|

|

Post by sd on Jun 16, 2009 20:11:07 GMT -5

Today I saw the market open for a few minutes, and my 2 remaining positions, UEC, and UNG both had jumped higher-Later in the pm I checked and it had been a matter of decline for both, although both were still higher- There just wasn't any follow through to the optimistic starts. I had my UEC at breakeven, and considered raising it, but then the volatility in the price gave me pause to leave it alone this day- and it's a small spec position. Price is up 20%, was up 60% intraday.I'll let this one run itself out on the off chance it will continue higher, with gradually raised stops - In the unlikely event Sar catches up with my entry, I'll go with the SAR.

UNG started the day off by gapping higher at the open and slid down the balance of the day- About 2:30 pm I got to glance at the chart, and where I had been expecting a momentum push to retest the more recent highs, I got chopped liver. The stock had opened at $16.26, retraced steadily downward and hit a low of $15.38 and then was moving back up. I went to put a stop in just under the intra day low @ $15.25 to sell if price dropped down, and also to carry over to the next day as a stop level.

I had split stops on this, and in readjusting the stops to a single full position stop, was apparently careless, and did not adjust the auto-fill price feature in IB- Matches prevailing price, and pushed the transmit button, and was taken out at the active price- which was higher$15.47. Net gain here was 8%, The stop would have been 6.7% , and a sell at the open would have netted 13%. Why not sell at the open on such a good gain? Greed, expectation the trade would go higher....I think this will prove to be a smart exit, as everybody and his brother , and the wall street journal has this trade in their headlines- either for it or against it. Tonight, Even Callers in to Mad Money were asking about this as a trade.

Here are my sells this week. Minor differences in any chart I post will include the cost of the trade

EWZ 54.90

EWZ 55.71 (split stop losses)

SQM 37.51

EEM 33.08

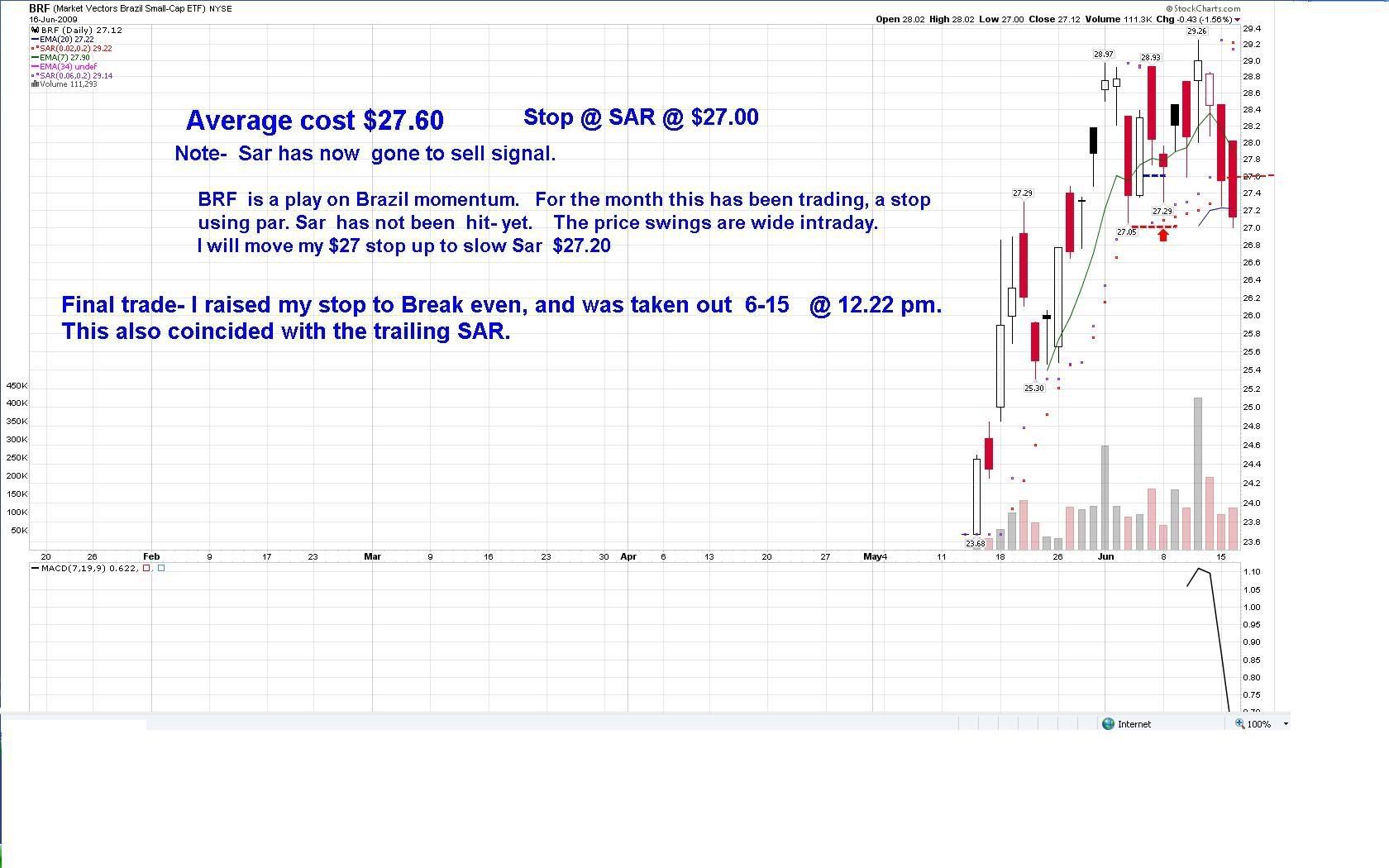

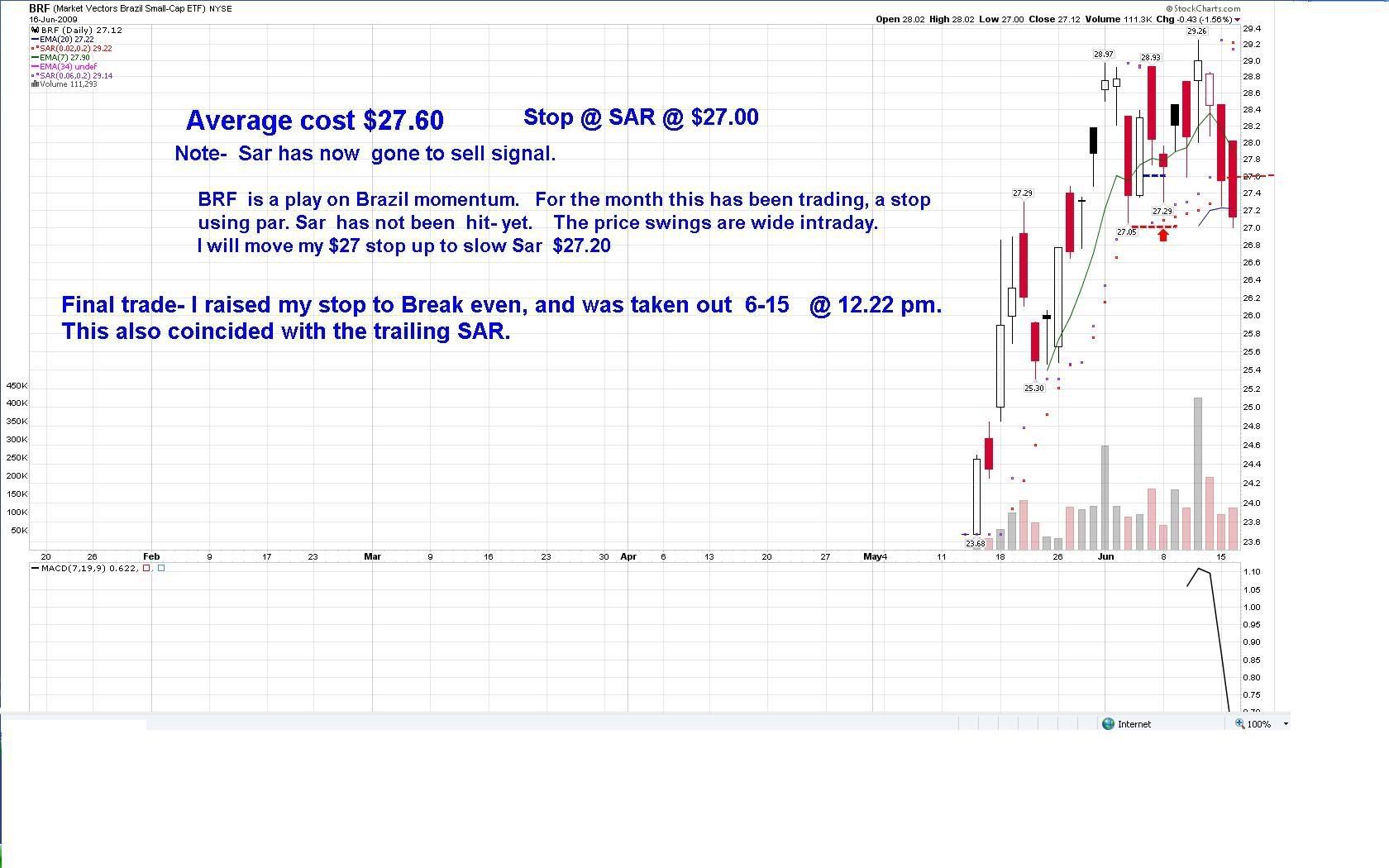

BRF 27.60

GGB 10.76

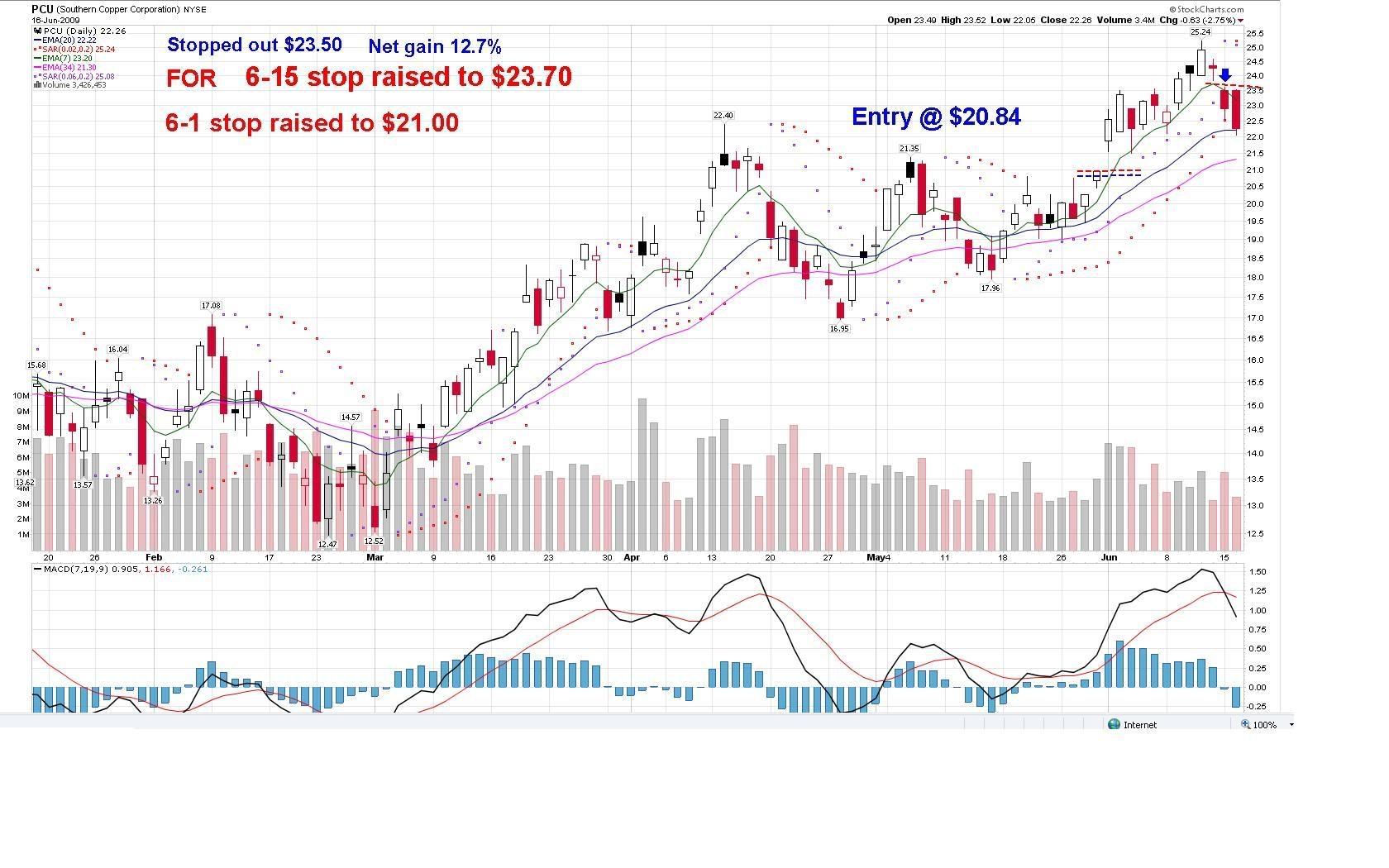

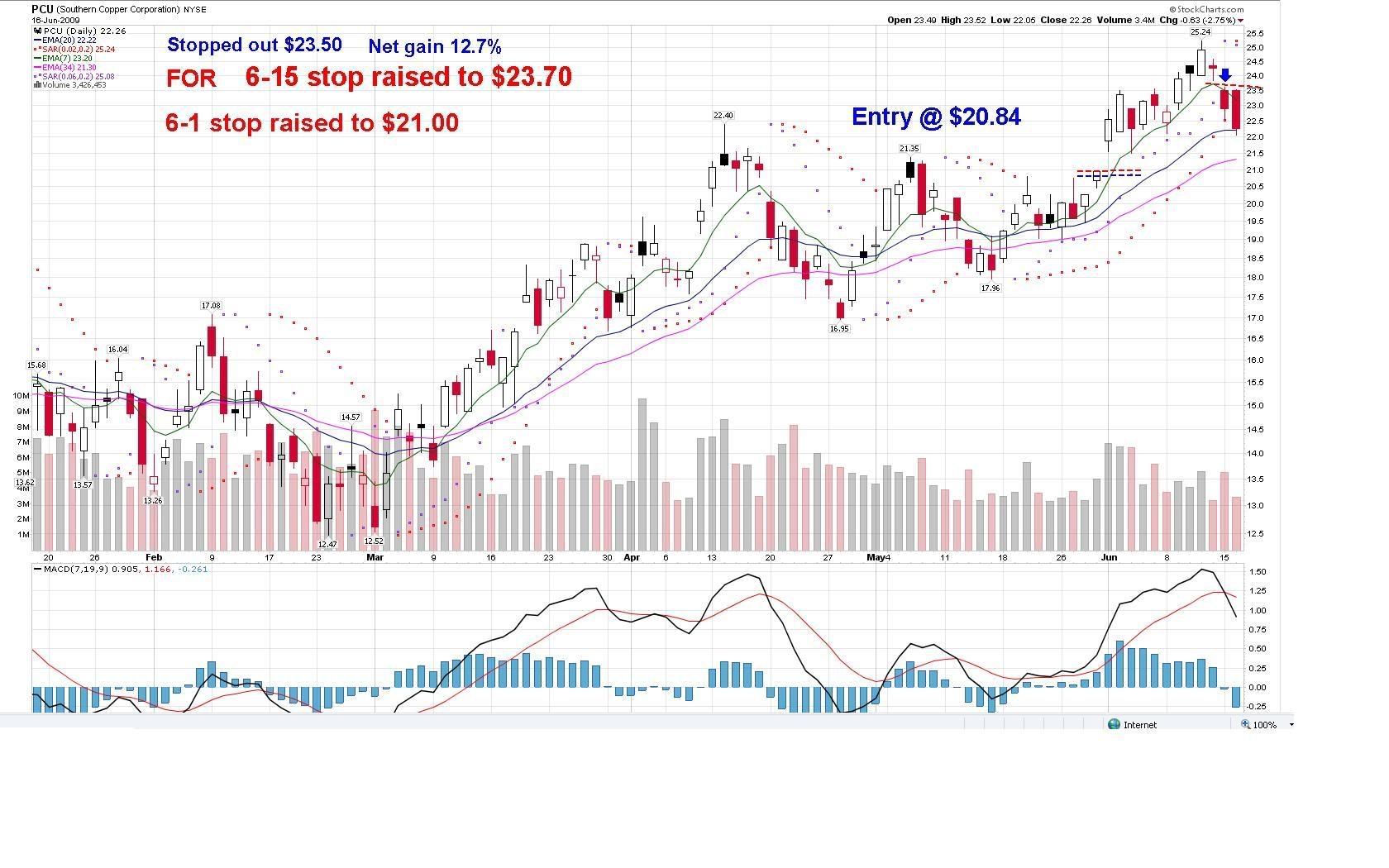

pcu 23.50

DBC 23.62

|

|

|

|

Post by sd on Jun 16, 2009 21:25:35 GMT -5

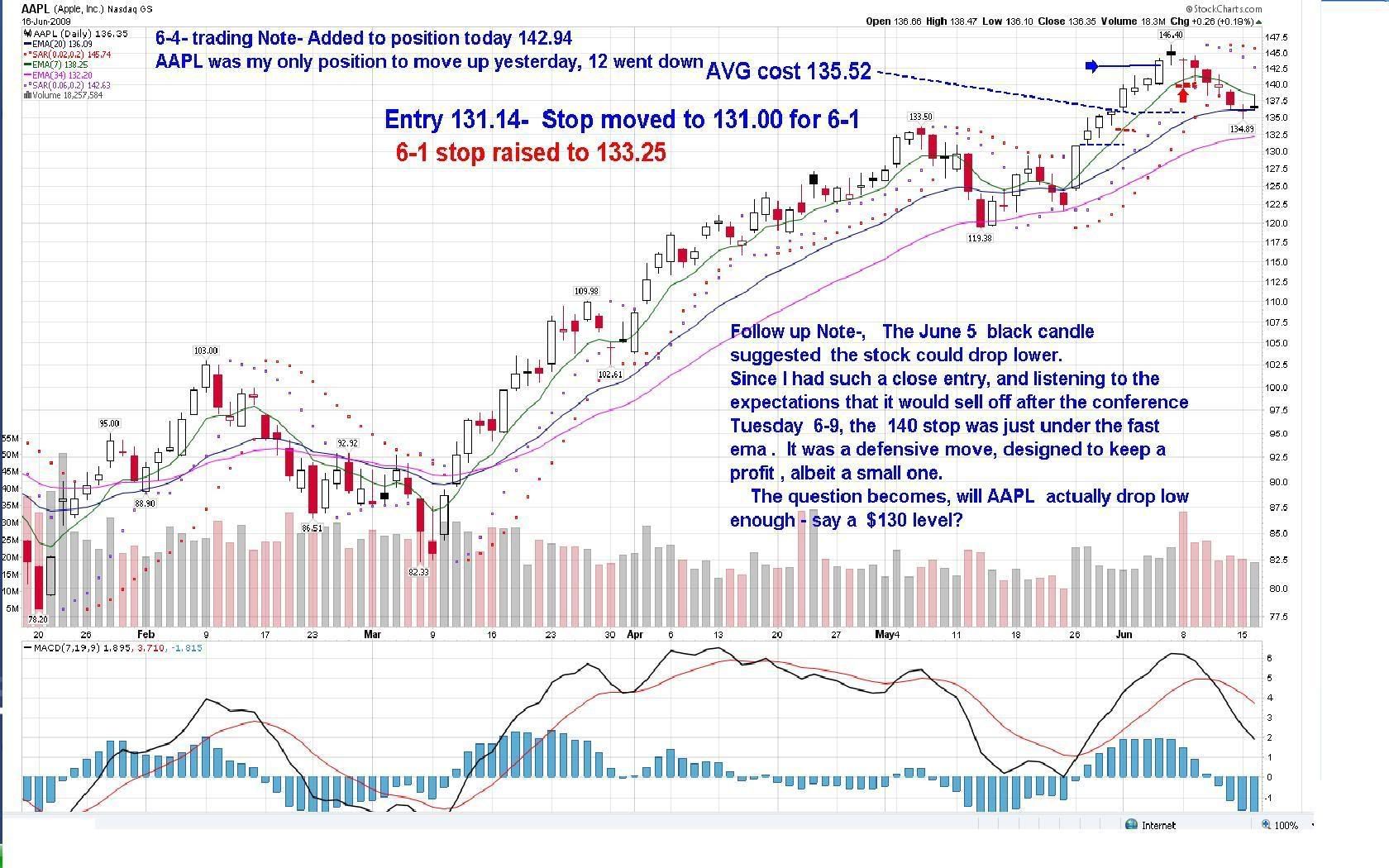

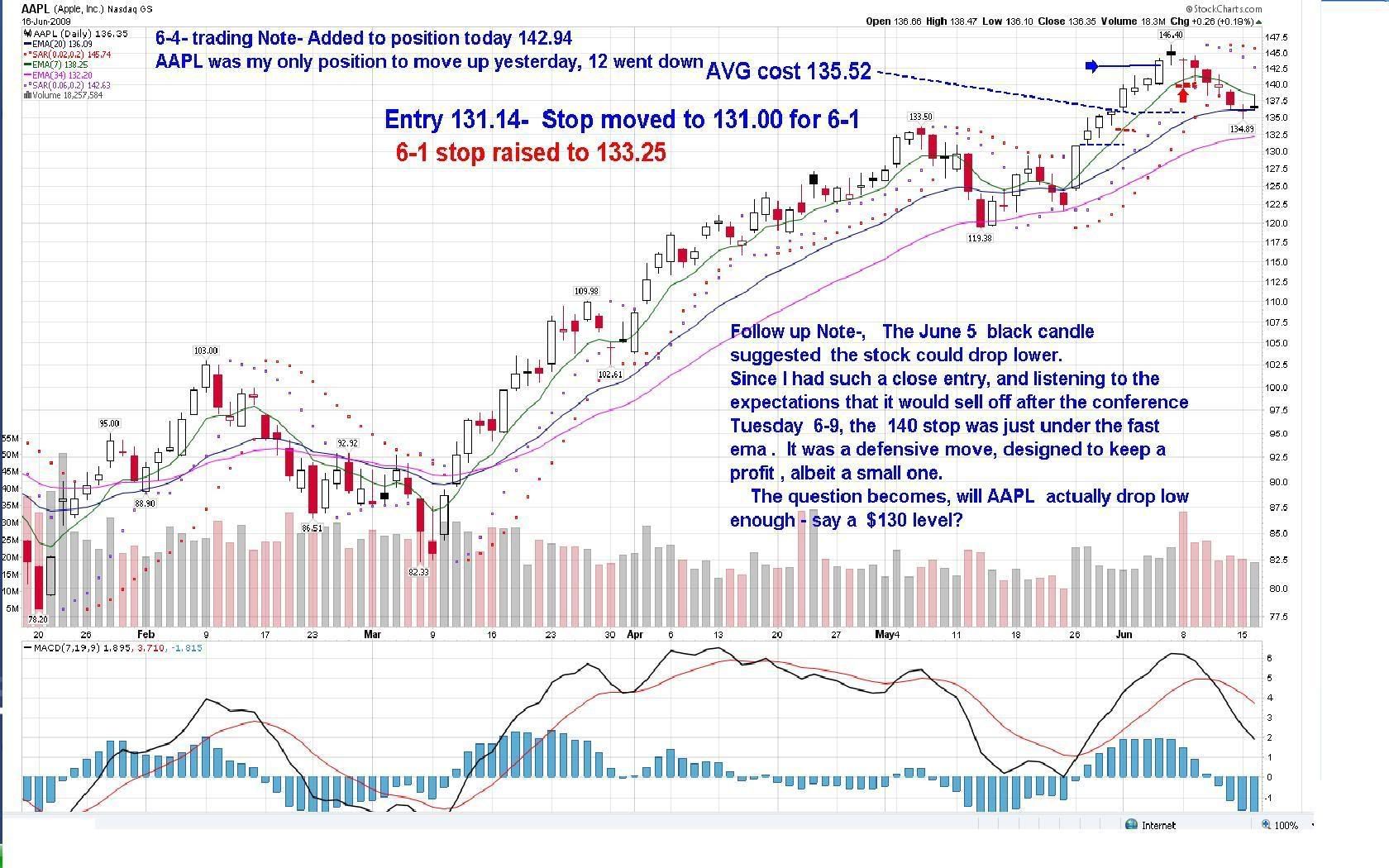

aS A FOLLOW UP, I'm posting some charts that the stop was aggressive- I have some OTHER losing trades that I simply have run out of time to include tonight. However, the theme at this point is to capture and hold gains, while allowing profits to run- It doesn't seem profits are running, so this approach has been good at this time. In a few weeks, this will likely change. In view of what seems a market struggling to hold it's own, it's a time to be more aggressive in protecting what gains you have IMHO. The converse to this is limiting your losses- SD AAPL, AGQ,GGB,BRF, PCU charts to follow:      |

|

|

|

Post by bankedout on Jun 18, 2009 18:44:31 GMT -5

|

|

|

|

Post by sd on Jun 19, 2009 17:55:45 GMT -5

Good article Bankedout! When and if I return to Nat gas plays, I will definitely look at it over UNG! Thanks for posting- SD

|

|

|

|

Post by sd on Jun 22, 2009 20:25:53 GMT -5

No charts, just some observations here:

I ended up totally in cash Friday, and actually had the majority of my trading account in "free cash"- ready to trade. I couldn't find a single likely reentry on my recent holdings, and didn't like the way the emerging markets and commodities were rolling over- So I didn't pursue any trades, stayed in cash, and enjoyed the weekend. Sometimes it helps to be able to step away if it doesn't feel right.

The market has been topping here for weeks, and today market wide buys for the short side were the favorites. I'm glad I took a more aggressive approach last week in reducing losses and capturing profits.

Tonight I also elected to modify my IRA retirement account positions- Unfortunately , these are limited to mutual funds /bonds and only execute at the close of the market-

I've managed to get some gains there with a portion of the money in Emerging mkts, small cap value, and real estate- and the rest in money markets.; and as I check the charts on those funds, they are rolling over- I want to lock in those gains - or what will be the close Tuesday, and look to repurchase more for less a bit later down the road.

Some market pundits claim that the Financials need to be a leader for this rally to have continued, and the financials are rolling over.

The emerging markets are the basis for the commodity plays, and they rolled over , and commodities have followed lower. And today virtually every sector was down.

I think this is an opportune time to be very defensive , and possibly take on some short plays. Or sit on the sidelines. because every single position I held last week is lower than where I stopped out for a loss or stopped out and locked in gains. Glad I went with the more defensive approach. They're still in decline .

This market can rally on a whim, or a positive note from the Fed.

Any short trades I take will be with aggressive stops-

I still need to post my prior losing trades, they look like very smart insightful winners in this market- that is compared to where they would be today if I had held onto them- Keeping this in perspective- I was in denial for the march rally for a month- That was a lot of potential gains lost by being late to the party that went on for 3 months.

Let's make the assumption that possibly this market, the financials, the housing market, and possibly future earnings are not going to be a positive for the next 3 months- It's all about market sentiment- and to me, it suggests adopting a trading approach that will be choppy, or not trading much at all. take those profits when they are available, on the first indication of weakness, and take the smallest loss possible- it is the least painful.

All of this is simply positive reinforcement for my present approach to the market- My sense of things is that most of us would prefer to be long term trend traders, make an investment today, and see the profits unfold in the future months/years.

The reality is, we have had 3 months down this year, followed by 3 months up, and I believe we are headed lower again- possibly not as low. The impetus for the rally was it was an oversold market. and here we are, trying to sort out the reality. We will likely swing lower than deserved on this leg.

This "new reality" suggests that it will be beneficial to not employ the same strategy used in the prior 3 month bull market.

- For most of us, this is the extent of our experience level between bull and bear markets. Consider the idea that this is indeed a short term bear market rally , and it needs to be traded from a quicker and more defensive time frame-

If this approach is taken, and is proved wrong, it means less profit will be achieved. Also, smaller losses will be sustained.

Or , sit back until it unfolds to where it looks right- SD

|

|

|

|

Post by sd on Jun 24, 2009 19:16:03 GMT -5

About 10 am Tuesday I glanced at some charts and felt it was a market wide sell underway , and took 5 short etf trades on @ 2/3 of average position size.

My premise for these trades was the daily chart showing reversal moves higher from Monday's move up. It lost steam in the afternoon , and several positions were slightly negative-

My stops were based mostly on the intraday low / and a look at the 60 minute charts.

Today, futures were higher at the open, and the only trade that was still positive at that time was twm, and they all stopped out. I haven't had time to do any charts or calc the losses- but they should be in the 2-3% range .

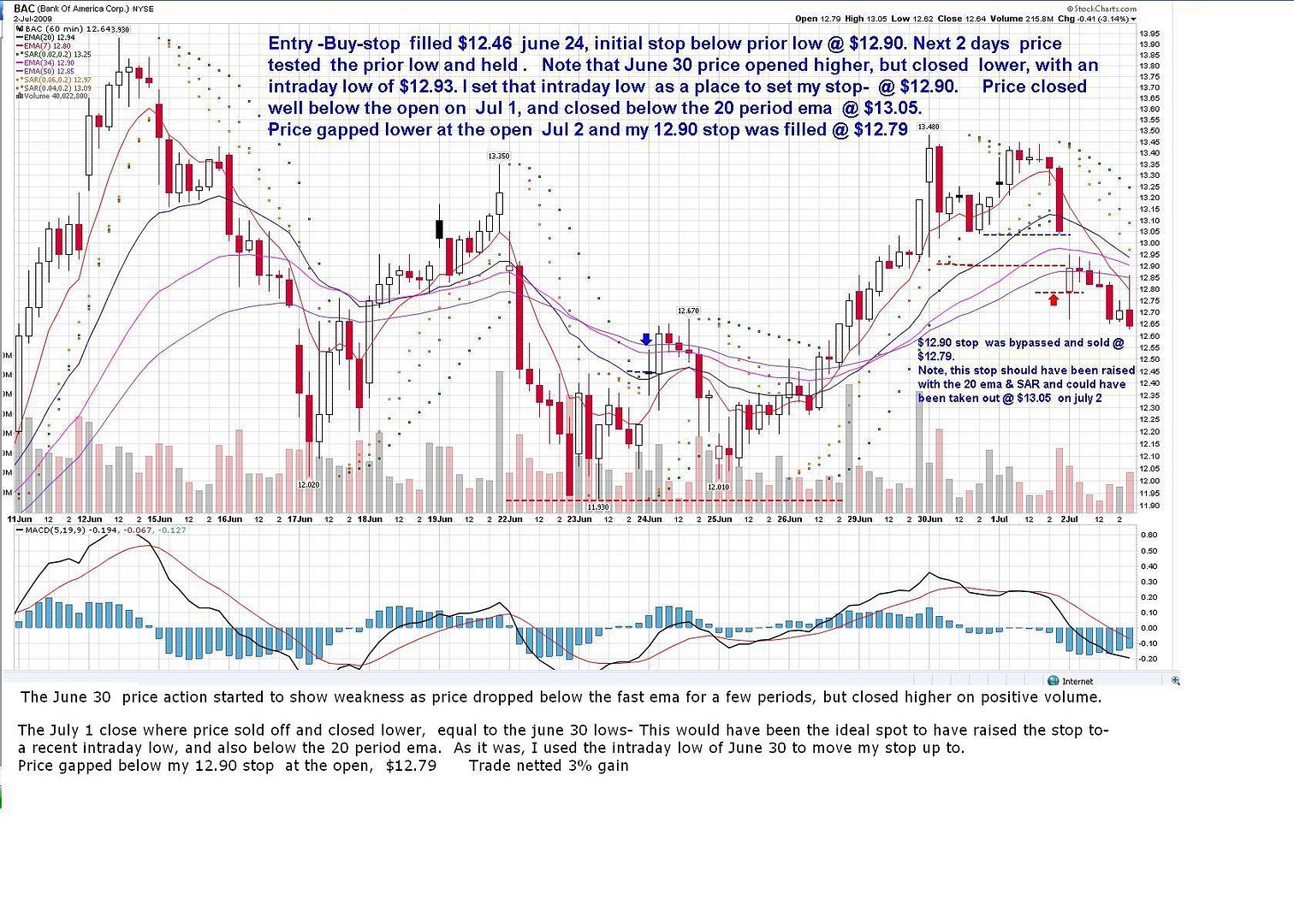

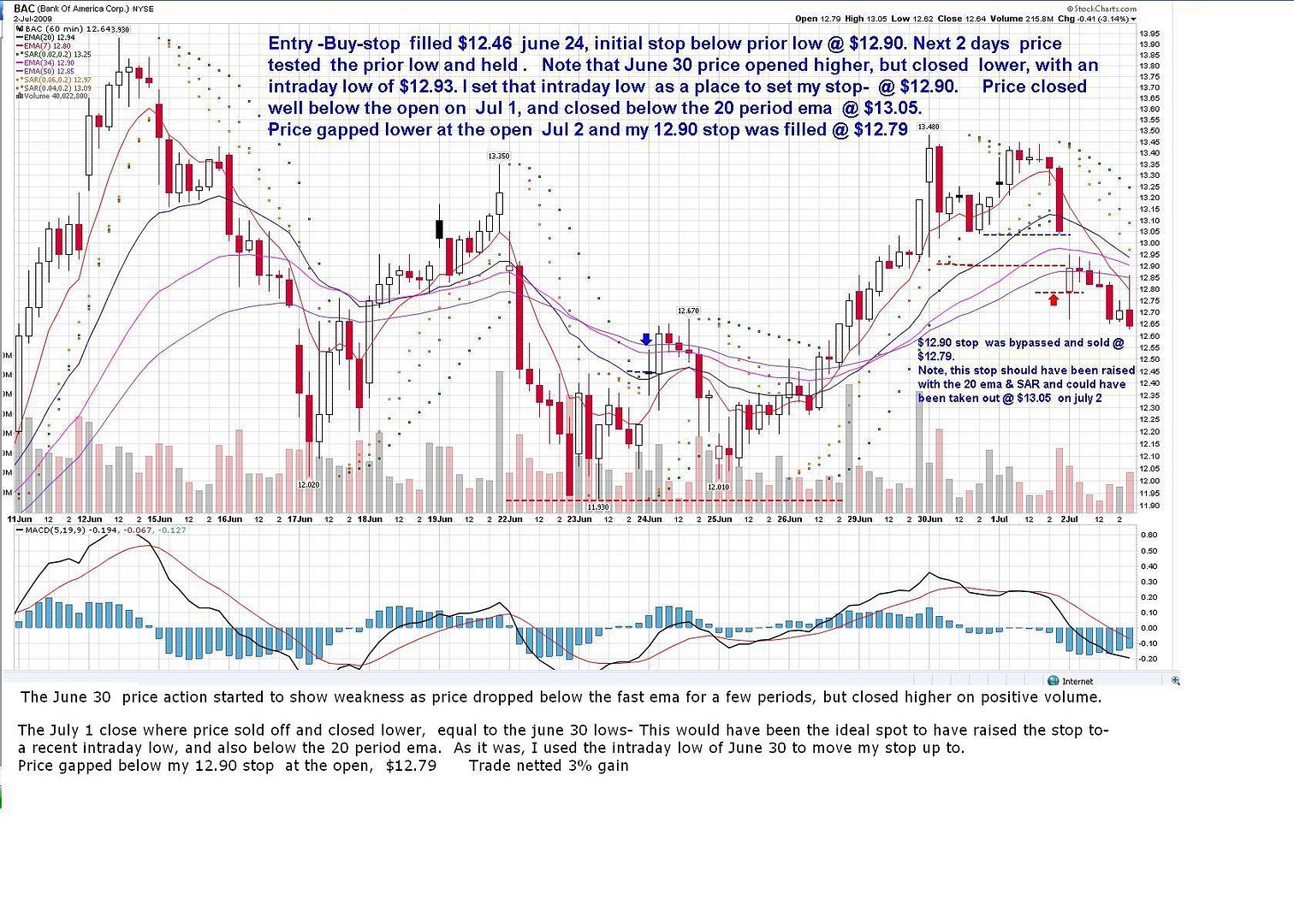

I had noticed yesterday that BAC was gaining slightly in a bad market, and was also moving up today, and so I took a position in BAC. This gives me a tight stop should the trade break down lower- SD

|

|

|

|

Post by sd on Jun 25, 2009 19:47:46 GMT -5

Didn't have any time to check on anything intraday, and lo and behold! the market rallied -

My sole position = BAC dropped a few cents- On a day the market rallied sharply, that doesn't portend well.

As I glanced over the charts of my recent positions, most are still early from a price-action /indicator to reenter-

No time this week to dwell on the markets- May be for the best......SD

|

|

|

|

Post by sd on Jun 30, 2009 20:31:49 GMT -5

June 30-

Quick note- BAC closed @ 13.17, I feel I shoul put in a market sell here, but instead will set a stop @ 12.94 - merges with the intraday low and also the 20 ema on a 60 minute chart.

Haven't made any other trades, not much time - I don't have a sense of market direction here in the little bit I catch in the pm.

Hope to get some vacation time next week, will try a day or two of intraday trading.-SD

|

|

|

|

Post by sd on Jul 1, 2009 19:22:30 GMT -5

Oddly enough, BAC hasn't sold yet.

Hasn't dropped to the stop yet, but is getting close.

If it stops out tomorrow, I'll have a 7-8 day duration and a profit.

Looking for a couple of spec trades tonight:

The real estate ETF- URE- has been heading up the past 5 days.

No time to post a chart- Nice uptrend on the 60 minute-

I'm going to use a $3.70 buy-stop ( meets the open high, combined with a $3.50 initial stop- Should be about a 5% @ risk.

Since this is a cheap stock, I'll reduce my position size, and risk.

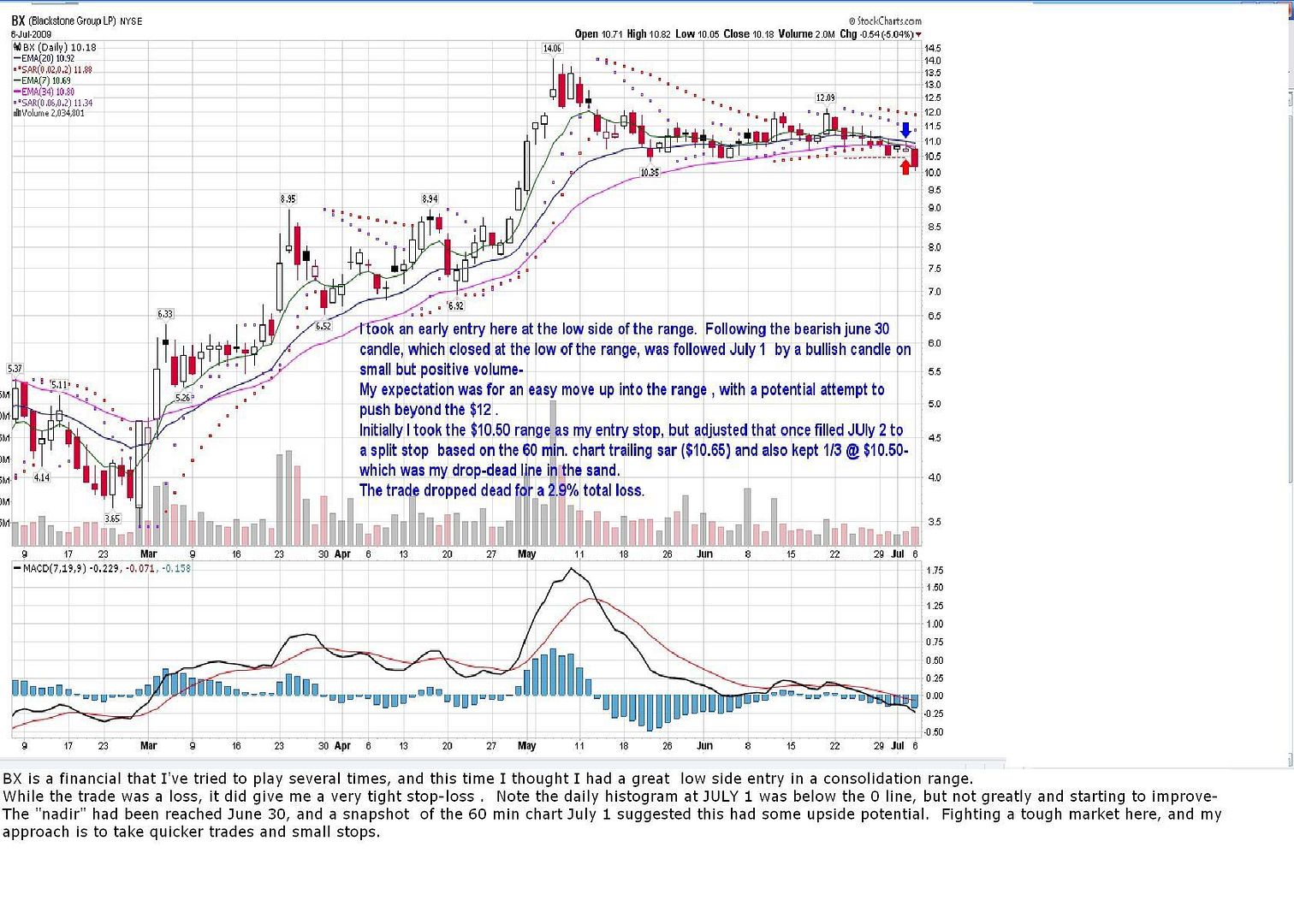

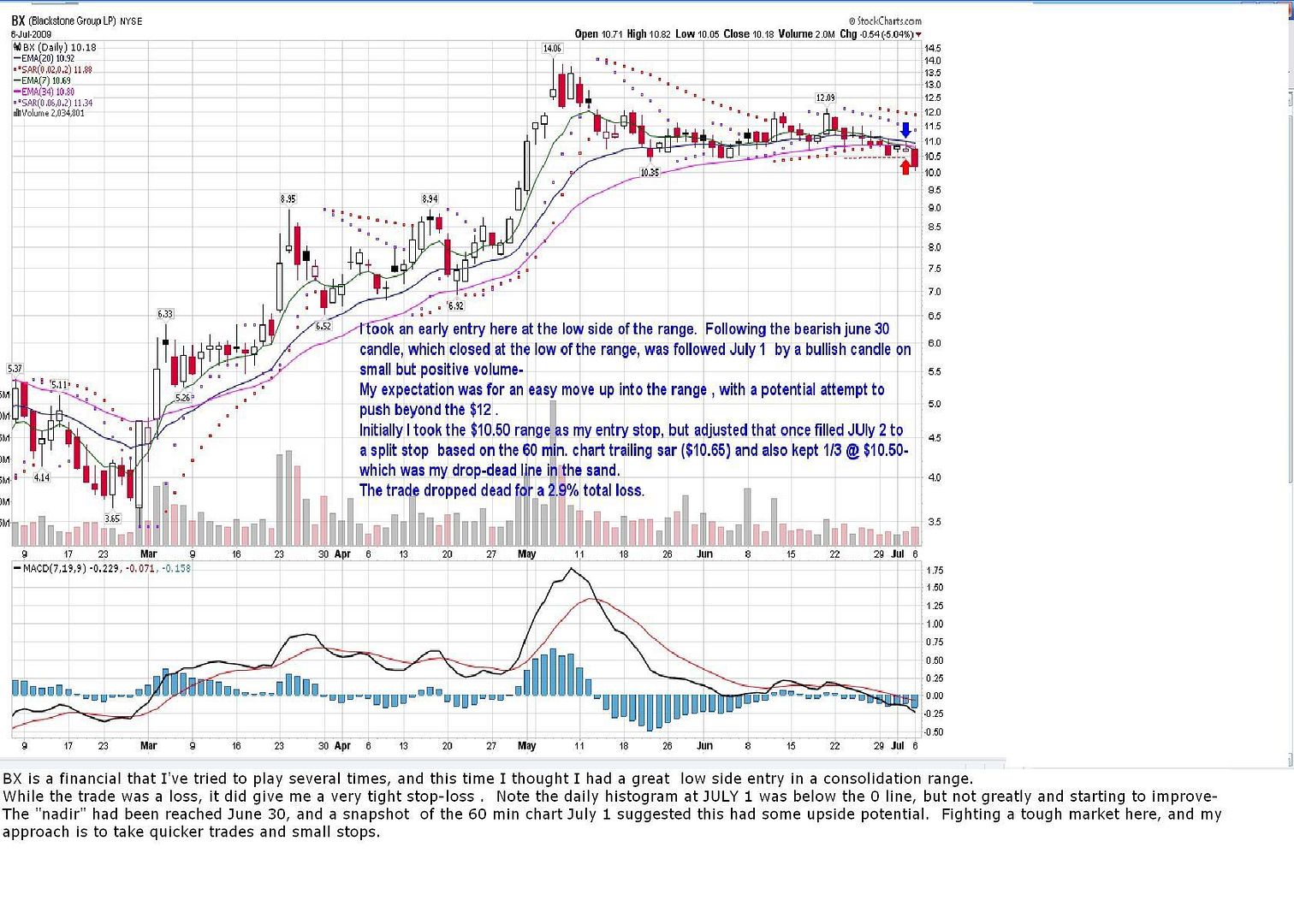

The other play is BX- This is at the low end of it's recent consolidation range, and thus provides a narrower potential loss .

While a look at the daily shows a positive narrow candle following a much larger sell candle. When this has occurred at the bottom of this range, and we are there now, price has rallied.

Only for a few days, and this is planned as a few day duration trade if filled.

I also looked at the 60 minute chart on this trade for indications of volume and price activity.

I'll be taking a $10.90 buy-stop with a $10.95 limit and an initial stop of $10.50 below the prior week's low. If filled, this stop will be adjusted . I intend to take a 2/3 position for this trade.

I will reassess the trade and the position if filled tomorrow pm.

Again, these trades are shorter term, and I will likely move stops very close to each day's action if filled.

SD

|

|

|

|

Post by sd on Jul 2, 2009 20:16:17 GMT -5

Reply to 169- June 24 I went to cash in my retirement account-and that hasn't disturbed my sleep at all. Today is July 3- Seeing the way the market closed this week with the Dow down 223 today- reportedly on the higher unemployment numbers- but this was expected- and I thought the market looks ahead 6 months- The news I heard earlier was there were higher mfg orders- which led me to think when I got in, there would have been a large market wide rally on a snippet of good news . On the other hand the unemployment numbers are more severe than anticipated. On top of that, wage erosion is a real concern in most segments of the economy, unless you're employed by one of the major banks that took tarp funds and are now raising base salaries and/or bonuses- in order to "keep good people"- I suspect there's a lot of 'good people' that are presently unemployed and would be tickled pink to fill the shoes of the reportedly disgruntled . Gosh, most Americans at this point are thankful they still have a paycheck, and aren't ready to storm into the boss's office demanding a raise-Is there a disconnect here from the real American situation? Of course, while it's easy to focus on the news worth issues that can get our adrenalin up- such as the bankers we bailed out now raising credit rates on the public and paying themselves more.....That's all just good temporary news fodder-the much larger issue facing America is the knock on the door most of us are hearing that tells us that there are changes ahead we are not prepared for, as people, and as a country. I feel we're in for a precarious situation at best, and that it's a long term struggle ahead for Americans in ways that most of us cannot comprehend. - In taking stock of my own situation this year, I realized it is entirely possible that I could face an uncertain employment situation as the market unwinds, and more contractors struggle for smaller slices of pie. It's just the reality that 10% of Americans know , and many more fear. Several months ago I applied for a refinance on my home mortgage- Just tonight we signed the papers at our home for 4.37%- and it makes a very big difference in our monthly payment- The closing costs will be realized in the savings I gain the first year alone- Over the longer term, it's tens of thousands of dollars saved in interest. Prior to this year, I was 'comfortable' - and didn't concern myself with initiating any changes in the status quo- work seemed secure, etc. The new reality - is taking steps to be defensive, hope for the best but plan for the worst. I find myself listening to Dave Ramsey and thinking that this guy makes a lot of sense. WWW.daveramsey.com He adopted a different financial strategy to eliminate all debt- To not pay those bankers the interest they bleed from consumers .... Worth a listen- Of course, that's only if one thinks his/her situation may change for the worse. His financial strategy is extreme- unless you're unemployed and facing the unthinkable. At present I'm not wanting to do without the frills- motorcycles and truck, but it's a time when it's smart to consider all aspects and also adopt a more defensive approach in face of an unknown, and potentially hazardous situation.- both in my financial life and also in my trading.- I'm mentioning all of this because a traders mind set is likely a key to success or failure- That mindset has to adapt to changing market environments. And to recogonize when those changes are in process. One thing I've noticed the past few weeks as the market seems to have topped and wobbled, is that closing in on the trade with tighter stops at signs of weakness- and entry with tight stops- has been the best approach. In April, this approach would have missed the big move up higher. However, this is a different time, and the market momentum is not towards a market wide continued uptrend. I could sit back and simply not try any trades until September - and that may be an option I choose- For the moment, I'm trying just a few trades -keeping my toes in the water- and expect those trades to be relatively quick- with tighter stop-losses. The BAC trade stopped out today- and I did net a small profit- it was an early entry- The only reason this trade netted any profits is because of a much higher stop I adjusted seeing signs of weakness. If it was a strong up market and a slight one day weakness in BAC, that would be one thing- Different scenario here. The URE potential trade I posted yesterday never touched my buy-stop and dropped 10% lower. Buy-stop saved a failed entry. The BX trade was actually filled, and still resides at the very tight low end of the range- It has potential to easily move 10% up , and I have a tight stop below. Saw that the fertilizer /ag plays moved today- may look at that sector on Monday- Don't mind the personal rant here, just trying to pass on that this indeed is a time to be cautious to a fault IMHO- SD - |

|

|

|

Post by sd on Jul 6, 2009 20:54:27 GMT -5

I haven't been very active in the markets lately, and haven't been very successful when I am- I've got 1 small profitable trade -BAC- where an early entry and aggressive stop-loss captured some gain. That's the only positive in 6 trades. I went short the market with 4 short etf's on 6-23, and all 4 were covered the next day for what I expected was to be a small loss in each- As I went looking back over the actual trades, IB had me listed as having a fill that was more than $4 above the intraday high- I sent them an e-mail, and a chart, and they say that the price was accurate at that time- I entered this trade and 3 others at the same time that day,(only partial size positions) and fortunately the other 3 were accurate fills and ultimately small losses. My Mistake here, is that although I was looking at real time bid and ask, I did not specify a limit as I normally do . This was a $94.00 lesson that should have been a $15 loss.. Today I was stopped out on BX- and I feel it was a good- but early -trade. A good loss . I took a different approach- BX was at the low end of a consolidation range it has been in for a while, and I tried for an early entry expecting 2-4 days attempted move back up into the range. I took a full position because this gave me a very close stop-loss point to draw that line in the sand- I'll post what charts I got uploaded tonight- After my recent at bats not seeing much success, I will wait until I have time to pay more attention to try to see a trend in the market, and will also reduce my position size . Hope my loss is your gain- SD     |

|

|

|

Post by sd on Jul 21, 2009 20:08:10 GMT -5

I went 100% long last week mid week-Had 11 trades on across a wide spectrum incling fcg.not ung.

Due to circumstances, I was unable to make any adjustments in my stop-losses last week, and missed the horse race as well. I should apply this absentee approach more often. LOL!

Caught some nice upside here, but don't think this rally has much further to go. I raised all stops yesterday , using the intraday low or the 7 ema, and tonight tightened again .

One thing I've noted in trading a rally in the past, is that I've been inclined to believe the rally would continue, and so gave some excess stop room for volatility, and then gave back a substantial portion of the gain.

This has happened several times this year, and for my approach, I'm not willing to withstand a 20% up-down move and still stay in the position-

As I finish this post tonight, I have made the decision to sell every position at market at the open- My account has squeaked out an all-time high, and I don't believe this will continue much higher- So I'm going to protect myself from a downside market move which I feel has to happen this week.

SD

-

|

|

|

|

Post by sd on Jul 23, 2009 20:45:02 GMT -5

I was 2 days early to sell- But it looks as though MSFT, AXP and AMZN will be the rationale for the market to sell-off Friday.-tomorrow 7-24-Today the DOW broke above 9000.

Watching a panel on CNBC this pm of bulls and bears....

On the plus side- apparently some 70% of S&P companies are meeting or exceeding estimates as I listen to the market pundits this pm. On the downside, this is not by real top line growth- increased sales etc, but by counter measures- lay-off of employees, selling assets, cost cutting in general-

Part of the panel- John Brown, John Dent- believes this market will head substantially lower in late 2009-2010, because unemployment will likely continue, credit will still be held back from the consumer who is now going into a defensive posture, and that earnings will erode further, because the China market is dependant on world and US consumer demand, and that will continue to slow.

What is noteable here , is that this market has indeed rallied going into the summer- and -coming off this recession, the prior market wisdom of "go away in May", was not the way to go.

The trading wisdom I think is appropriate, is to not trade the market you want to believe in, but to trade the market that is.

For me at this time, that suggests continuing to apply a shorter term trading approach, because I feel it's as important to limit downside risk, while trying to achieve upside gain. Just staying conservative with my risk level, and not allowing a significant downside loss in any position no matter what I might believe.

At the present time with work and personal demands limiting my trading focus, this shorter term approach is justified-

However, I also think that a shorter term approach is appropriate for even those that have the time to watch the markets on a daily basis.

It comes down to Fear and Greed- we tend to be afraid to lose out on expected upside move , and that fear allows us to sustain unwarranted downside risk.

On the other side, is the tendancy to take profits too quickly, and close out winning trades too early.

What direction the market will be in 6 months is hard to say-The optimists in us say it will be higher. I don't know that I believe that will necessarily prove to be true. I think it is prudent to continue to be prudent and limit potential downside risk.

Being defensive limits potential upside gains, meaning bailing out on a sign of weakness- and this supports trading using a shorter -chart daily for me as the primary.

However, while limitimg upside gain, it also reduces downside risk and potential loss.

In cash tonight, SD

|

|

|

|

Post by bankedout on Jul 27, 2009 20:29:46 GMT -5

This may sound like I'm a conspiracy theory type person, but I believe that the markets are being pushed higher by government money. I can't think of any rational explanation for the move up since March. The only thing I can think of is the government is giving out cash and forcing people or corporations or whatever to buy stocks with the "free" money. Maybe I'm way off, but as strange as it sounds, that is my best guess.

Maybe I am wrong and big growth awaits this empire and these high valuations on stocks will be justified in the coming business boom. However unlikely that seems.

|

|

|

|

Post by dg on Jul 28, 2009 16:46:45 GMT -5

The sell signals are in, but the prices refuse to fall. I got burned last week on twm (trying to get in early).

|

|