|

|

Post by sd on Dec 30, 2017 21:31:16 GMT -5

2018 is here- Time to consider whether it will be a market similar to 2017- low volatility, strong trending periods- or will it be more volatile?

i think 2017 was as benign a market as we've seen in many years- and a strong trending one- Easy to confuse what I view as a successful year as trading prowess, and fail to credit the underlying market conditions as the most significant contributor to that "success."

Some of my best win trades were positions I held for several weeks and then captured good breakouts-trend continuations.

I held these through some slight declines on my initial entry and didn't hold a tight stop-

Some of the best trades were selling-some-or all - on the pullaway peak-

and others were entering some trades overweight- or adding into the position- and then scaling out with a couple of different stop-levels.

Looking back, 2017 was a smorgasbord of various means and methods- and so- i don't have a singular structured approach for all aspects-

I think that i did a lot of adapting in 2017, learned that momentum can continue for much longer than one may expect- and that trailing stop-losses shouldn't be too tight to price if it's behaving and trending- And- i reentered when stopped out if the trade moved back higher-

Also- when the trade appears to break-puts in a below ema swing low- time to tighten stops, and take that smaller loss rather than waiting for it to become a larger one- Much easier psychologically to take that 1st loss-

Understanding the Macro influences is something i would hope to gain more insight on this year. This would also extend to taking note of the market cycle- and How money shifts amongst the sectors- Simply put - Why does Tech outperform and then roll over? What market forces cause this to occur- Have to review the Ray Dalio- market cycle -on you tube.

Discussing Macro influences would include understanding the "Yield Curve"

Helpful Article on understanding the Yield Curve historically-

seekingalpha.com/article/4134460-10-lessons-major-market-risk-2018?li_source=LI&li_medium=liftigniter-widget

|

|

|

|

Post by sd on Jan 3, 2018 21:37:11 GMT -5

Some nice moves in NAIL- so, Horse goes back to the watering trough-

Also using 2x for DDM, QLD . Overweight both,.

Very Bullish market- so, as i consider the ARKK ,ARKG,ARKQ,ARKW -which were among my year long investments- I think I will take smaller positions in Each, with very wide stops-perhaps at the 50 ema- Note that the ARKK also has a significant exposure to Bitcoin- GBTC- about a 6% position in the fund- So, I think this is a good way to get some exposure to the Cryto currency craze without betting the bank- and enough other positions to offset the volatility and potential large loss of value in GBTC....

If this was a large position, I would likely stalk with trailing a tighter stop-

Theme is a market that is in full incoming tide- Surf's up- don't know what derails this- but can't stay on shore and be a bystander.

|

|

|

|

Post by sd on Jan 8, 2018 21:49:26 GMT -5

After doing some follow up accounting- i found that I failed to outperform the market's gain this year- I thought I did much better-

The Active account return was 15%+ and some of the partially active- one was up 25% - @ week 53- another small segment flat-Investment account transfer sat in cash until August/September- and so a very modest return on it- as it exemplifies holding a basket of diverse Core ETF's and then some added sector trades I have gradually accumulated-

Even holding a bit of leverage there- with trailing stops. Will have to wait until 2018 when all assets are now in play- and no excuses....

Despite not beating the 'benchmark' I feel it was a successful year overall - and a transition period- started out cautious and now I find myself - after hundreds of trades- realizing that to take full advantage of my limited time, and this market's continuing momentum- I don't need to overtrade; Go with Size when it feels right; and use stops to make up for when it feels right but the market says I'm wrong.

I can compare my performance against a professional manager that gives me a 9.6% return on a small account that is more Risk adverse focused with a diversified account- including a number of bond funds - and so my rationale for taking the higher Risk is that i have employed stop-losses whereas- they do not- they don't rely on market timing - instead, it's about asset allocation and frequent rebalancing if things move excessively - That is the end result after they deduct the 1.70 management fee- I will give this account another year to see how it performs in something other than a bull market--I expect we'll see that this year- and if it holds up well, it continues-

There is a balance in one's life with one's time and effort expended- and this trading/investing stuff can consume one's waking hours- and typically that only results in market under performance by the majority of active-self-directed investors- about 1/2 the return is typical.

This 2018 year, I am now fully invested/allocated - Primary changes left to occur will be to transfer small Roth accounts out of Scotttrade and Ameritrade for my wife and myself into our Vanguard brokerage accounts- Vanguard will be offering some smart beta factor funds in Feb/March- That I will likely transfer some monies into- Vanguard had several funds that bested the market this year- VOOG had a 28% return- S&P500 Growth Fund- low expense ratio-

Clearing the Air as I start 2018- lot's of things ongoing in my daily life outside of trading- Job, Family, LIFE - and time allocation is critical.

My focus is more ETF's than individual stocks- but i may select a few now and then- Look at Spiderman's default EXAS- +240% gain last year! But what a ride!

And look at that combined group of default single picks- by members in the horse Race- Very nice gains- and all market beating.

Other than the Black Swan events-Meteor striking earth; When Donald calls up KIM and suggests he bend over and Kiss his arse goodbye- The Dems and Reps not getting anything done- Or Trump getting charged by MUeller- for collusion and High Treason-

What will derail this market? It has global momentum, a few hick ups now and then- and an accommodating FED-

As i proceed in 2018, I intend to take some size adjusted Risks (stops employed) and seek to find some of the better momentum sectors- At the same time- The investment portion will keep a diverse allocation to the broad global market- That strategy needs some refinement and definition.

|

|

|

|

Post by sd on Jan 9, 2018 21:58:02 GMT -5

Updated stops on ALL positions- giving some wiggle room on some- but fairly tight on some of these momentum pull away moves- Clearly viewed on a 1 year chart as price has made that much wider move away from the norm- slower 20,50 trend line- At some point, this becomes unsustainable - reversion to the mean- rubber band effect takes hold- smart money selling - price comes back - I've held a few positions for a while -particularly in vanguard -without any stops- No need to get too anxious- but tonight i chose to place stops in all positions-

Very nice short term gains in Nail- and had a blue pause bar today- Holding nail in several accts, so it makes sense to protect what can easily slip away-

So, the momentum has been good- and relatively steady in nail- but today's higher open, lower close- I set a stop in Vanguard @ $101.50 under the blue bar- could have allowed $98 but the momentum has been increasing- and a slight pause might be in the cards- This is the issue of trying to time a move and read into the tea leaves-

I've also got some very nice gains in Robo, Botz- and these are doing a pull-a-way from the 10 ema that cannot hold - so, trailing a stop on these & other positions- ideally allowing some wiggle room- but on much down volatility, these tighter stops will be hit- Instead of putting in a Sell order- i want to allow prices room to continue to run -if so inclined- and then I'll adjust stops higher again.

|

|

|

|

Post by sd on Jan 10, 2018 22:30:16 GMT -5

Had 4 stops execute in Vanguard- NAIL @ $101.35,GMF,VAW, QLD- due to my ratcheting up stops higher based on the TA/ema price action slowing.

My recent base purchase was 12-26-17 @ $91.70 - so approx a 10% gain in a few weeks - Prior to that I had also bought and held- so NAIL is a trading vehicle based on a fundamental Theme- Strong housing industry- However- it carries a 300% Risk-

I think it's worthwhile to reinforce the concept of "RISK" or trading High beta stocks-or leveraged stocks-

Nail is a 3x play on the homebuilders- so it moves almost 300% relative to the underlying index it follows- I assume that is XHB.

I believe that staying LONG the trade is the ideal For long term gains- and timing is difficult to be consistent with to lock in success over many trades- Law of averages comes into Play- and the whipsaw moves often negates the smart exit/profit taking- only to see the next leg gap up higher- and to be sitting on the sidelines- as the smug satisfaction of smaller profits wanes in the face of a much larger move higher-

I kept my stops wide , until yesterday when reviewing the charts felt like it might be prudent to lock in some gains, as price action seemed to stall a bit. I didn't set my stops to a sell- and gave a bit of room in case price might bounce back higher- Using NAIL as the example- It had posted a $106.70 open area high, but declined to a much lower close at $103.56.

This Close was below the prior day's Close, but was still above the fast 4 ema- Not much to be concerned about there- but the prior momentum bars (green) now signaled a drop in momentum- with a Blue bar- Got to take that all in context- the deciding factor was the wider gap between the 4 ema and the 10 was noticeably wider than prior weeks-

But this- despite what may occur tomorrow- was a well executed Trade-

I had given it some room to potentially continue higher

My stop was activated near the high side of where price opened and then declined further-

My stop execution captured profits from my initial entry- and is also 2% + higher than where price closed today- Another Blue bar, lower and below the fast ema, Closing near the 10 ema-

The premise is that price is somewhat extended due to momentum, and has had a "pull-away" from the average- trend line- that gravity will cause it to come back into alignment-

That's where a lot of Wycoff followers base their bread and butter-and it works until it doesn't- My simple perception- visualizes how far the price action is above the fast ema, how wide the gap between the fast and 10 ema is- and that gives a quick snapshot to compare what happened on the left side of the screen in the prior weeks or months- TA suggests that history may not exactly repeat- but there are often enough similar occurrences to warrant it's consideration.

the price chart illustrates a net actual profitable trade- not just the "ideal possible" trade-

In this chart- the 1st green bar suggests a reversal higher may occur- An entry could have been based on a higher move - at the 2nd green bar with a buy-stop order perhaps- or entry at the positive close- My real world trade occurs day later-

Note the rather equal spacing in the ema lines- and then they turn up as velocity increases- and the space between the emas widen- this is a visible momentum increase.Price bars are taller, and the widening gap between the lines is a clear indication of momentum- Note all the bars are green and closing solidly above the 4 ema line. Note that the Jan 4 bar had a higher ooen and a lower close- Yet the bar stayed Green- as price progressed, the Jan 9 bar opened higher and closed lower- all the while staying above the fast ema-

This looks extraordinarily similar to the Jan 4 Green Bar- But 1-9 is Blue lower close AND at point of wide momentum- Potentially looks that the up trend may hit a detour- So i raised a tight stop-loss.

Note that while the stock or ETF is trending Well- There is no point in tightening a stop too close- Price action typically will give a reversal signal - perhaps with a wide bar pushing lower- but often -then closing higher- A tight stop simply gets whipsawed - Of course, this all depends on your time frame and what you can stand psychologically-

Note that the attached chart illustrates the promoters numbers- The big potential gain if you sold at the price open High- followed by my actual tight stop about 5% lower- then by the lower yet close- and we don't know where this trade goes from here- I'm thinking it will step lower again- and possibly present a much lower reentry.

-

|

|

|

|

Post by blygh on Jan 13, 2018 20:51:57 GMT -5

Great trading SD. I'll admit that I don't touch leveraged ETFs without being glued to the computer - just too d**n volatile . I have held SOXL and SOXS and TECL and TECS for a day at a time. Housing looks like a good bet for increase in the capital coming to the middle class. I have TOL , LEN and LECO. I am positive on energy services, materials and aerospace - IEZ SLX BA. I am into health care with IHI and PPH. Also holding insurances IAK BRK/B.

Blygh

|

|

|

|

Post by sd on Jan 14, 2018 20:32:52 GMT -5

,

Thanks Blygh,

But it didn't drop enough for me to game it for a better -and lower reentry.But that's my net approach in holding leveraged positions for multiple days- rely on the stop to capture the gain....

I'm putting my full faith in this extraordinary market- but with stops trailing - holding positions for the longer term where possible- I still hold a small position in Nail- forgot I had added to the position I think, and so just modified the older order- I reentered QLD and VAW -and keeping stops in place - I held off on GMF as it is so extended in move- has to come back, or so I think, and I want that exposure- Might use the Chindia ETF- Haven't been able to focus on markets much -this week for sure- but may as well not second guess when this bullish move ends by holding too much cash or jumping out on small gains. Now that I've said that- watch it tank next week!- Just think of the sell-off that would have occurred had the news about Hawaii under a ballistic missile attack have happened during the week! Black Swan event indeed!Everything would have gapped down on the news, and large losses as stops became market sell orders at much lower prices!

At the present time, my primary focus is approaching the market with etf's- Holding CBOE -

I'm holding a number of varied Vanguard funds for global exposure,; and diversification- and then some concentrated sector funds-as momentum bets- The thinking is that the sector/segment ETF's can significantly outperform the "Market", but have to watch out for sector rotation-

Will list another day- out of time this pm!

|

|

|

|

Post by sd on Jan 15, 2018 21:28:47 GMT -5

A BLACK SWAN EVENT- is a rarity- but not so rare that we don't see them occur periodically in the markets-

Something generates a rapid sell-off in the markets- some stocks more than others- that occurs very rapidly- where price drops very low- 15-25% all within a 2-3 minute time frame- and then it recovers.

The weekend announcement of a ballistic missile heading towards Hawaii would trigger an immediate market sell-off- When such a sell-off occurs, all stop losses would turn into market sell orders- and with the velocity to the downside- it is entirely possible that a stop-loss intended to execute at a 5% loss would be filled at a 25% loss.

The only way I know to not allow this to occur is to have a stop loss with a limit order attached-but the order would execute near the limit price on the recovery side.

Too late to expand on this further- but it brings into question what could the outcome be of holding average stops under positions and to be caught up in a market sell-off in a Black Swan Event? I think it is entirely possible to lose 25% of one's portfolio value in a 5 minute event- with price rapidly correcting back above the initial stop-loss.

This would be a great argument for trading without a hard actual stop. Such events are rare- but they do occur.

This adds another complexity for an EOD trader to consider-and who wants to be locked behind a computer screen all day while Life goes by anyways?

I recall BankedOut talking about a type of market sell order that would have to be hit several times to become activated- not sure what that was-

perhaps a stop-loss with a limit sell would serve the purpose of not getting filled -20%, but what about the big gap lower below the too tight limit?

Something I shall need to consider in 2018.

|

|

|

|

Post by sd on Jan 16, 2018 5:38:36 GMT -5

1.16.18

i'm putting MOST free cash to work this am with some higher limit orders- Futures pointing to a higher open- Have to believe this market has much more upside this month-

Adding back with a buy-stop -limit NAil 106-108.50, bACK INTO EMERGING MKTS WITH SIZE VWO- IN THE vANGUARD ACCT.-

EDIT- Update- The markets all opened up and reversed to close lower today- A significant reversal it would appear-as to the Why? Fast money crew were considering it could be associated with the decline of Bitcoin?

Was filled on Nail @ 107, and it closed down 7% so I'm now underwater on this .trade. The question i need to resolve is do I give this the wider move- and the potential for a wider loss?

Will try to resolve that question in the am-

Interestingly enough- BOTZ and ROBO both gapped up and held that gap-

I have held overweight positions in both of these based on the automation theme-robotics- self driving cars etc, and have been stopped before- only to quickly reenter-

I may elect to tighten stops close to the bottom of the gap to see if it pulls back , but will reenter again if stopped out- This is an area that should only prove to outperform over the next year-or two- I may keep the Vanguard exposure with wider stops-

Article on these etfs:

www.etftrends.com/outperforming-robotics-etf/?utm_source=Pagination&utm_medium=pagination&utm_campaign=pagination

|

|

|

|

Post by sd on Jan 17, 2018 19:00:17 GMT -5

2018 is starting off as a barn burner for certain-

I put the last of my free cash to work today buying DDM- the leveraged DOW-where I already had exposure from a lower price level. and I own CBOE, but my primary focus is thru ETF's-

As I have now combined some smaller trading accts along with transferring some IRA monies into an IRA in a Vanguard Brokerage acct this year, I have the responsibility to actively "manage" a larger amount of assets- still spread across a few accts-

This year will undoubtedly prove to be a learning experience- as i will be approaching this additional responsibility with both an "Investment" focus and a trading focus-

This market is now experiencing the longest historical run without a 5% correction- in market history - or so was noted on CNBC - This lack of overall market volatility , and continued momentum, and the poor yield on Bonds - has just kept $$$ coming in -

YES, it feels surreal- and YES- the market has gone too far - and YES- it will find a need to correct -someday- and the potential for a huge profit taking may occur- but that is also why one could protect some of those profits with trailing stops- Put options etc....Or the finger on the trigger- To sit on the sidelines and "wait" for a correction is perhaps the conservative investor's rationale to be the cautious value buyer-

Yesterday's weak Close after that bullish gap higher start has to be respected though-

Leverage works until it goes against you- and i'm well aware that the upside I've gotten from these leveraged positions could quickly be erased in a matter of a few days in a market sell-off. The markets seem to be able to ignore a lot of the possible negatives- missle warnings in Japan, Hawaii; Possible default on funding the government (we've been there before!)

and all the political rhetoric- but the market seems to believe that the Tax bill, the economy, all will be a boost for the US- Maybe we simply had 8 years of apathetic treatment of business that is now possibly going to be sparked and ignited by new policies that are business friendly-

Getting off on a rant- back on task-

Part of these positions are momentum based- and part represent a diversified approach to the market- Missing is a large Bond component - except for the corporate bond VCLT position.

I hold an annuity that would equate to a "SAFE" approach to the market- , and so these assets- while equity focused- are not representative of where someone my age should be positioned

in terms of taking on lesser risk. But I'm OK and aware of that... Also, there will come a time when everything that is working today will be out of favor someday- so no need to have blinders on - and it's good to consider what a PLAN B might look like-

Only a couple of stocks- I don't want to have that large an exposure to an individual stock - I did buy PSTG today on it's momentum move- and will keep a small amount of stock exposure.

The leveraged ETF exposure should provide that sizzle without collapsing on a single bad earnings report....

I also want to have global exposure - and so the Vanguard Funds give me a no commission way to capture some of the broad global growth story-

And there's significant growth in some of those funds- Just take note- VOOG- US growth- returned 28% last year. I haven't looked at all of these funds performance wise- but dilution is not always bad when the sector is in favor and growth mode.

On a side note- I'd refer to John Bogle of Vanguard-who suggests that the majority of professional asset managers will fail- over time- and after expenses- to- beat the passive approach. There are a few exceptions, and undoubtedly- I and others that attempt active management want to believe we are-or - will be in that 'exceptional' grouping. Since out performance is the hallmark of only a small minority, so the majority of us are likely to be disappointed as we shoot to outperform.

But, knowing that this market is in an elevated state is reason enough to plan to adjust stops to lock in some gains and be "active" vs passive.

As i group the various combined positions- QLD, DDM, NAIL - Leveraged exposure to Tech, Dow, and Home builders- Weighting is a net large % to the overall- approx 20% .

Except for the Nail segment added yesterday, the positions are all into profitable territory and trailing stops will lock in a gain on 15% of the 20%. This reinforces the need to be ready to reduce the exposure and take profits on any weakness.

Exposure to tech is both wide with QLD, VGT, BOTZ and ROBO- Botz and ROBO are theme plays on AI- had 40% & 50% gains last year- I would think this is an area that is going to be strong for years to come-But, I have owned both of these for a while, made a couple of trades and got back in- never had a lot of significant declines -even on a pull away move- Been very steady. So, the tech exposure is about 20%- and The narrow AI sector is 70% of that weighting-

VGWLX, VWO,VIGI,VNQI,VYMI, gives intl exposure about 20%

The remainder gives some exposure to WOOD, metals-DBB, (will change this to a different fund), med devices, defense, biotech, materials, industrials ,Brokers.

The ARKK funds - actively managed - theme plays- that outperformed last year with 60-80% returns- but I have a small 1% exposure to each - and NO stops-

CBOE- trading platform similar to the CME- and PSTG was a momentum move i bought today with some free cash-got to dabble a bit .....

This is how I'm starting 2018- I am certain that this will not be where I finish 2018 - as i hope to keep up with sector plays.

I intentionally will not try to trail tight stops on all of these positions- As a matter of course, the ARKK funds are a small exposure and I will give them plenty of leeway.

I will still rely on TA - but will also consider periodic rebalancing- Vanguard funds- with no trading commissions if trading between their funds- is ideal for selling a smaller amount and buying a smaller amount-

Also- Vanguard is supposed to be bringing out 4 "factor" funds-in February- These are the so called smart-beta funds that select holdings from a set of criteria that should outperform a general index. I will likely consolidate my positions some using these new funds-

Will I "Outperform" the Market this year? That remains to be seen- The "Market" was up 18% this year, but A professionally managed, Risk adjusted fund -After expenses- I hold returned just over 9% this year-

A note on "diversification" - Hard to determine that the value of diversification holds as much as it once did in what is now a highly correlated global marketplace-Perhaps you simply BUY-with one trade- The World markets- Ex us?

If i had the time, I would consider fewer- but larger positions - and attempt to follow & go with the global momentum- I don't have that kind of free time fortunately- and so I will "wing it" best I can

Combined Positions ARKG,ARKK,ARKQ,ARKW; 1%

DBB 2%, PSTG 1.7% (today) , BOTZ 2.3%; BOTZ 6.5; BOTZ 2.7; ROBO 2,3; NAIL 1.0 ;NAIL 4.3;

QLD 5.7; CBOE 3.3; DDM 3.6; IHI 2.6; IAI 3.3; ITA 3.0; 1BB 4.3; WOOD 3.3;

VOOG 3.6;VAW 4.2;VCLT 2.9; VYMI 3.2; VIGI 3.2; VIS 5.0; VNQI 3.2; VWO 7.3 ;VDE 7.0; VGWLX 3.1 DDM added 3.0 (today)

IAI LS 3.0; DDM LS 6.7; vnqi 1, vug 1.6, vht 1.1 ,vgt 3.1,vigi 1.6 ; vymi 1.6, vaw 1.1

|

|

|

|

Post by sd on Jan 18, 2018 16:31:56 GMT -5

2018-1-18 At Home today- 7+ inches of snow makes the roads here a significant challenge- and no one else would allow their employees to travel in the company vehicles-

Markets are flat today, and reviewed a few trades- I purchase a total of 11 shares with the free cash in IB in BLCN - a block chain ETF that came to market yesterday.

Also BLOK started trading yesterday

It's a small enough number of shares I won't worry with it regarding a stop-loss- for the time being.

|

|

|

|

Post by sd on Jan 18, 2018 17:51:25 GMT -5

2018-1-18

Markets stayed weak today, and I particularly watched the NAIL position-

Late in the day,3:30 it actually had an intraday gap lower and I chose then to put a stop-loss in place - which got taken out $103.47 for a loss of $144.00 or 3.3% I still hold a smaller position with a $92.00 cost basis without a tight stop. .

My purchase coincided with a big UP signal on the futures for the market- but that big rally fizzled- so my entry was at the open high-$107.00, and it closed just above $100.00.

Today it jumped higher off the open, but couldn't hold. As it declined below $105, I elected to set a mid point stop-loss- but my stop was hit that last 30 minutes-

|

|

|

|

Post by sd on Jan 23, 2018 21:14:16 GMT -5

Nice to be holding LONG positions when the market Agrees-

Other than the nail position, no other stops have been activated.

Nail is up to about $108- but instead of chasing-and using those funds, i will keep the $92 portion , but use the freed assets to Add to the ARKG position- as an Investment- and i will purchase INDA- as well .

ARKG is a genomics/healthcare play- and had an outstanding return last year, and potentially that may continue going into this year- The IBB position is finally moving up, VHT healthcare is trending higher- so the ARKG adds to the weighting in the sector and some sizzle - hopefully doesn't char me!

Inda -While China is a well known -almost topping growth story, India still has a lot of potential for outperformance- I have exposure through a broader Vanguard Fund, but Inda is a narrowed Bet on the global growth story that I trust we will see in 2018-

I've been busy with more pressing matters on the personal side and so haven't paid as much attention to the market recently- The one spec Stock PSTG I purchased last week moved up a nice 3.5%, CBOE just keeps on truckin higher- ETF's are green except for DBB- Which I will tighten a stop under the recent range- Hasn't moved much as everyone is chasing momentum- The industrials VIS gave a nice 2 month run and appear to have paused-

But, The nice thing is that I have made relatively Few trades since 2018 arrived- and the account values have benefitted from staying the course-

I have to ASK myself- "Will the Markets end higher Dec 31 2018?" Will we have a 5-10-20-30 % correction this year to erase the excess gains we have received in this extraordinary bull market?

Will Trumps policies continue to find traction? All of a sudden we are now at "FULL EMPLOYMENT? " less than -4% unemployed? Will the Fed, Wage pressure, Inflation, 10 year Bond and korea

fail to jolt this market? Or Bitcoin unraveling ?

I watched a few You tube videos on wealthfront- and Warren Buffet was in one segment- and said he absolutely doesn't give any attention to any of the "News"- Fed policy, govn't shutdown etc-

That's all immaterial to his approach to buying value in the markets- and he's got the deep pockets to hold through a decline if he believes in the long term profitability of a position.

Myself- as the average trader- typically cannot stand the drawdown and doesn't have the bankroll to sustain a big loss across a bunch of positions- So we find ourselves defensively timing the markets- to protect our gains, and reduce our losses- But - Our timing is usually non productive- over an extended long term period- Because we end up holding large cash positions when we should be in the rallying market, and we sell winning positions early- on profit taking or minor pullbacks- and fail to reenter- "GONE TOO FAR- DON'T CHASE"

Ultimately, I think chasing is fine in a momentum market, as long as the stops are trailed up-I don't want to allow myself to be complacent- nor too tight- Look- NFLX popped 13% just today-Sadly, I didn't own any.... It had reported great earnings just the other day and an increase in fees. Is up 13% too far to chase? Probably not in this market- but I've only got enough free cash for the 2 trades I outlined.

Will need to consider stop adjustments- with limits- this weekend

|

|

|

|

Post by sd on Jan 24, 2018 20:39:49 GMT -5

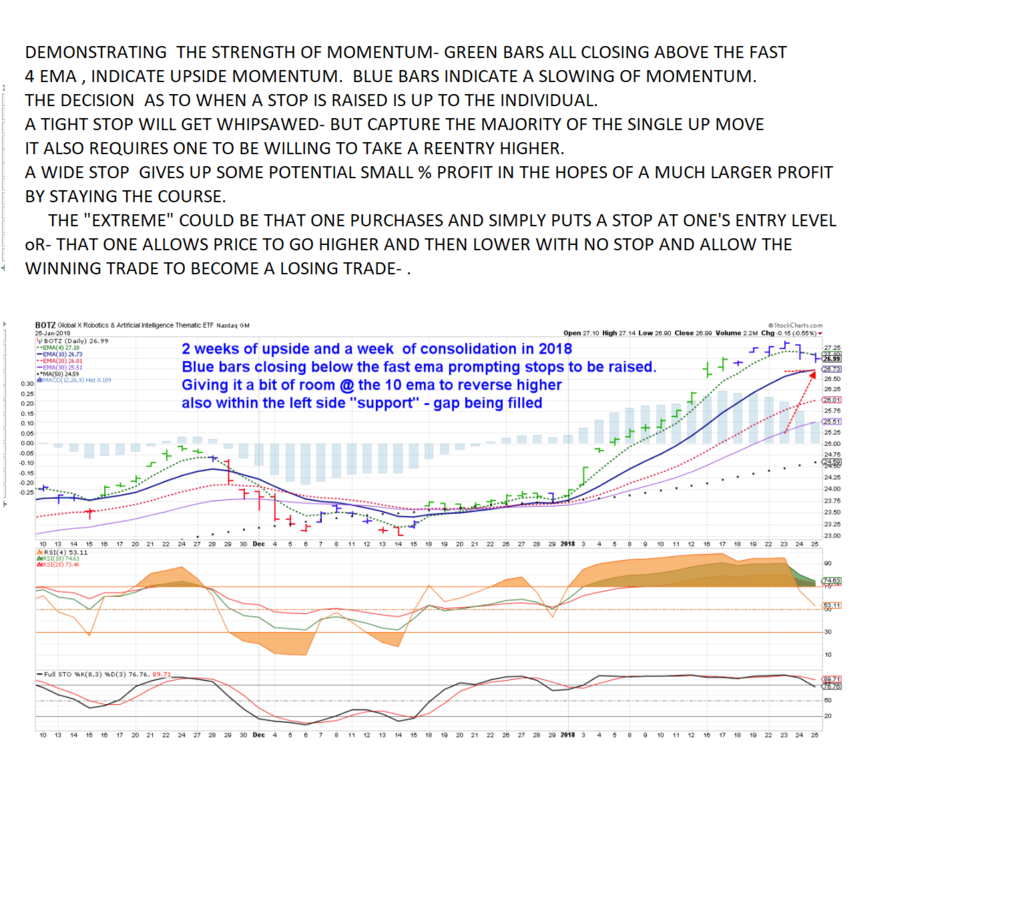

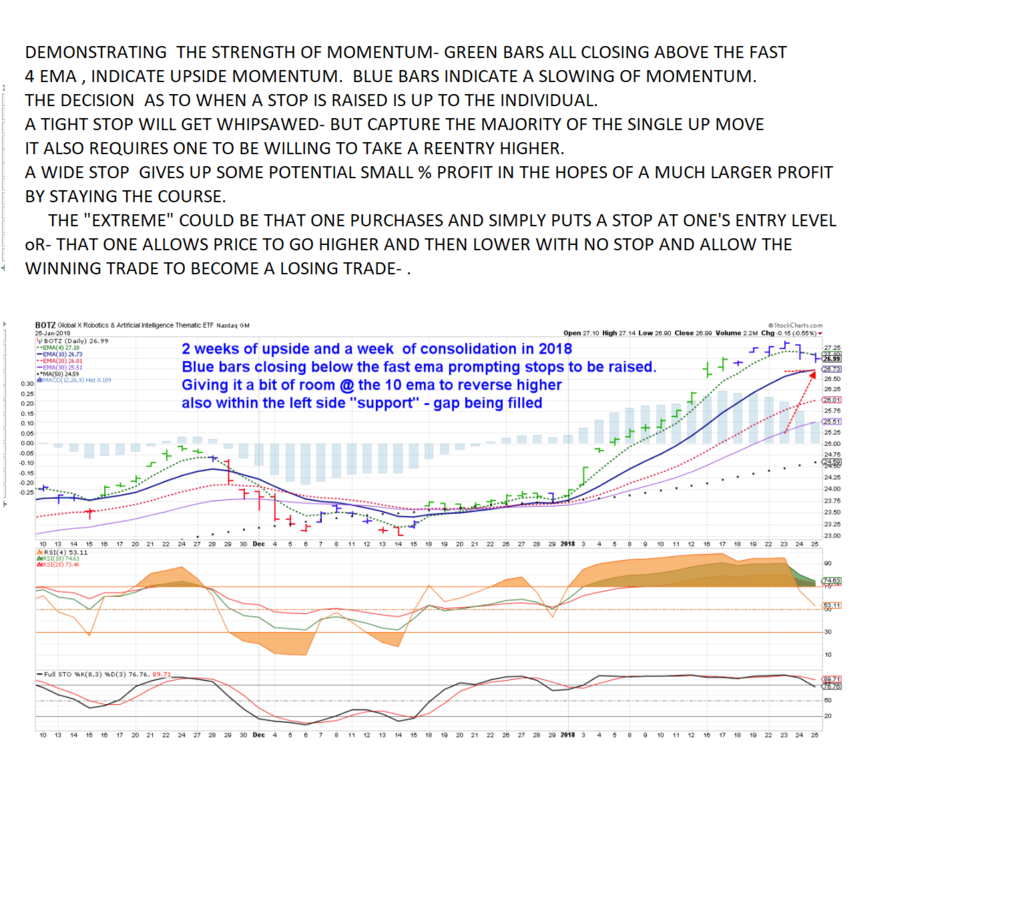

tIGHTENING A FEW STOPS- Botz and Robo have been pausing for a few days- $26.75 is somewhat aggressive a stop- but price made a 1st close right at the fast ema- It's been a steady uphill since Jan 2 , so this is likely a normal consolidation - Markets cant go up forever- Gave it a little room on the stop point, but i'm seriously overweight in this BOTZ/ROBO position-

and feel like they are definitely extended on the daily-

|

|

|

|

Post by sd on Jan 25, 2018 21:04:11 GMT -5

PSTG - Likely the best % gain I have today. Up almost 5% today, almost 10% for the week.

Entry was based on the strong up move, higher close- Big green bar on a saucer pullback- Notice how low the close was on the 1-16, and note the big gap up move 1-17-

I would expect this to pause - and will consider tightening a stop-loss to lock in some gain- but I'm really still a believer in -this market- to try to allow the stock some room to run higher than I expect- so, the stop will be based on a lower level- and - how price behaves-

I went ahead and entered near the Close of the day- Specifically because it had made such a strong move that day- It went sideways for a few days, and then has stepped up nicely higher this week.

I find that since I seem to be getting in late, and leaving out early- All i manage to pay attention to in the am is the Futures- and try to see how the markets closed at the EOD- Will catch up this weekend- Because this market has allowed it, I'm not micro managing trades- and perhaps that is bordering on carelessness- but I have made very few trades this month and am ALL IN.

That said, I have to recognize the benefits of capturing gains when the momentum may be signaling it has peaked and may be ready to give back that momentum- return to the mean- Botz and Robo are 2 good examples of small step by step incremental moves higher- that I have been in for some time- and traded- and they are good investment vehicles for the AI technology-

That said, Markets don't go in a straight line- so, my stop set is designed to capture the majority of the January up move if hit- and to allow me to repurchase- ideally more shares at a lower price- There is always the chance that the retracement will simply whipsaw me- Hit my stop and go higher- but i will then reenter and take the loss in asset value- Cost of using this somewhat aggressive approach-.

I wonder Why I even bother to include indicators -

Price and a few moving averages- a weekly and a daily chart - tells most of the story- the rest is Noise- In fairness though- the colored bars are based on MACD indicators -and at times seem to be be truly prescient. So much , that one could perhaps learn to not respond to a single green- or blue bar- but to grasp the context

by which the bars may be changing- and allow that larger picture to guide the trading decision.

A good example is my decision to raise a stop-loss on Botz- but i am not literally raising it to the bottom of the blue bar that closed below the fast ema- but some times I would do exactly that-to lock in gains- Botz and Robo have been steady- uptrending in 2018 - but i am giving them some small % room to base and pause- and slightly pullback- looking left, note the price gap higher that is being filled by the pullback- So, whgile I feel this is worthy of a long term position within a portfolio, it is also price extended which deserves the higher profit stop waiting on a deeper pullback.

A final note- Tonight I went ahead and moved all stops higher- but not too tight -on all positions- Hard to believe this market has continued like this- But adjusting stops is the best way to feel comfortable to stay all in - I'm generally within 2% on most positions with the stop-loss- and generally at or below the 10 ema as a simple gauge- Even the leveraged positions are still closing daily above the fast ema- No reason to get too tight with the stop-VERY nice % gains just this Month of January in almost every position- Corp Bond and DBB laggards- but offset by very nice gains by holding firm on the Long side-

Wish i could take credit for astute trading and stock picking- but it is simply making the choice to stay Long and go With the momentum- Flow with the Tide-Don't overthink it.

|

|