|

|

Post by sd on May 18, 2009 19:42:32 GMT -5

I previously posted some of my trades last week that I sought to nip some profits in, thinking a substantial market correction was in the offing. Apparently, a lot of other market players thought the same, or my TWM trade would have not held up for 3 days.

I also wanted to post some of my losing trades last week, including HPQ, PBR, BX- thought I'd have time to get them annotated - These were trades that I held for a number of days, and I gave them some stop range, and were taken out for losses.

My one remaining position that outperformed last week was SQM- a Brazil mining (Lithium) stock-and a stock that ignores the market is the exception to the rule -

With the futures looking higher pre-market, I changed my stop on TWM to a market sell. I then looked at charts of some of my trades that were sold or stopped out last week, and decided that the pullback made a good lower risk reentry.

I had bot AGU Friday , and added to that position- I went back to Brazil, and repurchased GGB, also BBD, and EWZ.

I had a speculative Bank position - RF last week, moved 10% today -along with the other banks.

I went in both Blackstone and Fortress BX, FIG, and Fig hit my stop.

I also went back into Ford- partial position only . Should have gone with Rimm or UYG with the last of my freed cash- but I only had a few minutes to decide to make the entries, with a fast glance at charts.

While I wasn't heavily short- TWM my only short trade, my experience last week with seeing profitable trades trying to become losing trades- I was really expecting more follow through to the downside, but hadn't jumped on that bandwagon with a lot of early short focused positions.

The predominant trend for the past 2 months has been up, and this market continues to find a reason to see light at the end of the tunnel.

I think this recent pullback points out how potentially volatile this market can become in a short period of time. Attempted correction fizzles without much impact other than presenting better buying opportunities. It points out that one should not presume that a bull market will continue, but until it substantially corrects , the short term trend is still up. This is why I simply reacted to the long side this am.

The quandry for most traders,self included- is when to sell, and when to take a -loss- If we believe we're in the beginnings of a bull market, we should withstand a 10% correction- If we wake up and find we're wrong, we'll likely be 15-20% poorer. When we get major signs that the larger market looks ready to correct, that is a time to be more defensive.

I want to be able to hold on for that big gain, but not at the expense of seeing a 15 or 20% move lower.

SD

|

|

|

|

Post by sd on Jun 2, 2009 20:53:14 GMT -5

It's been several weeks since my last post,-Busy times all in all.

My move to the long side and not looking back at TWM was indeed following the market direction. I was rewarded with some nice upside moves, and then had them slip away. The only 2 positions I held that did not stop out were GGB and EWZ, and these are the best performers , GGB up 38% in 2 weeks. Fact is, they never came back and retested my entry level, while the others indeed turned from profitable trades to losing trades, or marginal profits.

A lot of this was due to trying to give some stop room to stay in the position to allow it to be a longer term trade.

I found as several of my positions stopped out, I didn't know where this downturn was headed- Prepare for the worst and hope for the best. I raised stops closer, and most were hit and exceeded, many for losses, a few maintained my entry cost.

And then the market rallied some more, and I find myself with 5 days of a positive market rally, and I don't intend to allow this present higher gain to wither away- I have taken the approach to get my stops up to my entry cost as quickly as price action allows. And when a position such as GGB has moved this well in such a short period of time, I will trail this with stops following the prior day's price action. I may split the position in 1/2 with one 1/2 following the daily low, and the other one day behind or on the fast ema.

Some of my more speculative trades- RF, UEC ,FIG, had moved up substantially over 1-2 days, and then pulled back and it was largely a matter of trying to keep the once positive position from becoming a loser. I managed to do that with RF -small profit-

Uec at cost, Fig got me for $40.00. The point here , is that I had a better than 15% gain in both Uec and Rf and failed to capture that gain. It goes back to Greed and Hope, a trader's companion.

SD

|

|

|

|

Post by bankedout on Jun 3, 2009 18:42:58 GMT -5

My random thoughts.

Tradable items must produce a profit immediately. Then they must continue producing. If not, get rid of them.

Get your initial exit stop in as close to your entry as feasible. Move it to breakeven as soon as possible. Breakeven to include roundtrip commissions and any slippage expected on the exit order.

Very few tradable items are good long term holdings. Very few. So much more likely than not, the best route is to accept a short term profit.

Those are my current thoughts on the subject of trading. I know it doesn't mean much from someone sitting on the sidelines, so feel free to disregard my ideas.

Best of luck to you, and thanks for sharing your progress.

|

|

|

|

Post by sd on Jun 3, 2009 22:53:23 GMT -5

I think your comments are right on track.

I had tightened all stops yesterday, and on several positions, had aggressively raised the stop to just under the prior day's low, and above the fast ema.-AGQ, was one .

It is easiest on breakout entries to have that line drawn in the sand. Your expectations for how the trade will behave either follow through and generally move higher, or tend to weaken.

Since commission costs are not a significant factor using IB-$1 in and $1 out for most types of trades, some ETFs are $2-

The commission doesn't represent a major factor- As a matter of fact, it allows me to take some smaller and cheaper trades, where I fear the downside risk if I took too sizeable a position on a cheap stock (UEC, RF, UYG) where a technical stop would require a 25% loss to be in the range. That's not acceptable for any trade..

Back to the point of keeping a profitable trade from turning into a losing trade.

If I can take an entry into a stock, and it goes up some, then weakens and pulls back- I have the option of setting a stop where the trade actually doesn't cost me anything- I can move my stop to just above my entry price, and if I get stopped out, there is no financial loss- just that the monies are tied up for 3 days to clear. Or , I can hope that my initial decision to take the trade will be ultimately proven to be correct and allow the stock price to become a loser and then hope it rebounds higher. This is what many do, and it is just ego, and commission costs that prevent taking the smart action of cutting off the loss.

In this recent run up, I had 13 separate trades on, and Tuesday all were profitable. As I scanned the P & L statement tonight, by not selling yesterday at the close, I am down $300+ dollars today. This is about 2.5% of my port value.

Had I not raised my stops , I expect I would be down at least 4-5%.

I'm still holding some positions-6- 4 of which are locked in to be gainers unless there is a major gap down at the open.

2 positions are in the initial entry stop-loss range- less than 5% each, and I expect additional market decline tomorrow.

The only positive position I had today was AAPL!.

As I look at the P & L trading screen and see what potential profit I gave away- had I but sold at yesterday's close...........

I'd like to give several examples of what I felt was a good trade (we prefer to talk about them) , and a poor trade.

For the time I have left>>>> The good trade-

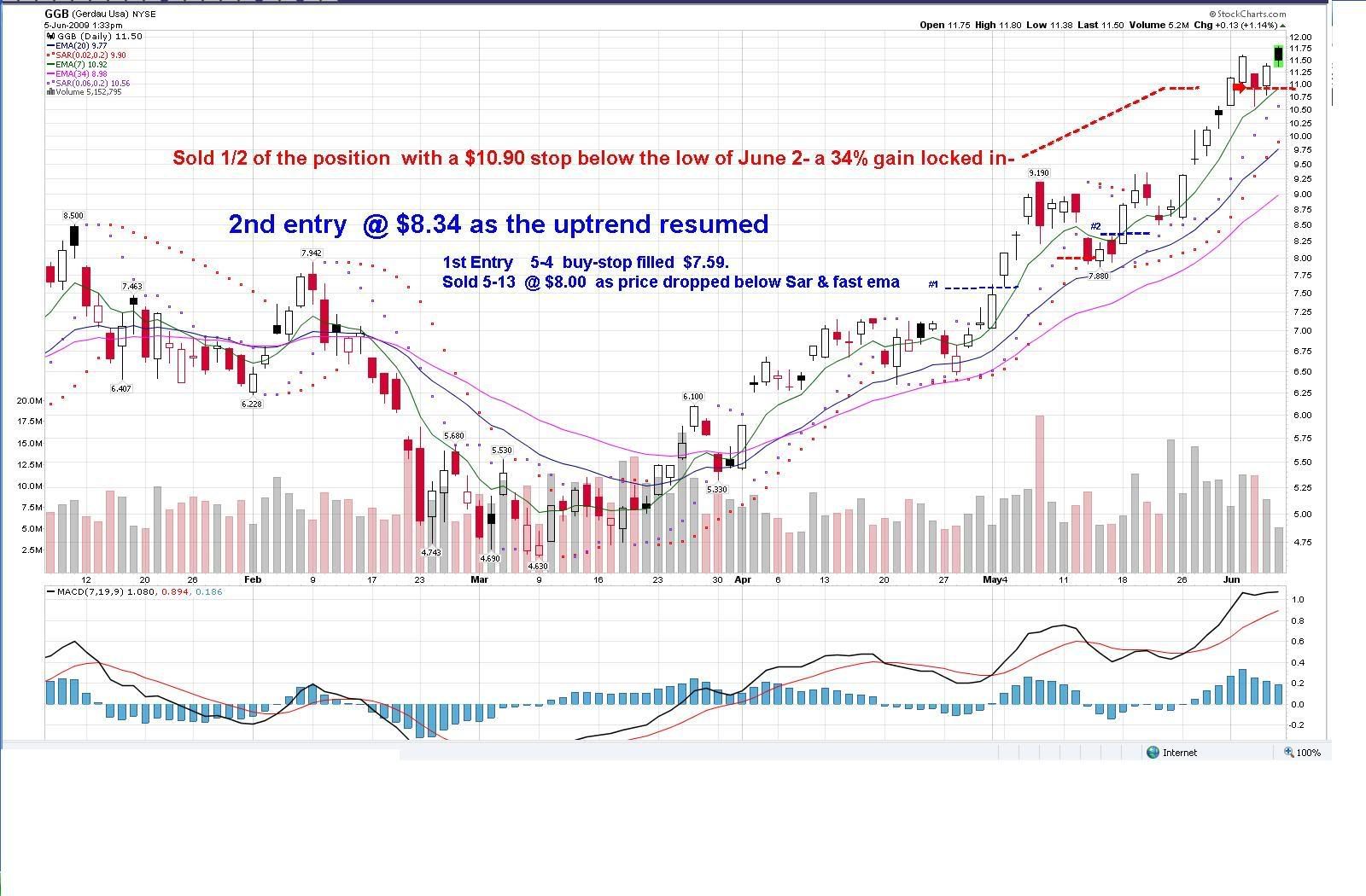

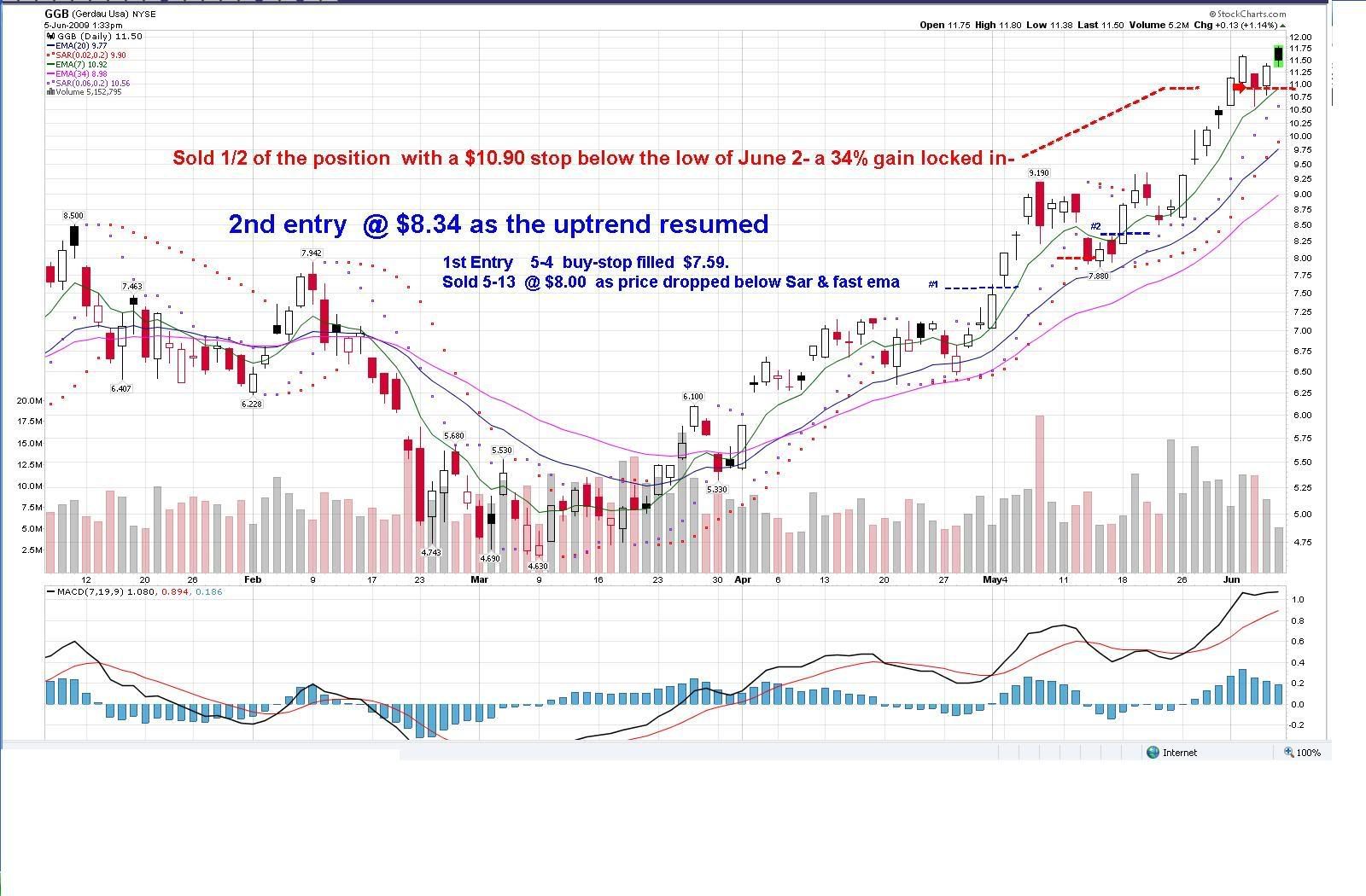

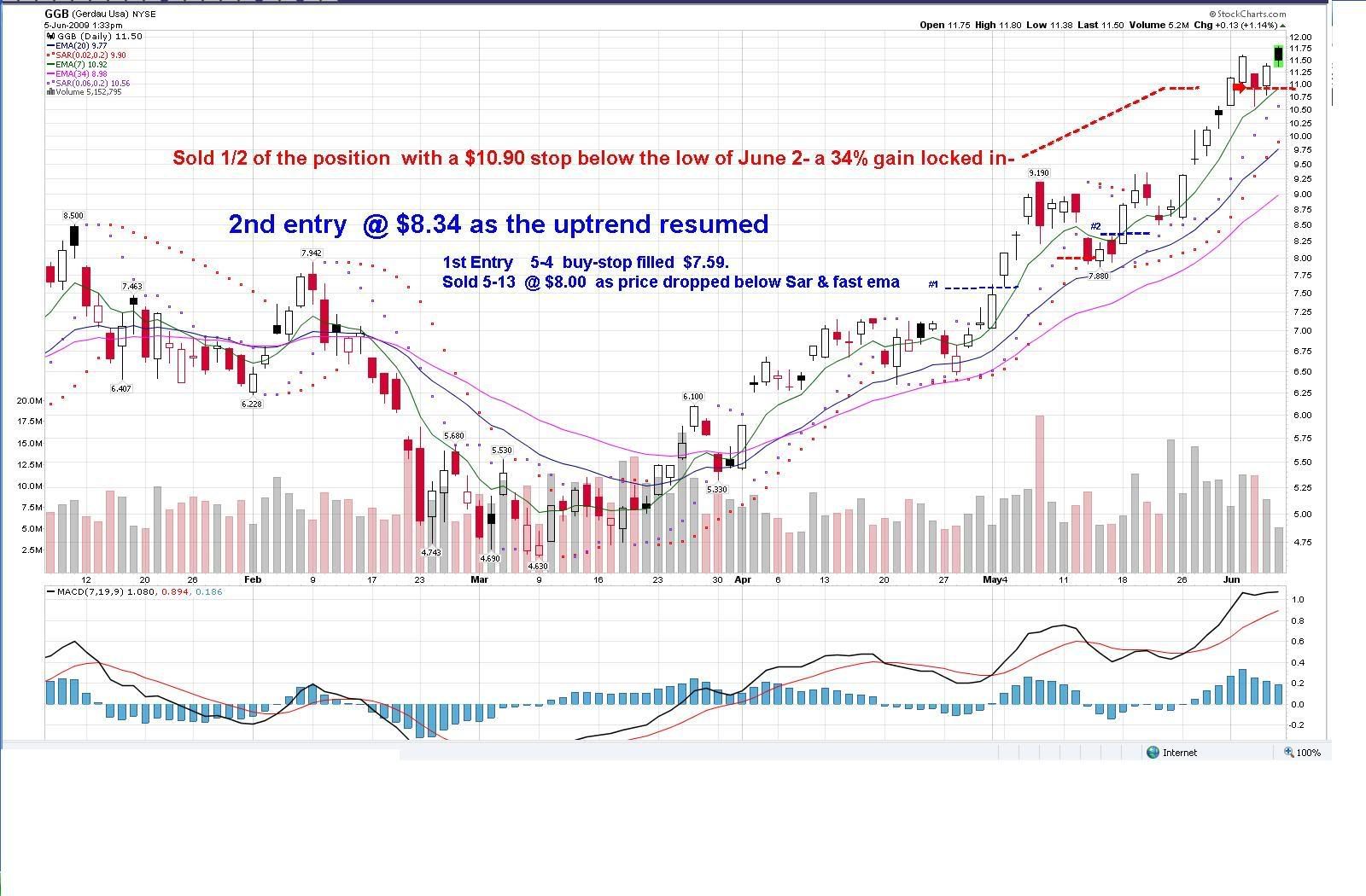

GGB - a Brazilian steel stock that had momentum- I previously entered 5-4-09 on a move up, $7.59, and sold 5-13 as price pulled back @ $8.00. This was only a $.41 gain but = 5.0%+

I then reentered the next move higher @ $8.35, and the stock moved up sharply. I sold 1/2 the position at $10.90 on a raised stop directly under a prior price low and above the fast ema- This nets a 30% gain.

The other 1/2 I set @ $10.50 on the chance that this is a minor pullback and the stock will then continue it's trend higher tomorrow. If this is taken out, it will be a 25% gain.

I consider this an example of my best trading- I was not afraid to reenter a stock that had just previously stopped me out- Chart wise it made sense from the technical view. aIt likely helped that I had made a 5% profit on the prior trade.

Between these 2 trades, I have a average 32% profit.

Had I held from the first entry $7.59 to today's close $10.93=a 44% move. That's a 12% difference to the good for the buy and hold position - if the stock continues to move higher.

It would be easy to say from the initial trades, that I missed 12% of the potential gain in this trade by selling, and then reentering, and then selling 1/2 again. That seems true at the surface, but my approach reduced the Risk that the trade would go South and not continue up higher. Also, I have the ability to potentially buy this stock again at lower costs.

This second entry caught a large % move.

Why not sell it all? By setting a lower stop on 1/2 the position, I am just sitting at the fast 7 ema, above the Sar levels I often use , and technically too tight for a stop- I also feel that there may be several days that cause price to be knocked down lower and offer potential reentries at the same or lesser amounts.

AGQ is another example- I entered this late since it was moving up from a $46 level pause and I got in several days later @ $48.53. June 1 it gave up a red bar, closing into the prior day's candle. June 2, it moved higher with a bullish candle.

I elected to raise my stop to the low of the June 1 red bar $53.90 instead of at the $52 range with the fast ema.

The stock had a low of $51.85 and closed $52.50.

I don't know what tomorrow will bring, but by raising my stop to 53.90, I improved this trade by 4%.

If I had sold at my first stop $52 with a 48.53 entry = a 7% gain.

By selling at my higher stop $53.90, the gain is 11%

I'd like to include a couple of charts here to illustrate, but it has gotten past the witching hour.

On vacation the next 2 days, but little opportunity to devote much time to trading- I'll be looking for some reentry areas.

SD

|

|

|

|

Post by sd on Jun 4, 2009 22:40:11 GMT -5

Never had to work this hard on a vacation day! Just got in @ 8:30 pm. See the markets closed higher- -

I watched the market open and by 10 am decided I would use the cash that cleared today. I only had enough free cash for 2 positions, - I decided to take 1 new position-BRF-Brazil small cap etf- only been trading for 2 weeks- , and then I decided to add a 1/2 to my AAPL position, after AApl's outstanding performance compared to my other positions yesterday. It raised my average entry cost to 135+

I also added to the DBC- commodities etf.. My thinking on this is that it has a wide diversification of various commodities, and should not be as volatile , nor as rewarding. Before I made the entries, I checked the 5 minute charts, liked what appeared to be gaining strength, and made the buys. Then spent the rest of the day taking care of business on the home front.

I'm still holding PCU,SQM, GGB 1/2, and NLC.

Everything went up today , except NLC.

NLC is also a commodity play- on water- and it's been in a struggling uptrend since March. I guess I was thinking it wouldn't hurt to diversify into water- but if it continues lackluster, and maybe topping here, I'll close the position or raise the stops. I'll see how it performs in comparisom to the larger markets for a day or two more and then make a decision.

SD

|

|

|

|

Post by sd on Jun 5, 2009 17:43:10 GMT -5

A rainy afternoon has given me some computor time- 3 charts to share here-I may post them separately . UNG - Nat gas etf- It was a recent entry. and I only held it for a few days and was stopped out on a raised stop. Chart wise I felt it was an excellent time to enter. The stock had been downtrending, had a counter trend rally to the upside, which failed, but it appeared to push up past the downtrend, and then did not continue to make a new low. May 1 the stock hit a low $12.69, and in the following 2 weeks moved up to a 17.55 high where it rolled over for the next 9 days and dropped down to a $13.29, and then started to move up. May 28 (2 days) after the low, a large bullish candle on huge buy volume suggested it was ready to move higher and retest that prior 2 week's run. I set a buy-stop to enter if the stock moved higher, and got above the moving averages, which indeed happened and I was filled at $15.22. That day the stock closed lower, and I had an initial $14.00 stop-loss- which was a compromise on potential loss- I couldn't go to the low of the prior day- Too much risk. The next day the stock stepped higher on good volume and I raised my stop to $14.50, and felt it was a solid move- The day following was a Doji- sign of indecision, and I felt I should raise my stop to just below the prior bullish day's low, and just under the 3 fast ema's. Those crossing moving averages have some meaning- because other traders are also looking at them, and I like to use them and take an entry as price action takes them up My stop was below the upturning fast ema . And the only other "indicator"- the macd histogram- signaling improvent in price and a crossing of the base line to the positive side.... It was also where it needed to be Price opened just above $15 and I was stopped out on what turned out to be a big down day with high sell volume. The following day- June 4, price opened higher, , sold off on big volume to a low of $13.40, but closed higher on huge volume- Normally, a hammer with big volume suggests price will be moving up because the sellers weren't able to drive the price lower. That was yesterday. Today, the markets were flat, and UNG wasn't able to close above yesterday's close. I'm thinking this suggests UNG will be making a bottom in here. I don't know what the stimulus will be to push this one higher- Final thoughts- I'm satisfied that I raised the stops on the sign of weakness and ultimately reduced my loss to a marginal one -1.5%. I will likely look elsewheres for trades with buying momentum. SD  |

|

|

|

Post by sd on Jun 5, 2009 21:11:05 GMT -5

AGQ is a double entry trade- Back in spring I had captured a good trade there while it was uptrending and then lost heart (and money) when it rolled over. I think I may have even taken a shot at the March 20 attempt to move higher, and lost money and put my tail between my legs and only recently looked this over again, made 2 trades, made a little profit. I want to note some similarities in it's Feb up trend, and then this most recent one. Too much to try to put all on the chart. In Late Jan 20 , the stock moved and started to uptrend for 25 trading days, stair-stepping up, and never dropping far below the fast ema. It did that for 25 trading days, and it never hit the fast Sar trailing price until the Feb 24 big red day down that marked the top. In March, price made 2 attempts to rally higher. The March 8 move up would have pulled me in- The only thing that looked wrong at that time was the disparity with the histogram being so far below the 0 line- That march 9 spike higher would have sealed my fate - and if I kept better records, I could confirm which one of these failed up moves bit me. March 18 there was a bullish hammer with good volume that signalled the sellers were going to the sidelines. Price gapped higher the next day, and climbed for 3 days. In this case, it had the ma crossover and histogram crossing the 0 line. Following the gap down lower on April 4, I took a buy-stop entry on 4-8 . Price gapped up the next day, but couldn't sustain an up move . After the April 14 doji I set a stop loss below the low and it was hit 2 days later as price crashed lower. This was a very risky trade to begin with, trying to get ahead and be in early on the reversal- The histogram looked good, and I figured price would succeed- and I was trying to get in "earlier" so as to get a larger gain....I was lucky to have made 2.8%. I then didn't go back to AGQ until I saw the May 21 bullish candle move up , and I set a buy-stop and was filled the next day. Price ran up for the next 4 days, and then gave a red bar. Price had moved further away from the fast ema, and it seemed likely it was signaling it would have to pullback. I set a stop just below the low of that red candle, 2 days later the stop was taken out as price dropped below the fast ema, and then dropped lower again today. The gain was about 11% there. As I look back over this chart, price action alone suggested 4 failed price reversals to the upside as it was downtrending. By combining the use of the histogram crossing the 0 line and the fast ema upcrossing the slower ema's, the potential entries would be reduced to 1 failed trade. This hindsight analysis also suggests that if in this 5 month period, one had applied a rule for entry that said only enter long if the histogram is above the 0 line, and the fast ema is above the slower ema's (trending) The follow up to this , is that a second guideline to be used could be that take the entry at any point that price is trending up and closing above the fast ema and the histogram remains above the 0 line. That last one would have made 3 of 4 entry conditions be profitable and also capture the biggest gains Note that once this stock started it's trend in Jan-Feb, it never closed below the fast Ema, and in the second trend in May it closed below the fast ema once and should have been stopped out because it fell below the trailing Sar. The uptrends seemed to be fairly straight lined, where the downtrend was pretty wide and whipsawing. This is but a 5 month snapshot, and I'm not sure it repeats itself in the months earlier. Also, market enthusiasm for various sectors is not a constant-  |

|

|

|

Post by sd on Jun 6, 2009 12:57:22 GMT -5

As a follow-up -I spent some time looking over AGQ's chart to get a sense of how it's price action could best be traded. Obviously, the approach will differ if the stock has been uptrending or downtrending. Losing less by not taking too risky trades, and gaining more profit % by seeing weakness and acting on it will improve the results. And that's not to say that What AGQ has traded like the past 7 months will be repeated going forward.- Market conditions will change, sector rotation will occur , etc. But I feel the exercise was helpful by backtesting what were possible entry signals that I likely fell victim to once or twice to the losing side this past year. Here is a daily chart with what were some attempted price moves that a trader could have reacted to - and lost, and some that provided winnings. I think I should have added something about taking a final look on a 60 minute chart to get that intraday perspective, - SD  |

|

|

|

Post by sd on Jun 6, 2009 13:07:36 GMT -5

Some technical help here if possible-

My chart page and spaces between multiple chart postings is very wide- and I assume this is because when I take the snapshot in paint, even though I crop the image, it is taking a photo that is 5 x wider and taller than the image actually is.

Any suggestions ? I use a 20" monitor,- I expect the issue can be resolved through the paint snapshot that gets uploaded to photobucket. Appreciate any help in getting this page sized right.SD.

|

|

|

|

Post by sd on Jun 6, 2009 13:14:12 GMT -5

Chart of the actual GGB trade- also 2 actual entries shown  |

|

|

|

Post by sd on Jun 6, 2009 13:51:07 GMT -5

I think I figured it out- In Paint- View-attributes it had the default setting at 6720x 4200- ? Don't know how or why it got to that size. If I make it 1600 x 1050, it gives me a full screen shot-Hope that will get this page down to a normal size. I think it's caused this page to expand to encompass the captured white space.?SD

|

|

|

|

Post by sd on Jun 6, 2009 19:29:05 GMT -5

This GGB trade image is sized 1600 x 1050-The preview screen appears correct. As of now, I am still holding the 1/2 position-SD  |

|

|

|

Post by sd on Jun 6, 2009 19:32:36 GMT -5

Trying to see why the screen is still so wide- may be due to the page size above-When I view this in preview mode, I see the normal page the size of the chart with a background border.  |

|

|

|

Post by bankedout on Jun 6, 2009 19:40:05 GMT -5

The size of your posts makes reading them tough, to say the least. However regarding AGQ, I don't know if you ever read Trader Vic, Methods of a Wall Street Master by Victor Sperandeo. If not, it is a worthwhile read in my opinion. A summary of the 1-2-3 change of trend can be found here: thepatternsite.com/123tc.htmlI rely on this method for drawing trend lines and determining changes of trend. Of course nothing is perfect, but this does work pretty well. Perhaps it will shed some light on where a possible entry is for this etf in your timeframe. Best of luck to you, and thanks for sharing your adventures. |

|

|

|

Post by sd on Jun 6, 2009 19:40:24 GMT -5

Correcting the paint settings did correct the height but not the width. If this page automatically formats to the page size that came before, because it is showing this in the "reply" mode- it may cause posts on the next page to be formatted to the oversized screen ?

|

|