|

|

Post by sd on Jan 26, 2018 22:08:18 GMT -5

Friday 1.26.18- Markets making new closing highs. The Trump Rally, the Tax cuts, the better jobs reports , the global economy, and the projected forward Earnings may actually bring the PE's lower- Companies repatriating monies back into the US, Sharing stock and bonuses with employees- Walmart increasing the minimum pay rate to well above the Federal level minimum-While it is hard to believe- look at what has occurred in just 1 year in the Trump administration- Whether this suits one's politics or not- this economy is seeing a resurgence of belief in America- Something we've lacked during the prior 8 years .

As the Tax relief comes into effect next month, Consumers- the life blood of the economy- should prime the pump for a continuation of this massive flow of new found belief in the American Way- When i- and other Average Americans get to see more $$$$ in our take-home pay- we can see our 401k accounts moving sharply higher- This restores faith that better times are on the way for the American working class- Naysayers and political Hacks can try to derail this resurgence- The prior Administration for 8 years

took an Apologetic tone in the World -all the while allowing American's to slide deeper into the Pit of lesser opportunity.

I applaud Trump's policies- while I hate his "Tweeting" and would prefer to see him be Presidential- and not emotional and reactive on the Web.

That Said- We finally have a President that does what he was elected to do!

Not wanting to make this a Political discussion- I simply see the benefits of his growth policies extending to All Americans-

Final Note- markets All Closed at New Highs this day- and- since I'm All-in , i've seen some upside as well.

A note on the prior post with Charts- BOTZ was accommodating and moved higher and did not stop out, moved higher .However, it did not make a new high-

That makes this yesterday Swing Low a potential significant support level that I might want to see not be broken- Pullback lows from an uptrend- qualify as higher highs and higher lows- This was not that significant of a pullback -but price is very extended.

PSTG added another 2% or so and Closed at the Very Top -$19.91. This is getting parabolic perhaps- and so i will trail this on the fast ema-

|

|

|

|

Post by sd on Jan 30, 2018 20:33:07 GMT -5

So much for not focusing too much-

Executed stops on Botz,Robo,VDE,DDM partial-,Nail (loss 88.27) Vigi,VWO, IAI partial,ARKG partial

2nd day in a row selling- markets down almost 1% - concerns about higher T rates- 10 year up -

I tightened up a few other stops - red bars all below the fast ema- With price having had this nice run up this month, why would we think that the smart money wouldn't take some off the table- I was heavily overweight BOTZ and it simply makes sense to lock in the gains- Sold the majority of DDM, the remaining portion raised the stop to 146.00 on the off chance it may rebound tomorrow- But it is likely that this gets choppier this week- lots of news related items to pick from- including the Fed talk-

PSTG - got a blue bar today, but the close was on par with yesterday's bullish close-I'll leave the $19.50 and $18.75 stop, because -considering the overall market weakness- Today's price action with a 19.75 low and a 20.35 close has to be viewed Bullishly- I don't expect it to hold up with another day of profit taking- but I'll give it the chance to have some wiggle room between the 2 stops-

The final question becomes- How much selling may occur? A Trader has to ask: Will wider stops protect me or just lose more profits? I feel comfortable with having to reenter the trade- perhaps at a higher price if I get whipsawed here- What if the market retraces 5-10%? That will become an unusual buying opportunity for those that have some cash- but that large a decline hasn't been seen in quite some time-shouldn't be counted on-But neither has this run up we've seen in Jan!

I tend to look at this recent up move as going to revert to the mean before it continues- so I'm good at stopping out early.

|

|

|

|

Post by sd on Jan 31, 2018 19:32:52 GMT -5

With some freed-but unsettled cash, I will be placing a Buy-stop order for SQ- It rebounded nicely and closed above the recent base- Still short of it's prior High-

I'll use $47.00 as the Buy-stop with $47.50 limit. I am getting a "Free Ride " warning not to sell prior to the 3 day limit on the prior trade I sold that made the cash available. Using a Normal weight position size on the entry

|

|

|

|

Post by sd on Feb 2, 2018 20:52:25 GMT -5

With the markets selling off hard again today- 2-2-18- and the Dow Losing "666" pts -Hmmm- does not portend well....

This wide volatility to the downside is something we haven't seen in quite some time - for several years- and yet, it was the "norm" a few years back-

My total All-in position size has been reduced this week as positions have stopped out-Fortunately some earlier than others. Recent Profits have declined substantially- as some stops that were intentionally quite tight- such as BOTZ were taken out early on, while i am still holding some other positions with stops at Break Even- Some Profits have evaporated, and now stops are at Break even and one more sell-off day will clear the house i suspect.

The mindset needs to be not how much I may be giving back in this week's pullback, but how much I have kept with the use of tighter stops-

It's interesting that the use of stops in a benign market seems to be a self-defeating mechanism- based more on the short term fear of Loss than the realized long term gain that minor market volatility - the use of tight stops is only effective if the reentry nets a repurchase of more shares at a lower price- otherwise- the simple cost of commission and a higher reentry reduces the position net gain vs the long term position hold.

Tight stops are effective only when the decline allows enough downside to profit on a repurchase at a lower price- So, stopping out early is fine- but best if the future decline is low enough to allow to take the reentry for more shares at a lower price- Doesn't work well in the shallow declines we've experienced in the past year-Perhaps this decline will give a greater opportunity....

|

|

|

|

Post by sd on Feb 4, 2018 9:46:02 GMT -5

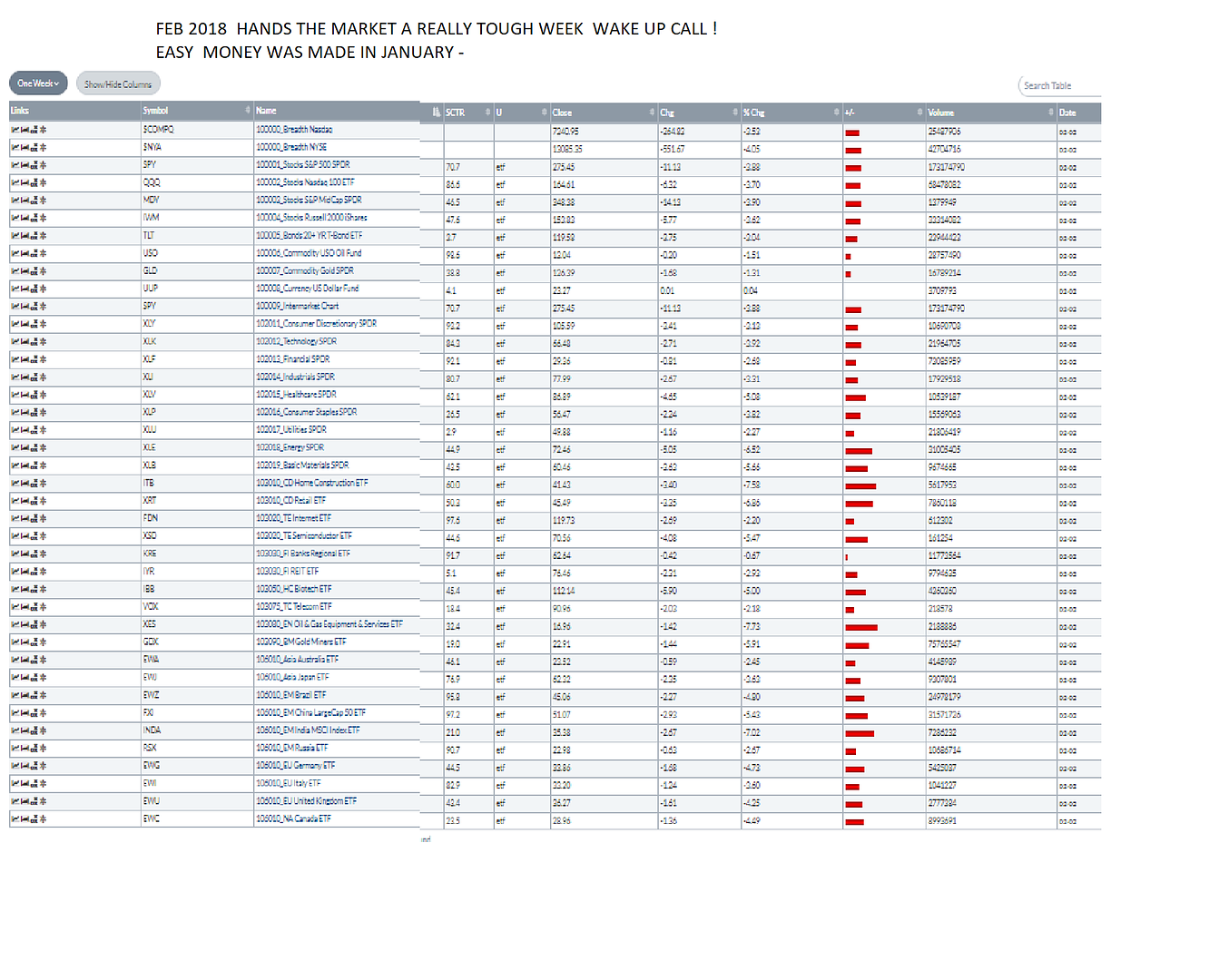

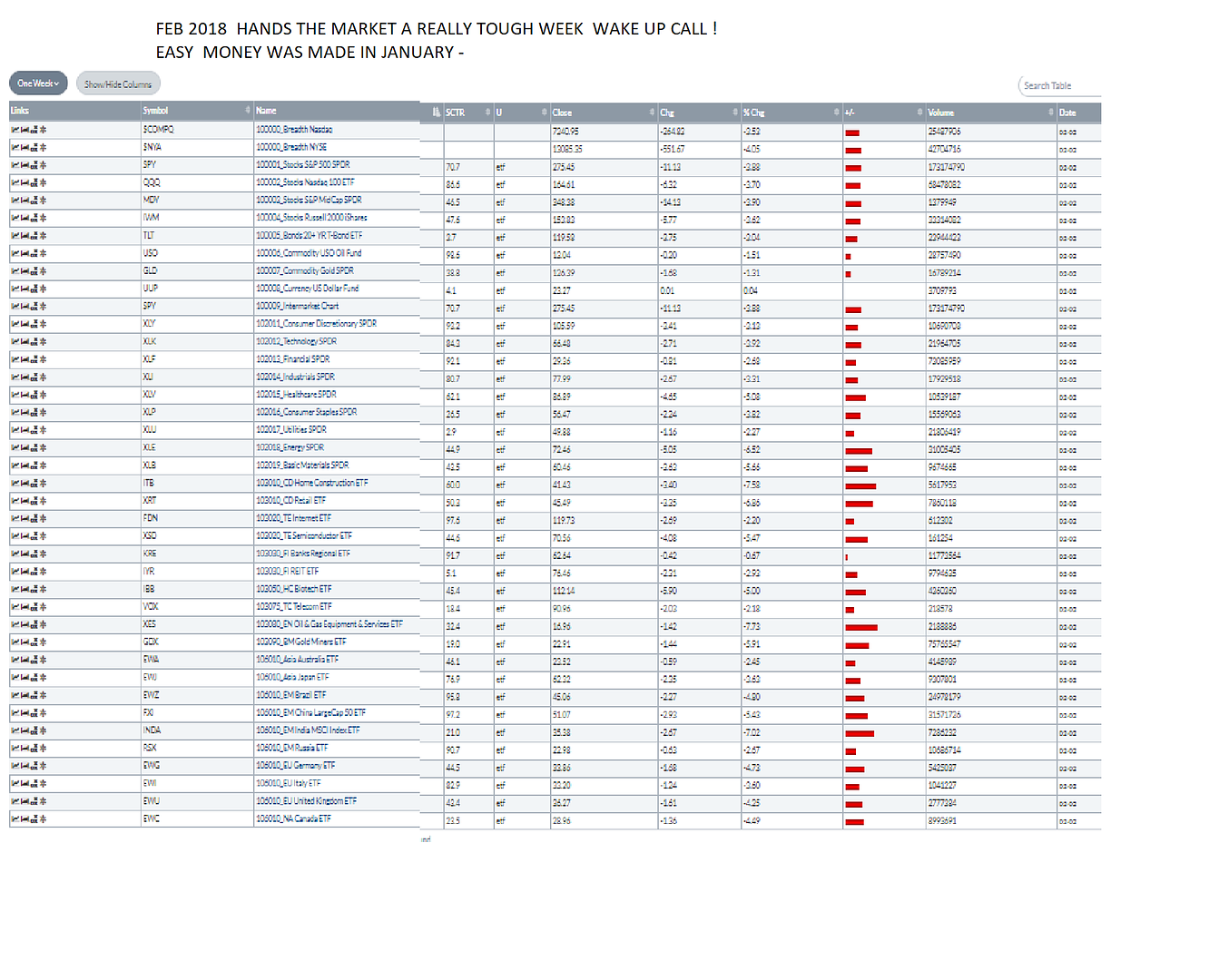

Took a snapshot of the stockcharts common sector performance for the week-

There wasn't any place to Hide this week- as even the defensive utilities sold off and gold as well.

I only caught a glimpse of some market pundits briefly- citing the strong job market as one reason for the selling- and the likelihood that the Fed may tighten sooner-.

Perhaps this will be the start of the long awaited market correction- As the chart shows, the week's selling was Global - so even a " diversified " portfolio was not immune- And- that may point out that the global markets are more closely correlated in today's world-with the US markets-

Notice in the % change column, UUP held up the best, while 7-8% losses occurred in some sectors- Home construction, Energy area, etc.

When's a good time to be a Buyer? Perhaps this would be a good time to put in some really low limit orders in those areas one wants to own for the longer term-

That's the Warren Buffet approach- to step in and BUY while others are selling. Of course, We don't have his financial resources or fortitude.

|

|

|

|

Post by blygh on Feb 5, 2018 17:58:14 GMT -5

When to buy? That is the $64 question. The weakening dollar should be a positive for the market as owners of foreign currencies can buy more. On the other hand, the Fed has always played a major role in pricing of socks. I am going to hold off major buying until the next Fed meeting. I want to see how it reacts to a quarter point interest rate hike - if there is one (I put the probability at 70% for a hike)

Blygh

|

|

|

|

Post by sd on Feb 5, 2018 21:04:20 GMT -5

"When to buy? That is the $64 question. The weakening dollar should be a positive for the market as owners of foreign currencies can buy more. On the other hand, the Fed has always played a major role in pricing of socks. I am going to hold off major buying until the next Fed meeting. I want to see how it reacts to a quarter point interest rate hike - if there is one (I put the probability at 70% for a hike)

Blygh

That's likely Prudent to be patient-and -while the market had "priced in " a few Fed rate hikes- this type of hard sell off may gut the newer retail Investor-

Even those of us that have been around for a while and anticipated that "someday" we'd see a correction- well, it is disconcerting to all to see profits evaporate.

I heard that January saw a huge amount of new fresh money into the market- With the Fed seeing the increased employment, possible increase in wage pressure, and with a new Fed Chair....

lot's of unknowns- and politics? Lots of wild cards ahead.

Since i stopped out early on in the investment account, I will look at trying to take a partial 33% reentry based on the November lows in some of the Vanguard ETF's - Don't want to catch the falling knife -as they say- but I'm hoping for another sell-off day like today at the open. Target perhaps is 12% off the highs- Another 5% leg down would be good -and since these are "investments" mostly since September, I've seen some gains-

I did keep a position in a Vanguard Mutual fund without any stops- for comparative purposes. Some samples are VIS 132,124 voog 132, vaw 132, VDE 84, vigi 61,56,51 ;

vwo 44,40 ; vymi 64,60, 54 vgt 150, vht 141, vnqi 54

While I'm not prepared to short the overall market-Not that nimble- I'm going to look at a short Energy position for Tuesday- DUG- $39.75 Buy-stop- Limit $40.12, stop $37.50. RD had suggested some shorts to me -but i had to pass- hope he got in early!.

My thinking is that traders will be taking profits off the table on big winners- So some of those could easily oversell hard - So a 20% decline is totally reasonable if you're up big and want to protect those gains- Algos and Bots are doing their thing- Professional traders are likely along for the ride- Isn't it said that they need the volatility to make their money ?

|

|

|

|

Post by sd on Feb 6, 2018 19:27:23 GMT -5

2.6.18 Market recovers and rebounds! Or has it? It certainly moved back higher- This could be the ultimate V rebound- or perhaps not-

I never trust the 1st reaction move higher-This time could certainly be different though- but I'll sit on the sidelines to see how it develops - My entry limits were all much lower-Interestingly - the DBB position sold today mid day- had held up through this turmoil and started to weaken finally.

As i view the charts, a lot of lower open, higher closes, but all RED bars still- I'd prefer to see a bottom, some consolidation-

I lost the link- but i read today that Credit Suisse is pulling it's XIV volatility ETF off the market! It did not perform as expected- and this points out the danger of being on the wrong side-of the leveraged trade in a fast moving market- With programmed selling- perhaps these instruments do not seem to add to the liquidity- as advertised- If there are No buyers on the other side of your position- you're in deep stuff......Hearing a lot of criticism in the leveraged arena- Wouldn't be surprised to see the SEC take some steps - but the culprit is likely programmed trading that causes the wide swings

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Feb 6, 2018 20:43:44 GMT -5

So far this reminds me of the way the 1987 crash unfolded. Big down move on Friday followed by high volume sell everything on Monday. Hit a bottom on Tuesday. I placed buy orders for mutual funds on Wednesday and those were bought at the closing price for the day, which was way higher than I expected. It turned out to be a sharp V bottom and the market came back very quickly almost like nothing happened.

But in a lot of ways this is much different. Iran was shooting missiles at oil tankers and international shippers in '87. International tensions were much higher. The backdrop of the Fed's role in the market was much different. I can't help but think all the QE bond buying and interest rate manipulation in recent years has contributed to the mis-pricing of some financial assets. The lack of volatility the past few years may be do to the assurance that central bankers had the the market's back and would bail out the market if stuff got serious. Now we may be facing a market that will sink or swim without a QE lifeline.

In 1987 the quicker you placed buy orders after the 22% down day Monday, the better you came out of the brief debacle. Maybe I'm drawing too close a comparison, but I'm a little afraid of waiting to buy and having the opportunity quickly pass. One big difference is the magnitude of the selloff in 87. This is a blip in the charts by comparison. Maybe that could leave more room for selling as I suspect the excesses of QE have not yet been washed out. It should be interesting to see how this unfolds. Maybe I should sit on my hands a bit and see what happens before getting trigger happy. -ira

|

|

|

|

Post by sd on Feb 8, 2018 21:28:43 GMT -5

Hey Ira,

I'm still holding limit buy orders that have been too wide to get filled- I've been too busy to view the market intraday, but I don't expect a quick V recovery at all- Now that there is a level of doubt about the WHY's we are selling off- it takes the bullish wind away- We seem to be selling for a number of reasons-and I would have to cite valuation concerns as finally becoming an influencing factor after all else is considered. Also, consider that this market is an already extended Bull market- Long in the Tooth- a Period of basing and lesser volatility at a lower level would bring some stability- all of this can take time to develop- We had an excessive uptrend in Jan, and, the pendulum swing reaction to that excess may go beyond reversion to the expected levels-

I'm also considering stepping in and starting to purchase partial positions in some of the Vanguard ETF funds- Friday- This would be an act of faith to intentionally purchase in advance of seeing a viable turn or sign of basing- As an example- SPY today is off it's high by about 9.8% Let's assume that we are only 1/2 way to the "Bottom" - and we have another -10% decline to look forward to- -20% - Or- perhaps it indeed manages to reverse higher-

My tight stops took me out early by design- but it would be for naught if I can't capitalize on a good higher exit by buying more for less $$$

During the past year and a half, we hadn't seen a 5% pullback- and that would have been a good buying opportunity- A 10% decline exceeds a 2 year time frame-

I find myself in the very Odd position of trying to think like an Investor -and essentially being willing to Average Down - Something i think is foolhardy when it comes to individual stocks- why should I think i can select ETF's any better?

I am starting off small- purchasing a 1/4 position in a group of different Vanguard ETFs- There will be no stops set under these at this time. Why not? because these will be the "core' starting positions- I may choose to weight these differently going forward.

This will put a toe in the waters, no commission cost trading Vanguard funds, so i can take the smaller positions-

I'm not even trying to guess at Trading- My one position in the trading account is DUG- which is just in profitable territory- shorts Energy -Thought it a no-brainer with the sell-off.We'll see.....

As i look at the other ETF's i owned and stopped out of - or even the CBOE-just trashed 3 months of steady upside in 5 days. Never would have thought the defense ITA would so easily drop below it's 50 ema - but it reinforces the purpose of TA, -employing stops- and tightening those stops when things are excessively overdone-

For those that have grown complacent this last 1.5 years, this has certainly been a shake up-wake up -call this past week. Now everybody and his brother can claim they "warned' this market was over heated- overvalued, and overdue- Which one is proclaiming it's the time to BUY?

I would guess that this is a good time to reflect on where one had their assets piled up in- because some things certainly sold off much further than others.

Even utilities are down -5% on the week, Gold down -2%, UUP up 2%-

I would think XLU would be quick to snap back higher- more of a safe-haven place to be---BUT WRONG! Check out the "safer" utility sector- Gave back all of the gains goind back to last March! 10 months -decline started in December- and while the momentum money was pouring in in Jan to other sectors- The XLU continued lower- - Should have been a safe-haven this past week and seen some upside - but Not to Be- That seems very ODD- If the utilities aren't benefiting here- At what level will they?

XLY- still down....

No ill wishes- but i would like to see my orders get filled at a lower open-

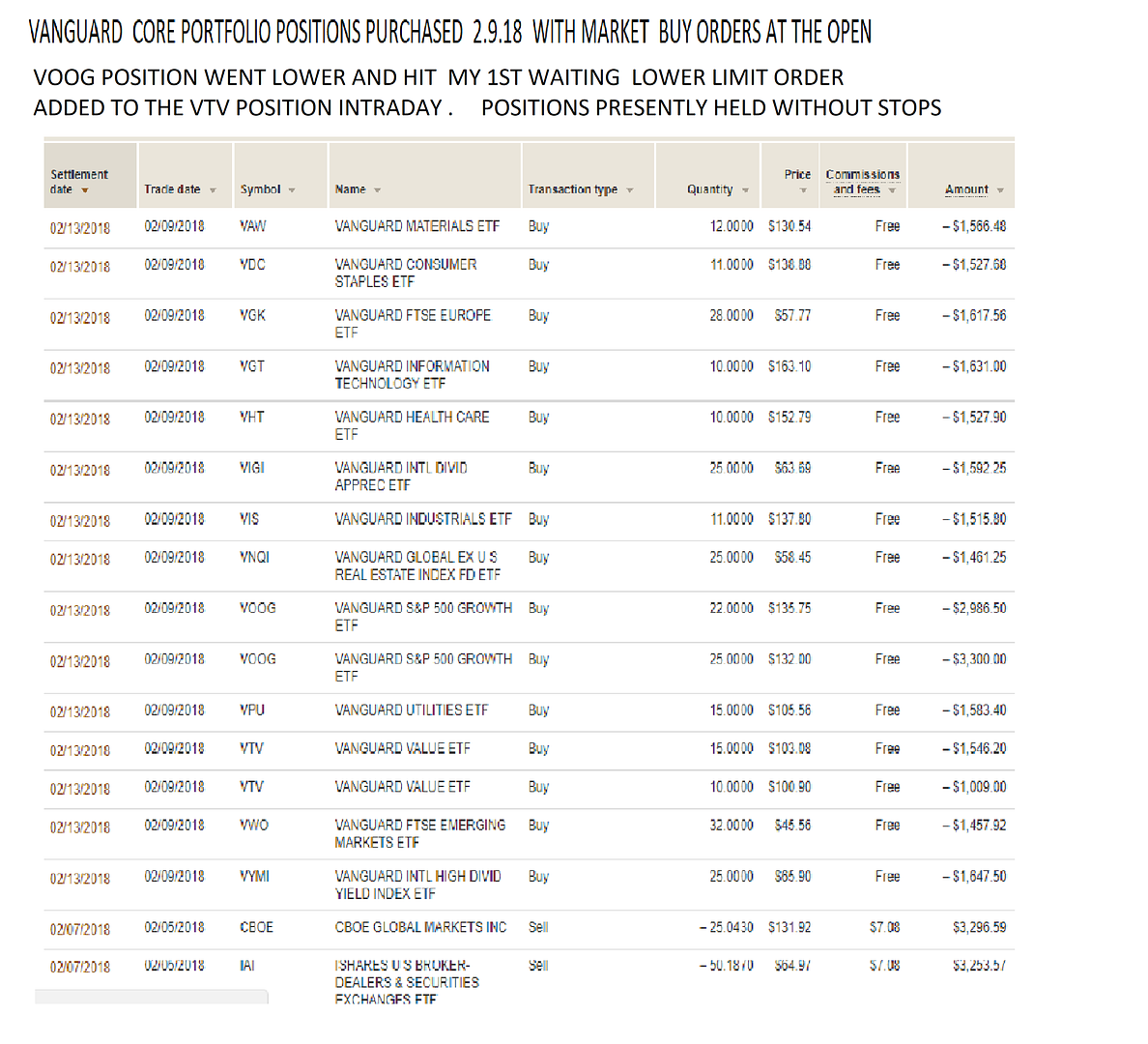

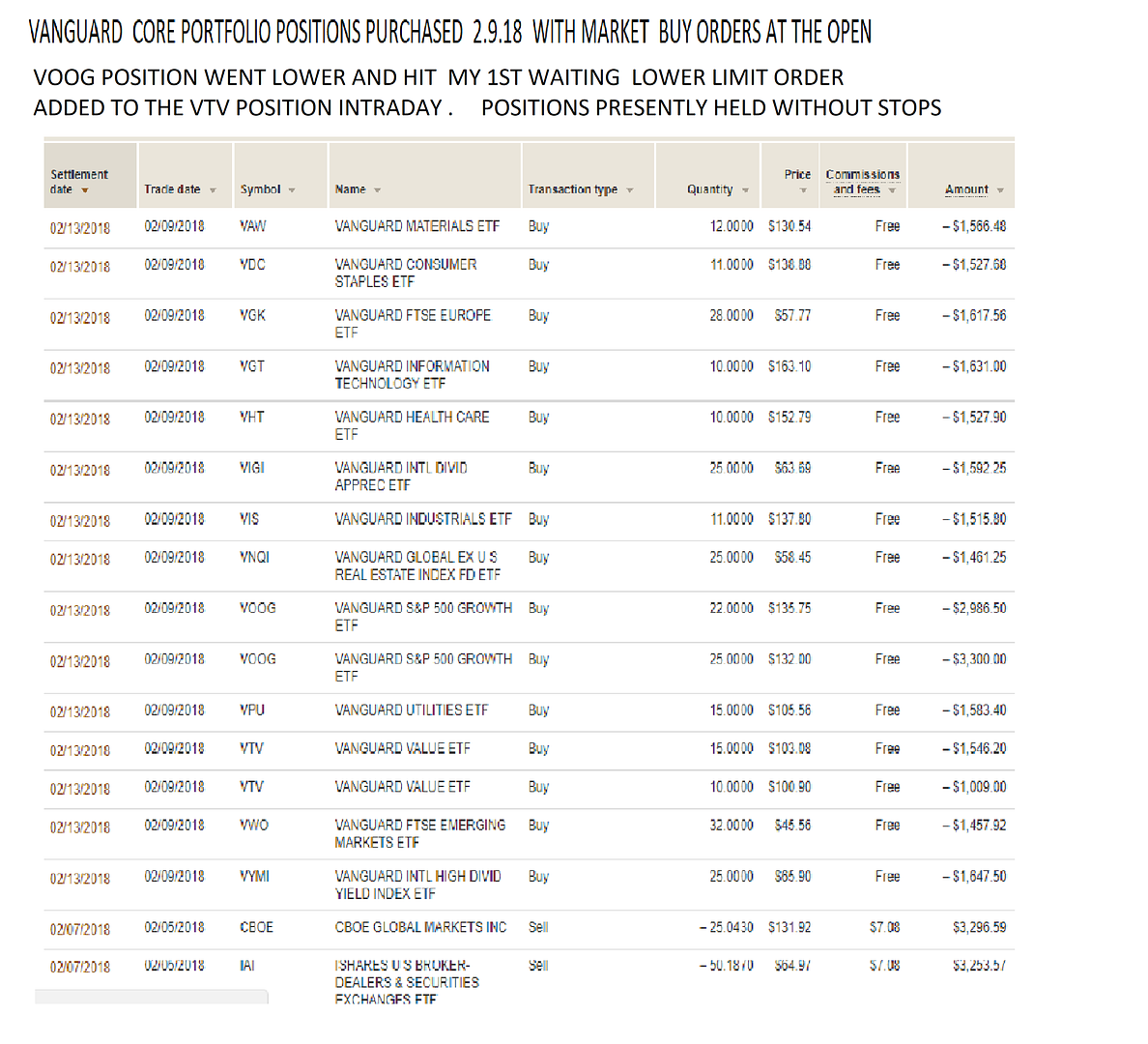

Edit- Buying approx $1500 ea at the open through Vanguard- Simply a diverse # of funds with a wide market exposure- OPEN ORDERS AT STILL LOWER PRICES.

tHIS IS ON THE INVESTMENT SIDE - Establishes a CORE group that can be added into if conditions allow-if the lower orders are not filled-

VYMI,VHT,VGT,VIGI,VNQI,VIS,VWO,VAW,VOOG 2X; VTV,VGK,VDC,VPU

|

|

|

|

Post by sd on Feb 9, 2018 19:30:37 GMT -5

2-9-18 Market orders filled at the open - When I was able to look late am, mkts had sold off- I purchased some additional shares of the Vanguard Value VTV- later on ,

my lower limit added shares to Voog at 132.00

The majority of the charts are long bottom tail dojis- closing near today's open-That's potentially a positive-. The remaining limit orders remained untouched-

|

|

|

|

Post by sd on Feb 11, 2018 20:20:44 GMT -5

the decision to purchase shares for an Investment portfolio this past Friday may prove timely, or not-

The decision was solely based on the amount of pullback we had seen- and the expectation that we would likely not see another -10% decline.

The Investment decision made also prevents me from setting Stops initially - as my entry level was not based on good technicals-

I also will be adding more to these positions should the market take another leg lower. Note that I am now overweight VOOG- on this initial entry - which is based on S&P momentum/growth. I had doubled the order for the basic entry position size , and was filled at a lower price to add into that position.

i will try to add into those positions that appear to be taking leadership roles in the weeks ahead- and may implement stops along the way.

I think a prudent Investment choice is to consider conservative plays - Utilities as having been oversold for some time- and "value". has been out of favor ...

Some areas of the market held up well- Whatever didn't sell off with the markets shows resilience. Ira noted that strength in his horse race pick for the week.

A lot of the positions show a long tail Doji- Often a sign of a reversal - as the selling closed back at the open-

A buy-stop above the top of the Doji is worth considering- Look at BRKB- i would prefer a multi-day basing- such as in the utilities.

Spouse decided to go back into AMZN on this decline- Will buy some at the open for her account Monday.

As I consider the approach that evolved- and I have used this prior year- It was the right time to hold positions for the longer term trend- ignored minor fluctuations, set stops a bit wider- and (Almost ALWAYS)- went with already trending trades. Right market- Right time for that approach- Also, getting to pay attention to the charts and momentum worked out well- and also being willing to tighten stops to lock in gains and when the move was excessive- Totally the right thing to have done.

I find i am comfortable with having sold out- and getting to make purchases now at a lower price-

This would not be the case if this had been a minor 3-5% decline- And note that market timers like myself tend to get out late, and are slow to Buy back in- Therefore getting about 1/3 of the market's return.

We'll see how that works out this year-

Just to be on the up and up- Chart shows my actual Investment BUY transactions on Friday in the Vanguard account- Vanguard trades come with NO commissions- allowing one to trade smaller quantities -such as I did here. My average entry cost was allotted to be $1500 +/- in each various position- Toe in the water so to speak-

Ideally i will add into some of these trades -once the market regains some footing-

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Feb 12, 2018 20:38:40 GMT -5

I looked at some interesting charts. Using bigcharts.com I compared SPY with 3 traditionally defensive etf's, XLU utilities, XLP consumer staples, and TLT bonds. SPY and XLP track almost exactly. TLT is down just a fraction more than SPY and XLU is just a fraction higher than SPY. These traditionally defensive alternatives didn't hold up well at all during the past month.

Next I put SPY up against XBI biotech, XLK technology, and ROBO. Surprise!! XLK tracked almost exactly the same path as SPY. ROBO was just barely lower than SPY and XBI traced out a pattern a few points better than SPY.

So the broad market SPY had almost exactly the same path this past month as conservative consumer staples and aggressive technology.

What's it mean? Possibly that there is no rotation of asset classes in this correction. Just a sell off and some bounce back that's pretty much across the board. No winners, no losers. Just some volatility after having none for a long time. But if there's no rotation, no change of leadership, is the correction really correcting anything?

It might also imply bonds might not have the traditional conservation of capital role in the next bear market. Interest rates have basically been going down since 1982. It could mean that with every borrower drunk on low interest rates and deep in debt, rates won't go down in the next bear market. Holders of bonds, thinking they are a "safe alternative" to stocks may get a rude surprise. Same with holders of those target date retirement funds that hold more bonds for older investors. When the bear gets here, there may be panic trying to find a safe hideout. I guess I ought to think about my bear market strategy. Might cash be the safe alternative? Cash? Who would a thunk it? -ira

|

|

|

|

Post by sd on Feb 12, 2018 22:23:49 GMT -5

You make some good comparisons- wish I had the time to review further in depth-But shorter term swings with everything in lockstep do not generally hold true over the longer time spans of many months or years-

Rates are going higher- that's a sign that the economy is strengthening- the patient able to stand on their own 2 feet- As i understand it, that somehow will reduce the effective PE valuations? I didn't understand how that could be- Because earnings are earnings and price is price- Didn't know that interest rates had a direct bearing-

Cash is not a viable long term option- but perhaps keeping a 10-20% cash available for great add ins makes some sense- but you lose that potential extra gain if the market selection is gaining and you're sitting on your hands.

I'm a big proponent of target date funds for those that just don't want to bother with this investment stuff. I also think that it's likely a mistake to do the 60-40 if you're 60 years old- Many will outlive their investments if they jump into bonds too heavily- And look back to the decline in 2008 and see how "Safe" your money was- even in Gold- GLD dropped from 100 in 2008 to below 70 - So it lost 30% peak to trough, - and did reverse higher months ahead of the market.

The advantage of target date funds- at least Vanguard- is the very broad diversification- That same broad diversification won't give you a 30% return - but it also likely won't give you that 30% decline- The key there is to be putting some invest monies to work month in and month out - and let decades of market gyrations make you a lot of money- and supposedly 40% of market gains-compounded- are from dividends- not to be discounted- While Tech this year was a great performer- and healthcare and biotech was a screamer for 4 years in a row a few years back, a well diversified portfolio captures a portion of that upside and reduces a portion on the downside- Target date funds at least offer those that are simply believers -a low cost way to participate for moderate risk and gain.

Investing for the longer term -at least for me- requires a different mindset from trading- I think it's prudent to fund both strategies if one is able-- My Company IRA- is limited to //////american Funds mutual funds- I did a partial rollover out of that account- Now into a self directed Ira brokerage account Ira with Vanguard -Which allows me to select from stocks, ETFs or mutual funds- That was a difficult decision actually, because I now get to take responsibility for what happens in that account- Previously, I could perhaps Cry if things didn't go well because my Broker or company custodian "managed" the account. Now i have to step up and be accountable.

A Roth Ira is where my trading accounts stem from- No taxes to be concerned with- and one should max out the Roth after they get the employer's match in the company IRA.

I'm off-on a tangent- but I hope to spark some interest ...

Looking at some charts, everything up- and a number of positions have made turn-

I'll be a buyer in the am- adding to some of the prior vanguard positions- and some other select ETF's -

Investment acct- WOOD 40 buy-stop $73.00 Limit 73.50 VGK $58.75 stop $59.00 limit VPU mkt, VIS 140-buy-stop $140.00 limit; VGK mkt.

I'll be putting in a very tight stop on DUG- had a drop lower today.

Will put in Buy-stops for Botz, Robo-INDA in the trading account- based on price going higher-

Note that the prior Dojis have seen higher opens and higher closes today. this bodes well- Charts are still 'early- Inda has been basing for 4-5 days- was a recent focus of mine so it is now a possible trade- Both Botz and Robo are theme plays on the AI automation- and I managed to trade in and out of them - but these seem to make sense to be worth an Investment focus - particularly on this pullback.

Good luck

|

|

|

|

Post by sd on Feb 13, 2018 20:45:01 GMT -5

The buy-stops for Botz, Robo, Inda Did exactly what they are designed to do. They did absolutely Nothing today,

The virtue of a buy-stop order is price has to go in the direction you want in order to be activated. They all opened lower and never reached the activation price-

The order sits there as price consolidates lower-

The other orders with Vanguard were filled- (6) -adds to Vis,VGK,VIS,WOOD,

over this year, Even in minor declines in trending stocks, the 1st reaction often fails to be the base to go higher- This is where the buy-stop order works well with the TA of the chart- Charts have not given me the usual pullback and basing period necessary that i would prefer to see-

Quite Frankly, it's very much a crapshoot still- But i felt comfortable in buying value and adding today- as well as Europe-

i have to believe that while we may be in a transition period, global growth will continue- That Europe and the eem markets are better values- but the US market still leads tghe world.

mention- My short trade with DUG is still profitable and alive

Correction- I was stopped out $40.93 2.13- totally missed the 1 day climax spike up to $46.00- but Not watching intraday.

|

|