|

|

Post by sd on Dec 15, 2013 17:27:38 GMT -5

A buy trailing stop order is a mirror image of a sell trailing stop- Trailing Stop Orders www.interactivebrokers.com/en/?f=%2Fen%2Ftrading%2Forders%2FtrailingStops.phpPDF A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing" amount. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. "Buy" trailing stop orders are the mirror image of sell trailing stop orders, and are most appropriate for use in falling markets. IB may simulate stop orders on exchanges. For details on how IB manages stop orders, click here. Notes: I presently have a fixed buy-stop order to enter PJP. I think I will have to stay with this order at this time- and could consider a trailing Buy-stop if price starts moving lower from the present base. IF PJP was to start trending lower, A % trailing buy-stop would have to be wide enough from normal price action . I will look to also apply an attached % trailing stop to this entry- if filled |

|

|

|

Post by sd on Dec 16, 2013 20:26:05 GMT -5

Stopped out for a wider loss $31.87 than desired on SDS.

PJP moved higher today, and the initial leg of my order to buy should have filled- but did not- It appears that I had flipped the stop entry with the limit entry-value- IB does a nominal $1 offset to price -The revised order is now Stop to Buy $51.72 -limit $51.80 with a 2% trailing stop. The second leg is to add @ $52.00-$52.10 with a 2.5% trailing stop-

|

|

|

|

Post by sd on Dec 17, 2013 19:55:01 GMT -5

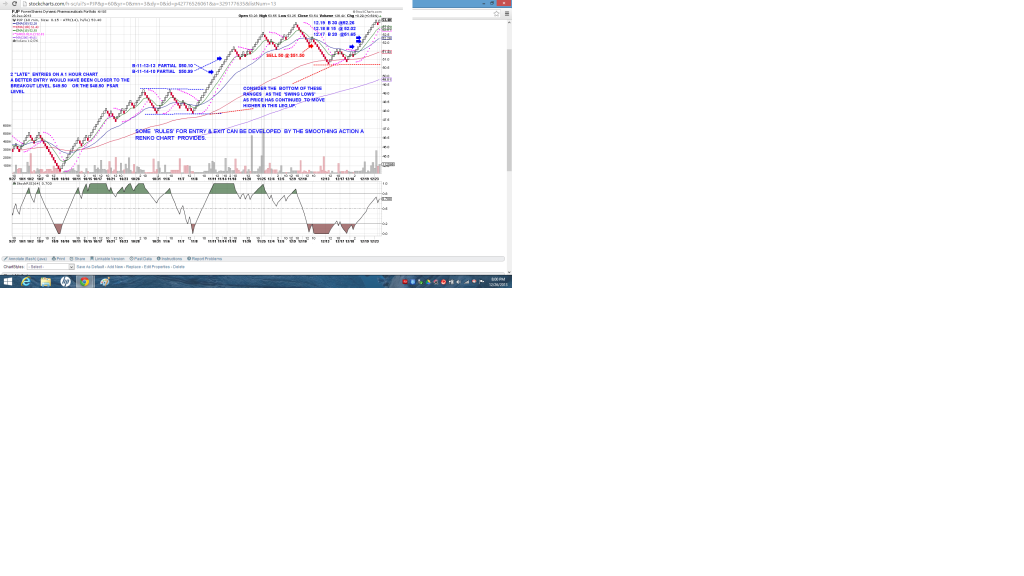

I have a partial buy-stop fill today @ $51.65 with a 2% trailing stop

The high was $51.75 x.02 =( -$1.03) so the stop should be

$50.72.

This is just below the recent swing low - If price resumes to trend lower, I will be stopped out on a partial entry-

I feel comfortable with this narrow a stop on a partial position entry.

Additionally, I have a buy-stop to add to the position @ $52.00 with a 2.5% Trailing stop-

In the event that these trades capture a swing back low range, and price resumes the uptrend, I will add further to this position.

|

|

|

|

Post by sd on Dec 18, 2013 21:53:30 GMT -5

I had an order for UPRO fill $87.75 @ 14:07 and stop out $89.95 @ 15:39 for a 2% gain-It was a 1/2 position compared to the SDS trade. The trailing stop caused the trade to be exited- but locked in a gain- Nice to have a quick small gain based on the expectation of the outcome of the Fed's announcement - as being a boost by the market. The trailing stop served it's function, but perhaps it was too tight?

My 2nd order on PJP filled today, increasing my average cost to $51.80 with each order holding a 2.5% trailing stop

I have decided I will be taking progressively larger positions with each positive position getting filled. My present positive position in PJP is 35 shares, and will add with a buy-stop for an additional 30 shares.

The present buy-stop is actually a stop-limit order with $52.00 the trigger and $52.50 the limit. In choosing this level, I am at a price further away from a potential pullback support- With the thinking that I have a greater portion of the position net profitible with a trailing stop that will execute leaving a profit, if the new order fills, I have elected to give this a bit wider margin on the entry levels, based on the swing low levels as a possible disaster exit should the trend reverse.

The present closing price was $52.35 with a large spike at the end of the day. My limit stop lower is based on the hope to get some price volatility and a lower fill , with the up trend still continuing-

|

|

|

|

Post by sd on Dec 19, 2013 21:57:28 GMT -5

My buystop-limit was filled $52.26 - raising my aversage cost

to $52.06. This represents 39% of my active trading account.

PJP closed $52.37 in a tight range, following yesterdays large move up.

SDIV- global dividends in a pullback- was a position in the longer term account which stopped out- This does not have a lot of volatility,

BX (Blackstone) is a financial group that is doing well-

The Spy chart is pretty choppy-

|

|

|

|

Post by sd on Dec 23, 2013 12:28:01 GMT -5

Perhaps this is the Christmas Rally Blygh was looking for.

I entered BX on a momentum move higher today, added to the SDIV position, still holding PJP overweight, and adjusted the trailing stop % a bit wider as price has moved up-

|

|

|

|

Post by sd on Dec 26, 2013 21:24:11 GMT -5

I've decided to narrow my field of view within the trading account- I have reviewed the trades of the past year, and have come away with the belief that I should trade with the trend, and if I take ROT (reversal of Trend) trades, they should be a narrow port Risk on the entry. My better trades were on trend continuations- after market pullbacks- and betting on the continuation of the predominant trend- One recent example is PJP-  |

|

|

|

Post by sd on Dec 27, 2013 20:12:39 GMT -5

iF YOU HAVE EVER HAD A PHONE CALL FROM A WALL STREET BROKER-....

You will appreciate the authenticity of that aspect of what underlies the brokerage industry- Movie-The Wolf of Wqll Street" with DeCaprio- The cold calling, the Sell- just for the sake of making the "SALE" -The sales pitch is universal- and most of us could realize that we have had that almost exact/same conversation at some point in time, with some voice on the phone trying to convince us to send our investment dollars to him.....DeCaprio plays an excellent part as the charismatic organizer of a trading firm that achieves a momentum success on Wall Street.

It's an interesting movie-but loses itself in scenes depicting a lot of the excesses that were indulged in- Gratuitous scenes of sexual & drug indulgence make up a large portion of this movie.

The movie should have been shorter, and more focused on the excesses of what was the excess sell and duplicity of the public by Wall Street firms- I think the film only slightly touches upon the SELL to an unsuspecting public- and spends far too much time with party /sexual scenes depicting what an endless supply of money and drugs can provide

However, after viewing the film, one can only be suspect if one receives a call soliciting funds from a broker- That is the true message of the film- somewhat got lost in turning a documentary into a more salacious film.

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Dec 27, 2013 22:31:46 GMT -5

I spent Xmas visiting Raleigh, NC going to movies and restaurants. Great town!! I think sd is nearby. The Wolf of Wall Street is not for those easily offended by nudity, sexual references, and drug use. Its based on the real life experiences of Jordan Belfort. He ran a big penny stock brokerage and was involved in manipulating thinly traded penny stocks causing them to run up so his sales crew could sell them as hot stocks. Then he'd dump them. Made millions. I've never done business with a firm like that. But early in the movie the character played by Matthew McConaughey explains he's selling hope to speculators, feeding on their addiction to the hope of a big score. He admits he doesn't know if a stock will go up or down and he doesn't care. He makes his living selling to addicts. He only cares about making the sale. I think his character is closer to mainstream brokers. Belfort's second wife in the movie is interesting. She plays him like a fiddle and dumps him when she sees the jig is up. She understood him cause she's a lot like him. Interesting facts about the real Jordan Belfort en.wikipedia.org/wiki/Jordan_BelfortNot a great movie. Way too long. But some of it is quite interesting. Would have been better if it was 2 hours long instead of 3. -ira |

|

|

|

Post by sd on Dec 28, 2013 12:22:24 GMT -5

Interesting Article on Belfort IRA!

And if you are going to visit Raleigh again-particularly on a weekend-

give me a holler- we could have lunch or supper and talk 'shop' and trading for a bit!

On Belfort

Of course, his pump & dump of penny stocks as a criminal activity -can also be viewed as very similar to the big banks 2006-2007 promoting securities as 'SAFE' they knew were not worth spit- and those same banks selling those speculative securities all the while they were shorting them. Some of these big brokerage houses have been 'charged' and fined- but few are made to be held truly accountable-

thingy Fuld with Lehman comes to mind as a recent 60 minute replay.

I think there is still a large element of Belfort in many investment houses-

The industry would change if their compensation was tied directly to how well their investments rewarded the investors.

I actually have received several "hard sell" cold calls after I had filled out some online request for "free information" at different times-

One- in particular- The technique of the one sales pitch could have been taken from Belfort's script- One was a "Futures" trader out of Chicago-

"Hey, let's start Small- just $5k- You don't know me and i don't know you, but give me the opportunity with this small initial amount to prove to you that we represent an outstanding firm that can make you a fortune over time...." etc. They don't easily take the initial "No Thanks"

They all play on one's desire to make a big score , to turn a smaller amount of money into a large one-Just Exactly what we hope to do with our own trading $$$.

When one hears that Sell technique- Whether in person or on the phone- Whether in stocks or Buying a car- where one is pressured to 'Act Now, Last Chance etc" - put your hand on your wallet and walk away-Impulse pressure to Buy Now" You're being Sold-

|

|