|

|

Post by sd on May 17, 2013 21:26:42 GMT -5

With the market moving higher, and it now past the middle of May, I reduced some of the active positions - and went to cash in 30% of the portfolio. This has been an unusual market rally and is well extended; I think we are presently in the rather rare atmosphere of a substantial months long momentum move-

What drives this market now is perhaps not the fundamentals, but the momentum itself- Retirees don't have the exposure they have needed, and hedge funds are playing catch up-

This suggests to me that the momentum can falter at any time on any "news" since everyone believes this market is 'overdue' for a correction. This is not a judgement on the fundamentals, it is a comment on the market psychology, as i get it delivered through CNBC in after hours.

Essentially, this is taking partial partial profits during a market high/top vs waiting for a pullback and a defensive sell at a stop-loss point- that would likely be at least 5% lower-

At this point, I have not committed any of the funding from 2012 or 2013 into active trades- Truly expected to see a large pullback. and this market is amazing-

One of the "reasons" I heard today as the "WHY" the market still has upside, is that many of the Hedge funds have a 30% cash position - having expected a pullback scenario as well.

Let's consider the math- NOW seems to be a good time to take a portion off the table- However- not all- But it seems to be

appropriate from having a higher risk exposure to now reduce that exposure-

I am still expecting that somewhat significant market pullback- But- God Forbid- What if this indeed is the momentum rally that matches the 1990s? Where anyone waiting for a pullback got left behind at the station.

This is what happens when one starts to focus on the markets on a day to day basis....and listens to the conventional wisdoms.

Seasonality suggests that one should have reduced exposure weeks ago- HMMM- goes to show that following average truths yields average results.....

However, investing is indeed about the long term results, and not the short term battles & skirmishes.

|

|

|

|

Post by bankedout on May 18, 2013 4:43:40 GMT -5

I guess it depends on what you define as the 'market' finviz.com/futures_charts.ashx?t=INDICES&p=w1Clearly the Russell 2000 recently had a pullback. The Nasdaq 100 is finally getting going after struggling for ages [probably due to AAPL being such a large component]. The Nikkei 225 looks more like what you are describing, with the long move up with barely a pause to consolidate. My 2 cents [keep the change  ] |

|

|

|

Post by sd on May 19, 2013 7:18:17 GMT -5

|

|

|

|

Post by sd on May 19, 2013 20:43:09 GMT -5

Yes, that was indeed a "pullback" on the Russell- Or one could view it as a possible consolidation, establishing a range at a support level? Note that in 2012, there were 2 more substantial +10% pullbacks to the 100 ema . I think I believed we would see something more substantial in a market wide- -sell off- locking in profits- Since i am not presently invested in TNA, I had not given it much consideration.

I also haven't spent much time following the market news in the evenings- It used to be a nitely ritual- Getting the recap of the day's events. No longer a priority for my time.

I guess i think of the "market" as the S & P, and perhaps the Dow-matching what the cnbc's of the world focus on.

The individual sectors certainly deserve attention, as the price actions of a sector represent the psychology of the other market participants.

I would assume a pullback in the Russel and a rotation into more defensive sectors suggests that the investing/trading public was getting nervous about growth and wanted to reduce their exposure- That appears to have changed......

It now appears that an "ALL-ABOARD" is the present

psychology- at least by the charts/price action with your link-

It would appear that all 5 charts are marching to the same drummer- This is indeed market wide momentum- Hear the music? How many chairs are there in the room ? When will it stop? There is no way to know, eventually, in hindsight we will declare that the market topped at ........

Fill in the blank- May 2013? Jan 2014? When did the Fed raise rates? That will precipitate a sharp decline I would assume.

In my trading account, I am using Renko charts and prepared to be stopped out and take a reentry once the trend resumes.

In my IRA, I cannot use stops and so I have sold some positions and raised a higher level of cash-

In my more recent ETF- focused Roth IRA accounts, I have held cash, expecting a significant pullback- Hasn't happened-Yet. I need to define that allocation approach and to be prepared to step in.

|

|

|

|

Post by sd on May 19, 2013 20:50:35 GMT -5

Check out the videos from PBS on retirement- and then John Bogle's site/ older videos if interested. This is a copy of an email sent to a few friends sharing what I thought would be informative to their investing approach. Some information on ways investors could/should do things differently heading towards retirement. johncbogle.com/wordpress/ WATCH THE PBS VIDEO There is a 5 part PBS video on planning for retirement that illustrates the workings of the financial advisors , and the high cost to the individual retiree of the expense in the products they "advise' us to purchase or invest in. Well worth watching. The simple truth is that the investor provides the money, takes the market "Risk" and in the column of annual expenses, the funds skim off the investors monies with the net result a significantly lower end return for the investor. Additional videos & interviews of Bogle can be found on that site. John Bogles' recommendation is to reduce the expense issue by simply holding the stock market in a low cost index fund, eliminating the excess fees and get the majority of the market return. His recent book :http://www.amazon.com/The-Clash-Cultures-Investment-Speculation/dp/1118122771/ref=sr_tc_2_3?ie=UTF8&qid=1368993729&sr=1-2-ent many others with profoundly sound advice. Andrew Solin- The Smartest Portfolio You'll Ever Own: A Do-It-Yourself Breakthrough Strategy [Bargain Price] [Hardcover] Daniel R. Solin (Author) www.amazon.com/Smartest-Portfolio-Youll-Ever--Yourself/dp/B007F7QK00/ref=la_B001IGOH3Q_1_2?ie=UTF8&qid=1368993160&sr=1-2 The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets [Paperback] Mebane T. Faber (Author), Eric W. Richardson (Author) The Ivy Portfolio by Faber- Took the investment techniques used by the large and prestigious Institutions and developed some approaches an individual could employ, using etfs and periodic rebalancing. www.amazon.com/Ivy-Portfolio-Invest-Endowments-Markets/dp/1118008855/ref=sr_1_1?s=books&ie=UTF8&qid=1368997660&sr=1-1&keywords=the+ivy+portfolioA book I will be considering is " Truth About ETF Rotation: Fund Your Retirement By Investing In Top Exchange Traded Funds in One Hour Per Week (Beat The Crash) (Volume 1) [Paperback]http://www.amazon.com/Truth-About-ETF-Rotation-Retirement/dp/1481238655/ref=lh_ni_t?ie=UTF8&psc=1&smid=ATVPDKIKX0DER The purpose of this e-mail is to be informative- While Bogle advocates a buy and hold INDEX approach to investing for the long term as the best way to achieve greater returns, the other books are focused on variations of low cost investing using etf's and periodic rebalancing- . Solin also is a member of IFA group which employs DFA low cost funds with their various portfolios. Their management fee is 1% - and may include the periodic rebalancing There is a lot of information to be viewed at : www.ifa.com/ Whether you are retired, or 40 years from retirement, watch the PBS video to realize you are -not- or may not - be getting the bang for your investment dollars that you thought you were getting through some "advisors" And consider some of the books- Bogle 1st for his view and then if somewhat active investing intrigues you, consider the others. Good Luck! Kevin (SD) Click here to Reply, Reply to all, or Forward |

|

|

|

Post by sd on May 20, 2013 19:35:02 GMT -5

|

|

|

|

Post by sd on Jun 18, 2013 20:28:52 GMT -5

Wow!

Having not watched much TV of late, The market is waiting on Bernake's speech tomorrow, and Obama seemed to give Bernake a "farewell" send-off-citing that the chairman has done a good job but is here longer than he wanted to be or expected.... opening the door for additional speculation as to not only what will the Fed do, but who will be Bernake's successor? Janet Yellen- the vice chair is the Fast money's guess of the logical successor to be capable of unwinding the Fed's policy of easing.

Volatility is up, and this certainly seems to be a market poised to move on news events. The 'success' of the market seems to be largely dependant on the way the Fed will communicate it's "plan" to the market, ...

I've sold the majority of my Bond positions as they have "rolled over" and are still in decline- I've also reduced the equity portion of my holdings- with a significant % now in cash-

I finally finished reading several books by John Bogle, and he makes a very compelling case for a long term investment portfolio using low cost index funds as the core portfolio.

The hidden costs of managed funds- i.e. mutual funds that have trading costs with stock turnovers, various fees etc and an annual expense cost - will often end up taking 60% of the investors monies in fees and lower performance. Over a longer term horizon, this amounts to a substantial underperformance.

The very existance of financial advisors lies in their ability to "sell" their methodology to investors -who -as an aggregate underperform the market benchmark- over time.

Bogle has many books- and makes a well-documented study of the mutual fund industry and investor's returns. "The Clash of the Cultures" - Investment vs speculation is the latest.

|

|

|

|

Post by sd on Jun 22, 2013 8:22:24 GMT -5

This week I further trimmed my IRA investments, - I'm over 90% in

cash, as there is no safety in Bonds - A very sharp sell-off in the bond positions I am offered, finds the "safe" bond position having

given up it's meager gains this year and is taking from the gains of 2012.

Typically, my attitude toward the market's direction is usually wrong; based on fear and tends to hold me back- I acknowledge that that attitude will cause a portfolio to be seriously ill timed and underfunded.

Presently, I am content to simply be a market watcher and see what unfolds in the months ahead.

Sleeping easy

sd

|

|

|

|

Post by sd on Aug 2, 2013 19:03:05 GMT -5

I have failed to update this thread on longer term investing- In my IRA, I went back into the market in growth funds, and sold ALL my bond funds as they had rolled over. I am holding approx 25% IN CASH - the remainder is distributed in growth & fundamental assets. I started this week to sell-off (take profits) on a small cap fund. I'm thinking it may not be a bad idea to monitor the trend and be ready to reduce the positions as new highs get made. One can get the idea that the market is overbought- or oversold- as justification for one's financial decisions- The true barometer of whether that is true or not, is what is the consensus view of the market's participants? If the momentum continues higher, the consensus is that stocks are worth their value- appreciating. The market determines what is the appropriate valuation is appropriate at any moment in time. In the shorter term, those valuations may become overvalued or undervalued- The Efficient market theory suggests that -in the long run, stocks will be fairly valued. Momentum investing /trading tries to take advantage of perhaps what is a short term excess . Does momentum investing have any credence? This morningstar article would suggest that is does- seekingalpha.com/article/1350651-seeking-alpha-momentum-investing-with-etfs |

|

|

|

Post by sd on Aug 3, 2013 18:53:19 GMT -5

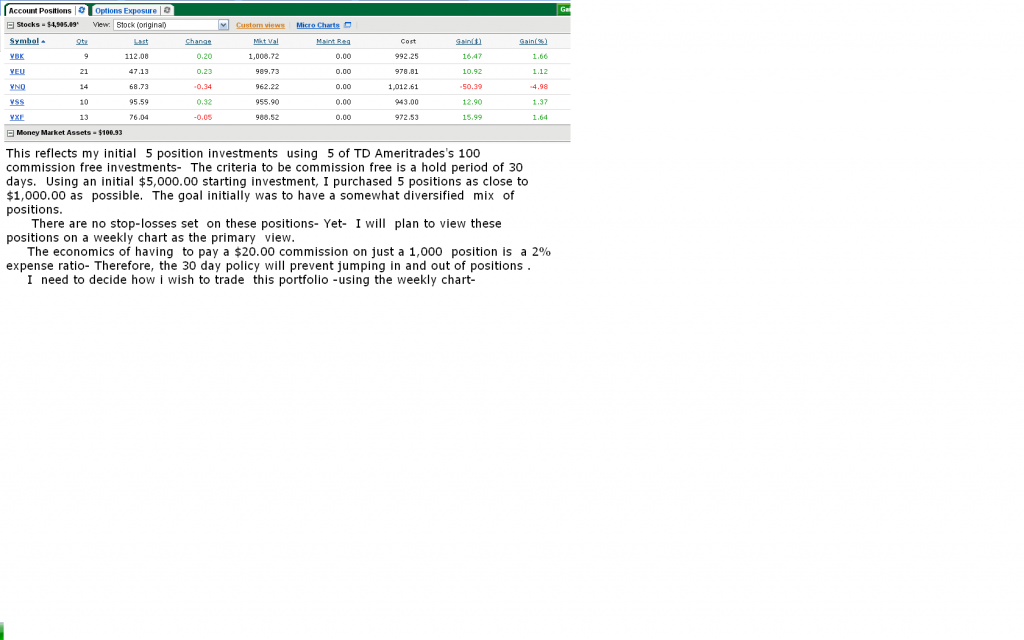

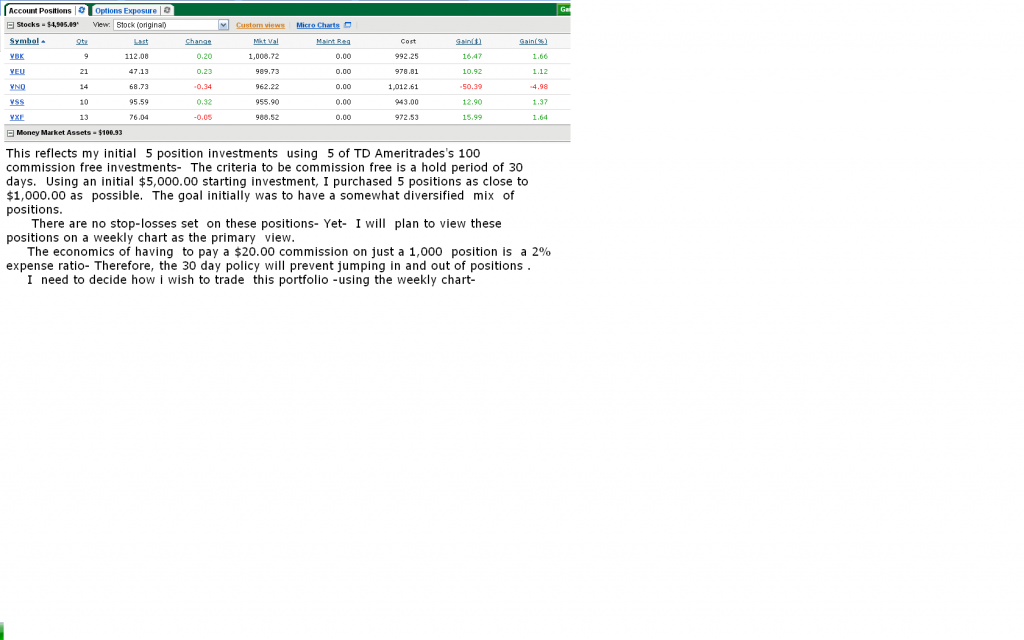

I indeed finally had taken the steps to make some initial trade selections using TD Ameritrades commission free ETFs. The caveat there is that you must hold the position for at least 30 days or you incur a $20 (I think) commission. i essentially divided the initial $5,000.00 account into 5 positions. Presently, these positions do not have a stop-loss attached. I may choose to try a stop based on elements of a weekly chart- I think i made the initial purchase 2 weeks ago- not a lot of momentum - The one losing trade about balances out the initial gains from the other 4.  |

|

|

|

Post by sd on Aug 4, 2013 10:26:51 GMT -5

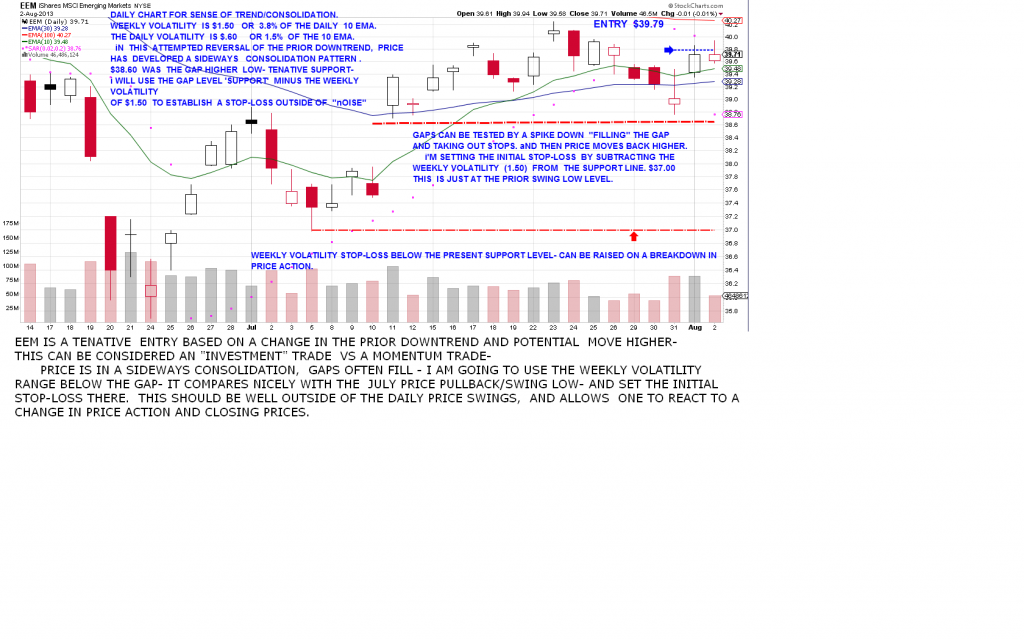

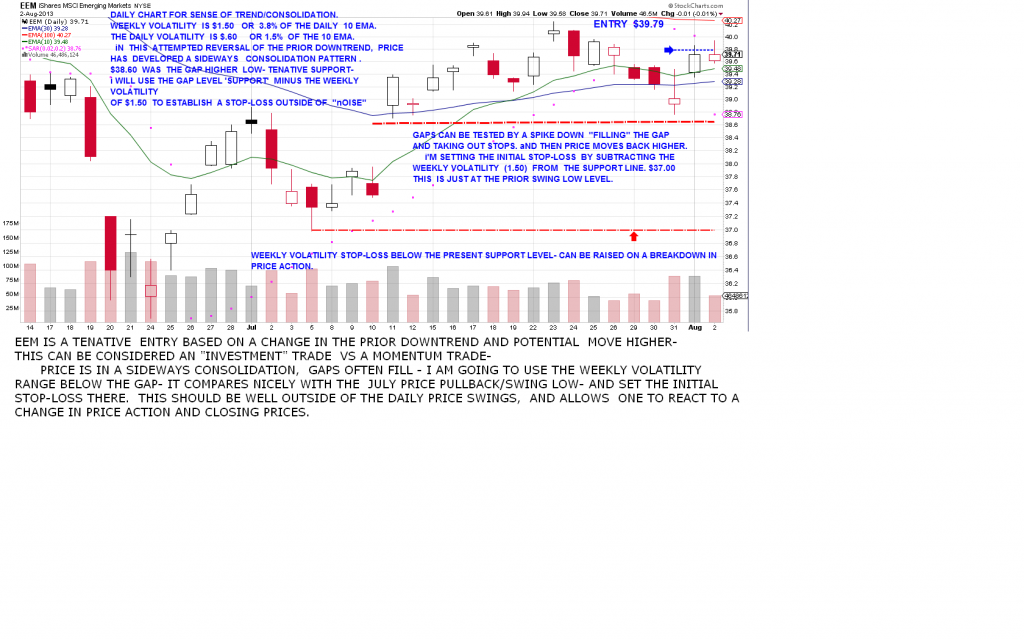

EEM - Emerging markets ETF has been selling off since January, and the past 5 weeks have seen a bit of a rebound- price is now in a sideways consolidation range- since this is not a momentum type of trade, but a more tenative "investment" based on perhaps an oversold condition- I'm not using the 60 minute chart initially- but the daily for the larger perspective. In recent weeks , I was stopped out of my other positions , only to see several of them immediately turn and rebound higher- Yes, I had gains on those stopped out- but by the time the trades cleared and I could take the required reentry on the moves higher (No free cash) they had made substantial bounces back higher-My gains would have been double-on several - Part of the issue was my inherent desire to protect gains on what was a few days of overall market weakness-affecting all of my positions. Nothing wrong with protecting some gains or reducing losses, but I had perhaps allowed my fear of loss to also cause me to cause me to lose out on the resumption of the trend higher- So, one has to have a systematic approach- and I have been looking at the average volatility range as something to consider to keep a stop-loss outside of what is average volatility- and the spike down that catches the stop, only to see that be the low- The closing price is much higher- As I look to make my ' investments' portfolio also protected with a stop-loss- iI think knowing what is the average volatility one should expect of price action is essential in determining the stop-loss and perhaps the position size of entry- To be outside of intraday market noise and minor retracements, I am looking to study the use of the weekly average volatility below the 10 ema as a trailing stop-loss that should be exempt from most intraday spikes - I will also be tenatively using this similar approach in my recent hourly trades- and that should give me time to react to a closing bar that is simply making a minor pause- The opportunity then is to react with all or a portion of the position. In the momentum category- price action and established consolidation areas that made a support level should be considered relative to the width of the stop- Should the market take a hard and fast turn South, this wider stop would get me out - but at a sizeable loss if I did not have time to modify the trade. Enough Sunday morning musings-  |

|

|

|

Post by sd on Aug 4, 2013 16:19:18 GMT -5

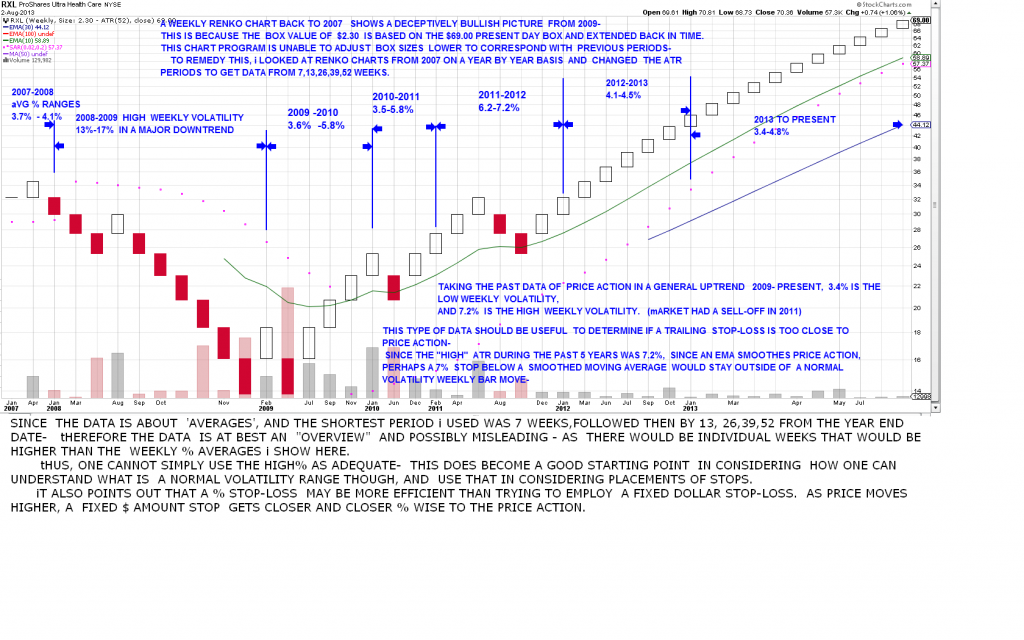

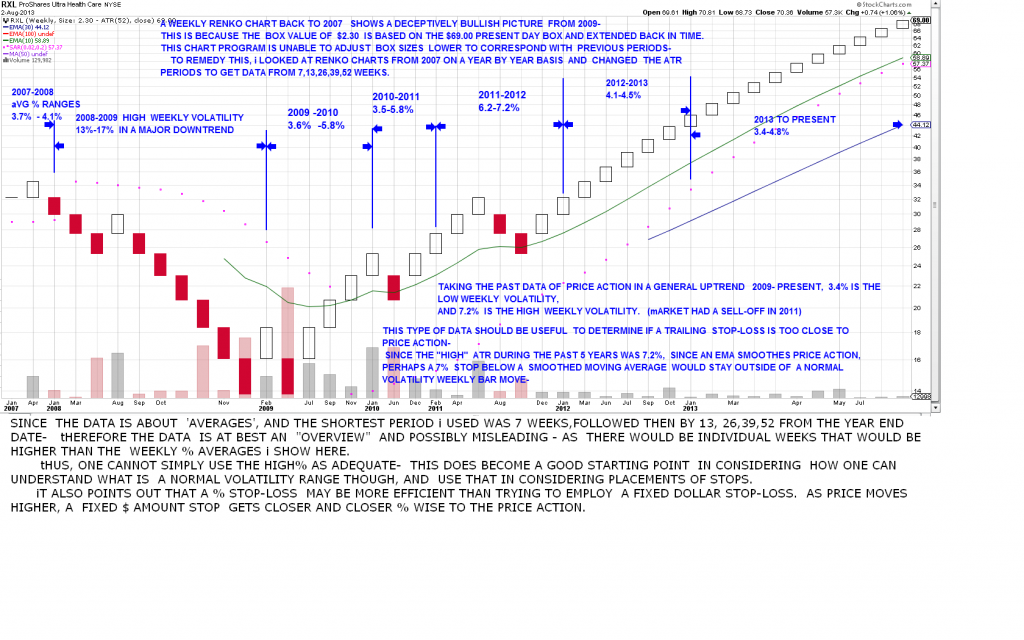

IN looking to establish some longer term positions (trend permitting) the question of stops is critical - with a desire for a longer term position, one method is to hand off-the trade from a 60 second chart, to a daily chart, to a weekly chart -and ideally a longer term hold. Maintaining a winning position in the process- With each progressive step up into the next higher time frame, the price movement becomes larger- price swings become wider, and a stop-loss will get progressively larger as one steps up to a larger time frame. While we understand that different time frames require different stop-loss levels, as the need to allow for normal price movement (volatility) widens , how to calculate that stop may vary- One method that should have merit across all time frames is looking at the ATR Average True Range of the price action. To try to compensate for the inaccuracy of using a present day RENKO chart going back in time to a lower price range, I went back and used 1 year increments from 2007. I checked the 7,13,26,39,52 period ATR for each year, noting the high and the low ATR dollar amount of each period, and then calculated what that dollar amount equaled in a high and low % range. The goal is to understand price volatility, have stops outside of the normal volatility swings, but to be able to respond if a closing price violates that time/frames trend direction and needs to be responded to. RXL- is a position I have held for a number of weeks- Health care sector- CURE is the leveraged big brother- I'm going to see if RXL can "graduate " intop a longer term hold, while CURE- with 3x the volatility- will likely stay on the 60 minute charts. Should the markets have the often talked about overdue to sell- event- then RXL may lose more if I apply a weekly chart, than does CURE on a 60 minute...  |

|

|

|

Post by bankedout on Aug 5, 2013 12:34:55 GMT -5

I think using a % based stop instead of a $ based stop makes sense for longer term trading/investing.

It is like looking at a logarithmic chart instead of a linear chart for long term or large price moves. It keeps everything in perspective.

|

|

|

|

Post by sd on Aug 5, 2013 19:26:27 GMT -5

Yes, I agree you are correct. A % stop automatically should adjust larger as price increases. I'm assuming that is true with IB-

I sent an e-mail to stockcharts support forum to see if there is a way to have a RENKO chart that would similarly automatically adjust logarithmic to declining price values- I don't think it would work because each period ATR would overlap the prior period-

Understanding what is the "normal" % volatility over any one time period- hour,day-week- - should be useful in determining

whether a stop is within normal volatility striking distance.

As an application, I think a % stop calculation would be good for a momentum trade as long as the trend stayed intact.

I'll carry this thought further in the other thread.

|

|

|

|

Post by sd on Sept 20, 2013 17:46:25 GMT -5

Have I already written on Brown's book in this or the other thread?

If so, sorry about the recap-

Brown is an escaped stock broker (sales/pitchman) and now is an 'advisor' and out of the Wall Street churning and perpetual selling for fees and commissions.

He writes an irreverent recollection of his years in the industry, living through the 2008 melt down, and gives what amounts to an early obituary of the financial services industry as we know it.

A Good read to gain an insider's perspective to what is the real motivation of the financial industry (Guess what Dorothy, it is not You they are most concerned with)

There is no stock trading style or guidance in his book- A number of times he references lower costs and ETF's and that the majority do not beat the "index" - So I think he could easily be in the ETF camp ......

The take-away from this book is a determination to take your investment dollars and don't pay large fees or commissions- Either find a for Fee advisor if you have ample assets, or learn to do it on your own-

|

|

]

]