|

|

Post by sd on Nov 6, 2016 21:05:08 GMT -5

Comey reports the added emails are not implicating Clinton in any wrong doing-

Market will rally IMO-

|

|

|

|

Post by sd on Nov 10, 2016 19:04:36 GMT -5

Boy, did i get that Election thing wrong! Not only did Trump win decisively, the markets only initially panicked on the realization that Trump was winning - and recovered and has now made new Highs!

Perhaps that is because a business person was elected- and also that the Republican party will now dominate the house and Senate it appears for the next 4 years- and Change will occur that favors business-It's time to now see a congress that can get something done for the benefit of All the American people-

Simply been too busy and challenged with the Day j.o.b. , and longer hours to attend to the market movements-

Had a buy-stop that filled in SLV that i had put in last week. Note that GLD had rallied some for several weeks prior to the election, SLV had moved up recently from a base- breakout .

GLD dropped Nov 7 following the election, and has continued it's decline- Oddly, SLV dropped Nov 7 and then rallied back higher- where it sits.

We'll have to see how the market reacts in what is traditionally a strong quarter- going forward.

|

|

|

|

Post by sd on Nov 10, 2016 19:49:07 GMT -5

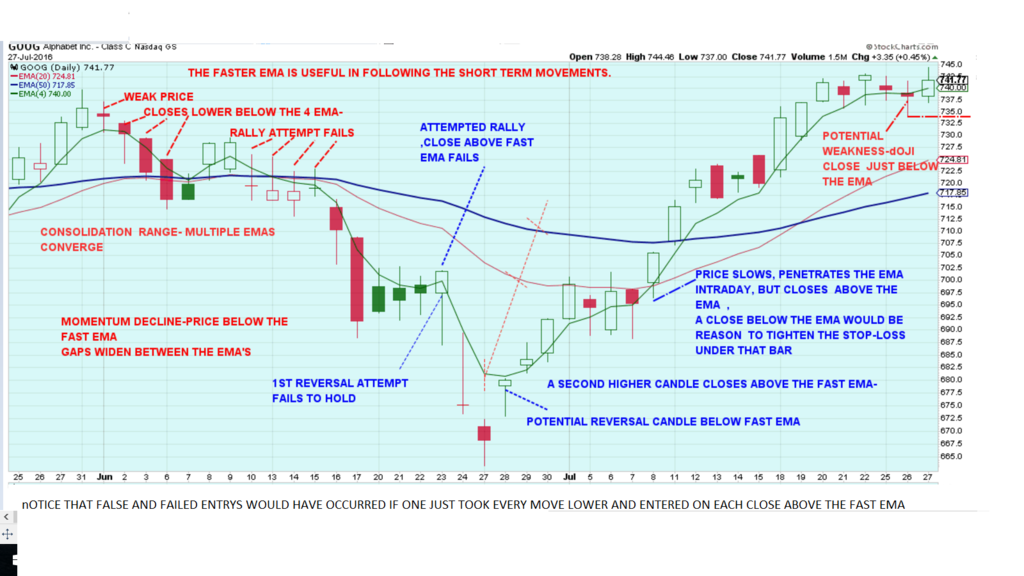

charts posted here are just a "test" of screenshots/photobucket .

Goog 1600 x 900 391 kb

The screenshot test 11.10.16

4924 x 2952 399 kb

|

|

|

|

Post by sd on Dec 7, 2016 9:36:22 GMT -5

vacation- adding to the jets position on a breakout premise

|

|

|

|

Post by sd on Dec 7, 2016 19:18:18 GMT -5

12.7.16 aFTER HOURS-

Hard to believe this market continues to rally- My tech positions stopped out on tech weakness as the market swung through sector rotation and tech was unfavored-

I had put in orders Sunday and was filled Monday RYI, ITCI, and a tight limit on KTOS- thinking it could retest the breakout- I was filled today as it pulled back lower- and I intended to also have a 2nd order lower- back inside the range- but - hot fingers on the keyboard and a vacation day at home -and i spent that allocation and bought T .

I tightened my stop on ITCI as soon as i heard about Trumps remarks about drug pricing a concern and being too high- This was a killer back when Clinton brought up the overpricing of a few glaring examples of greed, and so I bailed on ITCI-

I was filled on the move higher and added to the Jets position.

I hadn't placed an order for COO as it hasn't made a base and turn yet in the downtrend- but it's doing well this week.

Human nature being what it is, You have to expect we've come too far, too fast, and a correction/profit taking will surely be the order of the day-

As Ira's expectation with VIIX, the $vix continues to be down at the low end of the range.

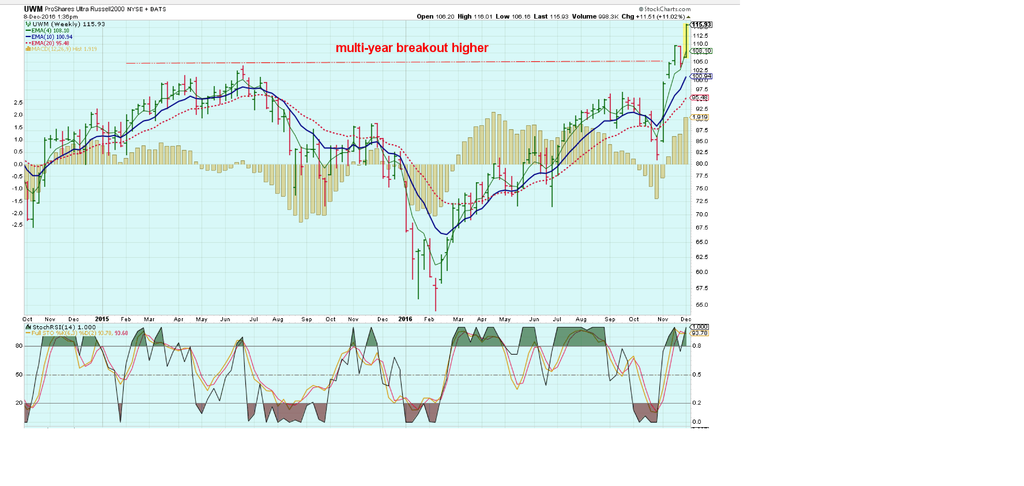

Presently holding a mix of long positions-UPS, (Delivery,consumer) ITA,(Defense); JETS- (Airplane etf),PFI ( a financial etf) Today adding KTOS, T, XLP(consumer) UWM ultra small cap.

It feels that I'm simply late- that the Train already left the station- But that was 4 weeks earlier! but after looking at how long some weekly trends can run after breaking out- we may see a continued momentum higher- The market attitude will be determined by the reaction to the news that the Fed is going to raise in December.

I have a book on the shelf that I need to read again- "Markets Never Forget ...but people do" by Ken Fisher-released back in 2012,

It's about " how your memory is costing you money- and this time ISN'T different"

He was essentially right-again- here we are some 4 years later, and despite several years of flat markets- we are now off to new highs- not the catastrophic major market sell off boogey man we all look over our shoulder for......because -for many of us- we've experienced 2 sharp declines in the past 15 years and it is somewhat imprinted on our investing psyche- double that fear when we realize that -for the majority of us- opportunity has not been waiting just around the corner economically- We have stalled out on growth in this country - with anemic and lackluster describing what many Americans feel about what lies ahead- If we described our attitude Pre Trump as Glass half-full- or half Empty- I would expect that Half empty would be the response of the majority-

This Trump rally- has sparked a belief- that our road ahead is not as dark as what it has been while viewing though the mirror-

I will try to take advantage of this new found optimism in the markets, and not allow my bias to hold me back-

That said- I will still employ stops- and be wary of possible reactions to Presidential Tweets- affecting the Healthcare and biotech -as one example.

|

|

|

|

Post by sd on Dec 8, 2016 9:19:00 GMT -5

Here was my thinking with KTOS and a limit purchase- followed by a lower purchase-

I was filled on the pullback I was anticipating, but decided to use the remaining amount to instead purchase T -even though it had gapped higher-

|

|

|

|

Post by sd on Dec 8, 2016 13:33:55 GMT -5

Nice up move today in UWM ultra small caps, some weakness in other sectors, including defense  the weekly-

|

|

|

|

Post by sd on Dec 8, 2016 20:18:41 GMT -5

While a trading account gets close attention- perhaps daily- a retirement account generally does not get much scrutiny- particularly if it is a company sponsored account- and may be viewed as just part of one's job benefits. Out of sight- out of mind- may be the mindset-

There are a lot of things to realize about these company sponsored accounts and how they are executed- and costs etc. - And one can transfer assets at no cost into another approved account without incurring any tax penalties. The new Dept off labor requirement of more stringent Fiduciary standards are a great benefit to the average investor.

My present company financial "advisor" Edward Jones- called me this week to advise me that they will have to cease to continue the same arrangement with American Funds- and that all future contributions will have to be done within a new IRA account at an expense ratio of 1.2% for assets under management.

Be aware- that the new Fiduciary standard benefits you- the employee- and is designed to cause the adviser to suggest assets that benefit you more than him- or her-

When discussing company benefits and policies with a friend, their response was to not question the company designated adviser- because they were the professionals. This is naivete at best, and trusting .

The company adviser makes his % on top of your assets- win or lose every year. You take on all the market Risk- hE GETS HIS CUT WHETHER YOU HAVE A WINNING OR A LOSING YEAR-

Several months ago, My financial adviser did not tell me that bonds were at risk and failed to advise me to reduce my exposure- Surely- he is the professional, and can determine when major market turns are occurring- It was certainly spoken about in the financial world. However, it was not worth his time to bother-

Timing a trend direction can be difficult on a daily chart- less so on a weekly chart because it encompasses that larger swing in price movements.

holding a bond component in a diversified portfolio is designed to add stability -and relative safety- to that portfolio. I went to cash in the bond component several months ago- and it proved to be a timely exit-

note that the attached chart illustrates following the investment on moving average crosses - and did particularly well in this most recent exit in reducing Risk and saving capitol.

Whether this basic weekly crossover strategy can be extended more broadly to stocks & etfs effectively remains to be determined-

The decline in this fund was somewhat precipitous, and this week was the 1st week that a possible reversal of the recent decline may have occurred.

The strategy starts with understanding when a price declines beyond an appropriate faster moving average and closing below a slower moving average.

This may be the start of a downtrend- In this chart example, this is the case.

|

|

|

|

Post by sd on Dec 11, 2016 11:05:10 GMT -5

12.11.16 Posted in the horse Race thread and copied here-

I had been curious how the Horse Race Weekly #1 winners would have fared had one made a purchase at the closing price and held until the present day.

This assumed no stops were used- just buy and hold for the long term.

started 7-29-16 when we excluded leveraged picks from the race. That's 18 weeks and the averaged gain is 4.67% No stop-losses on any of the positions.

Spiderman holds the highest gains and highest losses

8.6.- EXAS won $19.25 today it is $14.39 down -25%

8.13 GPRO won $ 14.30 today it is $9.23 down -35%

There were 3 other past winners that are down today- for small amounts -0%, -1.8%, -3% 5 losing trades and 13 winning trades is a very respectable win/loss ratio. 72 % winners.

10-7 DXPE won $ 29.13 today it is $37.36 UP +28% for the largest gain to date.

Blygh and Joe both had winners taking the short side-

Gains to date for the short winners are 22%,0%, 13%, 6.5%, 14.4% for a net gain of 55.9% =avg gain 11.18%

Blygh has a high win rate on his short winners still making money.

One could suppose that if stops had been used , reducing the 2 large losing trades to say -10% each, the net average gain would be 6.8%.

it might be interesting for another day to review what a -10% stop set on all positions would yield in terms of actual execution price.

Also what would a trailing stop-loss -10% price on each position have gained?What about 15% ? 20%? That would be selling any position that declined more than 10%, 15, 20 from it's high. Good rain day project to consider.

Reply

Quick Reply

|

|

|

|

Post by sd on Dec 14, 2016 20:50:11 GMT -5

12.14.16 Well, the Fed spoke, raising the expected .25 bpts- but apparently intimated they would consider 3 rate increases in 2017 vs just 2

So, the markets knee jerked and sold off- WHY???

We have been here many times before- and for myself- It is tiresome to play this game with the Fed manipulating markets by manipulating rate policy.

I expect that once Trump takes office, Yellen will be sent Home feeding her chickens and a new Fed chairman will be much more transparent and decisive.

i would expect nothing less from the new administration whose mandate & Focus is to grow the economy .

Here was an interesting article in SA on past peak market leaders and where they are now, and some comparisoms to the leaders of today.

It points out that Technology is indeed disruptive, and replaces those that fail to adapt quickly enough to the new leadership roles-

If taken a step further, it would be a negative to having a long term hold on specific positions- particularly in this field of Technology.

Decades earlier, in a slower changing economy, you could purchase shares of IBM, KODACK, GE, REMINGTON, SMITH-cORRONA- AND -AT THE TIME- THOUGHT YOU WERE PURCHASING SHARES IN COMPANIES THAT WOULD BE AROUND FOR DECADES TO COME.

Surprise!!!

Back in 2,000, you would have thought that the INTERNET WAS THE ENTIRE WAVE OF THE FUTURE- and you would have thrown $$$$ at the market leaders at that time- The famous riches of the few companies that succeeded and survived outweigh the many that failed and no longer exist-or are seriously lesser valued than back in the day....

I found this an interesting article on SA -comparing the big names in the internet bubble to the names of today

seekingalpha.com/article/4030587-todays-amazon-facebook-google-cisco-intel-microsoft-internet-bubble?app=1&auth_param=27a1v:1c53m88:43c4e4ec24671ff50aca9e15ef3ce0eb&uprof=44#alt1

|

|

|

|

Post by sd on Dec 14, 2016 20:55:28 GMT -5

Yesterday, 12.13.16, I was not considering the Fed meeting today, but went through my open positions and decided to tighten stops - proved to be a prudent move, as there was a lot of selling across the board. I still own Jets, T, and purchased-new PJP on the sell-off.

|

|

|

|

Post by sd on Dec 15, 2016 6:04:51 GMT -5

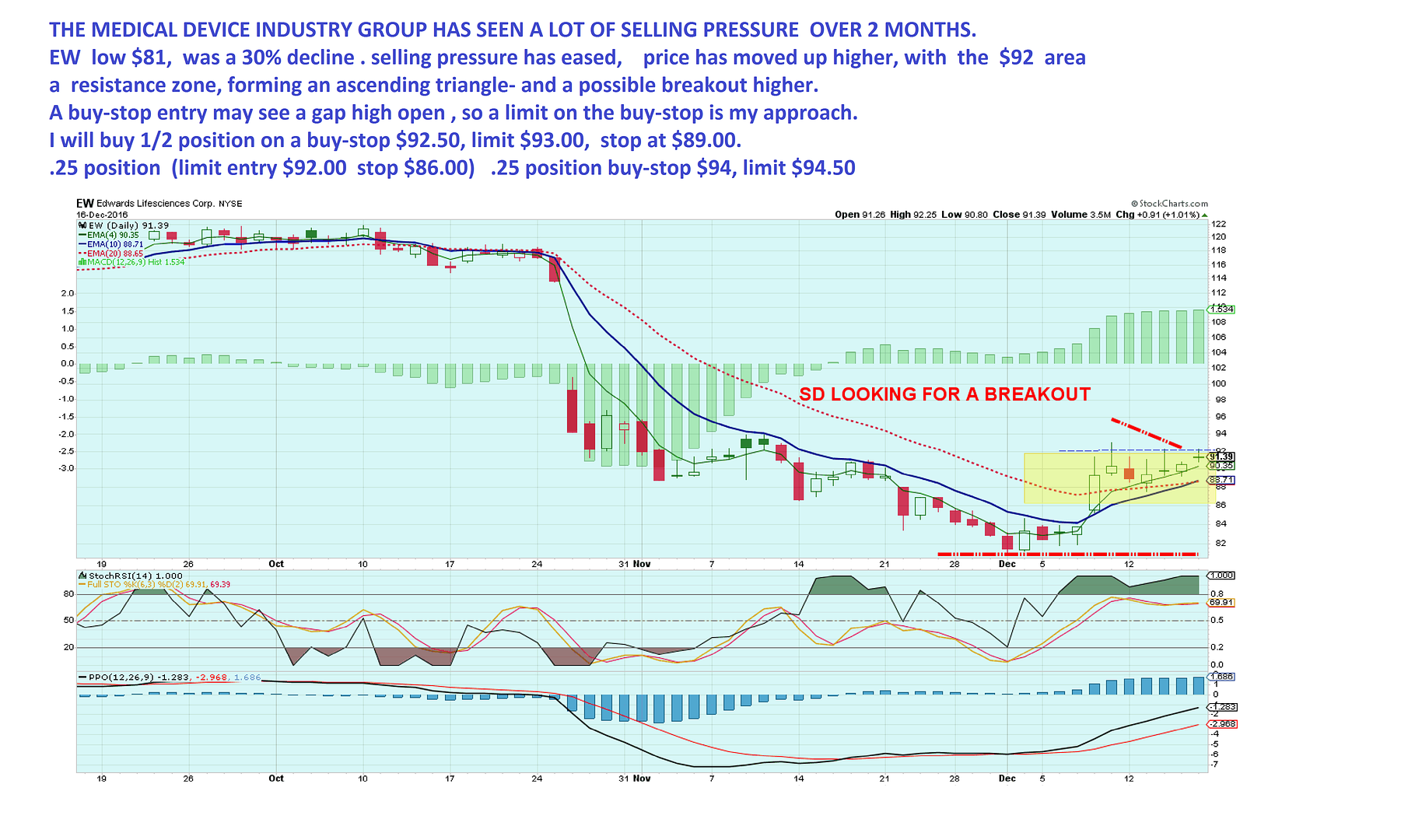

Up way too early, placed a couple of small orders-Going with IRA- short gold MELT 1x, a couple of medical instrument orders EW, HOLX with buy-stop entries and NVDA. Holx trending- EW a possible bounce off the decline- see if it goes higher-

|

|

|

|

Post by sd on Dec 15, 2016 19:05:22 GMT -5

The Gold short opened much higher than my limit- NVDA filled- No fill on the other 2 -buystops never reached.

|

|

|

|

Post by sd on Dec 17, 2016 13:17:36 GMT -5

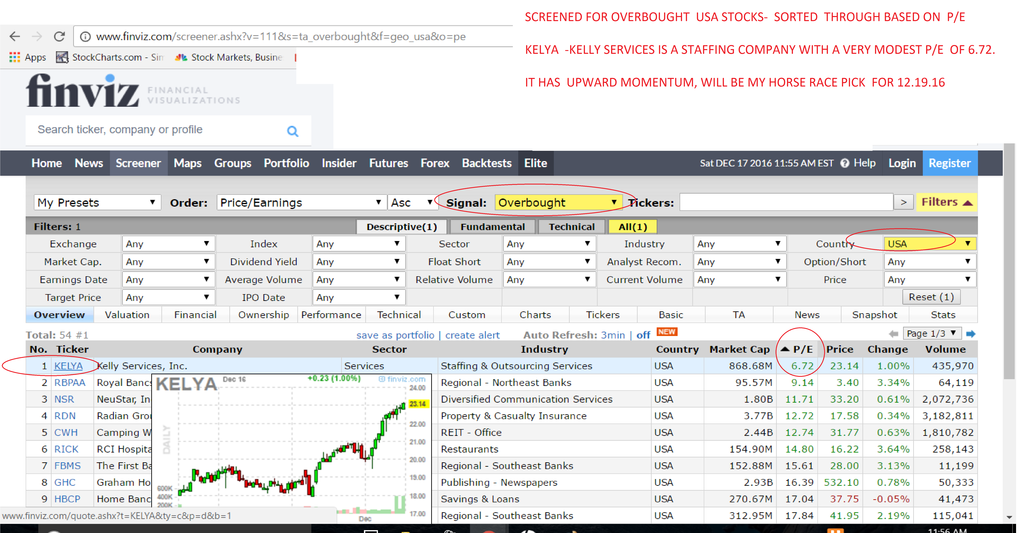

12.17.16 I copied the horse race post-thinking to expand my understanding of the screening process-

There are a number of YOUTUBE videos that give instructions-

www.youtube.com/watch?v=C2rptGOMJcg

\

"KELYA" is my tenative pick . .....Blygh has expressed that he'd be interested if we'd give our reasons for Picks- Here is some of the reasoning ...

I may make a different selection before Sunday's deadline- but I spent an hour this am watching a Vector Vest promo, screening for stocks with good values and

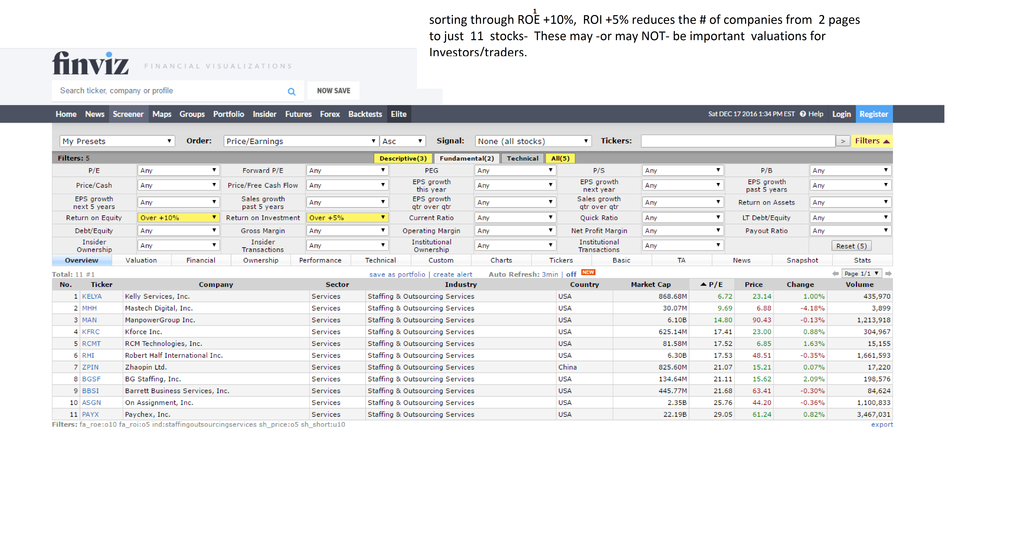

uptrending charts- Thought I'd compare Finviz.com so i selected to screen for Overbought USA stocks- (Note, stocks can remain "Overbought" for weeks and months, going higher)

I then sorted using the P/E column tab-

Since the market has made a good run, and the economy appears to be improving- Kelya should be finding a greater demand for their staffing services,

and -additionally- as the market itself is "Overbought" , Kelya may offer a good value for those not seeking to pay up at higher valuations.

The 1st chart is the "Overbought" screen- and the second chart drills down and sorts through just the specific industry group- separates the staffing services companies by themselves from the rest of the market- I may have explained this process before-if so- sorry - comes with the CRS.... but it is then easy to hover your mouse over the Tickers on the left side and the chart for each will pop up- allowing an easy way to sort & compare data for the individual stocks in the group as well

The industry group returned some 2 pages of stocks- I then clicked on a couple of fundamentals- ROE, ROI, and the list got narrowed to 11. I don't know whether these "fundamentals " work in guaranteeing the success of any one trade. It would seem that the elimination of those companies that don't meet minimum standards would be a plus in narrowing the group. and also price- The industry group returned some 2 pages of stocks- I then clicked on a couple of fundamentals- ROE, ROI, and the list got narrowed to 11. I don't know whether these "fundamentals " work in guaranteeing the success of any one trade. It would seem that the elimination of those companies that don't meet minimum standards would be a plus in narrowing the group. and also price-

|

|

|

|

Post by sd on Dec 18, 2016 10:59:28 GMT -5

12.18.16 I need to be outside working on the Home front & enjoying the 65 degree day here in NC!

Instead, I spent more time on Finviz this am focusing on learning more on using the screener tool- and it's potential to allow me to drill down and check my stocks easily against other stocks within the same industry group- at a very quick glance at the charts-

What i did notice- for example- many of the bank stocks have plateaued over the past week-

and then I checked Medical Appliance and Equipment industry group - click on the charts box, and multiple charts specific to the group can be compared! quick and easily- and note the downtrend similarities- of the majority- So, this is a quick view way to determine if your stock is flowing with the tide that the industry group is responding to. I changed my Horse race pick from Kelya to EW- because EW may have more breakout potential. stocks that are in decline are usually there for a reason, and the entire industry group has been down- While I own some PJP the ETF has made a similar up move. EW- likely included in PJP , potentially would give more upside (and downside) . Looking for some sizzle on a sector that has been beaten down.

I decided I would break the order up , as much as an experiment- as anything else- I am buying .25 with a limit of $92, stop-loss $87.00

This is below the recent swing low and the 10 ema value at that point. This will give me a partial position prior to a breakout-or breakdown with a well defined risk with stops in place. Then I chose to consider that if the breakout should occur, I will have 2 buy-stops- buy 1/2 on the closer buy-stop- and .25 on the wider buy-stop. Commission costs for all 3 entries is a total of $3- and if all should sell, another $3 for a total round trip cost of $6.00

|

|