|

|

Post by sd on Jul 17, 2017 9:52:03 GMT -5

7.17 am note- TSLA looks to be close to stopping out as price is pulling back. Finally seeing some positive upside in ALGN, akam, and MNK up nicely.

Order was placed to add to the TQQQ position- DIG- not a position- Ultra Energy ETF moving up - possible dbl bottom here- Options guy - Carter Worth technician thinks Energy is at a bottom here.....Value play or value trap?

|

|

|

|

Post by sd on Jul 17, 2017 20:02:15 GMT -5

Several positions moved up today that I had been holding for weeks- with some patience- ideally these initial moves will lead to some larger gains- Both AKAM and ALGN were basing near lows-

and I was chastising myself a bit for staying with them.. I likely do better with those trades that are already trending- but being patient has been rewarded in this bull market-

I previously had a small partial position in PBYI - held for weeks and sold for a very small gain- and just went back into it - a bit larger-with a "Full" position- Saw tonight affter hours it was up some 3% on some news- hopefully it has legs...Elon Musk -TSLA CEO declared that his company is highly valued at this price level- and is priced for the "future"- My stop was not hit today, but It came close- so I'll be setting a market sell for the open and take a loss I had just purchased this past week - and will take a controlled loss- I didn't want to set a stop at the 300 level- had it set on $310- purchase was app 325.00 -6 shares-

Which brings up the question of position sizing.... How many positions are too many? If the amount at Risk is appropriate, no one losing trade would affect the account by more than -2 to -3% of the account value- If one hangs their hat on only a few stocks- and they are winners- they get the greater reward- But at the potential of a greater potential for single stock surprises- and greater Risk... It could be argued that taking many smaller positions is dilutive- but it also reduces the Risk of any single larger position going South.

Greed makes one wish for the bigger bets; Fear is the co-pilot cautioning "What-if?"

A compromise can be reached by how much one allows any single position to be-

Active trading incurs commission costs- and that becomes a real factor in the decision making process- IB charges $1/100 shares- whereas Scottrade and TD Ameritrade are both now about $7-

Ameritrade was a ridiculous $10 earlier in the year-

Another method one can try to reduce Risk is to set a stop-loss closer to the Entry price- The math works, but does the volatility work also? If one sets a stop too tight in a volatile market, one gets whipsawed intraday-

I've been learning to take larger losses-

It's not comfortable, but it's part of the learning process and -ideally- evolution- into becoming a better trader in general- Easy to think that is the case with a bull market supporting you. This year has been a good year- so far- It's been a year of transition for me- and getting active back here at DG's largely contributed to that transition.

While i have owned the biotech index now and then- I hadn't really considered buying any individual stocks- previously until this past year- and some of the stocks the members have posted have been great out performers- And i have also learned that because a stock has already made a big run- doesn't mean that there isn't more ahead.

I also am taking partial profits- and trying to develop my positions to retain a portion expecting a larger move may happen - AAOI was the best example of trying to implement this, and i blew it adjusting the orders. Ideally, holding a portion of a winning trade allows that trade the potential to outperform the market- and could perhaps be trailed with a 10% STOP ABOVE THE ENTRY ...

As of this evening, I hold some 15 positions- across different sectors- some smaller, some larger - Tech has been a reoccurring outperformer so far this year. Semi-s doing well- so there's a sector theme there that can be focused on the group outperformers-

Biotech/pharma - each one is it's own lottery ticket -is it not? I own the XBI, but also taking a couple of chances with the individual stocks-

Bottom fished tech with AKAM, ALGN, and then MD -had a nice trade/gain, and decided to come back one more time-

We'll see how this works out by the year's end- I think following sector strength when it is this well defined what is leading the market.... is where you have to go- Sector rotation is when the market seeks a better valuation and looks elsewheres. These are fluid and change- perhaps on a whim- look at the tech sell-off on 7-12- so , it pays not to be too complacent.

.

.

|

|

|

|

Post by sd on Jul 18, 2017 10:07:11 GMT -5

AUPH- was a pharma play- discussed the evening before on Cramer- The stock had made a large move earlier in the day- and coincidentally was featured on Cramer that evening? HMMM-

I set a lower limit- filled @ $7.09 and was filled o0n the pullback, with the stock closing near it's lows. I had a stop set at $6.50-cancelled and decided I would see how this acts today-

I will have an opportu ity at lunch to see if yesterday's lows will be penetrated-and do I want to split the position with 2 levels of stops?

I had added to the TQQQ the other day- from 14 to 29 - now Overweight nice gap open higher.

AAOI- my 3 remaining shares -LOL! going higher-

I'll be buying some AMD- it pulled back after I sold, can get it for less, earnings next week.....? wrong- n o cleared funds...

Got cash -needs to clear...

Nice 20% pop in VRTX- I had held it until a week or so ago.... stopped out of it...my entry in the base was 125.00 , I had tightened the stop to 125.62 last week on a tightened stop and a price pullback intraday! would have made up for a little bit more leeway, and several losing trades....+

It's lessons like this- that reinforce the mindset of not being too tight with a stop-loss- particularly if the market, sector, or Industry group looks to be trending- a bit of patience would have paid off handsomely!

|

|

|

|

Post by sd on Jul 20, 2017 9:25:28 GMT -5

MRAM stopped out -TQQQ up higher,ALGN, AKAM .,BABA higher into the open . Energy- Dig -possible dbl bot made previously- gap higher at the open-

not taking a position- just a notation on it perhaps pausing in it's decline.

|

|

|

|

Post by sd on Jul 21, 2017 12:25:57 GMT -5

Bought some xlnx in the am- ARNA as it tries to push past 24 in the pm.

XLNX is more of a range experiment. ARNA looking at on a 10 min chart IBB making a solid move higher out of a cup- forget developing the proverbial handle- xbi is similar-

believe XBI is equal weighted- I need to do a compare of the 2 - See that chips -semis are lower, Tech lower today at present after 10 consecutive up days- Trend still very much intact....AMD- pullback off a dbl top, higher swing low- Intended to buy some the other day- cash cleared... Buying an entry position today.filled- $13.98

Bought some IBB didn't have much free cash remaining-

|

|

|

|

Post by sd on Jul 23, 2017 20:36:02 GMT -5

Sunday Evening and trying to play catch up- made some stop adjustments , and some reassessments-

I've decided, moving forward, that it's easier to be pickin from the tree that already has fruits on the branches, than the one that may be struggling to become productive.

I spent a lot of time in the garden this weekend with the heat index climbing well above 100- and plants that were already holding their own managed to maintain, while those that seemed to be lagging- really suffered more in the heat- despite the extra watering.

Perhaps that over simplifies the difference between selecting from stocks already in an uptrend, and selecting rom those oversold- ready to make a bounce....

It's a challenge- to pick a bottom and a reversal - maybe there'a bit more pride when one gets it right- But i've sat with AKAM for a Month - and it's finally moving- I think I was drawn to take this trade because of a gentleman back in the Clear Station days that bought AKAM above 40 and was holding it down to $22- with his retirement monies.... He had put over $40,000 into the one position = and was rightly panicked......He had no choice but to hold = It eventually went back higher- and , if he held, it doubled over the following 5 years before giving a lot back.

There's been a lot going on- work and on the homefront- and I'm spread in multiple directions- and stocks have been still an ongoing interest... with the tech bull still alive in July!

I think i allowed myself to get too caught up - and i'm not happy with the individual stock exposure i'm carrying- so I'm setting stops to take partial profits, widening the remaining- and putting more into overweighting the indexes-

For Tech I'm using TQQQ- it's a 2x, and - as trades develop, stop-out, etc, i will shift more to the ETF sector .

I'm more comfortable with being overweight the leveraged ETF than any individual stock.

I'm also not happy with getting whipsawed on a too tight stop-loss = VRTX is my example- Blygh had ARNA and got stopped just prior to it's big gap up....

So, I've done better this year by holding longer, wider stops- and NVCR is a good example of what may gel as a future approach- With a gain of 7-10%, take a partial profit- Also did this with AAOI- and that makes the stop-loss home free and above break-even - Of course, you have to take the losses when they occur- but this market is still trending higher- so it pays to ride the wave of a rising market with a bit of leeway on the stops-

In viewing price action- there is no use in being right up a stock's backside as long as it is holding and closing above the fast ema- Unless there is a momentum pull away - stocks holding a steady rising ema should be given some breathing room- there should be a warninbg- or a catalyst- earnings reports- etc- that can rapidly ruin the trend...

But aside from that type of event- and market moving influences like political news- economic data- I'm giving it some room

|

|

|

|

Post by blygh on Jul 24, 2017 19:14:16 GMT -5

"In viewing price action- there is no use in being right up a stock's backside as long as it is holding and closing above the fast ema- Unless there is a momentum pull away - stocks holding a steady rising ema should be given some breathing room- there should be a warninbg- or a catalyst- earnings reports- etc- that can rapidly ruin the trend...

But aside from that type of event- and market moving influences like political news- economic data- I'm giving it some room"

AgreeD - I am going with steady growers with a constant (+/-) rising slope - I have SBIO for biotech - IAT LMT, BA and HEI for defense and aerospace - In and out of FANG stocks (Facebook, Amazon, GOOG(L) and NFLX) - - ON, IDTI and CRUS for technology - IHI IHF and ISRG for health care. Starting to look at insurance (IAK) and chemicals DOW CE APD EMN WLK MON. This week is the anniversary of the 2007 market peak - I remember saying to myself - "If i sell everything and buy 5.4% 30 year Treasuries I will be set for life - but I got greedy - Bulls get rich - Bears get rich - Hogs get slaughtered

Blygh

O

|

|

|

|

Post by sd on Jul 25, 2017 4:46:56 GMT -5

I like your diversified approach Blygh! I believe you've put much more thought in your selections of the individual stocks- Are Fundamentals combined with Technicals part of your selection process?

I'm overly diversified- Diluted if you will, With a focus mostly in Tech This has been a year of transition for me- With seeking to hold for longer periods- and not getting too impatient- Getting myself to understand - and to quote you- patience... that stocks have to take a rest- now and then- so I've experimented- and been rewarded largely by holding for longer durations-And- not to forget a share off LUCK being in sectors that have had momentum... I've also been tweaking position size- larger with momentum- TQQQ has been rewarding -as the Tech sector has been on a tear- but I've been in and out of it on technicals-

As part off this experimenting process, and to a certain extent testing myself psychologically... I've held some picks just because they were in a sector- AKAM, ALGN for over 5 or 6 weeks before they've finally started to move-

I think I will keep the majority of my focus on those already trending .

AUPH is a present "Test" but a real position- just 100 shares- I've split the stops- - It looked like it had a good start to move up out of the bottom , but is retesting- and has to see if any Buyer interest will show back up .

Going forward though, I expect to refine the selection process- and narrow the field- Stockcharts has a SCTR screen -

Also, I need to differentiate- That a trading account and an investment account- for me- are 2 diffferent approaches-at this time--

Presently, the intent is to trade with one eye on the technicals-One on the sector itself, and lock in some gains on good initial upside moves, while keeping a wider stop on the remainder- (Still holding 3 AAOI LOL! from the $62 area)

Thanks for sharing your picks- I'll get what I'm holding listed-later today perhaps... but they are not selected by any diligent process- so Caveat Emptor anyone reading this-and exposure-weighting varies widely.

|

|

|

|

Post by blygh on Jul 25, 2017 8:05:59 GMT -5

As Cramer says - diversification is the only free lunch on Wall St - I am putting all my steady growers on Blygh's Trading Journal today

Blygh

|

|

|

|

Post by sd on Jul 25, 2017 20:18:07 GMT -5

When i tally up "Positions" I have quite a few- 23 today- between several different accounts- both mine and my wife's "Active" trading accounts.

I'm really Tech heavy- Present positions range from 3 days old to 6 weeks old- Accounts are in Scottrade, Ameritrade, and Interactive Brokers--

With IB , commissions are low, $1.00 but there is a monthly fee for inactivity if you make less than a certain number of trades per month- If you want to test drive with real monies an approach to the market with taking smaller risk, smaller positions- IB is the way to go - And If you trade Frequently- I made some 180+ trades with IB this year to date- grinding higher-

With Scottrade and Ameritrade at $7 or so, commissions become a consideration in taking smaller trades- I was surprised by the actual number of trades i have made in those other accounts-I think i ended up with $400 in commission fees in those accounts- in many fewer trades.

easy to lose track of how much those commission costs are adding up to- So the goal in those accounts was to trade less frequently,,,,

The End Goal for this year will be to transfer out of Scottrade and Ameritrade into a Vanguard brokerage account that i already have open, but not active....Ideally, trades will develop more into positions- and will be viewed perhaps weekly- not daily.

I will keep the IB account, because it is best suited for Active Trading- Great platform, allows complex orders to be attached to the prospective trade- Frustrating to try to do this in Scottrade where you have to place a Buy order and then you have to modify it ....very confusing...

Ideally, we all want to grow our seed trading accounts into this massive Oak we can someday sip Pina Coladas beneath--- This past 5 months - for me- active again when time permits, - and in a trending market- and taking some higher Risk trades instead of playing it "Safe"- and some of those great horse Race Picks- ends up with a very decent year to date overall- If the SPY is the benchmark for active trading accounts- and TECH continues to outperform 2x - Tech is the place to be- But- like June 12- sector rotation can take that $500 gain and make it a $500 loss in the matter of a day or two.

I think my goal is to set up the Vanguard Investment account with a diversified portfolio- A Vanguard Brokerage account for more active trading - (You can trade Vanguard ETF's and Funds for Free!) and retain the IB account for Active Trading. This should all be After one maxes out any employer match IRA- BTW....And -ideally fund the Roth- -

All of these listed accounts are Roth accounts-There are no Tax issues when trading within a Roth unless you take profits out early- So Fund your Roth Account with After Tax monies- and never pay Tax on any of your gains!- just wait until age 59-1/2 to start to withdraw the profits- but you can always take back out the principal amount you put in without penalty!

Check with a CPA 1st to be sure i got this correct....

So , 23 positions- small small and a couple of shares- some overweight- based on my account value - Some are just experiments - but I am learning Patience- I simply chose ALGN, AKAM because of the names, strong sector, oversold conditions- waited to see if the market would see it the same way... MNK- got to tighten under it's shooting star today. i drive past that plant every day and don't know what it does.... I consider a "Full Position" $1500-$2000 range- or approx 1/10th of the account value- I'm somewhat overweight Tech in TQQQ- and i'm underweight a lot of the positions- because i don't know which will become a good mover, which will breakout- and give that big gain- Which brings into focus the impact of being long in a sector or Industry group that has the Tide working in it's favor- But, that is indeed a moving target-

Look at MRAM, MU, dropping hard today.... but trends can last for weeks and months- and sectors can remain outperformers for extended periods of time and with the RSI pegging the high range - and don't sell because you think it's gone on for longer thaqn you expected.... Sell on the technicals-

Chart attached is screen pics of actual positions, in several accounts- and we'll see how they work out .

These are not long term positions- simply active trades- The 1 share of AMZN is non-negotiable- would incur the Wrath of the Spouse if i ever sell it LOL!

The majority of these positions are "tests" of sorts- But i like HDB as a financial ADR that has a solid trend behind it-and not US based!

|

|

|

|

Post by sd on Jul 26, 2017 10:34:21 GMT -5

Stopped out on the open with AKAM- Price had moved up nicely the past week, and the "Patience" trade was finally in the green- It closed yesterday at a recent High from the prior base it had made following the earlier decline- It "Beat" on earnings, but gave weak guidance going forward....Options market had significant Put buying in place-

So, a small paper profit turns into an actual loss -from my entry $51.43, sttopped out $49.80 - loss of $1.63 =loss of 3.1% on the entry- Net loss was 50 x 1.63 = - $82.00 on a position size of 50 shares....

MNK gave a tell-tail 'shooting star' - tall spike with a close where it opened- or a topping tail- I intended to raise the stop pre market, but got tied up- late break- and moved the stop up to $46.75 but it executed at $46.49 for a net gain-

HDB doing well, AMD gap open higher on an earnings beat and positive forward guidance. MU is down as well as MRAM neither is a present position, but the fact they are declining today....

I am holding 75 shares of AMD with a $14.00 entry- I see some price targets up to $20 ....Present price action makes a breakout on the Weekly if it holds- Always a possibility of a retest-

I was considering a partial sell, but the position is not a full position- so I'll see if it can get some follow through higher in the days ahead- Meanwhile , I'll raise my stop to my entry.

ALGN has a positive Zacks outlook- and I think Earnings today

finance.yahoo.com/news/buy-align-technology-algn-ahead-124912540.html

Fingers crossed on AUPH- see that it's up today....looks bullish off the pullback base it has made- $7.10 gets me in the green...

|

|

|

|

Post by sd on Jul 26, 2017 20:17:06 GMT -5

A chart of my present positions-7.26.17 In that we have a bullish market- and the Tech sector has been outperforming the S&P by 2x , the momentum has been rewarded by being in that space- Tech covers a broad range of individual stocks and individual industry group sectors-

Semi conductors have had a great run- Artificial intelligence is an on going theme as we move into an era of self driving cars- Automation will be a theme play - Companies within these groups should stand to see a lot of attention in the years ahead- Broad coverage through ETF's like Botz, Robo may be worth a look/investment.

As Blygh noted- Diversification is important- It both reduces your upside, while protecting your downside- if done properly. The end result is to not ride the wild Bronco up and down, but to find a middle ground with a smoother ride overall- That is both good for the account and for the emotional stability of the investor/trader.

Active traders have the potential to seek out where the market's momentum is in favor- and to select among the better stocks within that sector or group-

So, If we take Tech in general- and see it is outperforming the SPY, we could buy the QQQ index- nas 100 - or - allocate some monies towards a leveraged play of the sector- 2x TQQQ.

If the q's are outperforming the Spy by 2x, the leveraged should outperform by 3-4x because of resetting ...and repurchasing the derivatives daily. Have to be cautious with any leveraged instrument because of the built in decay.... usually does not favor longer term holding periods.That combination of trending markets and low volatility are a rarity to be taken advantage of-

When all of the indexes are up- it supports the broad market- When it narrows- The opportunities decline-

While it is easy to think that one's approach in this market is the ":Right Approach to trading" , the reality is that this is a candy striper's market- bullish in some industry groups and it feels just like you've got this Trading stuff in the Bag....How long it lasts for- no one knows- So, the balancing point is Hope for the best- but have a Plan B -

By Hoping for the Best, i don't infringe too close with a stop-loss on a stock that is clearly up trending- Plan B is sensing when the price action tells you that the momentum has gone out of favor....

I have gotten active in individual stocks this year without a lot of due diligence- or fundamental homeworks- and, it's been rewarding due to the market we are in favoring certain industry groups- and some Racer's selections....but the year is not over and we are entering a seasonally Weak period in the markets- I think this requires a shift in strategy to be more defensive- smaller positions in individual stocks- or even industry groups- Market rotation will occur, and the big money will sell out and go elsewheres- Focus should be on what is solidly trending higher based on the ema's.

As i tighten stops on some lagging positions- i will be seeking to focus more on those areas that are already moving ahead-Eventually, I intend to reduce the number of positions-

and increase position size in winning trades.....

|

|

|

|

Post by sd on Jul 27, 2017 8:43:53 GMT -5

A cautionary note from Tom Bowley @ stockchart.com regarding historical seasonal performances-Which makes one wonder if this bull gets derailed here- and by what?

"

Historical Tendencies

We're less than a week away from August and this summer month has not been kind to U.S. equities over the past two decades. The S&P 500, NASDAQ and Russell 2000 have posted average August returns of -1.1%, -0.9% and -1.2%, respectively, over this past 20 year period. That's the worst calendar month period for each of these major indices. The second worst calendar month? September. Seasonal patterns are suggesting that we buckle up while technical price action remains bullish as we keep breaking out to fresh all-time highs on our major indices. Which wins out? We'll have that answer in two months."

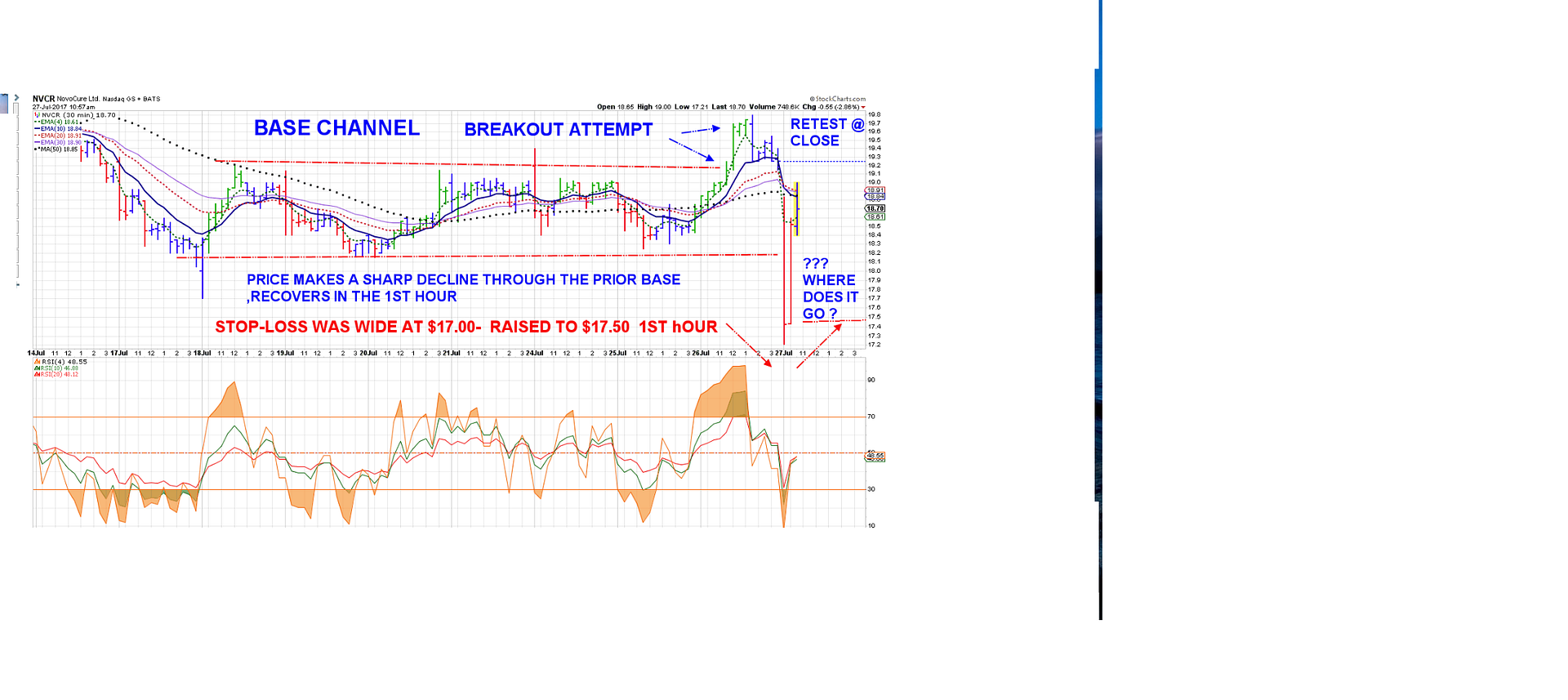

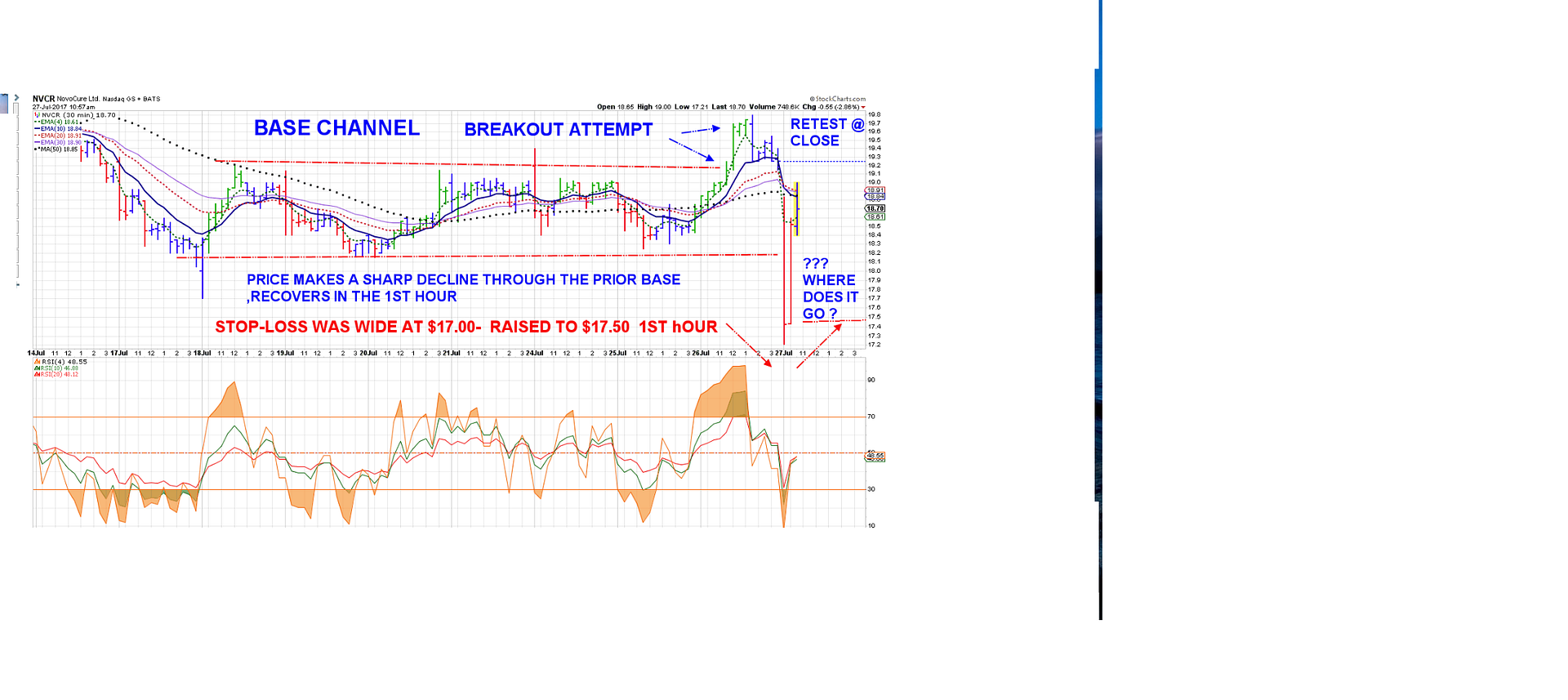

As we're just a few minutes into the open-. TQQQ is up over 2%- bodes well for Tech positions....We'll see how the day unfolds....BABA, HDB, TQQQ all time highs , XLNX popped to above 68 in the 1st few minutes, but was sold into the move, lower-TVTY lower,NVCR lower, but it's just 20 minutes into the day.....

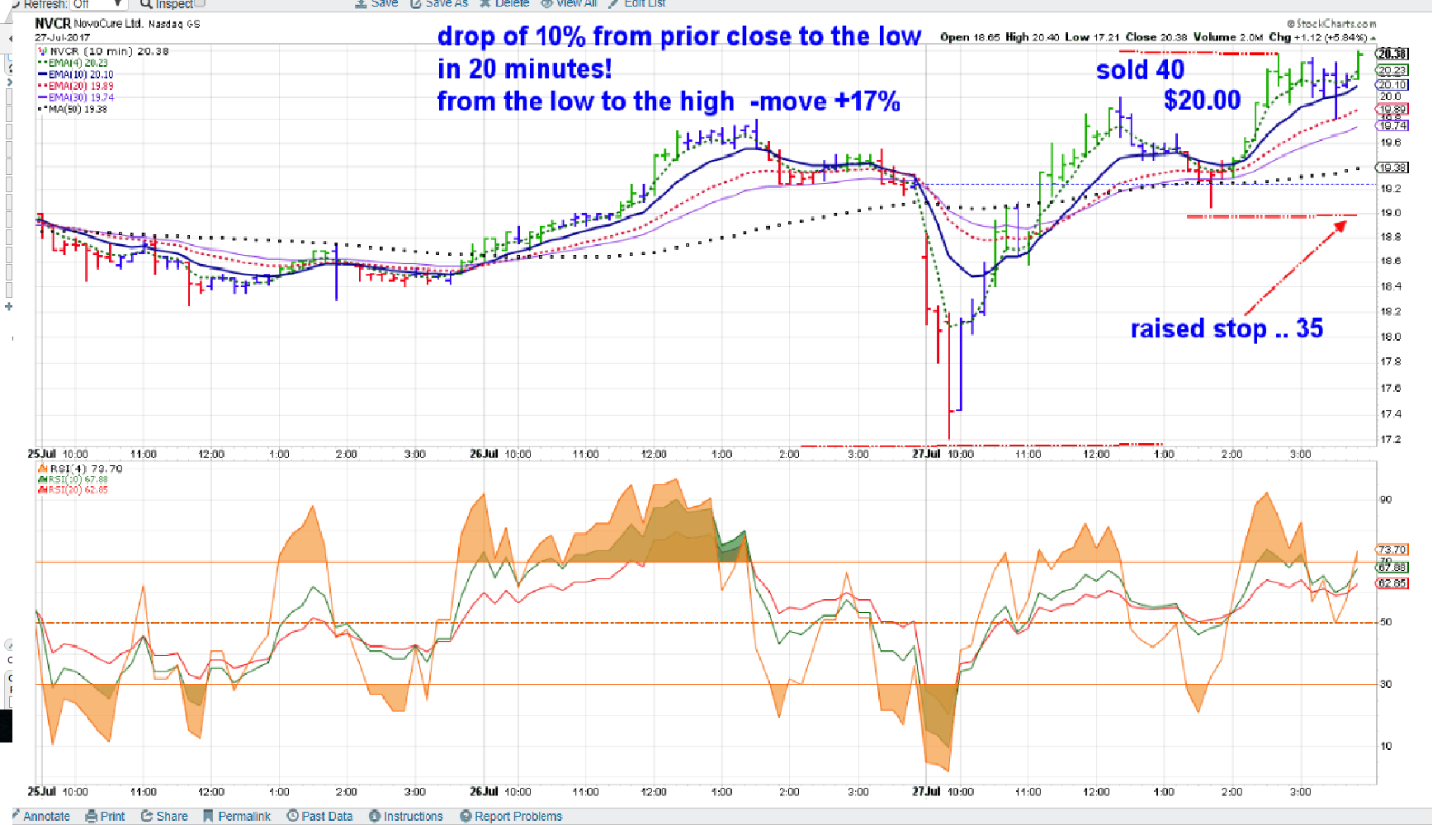

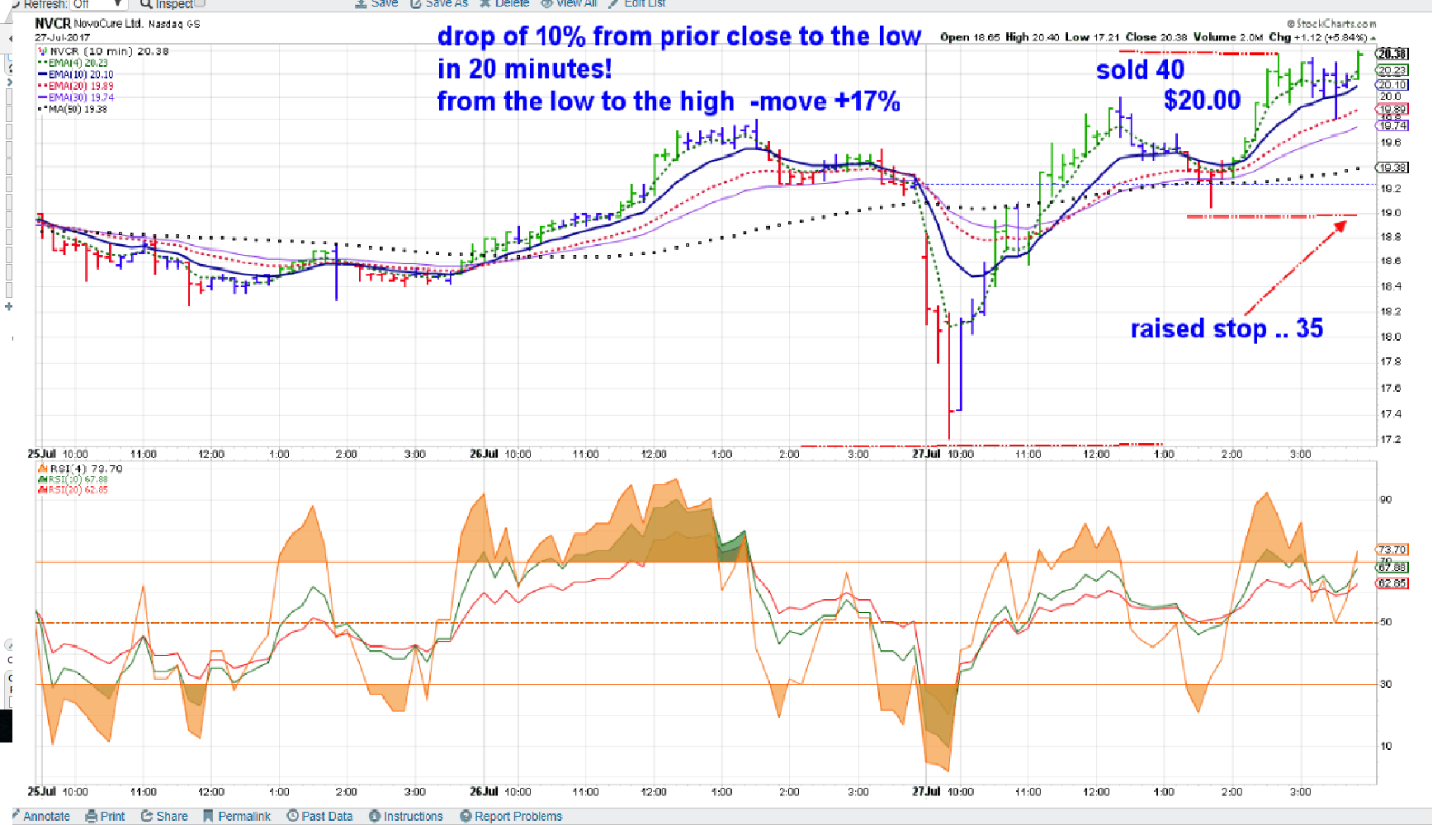

NVCR had that initial pop higher and I sold 1/4 going into that for a quick lock in, leaving the remaining shares to hopefully go higher- It had moved up for 2 days, then pulled back on a "retest" and put in a higher swing low- from there it has based sideways- I consider this normal- and kept a stop loss at 17- below my entry, but it would have been an overall breakeven trade if hit with the earlier gain... Today, price pushed to a recent low in the 1st 30 minutes- down to $17.21- and then moved back above $18.00 . This could simply be price is weakening, or ideally some buyers are pushing to find weak hands that want to sell prior to a stronger up move- Because I've held this for a while -5 weeks- I'm raising my stop to $17.50 , and may look to exist the position-this week and put the $$$$ to work elsewheres' I would have expected that with the sector strength, this should have picked up more interest to give it another higher step up... Perhaps a bit o impatience in thagt it is "dead" money sitting- Could give it a better opportunity to increase a winning position size...

Had a nice pop in shares off AMD- and I considered selling that partial into the +9% move during that day- I failed to do so because of the relatively small position size- but it is now a $1 lower than where i could have locked in that partial gain.... At 10:30- Price is higher  A bit later, the 30 minute view  at 12:00 it looks like a potential solid reversal and challenge of the recent push higher may be underway- at 12:00 it looks like a potential solid reversal and challenge of the recent push higher may be underway-

this type of push down of price below a support level and then a move higher means that sellers quit selling, and buyers started paying up- of course- how much of this is Big Investment players and how much is machine trading/day traders? Can Hope that it's the Investment side buying ahead of a larger position - or "news". Looks promising at the moment....See if it holds the momentum- if it weakens and taqkes me out on a fade in price, that's trading....

and it makes a close at the high! I sold 40 at the pullback into $20.00, raised the remaining stop loss to $19.00

|

|

|

|

Post by sd on Jul 27, 2017 14:18:44 GMT -5

Wow- Tech selling -correction again like June 12 or something more serious? Numerous positions are stopping out, and I've sold a number - I don't know what shook the markets- to cause this kind of turn down- day had started off well. I've got a 15% gain in NVCR at this moment- on my remaining 75 shares- Something prompted this to move up strongly-

but I'm considering to see how this behaves going into the close- perhaps sell 1/2 of the remaining-40 and keep 35

Note- I added in the screenshots throughout the day in the post above this.....

|

|

|

|

Post by sd on Jul 27, 2017 19:14:58 GMT -5

Well, a nice profit evaporated with today's sell off. It feels like 2 steps forward and one large step back- June 12 was a quick snap sell-off, but we recovered and made new highs in Tech (QQQ) However, as i just posted Tom Bowley's caution about seasonality- for the sector- Today's large and wide sell-off may indeed indicate that the easy run is over-

Blygh noted that he was cleaning out non-performers, and today's down move helped do the same for me.... plus i was able to adjust stops to sell at higher levels in some cases.

In the account positions i had noted earlier this week, some belong to the Wife who has selected to take a Buy and Hold approach- In that account, FB went up , AMZN and Goog down, SPLV up and XLU up Both SPLV and XLU would be considered defensive- s& P Low Volatility, Utilities .

Will assess tomorrow

|

|