|

|

Post by sd on Aug 14, 2016 20:17:21 GMT -5

This week, I am starting off with several new orders-I've reduced my position size as i am running out of free capitol.

EXAS has been in a multi week uptrend- Spiderman's pick- so i'm buying there with a limit @ $21.30.

I hope to get NVDA at a pullback to $62.00

BLCM was a medical/pharma pick off the Finviz screener- it is basing, i assume it should move higher.

I've got a buy-stop at $20.00 and a limit of $20.50.

Last order is A- on a buy-stop entry if price moves higher $48.40 with a limit of $49.00

As i do this experiment/study- in real time, real $$$- I would hope to accumulate some real world results- ANLY - for example- I knew the price was really extended , yet I chased after it and got filled on the high the following day- In this approach, I'm not holding tight stops- instead, I'm comparing 3x ATR values, prior supports- ANLY will cause me a few rolaids if it declines lower.

I'm also testing my interpretation of the charts- seeking trades that may have or will develop momentum.- I'm scrolling through the Finviz screener, and then looking at the weekly charts to get a 'feel' for how price has been acting. The goal is to not be afraid to climb onto a trend in motion- and then to not get tossed out on a little weakness.

I've reduced my position size lately to get a tracking position $500- $600.00 in these most recent positions, allowing me to choose to try to add 4 positions this week.

If these fill, I will be holding 11 positions. Since i've owned a few of these for a few weeks, I think the goal I am trying for is to hold a trade and not react unless it violates

the predetermined stop-

I'm also using a much wider stop-loss than I am accustomed to - Comparing the stop with "Chandelier Exits- an automatic multiplier of the Average True Range- typically set at 3x the ATR.

I may not follow that to the letter, but it would be useful to have a sense of what a 3x ATR and a 2x ATR would do over the long term.

|

|

|

|

Post by sd on Aug 15, 2016 19:16:45 GMT -5

Monday 8.15.16

I had 2 orders fill today- BLCM buy-stop filled at $19.99 -buy-stop was 20.00- and quite close to the present price range- After hitting my Stop level, price pulled back into the range and closed lower- leaving me with a larger negative value on the trade. A also filled- closing higher- but with no net gain for my position.

EXAS gapped higher-and closed lower than the opening, but failed to hit my limit order. I will leave it standing, and possibly get filled on a further close of the gap-

NVDA did not come back to find my limit order either-closing the day with a Doji near Friday's high. I will allow the limit order to stand, expecting price -as extended beyond the fast ema, should see a potential pullback.

I have mixed feelings about ALNY- and chasing the trade- Seeking upside Momentum trades is fine- but ALNY was a larger position than I will use going forward to sample this approach.

With BLCM- I question WHY did I not set a bit wider Buy-Stop to enter on- Although BLCM has not "failed', it has not succeeded in closing higher than the recent range- and so I find myself 'stuck' with a trade that could potentially drop lower- and still be uptrending.

In this regard- instead of being reliant on a 3x atr value- for a stop- My typical natural inclination would be to sell and take the loss if it goes lower.

Markets all made new highs today- so I have to question "WHY" did BLCM fail to participate?

Clearly, If the 3 major market averages are making new highs- Why am i still treading water? I think a lot of the answer lies in the stock selection-I choose.

We will see what develops ......

|

|

|

|

Post by sd on Aug 16, 2016 8:29:21 GMT -5

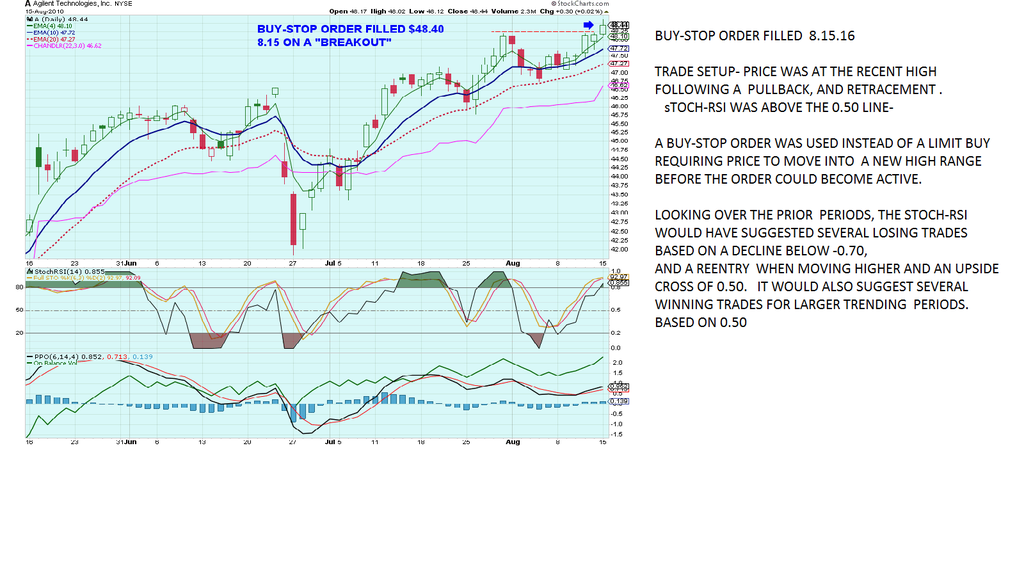

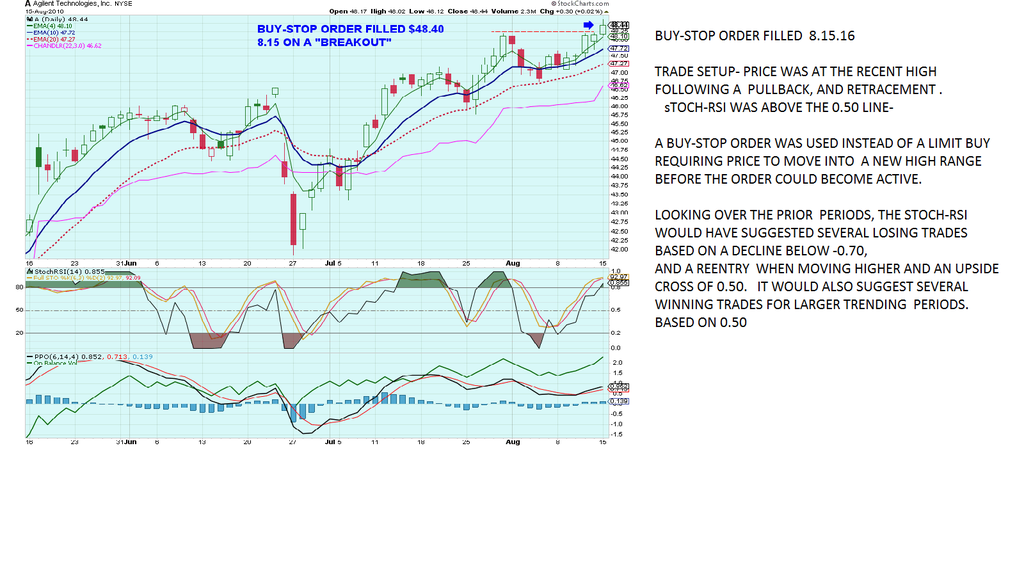

THE AGILENT TRADE- TICKER A

A set up as a potential 'breakout' above the recent high- A buy-stop order was filled 8.15.16 $48.40-

as i review the stoch-rsi -levels- in today's entry as well as in prior periods of the chart, a move above the 0.50 line as a general "rule" to be needed prior to taking a long position

would still be prudent- but -as A shows, it would have also had a series of consecutive entries that filled and then quickly declined- essentially losing trades.

from the left side of the chart, a good trend flattened out and price rolled over -lower- prompting 2 possible entries that would have resulted in losing trades. Followed by 2 periods of entry signals that potentially would be net profitable- but also were marginally weak upside moves-

One method i used to use when watching price action- is to allow price to make only 1 Close below the fast ema, And that would prompt a stop-loss to be raised to the low of that bar-

The goal there would be to allow some initial weakness, and by only reacting to where price Closed, would save a long position from reacting to intraday volatility spikes lower. I think having that leeway when markets are trending higher is possibly needed - since markets are not linear in their trends-

another comparison that I will consider is backtesting whether reacting to price weakness ahead of the indicator break down becomes a winning approach over multiple entries, just don't have the time needed .

/font]

|

|

|

|

Post by sd on Aug 16, 2016 8:32:00 GMT -5

filled EXAS $21.21 on market weakness at the open.

|

|

|

|

Post by sd on Aug 16, 2016 19:13:00 GMT -5

[font size="3"

Several Fed spokespersons threw some cold water on the markets today- suggesting that another rate increase may actually occur in September-

All of the major indexes got the air punched out of their sales today, and generally all closed lower.

From a trading ac count view, i have lost -on paper- 2 % + in the past view days in net portfolio value.

Tonight, i adjusted stops - minding the 3x ATR - and not employing the more active- raise stops on weakness.

If my stops are actually hit , i would expect the overall portfolio to be down approx 4%.

I have to realize that this recent market trend has been ongoing for weeks- without any substantial pullback- and seasonally, this is typically a weak point in the markets as well.

Using the 3x ATR value as a stop seems wide-when prices are trending- but it may only result in wider losses if the market rolls over and declines in the days ahead.

While i have held some of these positions for many weeks now- Hack, HPE 7.25.16 entry..... FB 8.3; SLV 8.1 the UPTREND had already been in play weeks earlier.

So, In fairness, to doing an analysis of a certain approach, it needs to start with the first entry, and follow it through- Just because i took an interest to get involved in the 11th hour, does not mean my results - if poor- would reflect poorly if executed from the earlier time ......

I actually had some positions rise today - HACK- go figure- the Gov't gets hacked ,,,,,HPE has been a winner for weeks, BLCM moved a bit highe AMH also moved higher- and it is showing very wide Bid-ASK af. ter hours-

Despite a few positions gaining, the net is a decline . Well, being a realist- I hadn't filled any losses yet- with the trending market and wider stops- long past due....

[/font]

|

|

|

|

Post by sd on Aug 17, 2016 20:06:19 GMT -5

WELL! REALITY CAME KNOCKING TODAY! i was Stopped out on 2 positions today ( LMT $254; and SLV $18.60 And I bot some NVDA $61.25- as it declined and came back to meet my limit buy.

Another form of Reality is the net port value decline as price starts to approach the wider 3x stop-loss values . I have to remind myself that this is an education expense- and could be deductible if one has a creative accountant (LOL Just kidding) .

I would hope to catch up and demonstrate some of these losses- (Yes, actual $$$) - but the point is not what occurs over a few trades- but what occurs over a larger number of trades over a longer period of time. And, besides getting home too late, i misplaced my mouse- so i feel kicked by the market and crippled by technology.

I remind myself- I but recently become active back into actual trading- with a determination to allocate what time i can between the Day job- to determine a more systematic approach-

Had I started this same systematic approach a month earlier, perhaps it would all be well into the green with this strategy- This is where the value of setting certain Rules ffor entry and exit , and then looking back over a longer period analytically brings a proper perspective as to how valid and Robust a strategy one has. There will be periods where the approach fails, and these will result in portolio value declines- drawdowns. The idea of trading systematically assumes that you can take the emotion and bias out of a trade decision and take each and every trade that passes the entry decision making process. OK- Put the helmet on your head and become a quant trader.

Well, most of us would not be quant traders, but what is our strategy? Have we actually backtested any of it - even against the stocks we may be inclined to buy and perhaps hold?

Unfortunately, we are all susceptible to what is called "survivorship bias" - meaning that the picture of the market today is that of those who have survived- and does not include those companies that failed, or have been replaced- The Churn- or the Turnover- we think we exist in a relatively stable marketplace that has longevity- It does, because it throws out the losers and absorbs the new offerings.

Look up ENRON- When i search for it in Stockcharts- it does not exist-

What has been the turnover in such a limited club as the S&P 500 over the past 20 years? 30 YEARS? bACK IN THE EARLY DAYS, IT WAS ALL STEEL MILLS AND RAILROADS i ASSUME.

I would hope to find a strategy that I could approach investing with that keeps me out of trades in a decline, and puts me in trades gaining in strength. and then to have an exit strategy that would suggest it is time to bow out because the price action clearly dictates the bears are in control.

I think a good starting point will be to follow the market momentum starting with the indexes and drilling down into Industry groups, and then studying where the longer term trend strengths are focused.

Feds gave, a bit of appeasement talk today,perhaps the markets will gain some of the lost lustre of the past weeks if the spectre of a rate hike is conceded to be off the table in the immediate future....

|

|

|

|

Post by sd on Aug 18, 2016 18:26:04 GMT -5

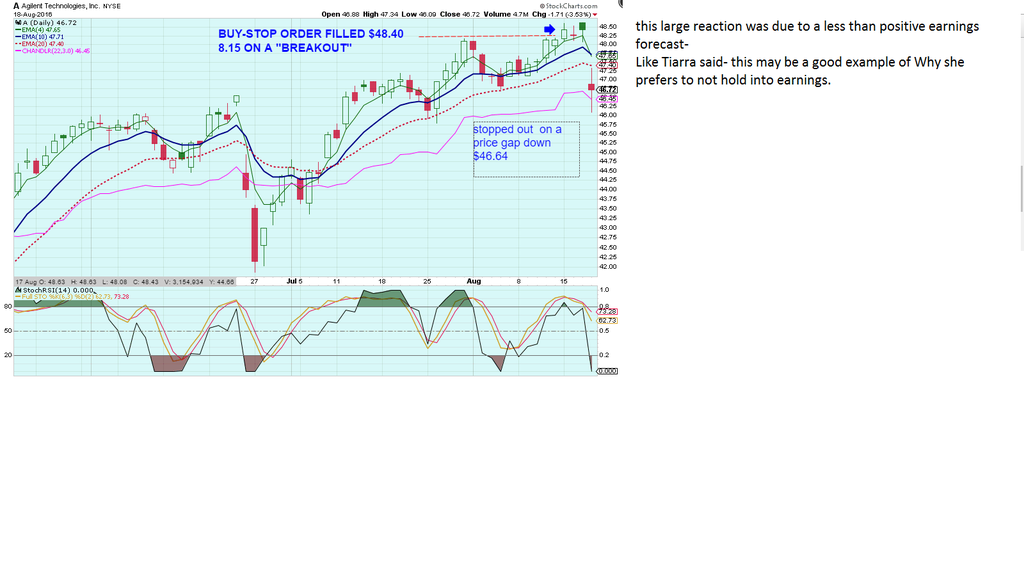

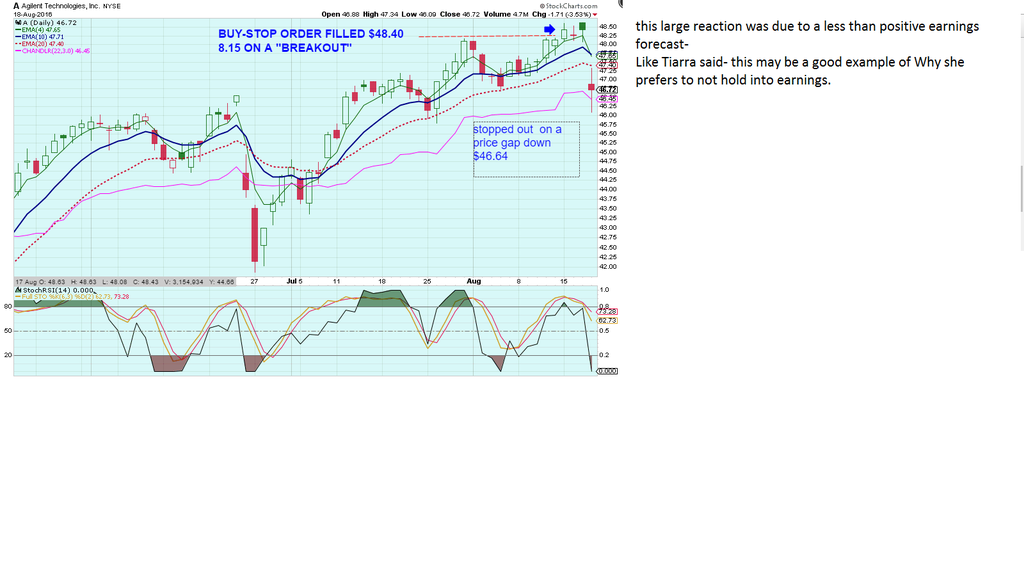

I was stopped out on A today -for a loss- purchase was $48.40, and stop was hit $46.64.

Haven't had time to review the charts further today- will get to that next I hope.

My intent is to print out - all trades- and post as well- when i get the opportunity.

So far, i am not impressed with the results-of this initial test group- Thought they would hold up better- but since i am out of touch with what is occurring in the markets, I can only react

after the fact. Instead of reacting-to a few losing trades, i hope to see the benefit of holding trending stocks outweigh the losers.

|

|

|

|

Post by sd on Aug 18, 2016 18:48:07 GMT -5

OK, A was an earnings let-down- This is why Tiarra has expressed not liking holding through earnings- You get a sharp move -up or down- and all the chart stuff only suggests what was anticipated by the market.

Perhaps Knowing When Earnings will be reported - and taking steps ahead off the earnings- This was a quick 1 day gap down of 4%- on what appeared to be a decent trending chart.

Just one more consideration to add in considering an approach- Fed speak and Earnings....NEW YORK (TheStreet) -- Shares of Agilent Technologies (A) were dropping on heavy trading volume midday Thursday after the company posted light revenue for the 2016 fiscal third quarter and gave downbeat guidance.

After yesterday's closing bell, the Santa Clara, CA-based life sciences services company reported revenue of $1.04 billion, while analysts were looking for $1.05 billion.

Adjusted earnings of 49 cents per share topped analysts' estimates of 47 cents per share.

ADVERTISING

For fiscal 2016, the company sees earnings per share between $1.89 and $1.91 on revenue of $4.14 billion to $4.16 billion. Wall Street is projecting earnings of $1.91 per share on revenue of $4.18 billion for the full year.

Agilent expects fourth-quarter earnings per share in the range of 50 cents to 52 cents on revenue of $1.05 billion to $1.07 billion. Analysts are estimating earnings of 54 cents per share on revenue of $1.09 billion for the current period.

Barclays maintained its "equal weight" rating and $45 price target following the quarterly report.

"The company's guidance implies 1.2% core growth in FY4Q16 on the top line, weaker than recent quarters, though we thought management's commentary around recent weaker global GDP forecasts and continued challenging industrial end-markets was reasonable," the firm wrote in a note earlier today.

About 2.97 million of the company's shares changed hands so far today compared to its average volume of 1.71 million shares per day.

Separately, TheStreet Ratings Team has a "Buy" rating with a score of B on the stock.

prev 1 of 2 next

|

|

|

|

Post by sd on Aug 21, 2016 19:36:17 GMT -5

I think this is a time seasonally that the markets are usually weak- and this recent August bullish movement is not the "Norm" .

Reviewing the sector groups on Finviz, the past week was certainly a decline from the prior week's upside momentum. Some sector rotation is worth noting- as the Fed Speak about market policy and Rates are what this stock market is all about. Going into a presidential election adds another element of indecision-

When viewing the sector groups - ideally, I would see my positions among the winning sectors gaining strength.

This week does not look favorable for supporting many of my positions.

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Aug 21, 2016 21:10:17 GMT -5

My goodness, you've put a lot of work into this. I'm exhausted just reading it! One small issue came to mind, but it's far from your main points. Back testing. The conditions in back testing are often much different that the current conditions. For example, through all of my investing career we have had falling long term rates, roughly 1981 to present. Now with nearly zero interest rates and record corporate and government debt levels we are in interest rate and debt levels never seen before. Is back testing of any value when we are in an unprecedented situation?

Of course if this really is unprecedented, then we have no basis of experience to answer my question. So it's a question I doubt can be empirically answered.

I think about this due to the possibility that these debt and interest rate issues may lead to another crisis that we can't see coming because we've never seen anything like this before. With extraordinarily cheap debt I would think there is hazard governments and corporate boards may feel like they would be dumb not to load up on cheap debt while it's on sale. -ira

|

|

|

|

Post by sd on Aug 22, 2016 21:15:23 GMT -5

You bring up some excellent points IRA- I'm likely not qualified to respond to much of what you question- but i'll give you an opinion none-the-less...My goodness, y

ou've put a lot of work into this. I'm exhausted just reading it! One small issue came to mind, but it's far from your main points. Back testing. The conditions in back testing are often much different that the current conditions. For example, through all of my investing career we have had falling long term rates, roughly 1981 to present. Now with nearly zero interest rates and record corporate and government debt levels we are in interest rate and debt levels never seen before. Is back testing of any value when we are in an unprecedented situation?

Of course if this really is unprecedented, then we have no basis of experience to answer my question. So it's a question I doubt can be empirically answered.

I think about this due to the possibility that these debt and interest rate issues may lead to another crisis that we can't see coming because we've never seen anything like this before. With extraordinarily cheap debt I would think there is hazard governments and corporate boards may feel like they would be dumb not to load up on cheap debt while it's on sale. -ira

Backtesting is - in it's simplest form- a test of one's assumption that A + B = C - or that when such and such an occurrence happens, the likelihood that it will be repeated into the future in the majority of instances- does assume there is a repetitiveness in the markets that can supply a trader an edge that may better 50-50- It is a worthwhile exercise- whether one is a technical trader or a fundamental investor btw. Can backtesting take a trader out of a long position and be -in cash- on the sidelines-certainly- would that approach be effective in larger market moves? It would seem so. If we are in an unprecedented market period- would backtesting serve to recognize -or be useful- in such aperiod?>

bACKTESTING IS BASED NOT ON THE POLITICS, THE MONETARY POLICY- SIMPLY ON THE PRICE ACTION . Since price action is largely distinguished by determining whether price is uptrending, downtrending, or range bound, and deciding to take sn sction based on the time frame in which this occurs.

Your question "Is back testing of any value when we are in an unprecedented situation? " somewhat supplies the answer- You cannot backtest something that has not previously existed.You can just plan to prepare for what the future may unfold- A plan assumes one has a course of Action-

With the unprecedented manipulation of monetary policy, we have seen the markets climbing higher, PE's climbing higher, productivity and earnings arguably failing to keep up with the Buy! Buy!.

As the Title of this thread suggests- One can have a negative Bias- but as long as the music is still playing, and there are chairs to jump into, one can play along- But it is useful to have an exit plan in case the music stops, and all the chairs are taken. A responsible investment approach would include the question of what happens When the unthinkable decline occurs in the future/

Getting back to the usefullness of backtesting- and i appreciate your thesis that a long term investment position outperforms jumping in and out of investments. Largely true- as long as the major trend stays intact-

"NORMAL BULL markets have periods of declines, and then the trend resumes- We have been in an unprecedented long term bull since 2009- over 7 years- and much has been due to Fed QE, and false propping up of the economy - My "BIAS" is that this is the puppeteer behind the curtain- giving us a show, and as long as all the other players in the show go along- all is fine. Eventually, this will likely erode , and that will be a tragic period when-and if it occurs.

You can listen to all of the disaster pundits- predicting that such and such is about to occur, but the evidence is perhaps viewed simply by the market reactions- and eventually - when there is no one willing to pay a higher price- the bid-ask goes lower, and lower, and lower. And we self-correct until Value is found by the majority- Back in 2007/08- it took 16 months of declines and attempted rally higher , with the net decline repricing the markets at a 40% discount from 2007.

I think that it took the average investor that "Held" his positions through the decline- about 6 years to get those investments back to Break even in 2015. A simple weekly TA view would have suggested that the investor could realize price was in a downtrend-

Adding to your closing questions- It's quite possible that we will see - the $USD eventually lose it's sovereign status in the world's currency, and as economic forces in the global emerging economies seek parity with the more affluent nations- The next decade or two may find that the US $Dollar is not the world's safe depository- It may indeed transfer-

The bigger picture is that we are in the midst of a global economic wave, and redistribution of wealth from Have nations to those that want to acquire a basic standard of living that allows their citizens to survive-We are becoming a global economy- and all of the disruptions - Nafta, Export/import imbalances, jobs leaving the US- are just the obvious indications that suggest Change is going to occur over time- as the Wealth transfer will occur from the majority to the NEEDY. It is Capitalism at work- Supply and Demand on a world wide marketplace-

This will not occur overnight- but it seems inevitable as we become more closely linked via technology and market places reacting in moments instead of weeks-or months-

I digress- sorry- IS Backtesting appropriate for today's -and tomorrow's unknown market place?

I would certainly Say YES! There are characteristics of price of Investments that -for example- follow trend lines- One of stockchart's contributors-Arthur- back tested the S&p AND DETERMINED THE 10 WEEK EMA OVER THE 40 WEEK EMA PROVED TO BE A SUBSTANTIAL LONG TERM ENTRY/EXIT/RE-ENTRY - Know whether your Investment is in the uptrend , downtrend- or Range phase-

i THINK IT IS WORTHWHILE -EVEN FOR iNVESTORS- TO EXPLORE THE CONCEPT OF CAPITOL PRESERVATION - BY EXITING SOME OR ALL OF A POSITION BASED ON PRICE WEAKNESS- This would be based on your time frame, and acceptance of Risk- An Investor is willing to accept the greatest Risk- Is that at a 20% LOSS , 30% , 50%, MORE?

I WOULD THINK AN iNVESTOR SHOULD REVIEW CHARTS OF THE PAST DECADE OR TWO - AND DETERMINE WHERE THEY WOULD HAVE PREFERRED TO BE OUT OF THE POSITION AND IN CASH.

We have essentially been sold by the investment community to Buy and hold- The investment broker makes monies each year on our investment- whether we gain -or we lose-

If we have a 40 year horizon before we need our assets, we can take Risks and enjoy the roller coaster ride higher. If we are closer to retirement , we want to protect our monies at greater Risk - Great to ride the Up move, but not so good to hold in the decline-

That's where backtesting- trying to determine when a combination of factors- Trend, price action, amount at Risk- seeks to improve the results of a simple Buy and hold approach.

Here's the dig- A back test should include a wide sample- over a longer period of time- And determine if the results would improve a Buy and hold approach.

Final comment- YES- i AM TRYING to put some detail into outlining a more structured approach -around a daily time frame. I am limited by other obligations - Day job , home projects, etc

but i think there is a lot of value to be recognized starting with where price resides on a chart-

Is it trending Higher, Lower? or in a sideways consolidation? Look at it on both the daily chart, and -for greater perspective- the Weekly chart.

Is it climbing higher above a fast moving average, or is it declining below? This is basic TA worth taking note of- and for Investors- a Weekly chart should do.

THANKS For posting- This is a learning process-feel free to comment more! -- Hope this reply makes some sense- had a number of interruptions....

|

|

|

|

Post by sd on Aug 23, 2016 20:18:48 GMT -5

I want to illustrate how one could do some "backtesting" to try to compare the advantage of buy and hold-Invest- or to consider the need to take some action - exit the position and stand aside until the position appears more favorable. This is an impromptu example- and _ I hope to challenge Ira's thesis that a straight forward Buy and Hold wins over the long term.

and- for this example- I will choose to pick on IRA's horse LMT-

the chart goes back 20 years- it's a monthly chart, and the premise is that -by employing a couple of moving averages, a savvy investor would capture the majority of an uptrend, and be out of the position during the majority of a period of decline. Because it is a monthly chart- and the moving averages are based on that time frame- there are relatively few trades- indeed there are periods extending YEARS- that no long trade is "allowed", because the Fast moving average is below the slower moving average.

What i want to communicate here, is that Long term Investing - just Buy it and hold It- may not be the most prudent -or profitable approach. We are lulled by an overextended bull market

into thinking this is the "new normal", when it is anything but 'Normal" One could simply say -"I don't trust this" and hide in cash- but the majority have to seek some return for their investment dollars- and so the stock market beckons. What can one do to try to determine a method to "protect' their position? Look back in time,At a chart, and determine when you would have preferred to be long a position, and when you would have preferred to be out of a position.

Consider that the Investment adviser would suggest that the historical market return is 7% per year average over decades- But fails to inform you that in one year price may drop 50% and in another year, markets may rally 30%. They are not lying, the "average" market return simply equates to

In this chart example of LMT going back 2 decades- Those declines in the monthly chart represent declines of 70%, 50%, 40%. and the period to recover back to the prior high preceding the decline is over 3 years minimum.

This example is not really "Backtested" or Optimised- It simply starts with 2 moving averages- and the premise that if price weakens enough on the monthly chart to cause the fast moving average to drop below the slower moving average, a new downtrend may be occurring- and an exit is required-- Sell , and sit on the sidelines - Wait for the fast moving average to close above the slower moving average, and reenter the trade long.

What the previous decade brought were periods of large market swings in that decade, and it takes YEARS for price to recover to the prior highs.

Note that in those periods, the moving average crossover exited the trade below the recent highs, and reentered at a lower price- Essentially selling near the higher point in the prior trend, and taking the profits to purchase more shares at a lower price.

As noted earlier, This is an Impromptu chart and hypothesis- that suggest employing some comparative technical indicators- basic moving average crossovers- Would substantially reduce the potential drawdown compared to Buy and hold, and increase the overall profitability of the position.

Note that this is a MONTHLY chart, and may be appropriate to Investors with a cast iron stomach-

In most of the trading world, position traders likely would employ Weekly charts, as using a faster time frame reduces the allowable % of price movements - and the possible greater loss that a monthly chart time frame imposes.

Since i have suggested the TA application of moving average crossovers- note that a monthly crossover may reflect a 20% price movement, a weekly crossover would reflect a smaller % , and the daily chart even less.

For traders to 'find' their comfortable niche- in their approach to the market- is to Know where your comfort level is violated when a position turns against you.

In my recent experience of "allowing" trades to pullback based on some ATR value - exceeds my normal comfort zone of a quick stop-out on weakness-

However, i hope to not be shaken out of a winning trade on what is minor volatility in the marketplace.

Previously, i tended to employ a faster 2 hr chart view - which generated more buy and sell signals- but i want to seek the larger gains that can be found by holding longer- as long as the trend is intact. It has tested my resolve during this recent period of market weakness.

Back to the LMT chart - 20 years- It seems obvious that a simple ema cross approach would have exited a trader on initial weakness, and kept the trader out of the position until some strength had resumed a move higher- but at a much lower price. This is the basic view of trying to determine when a TA approach can bring value and improve the results of the long term investor.

Caveat Emptor- This is not a 'suggested approach' - but it certainly illustrates WHY an Investor with a long term time frame might choose to employ some TA to exit on weakness, and step back in on strength.

Eventually, this long term-relatively steady uptrending market will have a pause, and then a decline- similar to the prior decade. How one positions one's self- ride it out- or sell on weakness and purchase more for less dollars..... Both approaches carry Risk- but i'd rather take a calculated Risk -based on 2 decades of past pric e performance- Than listen to an Investment adviser suggesting to Stay the Course- He has no crystal ball to what may occur. We have the price charts going back years- different markets, different environments each, but they hold a common reaction of substantial decline that one can react to for their benefit.

JMHO of where TA brings value worth further study.

|

|

|

|

Post by sd on Aug 24, 2016 19:57:10 GMT -5

8.24.16

Got home , fired up the computer about 7 pm to see how the markets fared today- Solid RED in the positions, with almost a $300.00 loss on the day- notably in the positions in the healthcare/biotech sector.

looking to find the "cause" of such a large across the board move, found this tidbit of a news release about HiLLary- but it was enough to toss cold water on the entire market-

suggesting that the market psychology is indeed fragile-

"Markets watching out for Janet Yellen on Thursday, and now also Hillary Clinton

Patti Domm | @pattidomm

36 Mins Ago

CNBC.com

5

COMMENTSJoin the Discussion

Stock traders have been watching out for Janet Yellen all week, but they were blindsided by Hillary Clinton.

Fed watching should continue Thursday, as traders digest durable goods and jobless claims data ahead of Friday's Jackson Hole speech by the Fed chair. But they will also be licking their wounds after Democrat Clinton punctured the health-care sector with one powerful tweet Wednesday afternoon. The IBB Nasdaq Biotech ETF fell 3.4 percent, after Clinton tweeted that there's no justification for the high prices Mylan is charging for EpiPens."

BLCM stopped out - the 3x ATR stop did not save the relatively large loss- and ANLY dropped sharply from where it had started the week-

I tweaked my stops on the remaining positions- and it would appear that my "experiment" will be a net costly one in this non-trending market.

While i am net positive with gains in FB, HPE, HACK, those gains are relatively minor compared to the declines of those other positions-

I am not whining here- as i am willing to spend a little in the pursuit of a strategy - that i can replicate-

Note that I intentionally took some trades in Riskier sectors- Biotech is known for it's volatility and also potential reward-and - I have been given a market lesson here about how sensitive the markets can be and- pushed by political rhetoric - the entire sector sells off in reaction. Since the election is but a few months away , such commentary by Clinton suggests that she would favor regulating the space to be "Fair" - which means limiting price expansion by the pharma industry.....

What this also illustrates, is that there is a definite higher Risk in some market segments over others.

In seeking a higher reward, one also can expect the potential for greater volatility- and that should be factored into the position size one enters into in the trade.

The fact is, while all of my positions declined compared to the prior day, The market Advance/ decline was a dismal 26% advance, compared to a 66% decline- and the $VIX -volatility indicator increased +8% today from complacent lows.

So, as i started seeking some "real world results " 8.14 post- it didn't take long for the Real to make itself known!

I think my expectations in allowing the wider ATR stop was that it would allow price to pause and move sideways- but does not allow a lot of downside/break of trend movement.

As those levels are approached, and hit, the net decline in the account value is a wake-up call- Dropping $300 in one day is an attention getter on this-11k account. OK, now

That exceeds a 2% loss for the account on a single day, and the overall exposure is still greater than that single day loss.

Worth mentioning here is that even systematic strategies will have periods of decline- and net losses- That does not mean the strategy itself is invalid- it simply acknowledges that there are winning and losing periods, of which a robust strategy will eventually exceed the losing drawdown periods-

Here's the issue- suppose the drawdown period lasts for more than a few weeks- let's say it extends to a few months- of non-trending sideways chop - which occurs about 30% of the time-A period of successive declines and portfolio hits could do a lot of portfolio damage- and psyche damage - as well.

In reading the market Wizards- it was noted that some of the Wizards kept to their strategy despite very long periods of declines-and eventually, their strategy came back into favor and yielded market beating performance. These were trend traders i expect, that applied a somewhat systematic, rules based approach to the markets.

Some had long periods of declines, but 'stuck to their approach' and eventually were rewarded. i think they had "Deep Pockets" and Investor monies , and were not trading smaller individual accounts.

let's assume that most of us here are trading individual accounts that could stand to become larger.

How do we get that account to become larger unless we apply an approach that we can analyze, and repeat, analyze and repeat, and make refinements and adapt to changing market environments.

Will we outperform the single Buy the market Here, and Hold?

|

|

|

|

Post by sd on Aug 28, 2016 7:51:20 GMT -5

|

|

|

|

Post by sd on Aug 29, 2016 20:06:38 GMT -5

8.29.16 wAS FILLED ON A LIMIT bUY MYOK. Missed getting a lower fill on Amba- earnings this week- so that may not be a bad miss.

Looking at UNT- it had several strong up moves in the prior weeks- Getting a wider perspective with the Weekly chart,

Looking at the weekly, Price has generally been in decline for over a year, the one serious attempt to reverse higher failed to hold , and that level becomes a Supply & Demand level- Where a lot of price exchange occurred, that the bulls were unable to absorb the Supply and sellers unable to force prices to be offered higher-

We are once again, at that same price range, and it is interesting that we have hit a ceiling here for a few weeks in a row. - This is the supply being offered, and the Demand buying, but somewhat timidly at this level. Prior Buyers that purchased during the decline here are trying to get their money back- Eventually, the equilibrium between what the sellers ask, and what the Buyers are willing to pay- will work through, and price will either decline or move higher.

Since this level represents a well-defined area, there is a lot of potential upside room if this area is broken through.

I think there are 2 ways to view price in a range stopping at a resistance level. You can Buy the price action when it is near the low of the range, and it gives a lower Risk stop-loss,

or you can consider buying once supply is exhausted, and price demand moves prices higher. In this example, it needs price to close above the prior supply highs-and -even then, it is open to a retest to verify that the demand will exceed the supply.

It is worth noting that UNT appears to be recently trending to the upside on the weekly..... which adds substance to taking the Daily trade.

|

|