|

|

Post by sd on Dec 4, 2008 21:25:00 GMT -5

Didn't have the opportunity to try any trades on Wednesday- A totally busy day,. and it likely saved me some $$$$ In the pm, My wife and I helped my daughter and future son-in-law build a Count Rumford style firebox in their renovation of their circa 1860's log cabin portion of the farm home they are remodeling .I was a mason by trade several decades past. Had never built a Rumford style, and have reservations as to how well it will perform, but it's their desire and their house- and credit to them for the project they have undertaken-

I did take a trade this afternoon when I had a few minutes-

I checked the market summary, and it seemed mixed- Perhaps I should include only trade on an all-red or all-green market - none of this bifurcated mixed signals.

I had a few minutes, and as the afternoon was underway it was the first chance I had to look at the market.

There is no set guide as to which way the market will go- but often it seems the afternoon gives way to momentum . I actually think it's something of an advantage to not have resources- TV, etc to pursuade me in one direction or the other. This week has been less than co-operative though, and I'm recognizing that I'm getting into the trading range grind Banked out referenced some time back. And I'm not achieving the results I expect.

I'll try to get caught up with charts this weekend- The bottom line, I had to leave the computor five minutes after I made the entry- I decided I would split the trade , with 100 shares stop higher, and the remaining 200 shares lower.

I came back at the end of the day to find that the entire market had sold off and my stops had been hit- Looking at the chart, I'm glad I hadn't walked away without putting the stops ion place.

This has been a consistant losing week, and I will need to reconsider how to approach this market, if I try to trade it at all.-SD

Today, In the few minutes I had to look, I felt I had a reasonable

|

|

|

|

Post by dg on Dec 5, 2008 0:07:00 GMT -5

Perhaps in this market, the best strategy is to place twin trades in opposite directions with tight loss stops. If the market plunges, your short makes out good and your long stops out early; and if the market rallys, your long makes out good and your short stops out early. Just a thought.

dg

|

|

|

|

Post by sd on Dec 5, 2008 21:40:13 GMT -5

size=4] Reply to DG: I was thinking along those lines as I was attempting to time those moves with those 4 flip-flop trades in one day this week, I was really expecting a trend change as opposed to a roller coaster ride. I was exactly out of sequence- as I exited one trade with my stops and felt the trend was going the other way and I flipped to the other side of that trade, I just caught the peak that had already been underway, and then caught the rollover, and stopped out. I plan to get caught up and post those charts of my losing trades this weekend- have to work Sat. though. Particularly at this point, I don't have the luxury of the available time - Didn't get lunch today until 2:30 , and glimpsed the screen for 20 minutes at one time . That should change for the better in the next 2 weeks, and then I may be able to take some use-it or lose it vacation before the end of the year- and that may be something I actually will have the uninterrupted time to try to engage . This week is the first significant losing week I have had since September- And it illustrates to me how lucky I was when I managed to jump into strong trends and capture those gains. I hope to not make the same mistake as I did a year ago October, where I had garnered some gains the prior year, (Who Hadn't?) and then bit by bit frittered them away in feeble attempts to trade using exactly the same methods in a downtrending market trying to think I was catching bottoms etc. Heck, My mindset was to always trade to the long side- I was in denial and didn't recognize that taking a short-side trade was a normal process that one-sided -long only traders ignored with blinders, believing the optimism that came with the mantra of buy lower because it's cheaper. Back to today's style of trading: I also just recently increased my position size and also my Risk- This aptly illustrates my inability to do the Texas two-step- just ask my wife. It was confidence in my approach that allowed me to be comfortable with doing this, and this week is telling me that my prior methods are not giving me the results I want in this market. So, I'm going to get defensive and reduce my position size, for the first step. I will also likely not make frivilous trades if I cannot monitor them. I will likely tend to cut my losses faster and take my stops quicker instead of trying to give them more leeway. My approach worked well as the market caught some strong daily trends- It hasn't done well this past week though. Today's market action- end of day rally and all despite the huge job losses- is based on a bear rally- My personal belief.... I can only think that right now , in this market, some pundits(Kudlow) are proclaiming a market bottom is in place, and that those daily traders wanting to invest to the long side may feel they are being left behind - I believe it is: BEAR MARKET RALLY and not to be trusted . I may be wrong- but I would rather err on the side of caution and capitol preservation , than fear I am missing getting in at the bottom of the next bull rally. That leads to Greed, and the desire to be right and then believing we're at a a market bottom. Ask yourself, At how many points in the last year decline did buyers step in as market leaders decline 20, 30, 40, 60, 80% - Thinking each step down was a better buying opportunity? We are at a major crossroads in our economy that will likely exceed anything previously experienced unless you experienced the Depression of the 1930's. If you are still living now, this is not a great concern, because you have lived through it all. But for the rest of us, this is likely a life-transforming experience. And if the post dgoriginal.proboards.com/index.cgi?board=yak has any validity, we're really in deep s... despite our best manuvers- SD |

|

|

|

Post by dg on Dec 6, 2008 0:09:41 GMT -5

in regard to the referenced article, remember to read the links in the followup posts -- not just the thread.

|

|

|

|

Post by sd on Dec 10, 2008 21:44:53 GMT -5

Last week I had consistantly losing trades, and I allowed some positive trades to turn into losers- In a ironic sense of timing, I had increased my position size last week to 25% more- From a $1500 position size, I ante'd up to about $2000.

This is every trader's nemesis- Where do you put a stop-loss in that won't just get whipsawed , and still be within a reasonable distance of price action?

I've been using Parabolic Sar, as well as having a feel by looking at the EMA's and price action- When Price drops back through the slower ema's, stop is usually taken out. There will be time to evaluate how best to adapt stops in different market environments.

Instead of establishing an arbitrary stop - Say 8% - stops can be based on logical support, trend lines etc. Position sizing can be adjusted to accomodate the stop. Greater Risk- less position size.

In using the faster time frame charts, I apply and adjust stops relative to the price action- For example, if price is trending sideways and is consolidating, I expect a continuation of the prior trend, and will usually set a stop just under the range.

I'm going into this in more detail because I'm second-guessing myself during last week's trades- Unfortunately, I was unable to actually be at the computor during the roll-over in price action, and possibly I would have reacted. Next week, I will take a more aggressive stop approach if I can monitor the trade.

Playing with statistics is interesting- Van Tharp gets into this in detail in " Trade your way to financial Freedom" Time to read again.

One example - 50-50 win-loss ratio = a draw if the size is the same.

Supposing I make 10 trades, and 6 trades are losers and only 4 trades are winners,. Under what conditions would any trader survive this ratio ?

Let's assume that each losing trade is cut quickly- Say at 3%, and the winning trades net 5% .

That's a winning strategy- with 18% loss for 6 trades, and a 20% gain over 4 trades. Net to the good of 2%.

Well, If you could do that combination just once a week , at the end of one year you'd have gained 100%.

Many times we have winning trades that exceed 5%-

However, how many times have we limitied our losses to 3%?

Not possible?

There's that Hubris thing at work again-

I haven't been able to even look at a computor intraday this week, -Should the opportunity arise, I will reduce my position size on the next trades and try to get a feel for the market.

The market is trying to rally despite all the horrifc news .and then it has buyer's remorse and gives up the gains.

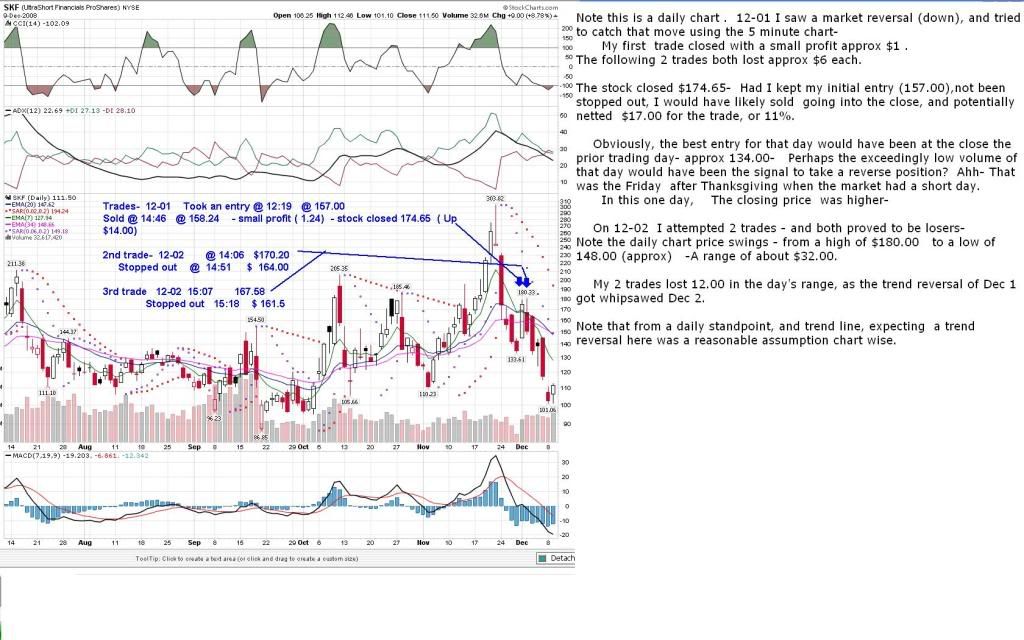

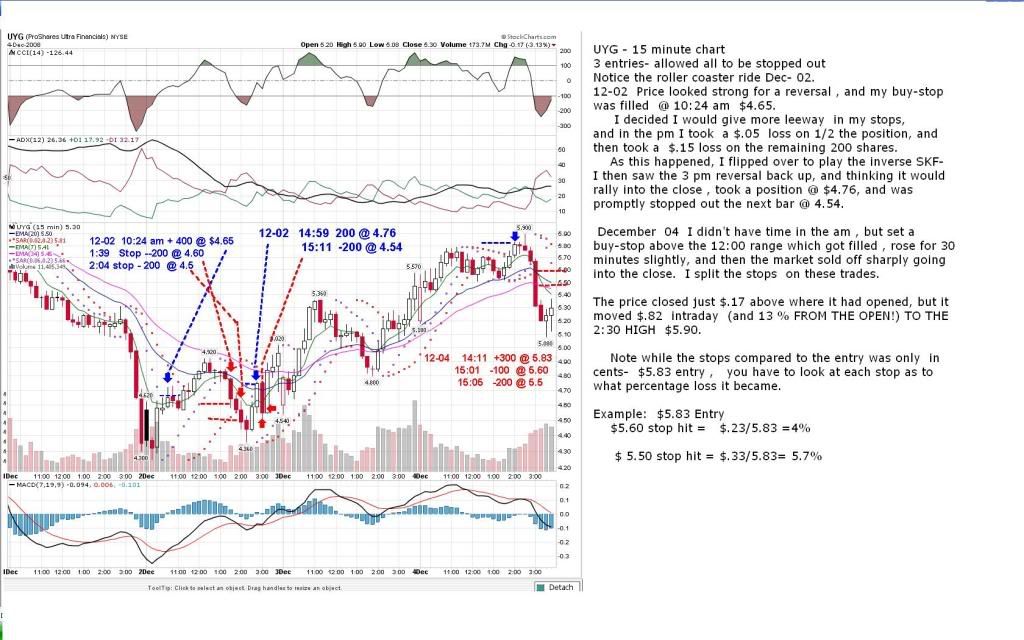

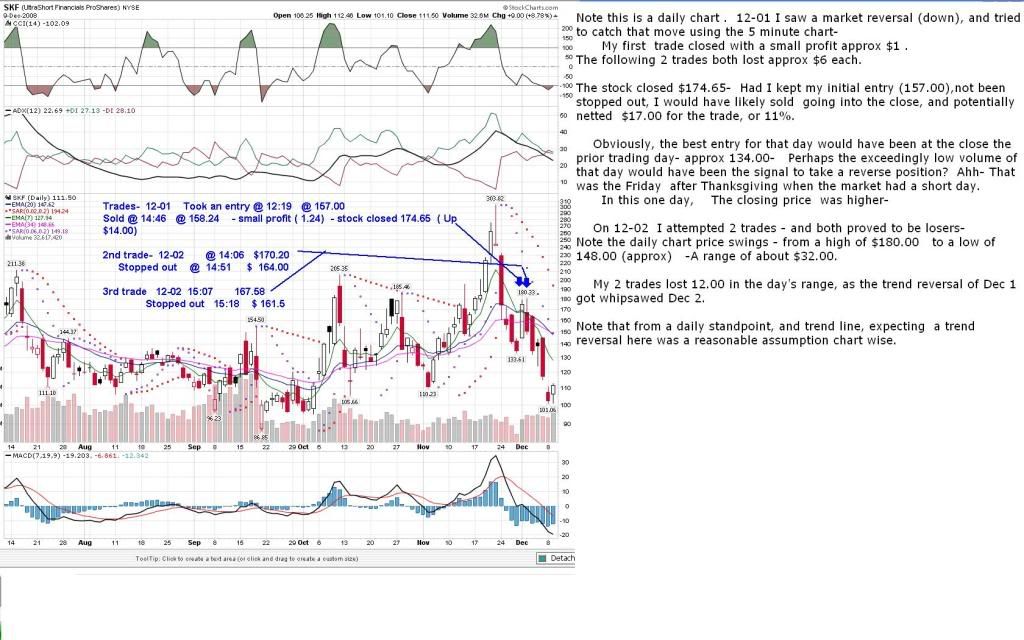

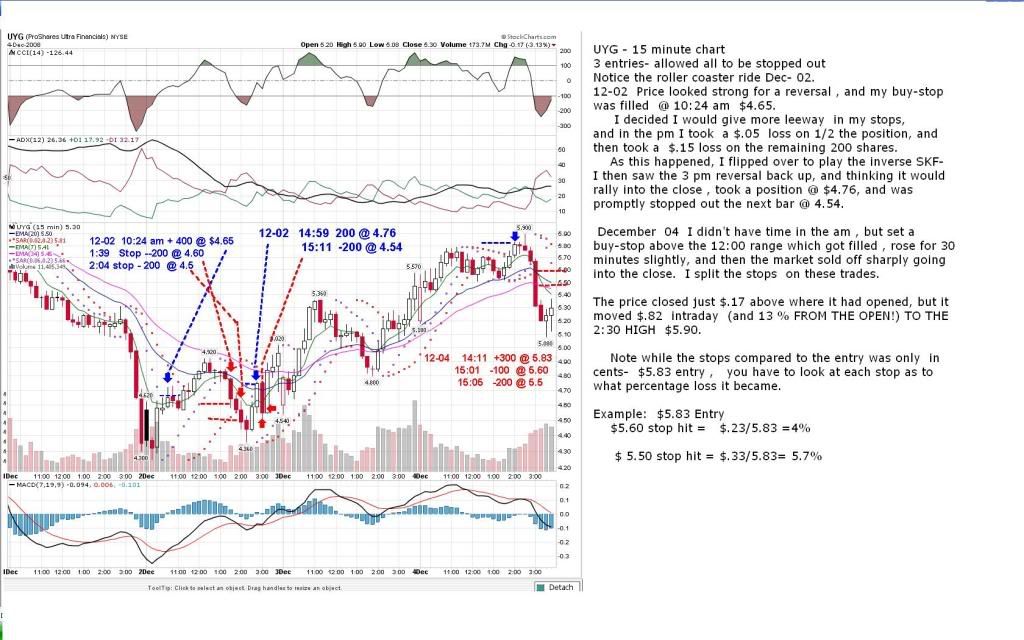

When I started this thread, I intended to post each trade as I went along. I'm playing catch-up this week , and am including my losing trades last week in this post-

I tried several days as the market went one way and then rolled over to flip my trade to the inverse- as DG had commented- I think the only approach in this type of undulating indecisive range is to cut the loss as fast as it appears the reason to enter the trade is changed. I also did not have time to stay and monitor the trades- That may or may not have made a difference-

While I enter on a 5 minute chart usually, I want to drop back to a 15 minute chart if the trade is going in my direction- The Sar and moving averages give a bit more leeway and perspective , while still being close to the price action.

I also started taking "snapshots" or screenshots of the screen I am looking at as I make the trade, or set up the buy-stop- and send them to my home e-mail. The intent is to give me a perspective of what was I really seeing to make that trade at that moment. Anybody wants to do that, Just push down the CTRL button at the same time as the Print Screen button- Then open microsoft Paint program- go to EDIT and click on PASTE- go to file and save as a photo.

The SKF and UYG trades:

Sorry- I am unable to include the charts saved to photobucket at this time- The screen selection disappears as I scroll my mouse down to select it-

As they say, a picture is worth a 1000 words- SD

|

|

|

|

Post by sd on Dec 10, 2008 21:48:54 GMT -5

OK, There's a different way to link the charts:   |

|

|

|

Post by sd on Dec 11, 2008 20:45:44 GMT -5

No time for any trades today, but I did receive an e-mail that had the following quote:

"Victor Niederhoffer was once asked: "What makes trading so hard?" He replied: "That's simple. It's because the stock market is always changing."

The implication is that if the market stayed the same, once we figured out a profitable strategy, we could program a computer and go on vacation for the following 30 years. But the market doesn't stay the same. It constantly changes, and if you don't change with it, you'll die. "

Recognizing that the market place is different now than it was yesterday happens when we experience different results using the same methods.

We tend to stay with what has worked in the past, expecting our adherence to a proven discipline established over time to prevail.

Interesting market news tonight- Bernie Madoff -ex Nasdaq chairman; arrested for a huge Ponzi scheme - had outperformed for 10 years +, reportedly 17 to 50 billion dollars .

Jamie Diamon thinks the markets will be bad for several quarters;

On what positive news will the market rally tomorrow-Friday 12-12-08?

SD

|

|

|

|

Post by dg on Dec 11, 2008 21:34:36 GMT -5

Ironically, the message one takes from the "broken strategy" news article I linked today in the news section comes to a similar conclusion. Yesterday's "genius" traders are falling in disgrace -- one by one. Perhaps this time, things really are different?

|

|

|

|

Post by sd on Dec 13, 2008 18:27:11 GMT -5

Reply to 52, DG-

I read in one article that essentially said that Miller didn't all of a sudden become dumb after a decade + outperformance.

Look at Warren Buffet- BRKA had a substantial losing streak during the tech bubble, dropped 50% in value, and it took 4 years to recover to that 1999 high . BRKA had also lost 50% of it's value this year, and has since gained some back this past month.

I do think things are different in some respects-

In 2008 , everything sold off. There are also a lot more people realizing they better be pro-active with their money- Miller made a gamble , and didn't take his losses as his strategy didn't work as any good trader should. I think the rate of redemptions didn't allow him any time to make a difference. That's the new investor today, that is a lot more active in protecting his/her monies. And rightfully so.

It also illustrates the importance of being willing to have the discipline to employ stops, along with proper position sizing.

Of course, if you are a huge fund, you expect to be diversified, and have some balance - You didn't expect the entire market to go South. Or so I assume. It points out what can happen to the pro's and novice traders alike when they don't expect the unexpected to occur- It can be a disaster, as it was for Miller who excelled those many years.

I was amazed to see Henry Blodgett even being allowed to comment on anything to do with the stock market.

I'm trying to copy the BRKA chart into this post and am having problems clicking on the IMG bar- Like my navel, probably need to get the lint out of the mouse!

SD

|

|

|

|

Post by sd on Dec 15, 2008 22:13:56 GMT -5

I was surprised by the market's up close on Friday, following the Madoff financial scandal, and I tried to get a snapshot on Sunday evening - I was looking at the market summary, and perhaps it was a carryover From Friday and did not include the open Asian Markets.

I went to work today hoping to find some time to put on some trades- Since last week's trades were all negative, I decided if I traded, I would both reduce my position size and also take stops closer and minimise any losses when possible.

I had a preconceived notion that the market would actually rally today , since the market closed higher Friday despite the news.

Well, as usual, the market didn't start off as I expected. I was looking to the financials to lead and UYG with counterpart SKF (short)

I believe UYG gapped down, and as I watched on a 5 minute chart, it started to turn and then move back up-

Tangent here: Often the market gives false starts and heads in one direction and then does a 180 turn and goes in the other. This is not readily recognized if one only uses a daily chart- But a 5 minute or 15 minute chart tells a more focused story about what really is happening.

I would also like to add a comment about indicators - they are generally lagging, and in the shorter term time frames the lag is evident.

Their function can only be supportive- I'm thinking I may continue to apply the macd histogram, but I haven't had much guiding application from them- And I've adjusted the time frames to faster periods.- It becomes a judgement call on perceived /expected market direction, price support, and ultimately price action.

When price fails to meet your expectations, take action.

I'm unable to monitor my trades continuously during market hours. My UYG trade eventually headed up as I expected, but then fell back and eventually hit my stop-loss set when I initiated the trade. Had I been there and seen the upmove and then the pullback, I would have likely raised the stop and not allowed the loss- The up move was large enough that the failure of it to hold tells me that my preconceived notion about where the market would be going was mistaken.

What constitutes a large enough upmove? In a reversal situation, it is simply price action reversing and starting to close higher than the declining price- a close above the fast trailing ema , and an improving histogram to the base line suggests that it may be well founded- or premature- as my initial entry was.

tHE ENTRY was on a bullish up move candle in real-time, and I took the trade , and then set a stop just $.03 - that's 3 cents- below the low of the low bar 10 minutes earlier.

By minimising Risk using the low tail , it also sets a realistic stop just a couple of cents below- If I'm wrong on my interpretation of what price is saying at the moment, I will be stopped out for a minimal loss. It's when I want to be right, and I let my ego guide me that I will stretch those stops larger than what they should be -in the hopes I will be justified in the end.

And I think this is the #1 issue that really confuses and eventually ruins one's hopes of becoming a successful trader. We don't want to take a loss. Setting arbitrary stop-loss limits at dollar values or % of price means you didn't evaluate the trade- Just taking a lazy approach. Once you determine by price and chart action where a stop should be set, you can determine position size.

#2 might be failing to adapt to changing market momentum and dynamics, sector change etc.

#3 should be #1- Trading with too much of the portfolio value invested in a few trades. The goal should be - while learning, lose money slowly, and while winning, gain money gradually. Understand position sizing and don't try to get rich quick.

I will likely come up with a few others in the week's ahead.

My goal this week is to keep my losses as small as possible, and if I get the chance , to trail price action to maximise profits.

Back to the initial UYG trade- Using the 5 minute chart, price was trending straight down , and then bottomed, and tried to reverse. I focus on the candlestick bar, and volume, and also the fast ema. The macd histogram tells me that selling momentum is in decline , despite the fact that price is still falling.

I let my "belief" that the market direction will be up guide me to take the reversal signal and take an entry.

The reversal doesn't have any substance behind it, and price drops into a trading range within $.03 of my stop. Later in the day, price rallies, and that is the move I would have been waiting for- But I wasn't there- when that move happened, I would have likely raised my stops, and if it failed, I would have been taken out higher.

I flipped directions, and took a position in SMN @ 11:45 believing it looked as though the market wanted to go South- Had to go back to the field ;

@ 2:48 I went long SKF which shorts the financials and UYG stopped out 7 minutes later - I lost money on UYG , and made a little on SKF.

Going into the close- I was hoping for a strong rally, and followed the price action with both SKF and SMN starting off with the fast SAR which trails the fast ema. When the 5 minute bar turned red, I raised the stops and started looking at using the fast ema-

SMN sold off @ 68.00 @ 3:34 pm with a 66.70 close

SKF sold off $133.87 @ 3:35 with a $130.08 close

I think it averages out, I lost 2.1% on UYG, Net 1% on SKF, and Net 4.6% on SMN so a winning day all in all.

I'm thinking tomorrow the Fed's will rally housing and the markets-We'll see.

The Charts:

I'm having trouble using the mouse to highlight the IMG bracket below the chart- I think I have the UYM trade but not the SMN chart, nor the SKF-

Can't contend with it tonight- SD

<a href="http://photobucket.com" target="_blank"><img src="http://i368.photobucket.com/albums/oo126/sowterdad/DEC15SMN.jpg" border="0" alt="Dec 15 SMN"></a>

|

|

|

|

Post by sd on Dec 16, 2008 21:42:45 GMT -5

Today I had placed 3 trades during lunch time-It was the first opportunity I had to look at any charts and market action.

I was aware of the pending Fed announcement and the expectation they were going to lower rates and rumor maybe a bit more-. Pull out something else out of the hat.

I can only comment that while some prognosticators say the market looks ahead 6 months and is a "discounting" mechanism,

the market was clearly waiting to react to the Fed's announcement.

I set up 3 trades, UWM, ,UYG,UYM which had all entered a basing /consolidation at that time. All were up .

I set my buy-stops above earlier highs , expecting the consolidation to give way to upside momentum if the Fed delivered as expected.

The Fed did indeed deliver later this afternoon.

However,after placing my orders, I realized my schedule would not allow me to even glance at a computor screen for the rest of the afternoon, and I chose to cancel all trades.

Of the 3 Buy-stop trades I had placed - All 3 would have been filled when price moved to the upside.

What is noteable about the substantial move that happened, is that it weakened in the first hour and had a sharp pullback.

Had I been monitoring this in real time, I would have closed the trade and locked in profits or not allowed what had been a substantial gain turn into a loss. This is principle, and today that principle would have caused a stellar day to become a mediocre one when price moved up sharply and then just as sharply declined lower , and then turned around to rebound higher.

When I realized I would be unable to have the time to log on and check the trades, I cancelled all 3 trades- 2 of the 3 would have done well at the end of the day- UWM would have exceeded my disaster stop and been a loss- UYG & UYM would have been a success.

Having the ability to follow these trades with real time charts has had an affect on my approach- I no longer want to consider 20 minute delayed quotes- That is ancient history when using a 5 minute chart- It's compelling to have 2 screens- One with the Broker/trades price action, and the other with the 5 minute chart active.

I actually can't understand how I was able to be success\ful from last September until now - unless it was just lucky timing in a narrow market cycle- that likely won't be duplicated in the near future.

I took a number of those trades before I used real-time charts- I should likely revisit those trades to determine what I did right and what was wrong.

To anyone that may happen to read this blog- I would suggest that you look at your charts in different time frames- and determine the larger market trend in the higher time frame context- For example- If you trade based on the daily charts, look at the Weekly to establish high and low trends-

Same is true if you want to scalp a few % - Know the daily trend and go from there.

This market has had extreme volatility and that is why I favor a one day In and Out trade- It actually lessens my Risk -

Here's one chart of 3- The UWM is not included, but it shows how reactive the price swings can be-SD

I seem to have an inability to acquire this photo as I am accustomed to doing- I used to be able to highlight the selections below the photo with my cursor- I think this is my issue- perhaps with the mouse- SD

s368.photobucket.com/albums/oo126/sowterdad/?action=view¤t=Dec16UYMcanceledtrade.jpg

Not the Link that will work here- I need to be able to copy the IMG link-

From the properties screen:http://i368.photobucket.com/albums/oo126/sowterdad/Dec16UYMcanceledtrade.jpg?t=1229481666 |

|

|

|

Post by dg on Dec 16, 2008 22:02:55 GMT -5

Your problem isn't your mouse. You just aren't familiar enough with photobucket and the commands here at this website. If you left click your mouse below the photo you want (at photobucket), the lower menu will become available. Then you can left click & copy your img address for publishing here. Alternately if you have the url address, all you have to do is put it inside a set of img commands here.

|

|

|

|

Post by sd on Dec 17, 2008 21:54:01 GMT -5

Still trying to get the print size command working.

No trades today- Work totally interferes and has absorbed all of my time- I still try to have a sense of what is the market direction- I'm trying photobucket again , to include a chart here-

I found something different on my screen-

Previously I could pass my mouse/cursor over the photo and 4 different command code boxes would appear, and then I could click on the img box. Now, the 4 boxes fade out- I just found a pull-down arrow following the photo at the bottom of the page

I believe this will work and is different than what I used previously. A;lso applying the Size command-SD

|

|

|

|

Post by sd on Dec 17, 2008 21:55:19 GMT -5

That works-

|

|

|

|

Post by sd on Dec 18, 2008 20:02:34 GMT -5

OK, That' prior post must have been a 6 print size- I can read it from across the room- This is a 4 size. much better visually for me per the preview screen-

Sorry for the hollering-

No trades today, and likely no opportunity until tomorrow afternoon if I get off work early as I expect.

Not too surprised to see the market giving back the gains made earlier this week. But, Each time the market rallies , you have to ask if you just totally missed the best buying opportunity of a lifetime. However, I take some comfort in this one day at a time approach when the market is still so undecided. At times I'm tempted to put more back into use in the 401K , but as I said elsewhere's- borrowed from Banked out or DG- Holding cash is also a position

How will the market react when the Gov't bails out the autos?

How long will that last? Candidly, I don't think most Americans want to pour money into businesses that haven't adapted well to changing markets. Unemployment is increasing , despite the 4,000 less number reported this week- What happens when the unemployed ruin out of benefits???

When I cancelled my buy-stop trades earlier this week and missed the market rally, I did so because I knew I wouldn't be around for the balance of the day. It made me nervous and uncertain - and I pulled 3 trades-

This is a new development, and as I thought about it, I have begun to rely tremendously on having real-time charts, to know that the chart I see matches very closely the price action on my trading platform. I would hate to revert to 20 minute delayed charts at this time. Particularly going into the close, I want to adjust those stops higher on winning trades and try to net as much as I can before the sellers bail out- I knew it was likely I couldn't raise any stops - and I could have tried to set "reasonable bracket orders".

I've occaisionally used trailing stops long ago in the past, and this may be something I look to again if I continue to have little or no free time.

I'll try to post a chart on that thought and see if I have also gotten a better handle on photobucket's commands.

SD

|

|