|

|

Post by sd on Sept 2, 2017 13:17:34 GMT -5

This labor day weekend- Flooding is still occurring for some areas of Houston as water is being released from containment areas, Huge relief effforts underway- made a contribution through the local Walmart- as they are matching every donation. There will be a long recovery road ahead- and-tragically- the vast majority of those affected will not have flood insurance because they were not in a listed flood plain. And what about the automobile insurance policies? How many vehicles are automatically protected from damage by flooding in an average policy? Or, would you need a flood rider on your policy? Auto stocks jumped higher this week as the expectation was that millions of vehicles would need to be replaced- But, consider if you are a homeowner without flood insurance- you're really facing a huge financial hardship-

Went on line to Glennbeck.com and actually ordered several of the PatriotSupply meal packages- about $1/meal on Beck's site.- More if you go difrectly to the Patriot site.

www.glennbeck.com/# scroll down to find the food offers- with $100.00 offf- note that the 2 week -140 meals also has free shipping-

up to a 25 year shelf life- Last Hurricane we had locally here left most of my neighbors without power for 10+ days- Having a sealed food supply that doesn't require refrigeration-

is just insurance- and a supply of drinking/cooking water- -

When I grew up in Upper NY State- we had an ice storm/blizzard that took out power in the region for several weeks- Hurricane Alicia when we lived in Texas,; Floyd, Fran, Matthew, Bill and smaller over the past 20+ years in NC. Grocery stores empty out quickly when a storm is identified as tracking here- IRMA is a potential class 4 - that is possibly heading for the US-

And- consider a generator- If power is out, gas stations aren't pumping gas- and a whole house generator is at least several thousand dollars and needs a fuel-nat gas or propane supply. Taking steps to be somewhat prepared in advance of a NEED is good insurance-

|

|

|

|

Post by blygh on Sept 4, 2017 10:17:09 GMT -5

Good advice - wish I had know of the multiplier offers a few days ago - It is worth pointing out that the more people who buy insurance, the less expensive are insurance costs. I find it hard to believe that the mortgage companies would have written so many mortgages on homes without insurance.

I am picking up a few auto part companies on response to the 500,000 vehicles destroyed - I like TEN - P/E 10, PEG 1 +/-. I am holding DLPH - and considering DORM TWIN and JCI.

Blygh

Thanks for sharing - Looking at the longer term weekly charts, I particularly like DLPH for virtue of it's upwards trend through out 2017- However, it is based in the United Kingdom

so it's success going forward likely has little connection with the flooding in Houston. It certainly is in a strong uptrend- throughout 2017 , and i would always favor stocks already in an uptrend as the better choice than a reversal of trend.- particularly if they are within the same industry group -

JCI controls over a wide market- and the automative portion may be a smaller segment to it's overall business- But if repairs and replacement sales will be big, JCI should benefit...

Dorm was trending until June and a $62 based on the weekly charts should provide support-

Ten, Like AZO- What caused these to sell-off so much this 2017 year?

You likely have already done plenty of homework to make your selections- Consider that while the impact to Autos and Homes in the houston, LA area will be huge- for that region- it may not be enough to do more than provide a short term pop for the auto mfg's - My thinking is that this pop in prices in the autos and related industries may be short term - What is the company story beyond the disaster area? Why were they already in decline? What about the increased demand for used car sales- ? Lots of folks won't be covered for their losses-

Perhaps companies like CAR, AN will be the ultimate winners? They were already coming off lower bases...

While discussing trends in the auto area- check out RACE.....! doesn't appear that the flooding will have an effect on it!

All are Rhetorical questions- Because i am already holding All IN -in the trading accts, with no free cash ---Something of a surprise as we enter September to find i am all IN, and back

at the prior highs...

Your potential trades illustrate the capacity and flexibility to adapt to changing market conditions and to try to take advantage of those shifts-Call it Industry group rotation because of a catalyst...or simple gross overall sector rotation- The ability to move in response -or advance- of such a catalyst ... shows great flexibility in the selection process.

,

|

|

|

|

Post by sd on Sept 4, 2017 20:13:36 GMT -5

Following up on the previous post- Blygh contributed some tenative picks that could be considered as benefitting from the Houston Disaster-

That is tactical - trading with a catalyst - and I appreciate that he is willing to share his prospective field choices . Few people are willing to commit and post their tenative actions-

Notice that one of the positions he already has in that field is uptrending, and has been doing so for 2017.

In the same sector/ narrower- the same industry group- some of the other performers have been underperforming his selection-

A friend of mine likes to quote from the wisdoms of Warren Buffet- likely Americas most famous long term investor-

One quote he attributes to Warren is that "diversification is For Fools"..

I replied to my friend that Warren has -at his resources- not only huge financial resources, but also extremely educated professionals to assist in his decision making process of what stocks are ripe for investing in...

The long and short is that Warren has all the knowledge and financial where -with-all while the average investor/trader can take his words to heart- Their throwing their hard earned investments into 4 or 5 picks is not necessarily the path to success because you chose a specific stock to represent the value of your position-

A Gallant move perhaps - but it puts an inordinate amount of portfolio Risk into just a few stock positions. It would likely be more prudent from a casino view to Buy BRKB than to choose to Buy just one of Warren's positions. And Why is that? It is because Warren's holdings are a mini ETF and somewhat diversified in their totality.

Warren does not Buy just 10 companies- BRKB likely holds hundreds of positions in diffferent weightings across a conglomerate of different types of companies. No single company failure can have a huge impact on BRKB over the long term because oif it's structure and diversification.

My point to my friend was that he had made a few selections that he stayed with- and while the industry group has a profit on the year- his single selection lagged the group's overall performance- and Would he not have been better off simply going with the Group and getting the average gain ? Black or Red at the casino?

I came to the realization this weekend that the complexity of the marketplace can be as broad or as focused as one wants to manage- and has the time to put forth the effort-

The broader the index, the larger the input to get the averaged down results- But that also comes with a signifcant reduction in the Risk side of the equation of picking the single stock in that index that will become a market leader- or loser. Seldom is it just one that leads -or fails...

I am becoming of the opinion that -In Spite of Warren's admonishment- That Diversification- with periodic rebalancing- is the course of action i want to set my future sails upon-With a little sizzle from the trading side-

That also requires more involvement and work - and a defined plan as to when a trade has violated the reasons to be in it- As i seek to shift to more long term position trades-

it's a choice to shift from a -2% stop loss on a daily chart , to a wider stop-loss viewing the weekly trend- I'm not certain that I can make that wholesale shift - but allowing the past week's decline to be followed by a recovery higher and no stops beyond UUP - Presently feels like this is a course worth exploring further...

9.5 pm edit

A lot of red across the boards today- Korea is again front and forward and a subject of world wide concern- With the major indexes all giving up from Friday's gains-

Since i'm holding a large intl weight in the trading account- I only had Vale as a substantial gain today- others within the sector were lower, With one position down by 6% from Fridays .

In terms of portfolio weighting- i am overweight the mining / minerals. But this has my net portfolio very overweight in one narrow market industry group- it essentially becomes a very large bet on the industry group strength and stability in the global economy continuing to gain . Since this is a relatively recent shift - just a few weeks old- This volatility comes at a time when i don't have much cushion in the trades- and so i'll get to test my willingness to hold a position - under some duress- The question I ask myselff- iF it is just the entire global markets selling, then will these positions also resume on the recovery side- I don't know the answer- but i'm not bailing out yet- But like my prior post- Within the same broad sector group- I hold Vale that went up again today, while Teck went 6% lower-

This is very similar to buying the Dow 30 DIA and selecting BA and GE as 2 positions- They are both within a narrow index, but there appears to be quite a performance difference evolving (perhaps) I also own the broad index as well, which should suffice as the benchmark for the individual positions.

I have no idea what September may bring to the markets- Seasonally, it is a weak time for stocks- but that is not a 100% reliable prediction for this year. August turned out to be a gain for tech compared to the prior 4 years- but it came with a lot of volatility- did it not? How many got shook out only to see their position move higher after they stopped or exited the trade during the volatility?

I'm expecting that today's market reaction may not be the death knell for stocks- just a minor volatility contraction- perhaps one of many more to come - What is the mindset as we

view these relatively small and - we forget- normal market periods- of pullbacks within a larger uptrend-

most of us here are likely suffering from the stock market version of a 2000 decade of 2 large declines that are embedded in our thinking- as that is what we need to listen for- the Boogeyman around the corner about to appear- He's past due we fear, after all..

|

|

|

|

Post by sd on Sept 7, 2017 18:30:38 GMT -5

9.7 update-

Exposure to the intl mining sector, ETF PICK, and individual continues to perform well VEDL - up 3.5% today, TECK, LIT, VALE, copx all working higher- in an uptrend-

IBB doing well, HBB, PIN, trying to regain the trend- EEM affected by all the political concerns I am sure!

I had a starting position in TMUS I took a few weeks back- It was an odd discretionary entry based on looking at Telecom as a defensive go-to- and the hubris of the CEO- sold today for a very small loss-to free up some capital After i get some cash to clear, I will look to purchase some BABA- subject of a discussion

with a friend-Choose what is trending! It's almost a double in 2017- Why chase the SPY ?

|

|

|

|

Post by sd on Sept 11, 2017 13:30:21 GMT -5

Got some mixed signals- in the mining sector-tECK WAS DOWN THIS PAST WEEK, pick IN A SIDEWAYS BASE- copx HAD A SLIGHT DECLINE- slightly higher today- Got a big am pop in LIT up 5%, bit of a gain in HDB, nice up move in EEM....which should continue the Global growth story- as alive and kicking...Sold TMUS for a slight loss- Purchased BABA- Thought it might pullback from it's base, but it is moving higher today $173.52 entry

I've been holding positions without any stops - TECK has pulled back into negative territory, and i am using the swing low as the present stop-loss-I will take a loss on TECK if the stop executes- I've also set stops in the remaining positions- most are above the entry cost ....but not tight to price- except LIT

I'm overweight in LIT- Todays gap up large gain has prompted me to set up a sell at $40 and a stop-limit $35.50 & $35.00 in the IB account- also holding LIT in Scottrade- will Add the limit sell on the chance of a 15% gap higher on momentum spike getting taken out at $40.00 This is an ETF on Lithium- the battery component that likely will power our cars and battery operated equipment for the next decade . The intent is to anticipate an excess momentum move and purchase the rubber band pullback at a lower cost basis. These moves may last for a day or two, but generally not sustainable-

|

|

|

|

Post by sd on Sept 12, 2017 9:05:50 GMT -5

BOTZ gapping higher, Lit making another gap up + 2%

Seeing overnight weakness in COPX, TECK- I set a 22.80 stp on Teck- and tightened the remaining positions- with a little wiggle room .

I was stopped out on Pick at $32.61- and I must have made an error in setting the stop order. The stop-loss should have been below the swing low- approx 32.00

A reminder to myself is that I should take a screenshot of the order page- I had intended to review the orders this am on break pre market open, but got tied up.

As a follow-up, I will mark up the stop orders on the chart within the active positions group.

an initial knee jerk reaction is to sell a portion of LIT, and keep a limit sell at $40.00 - The Scottrade platform is limited when it comes to putting in multiple partial position orders-It thinks I may be duplicating orders-

With IB I can have a stop-loss as well as a higher limit sell. I should simply combine the other accts into Vanguard for a longer term Investment focused account, or into IB for a more active trading account-Presently holding profitable positions in those accounts-

|

|

|

|

Post by sd on Sept 12, 2017 10:43:10 GMT -5

Performance chart showing 1 year, 6 mos, 1 mos of the various positions- Note that the SCTR rating column is stockcharts rating system- Ideally above 90 is showing strength-

EDIT clarification- I only recently acquired tthese positions- The point in posting the chart is showing how performance can continue for extended periods- Another point to examine in the trading approach is discovering where sector rotation is starting to favor an area-

In part, because we have limited time and limited capital to put into the markets, when we find an area that works, we jump into it and perhaps leave our focus to the stocks within that area. This may be reflected in our trading- or investing- as we find success with one area, we naturally want that to continue-

It is likely a good approach to not put all of one's eggs into a single sector group- The FANG stocks for one example-

Pertaining to my own situation- I tend to stay with what's working- and only when that seems to be shifting- Tech sell-off this summer some 5% was a motivating force- did I start to look elsewheres in Earnest- I jumped onto the global mining theme as it seemed to have good momentum on what is a global growth story.

Also, a "Theme" followed by a narrower sector- AI- BOTZ, ROBO, position in Botz; HACK- cyber security - should be a good theme - PICK as a metals/mining approach for the global markets- Many other sector segments outperform - Tough to find just the right winning two or three stocks- sector- or industry group ETF's narrow the field.

ETFDB is one ET resource- Also- Stockcharts, Finviz allow one to drill down into the individual areas. Even knowing where such "tools" can be found is just a starting point-

Presently VALE and VEDL are back in the last month performance- Notice how Vale had declined during the 6 months performance- LIT really has popped this week.

|

|

|

|

Post by sd on Sept 14, 2017 12:22:46 GMT -5

Today selling continues in the mining stocks I own. LIT is the one gainer in the minerals sector- I've raised stops on LIT, as well as my other positions, and several have pulled back and executed today. I'm not sure what has prompted the weakness, and -as much as i'd like to hold through a minor pullback, when it seems sector wide,. time to protect some profits and reduce possible losses.

I've generally elected to increase some position weightings- Which makes it more economical to tighten stops- but it's really necessary to have size in the play to try to swing trade for small % gains- For example- the attached chart in LIT- which gained about 30% over the YTD 8 mos and is up 15% this past month- Note that the channel is about $2 wide on a $32.00 stock- Which means the price swing is a max of 6% from the very top to the very boOptions, margin, ttom- and there was only a few times the max ever occurs- If one was lucky, one might be able to find a swing opportunity that is 60% of the channel width- perhaps even 75%- or about a 4% total price range from the swing high to the swing low.- on a $30.00 stock that represents about $1.20 of maximum potential price capture- assume one won't buy at the exact low, nor sell at the intraday high- so perhaps the yield on the trade is actually about $.75 -90.00 -

Assuming i only take the long side of the trades in the channel- There were 4 nice upswings in 2017- Of course on the downside of hitting the peak, it wasn't a consistent decline- interspersed with a few attempted rallies to get one to jump in to be on time and early- and be whipsawed a time or two-

And unless one has control of plenty of shares- through options, Margin, or Cash- it's difficult to make money even on a 100 share lot after broker costs etc.

This is my most profitable (potentially) trade this week with actual dollars- I've held this position since 8-22- 3+ weeks - 32 shares in IB, 100 sh in Scot- and I'm tightening stops as this has gone vertical- I've got a $40 limit sell in IB - Scottrade won't allow for a stop-loss and also a limit sell- One order should cancel the other-

This is just an example of being "lucky"- I jumped in here along with the minerals and mining stocks- Thought this had a theme i can understand- Batteries for the future-Cars will go electric- Lithium is needed.

Anyways- Had i done my homework before deciding to buy based on a 2 mos daily price chart - and did the YTD with channels- i might have waited- for a decline back into the channel.

As it was I saw the recent high, the short decline, and attemt to move higher- The decline provided a good area for a stop- and I decided to go overweight the trade-

Course of action now is to not give it all back by holding onto this in an obvious momentum move- At the same time- One cannot know if this move reverses today, tomorrow or ater another 12% increase- So, it's partial profits at $40.00 Raised stops following.

This September has been a surprise with the markets gaining - and seeing a net positive gain in the trading accounts overall- just don't want it to slip away - by careless lack of attention.

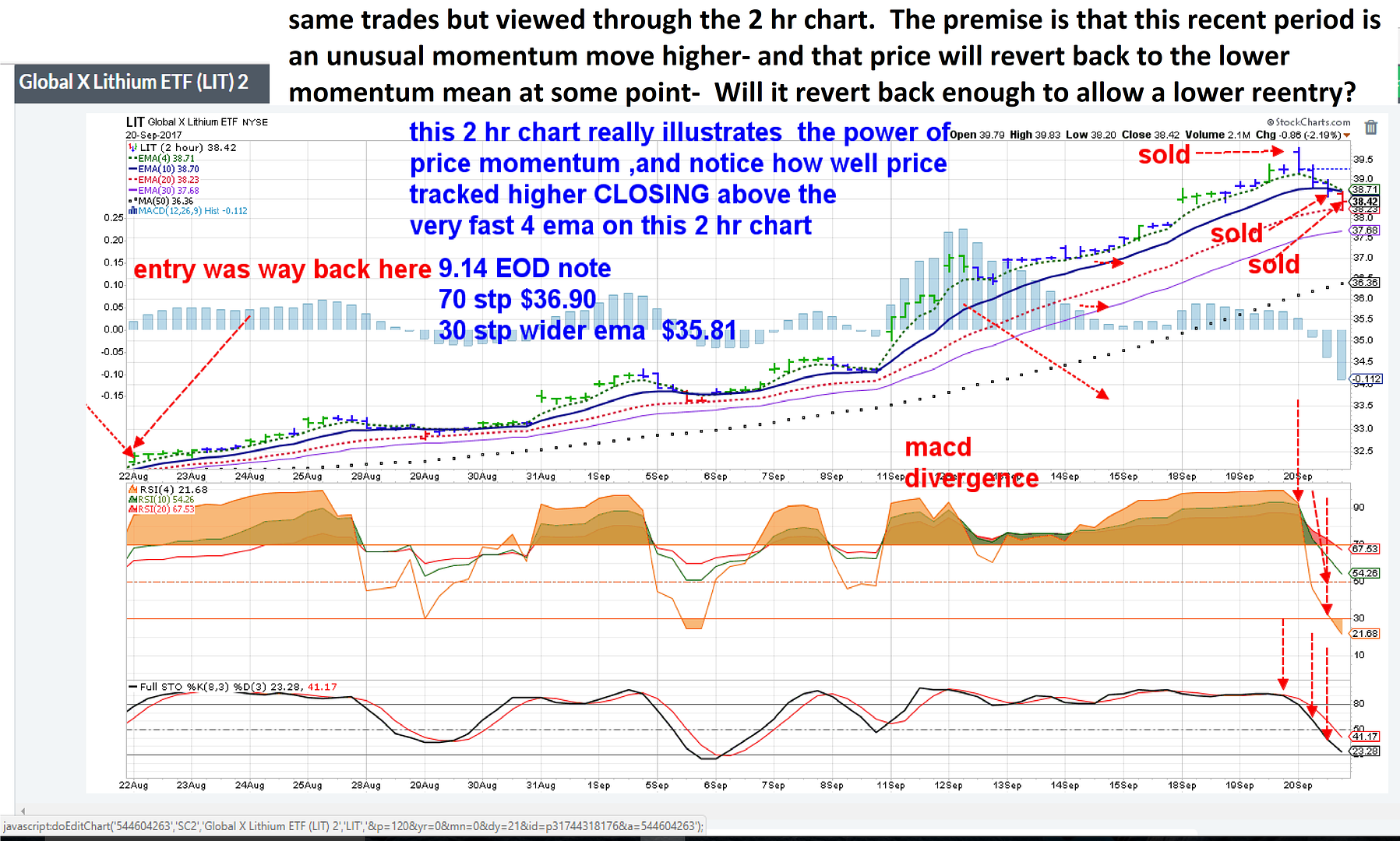

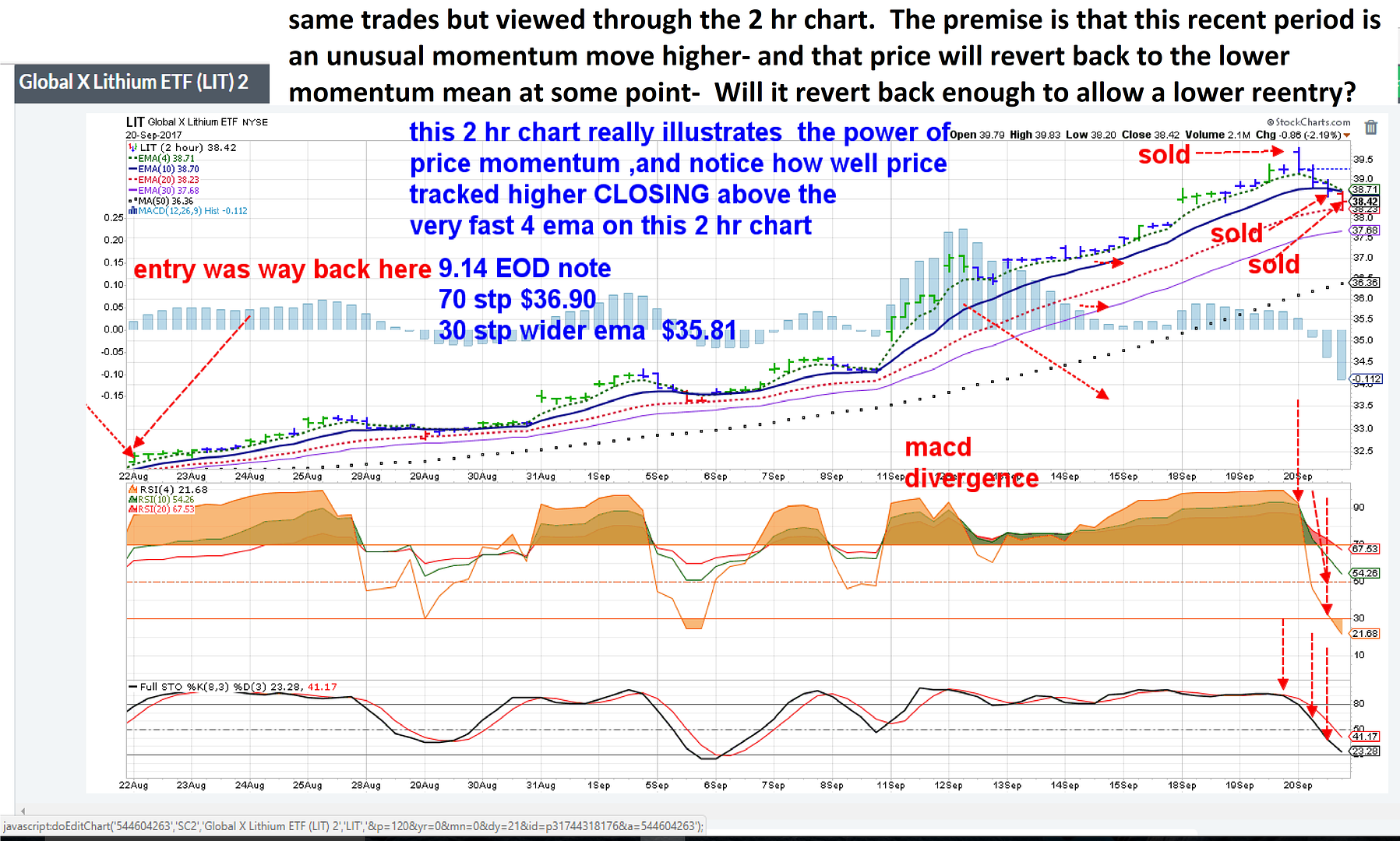

In After hours, reviewed a faster 2 hr chart- It's really about nickels and dimes at this point in setting a stop-loss- Once the momentum halts and starts a decline, it will likely execute any stop loss within a close proximity- but what's too close? Since i intend to sell 70 shares of the 100 at a tight stop- and the remaining 30 in that account a bit wider-

The 2 hr chart shows price uptrending smartly for 3 days and the 10 ema on that time frame untouched- It's a bit tighter than the daily, but allows me to also consider a tad wider on the remaining 30 shares-

What i think will happen is that price is so extended beyond the normal channel is that it will have a snap back and both stops will be activated- That may not happen Friday, and i will adjust both stops higher if they are not activated.

The goal is to allow a winning trade room to run, and i've essentially not given this one much room to decline- because it is overextended, & because of the overall weakness in the larger sector-but i also plan to reenter this trade- ideally on a pullback at a lower cost- and purchase more shares in the process.

just a note on Lagging indicators- As seen in this 2 hr faster chart- The RSI is good , Stochastic is good- and that is already obvious because the price is holding up-

The MACD histogram - those blue bars- are indicating a divergence - and the histogram often starts to decline ahead of price action it seems- The very high momentum bars are now stair stepping lower as price tries to grind out a new high and hold onto the gains- Notice the color change from green bars to the warning Blue bars- That does not guarantee a price decline- just that the momentum is slowing- But- if viewed in the totality of the price action over the recent days, it suggests that the enthusiasm that propelled it so strongly is perhaps waning-

|

|

|

|

Post by sd on Sept 15, 2017 9:46:32 GMT -5

LIT appears to be gaining today- will see how it holds-

BOTZ position is still trending strong- Play on Global AI- It has performed very well YTD up approx 40%. A similar ETF ROBO has done well- up 32% QQQ's up about 24% -outperforming the SPY by 2x -Spy up 12% That does not guarantee that any outperformance will continue the rest of the year- AT one time I thought the HACK ETF would be a big outperformer as well, but it has only performed on par with the SPY, and underperformed the XLK by 1/2. (Hack not shown)

I added BOTZ- 100sh in IB- Holding 100 in Scot. Looking at how strong semis are today- NVDA got an upgrade- target price $250- it's in the artificial intelligence arena as well- likely own some through BOTZ- I was looking to place an order on the 2x semi Etf USD- I actually placed a small bid to buy- just over the Ask- but it wasn't filled immediately, and then i saw the spread on the Bid- Ask was very wide- about $.60

Instead I bought the SMH with a tight spread . Used Friday's freed cash- Will have to wait for Monday in IB for the remaining miners I sold to clear- And- it may be time to reenter miners by then...

4 pm Edit- Today was a "jump in " day- I've had some retirement capitol in Vanguard- for quite some time waiting for the soon -to- occur market correction (it will be any day now!) so I could put on some value trades-Investments- at a discounted price- On the investment side, I funded that account with just small positions in a few stocks- and took entry positions in mostly Vanguard ETF's- Free of any commissions! In the small section allocated to Active Trading- i took 2 positions- BABA and AZO- adding to the position in BABA-

On the Investment front, some small exposure to the QQQ's, ROBO, BOTZ and then starting allocations into a mix of various Sector ETFs and 3 bond ETF's .

It's going to be an interesting "TEST" of will - because i have decided i will be more aggressive in protecting profits inside the trading account-based on what had seemed an increase in volatility- And the Vanguard Investment account will have to get more flexibility. Ideally, it would get rebalanced at a minimum each quarter- and with no commissions, it could even be monthly if one had the time and inclination.

The goal in the Investment account is to be diversified - -and that could be easily accomplished by buying the entire World stock market- in one ETF- But i have made some general allocations - Growth, technology, materials, Health care, biotech, INtl growth, several dividend focused funds-and even some energy exposure- YES, all of these various funds could be dilutive- but the goal of rebalancing is to gradually skim off gains from outperforming segments- and making some investments with those gains- I did not go all-in today on the investment front, and will keep some cash available for those future better "buys".

|

|

|

|

Post by sd on Sept 16, 2017 8:05:57 GMT -5

REVIEWING THE AZO TRADE

AZO has been declining steadily during 2017- Autoparts supplier- From a high near $800 at the beginning of the year, started off with a gradual decline, then an increase drop with momentum-It gapped down late May and tried to make a base in JUNE, but that failed to hold and it declined further into July where it made a sideways base in JUNE, and then a 1st multi day rally higher. The steady decline this year gave back everything gained since 2014! That rally stalled in AUGUST, followed by a pullback-sell-off that retested the JULY lows $500.00- August 25 Harvey hits TEXAS, AZO starts to get some buying, breaks through the prior 1st rally high this week, and I took an entry Friday-

Looking at the really "Big" weekly picture- This trade makes sense and there is a dbl bottom on the WEEKLY $490-$500 . Ideally management has made some changes that prompted the sell-off this year, and the benefit of 2 hurricanes damaging vehicles should prompt sales in the Used Car market repair-

I'll start with a stop loss at $525.00- Risking about $45 / 570 -approx 8% away from the entry and will monitor to see how the position behaves-

Note that BLYGH early on posted some Auto related trade prospects-

Here's a multi-year WEEKLY chart to give perspective of the magnitude off the decline.

While the daily chart may appear to have made a big jump- the weekly bullish bar is simply the 1st bar that qualifies as breaking out from the weekly base.

The 'issue' of trading based on weekly signals is the spread in the price range is considerably wider than the spread on a daily chart-

As a person that uses TA as a guide- and normally employs a daily chart EOD, The weekly chart can be intimidating to consider- but it also gives a perspective that carries more weight than the Daily chart-

oN A DAILY CHART- Price bars can go higher or lower -and on themselves appear to be an ideal early entry- or exit- If I just focus on a single daily bar's price action intraday, I may very well react when the closing price will tell a different story- But, If I can view it in context of the overall trend, and what the recent price action suggests, I hopefully can make a better informed decision.

Which brings up Indicators/Oscillators-

Price Action and Trend are KEY - I use some moving averages to keep these in perspective-

In the attached chart, I removed the moviung averages for clarity in discussing indicators/oscillators-

The MACD histogram is based on bars above or below the 0 base line- As price moves higher with increasing momentum- the bars get progressively taller above the 0 line-

Conversely, as price declines with more momentum, the bars get larger away from the 0 line. When the bars reach a peak, and a bar then steps back towards the 0 line- it may signal a peak in that momentum, and possibly a reversal.

The RSI typically is set at a 14 period- i have posted 3 different RSI values- a very fast 4 that closely follows price, a 10, and a 20- During strong trending periods, RSI should stay in the misnamed "Oversold" above 70 level. It should be called the Power Range level- because once it declines below -and breaks the 60, 50 level, it may be the end of the present trend- RSI is useful- also- consider coming up from "Oversold" territory-30,70 Usually it's best to wait to see RSI well above the 20 level depending on what RSI value one uses- Also needs

to be evaluated in context of trend direction, . It's particularly prudent to not Buy just because price is in a decline and is in "oversold " territory

The stochastic also can give early crossover signals- but one has to not necessarily react to the crossover- as they are often early- to buy or sell- best to wait for stochastic to make a move heading towards the 50 line as it has crossed the 20,80- so some suggest using values at the 30,70 level . So crosses exactly right at the oversold/overbought may be premature-

On this chart- The colored bars - Elder Impulse- also are color coded based on a momentum calculation-

A last chart- Note that indicators are all built on lagging past price interpretation- but they can also add value in trending periods (not so much in flat markets)

Divergences are when price appears to be doing one thing, but is not confirmed by the indicators- Notice that as price tried to rally off the highs, the stochastic kept declining- and while the RSI did move up with the daily price bar that closed higher, it was a lower relative high to the prior rsi value- And the histogram smoothes the price as well- and the histogram can also diverge from what price is saying- It can decline while price still goes higher-

Price action 1st- trend direction next- perhaps a look at indicators last-in context-

edit note- 9-19 AZO dropped 5% and closed significantly lower- I set my stop-loss at the 533 bottom- Despite what i thought would be a solid catalyst, the hurricanes and price already well oversold, i'm disappointed in the price decline- and the $150 loss or more i will take on this trade- as the stop will likely execute Tuesday. This should be a good reminder to me that the reversal of trend trade is inherently a lesser probability to succeed- Compared to going with a trade that is already heading in the desired direction- I debated on considering a wider stop- but that would entail an additional 5% Risk- Better to cut the loss at 5% than at -10% -

|

|

|

|

Post by sd on Sept 17, 2017 20:57:55 GMT -5

, and -on the investment side both ROBO and BOTZ are focused funds for the rapidly growing field in AI/Automation- finance.yahoo.com/news/investing-robotics-etfs-segment-surges-151503568.html

I've caught a nice surge in LIT, Don't have any idea of where it may stall - but I assume it will revert to the mean and give me another opportunity for a reentry on a pullback- I tightened profit stops to the Friday low for 70 shares,$37.35 and $36.25 for the remaining 30 in IB-Duplicate order in Scottrade- I've got a substantial gain (relative) from being overweight Lit and want to capture and lock in the majority of that gain should price stall. The after-hours bid-ask is 37-38 this Sunday pm, markets ideally open higher- Might get to that $40 limit sell -

At some point- LIT will take a downturn just as the global mining stocks have- I expect they will rally - and i will repurchase PICK or VEDL, or VAle as they make that 1st higher turn- I was careless with TECK, allowing it to decline and taking a small loss even though i had a gain ,,,, It somewhat prompted me to not be too complacent- and certainly not allow a winner to become a loser- I'd rather pay the extra commission cost to take a reentry -

EDIT 9-19-

|

|

|

|

Post by sd on Sept 18, 2017 20:09:47 GMT -5

raised trailing stops on LIT rather aggressively-

With the freed cash, looking at the metals/mining - COPX looks like a tenative base-on the pullback- This is rather aggressive- but i have set a buy-stop $25.50- lmt $25.90 with a stop at $24.70

[/font]

|

|

|

|

Post by sd on Sept 19, 2017 4:54:20 GMT -5

I have set up a trailing buy-stop for a reentry into COPX- $25.50 activation, 25.90 limit- stop $24.70 below the 50 ema and below the prior low price just in case I get a volatile entry-

Price made a tenative close higher, but it's tenative- stochastic is still oversold without an upside cross- a higher close today would provide that momentum to make a cross- but i hope to enter as that occurs- The MACD histogram is interesting- the nuance being the histogram made a bar further away from the 0 line- but with less momentum than the prior 3 days- still quite bearish...

Overseas markets flat today- waiting on Fed to speak this week.

Edit 9.19 COPX closed $25.31 - a higher open/close Doji - which looks promising for a move higher- I'll leave the $25.50 Buy-stop order in place- but consider that $25 has been touched 3 of the prior 4 days- It would be easy to assume a cheaper entry with a $24.90 stop-loss as the POF.

|

|

|

|

Post by sd on Sept 19, 2017 20:42:03 GMT -5

For 9-20 I have a market SELL for 50 LIT- price is very close to the $40.00 target- The remaining 81 shares i have simply raised stops to the low of today's bar- and will continue to do so until stopped out- in the event price manages to continue higher in such a steady fashion- i also have a limit sell set at $45.00 in case of a momentum surge- I will adjust that if fortunate enough to see price go that much further- The move is obviously extended for a 4 week period - up above 20% - and with a momentum not seen in prior months- It may be short sighted and greedy to be tightening the entire position- when a potentially larger move may occur- and i perhaps should have kept a portion ffurther back- but i look at how the other mining related stocks have pulled back- and this one has kept on truckin".... Because this was a relatively large overweighted position for my account- i should consider myself fortunate this has worked so steadily in my favor- I'm Up $600 + on this trade- but down $150 in AZO- Both positions i took overweight size in - While it took a month to get the gains in LIT, I lost a quarter of the gains overnight in AZO! They're held in separate accounts, but it keeps things in perspective- Hard to come by, Easy to Go! I've got a stop at the low of AZO- but it could potentially drop lower on a gap open-

Let's hope the Fed doesn't shake the markets with an aggressive policy statement- or there will be a lot of red ink!

9-20 update-

LIT opened higher- $39.73, and my 50 share market sell executed $39.79- and it has since declined swome intraday-

The net gain on the 50 shares is 23%- not bad considering it's not a pharma/biotech-

The remaining stop-loss for 81 shares is tight- $38.70- with today's intraday low $ 38.90- and I'm going to consider pulling it back to $38.60 - the very fast 4 ema.

Note that the 31 share portion in IB executed at the $38.70 as price pushed lower intraday- I lowered the remaining 50 to $38.60

By the EOD, all 3 stops were reached and became market sell orders-

My initial decision yesterday to Sell a 50 lot at the open seems timely based on today's price action. Selling 50 shares at that level gained an extra $50 instead of leaving it all to a lower trailing stop. The next stop was hit , and the remaining stop was also hit, Leaving me 0 positions-

The expectation is that this recent momentum will slip back - enough to allow me to take a reentry as price retraces a portion of it's recent gains - all the while maintaining an uptrend on the daily time frame- I was also stopped out on a number of other raised stops today- BABA, SMH, PIN as i have chosen to apply a tighter stop-loss approach- AZO has put me into negative territory, but my initial stop was wide enough to see it rebound today- With the IBB, i have an overall profit- but it's relatively small- but on the recent price weakness i raised the stop a couple of pts below the swing low- Now that price has put in a swing low and taken a step higher- it offfers me the opportunity to tighten my stop close to that swing low- If executed, i'll have a small $50 gain- The latest entry was $320 and the stop is set at $329- with today's higher move a hopeful move back higher

|

|

|

|

Post by sd on Sept 21, 2017 19:47:52 GMT -5

Just a trading note- Been busy with work-Home late - and haven't caught up with any market news this week - i can see by the overall weakness in the charts the mining sector is falling out of favor further- I thought i had a good reentry in COPX- but it 's pulled back and is sitting just above my stop-i intentionally took the early trade to get back in and would do it again-but it will likely get stopped out tomorrow as the tide is going out on that sector the past few days...I really don't know how much weight the Fed Speak carried this week in affecting the markets reaction/interpretation.

This brings me to the point regarding the need to have a sense of the Macro climate at work, What the major trends are, where is there strength , and where is their weakness.

Just as you feel you've got a good sense of where the market is heading- Uh-OH! Left Turn without much of a turn signal -to bring it back into perspective- I had just added SMH, but chose to take the quick stop loss. it was a belated entry, ema spread was wide- price had been trending for days- But that was similar to Lit and others- sometimes, it's just the way it works out,

take the loss and move on- wait for a lower pullback and hop in cheaper.

Botz will likely stop out in the trading account if it declines much further tomorrow- I had added to the position, and that seems to be the sell-off trigger-

I am keeping the Vanguard position without a tight active stop-loss including ROBO -on the Investment side-

|

|