|

|

Post by blygh on Nov 25, 2013 19:19:42 GMT -5

"For what reason do people feel compelled to know WHY prices have changed?"

I am not smart enough to know which individual stocks will perform best - but I do understand a bit of economics. And while smart traders are a lot richer than smart economists, I have not been altogether unsuccessful in trading on the basis of economic trends. For example, as fear subsides, the price of gold falls and gaming stocks rise. As Energy prices fall, airlines rise due to lower fuel costs. For the past 45 years I have traded a lot based on 'boomernomics' - where are the baby boomers spending their money. Travel stocks are doing well as aging boomers work on their 'bucket lists.' And one can look for positive correlations - e.g. if 5 solar stocks go up significantly, is a sixth a good investment if sales and profit margins are similar. Probably .

I appreciate your focus on transactions - to that end I have KNOW - an ETF based on insider purchases - It is doing quite well. I always look at insider purchases on individual stocks, also, short interest ratio - rarely buying stocks with more than 3-4% short interest.

Blygh

|

|

|

|

Post by sd on Nov 25, 2013 20:04:53 GMT -5

"Instead of trying to have a bullish or bearish bias about the future, maybe the bias should be that we simply do not know what future prices will be. A permanent neutral bias.

Accepting that the future in unknowable, you can just let it unfold in front of you.

When price stops trending higher, it is time to liquidate your long position(s).

When there is no clear trend in price, it is time to sit on the sidelines.

When price is trending lower, it is time to be short.

For what reason do people feel compelled to know WHY prices have changed? How does knowing the reason(s) 'why' help you as a trader?

Can any of us accurately predict the future?

I think that is why we need to keep our eyes focused on transactions. Transactions are the sum of everyone's knowledge. If a person or corporation has any knowledge that is 'valuable' that person or corporation is certainly going to act on that knowledge. Those 'knowledge' transaction(s) will show up on the chart. The more valuable the knowledge, the larger the effect on price.

Whether the Fed is (or will be) successful nobody knows for sure. It is our job in the markets to attempt to make money no matter what the Fed or anyone else does. Whatever the reason price went up or down doesn't matter in the end. What matters is that you either bought lower and sold higher, or vice versa.

You either have more electronic pieces of paper than you did in the past, or you don't. How, or why you have the paper doesn't matter too much when you go to trade your paper for food or shelter."

I agree with you- with the caveat that the market trends Up, Down, or Sideways- and the time frame one chooses is the determining factor in how well one will succeed over the final determinate- TIME- and % of price movement.

The reactions and fluctuations of Price can be wide , but eventually a predominant trend- or a Bend of the trend- and a decline occurs- To the extent that I take a profit on a break of a moving average on a 2 hour chart, I have made a profitible trade-

But if that trade nets me 5% BUT THE TREND REVERSES AND GOES ON FOR A 30% MOVE HIGHER.... I have the short term satisfaction of a precise tactical trade well executed- but failed to garner the results of a substantially larger profit.

We can make an outstanding short term ROT counter trend tactical trade on the Daily chart, but Miss out on the major trend move on the Weekly. Minor profits within a major trend

How much of a stall in an uptrend is a reason to exit a trade?

How much of a decline on an entry is a reason to stop-out?

How much of a gain is a reason to take profits?.

These are Epic types of questions- Trading Wisdom is to give yourself 'enough' room to allow your profits to run.......

The final summation, is that one needs to compare one'sself against a benchmark- That could be a market INDEX - such as the s & p OR THE nAS- oR perhaps test one's self and one's approach against several specific stocks/ indexes/ that one trades.

One major aspect of trading is the amount of RISK one is willing to be subjected to- This translates into the drawdown of one's account value, as one takes a position and sits through a decline in value.

If one seeks to minimize RISK, one may miss out on the stellar gain.......It is trading afterall- and no guarantees.

Against my inner judgement, i am long in several positions & IRA.....

|

|

|

|

Post by sd on Nov 25, 2013 20:49:09 GMT -5

"but I do understand a bit of economics. And while smart traders are a lot richer than smart economists, I have not been altogether unsuccessful in trading on the basis of economic trends. For example, as fear subsides, the price of gold falls and gaming stocks rise. As Energy prices fall, airlines rise due to lower fuel costs. For the past 45 years I have traded a lot based on 'boomernomics' - where are the baby boomers spending their money. Travel stocks are doing well as aging boomers work on their 'bucket lists.' And one can look for positive correlations - e.g. if 5 solar stocks go up significantly, is a sixth a good investment if sales and profit margins are similar. Probably .

I appreciate your focus on transactions - to that end I have KNOW - an ETF based on insider purchases - It is doing quite well. I always look at insider purchases on individual stocks, also, short interest ratio - rarely buying stocks with more than 3-4% short interest. "

Blygh- I think you have a unique approach ,(on this board) to investing/ trading that incorporates both the technical aspects as well as the rationale for the perspective-that there is a fundamental macro driver- that influences your trading decision.

You seem to do a significant amount of fundamental analysis-

You likely understand that as true trends develop, they have sustaining power, and align yourself-accordingly. How much of the technical combines with the fundamental to make your choices?

You also seem to have a "wider" perspective of the MACRO influences than most.,

Your analysis-

This is likely an outcome of your business exposure, or market time exposure that provides you with a wider macro view- beyond any other member of this board. Since you have been trading/investing for a few decades +, allow me to ask how you combine your sense of the economic trends with the technical trends-

I would expect that you would prefer to apply a Weekly chart to your trades, that you have the conviction of the correctness, and are willing to undergo some short term volatility and pullbacks in order to see your trade play out as you expect.

You seem to have a strong sense of the "fundamental" drivers that should support a move. I have noticed that you will often purchase a 'basket' of sector related stocks when you think a market sector is gaining strength.

I appreciate you posting your 'wider' view of the trends as you see them-

I think it would be instructive if you would take the time to expand on why you choose to enter a trade, and what determines when you decide to exit a trade- My sense of things is that you have a longer term approach and stay with that trade until you determine it is not performing to your expectations-.

Expand on this when you have the time-

|

|

|

|

Post by blygh on Nov 27, 2013 17:55:22 GMT -5

I think your analysis vis-a-vis my trading /investing technique is correct. In the end fundamentals dictate prices ( I think - although there are a lot of counter examples) - But sectors come in and go out of favor - seemingly in a random fashion. There are sectors believe in (i.e. I see a likely scenario of increase demand, PEG ratios (like 1-2) , Price/Sales (like it around 1)) but which are flat to down. Then I watch charts, MACD, and Short Interest, Money inflow, volume ). So when I see positive activity in a sector I like, I buy best of breed or a basket of sector leaders. For example, railroads have seen increases in freightage - They are in non competitive markets (there are not two railroads on the same routes) - unlike truckers - they are efficient in terms of energy costs - with improving economies they should do better - UNP KSU NSC CSX PWX GWR make a nice basket. COmpanies which support railroads should also do well if the railroads (like buying BEAV when BA goes up, or CRUS when AAPL goes up) -I presently hold a basket of WAB, ARII, RAIL GBX.

It works for me - at least enough of the time to make me a buck.

Blygh

|

|

|

|

Post by sd on Nov 27, 2013 19:06:21 GMT -5

Thanks for sharing your perspective-You do quite a fair amount of due diligence in making your selections. and it sounds as though that has been a worthwhile qualifier/process for taking your trades. You seek investments where the value is compelling, and do the homework to select a sector that is-or should be appreciating. Would it be fair to say that you are a value investor with an eye for the market's momentum?

If you don't mind a follow up question- As you mentioned sector rotation can be a fickle dance partner- Is there a point where you decide to throw in the towel because the sector/basket does not behave as you anticipate?

Also, Feel free to disregard my queries-I think it's informative to ask questions that may be of interest to myself & others ; but perhaps that is simply my own way of processing a different view -

Not intended to be intrusive, just overly curious as to what makes other's tick regarding trading decisions.

Have a good Thanksgiving! SD

|

|

|

|

Post by blygh on Nov 28, 2013 9:33:42 GMT -5

"Would it be fair to say that you are a value investor with an eye for the market's momentum?" - That is fair - Consider Ira's plays on DUST and NUGT. I can't make those work. Gold is a "psychological" commodity with little intrinsic value - like works of "art" - value is a function of personal preference. Tastes come and go and I am not very good at guessing their direction - not unlike retailers catering to teenage fashion preferences. Other areas are more reliably predicted. Jimmy Rogers (Investor Biker) bought newspapers and brewers where he liked the political economic climate. I am a big believer in industrials, technology, biotech but I think they have had their runs hence I am more heavily invested in transport, financials and consumer discretionary.

|

|

|

|

Post by sd on Dec 5, 2013 20:53:24 GMT -5

Thanks for the Feedback - and sorry for the belated response-

I recall seeing Jimmy Rogers over the past years- and he certainly strongly believes in commodities & that the market is fundamentally overpriced. He has held that belief for some time.

He is likely a strong fundamentalist- And likely has a 1 year supply of food stashed away- He may ultimately be proven correct-

Peter Schiff is the Gold Bull- and I think he has it wrong.

As for the more spec plays- I think if one has the time and the fortitude available to take those leveraged plays, the potential is there, but so is the greater RISK. That's alway's the trading partner of seeking greater gains.

You may be correct in your view of the market themes, this month will give a tell for consumer discretionary- and there may be a pullback- But Why would Tech, & Biotech not continue to be the drivers in the new economy? If there is anything that is a growing force in the economy, it seems to me that the Tech, and Medical/ Biotech sector will be long term drivers- I think the dempographics are strong for the Biotcech sector as a long term theme play- the new political /healthcare environment may be a large unknown, but outside of repressive legislation, the health/pharma field seems to make sense as my generation hits the turnstyles. We will seek all the offerings to prolong our existance.

Still owning PJP but with a raised stop

|

|

|

|

Post by sd on Dec 7, 2013 20:47:17 GMT -5

|

|

|

|

Post by sd on Dec 8, 2013 14:23:32 GMT -5

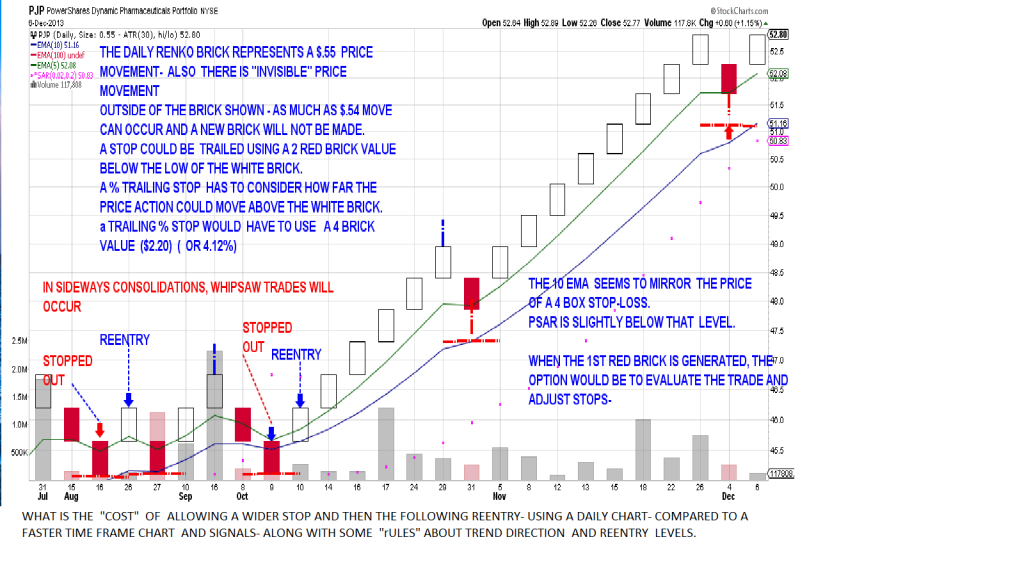

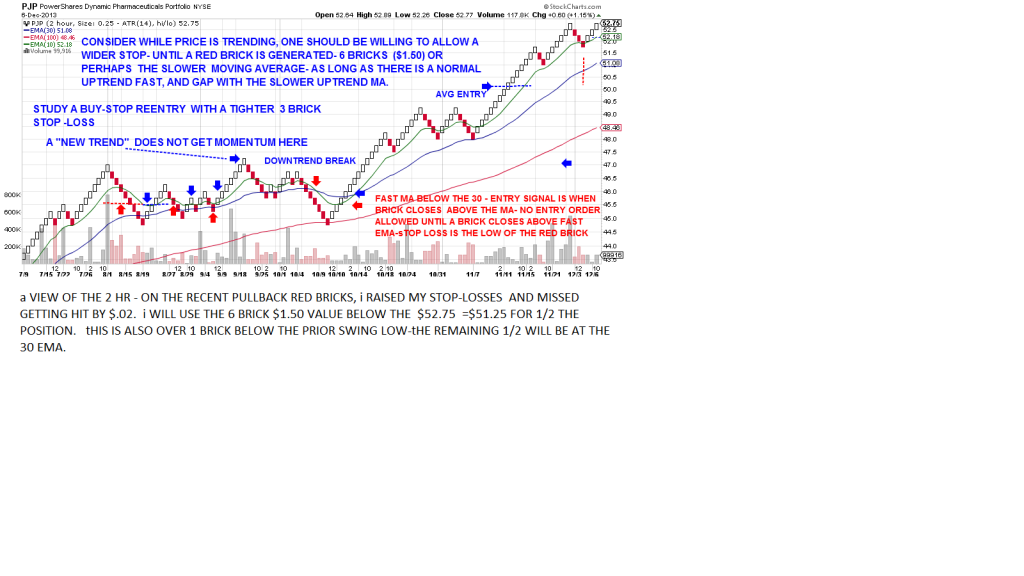

Haven't been able to follow the market much of late- My single remaining position is pjp- I may focus on this single position for the near term as long as the uptrend remains intact. I'm now holding 50 shares of PJP with an average higher cost at $50.17. The question of volatility - what is "normal" price action- and how does one allow for that normal volatility in price swings- to stay in the trade- as long as the "trend" is still in effect. In the case of using a 2 hr chart, I like to see what price action is suggesting. For me, some moving averages allow me to gauge where price is relative to the trend- and that price momentum- and a longer period moving average tells me the direction of the daily- larger time frame trend. Viewing the up and down price movement on a 2 hr chart has to be kept in perspective though, because the swings above and below the moving averages that look dramatic, would not appear as anything but a nice uptrend on a daily chart with a 10 period moving average. In the attached chart, I've illustrated some of the moves higher and then the swing lows - with a view to understand what is "normal" volatility on this time frame, and what I should consider as a normal % movement that still allows the uptrend to remain in effect. This includes a price pullback below the moving average- the Low of this move is the swing low point, from where price again moves higher. Looking back 3 months, a 3-4% price movement still allowed the trend to stay in effect- There was 1 violation of the Higher Highs/Higher lows definition of trend that was a 4.7% move. Critical to me with my entry costs higher- above a swing low, that i am prepared to not allow this trade to go negative on me- Using 2 hr Renko charts to also follow price action is another view. As long as a red brick is not produced- everything else is just normal volatility 'Noise".  a RENKO DAILY CHART- Has a brick value of $.55. as the ATR. In viewing the daily chart of PJP, a 4 brick stop level % seems to make sense- This range allows for the white brick to also have price movement above the generated brick higher, a red brick to form lower, and finally a second red brick hits the stop-loss. A reentry on a new white brick buy-stop assumes a resumption of the uptrend-Which may not be the case. Assuming the initial buy-stop order is filled-a new stop-loss could be considered at the low of the preceding red brick- Compare the sideways price action earlier in the year would have had several entries stopped out for losses prior to getting back into the uptrend. How can the wider losses associated with the daily chart be reduced? The application of a 2 hr or 1 hour chart reduces the size of the price movement. However, a requirement to not be entering on any new white brick needs to be considered as a qualifyer for setting a buy-stop entry. Note the "stopped out " are not my actual trades- illustrating the stop & reentry levels of this chart  The 2 hr RENKO chart had generated a red brick this week, and i raised my split stops- and came within $.02 of stopping out on the higher stop. Since the trade is now above my entry cost, and still appears to have some upside momentum in effect, I am using 2 stops- one will be using the 6 brick ($1.50) below the close of the present brick, the other stop-level will be slightly wider using the 30 ema. Should new red bricks appear, i may choose to tighten one or both stops.  |

|

|

|

Post by bankedout on Dec 8, 2013 22:06:06 GMT -5

Have you ever used an actual trailing stop, meaning one you submit as an order to Interactive Brokers?

|

|

|

|

Post by sd on Dec 9, 2013 22:04:34 GMT -5

"Have you ever used an actual trailing stop, meaning one you submit as an order to Interactive Brokers?"

I have used a trailing% stop only a few times- but it actually makes perfect sense to employ that type of stop since- If i use a RENKO

chart, I have a consistant defined level that tells me that price is declining beyond my 'comfort zone'.

This would also suit my present work/ family situation- where I cannot view the market daily- and make necessary adjustments. This would also gear me into testing a more methodical approach -and less intuitive/discretionary.

Using that type of stop on a faster time frame would also necessitate a conditional order to reenter the trade on a trailing buy-stop should price move higher- I think IB may also offer that as part of it's order platform- It certainly would be worth a closer look - and greater consideration-

There are certain conditions in which one would want to not take a reentry if price was 'downtrending'- meaning perhaps, one would define a minor pullback vs a more serious pullback as- for example- a minor pullback, a fast moving average stays above a slower ma, whereas a more serious 'downtrend' condition exists when the fast ema is below a declining slower ema- and a reentry is not allowed until X occurs-

I'm supposed to have an aptitude for Math , but failed Algebra 1 -3 times- My future son-in -law writes programs, and i will see him over the holidays and get his input-

In the mean time, employing a % stop loss simply makes very good sense- I will give that a shot and refine it this weekend!

I noted the % values on one of the charts- The thought was mulling around vaguely in the back of my mind-

Thanks for the question-It has prompted me to Ask myself - "WHY NOT? " it could save me time - and missed opportunities- and would likely improve the end trade result-

Thanks for the input-

|

|

|

|

Post by bankedout on Dec 9, 2013 23:38:41 GMT -5

Here are the order types: www.interactivebrokers.com/en/index.php?f=4985Click on any type for an explanation. Maybe also explore 'Trailing Market if Touched' I'm interested in how that will work for you. I may consider trying it myself. |

|

|

|

Post by sd on Dec 11, 2013 23:04:46 GMT -5

Modified post-

PJP stopped out today on both a RENKO chart values, and on a 2 hr candlestick chart-

The pri=ce move exceeded the recent pullback low and coincided with a larger market pullback-

the chart suggests price could drop much lower-- perhaps 5% to a lower minor support level- It will likely trade with the wider market's momentum-

At this point, price action has violated any level at which I would normally put in a potential buy-stop reentry. It is in a "No Entry allowed" condition of price below multiple declining moving averages.

However, based on viewing the "Renko", I will try to construct an order buy-stop if allowed through the IB order system. I will try to further review the various orders IB offers today. In this type of decline, an order would not want to be filled on a first white brick- It would require a white brick to clear above and reverse the declining fast ema -Also could set a Buy-stop on a fixed reversal higher level-

|

|

|

|

Post by sd on Dec 12, 2013 21:46:45 GMT -5

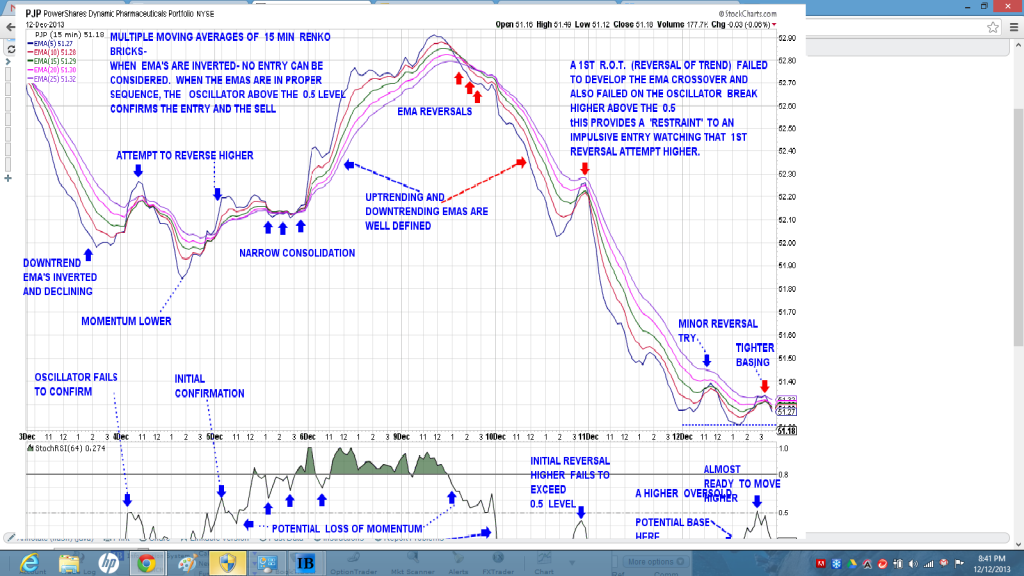

I was watching pjp periodically today as it was declining, I was stopped out for a small gain on the initial trade, and desiring to make a bid for a reentry buy-stop should price move higher. The overall larger market is declining in fear of Fed pricing. I think I like the relative visual stability of the Renko charts- but the desire may be to more closely define an entry with a tighter margin to the point the trade may stop out. So i chose to experiment with a very fast RENKO 15 minute chart- and then made the price action "invisible" i threw in some multiple moving averages for a graphics viewpoint,and a momentum oscillator- The STOCH/RSI and extended the time frame from 14 to 64 periods to relax the response time. This is to average out what is actually occurring over a longer period- A 64 period on a 15 minute time frame , amounts to about 3 days look back. The realization in viewing a faster time frame chart is that one needs to not respond to every minor move that appears to go in the desired direction- One needs to balance a relatively minor price action move in the perceived direction with a method that is not too reactive-Specific to the present stgopped out PJP trade, a basing position has appeared- but this could be a false base and may not be a buy opportunity in front of a continuation higher- Confirmation is higher- and it comes with a cost of entering price at a higher value and fewer trades- In the case of the attached chart- Price action has been eliminated- The chart is one of multiple moving averages on the 15 minute time frame-- Why is this worth even considering? Moving averages are actually lagging price action- and tend to average out (smooth) what may be some volatility- Everything that "smoothes' price action tries to make an 'average' line- so the smoothed action may not fit in periods of higher volatility. Anyways, the concept of not viewing price itself , but perhaps the average smooths the actual action- Whether this has an actual application in real time is questionable-but as one changes and adjusts the time frame gives faster or slower signals across the signal mechanism. To balance out the potential signals, a momentum indicator- could be added- In this instance, I increased the time frame reference from a 14 period to 64 periods to reduce the volatility and to only show more significant fluctuations. The end result -is that a reentry in PJP is not in the immediate cards, but could be if price moves above the prior rally high  |

|

|

|

Post by sd on Dec 13, 2013 21:29:23 GMT -5

I took a 100 share position in SDS on Thursday, and it has muddled around-Entry high $32.31 - Stop was $32. I will review over the weekend- It is basing sideways, but higher than the prior swing move .

PJP came close to hitting my buy-stop- I adjusted it lower intraday as price pulled back from $51.30 high- but it proceed to close lower. I may modify this stop for a higher entry on Monday.

Fed meeting on Wed to set the tone of how their outlook will be.

|

|