|

|

Post by sd on Aug 30, 2016 4:39:31 GMT -5

syna- Buy-stop $58.50,lmt $59.50;

rdcm, limit $18.25

2 trade orders I will be making today.8.30.16

will raise my limit on UNT to $17.00- I'm optimistic it will push through this resistance level.

|

|

|

|

Post by sd on Aug 30, 2016 19:38:28 GMT -5

I had a decent fill on SYNA @ $58.75 at the market open. UNT moved higher and ignored my $17 limit-

I had a buy-stop in EXAS and was filled $.02 from the high, and it dropped back .

AMH hit my stop for a loss. $21.75

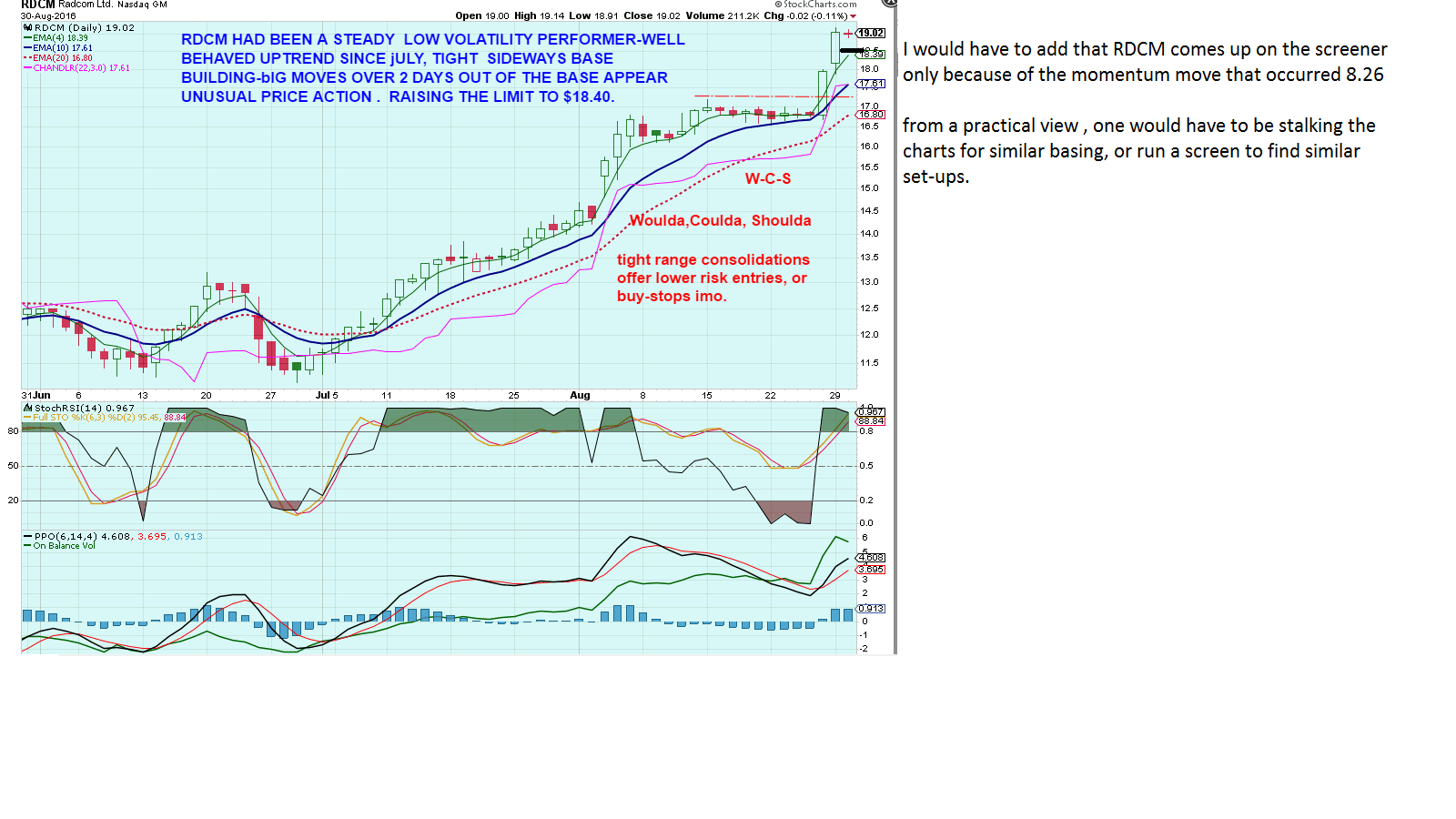

still pending, RDCM after 2 up days, today was a tight DOJI. Failed to even retrace to $18.25 limit. I will raise it to $18.40- fast ema, expecting a possible pullback loweR

|

|

|

|

Post by sd on Sept 1, 2016 4:23:47 GMT -5

August is considered to be seasonally a poor month for stocks,AS WELL AS sEPTEMBER- and it's made me a bit poorer in the process as well!

Perhaps over the weekend (heavy rain expected) I will have an excuse to not attend to the home project chores, and get to review the status of all the trades made this past month, with a

large percentage hitting even my wider stops- and will make some adjustments in my approach-

Exas hit my stop $18.56 fill, and UNT declined and I was filled at the $17 limit.

Chart wise- UNT is holding in a range below a prior swing high. The assumption for my entry here is that it has a defined range, and looks to be holding within that range, once supply is absorbed- it should "break " higher- or - if demand is not strong enough, it drops below the range, and will stop out.

One of the characteristics that I have noticed in charts, is that it is not uncommon to have a drop below the range for a day, looks like failure and you assume price will decline even lower, but is followed by buying the dip, and the stock propels higher. Futures are higher this am.

Box beat on earnings- had a large one day move- but I'll see if it comes back to $13.10 with a limit order.

|

|

|

|

Post by sd on Sept 2, 2016 21:21:39 GMT -5

2 up days in a row!

Pending trades- I had a buy-stop for AMBA - This was Tiarra's short pick for the Horse race this week. It was a good thing I used the Buy-Stop order- meaning price had to move up before I would be filled. Since Earnings came out Yesterday, and the price barely moved- closing where it opened, I felt certain that the prior trend would resume higher- Look at Amba's move today!

Somebody yelled "Fire" apparently and buyers disappeared. Saved by waiting until earnings, and the order type. I'm just a sucker for a good trend walking higher.

RDCM order- I debated how i would play this entry- instead o a buy-stop I figured the market was weak, I'd try a limit- lower- should have tried both- Nice breakout higher today.

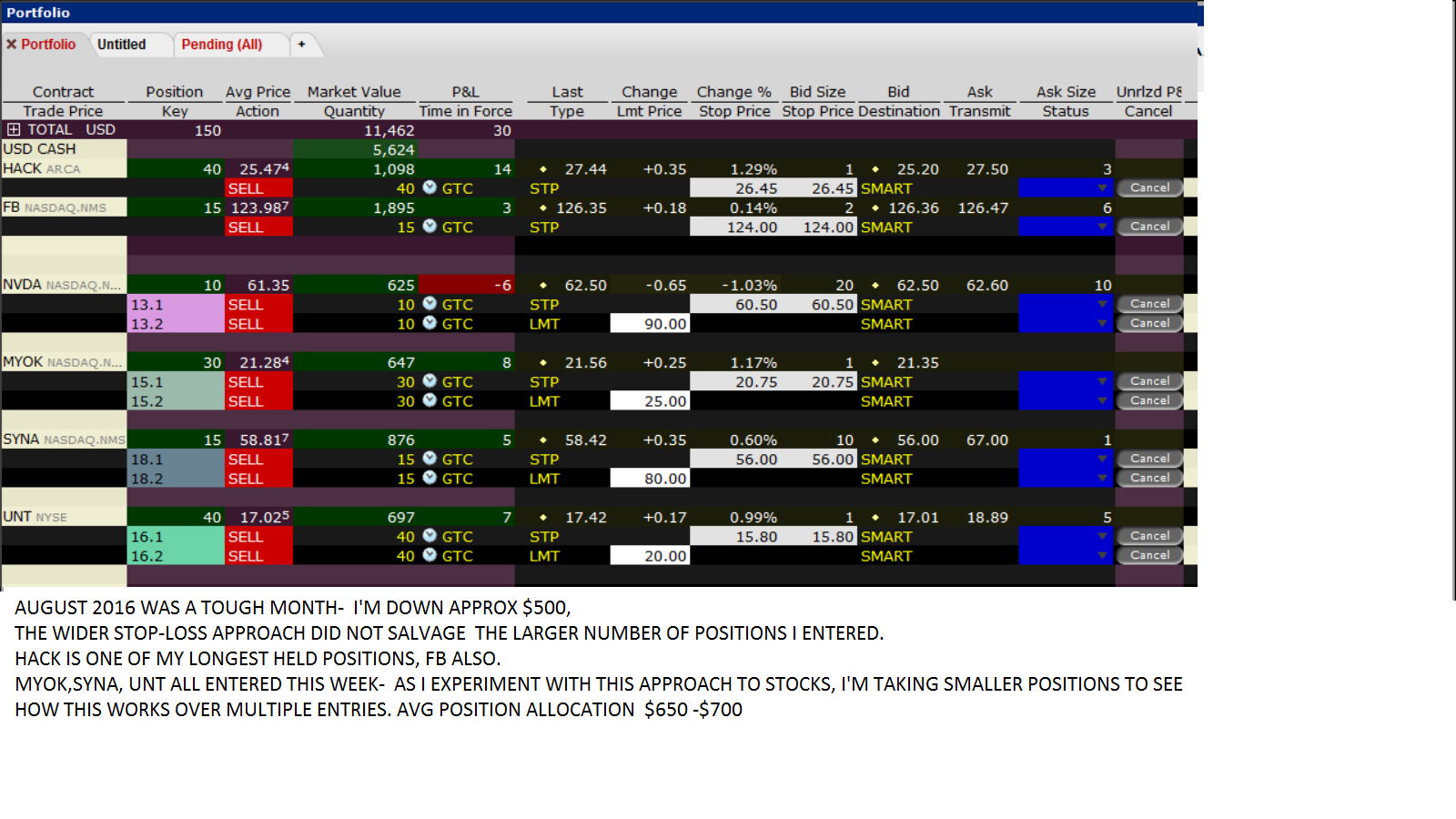

For the past Month of August, I've applied a different focus- purchasing stocks and not ETFs- My work schedule is still such that I don't get much intraday information- or even get home in time to catch a Fast Money take on the day's action. Part of this approach is to locate stocks that have positive momentum, and find a place to get on board- The other part of that approach was to use wider stops to try to be outside of typical volatility swings-

How did that work you might ask? Not profitably. But, this was August. Now it's September- Will still seek momentum players- I'll look at Horse Race picks, and momentum in the Finviz screener- drilling down by sector- I'm favoring technology at present-

I still need to do a trade summary- maybe will get that done this weekend- Part of my larger losses were the focus within biotech-Yes, seeking that bigger pop, but got my knuckles rapped on several positions for large % losses- as well as my position size I had on. Note that this a good example of what happens when one is not diversified across a wider spectrum- and takes that narrower view.

My belief structure is similar to IRA's- You have to be in a position to capture the bigger and longer upside moves. Thus, I want to allow a winning trade room to take that leap higher-knowing that the large winner is the rarity- but it can make up for a number of smaller losing trades.

Another observation- Is understanding that external influences- will affect the chart- So- as Blygh noted - Amba had a large short interest pushing against it-

As Tiarra noted, earnings were coming out and earnings results are a crap shoot. These are both the kind of items that having an awareness of, might influence the decision to buy or sell- or not enter into the trade at all. These had not been a past consideration for me- simply a chart....

The "MACRO" ENVIRONMENT It has a significant influence on the market tide- and most boats flow with the Tide. I think spending the time to view sector rotations gives a clue as to the market's bias- When utilities are bid up to a 24 PE ratio- people are chasing yield and safety- and all aboard the same boat.

By tailoring my positions back to smaller size, It allows me lesser Risk per trade- and the opportunity to take additional trades- Since September is historically the worst month for the markets, I'll consider in what manner I want to tweak/change/ major modify- my rationale for a stop-loss on each position.

Despite the larger losses in the past Month, I feel active and energized- and optimistic- that the end result will justify the process in allowing me to become more focused with my time and limited resources to engage the market. It's a process of adaptation to a changing condition . I feel i presently am at a disadvantage in accessing the source of the influences on the market tenor-but perhaps that's also an advantage in the bigger picture.

Here's the present portfolio holdings in the IB account-

|

|

|

|

Post by sd on Sept 5, 2016 7:20:26 GMT -5

TRADE RECAPS,

During August,for stop-losses I felt I would use a ChaNDELIER EXIT- essentially based on a multiple of Average True Range-

This would allow for some price fluctuation, and ideally stay longer in a trend- Poor market month to employ such an approach.

one option I will be comparing is my typical exit- combined with the chandelier as a wider trailing stop- and only tightening the stop-loss until price closes under the fast ema.

I think holding into earnings was alsoAgilent Technologies (A) Stock Falls on Q3 Revenue, Outlook

TheStreet.com

Kaya Yurieff

August 18, 2016

Agilent Technologies (A) reported soft revenue for the 2016 fiscal third quarter and gave a disappointing view for the current period and full year late Wednesday. a key mistake this month- I will rethink my positions into earnings in the future. Yes, I was cautioned about earnings weakness, but chose to ignore it, thinking the chart would know something better was coming.

Agilent technologies looked to be a good entry on a breakout move higher-  |

|

|

|

Post by sd on Sept 5, 2016 7:59:36 GMT -5

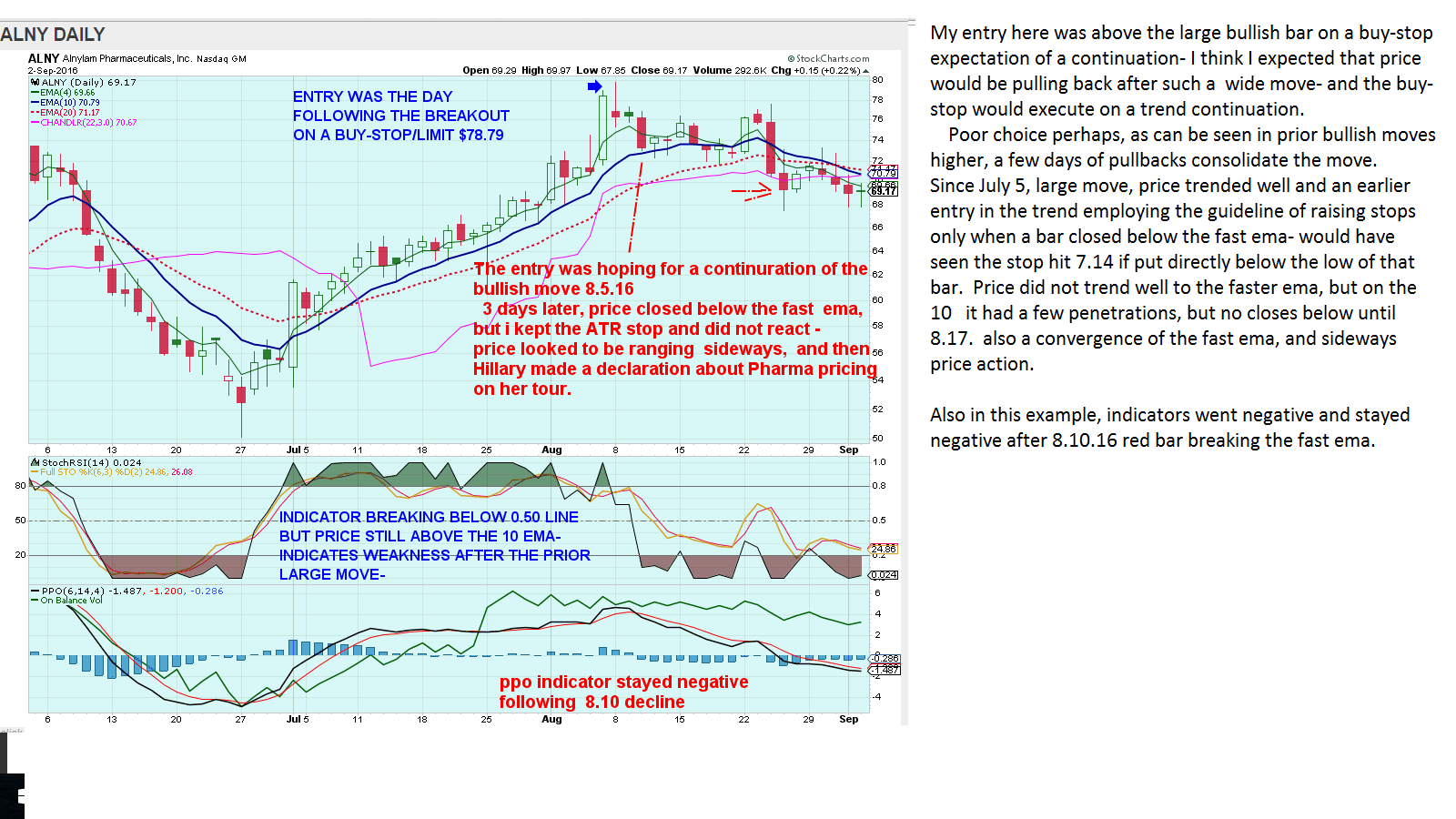

Biotech & Pharma-

Thought I had a good trending position until one of the political candidates - Clinton- talked Smack of the pharma industry pricing.

The biotechnology sector has been hit hard for the first half of 2016, as indicated by the NASDAQ Biotechnology Index being down -23.92 as of June 30, 2016. The sector overall should remain volatile for the rest of 2016, especially as the drug pricing may be a topic of discussion during the election process.

Read more: Top 10 Biotech Stocks for 2016 (ALXN, ALNY) | Investopedia www.investopedia.com/articles/company-insights/083016/top-10-biotech-stocks-2016-alxn-alny.asp#ixzz4JNqxE8nY

Follow us: Investopedia on Facebook

Clinton commented on tour and threw some water on Pharma- much earlier than this recent new article

www.usnews.com/news/articles/2016-09-02/epipen-price-hike-hillary-clintons-plan-to-take-on-drug-price-gouging

So, the lesson to be aware of, is that the "news", or the macro environment, can have a major effect on Investors interpretation of the future earnings of their investment-

We all know that also pertains to Fed policy, political unrests, oil etc.

|

|

|

|

Post by sd on Sept 6, 2016 18:18:46 GMT -5

9.6.16 TRADE NOTE- fILLED PX $123.28 ON A BUY-STOP ENTRY, PRICE RETRACED BACK fILLED DW $102.99 ALSO A SIMILAR BUY-STOP WITH PRICE PULLING BACK LOWER-

Both are simply testing the breakout levels , trying to find support for a move higher- I will likely just use the low of the recent range as my stop-loss on both of these.

|

|

|

|

Post by sd on Sept 6, 2016 18:29:56 GMT -5

I SHOULD ADD THAT there have also been a few winning trades- FB -I have held for over a month, and it finally pushed out of it's recent range to close bullishly higher today.

This was about a 4% + move - and if i could repeat that each month, I would be a happy camper. I am holding this as a position in the trading account, and outside the trading account.

Notice that the 121.95 stop was set After price closed below the fast ema after the entry- I think this type of raised stop on weakness- particularly if price is trending- is a good trailing method - The chart example of FB was not trending following the entry, and was range bound for weeks. With this higher move today, I will allow the trade to put in a continued up move- fingers crossed- and not rush to finally lock in a small profit.

|

|

|

|

Post by sd on Sept 6, 2016 19:20:00 GMT -5

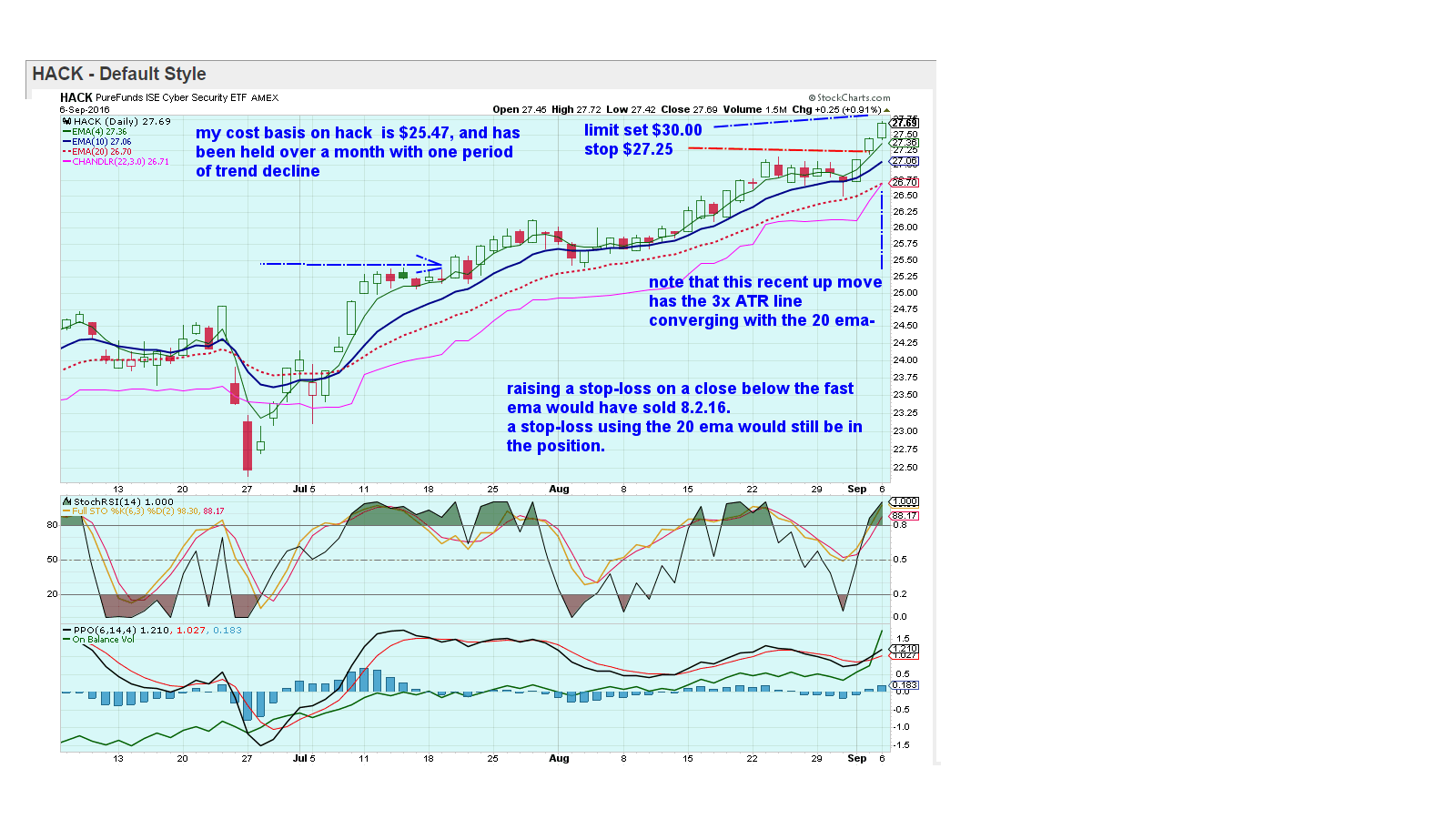

Hack is an etf comprised of internet security companies- It has done well -relatively- in part thanks to the popularity o political candidates with private servers being targets of sophisticated hackers.

As a chart example, it illustrates 3 moving averages and a 3xATR -

Notice that immediately following my entry, price declined and closed below the fast ema. Based on an aggressive stop-loss approach, a stop would be raised for the following day to the low of that sub ema close., which would have been adjusted some 5 -6 days later as price once again declined below the fast ema.

There was almost a crossover of the fast ema over the 10- Which - in retrospect illustrates that an aggressive stop-loss approach here would have had multiple exits and reentries.

worth noting, the wider 20 ema had not been touched, and trailed closer to price than the 3x ATR Chandelier line.

The recent moves of the past few days are indicative of greater upside momentum- which will not last forever- so I have included a Sell limit at $30.00- another 10% higher from here- and a stop-loss below the low 2 days ago $27.25- intending to tighten it until taken out of the trade- Zeus be willing.

|

|

|

|

Post by sd on Sept 7, 2016 19:32:55 GMT -5

9.7.16 Got home early, took a couple of small sized trades- Bought some AAPL and HPE- AAPL had a presentation that initially was viewed positively, and i purchased going into the close on a rising price $108.56 Tight stop at $107. HPE - I had held this for a month earlier, with a 6% gain- one of the few bright stars in August!HPE had earnings?or Guidance, but failed to hold the up move going into the close. I did notice UNT moved up nicely, and i tightened some stops in the port- bringing UNT stop up to my $17 entry.

I also printed out the past 8 month's trades , and calculating % gains and losses-starting with August- BLCM was a biotech that along with ALNY represented the highest % loss for the position size-

Alny position was $1574 and lost -10.6% ; BLCM lost 14.4% but the position size was lower $1,000.00 - both were excessive losses% wise. Some of this was inherently due to price gapping lower, exceeding the intended stop-loss- and market/sector volatility.

I remind myself that this is a testing period of looking to get in on momentum- and not trying to play it "safe"- and hopefully manage to pick enough outperformers. I am somewhat concerned by the seasonality of September as being poor for stocks overall- and the unknown with the upcoming election- and i continue to hear from the TV pundits when i get to see them, that the US market is fully + valued- and any upside is small compared to the downside - Prudent traders would simply roll up their accounts and go watch Andy of Mayberry re-runs for the next month-

I think the momentum approach- will find those stocks, those sectors, that the market goes into as rotation occurs within sectors and industry groups.

That same momentum will reflect the market's rotation, into different sectors, Look at the WEEKLY chart of the normally stable utilities XLU- I heard that the group was selling at an average of a 24 PE at one time.

Controlling and reducing losses will be the goal of this month's trades, while trying to hold winning positions for longer term and larger gains. I will likely table the 3 x ATR for the time being, but i may also be more cautious in how i select position candidates. BLCM looks tempting today, but i'll wait and see.

A friend questioned whether it would not be better to focus and limit one's trading to a few larger positions- and that indeed has merit - Lesser transaction costs, but that also assumes that the playing field would favor those sectors or positions- i think there will be times that sector rotation may throw out the present favorites, and find new players in favor.

Let's assume that commodities- will continue higher- but - how do you hold or trade these with a 20% swing over a few weeks?

This month, the stops will still try to allow price some volatility- but be tighter- As with FB breaking higher- let's tighten the stop - increase the net profit%- but give it a bit of room- to trend higher yet. The same is true with the recent positions i have added- Keep in mind the weekly trend direction- and try to allow for that in the present trade. I may just end up holding a few 50% gains over a few months if i don't get too up tight-

|

|

|

|

Post by sd on Sept 9, 2016 4:48:39 GMT -5

Basic mtls sector in the green - will add to unt and buy-stop for eca.

|

|

|

|

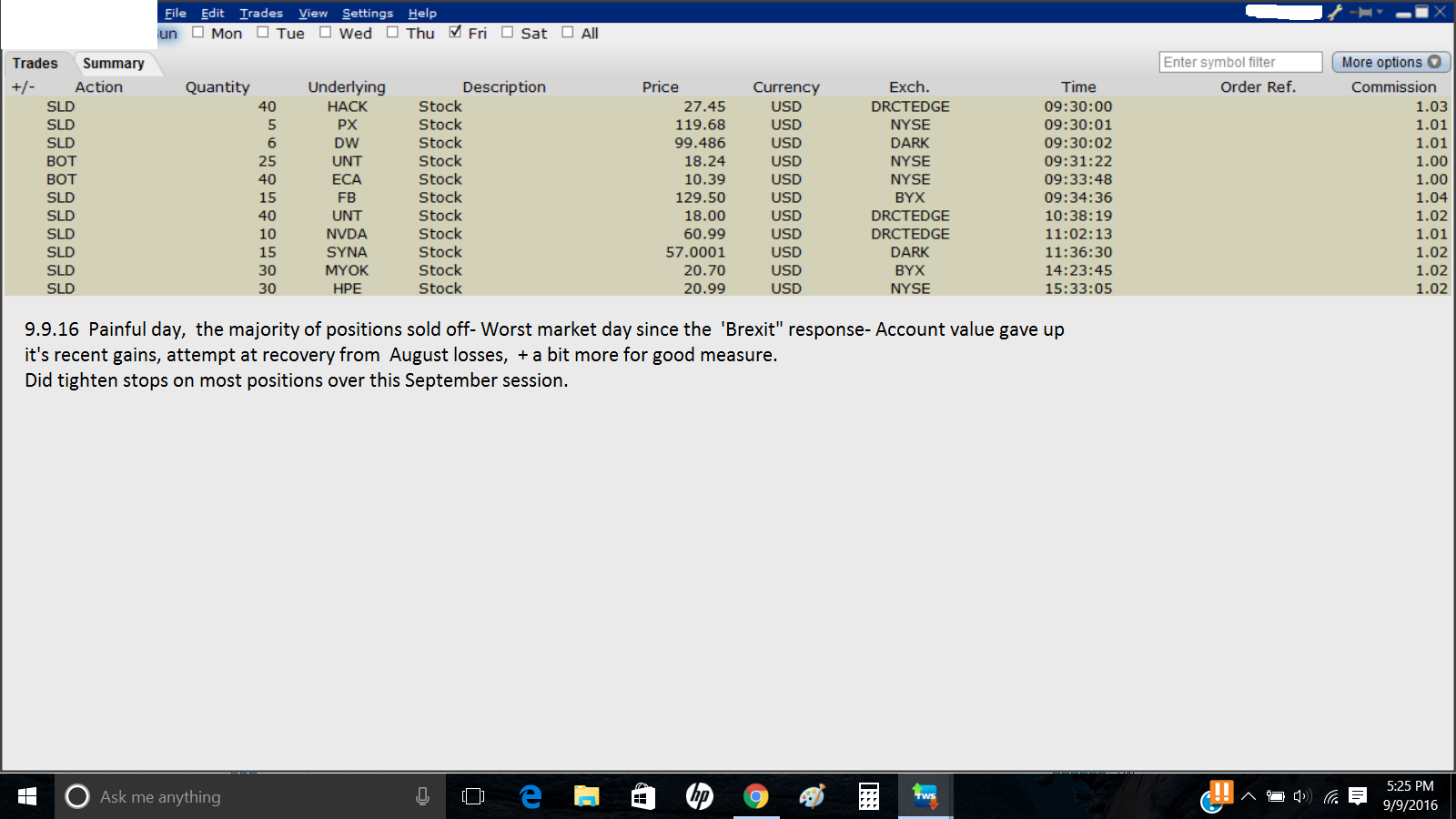

Post by sd on Sept 9, 2016 17:18:58 GMT -5

9.9.16

Anybody catch the license plate on that Truck? 2nd worst sell-off day this year after Brexit! September looks to be starting to live up to it's seasonal "worst month for stocks" history.

While i had recouped about 2.5-3% of my last month's loss,Today I am back down in the woodshed today at a new low- just thankful i had taken the tighter stop-loss approach. The sell-off today was sector wide- over -2% on the major indexes. Seems like Fed is speaking hawkish on going ahead and raising rates sooner-

Still holding a few positions- My order today for The add portion of UNT found my limit and filled- ECA filled, and RDCM came back and hit my lower limit yesterday.

With Brexit, I jumped short thinking there would be successive down days- This time, i won't assume the market will go lower next week.

|

|

|

|

Post by sd on Sept 10, 2016 20:45:10 GMT -5

Tiarra asked the question in the horse race- and I responded- re-political stuff.

Took it out of the Horse race- and included it here.

Perhaps I would be better off betting on the upcoming elections. Any takers or suggestions on that? An electoral count perhaps?

My bearish perspective is the markets are ALREADY highly valued, I would be surprised if the Fed raises rates before the election, and think we will be lower going into the elections-

Just Too much indecision, unless the market has confidence in who will be the winner-

I think Clinton is ahead presently in the polls, and a continuation of the same trend in politics as we've had for the past 8 years would likely be favorable for the markets,as they'd like to see the continuation of what has made this inflated long run bull market. Is the Fed A-political? I doubt it.

Trump is viewed as likely to stir the pot, an unknown in the political arena, and His candidacy would be about making sweeping changes.

I think the market would favor the Devil they know, than one they don't.

I heard an interview with JUlian Assange- Wikileaks-this past week, said he will be producing more email releasees that could have a substantial impact on the Clinton political machine- and said he would release those in advance of the elections once he verifies their authenticity- No one knows what might be contained , or how it would be interpreted, but his release of the DNC

emails certainly had a large impact at the democratic convention.

As to WHO would be better for the US of A? That is the $100,000.00 question. Someone that could get constructive work and reform between both parties accomplished-Someone that could get our government to act and work together-in the best interests of the average American-citizen. Someone that could develop A common sense approach to improving the economy, total energy independence from OPEC and foreign countries that sell to us but do not share our values, someone that realizes we cannot go on and on printing monies and increasing our deficit;

Someone that realizes that Americans depend on Jobs to provide for their family, and that jobs need to developed and stay in this country, and they should go to American citizens and not

undocumented Aliens. That way too many Americans are no longer employed, that are not counted as unemployed, exhausted their benefits, and what jobs are available -need to go to them 1st.

That open borders, unsecured borders, and mass immigration policy- while a humanitarian goal, simply puts an added demand on the social welfare, schools, and makes what jobs are available scarcer for the US citizen that has to compete in this country on a supply and demand basis- Yes, there should be a policy where verifiable immigration candidates are vetted - as long as they are not competing with US citizens in the community they join for the available jobs there- and they are not on public assistance. Much of what has been an "Open Door policy" -allowing millions of people to illegally migrate into this country- is not the fault of those peoples wanting to better their lives- I would try to do exactly the same- but neither the democrats, nor the republicans before ever made a diligent effort to stem the tide- as it benefitted Employers in this country with an undemanding supply of low wage workers that would not expect better benefits or wage increases. Both sides simply looked the other way, and now - a generation or two later, it becomes "recognized'- Bull Hockey on both parties.

My Great Grandparents had to Sponsor other family and friends from Europe they wanted to get to enter this country with a guarantee that they would have housing and a job when they came to this country. At other periods in our history, immigration has had quotas based on the supply that needed to be met to fill jobs, and skills, education.

While i am on this little Rant, I should mention that i have worked with such people that have raised their families here - Their children are now US citizens by right of birth-and these are largely all law abiding peoples that just wanted to be able to find something better than the poverty and despair they had in their home countries. These are a "good" people- good work ethic- and want to embrace the US of A , and assimilate into our fabric.

These people- although here "illegally" have been here for decades- They are the housekeepers, maids, the persons that built your house, that fix your roadways, that tend to your garden, that pick the produce you eat from the fields, Paint your house, mow your grass, reroof your house, and, in this past decade, they are the new individual business enterprises that are showing up in your community, signs on vans, and trucks. These are a people who are - through no fault of their own, those that have desired to travel -some at high costs- danger, financially and personally- to get to this country where they could try to achieve a taste of the American Dream- These are the juans, Jaime, Pablo's that filled a gap - and then proved by their excellent work ethic, reliability, and productivity, that they brought a 'value' to the employer- Unfortunately, they arrived en masse when many mfg jobs were being sold overseas, and construction was taken over - farm and field work- and the American worker was forced to compete with the more menial jobs initially- Supply and demand, costs were kept low as these workers competed, and, in the end, employers found a new and willing resource- with-in many cases- a higher reliability than the American worker - These new workers came from a survival society- so you worked whenever you could or were asked.

Additionally, Social Security taxes were taken out of these worker's paychecks, paid into SS and these monies went into False accounts, and the SSA simply gets to keep the monies (my theory) many of these workers have assimilated into our society- and built families, had children here- and this is now their home- They do not see themselves as transients- They want to embrace this new country as theirs- These peoples deserve the opportunity to eventually being recognized and documented- and to not live in fear that they will be "picked up" and tossed out o this country.

Now, we have entered into a new era and a changed demographic.

Donald Trump is 100% correct- We cannot afford to be grossly naive, and simply ignore that there is a faction in the world today that seeks the destruction and disruption of the society as we know it. We not only need to have secure borders to stop and reduce the drugs , but also stop the Cartels from benefitting in selling passage into the US for thousands of dollars per person. Also, these peoples are undocumented, and need to have a visa and- if they are coming here for work, have a job lined up- not a social welfare request-

Let's get real about the New World- and radical Islamic terrorism-

The Islamic terrorist message seeks to take advantage of those that do not see Our way of life- as including them with Opportunity to a better life.Perhaps this is simply instilled in them from birth, and then through their Youth- We- here in the US- growing up in the cradle of social support- are just soft , in denial, and totally unaware of the ferocity and dedication that is instilled and demanded by that type of culture to do it's bidding.

This is indeed a very real threat we face in the years-and decades ahead- Social communication allows this ideology to be perverted and manifest itself in radical thought that is bent on destructing societies such as ours. These activists are recruited,trained, indoctrinated, and view themselves as soldiers on a holy mission - with a religious reverence that makes personal sacrifice secondary to the glory of their Acting in support of their teachings. This becomes a complex issue- because this type of rhetoric and teaching seeks to engage the individual that is discontented, and to suggest to them their life has a larger "purpose" that will be rewarded beyond their earthly boundaries.

We cannot afford to simply bring in those that may be "Infected' with this psychology and allow them to wander loose in our society- So, there needs to be a very stringent vetting of applicants from countries that are under this influence-

This is a common sense approach designed to protect American citizens - and it is only the Naive American that fails to realize they cannot possibly understand the mentality of someone that is willing to strap and detonate a device whose sole goal is to kill and maim other human beings who think differently from you. WAKE UP! there is no rationalizing with this mentality. It is the weakness in our benign Social Structure - that we seek to "understand' that which we cannot comprehend and we try to rationalize the "Why" they do not see it as we do.

It is too late- Like the movie "Old Yeller" there is no solution that escapes an act of termination- violence- While we find this violence repugnant, realize that the opposition would just as soon behead you while you are groveling on your knees, just because you have a different view of the world than they do.

Proponents of this ideology do not need to be allowed to enter this country and infect those with some social discontent that their solution is the best solution.

YES- I vote for extreme vetting to protect my country from possible insurrectionists and terrorists!

On a final thought- The Republicans have complained about ObamaCare- and i hasve heard they will replace it with something better- BUT what is it ?

Our society- our country- is the only country of some 20 most industrialized countries that does not have included social medicine for it's citizens-

i think this is likely primarily because of the big money made in the healthcare industry. Over 40% of Americans have no healthcare coverage at all, and rates are going very high.

Certainly, if you live long enough, you get medicare and plan B if you can pay- But what about the other half that have nothing?

I can get insurance coverage for myself at $25/week, or $100.00 /month through my employer- Should i try to add my spouse, i will pay over $600.00 per month.

At least the Democrats tried to address the issue with Obama care- The rebublicans have talked it down, but i haven't seen how they will address the issue.!

The truth is, there is a large segment of the population that is now under insured, that has no alternative, and whose options are Nil.

Any of us with monies in a trading account are likely not at this crisis level- but it is a crisis -

Republicans need to get off the bench , recognize the issue that there are Millions of Americans- Thousands of Vets- and they owe the American people a pathway to afordable medical coverage- Why do medical costs increase at multiples o the CPI/ ?

I will move this response to my strategies section.

|

|

|

|

Post by sd on Sept 12, 2016 5:08:04 GMT -5

2 small short orders this am- likely will not fill as they are below the bid/ask LABD, SDS

|

|

|

|

Post by sd on Sept 12, 2016 19:51:59 GMT -5

both orders came back and filled- as the market took solace in some Fed assurances - I heard Yellen reportedly reassured that they are keeping a close eye on the economy and will pay close attention..... Meaning the thought of the rate increase has just been kicked down the road- likely it will be After the elections- because the Fed does not want to roil the markets going into the election.

Both orders ended up stopping out- LABD just 9 minutes into the open, and SDS in the mid afternoon- Both were fortunately small and lower limit orders with stops and netted minor losses- There was a time- and that is reflected in the title of this thread- that my natural somewhat negative Bias would have had me jumping into these short trades with size- and getting my head handed back to me.

Interestingly enough, I am down to RDCM-as my sole remaining position, which I had a limit low purchase price on Friday, and it rallied higher today, along with the rest of the markets.

I have moved my stop up to my $18.40 entry .

I got in kind off late- and missed any TV commentary post 7 pm - looking at the charts, we broke down hard Friday on the Indexes, and did not rally back above the pre-Friday level.

I'm not in a rush to think i am missing out on a large higher market move- The q's need to get back to testing 118, The Spy 219.00- and see where the market sentiment favors-

I'm back to square 1 in terms of the account balance, Still back to down that -5% lost in August-

The potential damage would have been more in this recent decline had i not had tighter stops-

I want to see what sectors/industry groups take leadership in the next couple of days,- I think if OIL prices go higher- The ECA, UNT trades will continue their higher trends-

I think Healthcare and biotech are at Risk of political posturing. Reportedly , the "safe" trades- such as Utilities- are done after August hitting very high 24x PE's- See the industry Group ETF XLU- note the month long downtrend- There are few "safe" places for money to go to .

The 20 year TLT dropped $5 in 3 days, the tbt short gapped higher- these might be worth watching as undercurrents in the market sentiments.

I'll lick my wounds for a day or two- and see what settles out.

|

|