|

|

Post by sd on Nov 10, 2008 22:55:48 GMT -5

I hope the subject title gives this thread all the sophistication it deserves. I would like to present this with an alternative appropriate title that would find it's way into the pages of Stocks and Commodities. We could call it -Alternative Adaptive Trading in a Volatile Environment for indeciseive would-be-traders.-

Sub titles would be - Go with the Flow, take the money off the table, don't hold too many cards at the end of the day.

I suspect there are not many readers that are interested in what I will present here, and it's not very scientific- I didn't think about it and develop a plan based on 10 years of backtesting .

I just did what worked, cut my losses quickly, found a one or two day momentum move and climbed on and just as quickly climbed off, and presently have seen a gain in my account vs a loss.

I don't have time to be a trader- I've got a regul;ar day job and until just very recently, didn't have computer access during the day. I was/am a lazy swing trader, and take my trading account $$$$ for the hobby it has been- It is actually money I felt fairly detached from (perhaps shell-shocked is the right word) since I lost such a large percentage in 2000, 2001. Giving up substantial gains, and then giving back substantially more.

I have an actual retirement account , and don't jeapordize it like I do this trading account. In my trading account, I would put on swing trades, hoping to find trends that would last for weeks or months etc.

My account did well over the earlier year until last October -2007, and then the market wobbled. I had listened to the bears, they made sense, and I moved my, and my wifes/ 401K into mostly cash- money market fund. She had a net +4% return this year- A good move.

Unfortunately, in my trading account I proceeded to continue to try to pick out up trends and find botoms- never figuring things could go this far down. I also didn't have any time during the day to monitor a computer screen or my trades- Work was pressing-

I'd have a few winning trades, offset by losing trades, and actually became indifferent - I kept thinking I'd do better by allowing wider stops , and what do you know?? The wider stops were getting hit, or the market was changing course. I was getting I disagree kicked when I actually bothered to look at my statements.

A few things happened to change things for the better-

I decided to trade ETF's- Liquidity, easy in and out, and diversified risk.

I started to cut losses FAST! If I was wrong, and the trade was turning against me, it quickly became obvious that the trade was going to get even worse.

I then started focusing in these times of great volatility on what the larger market swings were , - Hell, the VIX hit 81 this year!- An all-time- high.

I took a few trades that were successful with the ETF's and sold them in a day as they seemed to decline. I then bought some of the pro-shares levereged 2:1 ETF's both long and flipped them short and caught a market move at it's peak- and trough. That's enough to get the blood stirring.

I think that was Augest- I had decided I would not let my account go much lower- For Cryin out loud- it could pay-off my cruiser-

I started to pay more attention to the trades, and the market futures- I saw a couple of large market trends starting, and jumped in them later in the day, carried them over only 1 day and sold, and then the market sold off.

It seemed that the market couldn't go 3 days in one direction without going south for 2-3 days. It was clear it was undecided whether a bottom had been made.

I actually started to access my trading account intra-day when I had the chance, and check the price charts at lunch and break- Most of my trasdes were executed on stops placed the evening before. This last month-mid October- I activated real-time charting with Stockcharts. It's only $10 more a month!

I've caught 3 or 4 large market swings- I don't know which way the market will go- but when the entire market goes in one direction, that's the direction to go in!

What has changed, is that I no longer expect a bull or a bear market to start today or tomorrow- actually, I'm inclined to be bearish- and more defensive.

Today, the market futures were up, foreign markets were rallying , and then quickly the US markets started to decline- I ignore the market until after 10 am- gaps up and down at the open don't matter .

By taking quick trades, and cutting losses, since Augest, I have been able to gain substantially.

While I previously have had trades worth bragging about'

today's trades only netted 2.65% +- but that's not bad considering these trades were taken late morning short- after the futures were all positive..I ended up going against the pre-market indicators by waiting until I saw a real trend develop.

I didn't enter the trades until 11:50 am - when I saw the price action.

I forgot to mention: these are leveraged etf's - generally 2:1

There are also 3:1 coming on the market.

The point I would like to share with anyone interested- Over time we become adjusted to trading a certain pattern/trend/market- If that stops happening, what takes it's place? By the time we find out what had worked previously and no longer works, we are in financial pain.

I had some better trades last month to brag on- Today's trades are also woth bragging on albeit they are just minor gains.

Today the market was poised higher- Foreign markets were up, and a rally seemed in the making- I set up my charts to buy the long positions.

i disregarded the first 1/2 hour , and indeed the markets jumped higher and then started to sell off,- This would have hit every buy-stop order i would have placed.

I entered the market just before Lunch , all short positions- had I been an astute trader, I would have entered much cheaper and an hour earlier. but I was not at the screen.

I followed the trades up periodically, and raised stops.

After 3 pm, I changed over to a 10 minute time frame, and adjusted stops based on the lower EMA's. After SKF stopped out, I expected the others to be hit but kept the stops intact should the market decide to close higher- it didn't, and I am in cash .

The broader market swings today - Nas, Dow, S & P averaged 1.32% down. My short position trades averaged 2.65% higher.

I don't want to Jinx myself- I've gone both long and short since Augest- and I've realized a 28% gain-I've reduced my position size in at any one time, and most trades are under 48 hours.

I can't help but think that this type of trading - short term catch the moment- ride the volatility wave- won't prove to be the best going forward.

I will also add here: I know I am overdue for a come-uppance here, a hubris cross-check if you will- but that only illustra tes that a more competant trader could have done much better for longer.

SD

|

|

|

|

Post by sd on Nov 11, 2008 19:01:10 GMT -5

Rereading my initial post, I realize I sound like I'm due for an embolism due to all the hot air I must have pumped into the space between my ears- A bit too much euphoria having some success after a period of continual decline- Like the diver that was down too deep and comes up to fast- Or that guy with the waxed wings that flew too close to the sun....

Don't worry, I will get taken to task by this market likely in the near future- There is no doubt about that- I hope to limit that downside trend-

In the interim, I want to share some ideas- mostly based on my changing attitudes and perceptions. Taking the time to write this down helps me settle it out- I get long winded and rambling, but don't have any ulcers!

We're taught to buy-low, sell higher, and that pullbacks are buying opportunities because the pe's are getting cheaper. As banked out pointed out, present day stocks are still high vs their historical valuations. We believe they're buys because they are so much cheaper now than they were a year ago. That's because we haven't seen a really hard recession or crash, and most of us don't believe it could really happen- Since most of us on line weren't trading the 1930's . The only crash I saw was the tech bubble blowout, and I didn't trade it very well and took a serious hit.

I think the markets have given up 35-40% in the last year, and wiped out a decade of buy-and hold investments. I lost approx 20% attempting to trade to the long side the last year , and doing so half interested part time . Thanks to work, I was not able to even be in the market for a while, and it likely saved me some pain and additional downside. We all think this market has seen a bottom- logic and the charts seem to suggest this should be it- and a great value buying opportunity. This is a siren song- may be true- but it may just sucker us into believing NOW is the time to Buy, Buy, Buy!!!!.

We all would hate to miss the rally, and that 25% move up that could happen in just a few days. But what if the markets went down an additional 20% from here, and don't rally-

History saw the 28-29 highs not seen for 25 years! That's a tough long term hold!

We can't envision that happening- but whether we can 'see it' or not, it is the extreme possibility that could occur. But we are in desperate times in a world economy that is fragile at best. I will plan for the worst, and hope for the best.

The market volatility has been extreme- The market seems irrational- rallies for 3 days, and then sells-off Then bases for a while, rallies as good news- Fed rate cuts, etc and then sells. Last week the market rallied the day before the election and sold off the next two.

This week, the world economies rallied on rate cuts by most of the foreign big banks, and Monday am the US markets rallied higher at the open, and then turned and lost momentum and sold off.

I try to capitolize on this volatily swing, and have been pleased with the results-Instead of being a swing trader with a time frame of weeks, I've become a swing trader with a 48 hour stop watch.

|

|

|

|

Post by sd on Nov 11, 2008 19:31:48 GMT -5

Stop-losses-

Trading without stops is just stupid and naieve. That is trading with hope as your thesis

Hope that your trade will rebound

Hope that the market will bounce

Hope that you haven't lost any money as long as you don't sell.

Hope that you get just one more chance to get out by the skin of your teeth.

This year's market kicked my butt for 8 months! Yes , I had a few wins, As things got more volatile with wider swings, I took wider stops, based on good support levels etc etc etc. And that only served to cut my account deeper and increased the bleeding.

I realized my best trades were the ones that went against me and I then raised my stops and got out early. It's hard on that initial entry day- which way is the market going to wobble. Often it wobbles back and then jumps up. without me I might add. This volatility suggested to sit it out - it's not tradable- and it's not with conventional thinking and time frames. Your position can swing 25% any direction in a week- based on a mercurial market.

I started to take profits quicker, and cut losses quicker, and to not Hope that the market would trend higher and save me. On signs of weakness, I started to bail-out fast.

It was a move I had to make , or I would have continued to bleed , hemmorage from small losers becoming bigger losers.

I actually semi- decided that if my trading account dropped below what I owed on my bike, I would liquidate the account and pay-off the bike. Now that's a motivator!!!!

In today's short-term trades, I usually set a stop no lower than the prior day's lows as an initial disaster stop, and I then periodically raise stops intraday as price action allows. If the trend is strong, I look to get to break even ASAP- but not closing in too soon.

|

|

|

|

Post by blyghme on Nov 11, 2008 19:51:55 GMT -5

This is a traders' market - you have to buy and sell the same day - I have evolved some rules 1) Never buy before 11:30 EST on Mondays - 2) Never look at gains or losses with reference to the start of the trading day - look at gains and losses with reference to 11:30 price. 20 use 5% DOWN RUNNING STOPS . Since particular stocks are irrelevant to the systemic risk, trade ETFs -- trade DIA and DOG, DIG vs DUG, IYM vs SMN, EFU vs VWO,

Blygh

|

|

|

|

Post by sd on Nov 11, 2008 20:24:21 GMT -5

Why use ETF's?

Etf's allow one to make a selection based on a larger industry group's direction , vs an individual stock. Etf's also reduce the potential risk an individual stock presents.

In addition to allowing one to make a more general assessment of what the market values,

ETF's also come in leveraged varieties. This is where I have been trading for the most part.

There are Rydex and Proshares which are double the market moves for the tracking ETF.

If the market ETF moved 5%, the ultra ETF moves 10%. This works both to the long side and the short side. There are also some 3x etf's just released and more to follow- Direxion is one ;I haven't traded these yet- they just came out -There can be substantial moves in the 2x leveraged ones well worth trading.

Using the leveraged shares magnifies the gain as well as the risk- As long as you're on the correct side of the trend, no problem.

While there are a lot of ETF's, my focus has been trading energy, basic materials, financials, the Dow, the Nas, The S & P,

I have taken trades on both sides -long and short- and made money in 1 to 2 days as I have caught the middle of volatility swings.

As a general rule, I don't try to initiate a trade anymore until after 10 am or 10:30. It is striking how often the market seems poised to go one way and then goes the other. This past Monday had the Asian and European markets way up on their rate cuts, and the US markets opened much higher and then traded lower the rest of the day as the news was actually assimilated and rejected here.

It is at this time that I try to see if this is a broad market move, and I try to jump onboard.-

I add a new stockcharts chart for the day, and list the long and short ETF's I am viewing.

I also add the ticker symbols to my IB trading platform- Some of these open up pre-market for trading and gives an initial idea as to direction.

In this high volatility, markets tend to gap up on direction changes at the open, - Monday was a textbook case of why you should wait until 10:00 or later. The market gapped up and once it decided to sell-off, it was a straight trend down. Trying to trade the open is a lottery ticket.

the markets tend to trade in concert these days. If I have all prospects heading in the same direction after the first hour, it is a likelihood that this is a market-wide move, and often happens in reverse of the prior weeks move- both up and down.

I tend to take 5-6 positions across the broad spectrum, and watch those when I get the opportunity.

|

|

|

|

Post by sd on Nov 11, 2008 20:48:52 GMT -5

Reply to Blygh:

I can't find a way to reply directly to your post Blygh- Possibly me or this site.

I think you and I are on a similar tract here. I appreciate your input- I think there is opportunity and Risk reduction in this approach that will hold true for some time .

Hope to exchange more ideas on this with you! SD

|

|

|

|

Post by sd on Nov 11, 2008 21:18:39 GMT -5

Quick Trades:

I can say I agree with Blygh - Trade with the short term hold- but possibly one overnight...not longer.

While I have held overnight, and been successful, the third day is a guaranteed loser in virtually every instance.

I only jump in on momentum wide-market moves, and waiting until the trend has developed mid morning is smart. If it's a market wide move in the same direction, Go with the flow.

The market tends to over react premarket and at the open, and prices usually snap back and retest. By 10:30 a market direction should be likely-

Holding trades overnight

I want to see how the market is going into the close- Lately, I tend to sell if the close starts to weaken at all. I move my stops much closer, and ensure I've locked in a profit.

The rule here is that at the end of the day you have no idea what tomorrow's market may bring. Very often the market decides overnight to change it's posture, and then the open either gaps up or gaps down significantly - 5% or more.....and then there is a reversal in trend. The safest trade is one that is closed out at the end of the day -

That said, the potential for Risk and also for Gain is much higher by holding a position from the previous day. Often the market reverses 5% the very next day at the open- with a gap up or down.

Price then works out the direction it will go-

The compelling thing here is that I suspect both Blygh and Myself were trend traders in our past lives, and out of survival found that short term trading mitigated the risk and increased the gain. We don't have to be right in our perception of where the market is headed for more than 24 to 36 hours.

Discipline will set us a stop loss based on a 2 day chart as opposed to a weekly chart.

|

|

|

|

Post by sd on Nov 11, 2008 21:30:10 GMT -5

Approach to the Market:

I listen to the market preopen @ 5:30 am with a shave and a shower pre-work.

I used to believe that the Asian mkts affected the US mkts. They do but only in passing

Monday the Asian mkts rallied on China cutting the rates, and the US started a rally and then reversed the rest of the day.

Whether we like it or not, we are in a world economy, but we don't dance in lockstep all the time. The later market prices will either confirm the trend , or reject it.

I'd say look at the direction trades are heading from 10:30 to 11:00, and that will be the tell.

|

|

|

|

Post by sd on Nov 12, 2008 19:00:07 GMT -5

"This is a traders' market - you have to buy and sell the same day - I have evolved some rules 1) Never buy before 11:30 EST on Mondays - 2) Never look at gains or losses with reference to the start of the trading day - look at gains and losses with reference to 11:30 price. 20 use 5% DOWN RUNNING STOPS . Since particular stocks are irrelevant to the systemic risk, trade ETFs -- trade DIA and DOG, DIG vs DUG, IYM vs SMN, EFU vs VWO,

Blygh "

I would also include SKF and UYG-

I do it similarly- On my trading screen, if I have no positions - I'll list the ETF and it's counterpart-it's an easy way to see the momentum and market direction- It's also a quick guage of whether it's a market wide move if they're all heading (short biased or long) in the same direction-

I also don't trade the open- I'll wait until after 10 am- Usually 10:30 or even later. and if things started up, pulled back, I'll wait until I believe I see a trend -I don't know why a Monday would be any different- things seem to get unwound in an hour or so if there's a significant direction the market wants to go in.

I am only using the leveraged etf's- there are some new ones that have 3x leverage, and I may look into them this week.

As for the 5% stops, If I'm taking a bet on the continuation of yesterdays trend, I look at the prior day's swing low going into the close on a short time frame chart- and I initially plan to set a stop just under that- I don't take a set % amount- That swing low is looking at a 15 minute or 5 minute chart though- and it also depends on how the market closed- If it tanked hard in the last 30 minutes as it often does, that last 30 minute low may be the stop. This is all new territory for me, so the rules are greasy.

I then adjust stops as the day proceeds and when I get the chance to check the screen.

As the market gets closer to the close, I raise my stops, and then determine whether to sell-particularly if the market sells off at the end of the day as profit taking is the norm.

My belief is we will see more downside- and today's announcement by Paulsen didn't give any credence to the concept that they had a real workable bail-out . Time for pLAN b.

I took 5 short positions @ 10:30 am - One got stopped out on raised stops (SKF) and I held the other 4 - A bet on tomorrow. I look forward to your shared approach! SD

|

|

|

|

Post by sd on Nov 12, 2008 22:17:30 GMT -5

"Down She Goes"- Nov 12 -2008 trades

I went long 5 short positions today @ 10:30 am.- SKF,SMN,

QID,SDS,DXD, and I am holding overnight - except SKF (Stopped out on raised stops).

Holding overnight is not the norm, and I had a nice portfoloio 3-% gain today if I had sold at the close.

While I don't get TV or live news during the day, , I can check the CNBC 'latest video' at lunch- When I saw the clips showing Paulsen telling the American Public that the initial reason and purpose of the bailout plan was flawed, and now Plan B would be tried, I don't know why the market didn't take that info along with the bad earnings and simply drop a 1000 points.

I try to get back into the office @ 3:45 - ( We start work at 6:30 and leave at 4 pm )

I debated on locking in today's gains by selling the remaining 4 and I've decided to hold overnight- I believe this about face that Paulsen and the administration came out with tells even the most unsophisticated investor that this market 's problems are so profoundly underestimated-

Add to this, Nov 15- hedge fund redemption deadline- Great for added volatility I suspect.

I set up a new chart on stockcharts that only focuses on the trades I am interested in-Today, 1/2 of the ETF's I had on my charts would not update to real time- or any time at all.

I had determined I planned to go short as this is the primary short term trend- and only 2 charts were displayed in real time- SDS, and SMN- It was so frustrating to not have charts on hand as a reference. I sent several e-mails to support and they sent out a bulletin to all saying that some of the ETF's had changed their Data feed, and it would be tomorrow before the charts would be active- They're on tonight- but no help intraday at all- Got to be like a pilot flying blind by instruments (price).

Regardless, I looked at the couple of charts and the trading screen, saw that everything had held up, without much indecision, and went short .

I set my initial stop at yesterdays closing 15 min chart low.

During the day, I raised most stops to break-even after lunch, and later in the pm I only checked in on the trading platform- and I adjusted all stops higher to ensure I locked in gains on all trades. Without charts, it was difficult to set logical raised stops - I tend to look at a 15 minute or 30 minute chart and set a trailing stop based on the Sar level or that period moving average that seems close to the price action but not violated.

Anyone interested, stockcharts allows 'extra' members to add 'buttons' that allow you to view your charts in time frames from 1,5,15,30,60, daily,weekly,monthly- just by clicking the one button. I like it.

I ended up looking at price as it seemed to lose momentum mid afternoon, and raised stops to lock in a decent gain, but stayed off the market price by 2% or so . If I had had working charts, I would have been a lot more comfortable.

By 3:45 when I looked prices had rallied again and I was solidly ahead.

I felt the sell-off at the close was not going to happen, and that I would take the chance that logic and rationale would prevail and the markets would readjust their estimate of value lower tomorrow.

I will raise my stops,to today's closing prices, and also put in a higher limit sell should there be a significant gap down at the market. Which I expect.

If I get to be at the computer at the open, I will see if I can adjust stops higher should prices gap up as I expect. Often the reverse happens though- Again, it's a mistake to try to place too much logic in thinking why the market should go in one direction vs another. I already have a nice % gain for a day's trade, this over night hold is a bet that could prove costly should the market decide it feels all warm and fuzzy all of a sudden. I'm expecting to gain an additional 3-5% if the market does as I think it should. We'll see-

I feel like I have been very lucky adopting this quick type of guerilla trading, and having it prove very successful so far. It's about catching bits and pieces and not trying to be too optimistic or greedy. Those bits and pieces have added up- And I'm overdue for a rude awakening - That will come when I decide the market is going in one direction after the open, I take my positions and set my stops, and come back in 2 hours to find my stops were all taken out and I've lost 10%. on those trades. .

Even when that happens, I expect it won't be that huge an impact to my overall port as long as I continue to apply position sizing to my trades.

While temporary success tends to swell the head, I recognize that I may not have a long term winning strategy in place here- What changed is I adapted to this market- Quicker trades, cutting any losses, and taking even small profits before they became losers. It was an approach that luckily turned out to be timely in this market. I've done better taking the short approach, but also have made money on the long side swings. I expect I will be left behind when the market makes a huge rally or a huge crash.

From 3-4 months ago ,and my absolute worst lows, I am up over 30%. And compared to my last October high, I am up 7% +/-. a many years high, and I hope I don't jinx myself or piss off the Gods by posting that.

While I feel very good about this recent success, it came about by my changing my approach to the market- Both in the time I held my trades, the direction of my entries, and the timing of those entries.- And cutting the trades short- making sure profitable trades didn't lose money! I also started taking more interest in my trades- I wanted to be a weekend trader, and just check the trades every 7 days or so.Hah!

Frankly , Now I am looking at trades intraday when I get the opportunity , and that has made a big difference in my recent run. It can be a distraction from my job though- and I can't allow it to be that, or interfere with work performance.

What I want to convey to anyone that has bothered reading all this, is to consider some alternative types of short term trading- Most of us are programmed to think buy low and hold and then sell for a tidy profit.Eventually. Unfortunately, we're in a market none of us has ever experienced. THIS IS A NEW EXPERIENCE FOR EVERYONE!!! The rules have changed, and we don't recognize that this is also a brand new playing field. There is great opportunity here if you're on the right side of the market trends,- I have seen some short -term success,

and I'm not saying do what i am trying-

But recognize that if what you have tried does not work, and continues to get whipsawed, try making some smaller and quicker trades- Locking in A 2% profit beats a 8% loss every day of the week. That's a 10% difference! Do that 10 times , and you have made a 100% difference in your trading- That's all it takes to make a difference.

The major market trend is still down- I don't know why we have not retested all prior lows and then broke lower yet. But then again , I'm applying my logical expectations to this market . We will rally- possibly tomorrow- and that might be good for a quick trade- but not a long term one- SD

|

|

|

|

Post by sd on Nov 13, 2008 21:17:03 GMT -5

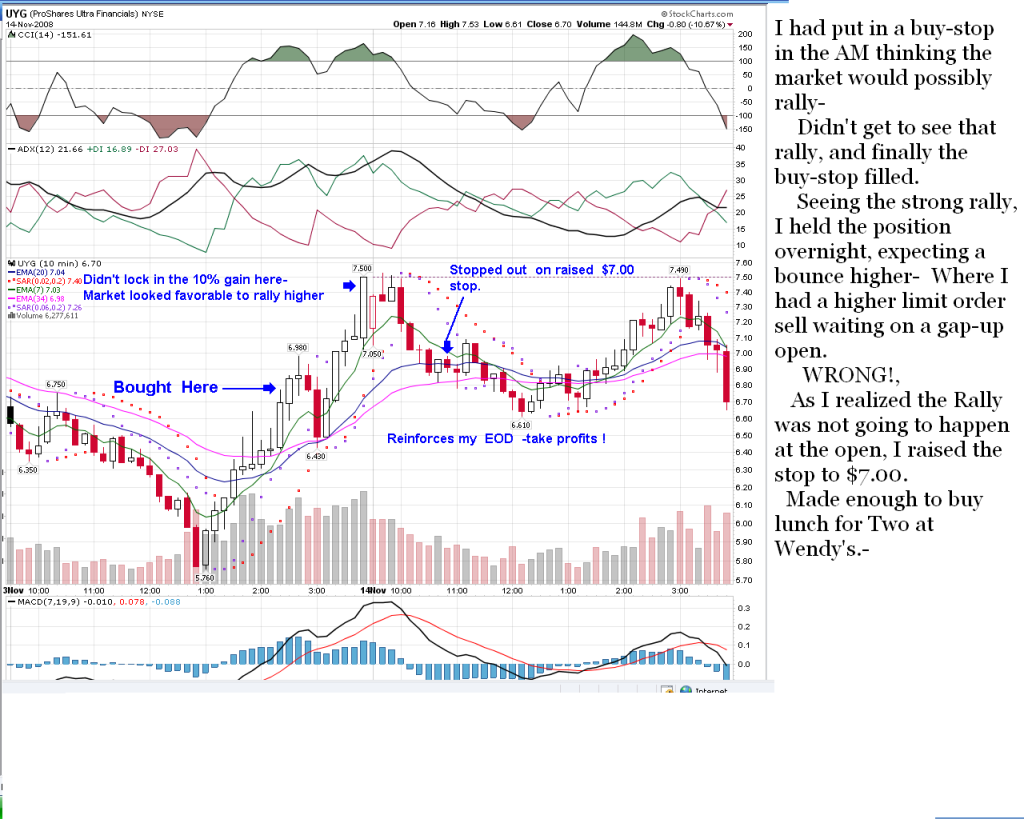

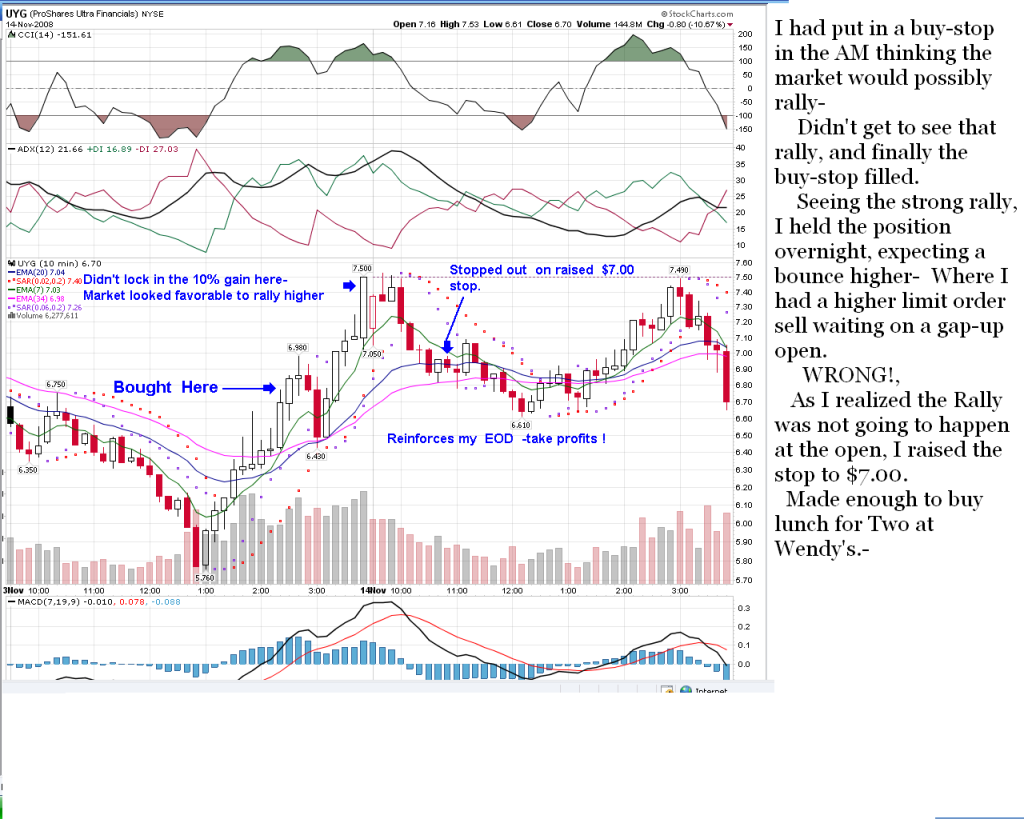

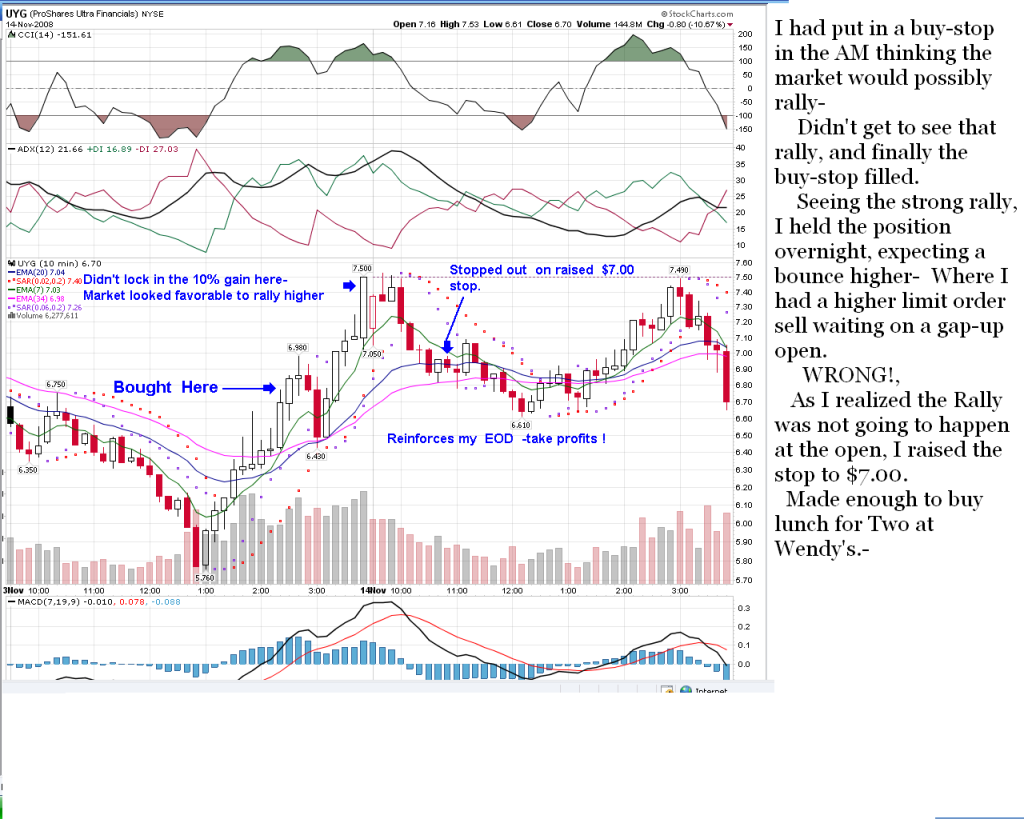

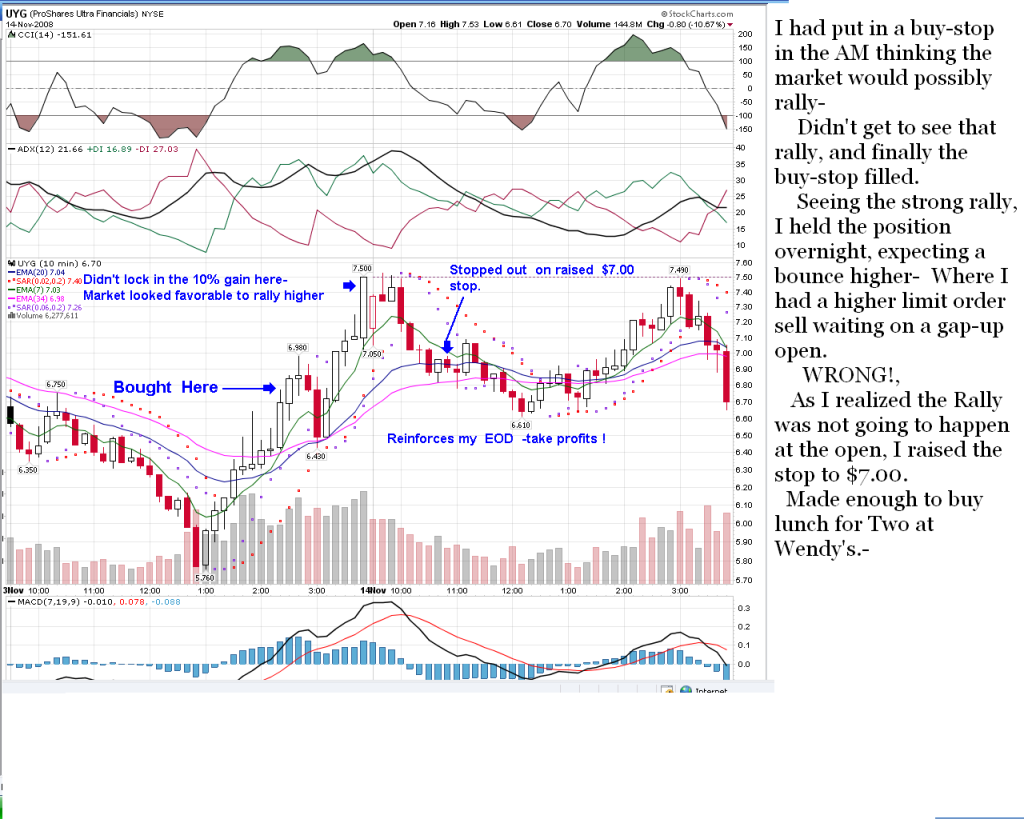

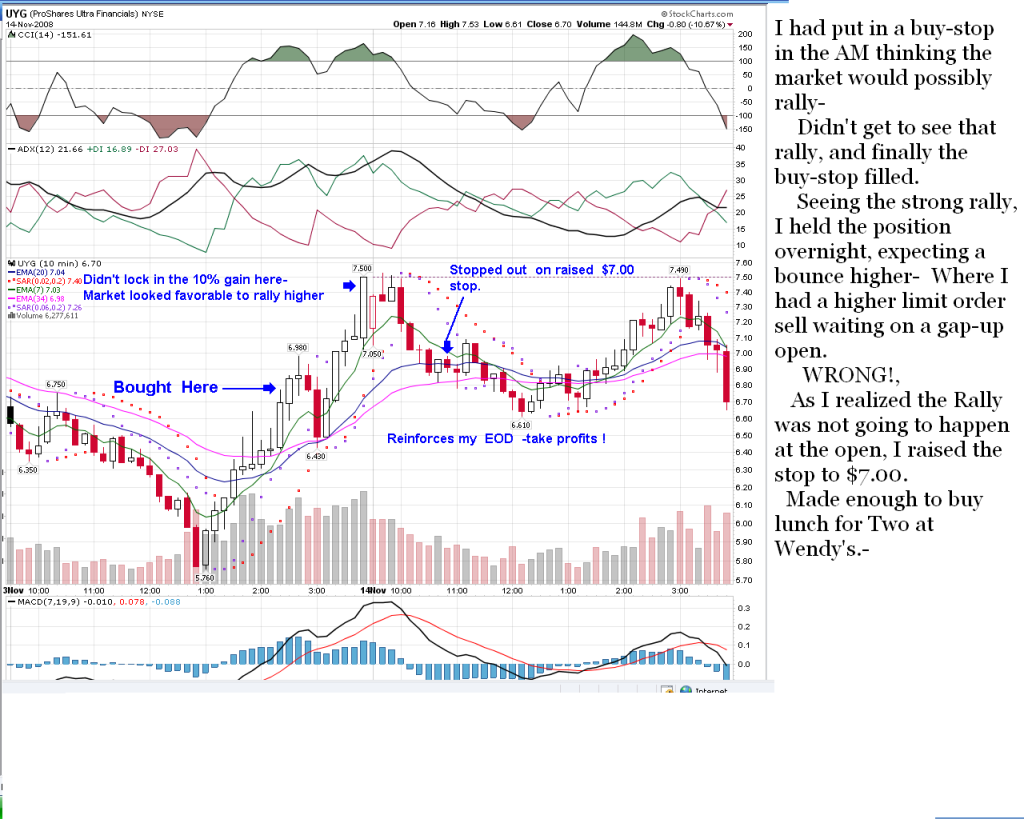

Today was not the success story I had expected- (trying to increase print size) Today was not the success story I had expected I noticed just before the open that the DXD early trades were not going higher, but lower. This was exactly the opposite of my expectation to not sell the trades near the close, but to hold on for a further down day- I was WRONG AGAIN in my interpretation of what the market would do overnight . I had raised stops based on the closing charts using a 15 minute chart..and I felt confident that was the way to go In yesterday's post , I took my portfolio position values as my net gain- However, the gain wasn't locked in because most of the trades were still open.. Yesterday, my SKF position hit my raised stop for a gain- and that stop was way too tight-even on a 15 minute chart- and it made a potential 10% gain(had I held longer) become a 1% gain. My remaining 4 positions I raised stops even tighter seeing the pre-market indication wasn't looking favorable for my short positions. By 9:31 my SMN and DXD sold, (3% + 1.5% +) @ 10:30 SDS sold (1%) and @ 12:53 QID sold at my limit sell high price and caught 11%. I knew the market was going against me, and left the stops intact. I had a few minutes, @ 10:15 am and pulled up UYG- The long side of the financials-opposite of SKF- Looking at a 5 minute chart, I saw UYG starting down and then trying to rally up- This seemed to coincide what I was seeing on my other positions on the trading screen- I only had enough  free cash available for a partial position, and put a buy-stop in @ 10:30 am- Didn't get a chance to look until this pm how these trades worked out. I'm down just under 1% with UYG being my one position-which closed up 10% --so my initial Wed trades would have been down lower. I've raised my stop; but am below BE- I have some cash freed for tomorrow, and I may add to this position -if I can get a feel for the market's direction Chart attached:

|

|

|

|

Post by sd on Nov 14, 2008 18:46:49 GMT -5

UYG Closed Trade- Reply to post 10- This did not work out as I expected at all- I fully expected the market mid day reversal to have legs for more than 4 hours, and drag UYG much higher. It was only a partial position- last available free cash that day- Regardless, It had moved 10% higher than my entry going into the close. ( My QID position had an 11% gain because I had set a bracket order - limit sell and stop with each order- Otherwise, it would have dwindled to a loss. Back to UYG- As I saw the market not heading where I had expected, I raised my stop-loss to higher than my entry- trying to stay clear of the first 30 minute volatility, but not wanting a gain to become a loss. I was wrong in my interpretation of what the market 'should' and 'would ' do- I was right by raising my stop and not taking a loss.-SD  |

|

|

|

Post by sd on Nov 14, 2008 20:34:13 GMT -5

Today was a Losing day-

And I again had confidence that the market would come to it's senses, see the Paulsen speech yesterday for a big surrender flag that the Fed and the financial leaders have no concept of what will work here- / I only had enough free cash to take 1 position- I elected to go with SKF- which is the opposite of UYG and shorts the financials, and has more volatility than many - Today the market opened lower than yesterday, and I felt confident (is that synonymous with arrogant? ) That the market would drop lower- But I held to my conviction that you can't tell which way the market will go in the first 30-45 minutes . SKF gapped up at the open, and then started to decline- I watched for 20 minutes, had to get off break and go back to work- When I next got back to look, The market had rallied, and SKF sold off initially and went down the first 30 minutes, then it sold off and I looked later after a new swing high and low was made. I was late to the trade, but in this market you never know. I left work @ 10 am. SKF got filled 162.62 @ 11:45 am. The last time I had seen a screen was 10 am. Left work, and when I got home, I started to take a series of snapshots of the trade, realizing as this broke the trend line, there was a likelihood that this was going to be a loser. Had to leave for a while to do grocery shopping -- There was always the possibility that it would go higher- But the markets were starting to rally- talk about a roller coaster! Since I only had this one position on, and had time to watch it develop, I kept the 157.00 stop intact , This risked $5.62/162.62 or -3.5% + slippage, commission ($1.00). I uploaded the photos to my computer, (Paint program) and then uploaded to photobucket . The snapshot images are small, and so I hope I loaded in sequence- It was interesting to say the least- . The markets did indeed Rally, and then sold off hard the last 30 minutes of the day. Sorry if these shots are not in order: I was late into the trade to begin with- but I can't sit at the computer all day. Most of these are 5 minute charts snapshots - I toggle between 5 minute charts and 15 minute charts, and often the indicators are saying 2 different things- I tend to look at swing lows, swing highs and trend on the 5 minute. I think the 15 minute gives a better (larger) perspective for trailing stops if the price action gets dicey. There are many times the market undulates and then resumes the trend. dAILY:  nOTE THE BIG SWINGS ON THE DAILY- How to decide to make an entry on an uptrend-  I like to add trend lines to the chart- Ideally the trend lines would also include the next time frame - to give a more realistic picture of what's possible- In this case the trend line is the 5 min. chart, and as it gets broken, it speaks volumes .  I realized I was a late entry into this traDE, and the 1st swing low represented a realistic stop - and I set a stop just below this. Some times this works very well.. Othertimes it doesn't- It all goes back to a trend being a succession of higher highs and higher lows. If we make a new low below the uptrending swing low, the trade is likely in trouble.  and the last photo- taken near the close with a 2 day snapshot - shows how there was opportunity to make some money in this volatile day- Unfortunately, it wasn't me. What went up came down, and then started back up at the end.  When the entire market decides to become a roller coaster, Up, down, Up , down in a single day, it's only for the most nimble of all traders that can sit at their keyboards. If I can't discern a trend , I better plan to trade within the fragments within. I likely don't have the time for that. We'll see what this market brings next week- I will likely reduce my exposure to a $1000 being a single position size -That was my freed cash limit on SKF for this trade. I still believe the primary trend should be down, and the markets will break this support - But then again, I don't have a very good average of determining which direction the market will go in- SD

|

|

|

|

Post by sd on Nov 14, 2008 20:43:32 GMT -5

I'll have to do a better job of labeling the snapshots on photo bucket- Not all the photos here were the ones I thought I was posting, but couldn't tell from the small thumbprints-

It's nice to have the ability to not worry about photosize with photobuckets.

Now, If I could only increase the print size on the posts up one higher, I'd be a happy camper. SD

|

|

|

|

Post by bankedout on Nov 15, 2008 10:40:33 GMT -5

SD,

If you are using Internet Explorer, go to the top of your screen in the View menu and look for Text Size You can make everything larger there.

|

|

free cash available for a partial position, and put a buy-stop in @ 10:30 am-

free cash available for a partial position, and put a buy-stop in @ 10:30 am-