

MA +.80 % , MSFT + 1.2%

SKYY +.83% ; SPLV +.87%

VOO +2.24%

These are some positions- mixed bag- note that the VOO was up over 2% - msft coming to a new high out off the base-

if seeking to outperform the market , SPY was up just 1.01%- today-

With the recent stop-outs- I have accumulated some Free cash- Not making any decisions tonight for any adds

|

|

|

|

Post by sd on Nov 29, 2017 19:57:01 GMT -5

Substantial selling as stops were hit- Some will lock in gains, some will be losses-

Stopped out in IB- TQQQ, pypl,fmc,rht,xoma

Stopped MA,LRCX,amat,Goog, Amzn, FB, Partial sell on Robo,BOTZ- tightened the remaining shares to a stop under today's bar low.

Hmm- NAIL up over 3% - SPLV barely higher,materials higher,industrials higher VIS, Vaw, IBB held even and healthcare up slightly.

Not having a sense of what caused today's selling, found it to be rather large 1 day moves and not minor declines- without having a source to precipitate the selling-

it makes me think this may not be a 1 day event- Stops tightened further.

The intl funds leaving as they are for the moment

I forgot I had a pending buy-stop on ITA- filled on today's higher move

And, Go Figure- AMP gapped up higher.....

Saving grace is being somewhat diversified and having some tighter stops to lock in some gains -

|

|

|

|

Post by sd on Dec 1, 2017 17:02:11 GMT -5

I added substantially to the prior CBOE position Today, -and i had bought CAT yesterday- Bought a full position in Energy in Vanguard- No commission cost -VDE.

CBOE has been a steady uptrender, and some news out today indicates it has been approved along with the CME to trade Bitcoin futures. My paltry RIOT position is higher today- came within .01 of hitting my $12.00 stop on Thursday.Full disclosure -only 13 shares bought with spare free cash!LOL! Might be enough to retire on!!!One day! BITCOIN Trust -I think GBTC was the most active Trade on the Fidelity platform.

Extremely volatile market day- with a recovery following the "News" that Flynn pleads Guilty- and may implicate Trump or his son-in -law in the Russia probe.

No regrets in tight stops as Big Tech is still declining this week- Still; holding a large MSFT position, IBKR gaining nicely making a 52 week high today-

Still looking to find areas of sector rotation to put cash to work in, but if the market breadth narrows to a few defensive sectors- doesn't bode well....

I sold NAIL late this pm - It had made a nice recovery off the lows of the day- but it felt prudent to lock in the gains ahead of the weekend and the possible market turmoil based on what political turmoil may unfold. If the Tax initiative fails to go forward, it will likely affect the housing sector.

The tech positions that stopped out- are all lower from my tight stops taking me out- SQ is about 8% below where i stopped out and locked in the gain.Same with BABA from the prior week- Now 5% lower -although it had gone higher initially.

I had larger overweight positions in Botz and Robo- and both closed lower on the day but recovered from the absolute lows.I had split the stops on both of those-sold 1-100 share lot tight and the 70 share a bit lower- The stops were taken out on consecutive days-

The thinking with a tight stop-loss approach is that the decline may be substantial enough to allow me to reenter lower and capture some additional shares for less $$$. That assumes the trend will resume , and the pullback/reentry will get in early on the upswing.

|

|

|

|

Post by sd on Dec 2, 2017 8:21:41 GMT -5

This Sat am- The Tax Bill got through yesterday- and it should provide a short term boost -Or will it become a "sell the News" as already being priced in-? And the criticisms will be coming forward-

Read through Arthur Hill's market notes from this week- From stockcharts.com- essentially still bullish

Notes from Art's Charts ChartList

The Home Construction iShares (ITB) is up around 30% since mid August.

SKYY (cloud computing), HACK (cyber security), IGN (networking), FDN (internet) and IGV (software) hit new highs this past week.

The Broker-Dealer iShares (IAI) broke out of its consolidation on 20-Nov and hit new highs this week.

The Insurance SPDR (KIE) broke out of a flag pattern and hit a new high this week.

The Regional Bank SPDR (KRE) surged to a new high this week.

The iShares Aerospace & Defense ETF (ITA) became oversold in mid November and then moved to a new high this week.

The Airline ETF (JETS) extended on its breakout with a surge above the early October high.

The Transport iShares (IYT) extended on its oversold bounce with a new high this week. This also triggered a Dow Theory bullish confirmation.

The Biotech iShares (IBB) is attempting a bounce off support after becoming oversold.

The Biotech SPDR (XBI) formed a higher low with a four-day reversal and turned up on Thursday.

The HealthCare Providers ETF (IHF) broke flag resistance and surged to a new high.

The Copper Miners ETF (COPX) fell the last six weeks, but this is still considered a pullback within a bigger uptrend. JJC failed to hold its wedge breakout.

The Gold Miners ETF (GDX) broke rising wedge support with a sharp decline the last three days. SLV broke down this week.

With the net bullish % relatively high, and despite some rotation/profit taking - Tech weakness worth noting! It likely will keep me bullish overall, but I can't help but be defensive in the approach- I may use Buy-stops next week to ensure that the move starts to go in my direction. Nail is that particular condition that I want to be cautious with- being leveraged.

Taking NAIL as an example- It closely mimics the Homebuilders in price movement, but with leverage . While the NAIL chart looks smooth on a trending basis, the XHB looks potentially toppish with the 3 wide ranging vertical bars last week pushing it to a new high- Rubber band looks stretched away from the normal uptrend slope

that preceded. The Friday price action of SPY -DIA- long sell-off bar with a late day recovery still closed lower than it opened-

Note that the Q's sold off Wednesday- and the Thurs, recovery bar was followed by a Friday weaker bar- The Q's trend -prior to the selling- was bullish, but not overly excessive and did not look sharply extended prior to the selling- Note that November's bullish price had a muted pull back, compared to this much larger Dec pullback.

If ALGO's are really behind much of the market's trading, what prompted the sell-of in Tech and Not SPY simultaneously? Look at the semis-SMH- 3 days of selling takes out the December gains- NVDA down 6% or so- When the leadership folds and fails to Hold up- you have to think the sector/industry group is at Risk for further selling and profit taking. The SMH sector YTD is still up almost 28-30%-

Market rotation- looking for Value? It' could be a simple product of funds rebalancing their portfolios- Taking some profits and investing in less extended areas.

|

|

|

|

Post by sd on Dec 3, 2017 20:10:14 GMT -5

I'm taking a "wait and See" approach-

Sounds like the Flynn saga just gets stickier-

Will the specter of Obstruction of Justice be put onto Trumps plate?

Does the Market care?

I've got an increased cash position that I'm not rushing to throw back in -will see how the Tech sector fares-want to get back into Botz, Robo -but looking for a discount.

See how the XHB/Nail recovers.... Meantime, I think good momentum still in the financial- Investment sector..Long IBKR, CBOE and am overweight in that sector.

|

|