|

|

Post by sd on Jul 29, 2013 19:30:19 GMT -5

7-29 was filled @ $110.00 on a reentry in CURE-

I also have a Buy-stop for BIB and for UGL- neither of which

was hit.....Only entering with partial orders at this point-

When the SPY rolled over, so did my other positions-

Both TNA & FAS continue to weaken- whether this is an early sign of a top, of simply a minor bull flag forming, only time will tell- A view of the gap between emas clearly suggests we are well extended,

The premise of thinking Gold may see a bounce higher, is based on a market pullback, and the weakening dollar, and rising Vix.

I have a buy-stop for UGL just above the present range.

|

|

|

|

Post by sd on Jul 30, 2013 20:13:36 GMT -5

Was filled on a partial position in BIB as it moved higher-

In a move i may regret- I removed the stops, and will check how price behaves-& closes- Potential market volatility tomorrow based on Fed speak & Data-

Using TNA as a guage for the small caps- No time to post a chart tonight, but i find it interesting that in the past 4 months on a 1 hr Renko- each time a PSAR sell occurrs, it has multiple boxes down, always breaking below the fast ema-This week got the 1st PSAR sell- In those prior instances, a sell on the psar did a good job of protecting profits..

|

|

|

|

Post by sd on Aug 1, 2013 19:59:51 GMT -5

market seeing new highs-

Some articles are claiming this to be a 'bubble' ; A false market boom by the Fed's policy that will have a hard time getting 'unwound'

I'm stepping back in here Long- However, i will trail relatively tight if TNA, FAS get filled .

I will be adding to the BIB position if it moves higher with a buy-stop-

I am holding with RXL/CURE as the healthcare exposure.

|

|

|

|

Post by sd on Aug 2, 2013 16:14:33 GMT -5

I am back -ALL-IN- at the close. I had not been stopped out of RXL-still holding. Earlier this week, my buy-stop for CURE & BIB had been hit as prices moved higher. Today, near the market close - I added to the BIB position. I Also took smaller positions in FAS, TNA, DXJ, EEM This market eeked out a new high today, in spite of what was seen as a poor job's number- The pundits say that means that the Fed won't start any taper this month due to that weakness- These numbers eventually get revised towards the end of the month to reflect more accurate information- Meanwhile, If there is no fear of the Fed taper, perhaps we continue to grind higher- In my mind, we are overdue for a correction- - It is only a matter of Time- but how soon or how belated is anyone's guess. I will execute stops on weakness- focus will be with the hourly chart. I will have to repost the snapshot of the trades  |

|

|

|

Post by sd on Aug 4, 2013 10:56:39 GMT -5

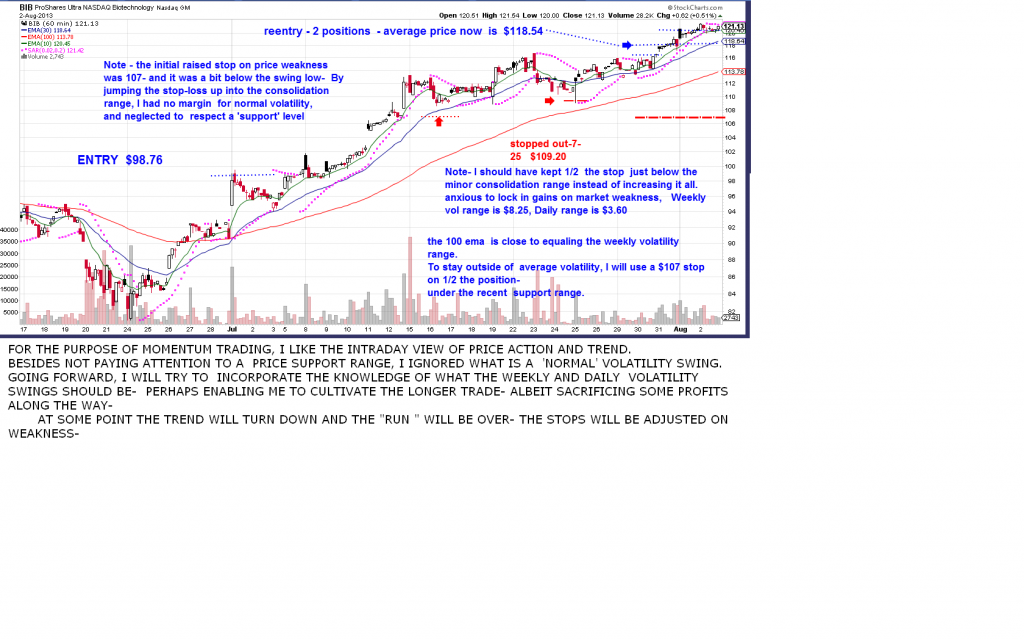

Following up on the recent stop-outs and desire to protect profits- also caused me to ratchet my stops higher than what is a basic premise of viewing price action and using a consolidation area as a normal occurance and holding a stop just below that area- The 60 minute chart does a nice job of displaying intraday price action, stalls in momentum, and gives an opportunity to react closer to a potential change in trend- I've also been toying with RENKO charts, and I am now going to consider that I should at least understand what is "normal" and Average in price movement on both the daily and weekly action. Using a look at the weekly and daily RENKO charts will give one the average price movement - This average price movement can be used to understand where price could go "normally"- The % figure can be calculated by taking the RENKO box size divided by the price- Since price can fluctuate substantially in leveraged trades, I am initially looking at what the move of volatility means in relation to the 10 ema.- and I am calculating the percent by dividing the box size by the ema value. I may change that to a 10 sma - With this group of recent trades, I will look at applying the weekly Average volatility- subtracted from the 10 sma as a way to be outside of intraday volatility- Should price start to break down, I should normally have time to react- Say a close of price below the moving average may be enough to raise the stop to just below the low of that bar with some or all of the position- For price to consolidate - a break of the fast ema is normal- it simply may mean momentum is taking a breather- bib chart attached:  |

|

|

|

Post by sd on Aug 5, 2013 20:14:38 GMT -5

Understanding what is the "normal" % volatility over any one time period- hour,day-week- - should be useful in determining

whether a stop is within normal volatility striking distance.

As an application, I think a % stop calculation would be good for a momentum trade as long as the trend stayed intact.

As has occurred to each of us, we establish a stop-loss level

based on varying criteria- A Price Support level- Price above trend,

Price above price -etc.

Volatility is simply what is the typical range of price movement in any period. That range changes over time, and will be different for different types of investments- Sorry for speaking the obvious- The reason to take a look back historically

at one's prospective trade, is that if one looks at a ATR 14- one is looking at the prior 14 periods of price action- and the Average in that period may be low due to price trading in a sideways channel. If one also includes past trending- up & down - one will get a different Average.

Where does one set a set a stop once one "knows" the average % volatility?

That is up for each trader to determine- based on their Risk tolerance, entry into the trade, duration, etc.

I was recently whipsawed out of 4 positions- 2 of which rebounded smartly and immediately jumped much higher-

My stops were hit- but several were at the tail end of an intraday spike down, which ended up closing much higher- Had my stop been just a smidge wider, I would still be in 2 of those positions, and a net 10% higher.

Trading leveraged positions- Cure, FAS, TNA- one has the benefit - or downfall- of substantial moves in either direction .

I think one should view price action first, and then also put that in the context of what is within "normal" volatility-

Which is where the RENKO charts excel.

In my price action trading, I view price with a 60 minute chart- which makes relatively small moves larger than life....

However, it is a useful perspective to view intraday price action, and to detect early signs of what appear to be weakness, but in a daily chart would simply be a consolidation.

I'm trying to combine that with looking at RENKO charts- which don't move unless price breaks the high or low level and establishes a new box- a Bullish or a Bear box (in decline)

Instead of Using a daily RENKO chart, I am looking at trend direction through a 2 hour Renko. With a moving average below the uptrending Boxes. RENKO is all about price moving up or down within the allocated volatility- box.

So, If I know what % a weekly average price move is normal, I can use that information to establish a stop that will be outside of a "normal" spike down- Giving me time -ideally- to react to what the closing price action actually implies.

Instead of trading the renko level directly, I will consider the fast moving average, and deduct that weekly avg volatility %-

The idea is that this stop is wide enough that one or two days of downside will give me time to adjust if necessary as price gives evidence of weakening-

We will see .

|

|

|

|

Post by sd on Aug 7, 2013 20:04:10 GMT -5

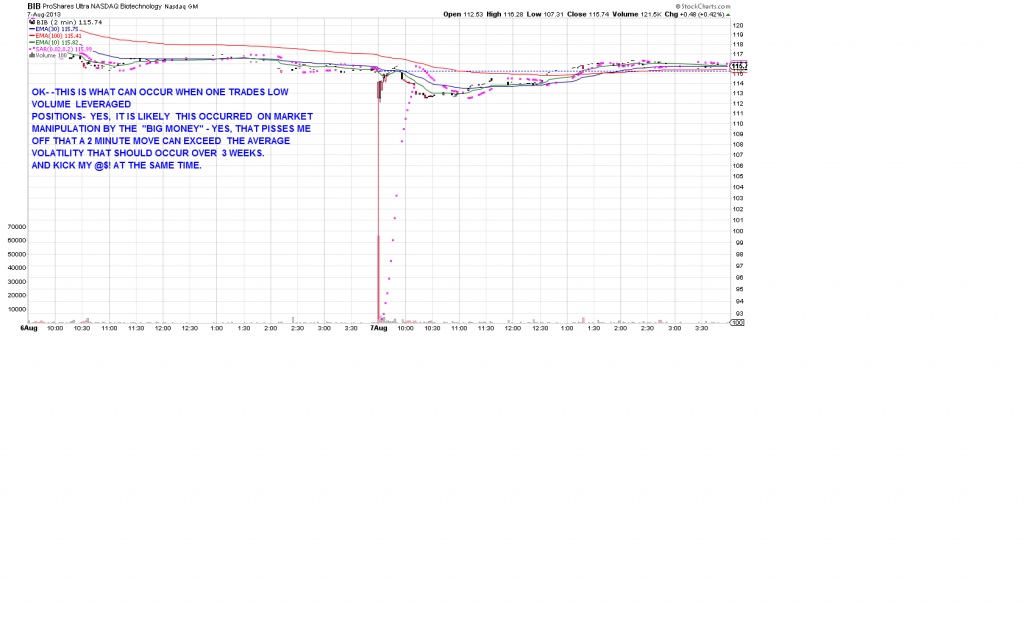

Check this out-tHIS IS INDEED PRICE VOLATILITY- In a 2 minute move off the open, BIB exceeded the 3 week volatility range. Yes, it is manipulation that big money can do with a low volume trading - It looks like a mini Flash Crash - It took out my stop - luckily my stop executed promptly and not at the low. The only protection gainst this is to be able to monitor one 's trades with mental stops- and only pay attention to closing prices-   |

|

|

|

Post by sd on Aug 16, 2013 15:31:36 GMT -5

Market has put in 2 down weeks in a row-

Cure & RXL both stopped out- CURE for a loss, RXL a profit-

FAS & TNA sold off Wednesday for losses,

Holding EEM, DXJ but in losing territory, and expect both will hit the stop.

As the volatility has increased over the past 2 weeks, The wider stops I employed ( ATR for weekly range) did not get out of the way of the market- Only served to increase my losses-

The only net positive trade is GLD- I had a Buy-stop trade with limit set Monday that gapped over, but backed and filled on Tuesday @ $127.60.

|

|

|

|

Post by sd on Aug 25, 2013 10:07:10 GMT -5

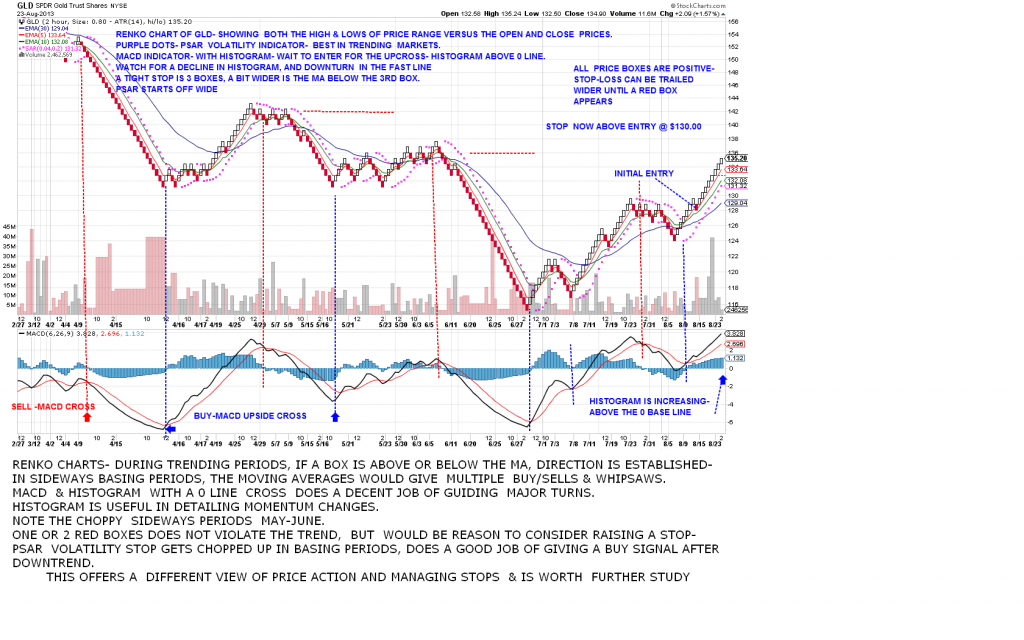

the market put in a rally this week-I had a partial position in GLD, and added to a full position with UGL Friday on the gap higher- Toying around with RENKO 2 hr charts , with the general premise that 2 sell boxes may be "normal" volatility and the trend is likely to continue, but a 3rd red box should likely be a reason to have a stop waiting-- Intraday volatility as indicated on the attached chart is based on the High/Low of price movement- Another way of viewing price action is through the more subdued Open/Close setting- In this chart, I also have PSAR- Parabolic Stop and Reverse, and a faster MACD indicator for entry/ exit signals. These become indicators of indicators- and the function essentially is to smooth the way one would view Price action- Obviously, these work best when price is in trend mode and get chopped in a sideways market. The MACD histogram does a good job of displaying changing momentum- and a drop below the 0 line - or the fastline/slow line cross means one wants to be out of the trade-or in a reduced position. The normal indicator values are 12,26,9 and i chose to "speed" that up. I am still using the 2 hr candlestick chart , but also viewing this RENKO type of chart to gain a different perspective. Truly don't trust where this market will go-  |

|

|

|

Post by sd on Aug 27, 2013 13:55:55 GMT -5

took a very small position in TLT yesterday-

1/2 position in SDS today-I'm not anticipating any major correction-but a couple of days of market uncertainty

The Gold trade is working higher presently.

|

|

|

|

Post by sd on Sept 9, 2013 20:39:17 GMT -5

Busy days and i haven't done a good job of updating. Nor, following the market-

Had a 2nd lightning strike burn out the electronics in the house within a month-Perhaps this was a sign from on high LOL!

Lost a TV, DVD player, DVR ,Modem,Router,on the 1st strike, and on the 2nd strike lost the new modem,router, and network adapter on the desktop computer-

Belatedly, I have learned the electric company- for $6/month will install a device that will assist in preventing electrical surges-

Not every device was shorted out through the electric/power cord though-We think several devices were shorted out via the TV cab le which provides our phone & internet service-

I could Rant about the customer service -3 days of no service, a tech that came to the house knowing the modem was trashed and yet did not bring a replacement with him---- wife had to travel the 20 miles to get a replacement modem whose firmware would not upgrade automatically, requiring a 30 minute encounter with an overseas tech support that had a very odd lilting intonation to her English that i could barely understand- Who finally transferred me to a 3rd tier tech support - country boy in Charlotte, NC that was really sharp and only took 45 minutes to get the modem to finally accept a firmware upgrade and realize that we had indeed paid our bill on time.

That feels better.....

Sold both TLT and Gld, for a small profit, lost out on the SDS trade.

Took entries in DXJ, EWA,EWZ today-

|

|

|

|

Post by sd on Sept 10, 2013 21:12:01 GMT -5

A Bit of self indulgence here- but it's my thread , so what the hell....

Not really about trading at all....No comments needed. My friend- John Miller- 1951-2013 I simply feel the need to acknowledge him here, in a medium that will remain for some time to come....

This medium will change, but somehow it gives a sense of being relevant in the here and now.

Some 50+ years ago I was over at Bobby Smith's house with a new fishing pole, and we were casting the sinker weighted line out across his driveway and the road, and some new kid in the neighborhood started to ride his bike up the road and i threatened him - that if he rode across my fishing line, I'd beat him until his eyes turned purple- I have no idea where i came up with that kind of attempted intimidation, but it was very temporary, and that new kid and i soon became the best of friends.

We went through the rites of passage that adolescents go through, the girl friends, then wives, then children ; and then I had a marriage that didn't work anymore and moved across the country to Texas in 1978/79. Met a wonderful gal that became my wife and the mother of my 2 daughters., that followed me on construction projects around the country/.

During this period, I would occasionally talk with my friend John, and eventually the construction industry found me on projects that brought me back North- in Mass. in the 1990's.

My family and his got to visit during the 4 years- we were relatively close- and then I had the welcome opportunity to move back South, to North Carolina.

Well, John and i remained friends, and would talk every few months and ;oddly enough, we often disagreed politically, and perhaps in personal beliefs, but were always able to respect one another;s viewpoint- We would challenge one another now and then- in politics and in general- He was more liberal than i .....

It came to a point this year that I had called, and left a message, and there was no response- I called again - and a few days later his wife- Jody called and told me that he had been to the doctor for a problem with pneumonia and weeks later diagnosed with a stage 4 cancer that was very aggressive and in his bones-and that he was not wanting to subject anyone to his decline.

The Doctor's had proposed that with aggressive treatment, he could possibly survive for a year. He elected to not pursue that course of action.

My wife and I drove up to see him that following Friday, and arrived on Saturday afternoon-

He was physically weak and held to the bed; and was determined that he would not go into a hospital- As he put it- "The doctors had gotten the last dime they would ever get from him"

I left that Saturday afternoon, having the opportunity to tell my lifelong best friend how much i would miss him, and how much he had meant to me over our lifetime together.

I am so thankful we got to spend that final time together, it gives me a sense of closure.

He passed on that following Tuesday with his wife and daughter by his side, at his Home, as he had wished. He got to

take the final exit under his control-

I will Miss my Friend-

His passing has indeed brought into focus the importance of attending to those items that we would prefer to postpone- Wills, Living trusts, Final medical plans- The responsibility is that each one of us can act now and take control of our final time in this life and not leave it to others to perhaps fight over or be in disagreement with-

Make those Final decisions in advance so others do not have to do so.

No comments are necessary- this is well outside of the normal trading blog- Seldom do we think of putting a plan in place for our final trade in this life- I us not fair to leave that burden on those that survive you., Have that discussion- Get those final papers done,

Look at the State you live in and find out about Wills and medical options /prolonging life.....

I won't visit here again- But the passing of my very close Friend points out that I have postponed taking the responsible actions I should do to define my requests for final treatment in my Stafe along with the proper documentation.

Something to think about.-SD

|

|

|

|

Post by sd on Sept 11, 2013 19:48:05 GMT -5

Added both VGK & IBB today.

The Syria fear has dwindled, some better than expected earnings/gdp in Japan, & change in gov't in Austrailia,

The market is showing strength- despite my ,thinking that September is seasonally a bad month for stocks,, Obamacare hits the market in a few weeks, should affect small employers? The funding of the Gov't comes up this month-as well.

|

|

|

|

Post by bankedout on Sept 11, 2013 20:10:38 GMT -5

It is good you had a friend like that. Thanks for sharing the story.

I would like to make a will and all of that stuff. At this point I don't feel like there would be that much to fight over monetarily in my estate, and I'm not sure who to leave things to (no children or wife). So I'm going to delay. Hopefully that plan will not backfire!

|

|

|

|

Post by sd on Sept 12, 2013 9:31:00 GMT -5

[size=4

]It is interesting, and I'm sure can vary State by State-Should you die Without a will, the court will decide how to divide up your assets- So, a distant relative you may have never met- or disliked could be awarded your estate-Any individual could also place a claim with the court saying that you had promised them all of your possessions & assets.....One could consider having something in place- and name a charity or worthwhile cause as the benefactor-

Another very important document would be one that directs physicians and hospitals as to your wishes should one suffer a permanent and catastrophic event- Some refer to this as the "Right to Die" essentially you define what should happen to you in the event you are incapacitated permanently and unable to make a choice concerning your care.

For most of us, this is something we think about as we get along in years- Should I develop Alsheimers, and lose my mental abilities and end up kept alive indefinitely by a feeding tube and a breathing machine- Most people would opt to Not have their life maintained in such an artificial manner-

However, relatively rare accidents or disease occurs where a person is not elderly, but none-the-less suffers a permanent injury affecting their ability to survive or have severe brain damage, no cognition, no hope for recovery- That person's physical body could be kept alive indefinitely by artificial means, .

Defining how you would want to be kept alive and under what conditions you would prefer to not be artificially sustained is in a document that you would provide to your health care / doctor-

Without such a document, and no one to speak on your behalf,

the choices that would be made by others may not be what you would have wished for. In that document, You can also express the desire to have your body maintained for as long as possible, should that be your desire.

You can find all of this on Google, and likely ways to freely import the documents that are appropriate for your State's approval.

That, and a Notary, and you've got a legal document that you can file . You can also modify the documents at any time -

Thus, when , in the future you find yourself with a Spouse or Children, a simple supplement to the document is easily done-

What was interesting here in NC, as i read about Wills, If I die without a Will, My Spouse would not automatically get everything I owned.

If I had 2 children, My Spouse would get 1/3 and each child would get 1/3 of I disagreeets- Just think of all the complications that could ensue for my wife if the house, cars, property should that end up being administered by a court with the added fees....and "divided".

Each State has it's own laws....worth looking into-

Something to consider though!

Yes, a remarkable friendship - His unexpected departure has prompted me to initiate some action and have that discussion with my family that we all do not want to consider .

I've made a 1st draft of my will, and discussed medical conditions with my wife- Have to get it finalized -and notarized yet-

This is one loose end I don't want to go unfinished.

[/size]

|

|