|

|

Post by sd on Jul 6, 2017 20:01:55 GMT -5

MD stopped out- My added position caused me to increase my stop tighter within that 7% upside gain- and it stopped out for a $15 net gain-I've also had a few other losses- need to update this weekend- I've given back about $350.00 in profits in the last few weeks- A bit too much Hubris on the pedal i suspect- thinking the market will present me with a turn higher-Tech had a very nice run last July- certainly not the case this year- and with valuations being as high as they are..... We've had a great run in the Q's this year- very nice uptrend - and just this week we've gotten a 1st close under the 12 ema for the year! Compared to 2016, the q's breezed higher this year.. However, The weekly stalled in June, and this week the close is a lower low and under the 12 ema.

VRTX - the remaining partial position also sold -slightly above my entry cost- This somewhat reinforces the premise of taking that partial profit with just a portion of the position -

That partial profit- memory is likely wrong- i think netted 7% - and that makes this sell average out for 3.5% + overall-

If I was Anxious- and focused only on the early gain- I would have sold all and made the 7% -or whatever the 1st sell locked in- But in doing so, i would be denying the stock the opportunity to move quite a bit higher- for a much larger gain. The early sell to lock in a certain % gain satisfies that side of the mind that may be Risk adverse and wants to take that smaller profit-

The same mechanism is true when we set a stop unreasonably tight- We are perhaps responding more emotionally and driven by our desire to not suffer a loss- or to reduce that loss-

I think i am getting much better at trading- Odd statement considering my recent losses far exceed my reduced profits.

When the sector/market trend was in my favor- I relaxed stops, allowed price room to breathe- and had some very nice gains by doing so-

Now is the time to consider that this pullback may go much deeper- All the indexes were down today - almost 1% - .75 Tide is going out. Like a good trooper, i figured the sector had a small sell-off but would rebound and rally- perhaps not so fast.....

i also don't have any sense of what is occurring that drives the markets- I don't catch any financial news except for the 5:45 am CNBC handover from England .

Ultimately, i expect that there are a few leaders in the industry groups that will rise to make a push higher- Perhaps Mram- or AMD- or NVDA starting to make a base here.... but if the sector is weak, Tide takes most everything out with it.

This perhaps is also the time to get more tactical- Is it worth the effort? Risk worth the Reward?

I'm reading a Book that RD contributed- "Mindful Trading" Mastering your emotions- and it's an interesting look at how we are emotionally driven - to make trading decisions- that may not be in our best interests- but we are living in a framework -based on our experiences in our life- that sets us up and can dictate our reaction to what occurs in our trading- and - we are not concious of the Bigger "Why" we are compelled to approach trading as we do-. I'm just partway into this book- and it's interesting so far-Certainly available as a winner's choice in the horse/investment race...

While we all perform similar actions in making a trade- We all likely interpret when to enter, when to exit- how much to Risk,,,where to set a stop- all differently .

Dennis  ? Turtle trading- Took a number of students and trained them to employ the Dogs of the Dow approach- but they all came up with different versions of what they were shown. ? Turtle trading- Took a number of students and trained them to employ the Dogs of the Dow approach- but they all came up with different versions of what they were shown.

It is the psychology of one's mind that interprets something diffferently from the next person = for example a price chart with a decision as to whether one should make a BUY at this point. Ask 20 people, and you likely get 20 different inputs -or views....

For those of us that have been doing this for a long time- and those not so long....We all could stand to take a fresh view in what we hold as beliefs, and see if those beliefs match with what the market does. One of my beliefs over the years was that -anytime now, the House of Cards will topple- and i would take small counter trend moves as the indication the wrecking ball was about to swing- Over extended.... PE too high.... Currency will be worthless... BUY GOLD- The market cannot continue.... And I think I lost a lot of monies quickly when i bet With my emotions and ignored the larger trend. News events would Trigger my response- like when the Senate would not ratify a temporary budget and the US was going to be downgraded the previous year- and i'd jump into the leveraged short ETF's -only to ind it was avery quick turn back to the normal business...

Trend was looking flat for the past few weeks- now it's looking down...

Time to ease back on the throttle, twiddle thumbs- get more tactical - and not believe that patience will be rewarded in this environment!

|

|

|

|

Post by sd on Jul 7, 2017 19:12:17 GMT -5

7.7 note- Tech got a back wind today and rallied! good jobs report exceeded the consensus- AAOI moved up +10% above my entry- i should have sold some- but got tied up today-

AMD moved up about +3%- and a couple of other positions gained a bit-

I think this may be the opportunity to sell a bit on Monday and tighten stops - and not rely on the market finding reasons to push higher- look at the sell-offs-

Can't update any charts tonight with Photobucket....

|

|

|

|

Post by sd on Jul 11, 2017 8:52:43 GMT -5

I was unable to upload anything into Photobucket for the weekend- I tried again and it appears I am able to upload a chart and they are continuing to "Host" those charts

For the Horse race, I went to my stockcharts account and made a public chart- the advantage of a public chart is it is updated daily, and members can see what iis occurring with only a 15 minute price delay if they are interested inn comparing it on a daily basis to the other positions-Blygh updates the actual daily results each pm.

The disadvantage is that the chart is not permanently hosted as I have to redo the public list each week.

May do both if time allows- the updated charts daily are easy to view.

Anyways- I sold 1/3 of the AAOI position. My limit was right nwith the bid, but delayed

|

|

|

|

Post by sd on Jul 11, 2017 11:56:36 GMT -5

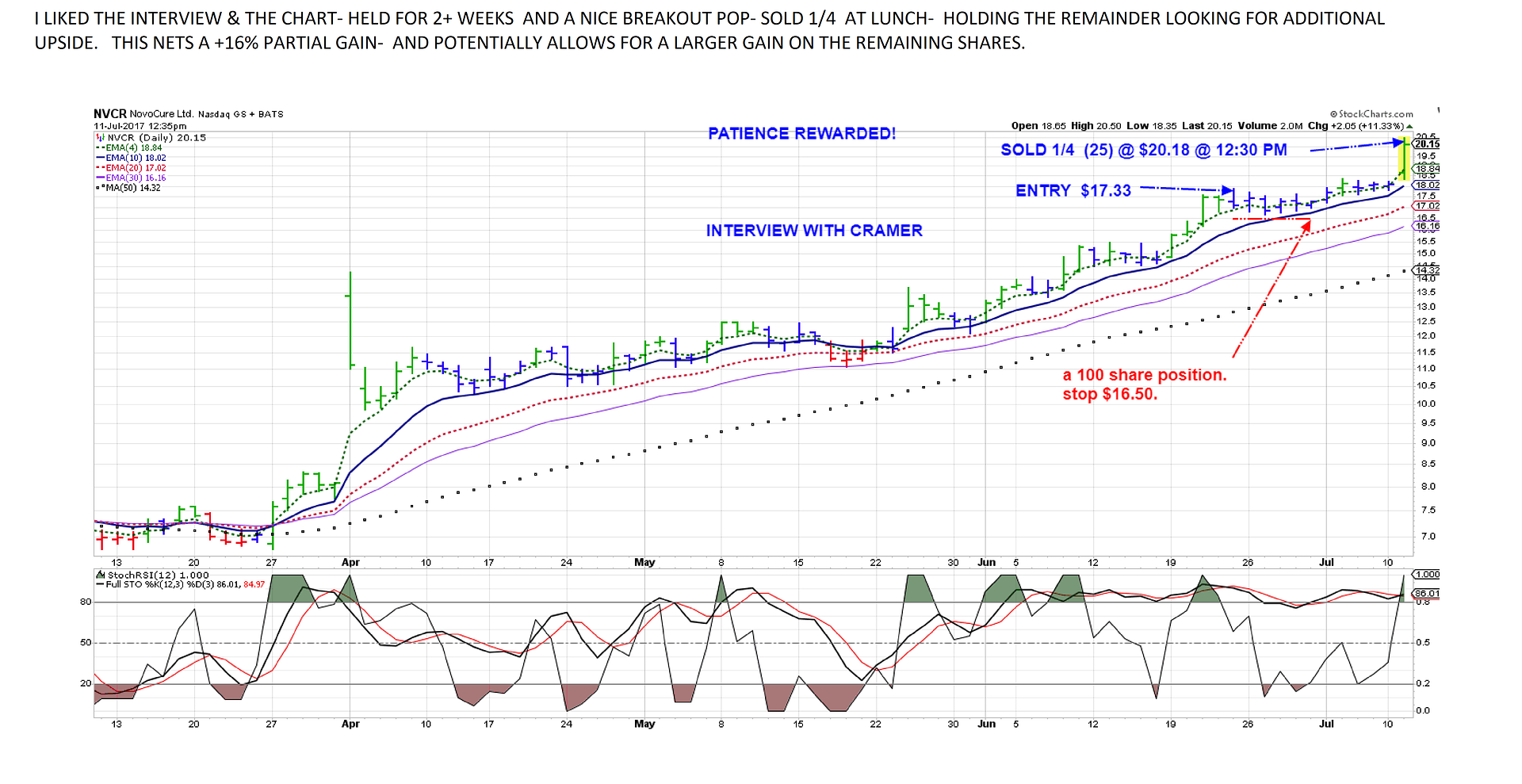

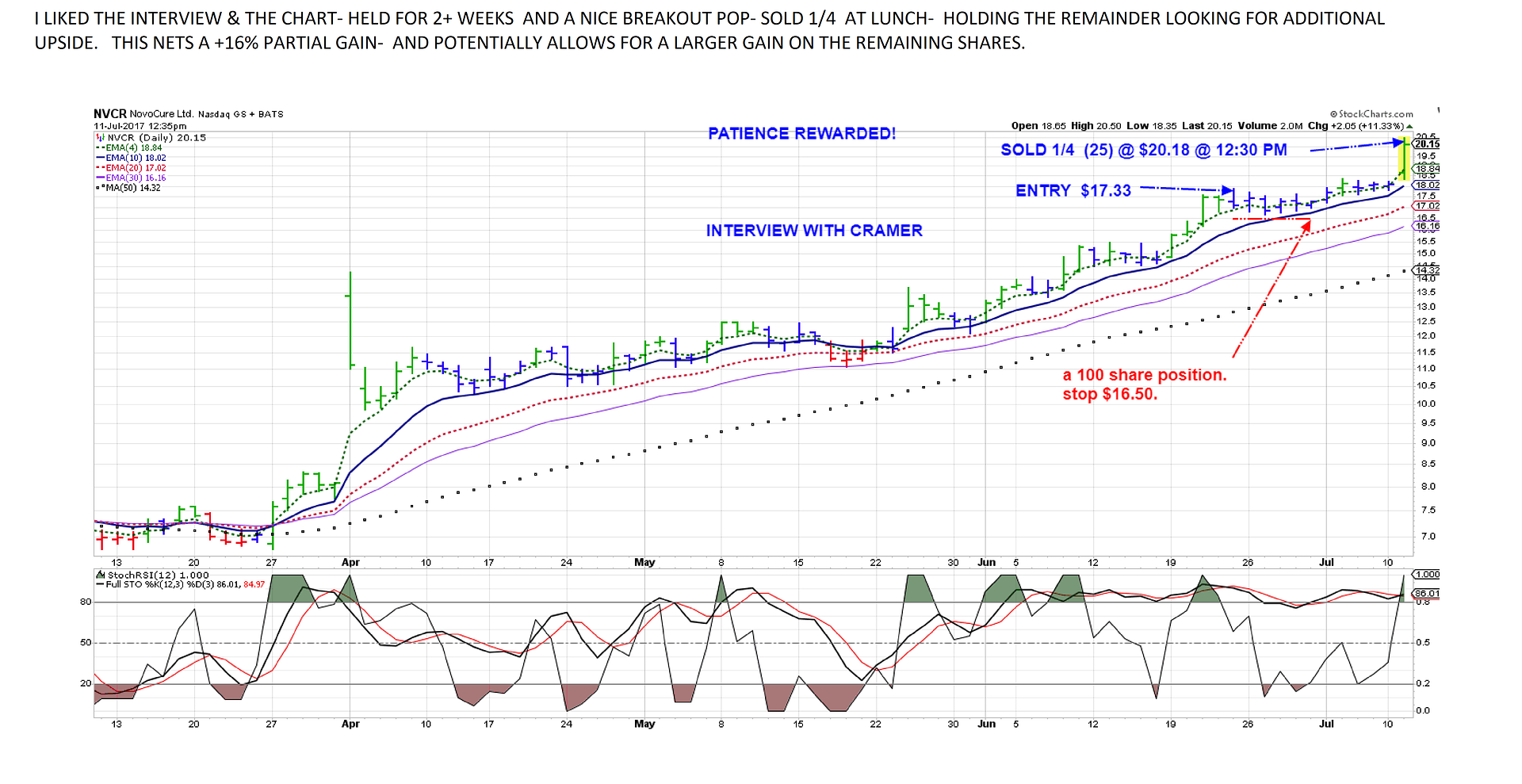

NVCR WAS a position I took after seeing the c eo on an interview with Cramer. The interview was upbeat- sounded like the company has a good niche, and more importantly I liked the trending chart. Today at Lunch, I saw the breakout from the base- some 2 weeks after my entry-

I elected to sell 25 shares (1/4 position) to capture the above 10%$ move, lock in the partial gain. This also allows me to raise my stop loss to above my entry- but I hope to not get too greedy-in setting the stop too close to price....My expectation is that this can potentially go much higher- Since there is no prior overhead resistance, price may see a big momentum climax move potentially-Which I may set a very high limit sell ....At least thats the potential. I'll determine whether I'll sell 1/4 positions or larger at that time.

I expect a pullback /retest is possible as well- so the stop doesn't need to be tight. And PBYI stopped out for a small gain $85.10

Again- Patience is rewarded.

|

|

|

|

Post by sd on Jul 11, 2017 15:17:16 GMT -5

bought TSLA $325.54 7.11. 17 @ 3:43

Had dropped to the 300 area- rebounding today-

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Jul 11, 2017 20:29:30 GMT -5

To my untrained eye it seems like AAOI is vulnerable to hit some resistance at 74. But with a nice gain and 4 straight up days I suppose we could see some profit taking now. For the horse race I'm hoping it won't correct before the close Friday. NVCR looks awesome. Looks like their specialty is drugs to treat deadly cancers like pancreatic and glioblastoma. If they succeed they would have huge pricing power. -ira

|

|

|

|

Post by sd on Jul 12, 2017 12:31:47 GMT -5

I hope you are correct IRA! I agree with your assessment- that the potential target should be $74, as that is the midst of the prior 2 highs- Of course, this is also the "resistance" line that traders expect. By selling another portion at $73, I expect a better probability that price makes it through that price level- I will keep a 1/3 position- allowing it to hit resistance, and possibly see a moderate pullback- and won't bail on just a modest decline of a few dollars-Because, there is always the potential for it to then move through resistance,

and it gives me a good cushion to simply add more back into a breakout -if it occurs.

I'm optimistic with NVCR - the breakout started higher again today, and is seeing some profittaking. My thinking on this pullback (during lunch hour) is that it is a typical retest- This is also where i do not anticpate price to decline below yesterday's breakout low.. I will set a 22 target on another .25 position, leaving a .5 position to run higher- or base- Ideally today's weakness is followed by more buyers later in the day or tomorrow am.

Biotech/pharma can hold huge moves potentially- and also huge declines. I'm holding several other positions in gthe health/biotech- VRTX for one- that I'm hoping for that higher move one of these days (125.00 cost)

It's surprising how well the Tech sector is holding after what seemed the initial sell-off- My XBI position almost stopped out but looks potentially higher today....

I'm still holding some non movers -TVTY,ALGN,

Thanks for the Feedback!

NVCR- THIS PULLBACK TODAY DOES NOT MEAN THE BREAKOUT HAS FAILED. THIS PULLBACK IS PRESENTLY A RETEST -AND THE OUTCOME WILL BE DETERMINED BY WHERE PRICE GOES AFTER TODAY.

IDEALLY I'M LOOKING FOR A CLOSE ABOVE YESTERDAY'S LOW, AND SOME ADDITIONAL BUYING SUPPORT TOMORROW. |

|

|

|

Post by sd on Jul 12, 2017 13:16:22 GMT -5

HDB TRENDING FINANCIAL BREAKING OUT -ADR

MY EXPECTATION IS THAT IT WOULD RESUME A SIMILAR STEADY UPTREND. WHILE IT'S NOT A BALL OF FIRE TECH STOCK- THIS OFERS A WELL DEFINED ENTRY WITH A DEFINED RISK TO THE P.O.F.

IT IS ALSO NOT DIRECTLY TIED TO THE US MARKET MOVEMENTS. I'll have to check where I took a sell on this-

bought mram , sold AMD -target hit.bought MD , tqqq.

|

|

|

|

Post by sd on Jul 12, 2017 21:01:58 GMT -5

MARKET WIDE RALLY

Got home this evening and see that all the indexes and all the major sector groups are in the green- Together- WOW! Liked Yellen's speech i guess...from the headlines

Because of this strong market Green close- I'm expecting tomorrow will see an up day- At least initially.... I may widen the AAOI partial limit to try for a higher opening spike-instead of $73.

Adjusting some stops- I added TQQQ a day later than i should have- it has gapped up- but I saw market sectors all green today- May as well jump onto the bandwagon, just ready to hop off.

Been busy- i need to update my losing trades- It's great fun to post winning trades, but I have a few losers as well- I took a loss on NFLX last week , Also HDB - I think stopped out on the break below the 20 ema- and i reentered today...

And a note- I am holding a number of positions - in several different small accts- Just have to get them under one roof - A transferr into IB will save on commission costs -and a much better trading format than Scottrade or TDAmeritrade -

Several years ago, it made sense to me and my goals to set separate accts- one designed more for position trades, the IB for more active trading. Now that is perhaps no longer the case.

A friend commented about how many positions I was holding at one time- Hard to keep track of-

This is true- but it is also part of a position sizing approach- More important with Individual stock positions IMO- than with ETF's - but too much of a position in any one stock is a potential for a Flash Crash, Black Swan event or simply that one position to disappoint on earnings or to read in the news the CEO was picked up as the mass murderer of all those girlscouts in the camp in the Ozarks....

Betting on just a couple of stocks also likely finds that one is betting within the same sector-Or- betting on Red or Black at roulette...eventually.......

The end Risk is enhanced when one is in individual stocks only and they are in the same sector or industry group... But i have found through trading some of the horse race picks- and the leveraged TQQQ, and focusing on the Trend, some market beating successes this year. While the pullback and sell-off of Tech on the 12th rattled the cage, here we are, back seeing Tech taking a leadership role again-possibly... So, go with the momentum- but use stops....

Stops were a subject of discussion this week- with Blygh commenting on the possible market manipulation of stock prices still occurring- and i am sure it does happen, and will do so in the future- Worse yet are those rarer flash crash events that drop price by 20 or 30% in the span of a minute on the trading boards, and stops will become activated and be open to a market fill- which may be 25% lower in the flash crash... The only way to protect yourself from this is to set a stop with a limit attached- that is ofered through IB, but likely not through most of the other brokerage houses.

no point to tighten a stop-loss while price is behaving appropriately and still technically uptrending- unless there is a pull away momentum move and one seeks to lock in the higher momentum gain- and wait for the rubber band to pull it back into the normal trend- JMHO- i'm trying to apply that mindset by selling into partial momentum moves, but not anticipating that the move is over- leaving some position still active for the ultimately larger move.

The MD Trade I took today is interesting- i was fortunate in capturing a nice profit on the prior trade that was a Reversal of Trend- Thank you RD for posting it.

It was outside my normal approach, but the trade worked well- I've reentered following the sell-off from the push high, and the price gap up slightly attemptinbg to reverse higher-

The Swing low is the Alan Farley " Point of Failure" - This trade is screwed if price closes below the recent swing low- If i want to be aggressive, perhaps i would declare that price should never penetrate intraday lower than the swing low . We traders look left to see where the other low was, and hope that is adequate.

A "swing-low" is a pullback move that establishes a higher low within an uptrend from a lower price. Since price pullbacks and consolidations are actually 'Normal' price actions, the swing lows are the volatility spikes that are sell-offs that find buyers stepping into. As buyers purchase as mprice goes lower, eventually the supply is met, and the remaining supply is offered at higher prices- and the swing low Closes the day higher than it probed lower.

Uptrends are defined by higher highs and higher lows (swing pullback lows) -yET THE tREND IS STILL INTACT DESPITE A MINOR PRICE BAR TWO OR FIVE PULLBACK..

EMA lines are useful in helping to gain a perspective- Looking at a daily chart only with price spikes up and down is like the rides at Coney island-

Throw in some moving averages to "smooth" that perspective of volatility ......

Hell, i didn't intend to go so far off tangent- i started with the premise that because the overall markets looked bullish- i think i will raise a target sell on a partial on AAOI above $73.!

Let's see if the MD trade swing low holds as the reversal stop from my entry on the gap higher- That swing low is the P.O.F.

HDB - Financial Indian ADR that has a great uptrend behind it....

MRAM has pulled back- pennant formation- reduces the potentional pain if it breaks lower....

TSLA- i WILL set a stop at the 314.00 - not the swing low.....

tHIS IS an Interesting market TOTO- - Rallying here in mid July- "Girdle thy Loins " sayeth the naysayers!

|

|

|

|

Post by sd on Jul 13, 2017 5:19:19 GMT -5

7.13 premarket- limit orders for MNK (pharma) and Baba (breaking higher close yesterday $150

|

|

|

|

Post by sd on Jul 13, 2017 8:47:50 GMT -5

7.13 sold partial $76.80 AAOI on the opening higher move. reduced to 1/3 of the remainder.

|

|

|

|

Post by sd on Jul 13, 2017 20:51:50 GMT -5

I screwed up today changing orders around at the open.

It turns out i sold shares at the open as well as at 10 am, leaving me with only 3 active shares!

I sold 7 at $77.05, AND AT 10 AM SOLD 5 @ $76.80- i ONLY HAD 15 SHARES REMAINING- HAVING SOLD 10 THE OTHER DAY.

Plan was to sell just 5-into the bullish open- and leave 10 for later in the day- or the week...

to recap- the 1st 10 shares i think was a +10-12% , these 2 sells today will be about +24% -based on the $61.98 avg entry.

It's trades like this that allows one to think they are getting 'better' at this trading stuff.

I passed on the initial AAOI rally because i thought it was lackluster after the tech sell-off-

However, i got back in relatively early in the basing that was occurring- Defines the P.O.F.....

and kept a stop wide enough to not take me out on a whipsaw volatility move-

The follow up to this little moment of self-backslapping... is that i will be trying to purchase AAOI tomorrow with a limit order of $75.10

for the remaining Free Cash in the IB account- $1210= 16 shares.

Technically, resistance was at the prior price high - call it a range but $74 is close-

Price gapped above, with a low at 74- opened higher- but closed just $1 above the open despite the higher price spike-

from a TA point of view- Resistance- having been broken- should now provide a floor for the price on a retracement.

I don't want to get all cutesy and try to nail with a precision order at 74 the technical level- I'll buy above that level and not worry about the $1 per share Chump change i may have left on the table.

My order will look for a limit fill at $75.10 or buy 16 shares- i can toss in the 3 remaining at a lower price - and see where this goes...

Sense the HUBRIS???

The struggle for all of us is- stock selection-sector selection Where to set stops- Where to take profits- When to go hard and when to ease back........and to quote the apropro ... Kenny Rodgers- www.youtube.com/watch?v=Jj4nJ1YEAp4

|

|

|

|

Post by sd on Jul 14, 2017 12:47:29 GMT -5

Taking a long lunch this friday -added - went back larger into PBYI because of the step up higher movement-and also bought a smaller position in BLCM-also because price struggled to get higher yesterday, down today -but this is potentially a retest- The thinking is that the markets will look to find places to make some money-Read in Tom Bowley -stockcharts, that seasonally, summer is historically a good time for the pharma,biotech - Maybe this will get some attention.

|

|

|

|

Post by sd on Jul 14, 2017 20:20:54 GMT -5

iT'S BEEN A LONG WEEK! Long work hours, and a heat index up over 100 a few days. Fortunately, I only have to periodically inspect the work the roofers are doing - and the remainder is spent inside an air conditioned server room ....

I just haven't kept up with everything -

IRA had a great win this week with AAOI +24%- and i locked in some gains- but I should have had a larger number of shares at today's close- but i tried to adjust a partial sell order and modify the shares at the market open-

The end goal was to sell in segments, but ideally leave a final portion for a longer term . I was using the IB webtrader platform rather than the usual platform I access from home- It is not anywhere's near the TWS platform I normally use... regardless....

The positives of the trade, was that I had locked in an early gain, intentionally planned to sell at a slightly higher another portion as it stepped up- I was not expecting market strength- and - perhaps mostly thanks to IRA's note- I was more aware and saw that the premarket was up , made the adjustment to sell at a higher price-above my expected $74 reistance- and target below at $73. Because of the positive wide premarket strength across sectors, i wanted to sell only 1/3 off the remaining shares - and hold 2/3 to see how the day worked out.

Ended up selling 2 positions within 30 minutes of the open- and left with 3 shares....and not the 8 I intended....Well, a nice profit from my entry- but a mis managed use of the trading tools as I tried to make adjustments from the front seat of my truck on the jobsite....

The markets all closed higher today- with the S&P making a new high- While we may be fearful.... extended mkt etc- valuations too high...The markets appear to be denying that which makes us fearful- at least for now.

For swing trading- stop-losses keep you at bat....

|

|

|

|

Post by sd on Jul 16, 2017 8:27:47 GMT -5

trading spreadsheet-

As i start to try to go back for the year and assess my various trades- A simple trading spreadsheet that automatically updates daily based on market prices would be a great tool,

and also one that would include historical results- closed trades etc. Since I'm not a tech savvy guy- Did take an Excel class once years ago but never applied it...I'm looking for something not too intimidating -

On you tube- lots of videos- and Google Docs allows you to link and update- and so I've posted in this thread here-

dgoriginal.proboards.com/thread/603/spreadsheet-google-docs

but the 1st link and associated video is really quite complex - while the second link is a very basic spreadsheet that I think I will apply.

|

|

? Turtle trading- Took a number of students and trained them to employ the Dogs of the Dow approach- but they all came up with different versions of what they were shown.

? Turtle trading- Took a number of students and trained them to employ the Dogs of the Dow approach- but they all came up with different versions of what they were shown.