|

|

Post by sd on Oct 23, 2013 20:06:33 GMT -5

Banked out had posted his buy-stop entry for UVXY.

I like the chart setup, as it has had a sharp decline, and several days of basing-

I have traded uvxy once or twice in the past, and been whipsawed -

I decided to take a jump onto the UVXY trade- for the technical set up-

The trade started off strongly, hitting both of my separated buy-stop entries-. But, while it started off strong, it declined progressively during the day, closing below the gap open.

This is not the type of action you want to see on a reversal trade.

The market had opened lower, and had gained some ground back during the day.

If there is some fear before the open, UVXY will gain some ground at the open.

If the Futures look higher at the open, I will have to assume UVXY will drop lower- I took a 2 part entry, and will try to reduce a loss by raising the stops.

Today's price action closing weakly does not mean that tomorrow will follow suit- A lot can happen overnight.

Should the position move higher tomorrow off the open, I will consider today's lower close as my price pivot ($25.80) .

Of my other positions, only XBI was up for the day-

Everything else gave back from 1/2% to 1.5%

One reason for taking the UVXY trade- or any leveraged trade-

is to get some substantial momentum in the account-

I also have positions in XBI,,and CURE (3x) Healthcare-

UVXY is a R.O.T. trade- reversal of trend- It needs to be used as a short term tactical momentum move.

Conversely, The healthcare , Biotech -Pharma- has trrend on their side-

Sell-offs may present good buying opportunities.

Paradoxically- While I am talking about short term tactical trades,

I am gradually trying to position myself to ignore the short term and focus on the long term

|

|

|

|

Post by sd on Oct 24, 2013 8:41:31 GMT -5

UVXY stopped out -in the 1st 2 minutes of the open-

UVXY opened at $24.90- Stops executed $25.48 & $25.57-

I was fortunate not to have my stop order to execute at the low open-

|

|

|

|

Post by sd on Oct 25, 2013 9:07:11 GMT -5

Entered back into UNG as it opened with a gap higher-

|

|

|

|

Post by sd on Oct 26, 2013 18:52:13 GMT -5

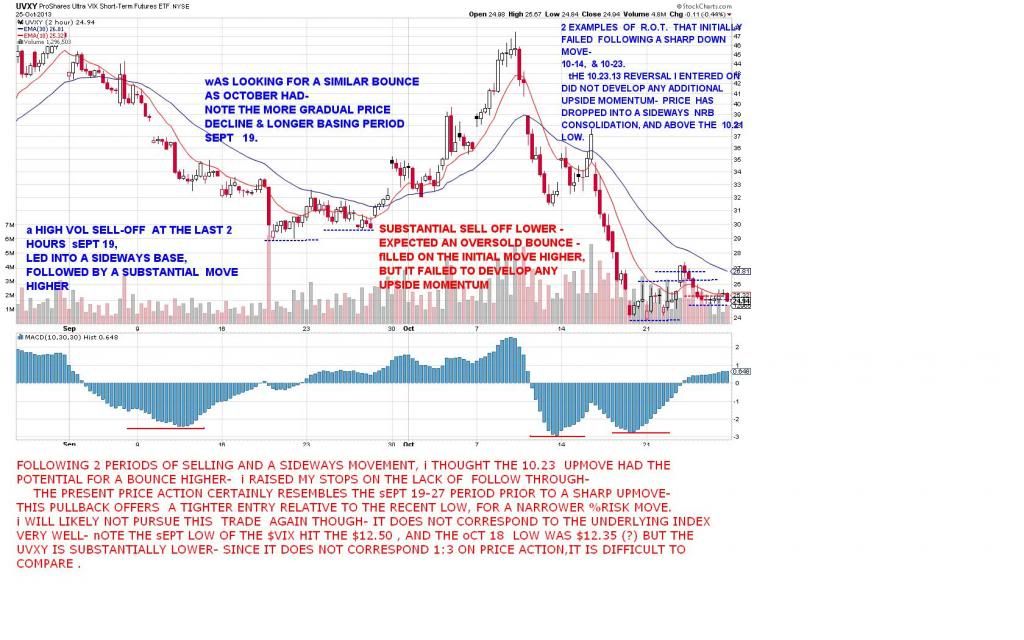

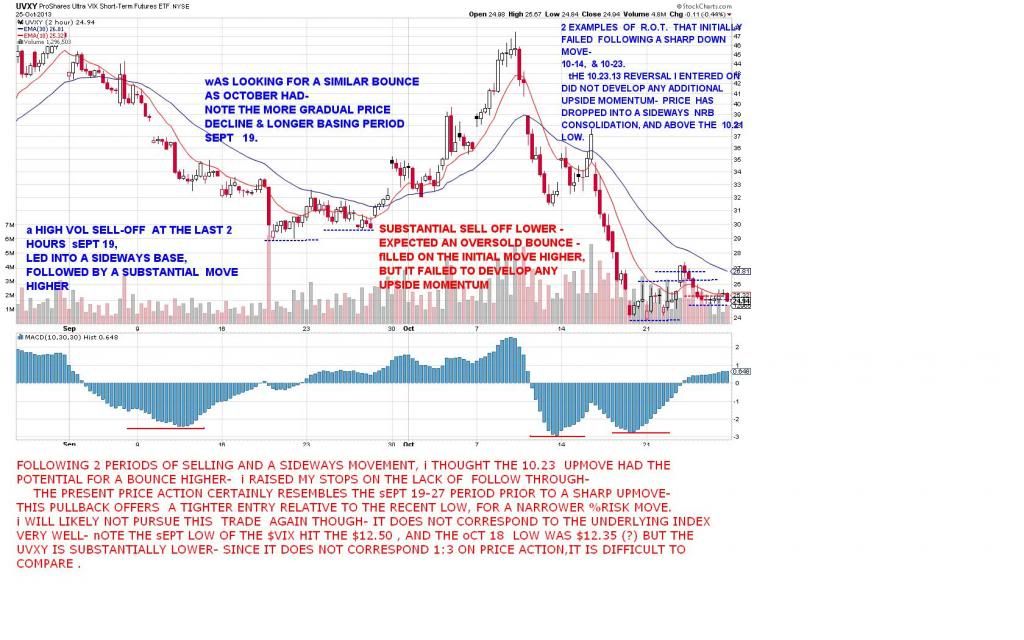

A COUPLE OF CHARTS ON UVXY it was a spec R.O.T. -reversal of trend- trade that I thought I'd give a shot- the potential reward was well worth the Risk- My initial entry did not work and I raised the initial stops to reduce the loss- The trade did not violate the swing low, but the lack of follow through indicates I was wrong on the timing- although the price action suggests it is basing here, and substantial upside could still indeed occur- Even Being a leveraged instrument, It does not appear to track the underlying price action of the $VIX -even within a short 30 day period-   |

|

|

|

Post by bankedout on Oct 26, 2013 19:05:40 GMT -5

"Even Being a leveraged instrument, It does not appear to track the underlying price action of the $VIX -even within a short 30 day period" The 30 day chart below seems very correlated to me.  |

|

|

|

Post by sd on Oct 27, 2013 19:03:38 GMT -5

The correlation chart compares well- To get a better example, I went back 2 months- Here's the reason for my comment- If you view UVXY , you see it is at an all-time low- if you look back at the $vix, for a couple of months, it put in a low back in Augest, $12, and since has moved higher, pulling back to the $13 level twice- where it is at today-but the latter pullback has a much lower value-although at an equal price The $vix is higher today than in Augest, but it's UVXY value is considerably lower- Go back 2 months to view the lower low- if you use the Augest closing price values for $vix & UVXY, you get a ratio of 2.67, At the october $vix/uvxy the ratio value is just 1.83. This is a significant decay in the present valuation . Would this affect the value of a breakout move adversely? That could be reviewed by doing the comparisoms of the bounces higher and the values at the peaks-over the past 2 months or so- Since UVXY does not 'match' at similar price levels, and the trend is down, that perhaps explains the $25,000.00 starting price 2 years ago- I think this is a good example of price decay in the leveraged instruments- One may catch a bounce higher, but needs to exit before a decline- If you bought in Sept and held until price came back to your entry, you lost 21% . A good way (I think) to spot check quickly if a levered instument follows the underlying with consistency or has significant price decay, is to go back over a period of time and compare the price values to each other at periodic intervals. It is the reason some of these instruments can lose monies over time while the underlying gains- Definitely appears to be for very short term trades- It will also give me reason to compare any others I consider- Good Luck!  |

|

|

|

Post by bankedout on Oct 27, 2013 20:07:43 GMT -5

UVXY is definitely only good for short term trades. I will not argue against that point!

|

|

|

|

Post by sd on Nov 5, 2013 22:35:05 GMT -5

It's been an interesting month-for me personally, I have been essentially long in a number of positions, and shortly following the WMT flash crash, i elected to shrug- take off all stops- and to see what would transpire, and how I would feel if i had a substantially losing trade- And I now have one in UNG. As an exercise, the UNG trade went south and broke support and established a new low.

Why would i allow myself this kind of drawdown in a trade?

Why would i want to test myself to undergo a losing trade and intentionally allow it to go lower/

The answer essentially is one that each of us that trades should really give some consideration to-

Actively trading is a great challenge and intellectual exercise-

Is it functionally a winning endeavor in the long run in terms of time and effort spent, vs a 'passive' and less active approach.

We make selections to enter a specific trade, using a set of signals that we think will give us an edge- and perhaps that is true in the short term.

How well do we execute our system? Is it actually a solid approach in all markets, does it get us out in bear markets?

If we view the markets since the bottom in 2009, the $spx & Indu are up over 100%- in 4 years time-

OK, that was an exceptional decline, but this year, are we not looking at an average gain in the "market of 20%" ?

So, Each of us trading should consider how we managed to perform vs the broadest (easiest) of the market indexes-

If we use the broad indexes, did our propriatary trading techniques- after commissions etc, exceed the single purchase of the index etf on Jan 1 and not incurring any additional fees-

One has to decide what has real value in the time one has to spend in this life. And, there should be a sense of 'balance' in how one chooses to expend time and energy, and what it actually brings to the table.

for each of us seeking higher gains through trading, that may be a totally different assessment of what significance an improved financial future would bring-

I think that each of us- All of us- are visiting this site- and others- because we desire by our skill, intelligence, and determination, that we can accomplish more than the market averages will provide over time.

Statistically- 80% of us believe we are above average - skill, intelligence, whatever.

HMMM- does that mean 30% of us are wrong?

Fun stuff- but there is a reality behind it all for many of us-

We have a great desire to do more with what we have, to improve our lives by our wits and application of TA, and investing wisdoms and Trends etc, We Want More- We Want to Believe that by sheer force of Will and Determination, that we will EXCELL!

OK, let's have that REallity check Mates!- (This is the Aussie segment of the family at work)

since 2009, the markets are up 100%+ that means one's account should be at least doubled . Just with an easy one or two index trades.

This year, I think the markets are up 20%+ YTD-

Follow this line of reasoning -

If I purchased a broad market index ETF in January 2013, and I have achieved a 20% gain with no additional effort , and no time invested, I have a nice return with no stress and no effort.

If I - on the other hand - spent 2 hours each pm each business day scanning for stocks or etf's and managing my positions- say-only 10 hours per week, and 52 weeks per year,

I have 520 investment hours in that year . (That is 13 - 40 hour work weeks Folks!)

That's Right! That 2 hours per evening you have expended on tracking the markets, watching CNBC, etc- equals 1/4 of the time you got paid to work on your job- Not including weekends!

So, Ask yourself- supposing I put in that extra time at work and only got paid straight time- Say that we had a job just paying $10/hr=400/wk

If our market time was 2 hrs/day x 5 days x 52 weeks x $10/hr= $5,200.00 in minimum value-per year. And most of us consider our time worth well more than $10.00/hr

oNE HAS TO CONSIDER- Did we equal the market's return AND did we get the minimum of an additional $5,000.00 gain for the time we expended?

Personally, I did not- I am heading back to square #1 -

I have had some good trades- Those memories of trades well executed are inspiration to strive forward. But, one has to take the total adds and deducts and determine what one has the time and inclination for. , i recently vascillated and dropped the tight stops- and have seen a significant decline.

putting this in context of effort \time spent:

If one's trading approach cannot exceed a passive market approach by a significant % factor to make it worth the time and effort, One should evaluate one's approach over a longer term market period of 3-4 years- If one has 20 years ahead.

If one has an approach that can yield an additional 10% return above the average market- and repeat that year in and year out, one has a vibrant winning system. If the Chimp simply Buys the market, and outperforms you with no expense, you need to ask if it is worth the effort. And the lost dollars.

In the end, trading is about the statistics- and as any life insurance person will attest, the reason life insurance companies will succeed is that they understand the law of numbers- Yes, there are exceptions to the averages, but they are few and declining as you get past the bell curve/median line.

I still find i believe i can make trading/investing decisions that will improve the outcome- Tonight I reduced exposure in several funds that have run up higher this past month- But, the reality is that I should have had a much greater investment at stake to begin with- but I withdrew that portion of the assets some 10% lower- thinking a serious decline would ensue.

TA tells us what is occurring- but truly cannot determine what tomorrow brings on the Right Side- The present trend has a 30% chance of continuing tomorrow -

|

|

|

|

Post by bankedout on Nov 6, 2013 19:13:47 GMT -5

The time to consider running without stops is to let big gains add up. Let's say you buy something that you think has a good 6 months of upward prices in it. You purchase with a stop, perhaps eventually move the stop to breakeven. Once the item is far away from your purchase price, you can remove the stop to prevent the flash crash scenario if you are worried about that.

I would say you always want to keep your losses as small as possible.

I think it is Warren Buffett who said there are only 2 rules to investing:

1. Never lose money.

2. Don't forget rule #1

As far as time expended, if you choose a permanent watch list, time searching for ideas is removed from the equation.

There is my 2 cents.

|

|

|

|

Post by sd on Nov 6, 2013 21:36:13 GMT -5

Good points-

I have always had stops attached from the moment I placed a trade order- The idea of having a certain amount of control with a stop to define the normal average Risk makes absolute sense-

This was as much an exercise, and reaction, as it was a moment of lack of resolve. Flash crashes occur infrequently- and would be much more significant an impact on a large investment account with a wide stop- vs a trading account with tighter stops.

Also instead of being satisfied in properly trading the chart, I was perhaps beating myself up - or indulging in a little self-sabotage- to show myself that the account will improve virtually based on a generally rising market. - and I need to be able to stand a bit of downside pullback to stay in the trade for a longer directional move- fewer trades- greater gains on a winning trade.

I also need to determine for myself how much time I elect to expend and on what time frame I should be focusing-

I think the early entry on a faster chart and "handing off" the winning trade to a slower chart - something you have also discussed- is my goal- Several of my present positions meet that type of approach presently- If they don't pullback further and hit my entry. And , of course, if past trends are predictive, these positions will all be higher in 6 months. Just plan to exit by May 2014-or sooner if the upcoming budget defecit agreements simply flounder.

Getting back to the original post- and the basic theme I was asking of myself-Time spent and results achieved- were not impressive-- therefore i need to take steps to change and improve those results.

Your point about trading within a specific and narrower field of candidates reduces the time element is spot on-this is actually a significant aspect to choosing sectors in momentum- and sector rotation is a present force-

I have a somewhat general focus- healthcare, biotech, Europe- a rebounding China, and a new era of the US of A becoming and delivering Nat Gas and Oil as a new world energy source. The nat Gas trade is breaking down I believe because we have abundant supply and an inability to transport to world markets.-

That will likely improve in a year or two - This illustrates the issue of "investing" on a belief- When the chart tells you what others belive is different from you, listen to the chart-I already Know this- Some of my frustration is that I have not been willing to risk enough in either my trading account or my investment account- and so my RISK has been relatively low, but I failed to get the gain of a booming market this year. The bottom line there is that If I had gone in on Riskier positions- in my major retirement account- i would have achieved a much larger gain- perhaps coming close to a market return- With not too many years remaining, all the guidance is to take less Risks % wise- However, by taking a more active approach and trying to take advantage of the uptrend with the fed/market , the opportunity to see a substantial gain was there for the taking. I allowed factors - like the debt ceiling- to cause me to position myself for the worst scenarios- which never came to pass- So, by not being willing to Risk more, i have in turn received a smaller reward than desired.

Thanks for the feedback-

I will have to circle the wagons and determine what is appropriate for myself-

|

|

|

|

Post by bankedout on Nov 7, 2013 19:31:26 GMT -5

Don't beat yourself up about this. We are all constantly making errors and learning new lessons. Sometimes we are learning the same lessons we thought we had already learned.....

You could always drop down to my current timeframe (3 month daily chart). At this level a bull market or a bear market lasts maybe a couple of weeks or so. So there are lots of new chances to grab the next one by the horns.....

At this current timeframe I'm operating in, you can easily check the market when it is closed and adjust your orders accordingly based on the most recently completed day's action. I think ideally one would be able to log in around 1pm or 2pm Eastern time and adjust open orders based on the morning action. However it is not necessary. I just think that would be ideal in this timeframe.

Best of luck to you.

|

|

|

|

Post by sd on Nov 7, 2013 21:22:56 GMT -5

"Sometimes we are learning the same lessons we thought we had already learned....."

YES! Been here, been there, , done that. Perhaps it's seasonal/daylight deprivation? LOL- Your comment is quite accurate, at least for me specifically. And for many others as well I would assert-

If we drop our diligence, If we allow ourselves to become complacent-- we deserve the wake up call-

(I initiated stops in my trading account and stopped out today on the majority of my positions) In my "normal' approach, I would have been stopped out days earlier. So, I inherit a greater Loss- for my flexibility and "Look Ma, No Hands" approach to stops this past week. I find i am well satisfied to be clear of those positions, some lost money, some stopped out with smaller profits than I should have gained.

One's attitude and psychology plays a significant role in determining the eventual outcome-of most of life's events- The actual mechanics- Whether it is a trading approach, or , perhaps an evening out with the spouse, or the outcome of a business venture- is greatly affected by one's attitude. One's expectation of the Outcome....sets the actions one is willing to take.

I've been listening to Anthony Robbins on Time management- and several other subjects in the 1.5 hours I spend driving morning, and another 1.5 hrs in the evening. Among my RPM plan is to make a final determination as to how I will allocate my time for short term trading, or do I simply roll it over into a longer term approach- And, quite honestly, I have hesitated to make a move with the IRA- Subject for the other thread.

My work destination will shift in the weeks ahead and be much closer- as i turnover the present project to another to complete in the next 2 months.

"You could always drop down to my current timeframe (3 month daily chart). At this level a bull market or a bear market lasts maybe a couple of weeks or so. So there are lots of new chances to grab the next one by the horns....."

I like your shorter term viewpoint- i prefer it even more on a 2 Hr chart simply because of the break down of the price action,;

i understand the mechanics of your approach, and I had a few really good entries in this last group of trades that were filled just off the downtrend / swing reversal to the upside- This also gives you a minimal Risk should the trade fail to move as anticipated.

I will credit your posting your approach- even when you were using the weekly- to motivate me to actually have that trailing order in place- and to get that early and positive fill as price reversed higher- and that occurred using the faster chart-

I also like the idea of taking a partial profit, but - if markets appear trending- allow a good portion to hold for a more substantial gain. One needs to judge the tenor of the markets at the time of the trade and make that decision at that point.

As stocks look to be pulling back today, the opportunity will be to look for other -as good- entries.

The question of course will become which candidates, and narrowing the field.

"At this current timeframe I'm operating in, you can easily check the market when it is closed and adjust your orders accordingly based on the most recently completed day's action. I think ideally one would be able to log in around 1pm or 2pm Eastern time and adjust open orders based on the morning action. However it is not necessary. I just think that would be ideal in this timeframe."

Going forward, i may not have Internet access during the work day- but I'm comfortable with that-

Thanks for the feedback- I don't think I will choose to follow you in UVXY though! You mentioned that you thought you might go All-In- I hear the music of Kenny Rogers- "The Gambler' playing in the back rows. It would seem prudent - for the long term- to have some ability to go in the other direction should the market do so-

I have often found myself in an All-In position, which - when the market turns, takes 3 days to clear the funds. It may be sensible to keep a portion on the sides- Let's use the UVXY- If you were all-in, but it turned and you stopped out , had to wait 3 days- and in that time volatility immediately increased - The big upmove could occur while your cash was waiting to clear.

Just a thought-

|

|

|

|

Post by sd on Nov 16, 2013 18:57:41 GMT -5

I could use some assistance - Somehow i have managed to minimize the text size of everything on this site on my laptop.

I'm at a loss as to how i did this, and how to correct it. I don't have this issue on any other tab I bring up. Suggestions are appreciated

I'm sure it's probably something I did inadvertently,Thanks..

From my desktop, this message looks huge- so I'm sure I'm sure I pushed some control key while on this site that changed the normal view while using the laptop- (windows 7 & 8) Again- thanks for any help.

|

|

|

|

Post by sd on Nov 16, 2013 21:09:57 GMT -5

I chose to double my position in PJP,, and went long UPRO following the market's assessment of Yellen continuing the Fed policy.

PJP has recently moved up out of a consolidation of 10 weeks or so-

It is also highly correlated with the S & P.

PJP is the more benign trend, but has doubled in the past 2 years-

UPRO has tripled in the past 2 years, but with greater volatility.

Both trends are pointed higher at this time.

UPRO has sustained pullbacks of 15%-20% on retracements of the highs, breaking down often close to the 30 ema .

Most of us trading would not allow any trade to have a drawdown of 10% , much less 20%. This suggests that one should look to take earlier opportunities and to reduce the drawdown by simply holding a position. Eventually- Surprise- The market will actually cease to be trending higher- Those that have a plan to trade With the trend, will be on the sidelines if that day ever does show up-

Those of us paranoid enough to think that day is close upon us, will continue to get rewarded with mediocre returns as we struggle to think every minor downturn is the start of the big pullback, as we struggle to not lose $$$$ in the near term trade, but don't have enough vision to see what has been the big picture- and - by being cautious , have less than stellar returns matching the market's.

So, What is the answer?How does one balance the fear of a significant market loss in one's trading account with the desire to achieve better than average market results?

One should find a way to simply do better than the market itself. If one can get the market return by simply buying and holding the etf that tracks the market- less a minor fee $.20% for managing the account--

I should be able to apply a TA approach that improves a buy and hold to the market. (past 4 years)

UPRO is a good study - It is already trending and appears extended in price movement.

How will I follow this trade, or How will I take a stop-loss?

What time frame or method will serve my purpose?

i do not think the weekly chart movements will "fit" my psychology of allowable swings in price- The relatively wide % swings of the ups and downs on the weekly chart would have me purchasing large amounts of antacids.

However, that would be mitigated if I had made an initial purchase at a more appropriate level- coming out of an oversold pullback condition.

This becomes the ideal Entry condition- One enters on a signal of a change in trend , and that entry -relative to the low of the prior trend- can often establish a point where one is willing to take a stand- with a well-defined Risk understood.

The very best entry would seem to be the closest entry to a reversal point in price action- This is where price moves above the prior trend , and gets buyers involved- The question becomes- is this move just a minor countertrend move, or is it the start of something more significant?

If we could but pick those points, we'd all be rich and famous and see ourselves on CNBC- even if we only did it one time.....

Is it our method, or is it ourselves that we need to question?

Let's take the example of my admittedly late entry in UPRO-

The weekly chart suggests to me there is likely a minimal upside move after the large move- If the next closing move is down, my entry is in jeapordy.

Can i translate this into the RENKO charts to my advantage/

|

|

|

|

Post by bankedout on Nov 17, 2013 6:56:56 GMT -5

Prices climb a wall of worry. Whether the worry is fundamental, such as will this business or economy keep it together? Or technical, will the trend maintain itself? You said IF the trend ever ends. I assure you at some point it will. They always do. If the goal is to be wealthy and on CNBC, you should study more wealthy and famous people. They are not always happy or satisfied. Ever heard of a movie star going in to drug rehab? Or a football star going to prison? Wealth and fame might not be all they are cracked up to be. Family and Friends are much more important than money or fame. Best of luck to you. Let the trend be your friend, until the end, when it bends.  |

|