|

|

Post by sd on Jun 6, 2009 19:42:15 GMT -5

Will enter a series of posts until page 11 comes up

|

|

|

|

Post by sd on Jun 6, 2009 19:44:25 GMT -5

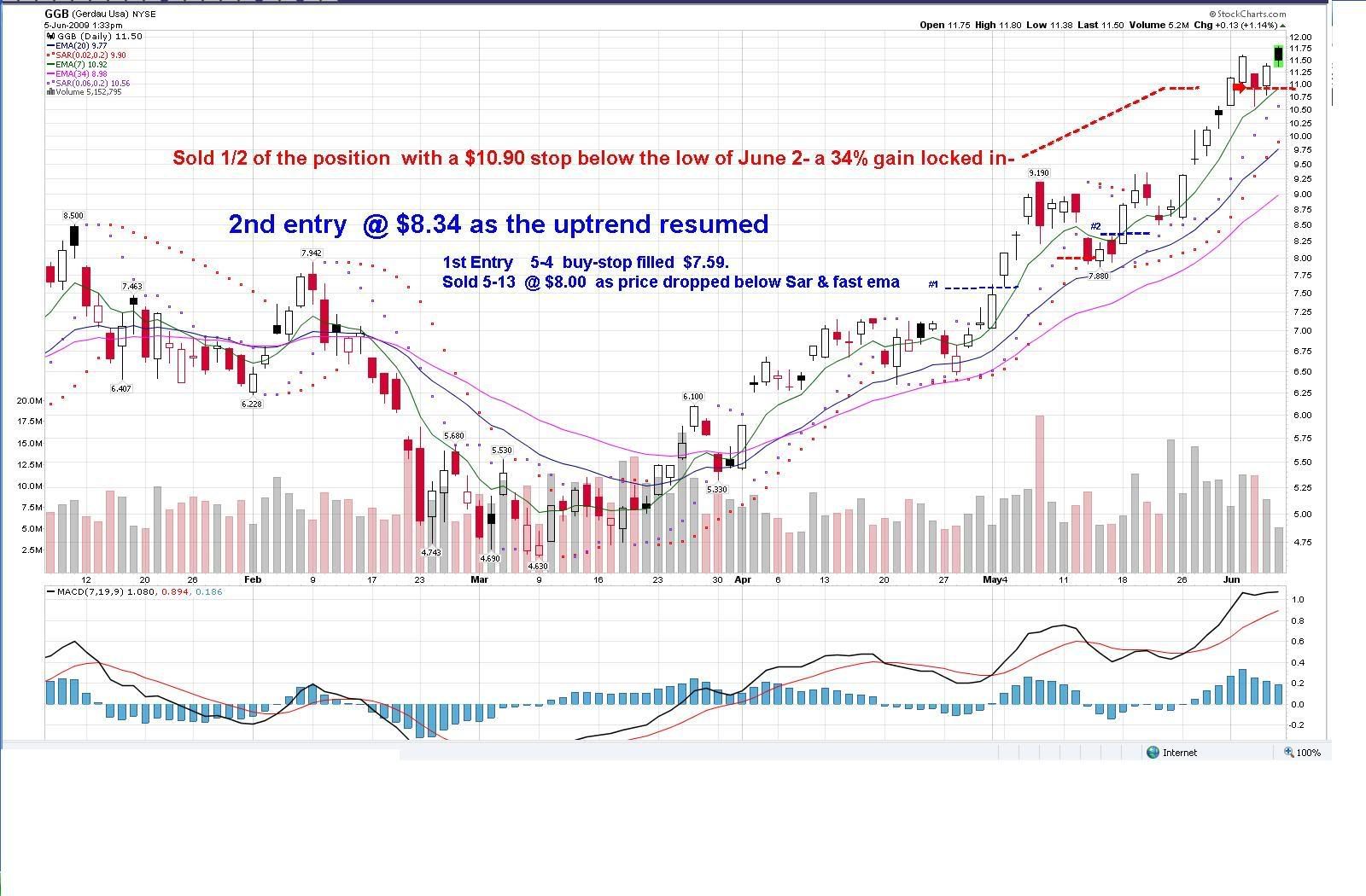

That's better, I think. Now I'll try to post the GGB screenshot  |

|

|

|

Post by sd on Jun 9, 2009 19:52:30 GMT -5

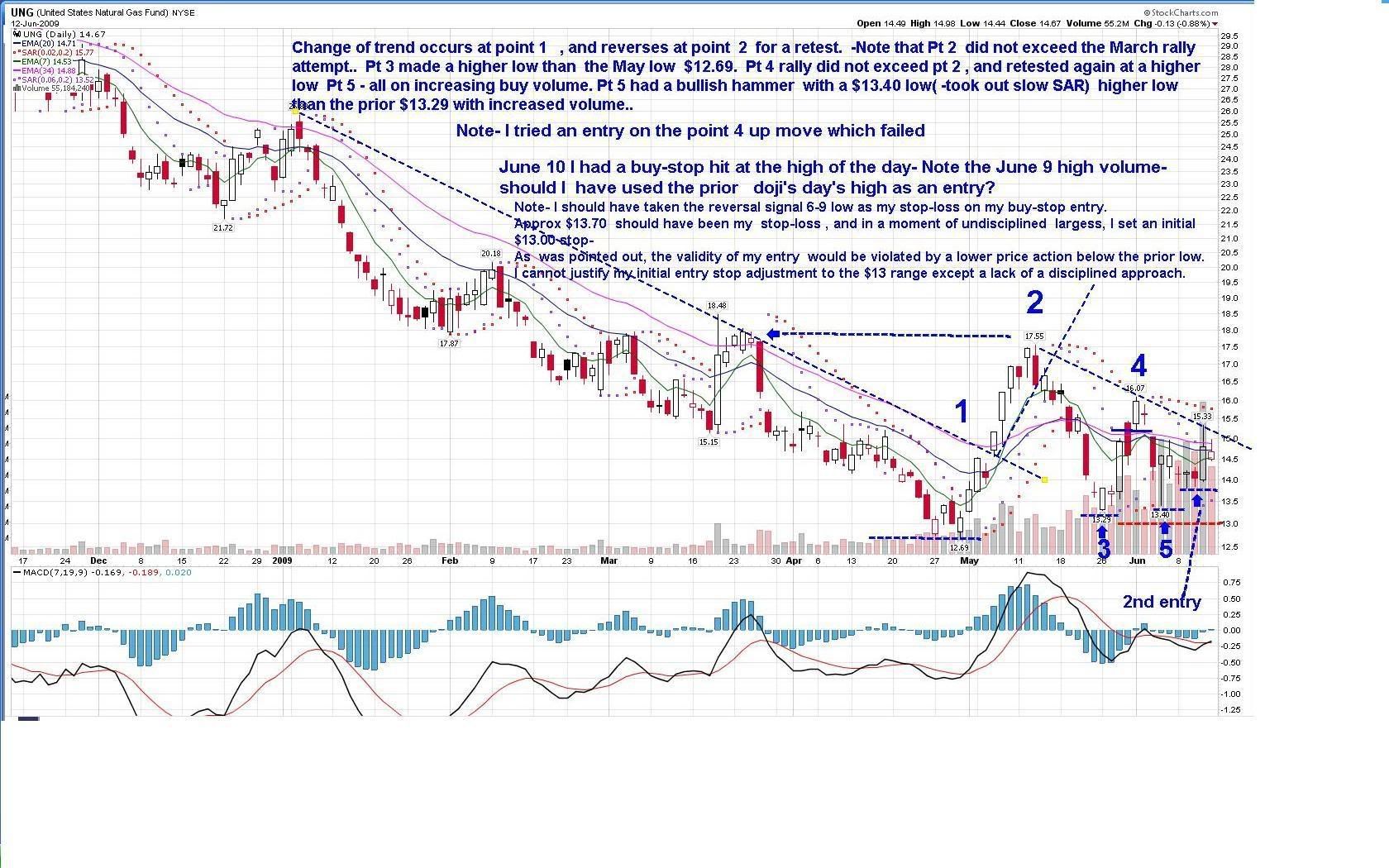

Looking at UNG again- Previously I took an entry in UNG @ $15.22 , didn't like the price action , and raised a stop to $15.00- In hindsight, this was a good move as price indeed dropped lower. As a commodity, UNG has not participated in the market rally- I also hear that the disconnect between USG and Oil- or Nat Gas and OIl is at an all-time extreme some 18:1 differential. Nat Gas always underp[erforms it seems- I tried an earlier move a week ago , and as it weakened, I raised my stop and realized a $.22 loss per share- This was acceptable, and turned out to be the right move. Tonight I find myself hearing the big options buying in UNG, and the price is lower, the chart shows good volume this pm, and so I will try a buy-stop entry with the idea that until this thing uptrends, it's just for a attempted trade- SD  |

|

|

|

Post by sd on Jun 10, 2009 20:39:07 GMT -5

Trade notes- The prior post of UNG had a buy-stop @ 14.30 and 2 tight following stops based on the 60 min. chart.

The high in UNG today was $14.30, and I was filled. I look at the prior 2 buying days and extremely high volume , and I have decided I will stay with the daily chart and not apply the tighter stops- Presently , I am at $13.00 which is lower than the prior 2 lows, this should give me some room to not get whipsawed, and reevaluate this trade daily. As noted before, there is a big disconnect with oil- at an all time high, plus CHK has been trending higher, has gas exposure- One other note about this entry- I recogonize I am getting in early before I see any credible TA other than 2 high volime buy days. I have to ask myself why I want to push an early trade entry on this- When and if it does move , it should snap higher. Perhaps I'm trying to get the best side of a low entry just prior to a move up- and that's second guessing the market- and that's a mistake....

On the other extreme-chart wise- I bot TIE high in it's uptrend yesterday

AAPL position sold @ 140.00 stop several days ago, NLC was a loss, GGB is coming back down and will likely hit my $10.70 stop- I was tempted to raise it, but SQM (brazil also) is moving higher, and so I'll see how it plays out.

Is the market getting ready to pullback,? TBT moved up today, may take another entry in it , it's a short on the treasury, should be a good investment as the US prints money , but it's a trade for me.

Bernake is on the hot seat with BoA- and the Merril deal-

The market will not rally higher , and it makes the financial sector dealings suspect . Likely a good time to take a SKF financial short position.

|

|

|

|

Post by sd on Jun 11, 2009 21:27:02 GMT -5

Just some notes here:

I had a buy-stop on TBT and it got filled at a gap higher open, and then sold off the rest of the day. I was stopped out- Perhaps if I had time and seen the futures up, I would have cancelled the order, but didn't expect TBT to move higher at the open. I sustained a 5% loss ina matter of hours on this trade.

Where AAPL had previously been my only position that went higher on a sell day, after hitting my 140 stop,the past 4 days declined slightly, and did not participate much in the market rally today. This suggests that I was wise to exit @ 140- we'll see if it gets traction and plows ahead or has further decline- say 130.00.

It wasn't until this afternoon that I got to see what the market was doing, a lot of blue on my screen compared to the red.

While I am now hearing how over extended we may be, even the commodities, I went long EWZ, EEM, UEC (small position).

Fortunately, my UNG position has moved higher, and this will justify my raising the stop and thereby lessening a potential loss should it not have any follow through. As I mentioned in the prior post, this was an attempt to second guess a bottom on this stock , and anxious to try to step in at a lower cost.

The commodity positions I hold all moved higher-PCU,DBC,GGB,SQM,TIE, UNG. I am left now with BRF, EEM,EWZ as my other positions.

This is now the 3rd time in just a few weeks that my account is reaching for new positive territory . I'm getting concerned because I am starting to lean in the camp that the market action the past few weeks is suggesting that we are indeed getting to a topping point- The prior 2 sell-offs took profits off in a 2 day period faster than a week could gain them . Sound familiar?

I find it easier on a trade like GGB where I know I'm profitable to be willing to give up some profit, compared to trying to sit through the -"get to break-even" process- say in a trade like UNG that didn't behave as anticipated. Or PCU where I have a nice profit margin, it's easier to trail a wider margin because it's not likely that the stock will give up all the gains in one single day, and I have time to react to lock in profits.

One of the shows I do catch in the pm is Fast Money on CNBC- and one savvy contributor I pay attention to is Doug Kass when he is on. He was right on declaring the housing bubble, caught the March low as a bottom, and now says the run up is overdone. Protect profits.

These folks are seeming to echo the same sentiments, market is topping, take profits, etc.

Are they right? Well possibly so, if not tomorrow, then perhaps next week.

Since June 1, the S&P has been going sideways, in a consolidation, and so trades in segments that are performing is my general approach. The commodities trades seem to be still working, and I've been overweight Brazil., and that has worked . What about those naysayers, that say "take profits"- meaning this rally is overextended?

You have to listen, and plan to be more defensive. At some point, they will be correct- Possibly tomorrow, possibly in a week- That means I will try to push my stops harder to break even as fast as possible, and I will look for candlesticks that suggest we're about to give back all the gains, and I will take action to put my stops where they will lock in some profit vs becoming a loss.

At some point in the chart, a bearish candle appears, upward momentum slows, buying volume has decreased, and the stock which had once continued it's uptrend and staying above the fast ema, has now slowed, price has hit the fast ema intraday, and the ema rolls over and price follows.

I use several indicators- Parabolic Sar, and a fast MACD.

Sar is helpful for setting stops based on price volatility. Macd is helpful to not get in too early, along with SAR.

What about profits? Well, I want to try to minimize my losses- That's why my TBT trade got filled and stopped out all in the same day- My origional order has a stop-limit buy, and a stop-loss attached- Unfortunately, this was what I had set as my entry day "disaster" stop- The maximum volatility range I felt I would try on an entry day - And it got maxed out today-

I hope there is some follow-through to the market tomorrow, and I will likely adjust my stops much closer to ensure I maintain profits, or reduce losses. If we see an increase in the Vix, this will likely be the better approach.

Some of the prognosticators I have heard suggest that we will be trapped in a trading range for some time to come, and that this will be a "trader's Market". I think this implies holding positions for a shorter period of time, selling on the first sign of weakness, and cutting losses if they happen before they become significant.

Let's apply this trading mindset to an actual trade- UNG

Today, UNG put forth the highest buy-volume trade in recent history- The positive buy volume is what convinced me to try a $14.30 position. Today, the stock opened @ 13.96 and closed @ $14.80. all on brand new high volume.

I gave this stock a bit more stop range yesterday, and today it propelled higher- Now, it's time for it to SHINe or get off the pot, so I will look at the chart and raise my stop to just under the recent few day's low, and set a stop @ $13.75. This stop will be below the low of today's big buying binge. It will also effectively reduce my potential loss by 50% should this turn South. This is not a bad thing, since today UNG gave all the buy volume anyone could ask for. If the stock underperforms after today, it will be a lesson learned indeed about getting in too early .

For anyone that has followed this post, and this trade, the question I would ask , is where would you place your stop after today's price action?

I am comfortable in raising my stop to $13.75 and reducing my potential loss from $14.30. This now is a potential $.55 loss on $14.30 = 3.8% loss.

Here is where my approach gets aggressive -stop wise. I had an initial lower stop as a disaster stop, and now that price has moved higher on big volume, in just one day, I am prepared to follow that price action and label it not just significant, but a make-or break action, where if it is violated lower , it's a false signal at this time. It may become true later- but if it does not hold tomorrow, and goes lower, I don't want to be in this position any longer- I can put the money to better use elsewheres is my mind set, and substantially reduce my potential loss by 50% if today's action is not affirmed tomorrow.

Just psycheing myself up for Friday- SD

|

|

|

|

Post by bankedout on Jun 12, 2009 8:20:05 GMT -5

For anyone that has followed this post, and this trade, the question I would ask , is where would you place your stop after today's price action? I am comfortable in raising my stop to $13.75 and reducing my potential loss from $14.30. This now is a potential $.55 loss on $14.30 = 3.8% loss. Here is where my approach gets aggressive -stop wise. I had an initial lower stop as a disaster stop, and now that price has moved higher on big volume, in just one day, I am prepared to follow that price action and label it not just significant, but a make-or break action, where if it is violated lower , it's a false signal at this time. It may become true later- but if it does not hold tomorrow, and goes lower, I don't want to be in this position any longer- I can put the money to better use elsewheres is my mind set, and substantially reduce my potential loss by 50% if today's action is not affirmed tomorrow. Just psycheing myself up for Friday- SD You entered the trade because of an upside breakout from a trading range you found on the hourly chart. It was roughly $14.30-$13.80 Your expectations probably should be that UNG should not go back in to that trading range. Otherwise your breakout is null and void. Therefore, you could place the exit stop near the top of the old trading range. If you weren't willing to own UNG previously in the trading range, you probably shouldn't be willing to own it in the future if it falls back in that range. If a tradable item retraces it's entire breakout move, that is a bad sign. JMHO & good luck to you. |

|

|

|

Post by dg on Jun 12, 2009 12:20:45 GMT -5

I agree fully with bankedout's statement. The reason for your purchase sets the failure condition logically. In this case, buying the breakout sets breakdown as the failure criterion.

|

|

|

|

Post by sd on Jun 12, 2009 20:48:40 GMT -5

Reply-

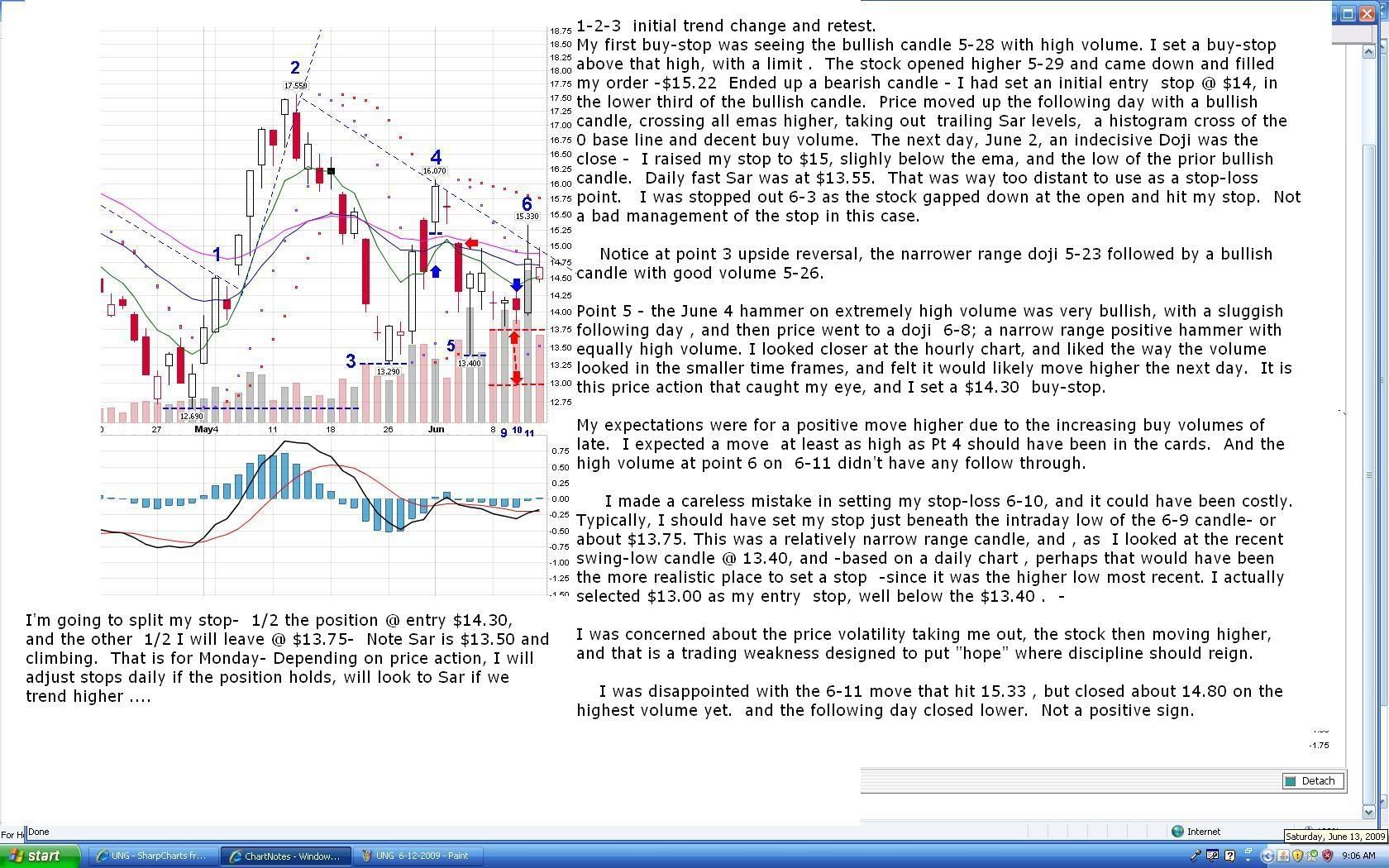

Banked out and DG - I have to agree with you both- RE:UNG trade

In a moment of weakness (wanting to save myself from a loss ) I allowed myself to use a stop-loss that greatly exceeded where the stop should have been placed based on this type of entry-

Thank you gentlemen, for calling me to task- I am usually more on track, I typically don't take trades that have been down trending , but I find that there are reasons that suggest this trade should become profitable. Where I failed, is in setting the tighter stop -loss below the prior day's low , and thereby limiting my loss to a failure in the breakout I was anticipating. The breakout did occur a day later than my entry- I was actually filled at the high. It was the second day that price and volume moved higher- A stop at the swing low would not have been touched and reduced the risk substantially.

While I seldom take an attempt at a reversal to the upside- or a break of a downtrend trade, I took the first trade based on a willingness to get in earlier on a reversal. I find I was influenced by the concept that most commodities have out performed, and Nat gas has been a laggard. Since Nat Gas is an energy source, and is at an historical extereme to Oil, suggests there should be a movement in Nat Gas -oversold-

I seldom get influenced by what the "fundamentals " suggest-

And in taking the second trade in UNG , I said I'd talke a $13.00 stop which was based on the prior swing lows . However, my basis for entry was a breakout higher , which gave me a better opportunity to define a lesser stop-loss .

I don't like the price action of UNG- While I feel the downtrend low is the ultimate low, the price has not performed despite the higher volume. And BTW, thanks for the prior link banked out, I am reviewing the Sperandeo book (thanks) on the shelf, and am also applying the same to UNG chart .SD

|

|

|

|

Post by bankedout on Jun 13, 2009 19:53:45 GMT -5

I don't understand why there should be a correlation in price moves between oil and natural gas. You cannot substitute one for the other easily.

If you have a natural gas fired power plant or home heating unit, it is not practical to have it burn crude oil because that is less expensive. An example to make a point, not current reality.

I do see the struggle for natural gas to make a bottom here. I think a lot of traders feel that if most other commodities are firming up, that natural gas should also. I think this recent churning in price is people making that type of bet.

I'm also closely watching UNG, though I am not willing to buy it yet. I want to see more evidence that the bottom is in. The trade off to wanting more information, is that I will have to pay a higher price. However, practically everyone who has guessed that UNG has been oversold for the last year has most likely been burned badly. Unless they were very quick to get out. I had to stop myself a few times from taking an early position. Recent price action looks more promising, however I wonder if it will take more time to make a bottom. Or if we will need a shakeout to get some of the shorter term traders to fold before the rise. Time will tell.

Best of luck to you.

|

|

|

|

Post by sd on Jun 13, 2009 20:06:42 GMT -5

In the 60 minute UNG chart , I was geared up for higher stops, and had planned to be defensive in doing this- I relented as I viewed the daily chart and actually got weak , fearing the volatility and believing the volume signals this stock has been giving , didn't want a whipsaw, and yet this is the issue most traders face. Willing to lose too much in order to become right. I'm usually better and more disciplined than this. The same signals given in the 60 minute were apparent on the daily price chart as well. The 60 just gives the details better. My trading is focused on the daily these days, with a view of the 60 to give some insight as to the intraday action- I flipped my thinking on the entry , and didn't do a properly allocated Spent a good part of the afternoon out under the tree in the front yard rereading a portion of Trader Vic. Something I haven't taken the time to do in quite a while, relax and refresh my thinking and rereading some of the better books I have. All of the better books have a focus that includes the psychology behind trading, Here's 2 UNG charts- the second a smaller snapshot . And Btw- I do appreciate any constructive criticisms! The time I spend posting and annoptating charts, is constructive for me, as I get to review what my decisions were based on , and do some follow-ups. Just don't have as much time to do that as I'd like, but it's a good exercise for all of us, even if we don't post them. SD   |

|

|

|

Post by sd on Jun 13, 2009 21:02:22 GMT -5

Reply 158- Bankedout said :

"I don't understand why there should be a correlation in price moves between oil and natural gas. You cannot substitute one for the other easily.

If you have a natural gas fired power plant or home heating unit, it is not practical to have it burn crude oil because that is less expensive. An example to make a point, not current reality.

I do see the struggle for natural gas to make a bottom here. I think a lot of traders feel that if most other commodities are firming up, that natural gas should also. I think this recent churning in price is people making that type of bet.

I'm also closely watching UNG, though I am not willing to buy it yet. I want to see more evidence that the bottom is in. The trade off to wanting more information, is that I will have to pay a higher price. However, practically everyone who has guessed that UNG has been oversold for the last year has most likely been burned badly. Unless they were very quick to get out. I had to stop myself a few times from taking an early position. Recent price action looks more promising, however I wonder if it will take more time to make a bottom. Or if we will need a shakeout to get some of the shorter term traders to fold before the rise. Time will tell."

I think it is prudent to wait until a true upside breakout is here, particularly if you are inclined to hold for an extended period vs a shorter term trade- which hasn't gone well yet.

I think the correlation between Oil and Nat Gas is only that as energy sources, Nat Gas is now at an extreme low historically to OIL. It's application is as different as Uranium use- But it seems anything that is energy, power related- Like the recent upsurge in Utilities this week, suggests that UNG should move higher., I have heard that repeated several times in recent weeks on the squack box,- the historical disconnect in pricing- and that actually is what brought me to look at this as a trade. When I look at some stocks with high Nat Gas components, they have moved up some - At least I hear they are nat gas plays- CHK, DVN, BTU- and if so, why would UNG stay depressed?

A related component- Propane - went to historical highs 2 years ago, and although it has come down - this past fall there were "fears" about shortages- but short lived. In response I put in an air tight wood burning stove and didn't burn 1 drop of propane after getting gouged the prior winter.

I have been trying to focus most of my trading on sectors in favor, and I tend to be way late on realizing when those are occurring, and yet have managed to make a little even not getting in early. Market action is suggesting further sector rotation now. I may have been ahead of the game on UNG.

I try not to get too involved in supporting fundamental reasons for a trade as the main catalyst , because that certain logic and conviction may be correct, but may not translate into higher prices in the market place. I thought my attempted trades were coinciding with the market enthusiasm....and price action.

Your approach suits your trading style . I always felt it was dangerous and a lesser probability trade to jump into stocks that were downtrending - Just thought UNG looked ready to go here, and so I was willing to take a chance. My entry here is definitely proving to be a riskier play than waiting for a confirmed move higher.

Good trading- SD

|

|

|

|

Post by bankedout on Jun 14, 2009 11:23:55 GMT -5

I pulled up a chart of Natural Gas (light blue) and Crude Oil (dark blue) since 1/1/1991 It appears as though there is a long term correlation in price moves, but they don't always move at the same time, and go to the same extent as each other. For what it is worth.  |

|

|

|

Post by dg on Jun 14, 2009 13:56:35 GMT -5

sd:

On your last chart, I would wait for the dashed line close breakout before buying. JMHO

|

|

|

|

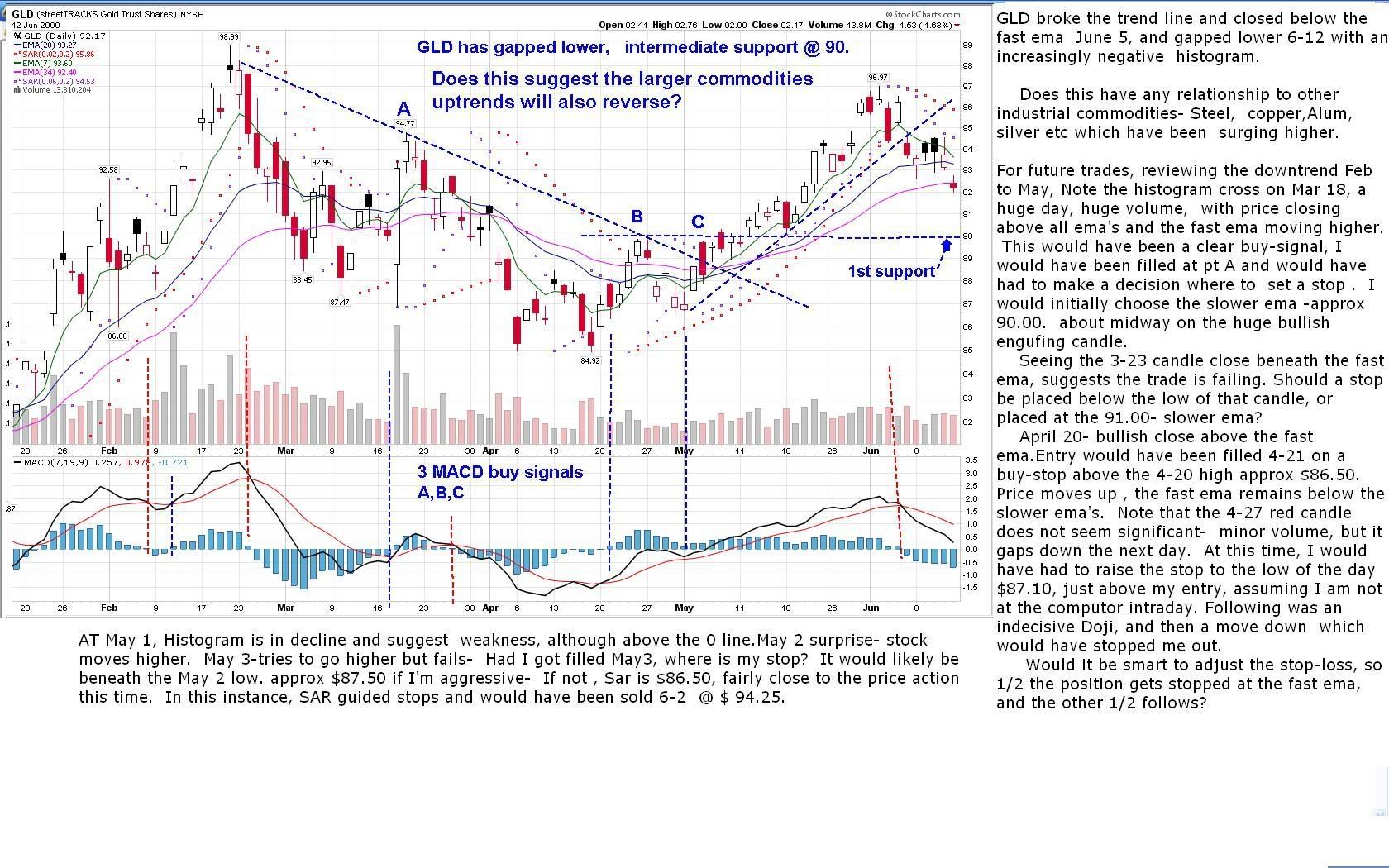

Post by sd on Jun 14, 2009 20:50:48 GMT -5

Thanks for the chart Banked out- The recent cross of Crude above gas is indeed a rare occurance looking back twenty years, the 09 cross up is indeed odd. I see the reason for the speculation. Where this goes is yet to be seen. Yes, a close higher above the secondary trend line would have been a wiser play DG. I'm reviewing stops on all my positions tonight. Note GLD has gapped lower Friday. On the one hand , GLD can be viewed as a commodity, but also as a hedge against gov't policy, inflation etc against the dollar. I suspect that GLD selling off supports the financials and the Fed manipulation - should have taken BAC for the horse race in hindsight..... I hold several commodity positions, and have also heard that the commodity play is getting extended here- I'll review the stops and see what the futures look like before the open. I've got a chart of GLD to post. It's breaking down from the recent uptrend. What I wanted to illustrate was the prior down trend's buying opportunities- Note that when a stock breaks it's uptrend and rolls over, often that is a minor correction and things resume. GLD would have suckered me in several times for losses , as the macd indicator and price action suggested the stock was rebounding. In actual fact I did not trade GLD in that period, but I'm using this as an example of - cover the right hand side of the chart up to that day, where price, and indicator suggest a buy- What would I have done? The first signal in GLD would have been so compelling- Ahuge volume buy day , with a second day follow through. If I had been following the stock, I would have been jumping in hard for that second day follow-through- which it did- but day 3 was a different story- and so the question to be asked is: "Where is my stop-loss now?" As I'm rereading Sperandeo, and reflecting on different aspects of trading, and my recent UNG -out of the ballpark stop-loss - I'm coming to a general conclusion that I need to define. There's a huge difference in going long while the stock is actively uptrending, and going long when the trend has started to decline and you're trying to catch the next move higher, or guess the bottom (UNG) In the GLD chart, it is obvious that any entry on price action that was not matched with the MACD was toast. In several MACD crosses of the 0 line, the trade turned South- It doesn't matter whether we are trading GLD or GE from a chart stand point- Can I evolve a practical trading rule to guide how to handle all entries that are based on a reversal of a downtrend? On an initial entry- A close beneath the fast ema - stop should be moved directly below the low of that day- Therefore, if the trade continues lower, it will be stopped out. It has this one opportunity to move higher . There should be a distinction between a stock that is actually downtrending, and one in a minor correction . Will have to examine this in greater depth - The chart of GLD suggests a new downtrend is forming, and I've annotated a prior downtrend period where both price action and MACD indicator suggested a buy- Only after the first Buy failure could a trend line be drawn. Note that Sperandeo mentioned that his 1:2:3 change of trend could potentially leave a lot of money on the table, and that he also applied a 2B that had a higher degree of risk, but also greater profitibility when it was applied to getting in earlier on trend changes. The distinct point he made in using a 2B was to take the loss immediately if it went against you.. The GLD chart:  |

|

|

|

Post by sd on Jun 15, 2009 21:04:20 GMT -5

The markets sold off sharply today- Dow -187, Nas - 42, S&P -22

I readjusted my stops today, and moved many of them up to the fast ema , a couple higher- Dennis Gartman has been saying for a week the commodity trade is over and ripe for a correction- Several times that was echoed on Fast money.

I had 7 of 9 positions stop out- 2 were at breakeven, 2 were losers, and 3 were gains. The gains offset the losers 2:1- only because of the raised stops.

I had 2 positions that gained, but I'm still lower this week than last, but didn't get too big a hit.

Had I not adjusted my stops higher, I would have sustained a much larger loss. A little positive self-reinforcement there for taking action.

My 2 gains were a spec position in Uranium, UEC ( Very small position), and UNG , full position- which closed above the down trend line. The explanation for the pop in UNG I heard on Fast money, is that Traders were jumping into UNG as OIl started coming back. I don';t understand the logic there, but I'll be happy to take the move higher.

I will ratchet my stops higher on the 2 gainers., and will have a few days waiting for trades to clear for any free cash.

This seems to be the market for the past 3 weeks or so- something will take the air out of the sails- And possibly this time there may be a substantial market correction on cascading worries about the economy, financials, commercial real estate, the swine flu, unemployment etc.

This feels like it has substance- We'll see where it goes- SD

|

|