|

|

Post by sd on Apr 22, 2011 21:28:33 GMT -5

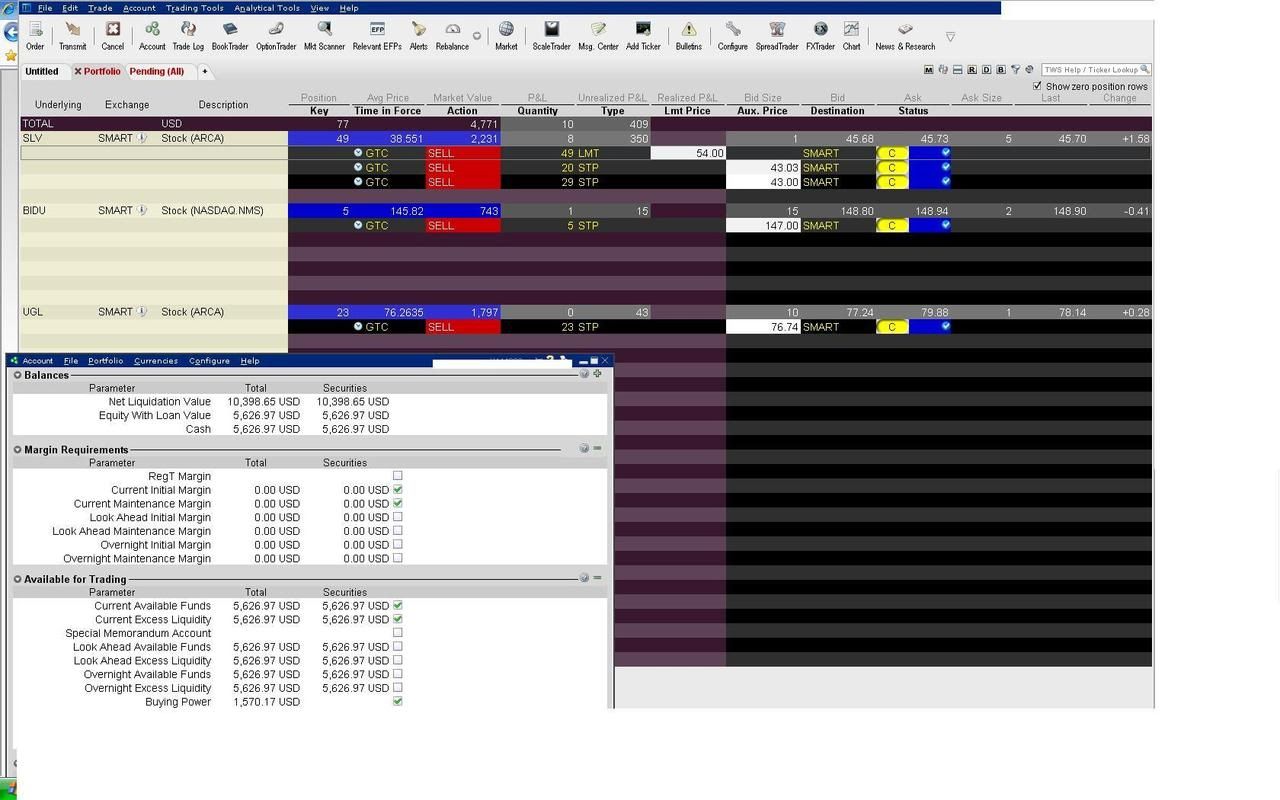

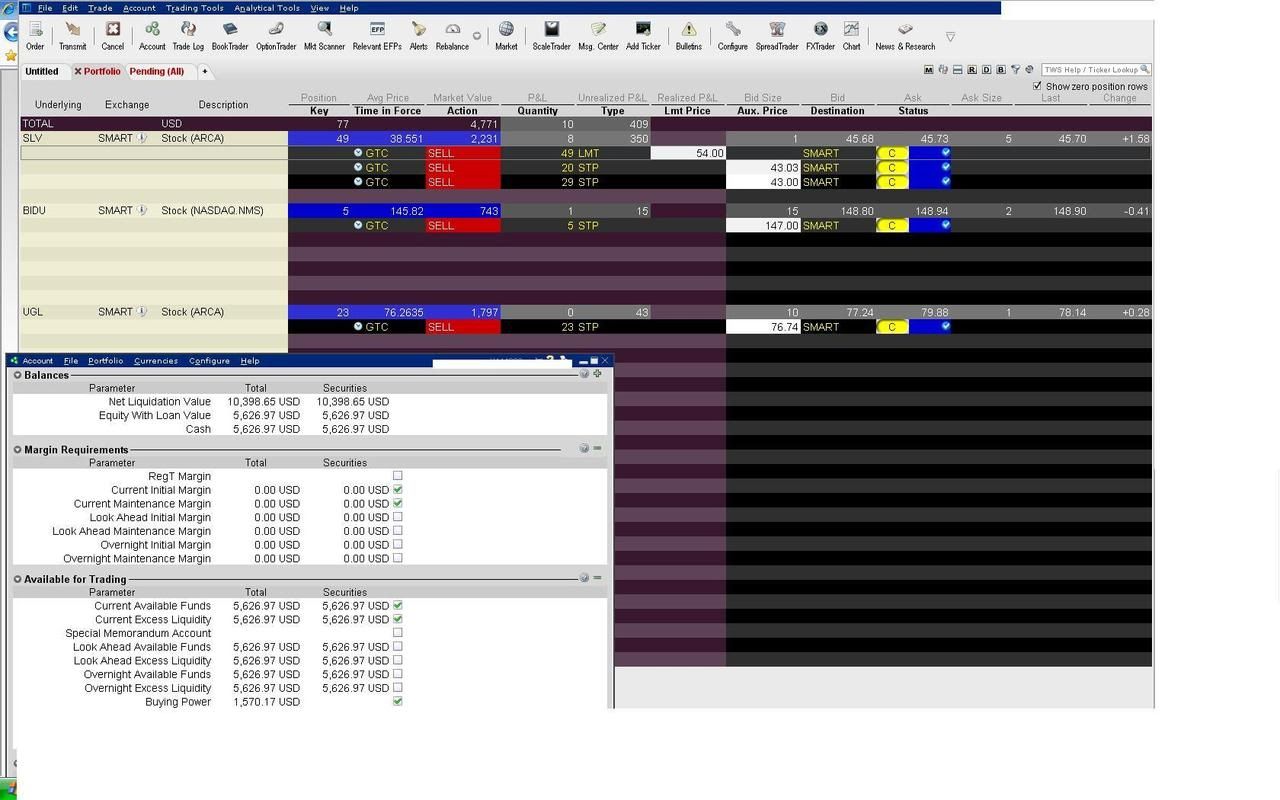

Trade update- Own SLV, BIDU, UGL

I've managed to see my account moving higher lately, and perhaps that's because i don't have the time to meddle much during the week. I've kept my stops tight, losses small, and netted some smaller gains as well. Momentum trades work until they don't.

Silver is a momentum trade, as is Gold.

I've traded SLV previously (wish I had stayed with it ) and went back to it again 4-6 even though it had moved above the recent consolidation. I also added UGL as a leveraged Gold play.

Silver and Gold are being run up in price as we continue to have a weak dollar- This trade could end by a few words from the Fed saying they are going to put our fiscal house in order. That not being likely, the recent price action is still over extended.

Since it is in momentum -high volume mode , it is fair to assume there will be a pullback again - and a potential buying opportunity to reenter when I get stopped out. I would think a 10-15% pullback to be within the norm on moderate profit taking, particularly after this recent run higher.

I went overweight the position a few days after entering it on a price pullback that did not hit my entry stop, and the following upmove higher. It gave the opportunity to enter with a close stop-loss due to the low of the pullback. While on a 60 minute chart, this pullback jumps out , On a daily chart it was simply a couple of red price bars that didn't violate the daily uptrending ema. I don't have time to post a daily chart, but check out the increasing solid volume bars on the daily, and then check out the 60 minute chart volume bars. When it sells off- it could have as much momentim down as it has up.

|

|

|

|

Post by sd on Apr 23, 2011 8:00:01 GMT -5

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Apr 23, 2011 22:23:07 GMT -5

You note "When it sells off- it could have as much momentim down as it has up." I've been wondering if you may go with an inverse on silver when the momentum turns down. ZSL is leveraged short silver. It would seem to hold great potential, especially if SLV has a final parabolic up surge. I love to see your work. Thanks for posting it. -ira

|

|

|

|

Post by sd on Apr 24, 2011 19:49:10 GMT -5

Thank you IRA

"You note "When it sells off- it could have as much momentum down as it has up." I've been wondering if you may go with an inverse on silver when the momentum turns down. ZSL is leveraged short silver. It would seem to hold great potential, especially if SLV has a final parabolic up surge."

Good question- and I'm glad you asked it-

It's something I need to consider and have not formulated a game plan.

When we think of an over extended stock reversing, we have a picture of what that day will look like- a spike high candle with price subsequently selling off lower in succeeding days, never meeting that high again. That spike high represents the "TOP" How far will that be from a possible entry?

Quite honestly, with my trading time relegated to an hour or so in the evenings, I'm not willing to Risk a lot to gain a lot-

Most of my trades have a Risk to Stop of under 5%- and usually ideally closer to 2%. A high volatility mover like AGQ and ZSL logically require additional stop-loss room just for "normal" volatility swings. AGQ has gone from $ 120 to $340 in just 3 months- almost 300%- Could the reversal also yield similar gains? Not likely.

I consider myself a 'conservative' in my trading. My Fear of loss also limits potential gains from too early profit taking and stops set too tight.

AGQ and ZSL, , both stocks can move 10% in a day and then give it back. I think it is smart to wait for a decided move and confirmed change in direction. Note that ZSL made a 20% rally in January and then gave up on the reversal.

Money could have been made there- or lost- depending on one's time frame and appetite for Risk. The faster chart Risks less and is more likely to get hit volatility wise.- In Betting on a reversal of trend, this is likely not a bad thing.

Will I try such a trade? While I went long SLV , I choked on AGQ- and did not take that trade. The SLV trade met my limitations for potential Loss (Risk) while the leveraged play in AGQ exceeded it. I now wish I was in AGQ, but I actually sleep quite soundly with the SLV trade.

i "THINK" a silver reversal will be a choppy trade - Not a climatic one. There's a lot of politics involved there- with the US Fed manipulating the perceptions of the market place.

WHEN the reversal trade is presented, I will take a chance only with a very tight stop -loss- I would not expect a V reversal to occur.

Thanks for presenting the question-

SD

|

|

|

|

Post by sd on Apr 24, 2011 20:05:05 GMT -5

A very busy weekend - garden, day at the daughter's remodeled 1800's house- very satisfying all-in all. My positions are SLV, UGL, and BIDU- Typically I would look for stocks making new highs to discern sector strength and possible candidates. No time this weekend-SD  |

|

|

|

Post by sd on Apr 25, 2011 19:30:46 GMT -5

Silver may have hit a quick momentum peak today- and hit $49.92 / oz . There is Fed speak this Wed, and that makes the market indecisive. The bet I am hearing from one market pundit on Fast Money suggests there will be a sell-off leading up to Bernake's speech, and then the trade will be back on as being fairly valued. Again, Silver and Gold are tied to a dollar that continues to weaken. My present positions are trades, and not beliefs. Therefore I will likely review the charts, and then raise stops. Here's a chart of AGQ- the leveraged Silver play. Note that price opened at the High, and then struggled to close modestly above yesterday's close- On extremely high volume. This may be the equivilent of the top I was anticipating that IRA asked about. The leveraged short trade- ZSL looks like it's making a base.  |

|

|

|

Post by sd on Apr 26, 2011 19:48:52 GMT -5

Indeed, there was gap down selling today, and 80% of my slv stopped out. I fully anticipate slv to retrace even further tomorrow and take out my remaining 20% position. Unfortunately SLV did not reach my stepped up limit sell order. Where will SLV go? I hear arguments on both sides- but the biggest influence - will be what the market "Thinks" the Fed will say- There could be a sharp push lower tomorrow , and I think that $39 is very likely, and why not expect an additional 10% to say $36.00 where price has some prior support. Conversely, one could try the inverse, ZSL Ira mentioned. and I may enter a partial trade 1/2 position size .($750.00). Will attach a chart should I take that reversal trade. SD  |

|

|

|

Post by sd on Apr 27, 2011 20:32:35 GMT -5

Wow! was I wrong in my perception of what the market "would do". Glad I did not try the Zsl reversal against the primary trend early.

Bottom line is that the Fed is not going to raise rates any time soon, the dollar will likely continue a controlled decline0 a benefit for the stock market.

Silver bounced back to meet the prior high seen 2 days earlier. I still hold the partial position.

my Bidu position stopped out at my entry cost

I am holding over 9k in cash, 5 k available for trading.

Take away- the same reasons exist to own gold this week going forward as last week.

Perhaps Silver as well.

I will reenter UGL . The leveraged Gold plaY.

i know I don't have the stomach for AGQ. How can one consider a $50.00 price swing to a stop?

I am long UGL $80.60 with a daily based stop $76.00.

Long Slv $47.20-

Overweight both positions- SD

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on May 5, 2011 22:08:06 GMT -5

I saw on the horse race board you were stopped out on UGL. I'm curious if you got into ZSL. I'm hoping you did so you can share your strategy. After getting whacked Monday on my SLV, I sold it and bought ZSL. The timing wasn't great, but the Wednesday and Thursday gains have been nice. But it's so volatile I know it's just a matter of time before it presents a challenge to hold it or get out. I'm hoping you're faced with the same question. -ira

|

|

|

|

Post by sd on May 11, 2011 21:58:10 GMT -5

"I saw on the horse race board you were stopped out on UGL. I'm curious if you got into ZSL. I'm hoping you did so you can share your strategy. After getting whacked Monday on my SLV, I sold it and bought ZSL. The timing wasn't great, but the Wednesday and Thursday gains have been nice. But it's so volatile I know it's just a matter of time before it presents a challenge to hold it or get out. I'm hoping you're faced with the same question. -ira" I apologize for the delay in responding IRA- I'm working 6 days a week, and have not had time to focus on the market, nor get on the computer daily.Didn't see your post until tonight. In my trading account, I actually had stopped out and gone to cash last week, and also had transferred a portion of my retirement monies into a money market fund . Just very busy, and juggling priorities. In response to your question- as per strategy- While i missed the ZSL trade last week, it rallied for 4 days, went flat for 1 ,and then sold off sharply. and today presented another indication - prompted by market movers and increased margin requirements- that there may be another move higher, as commodities sell-off and the dollar gains some strength. Much of this move is manipulated by market news- increased silver margin requirements by the CME as today's example. I would say that the best approach in this market would be a short-term approach, sell on signs of trend weakness- Positions that are leveraged like AGQ and ZSL magnify the gains as well as the losses. A trend trading approach can get chewed up- A more defensive strategy would be to take partial profits early, and get sharply defensive on any sign of weakness - Just my opinion- but wider stops is not a strategy. Therefore, i'd advocate studying the price trend on a faster time frame chart - a 60 minute- or 30 minute, I see using a faster chart as the only way to reduce the Risk in a volatile stock like AGQ or ZSL. On a leveraged position, the wide volatility ZSL or AGQ that occurs when the trend move pauses is too high a Risk- particularly guessing a reversal of trend. Tomorrow I'm buying- with buy-stop orders and set stop-losses in place. Chart attached- I may well be wrong , with the market digesting this information and discounting it...... We won't know until it happens. Would like to analyze this type of high risk- high reward trade going forward- Good Luck! Sd  |

|

ira85

New Member

Posts: 837

|

Post by ira85 on May 11, 2011 22:59:47 GMT -5

No need to apologize for slow responding. This thread is for you to illustrate your strategy with your picks. I don't expect you to take the time to give advice. But I certainly appreciate it. I got into ZSL May 4 @ 19.47. No where near the bottom. I held it over the weekend and suffered a nasty drop when it gapped lower on the open Monday. It went down from there. But I could see SLV was having a low volume rally, so I gambled it wouldn't go far. I saw all the paper profits vanish by Tuesday, but I held on due to the low volume. Today some relief. Back in the black. The logic of your suggestions seems spot on. I gambled and held on through the last dip. I think I'll sell on weakness and not take much risk now. Of course holding overnight has some risk. But hopefully this will be more than a one day move. Thanks again for the analysis. Great job. -ira

|

|

|

|

Post by sd on May 12, 2011 21:16:00 GMT -5

"I got into ZSL May 4 @ 19.47. No where near the bottom. I held it over the weekend and suffered a nasty drop when it gapped lower on the open Monday. It went down from there. But I could see SLV was having a low volume rally, so I gambled it wouldn't go far. I saw all the paper profits vanish by Tuesday, but I held on due to the low volume. Today some relief. Back in the black. The logic of your suggestions seems spot on. I gambled and held on through the last dip. I think I'll sell on weakness and not take much risk now. Of course holding overnight has some risk. But hopefully this will be more than a one day move. Thanks again for the analysis. Great job. -ira " Hi Ira- Not for me to necessarily give advice, just share what my experience is- Leveraged momentum plays can turn on you very quickly- or make you nice gains if you get on board at the right time. You obviously analyzed the underlying and chose to hold on. Glad it worked it's way back into the black, but I'd feel much better to see a decided up trend as the prior week had for 5 or 6 days. I see ZSL is now being quoted lower in after hours,. The wide volatility that can be within the norm just makes me cringe, because I can't allow myself to possibly sustain what may be a normal volatility price swing in some of these issues. However, the potential for a large % gain is also there. I have been reluctant to expose myself to that level of Risk, and will only do so by having stop-loss measures in place at the time of the order. My style is to take an entry predicated on the assumption that price will behave and move only primarily higher. Therefore , I often favor buy-stop entries where price has to move up before I am filled. I had confidence though in taking the ZSL trade today, as I expected some follow through, and was just disappointed- It started off right, but quickly lost momentum, and had a 16% price swing high to low today. I split my orders on ZSL, with different entry limits and different stops- One position sold at a small gain,(unintended low limit sell) the other hit my stop-loss- On a 2k trade I lost about 1% or $23.00. If I consider the market may well be getting less trending and more choppy, I'm inclined to take some profits quicker and cut losses sooner. Take a look at a 60 minute chart of ZSL- Note that from May 2 to May 5 -4 trading days , price moved from 15 to $24 (60%), and then dropped to $18.50 in just a couple of days. Those 4 days trended sharply higher, closed at a high and then sold off fast with a 20% FALL /gap down open after only 1 day of failing to make a new high. That's serious Risk, that stop-losses don't protect you from. In my recent trading approach to the markets, I have split the positions with different stop-loss levels as well as taking some profits at different levels. I like this approach , because I end up reducing my Risk with at least 50% of my position at a tight stop if the trade fails to go as anticipated. I also raise stops as the trade progresses. Maybe we should be thinking in terms of 3 day trades instead of 3 weeks in this changing market environment? Looking at UGL with a $78.50 buy-stop and a $76.00 stop-loss as my next trade- Good Luck! SD I got into ZSL May 4 @ 19.47. No where near the bottom. I held it over the weekend and suffered a nasty drop when it gapped lower on the open Monday. It went down from there. But I could see SLV was having a low volume rally, so I gambled it wouldn't go far. I saw all the paper profits vanish by Tuesday, but I held on due to the low volume. Today some relief. Back in the black. The logic of your suggestions seems spot on. I gambled and held on through the last dip. I think I'll sell on weakness and not take much risk now. Of course holding overnight has some risk. But hopefully this will be more than a one day move. Thanks again for the analysis. Great job. -ira I got into ZSL May 4 @ 19.47. No where near the bottom. I held it over the weekend and suffered a nasty drop when it gapped lower on the open Monday. It went down from there. But I could see SLV was having a low volume rally, so I gambled it wouldn't go far. I saw all the paper profits vanish by Tuesday, but I held on due to the low volume. Today some relief. Back in the black. The logic of your suggestions seems spot on. I gambled and held on through the last dip. I think I'll sell on weakness and not take much risk now. Of course holding overnight has some risk. But hopefully this will be more than a one day move. Thanks again for the analysis. Great job. -ira  |

|

|

|

Post by sd on May 22, 2011 9:36:52 GMT -5

Gone away in May,

Reduced my IRA positions a few weeks ago swinging 1/2 back into money markets anticipating a market that "should" see some correction. Key word being "Should" I'm usually out of step.

Not much free time -but Friday 5-20 I did take on a UGL position and EUO- not on any strong conviction, just a 60 min chart suggesting a possible base and move higher on UGL , and on EUO a small pullback and then move up again- I don't know what would cause the Euro to gain strength .

I accidentally went too large on the UGL trade, and will layer very tight stops to get the position to lower risk- It would be nice if I get a 1 day move higher on Monday at least....SD

|

|

|

|

Post by sd on May 24, 2011 21:08:20 GMT -5

Quick trade update-

Fortunately, both the EUO and UGL trades have moved up in my direction. I've tightened stops in UGl to break-even on 1/2 the position and risking $.25 on the remainder . I was overweight on the UGL trade and obviously feel better that it had moved forward as anticipated.

The EUO trade had some weakness today, and I'll leave the stop as is.

SD

|

|

|

|

Post by sd on May 25, 2011 20:20:40 GMT -5

Moved the entire UGL position to a Break Even stop . Not much action today.

EUO trade also weak.

Entering a buy-stop for SLV $37.10-37.25 with a $36.25 stop-loss.

SD

|

|