|

|

Post by bankedout on Nov 18, 2012 8:43:41 GMT -5

I can't even get to photobucket.com any longer. Now I can only access their beta site. beta.photobucket.com Maybe they will get things straightened out soon? I hope so.

|

|

|

|

Post by sd on Nov 18, 2012 9:56:23 GMT -5

I normally use IE- -I use XP and am having troubles with it lately- I accessed Photobucket through Mozilla Firefox, entered my account, and clicked on the restore to earlier version link- It brought up a question box, asking WHY- and after filling that out, it proceeded to go back to the original - I was then able to go on IE, and access my account albums- I'm assuming everything else will function, may start to use Mozilla- XP has been very stable and relatively trouble free on this older computor- Virus scan- AVG is up to date- Glad things are back to normal-  |

|

|

|

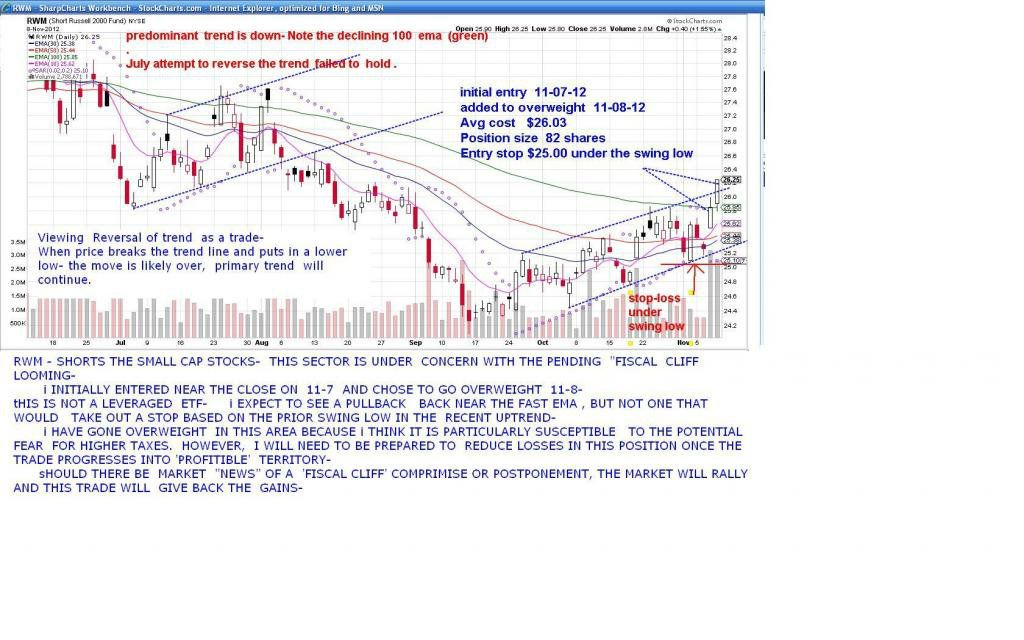

Post by sd on Nov 18, 2012 11:57:06 GMT -5

RWM SAW A PULLBACK ON FRIDAY following some "positive' talks on the fiscal cliff- regardless of the source, the upwards momentum has been broken as indicated by the price action on the day. I'm adding a chart here of my raised stop- As an eod trader, i can only review what occurs on the hourly bars after the market is closed. I look to price action- support & resistance levels, and individual bars, but I also tend to rely on moving average indicators as well I like to refer to the Parabolic Sar in trending periods as a reference- Renko charts are also volatility based, and I like the idea of understanding what the normal "Average" price volatility is and should be planned for- I have not studied a way to really apply the renko chart yet though- but is something for future consideration- I tend to be more comfortable buying price breakouts- as they seem to be more "probable" trades- particularly if they are in the direction of the trend. Bankedout has pointed out that he prefers to be a buyer on a higher low- which greatly reduces the loss % . One could have more swings at bat with that approach, with a greater chance of a winning trade yielding that much larger of a gain, and the missed swing losing that much less- Now that I've got Photobucket behaving properly, I'll post some different charts as time allows, trying to do an objective analysis & 'backtest' of specific approaches . I'm driving some 2 hrs ea way on a new start project- Ideally this will be only temporary - with a closer project in Jan. We'll see. I expect this trade to get stopped out at the open- However, there is added volatility in the middle east, and concerns still about Europe, and so the "good news" of efforts to resolve the fiscal cliff may be overshadowed by other market concerns- The only thing I can do is react to what the chart is telling me- "lock in Profits" on this weakness- SD  |

|

|

|

Post by bankedout on Nov 19, 2012 11:22:31 GMT -5

I'm glad you got your Photobucket working again.

"I tend to be more comfortable buying price breakouts- as they seem to be more "probable" trades- particularly if they are in the direction of the trend.

Bankedout has pointed out that he prefers to be a buyer on a higher low- which greatly reduces the loss % . One could have more swings at bat with that approach, with a greater chance of a winning trade yielding that much larger of a gain, and the missed swing losing that much less-"

I'm not entirely certain that either entry point is more probable. They both have their merits. You get in wherever you can find a good spot that makes you feel confident that the trade will go in your favor. Trading with the trend certainly helps. However also keeping in mind the trend in other time frames (and the trend of the overall market [if you are not trading a major index]) is important.

Best of luck in your trading.

|

|

|

|

Post by sd on Nov 23, 2012 11:55:25 GMT -5

"I'm not entirely certain that either entry point is more probable. They both have their merits. You get in wherever you can find a good spot that makes you feel confident that the trade will go in your favor. Trading with the trend certainly helps. However also keeping in mind the trend in other time frames (and the trend of the overall market [if you are not trading a major index]) is important."

I think my comment is simply a reflection of my personal bias-and actually I need to review and challenge some of my long held trading Bias's going forward.

as you point out, the net probability is actually not built in the specific time frame, but is in the way the trade is managed.

Each trader can develop his/her own methodology that achieves-for them- higher probability results-

I think an awareness of the higher time frames/ trends is indeed important- It can give a perspective of the present time frame move and where it lies within the larger time frame. As well as significant levels of price support & resistance.

Perhaps one should also consider seasonal trends in that larger perspective-

|

|

|

|

Post by bankedout on Nov 23, 2012 13:07:13 GMT -5

I think we all need to constantly re-evaluate and adjust everything to what we see and know in the present. This should be viewed as a journey without a specific destination. If you are interested in learning from what I consider to be 'The Master': www.traderslaboratory.com/forums/trading/12797-article-series-dbphoenix.htmlSpend some time poking around those links. Best of luck as always. |

|

|

|

Post by sd on Nov 23, 2012 14:11:37 GMT -5

I have been fermenting the concept that I need to be willing to take greater RISK in order to potentially see greater reward. By Greater Risk, I am looking to take a larger position size, or add to the position as it progresses- Also, Greater Risk implies greater volatility- and so I decided to dabble in some leveraged ETF's for some short term trades. As I had closed out the RWM trade 11-19 $26.46 as price rolled over, I made a very small net gain- but the timing was right- LONG AGQ 11-20-12 30 shares $52.97 LONG TNA 11-21-12 30 SHARES $52.40 11-23- MARKET RALLIES HIGHER- added 10 AGQ $55.47 Buy- 15 TQQQ- $50.28 @ 11:37 buy 15 TQQQ $50.56 @ 12:47 BUY 10 FAS $107.15 @ 12:48 MY Bias is that the market is very vulnerable, and that these trades need to be followed with close stops on an hourly chart. I will review the trades, the larger timeframe charts, and adjust target  s/stop-losses.- |

|

|

|

Post by blygh on Nov 23, 2012 16:42:13 GMT -5

Gutsy move buying a precious metals stock (AGQ) in a non-inflationary environment - but then I have not been doing well - at least on a short term basis So what do I know?

Blygh

|

|

|

|

Post by sd on Nov 23, 2012 18:49:13 GMT -5

As you can see from my account balance, I have not been doing well myself- particularly the past 6 weeks giving up the greater part of the slow gains I was accumulating in a trending market. I don't know that I would call the trade "Gutsy"-because i don't have the conviction of why this move occurred or where it could be heading- I also do not understand the market rationale for why at times certain things- Gold, precious metals- move in tandem with the market and then in spite of the market- Just have to trust what the chart suggests, and see if I can adapt my trading to it. I can only view this through a faster time frame chart , and hopefully make the right call by protecting some profits while giving each trade enough room for "normal" volatility, and the opportunity to move higher -on a day by day basis. While I am putting on more "Risk" in my trading account, I have used this week's up move in my IRA to close completely out of even the target funds with a growth component, and focus primarily on bonds that have been consistantly performing- I saw that you also were raising your exposure to bonds, and I think with the unknowns ahead , (resolution of the fiscal cliff ) that capitol preservation is prudent. Instead of going further overweight in bonds, I have raised more cash in a money market account. Chart attached is not a recommended bond fund- It is one of the bond funds offered through my employer's sponsored IRA- There are substantial differences in bond funds, and I really don't know much about them- I have exposure to 5 of the offered bond funds, and I chose those that offered better charts & returns historically- The point of the chart is that if you look at the relatively plain jane simple trend of the bond fund, and compare it with the SPY, You find that in this calendar year, you got similar returns YTD , but look at the volatile swings in the SPY relative to the slow and steady Bond. aT SOME POINT , BONDS may lose their upside momentum- and become a losing proposition- but a look at the charts will let one know when that is occurring- Good Luck, SD  A chart I viewed earlier this year in studying the swings of the fund:  |

|

|

|

Post by sd on Nov 23, 2012 21:40:41 GMT -5

LOOKING AT A 10 YEAR CHART COMPARISOM OF THE BOND FUND VS THE SPY FUND- LET'S FACE IT- If you were an investor, you would prefer to take the lower volatility and the higher reward that the bond fund has given. Of course, if you changed the time frame to when the market had tanked to it's low- the spy performance outperforms the bond performance- due to TIMING. The reality of a trading approach is that it tries to improve on an investment approach- by taking signals that are repeated and essentially time the market fluctuations- to improve the gain periods, and to lessen the losing periods. Is this not what we hope to accomplish in our trading? We hope to find a method whereby we maximise our gain while reducing or controlling our potential losses when the trend or volatility of our positions does not favor us. We have 2 major factors- Trend & Volatility- that we need to accomodate in our trading. I somewhat got off tangent, but as I reviewed and modified my IRA holdings & exposure today, it strikes me as relevant- Bankedout previously posted some suggested long term approaches to trading the markets- and I think there is value for actually doing a comparisom "backtest" -if one knows what their investments will be focused on. I think any "Backtest" should start with a long term time frame approach, and what works, what does not, and then to drop down into faster time frames- Without getting too complicated, I think a backtest using enntry/exit -raised stops- on a moving average would be a good starting point. There are a number of variables- If one trades a long position, one could also go short or use a pairs trade to take advantage of market turns- The question becomes- can one devise a systematic approach to the markets that can be effectively applied that improves the net results? This should be a 10 year chart of the Amhix vs Spy:  |

|

|

|

Post by bankedout on Nov 23, 2012 23:09:15 GMT -5

In long time frames dividends can add up in addition to price movement. You should factor that in your long term decision making and analysis.

|

|

|

|

Post by sd on Nov 24, 2012 14:14:14 GMT -5

"I think we all need to constantly re-evaluate and adjust everything to what we see and know in the present. This should be viewed as a journey without a specific destination. If you are interested in learning from what I consider to be 'The Master': www.traderslaboratory.com/forums/....-dbphoenix.htmlSpend some time poking around those links." Thanks for sharing the Link- I will check it out-this weekend. Also- Yes- pointing out the added benefit of dividends that needs to be included in a longer term approach. Yes, as a journey it's an ongoing process of discovery- both personal and market, and how we adapt- or don't..... |

|

|

|

Post by sd on Nov 25, 2012 10:43:08 GMT -5

The RWM trade was just marginally profitible- Had I held onto it with a wider stop, it would have slipped into negative territory for a losing trade. The purpose of a recap review of the trade is to see if I should revise my present approach to include taking some quicker profits at targets, Methods I use to trail stops, and combining the look back at the slower time frame. While the RWM trade is closed, it is a good starting point. I have 4 active positions that I will need to consider how to make adjustments- targets & stops- for tomorrow. the 1st chart is a recap of the larger trade, hourly chart. the second hourly chart will be a closer view of just a few days with the "breakout" approach.   |

|

|

|

Post by sd on Nov 25, 2012 11:22:24 GMT -5

HOURLY CHART WITH PRICE, VOLUME, PSAR, 10 & 20 EMA  |

|

|

|

Post by sd on Nov 25, 2012 12:59:46 GMT -5

this chart illustrates what i think i would have done as an EOD trader responding to the intraday price action chart- As a intraday trader, i would likely have reacted differently. the goal is to take advantage of as much of the trend as the chart & market will provide-using the EOD analysis- allowing swing trades to develop . i kept the same breakout level as the actual trade, recognizing the existing trend channel and recent price high- as the price chart shows, potentially there could have been a lower entry inside the channel using the double bottom that occurred on a mid channel pullback- i would likely not try that specific trade entry though- thinking it would be turned at the upper trend line. as part of this review of how I potentially would have traded price bars alone, i am doing so with the hindsight of the known chart in front of me- In my actual trading, while i look at the price action, i use the training wheels of indicators as a reference to what price is doing- not included in this chart is the analysis of potential higher frame support/resistance levels- that should be included in one's expectations for the possible outcome of the trade, but -as this trade illustrates- one has to be prepared for the unanticipated "news" that can move the market -in either direction. Also, i think it's prudent to have an initial portion of the trade lock in a profit at some level-  |

|