|

|

Post by sd on Sept 20, 2013 18:37:14 GMT -5

Back on Augest 3, I posted the TD Ameritrade 5 positions.

Starting Cash balance was $5,000.00 with each trade allocated to 20% - approx $1,000.00

I actually chose to not look at that portfolio, because I felt that I would be simply be too compelled to "React" to minor fluctuations-

I was appreciative when I looked last week and found that the portfolio was up about 3% and would have been much better if not diluted with the -7% losing VNQ Reit investment. I did not have any in place stops - and VNQ was clearly looking to continue lower.

The expression is : Stocks take the stairs on the way up, and the elevator on the way down"

So, while I had 4 'winning' trades, my one losing trade was cutting more than 50% of the small net gain. of the portfolio average.

I elected to set a stop below the losing VNQ trade this week,

Fortunately, the Fed "No Taper" gave a temporary respite and allowed VNQ to rally, along with everything else. I think a breakdown of the weekly chart is worth responding to.

With 10 days left for politics to roil the market with an approved budget, or a 'gov't shutdown' 10-1- My gut suggests that this will totally derail the market's focus.

As far as being in mostly cash in the IRA and missing out on this last month's higher climb- That is what happens when I listen to my Bias and don't trade the chart-

So, I perversely want a significant pullback to take my entries lower than my prior exit- Such is psychology- the desire to be proven "right" . despite the costs....

|

|

|

|

Post by sd on Oct 5, 2013 19:13:07 GMT -5

While this link is to a British documentary may be dated, , it also promotes the concept of a long term investing approach using a diversified approach using the lowest cost methods-

A Documentary against trying to "Time' the market over the long term- and - most imphttp://www.sensibleinvesting.tv/ViewAll.aspx?id=8B9BC346-E853-475D-9050-889E41CE0289ortantly- reduce those expenses.

|

|

|

|

Post by sd on Oct 28, 2013 20:00:03 GMT -5

I may have previously posted the initial link- Discovered the follow up comparison chart link though- So , If you're IRA plan offers "funds" to choose from, realize what the actual expense, load, 12-b-1 fees etc are taking from you in long term returns. The included link will take you to Vanguard Funds comparisom calculator- Where you can compare your mutual fund or ETF to Vanguard's funds offering- Vanguard is the low cost provider in many categories- personal.vanguard.com/us/funds/tools/fundcomparison?Place a fund or etf into the comparisom box, hit enter- This brings up the direct comparisom cost of expense ratio's , and how much you could save just in expense costs by choosing a Vanguard Fund. However, low expense ratios may not be all there is- To get a further in depth analysis of the Fund vs Vanguard performance, click on the "View a more detailed comparisom" to see a multi-year performance & cost comparisom based on actual historical data. This really gets you into the ' nitty-gritty" As one scrolls down- Note the load fees and 12-b-1 fees imposed by many funds- Note the "after tax" costs of many funds- I am comparing my present available offerings through our company plan - Obviously, If Vanguard beats on initial costs but underperforms over multi-year periods, the outperforming fund may deserve it's higher management fees- Actually, they "Should" deserve a higher fee, because the vast majority underperform over time- Vanguard does not have a "load" fee on many offerings, , 12-b-1 fees, etc. In the first 1/2 dozen comparisoms, Vanguard beats substantially on Fees as well as in performance. The obvious question becomes- If one can find a lesser cost, better performer- that will enhance the investor's returns- why not make that choice? One's loyalty should be to one's self, and not the broker/salesman that wants to retain your account for the expenses they can wring from it. While expense ratio and added costs may seem relatively minor,annualy, over time these expense have a very large impact on the end result for the investor- What is 1 % after all? A minor amount- HMM- What is 1% per annum over 20 years? Could that impact a total return by 25 or 30% less? That's worth thinking about- |

|

|

|

Post by sd on Nov 10, 2013 20:12:05 GMT -5

B ack in October, I had seen that VNQ- a Reit fund, was losing and was down quite a bit, affecting the gains of the 4 other ;positions- I elected to employ a stop , and fortunately price had improved a bit, and stopped out on 10-09-13 for a $96.00 loss - or 9.5%.

On the same day, I sold out the small cap growth fund just a few cents above my entry. it had been gaining, but was rolling over and appeared that it would join VNQ in the losers category.

Note that initially when I elected to get off the sidelines and to actually make some purchases, I chose to go all-in at one time ..

.

From my initial entry, all positions had dipped lower, but recovered and had gone higher- except VNQ.

On 10-11, I purchased IJS- a small cap value fund- 103.29

and FEZ- a European 600 fund $39.57.

The goal is to maintain some diversity in positions, but most likely are very closely correlated. However, ETF's today offer the average investor a way to get great diversity that was not available except to professional institutions just a few years ago.

The goal has to be to have a repeatable and methodical approach to the markets that takes the emotional aspects out of the equation- If x is above Y- go long- If x crosses below Y go to cash or short..

The issue will always be that any timely type of signal will give whipsaw/false triggers- but one has to eventually decide where a line gets drawn in the sand.

I'm going to look further into RENKO type charts - They ignore some of the "noise" and are more concerned with price volatility/range.

|

|

|

|

Post by sd on Dec 23, 2013 20:11:58 GMT -5

Back in July when I opened the TDameritrade account for myself, I opened an identical one for my wife-

Her account has maintained the original 5 entries with no trades-

Her account has $8 more than my account $5,261.00, -vs $5,253.00 -

both accounts having approx 5% return.

Her account had generated some cash due to dividends, which I used today to purchase 1 additional share of VNQ, and 1 share of VSS.

I lost 9.6% on the actual VNQ stop-she is down 8.6 on it.

in 2 of the funds, she has over 11%each, and in 2 of the funds over 6%.

I added to VNQ today by 1 share (No commission cost), but it may simply be that this fund has a greater downside from here- as it has not rebounded with this market- $64 appears to be the recent bottom- and I may add a stop at that level- At some point, one has to draw a line to stop bleeding- I think all of these shares had an initial decline from the entry point, but the others have rebounded. VNQ has remained in the tank.

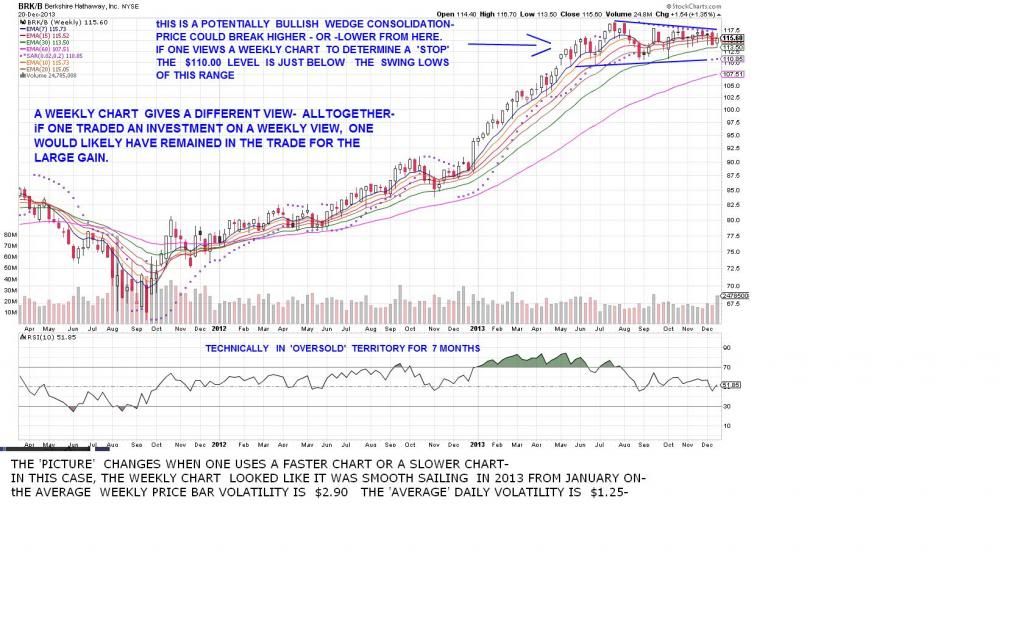

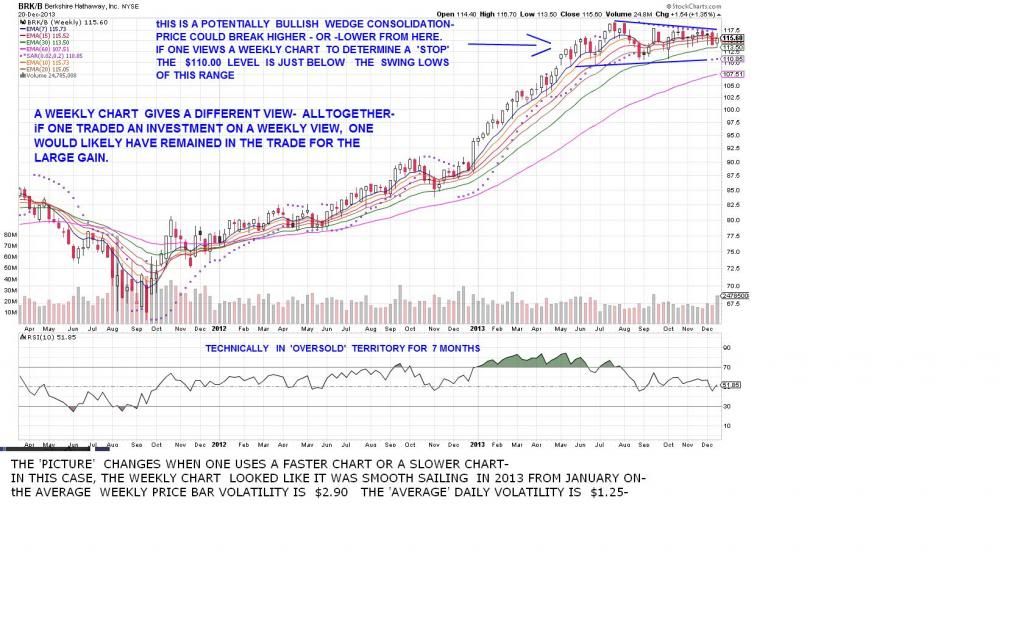

In a separate Roth account, my wife purchased BRK/b , and I purchased DTN- a dividend focused ETF- DTN is making new highs , while BRK/b has been in a sideways consolidation for months, after making a large momentum move in the first 6 months of the year.

Ideally , BRKB moves out of the present range in an up direction-As the market is showing some strength here, ideally that will be extended to Warren as well.

DTN cost was $68.09 + $7 for a commission (Scottrade)-

Separate brokers for separate "types' of trades.

I will monitor this trade and have protective stops in place - I expect i will be using a weekly chart to evaluate this position's performance-or a daily Renko chart-

|

|

|

|

Post by sd on Jan 4, 2014 12:13:35 GMT -5

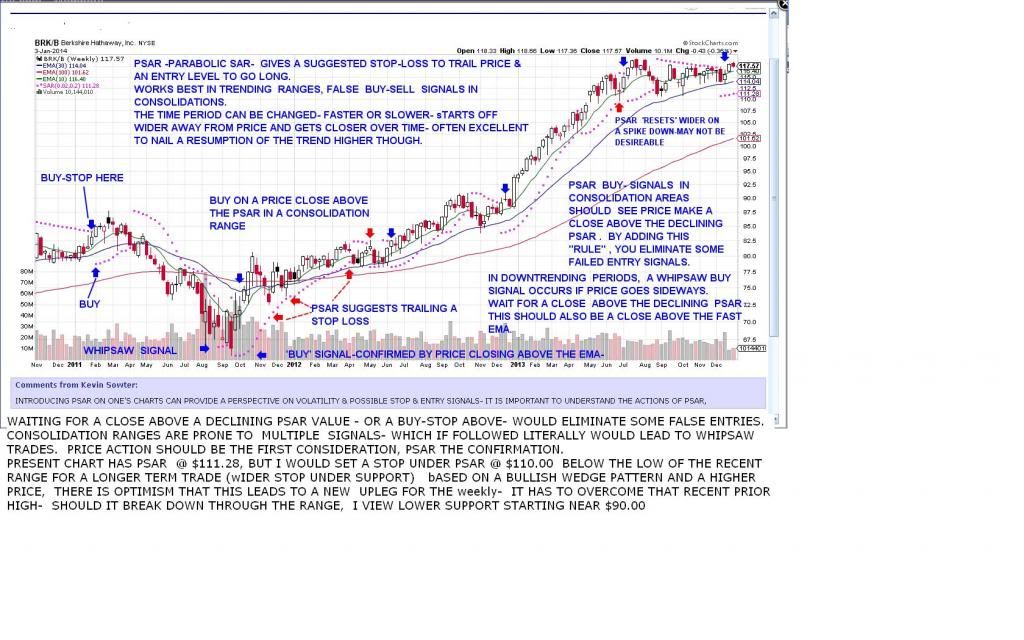

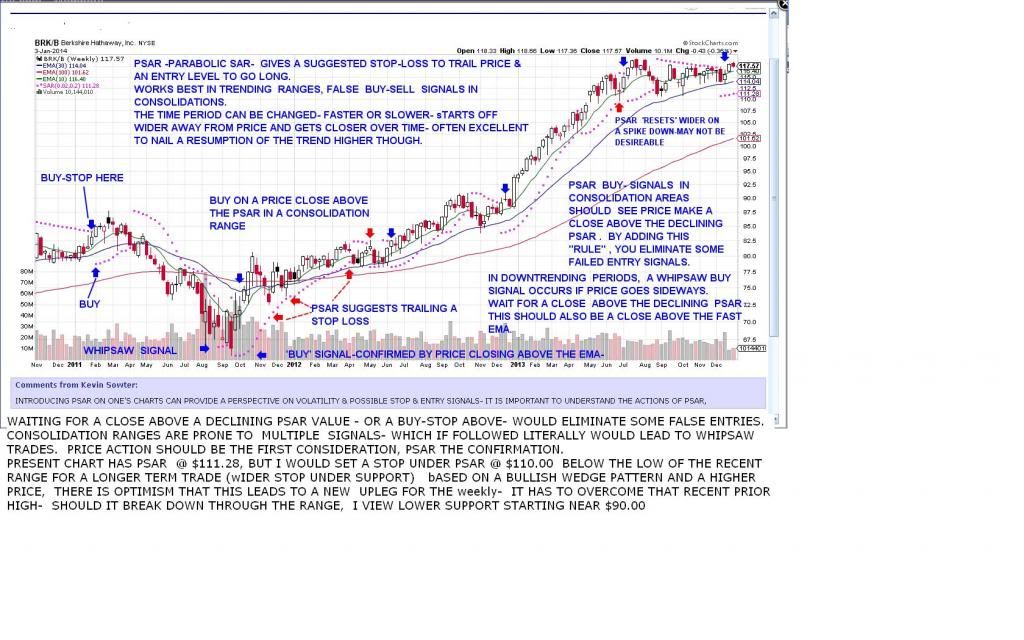

BRKB is a position in my wife's account- a recent add as price moved up in the range $116.84 The present stop will be set at $110.00 which is just below the range- a higher stop would be below the 2 recent swing lows in the 112 range- but we hope this trade will push on to a new leg in the uptrend- market willing. Allowing more room for this trade to succeed than I would within the short term trading account- If price looks to weaken substantially from the present the wider stop may be changed to a tighter stop- In an exchange of ideas with a friend, I'm posting some charts here- My view of the present wedge formation of BRKB, then a chart for illustration purposes of BRKB weekly with an eye to properly using PSAR as a stop-entry signal device.   |

|

|

|

Post by sd on Jan 15, 2014 20:25:51 GMT -5

1.15.14- As the market had pulled back but since has started to rebound- DTN, BRKB, GE etc and likely many others had sold off as well.

I was waiting for DTN to make an up move to Buy back long, but that move never occurred today- I saw GE move up, BRKB move up,

and elected to take a position as it was coming off the low in a relatively narrow range.

Purchased 43 shares $115.83 + $7 commission.

Since BRKB is not trending, this is as much a practice trade on a fast chart with a potentially narrow range.

Exercising this approach taking a larger position with a fast chart and relatively tight stops expecting that this will not be a "breakout".

|

|

|

|

Post by sd on Mar 7, 2014 19:03:48 GMT -5

I haven't updated in quite a while-been busy, longer holding periods is the goal now.

The BRKB trades stopped out , for relatively small losses. With BRKB dropping back towards the 108 Gap . What was interesting was how very similarly BRKB, VIG, DTN behaved. Instead of allocating those $$$ back into BRKB, I looked at DTN, VIG

I somewhat look at BRKB as the epitome of value investing under the guidance of Warren Buffet-

It seemed Value all took the same decline and found the same reason to bounce higher from early Feb.

I am holding positions in both DTN & VIG - Both pay dividends, which BRKB does not.

I had a small position in IBB which stopped out today for a small % gain as i had tightened the stop on weak price action. I turned around and purchased PBE prior to the close- I also purchased QCLN- gives exposure to the alternative energy space. Also raised stops on PJP & QLD- Until this week, I had simply moved the stops to just above Break Even.

I've been pleased that this market has continued to grind higher, and picking that which has been trending has been the right course of action.

As we all know, Few stocks- or ETF's - will be able to withstand the current of the market.

Is the market extended? Perhaps very much so. We are now 5 years into a bull rally - which according to the pundits is quite a rarity. Can it go higher yet- - It likely will - Particularly when we think we can predict the future-

As the market showed some weakness today I found myself tempted to take a short position- SH- but only for a flitter in a brief moment. Just didn't act on my fear/Bias. OK, so the market did not want to close higher today- That can be normal -Yes ?

Instead, I made a theme purchase - Alternative Energy QCLN, and a small partial PBE- again - back in biotech- Are these 2 segments extended? Absolutely- Are they ready to fall back ionto the abyss and not be a consideration going forward? Hardly- As I try to move out of a very short term reactive mindset, If I'm wrong in a short term position, I hope it is within a sector that has staying power.

It's been an interesting month or so, weaning myself away from watching the DVR of what occurred that day, Not even checking the status of my individual

trades on a daily basis.

Going forward, my goal is to trade less, and develop longer term positions, eliminate the need for reactive daily monitoring of the trades- Relax,

spend the minimal amount of time necessary to maintain the position, and spend more quality time in other aspects of my life. I think the ultimate goal

would be to allocate just a 2- hour period each weekend to review the positions, Easy to do when the market is trending higher or treading water-When things change- as they will, it will not be as easy to have such a complacent attitude.

For me, the realization is that I certainly enjoy the challenge of a short term trade, It is as much an intellectual challenge to think you can see the probabilities in a chart and take advantage of that potential by taking a specific action- Essentially, your hand on the tiller, guiding the vessel to those desired waters. However, Investing is about the long term results. I have been guilty of confusing them as identical goals- I have received much greater gains with an investment approach than with a trading approach. That may not be the case for others- but I would suggest that having a separate Investing account from a trading account is just good business for the long term.

Good luck,

SD

|

|

|

|

Post by sd on Mar 7, 2014 19:31:21 GMT -5

In my previous post I mentioned my desire to spend more time attending to my personal life , and reduce my time spent in trading-and better define my longer term investing plan. One has to understand the bigger picture that faces all of us.

One has to have a balance in all things they do. But an Eye to the reality of the future we will all likely face.

It is essential that one has a plan for the longer term retirement we all will face eventually. mAYBE WE WON'T GET THERE, BUT MOST LIKELY WE WILL.

My good friend of 50 years passed unexpectedly last year.

He was a hardworking - salt of the earth - kind of individual that did not believe in anything he could not hold between his hands.

He had a strong sense of self determination, and a refusal to consider that which was outside his vision of his daily life and expected future.

Life treated him unfairly, and dealt him a short hand of cards that made reaching out for alternative hopes unavailable.

None of us expect that Life would deal us this harshly, so soon. Conversely, If we indeed are granted the added years ; when the latter time in our life arrives, will we be prepared for it?

John and i discussed investing in the market, but he did not want anything to do with it- He paid for everything as he went through life, did not want to owe anyone and did not want to be beholding to anyone. He was a proud individual, worked diligently to provide for him and his family-

When he passed, he left his wife with the only debt the remaining motgage on their house. Unfortunately, he never anticipated leaving this Earth so soon, and so he also left his Wife without any life insurance to pay off his final bills, and left her scrambling, to reorganize her life and face the hardships of a new reality- In addition, the company she was working for was sold off and she was let go at Christmas-

That situation could have happened to any of us- We all will eventually face a reality of age or infirmity that we never anticipate and plan for-

Later

|

|

|

|

Post by sd on Mar 8, 2014 21:57:37 GMT -5

Following up on the prior post-

John's wife has a very practical nature and actually had started an investment account on her own.-It was through her local bank that charged her a small maintenance fee each quarter- and it was also through EDward Jones- that put her in Load funds with a 5.75% commission plus a high annual Expense ratio. I sent her information on Vanguard.com - no-load- no maintenance fees, very low expense ratios. I hope she takes advantage of the Vanguard approach.

As i have looked into Vanguard further-They also offer a brokerage account- with no commission cost if buying/selling Vanguard ETF's.

They charge $7 for other trades- stocks, etfs etc, but limit that to 24 trades per year and then the non-Vanguard costs go up to $20.00.

For 2013, My wife and i will be funding our Roth allocation with Vanguard.

I also started off on the Vanguard site comparing my Employer's American Funds target funds with Vanguard's -

There was a substantial expense ratio difference, and the comparisom showed the value of a 50,000.00 account over 20 years with both American Funds and Vanguard Funds- It assumed an average return of 6% annually, and just the expense ratio difference added up to many thousands of dollars in

reduced returns for the American Funds due to the higher expense.

What was not included in the comparison was the actual past performance of each of the funds- The comparison was just based on the average return of 6% for both funds. The Vanguard funds historically had an improved actual return over the prior decade.

Transaction costs matter- If one is paying a higher expense ratio & higher costs, but the return does not outperform the low cost index to offset those higher costs, one is not getting value for the extra they are paying for.

Vanguard offers a wide range of ETF's as well as low cost actively managed mutual funds.

Additionally, For a Core portfolio holding-that one could simply set up and add to - For decades. The Target Funds offer an excellent way to gain wide market exposure, get professional rebalancing, and that changes in structure over time as one approaches retirement. (More Conservative)

Target Funds through Vanguard can be opened with just a $1,000.00 initial funding- and regular contributions can be automated.

This is an ideal set up for someone that does not want to spend their time trying to follow the ups and downs of the market, or that wants to open an account for a core portfolio- or to start an account for a child-

Imagine the possibilities of compounded growth and regular investments added over a 50 or 60 year period.

One can select longer dated Target funds- potentially greater gains, but also greater volatility. Even once one's Target fund reaches it's target date, it keeps a 30% allocation to stocks- the necessity is to allow for some growth during retirement years to not deplete the principal amount.

One could fund several different Target Date Funds- Depending on one's tolerance for volatility, or need for growth- One could Fund an actual retirement year, but if more conservative in nature, one could fund a target date fund closer to today's present date- providing a very conservative approach-

Conversely, If one needs the Funds to Grow - and can withstand the potential volatility- One could allocate a portion of their assets to a fund that is 20 or 30 years further out- even if one is nearing retirement. Or, one could simply make investments outside of the CORE portfolio.

Something to consider.

|

|

|

|

Post by bankedout on Mar 9, 2014 7:14:10 GMT -5

That is sad to hear about the Edward Jones experience. So much for looking out for the customer's best interest! Vanguard sounds like a great choice for long term investing. With the global nature of today's large corporations, one could focus on the S&P 500 to cover all of their stock needs for the long term. This would probably be the lowest expense ratio. Return wise, it is exactly par.  One could focus on the Monthly chart. There wouldn't be much trading to do. Mostly sitting and watching the paint dry. If one didn't want to roll back to cash during down years, one could easily move to a bond fund. Again, this would have a very low expense ratio. Just choose a plain jane Treasury Bond fund. Whatever one has the lowest expense ratio. |

|

|

|

Post by bankedout on Mar 9, 2014 7:23:06 GMT -5

One could even focus on trading the Quarterly bar chart.  The moves last so long. It would develop patience and perseverance :-) When thinking about returns, the dividend paid will become a significant factor in this time frame. When you purchase the dips in this time frame, you are getting a much larger yield for your dollar invested. |

|

|

|

Post by sd on Mar 17, 2014 19:47:47 GMT -5

"Vanguard sounds like a great choice for long term investing. With the global nature of today's large corporations, one could focus on the S&P 500 to cover all of their stock needs for the long term. This would probably be the lowest expense ratio. Return wise, it is exactly par."

The S&P index fund would indeed cover a lot of Territory- The Vanguard Expense ratio is extremely low- As you said- The return is indeed PAR less the very small Expense Ratio- John Bogle's point exactly-

I recently read (don't know if I had posted it previously) an interview with Warren Buffet- Part of his advice - If one did not have the resources and business acumen/ skill sets to purchase individual stocks was to invest in a low cost S&P index fund, to hold forever.

Bogle makes excellent points - That even in the realm of Professional money managers, a relative small % outperform the markets with any consistency over a short period of time, and as the time period goes longer, There are fewer and fewer managers that can maintain any market outperformance.

Bogle cites in his most recent book- The churn of markets stock positions - Investment VS Speculation as a losers game in the long run- Citing the many examples of why the higher costs incurred by selling., buying, selling- serves the purposes of the financial companies, and does not serve the interests of the investor.

When you consider some of the world's most successful investors- Warren Buffet-, Charlie Munger- They Buy into businesses they believe in- and generally hold for a longer term gain. They 'Invest' and are not concerned with short term fluctuations- as long as they have a belief in the business they have invested in.

You made a very valid point about Dividends- As I read, Dividends account for 40% of the market's long term historical gains- I cannot confirm this is is accurate information- As one does some research - One is fed different statistics from different sources, all trying to confirm their thesis.;

Along that same concept, Warren Buffet in an article explained why Berkshire Hathaway did not distribute any dividends to shareholders, and a SA article seemed to show that a dividend payment over the past decades would have greatly improved Warren's already substantial financial gains.

We all have short term memories- The markets are now up substantially compared to their 2009 lows. And we are finally making a decades new high-

Again, there was a compelling SA article some time back on the benefits of dividend investing which made the "lost decade" far less painful than it was was for those that simply held stock positions. (Sorry, no link to that article)

So, we have a 30%+ S&P return this year- some 20% + plus last year- March 2009 SPY hit a low approx 62.00 Today is at 186.00- My math suggests that we are up from that low 300%. If one could have timed to buy at the very low. It appears that the prior peak was 120 in 2001- so we are only up 50% in historical terms over the past 13 years. That is sub-par to the average market returns.

The long term market historical return averge is now about 7-7.5%annually. That should double one's asset value approx every 10 years.

However, the above average market returns of the 1980's and early 1990's may indeed have been a period of market excess that will yet reset the scales.

There have been long periods of market malaise that suggest a timing mechancism to be long or short would be a more prudent approach. Our individual problem is that we tend to view the markets on a microscopic daily, hourly, minute basis- which makes us reactive to the motion of the moment.

It takes greater poise and presence of mind to be able to mentally step back and ignore the daily gyrations to discern the direction of the larger movements.

An issue in timing/ trading -even while watching the Paint Dry- is that the present daily price is reactive- What actually counts is the closing price within any specific period. The wider the time frame, the larger the % movement, If one seeks to be an Investor, one has no stops and takes the up and down trip with the market. If one seeks to exert some control, One sets some level of stop-loss and takes the Risk that the stop is executed and price moves higher- With one out of the position. And that requires a decision to make a reentry.

Assume one started at age 20 with a 4 decade investing horizon- and they invested 5% monthly - regardless of which direction the market was heading at that period of time- They bought at the very high, and they bought at the very low- and ignored the market swings- When the market was in declining periods, they got a larger position on sale prices. And- as Warren Buffet said- Never look at your account balance until you are ready to retire-

I think the perfect vehicle for this type of investment approach would be the Vanguard Funds Target funds with monthly contributions put to use

with no commissions charged. No maintenance fees- No 12b-1 fees. No reduced gains due to active position turnovers- Just follow the index. Reinvest all dividends to accrue more stock.....

Later....

|

|

|

|

Post by sd on Mar 18, 2014 11:59:30 GMT -5

Vanguard 500 Index Fund Admiral Shares (VFIAX) Also available as Investor Shares mutual fund and an ETF. Overview Price & Performance Portfolio & Management Fees & Minimums Distributions News & Reviews Expenses Expense Ratio 500 Index Fund Adm 0.05% Average expense ratio of similar funds* 1.09% Minimums Initial Minimum Additional Investments Minimum investment $10,000 $100 Learn more about Vanguard Admiral Shares Fees on $10,000 invested over 10 years- Typical fees & expenses would average 2,457.00 Vanguard's costs are $118.00 for a savings of $2339.00 See how costs can impact a hypothetical $10,000 investment with an annual rate of return of 9.00% over a period of 10 years, assuming no additional investments in the fund. This hypothetical illustration does not represent the return on any particular investment. Use our cost compare tool to learn how costs can affect your investments. personal.vanguard.com/us/funds/snapshot?FundId=0540&FundIntExt=INT#tab=3 |

|

|

|

Post by sd on Sept 5, 2014 20:12:23 GMT -5

After an extended period of intentional unplugged inattention, I figured i should look and see where at least one account with a dividend focused ETF was the sole position- Sorry about the Font size if it is huge- I can barely read it with glasses.

I also am holding positions in the trading account and another dividend account i still need to access- The experience of unplugging myself from daily computer & e-mail & TV has been beneficial in my personal life as i have made my spare time more beneficial in that I have spent more time with other interests and -most importantly- additional time with my wife. Some of the personal dividends of eliminating focusing on stock market moves and daily fluctuations is hours gained not watching the Financial channels, or reading the abundance of financial solicitations in my in box. What does one do with all this additional time? In my case, it benefitted the amount of time my wife and I share together in the evenings, as well as some of the side projects i had always intended to get around to- I think it is healthy to be able to stand back and take an appraisal of how one spends one's energy- at least in my case. That said, I tend to do the swing of the pendulum and go too far in the other direction- But it has been as much an exercise of will and experiment combined.

Will i resume trading? I haven't given it much consideration- I may simply do better as an Investor - I missed even seeing and reacting to that 7% decline in August- A good thing, since DTN has just made a brand new high!

[/fontDTN- Ex financials Dividend ETF by Wisdom Tree.

$5,000.00 initial funding for this single trade.

Initial purchase 12.23.13 Sold for a small loss as price pulled back (stoppedout?) , and repurchased in 2 trades at a lower cost basis, a few weeks later. Price continued to decline below the repurchased amount, but I did not initially set a new lower stop- Intent was to "ride it out' and see where it goes. Eventually, I did add a stop to protect a serious decline, but i did not pay much attention to the price over the past 8 months. I will consider raising the stop to protect my initial investment now that the price has appreciated. The net gain in account value is approx 11%- the dividend value into the account contributed approx $85.00 or 1.5% +YTD.

The actual account value of the position is today $5,455.00 - the 2 purchases 4,830.00 were in early February as price had bottomed and had reversed higher. The account value is today $5,587.00. So the net gain reflects approx 7 months since the repurchases.

For some reason, my stockchart does not reflect the trade prices listed- on those dates.

I have another account also with a dividend focused ETF. that i need to review.

Results No. 1 - 12 of 12 | page 1 of 1 Submit

Export to Excel

Date Settlement Date Symbol Description Commission/Fees Interest Amount Avg Price

8/29/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .20000 $0.00 $0.00 $14.60 No

7/25/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .19000 $0.00 $0.00 $13.87 No

6/27/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .19000 $0.00 $0.00 $13.87 No

5/30/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .12880 $0.00 $0.00 $9.40 No

4/25/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .13041 $0.00 $0.00 $9.52 No

3/28/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .15000 $0.00 $0.00 $10.95 No

2/28/2014 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .15000 $0.00 $0.00 $10.95 No

2/11/2014 2/14/2014 DTN BOUGHT 32 SHARES OF DTN AT $66.7199 ($7.00) $0.00 ($2,142.04) No

2/6/2014 2/11/2014 DTN BOUGHT 41 SHARES OF DTN AT $65.3999 ($7.00) $0.00 ($2,688.40) No

1/3/2014 1/8/2014 DTN SOLD 73 SHARES OF DTN AT $67.95 ($7.09) $0.00 $4,953.26 No

12/31/2013 - DTN WISDOMTREE DIVD EX-FINC DIVIDEND ON 73 SHARES OF DTN @ .24527 $0.00 $0.00 $17.90 No

12/23/2013 12/27/2013 DTN BOUGHT 73 SHARES OF DTN AT $68.0899 ($7.00) $0.00 ($4,977.56) No

The present account value is $5,587.00- a net gain of +11% in account value in "safer' dividend stocks over the past 7+ months. Will this continue the rest of the year? It will be interesting-

The August swing low looks like a good level to set a higher stop-loss- Retains some position profit- I may split the stop at both entry and just below the swing low and try to hold this one for the very long term.

A note about technical analysis- Basic technical analysis had the initial entry as price was trending higher- and i think I had set a stop to protect the initial entry should the trend breakdown-

My reentries several months later waited until it appeared that the trend pullback had ceased and a new uptrend was underway- Which was going in the direction of the prevailing trend. The reentries were at a lower price and improved the net results by approx 4%.

So, trading in the direction of the trend -at this time- proved to be prudent. SD

|

|