|

|

Post by sd on Nov 2, 2012 18:43:57 GMT -5

The FLR trade indeed was ill timed, and price gapped down lower at the open-took out my stop-(sold 20 $55.00 @ 9:30 am), So much for my thinking they would benefit from some reconstruction- The dollar is higher, and Gold has broken 1700- I went short Gold today with DZZ @ $4.45- I expect 148- 150 to be substantial support for the GLD- Is the market sell-off coincidental with the rise of the dollar- no further QE3 they say. I will watch the dollar along with the DZZ trade. I bought a couple of Shares of AAPL this afternoon as price continued to decline- I was getting ready to go to early voting, and I had a limit for AAPL at 578 and price was holding (at the time) in the 580- range- It held there for a few minutes, and I decided to modify my order to a buy-stop @ $581 since price was below- I was filled shortly after placing the order, took a screenshot and started to annotate the chart- Then left to vote. I see tonight that price pushed down to 574.75 Low on very high volume.- The chart screenshot I have was taken at the Buy point mid afternoon and is not the close- At the close there was not a sign of capitulation, with the close being quite near the low- It makes me concerned that my perceived support level 560-580 range may not get the Buyers to step in here- We'll see what Monday brings-  |

|

|

|

Post by bankedout on Nov 3, 2012 11:51:51 GMT -5

Here are my thoughts with AAPL

First and foremost, always trade the right side of your chart.

Second, if a stock is NOT trending (range bound) you can base a trade on something in the past providing support in the future. However, it is always good to see some evidence of buying in the present to support your theory.

In a trending stock, you look for signs of support within the trend. Not in the past.

Clearly AAPL is trending in your timeframe currently.

Those are my ideas and opinions. Best of luck to you in your trading!

|

|

|

|

Post by sd on Nov 3, 2012 20:33:55 GMT -5

You are correct in your assessment of AAPL- and the advice about the Right side of the page LOL!

I do Know better, and ALWAYS- except AAPL expect to see evidence of a reversal of the down trend- And i know that usually that first reversal fails, and it is only after subsequent basing and reversal attempts that a buyable bottom is put in-

The trade was impulsive, but had some precedent- as I had long ago previously said that on a pullback, AAPL should find support within this 560-580 range-

Previously, I had applied the similar Buy level and bought AAPL at - I think- $538 on the pullback- just above what I perceived to be a logical support then- Unfortunately while I was correct on the support level at that time, I sold the stock after it moved higher on a pullback and did not hold for the run up to $700.

So this was a kind of HUBRIS TA trade and I deserve the results

that I receive- I will likely elect to set a stop-loss just below $560 on the trade- with a lower level of $530 a do-or-die- for the stock-

Should the stop be hit, I will realize a $50 loss or approx 5% on this trade-

I hope my impulse trades will be offset by gains in my Gold Short- DZZ, and perhaps BAC will push higher-

I think the AAPL weakness is AAPL specific and not a market factor- I think AAPL has indeed lost it's momentum with missed earnings, early release of minor products, increased competition in the net books-

My wife purchased an ASUS transformer 10.1 net book with most of the features of AAPL- including Gorilla glass screen, removeable 32 GB memory, front and rear cameras for video conferencing etc, and the sales folks at BBUY were telling her that it was a much smarter Buy than the comparable AAPL- Perhaps they simply had better margins for the product?

Regardless, AAPL is indeed under pressure, but I felt compelled to take what I felt was an early TA trade- I do want to note- something that DG had pointed out to me some years ago- That moving averages- By and of themselves- do not provide support- In the past few days I have heard several TV -fast money folks say that a buy at a such and such moving average- or it "held" the moving average-

AAPL blew past it's 200 without a blink- 281- and coincidentally that was where I jumped in- because of time- and vascillating price action.

I actually had not intended to step back into the markets- as the new Highs were getting choppy- That was also likely a good preservation decision- Can I blame the after effects of the Anestesia from a Friday am colonoscopy? LOL!!!

Unfortunately, my impulse trades on Thursday saw a loss on FLR- and so my Presumption about FLR being a stock that would benefit was indeed not agreed upon by the market.

The remaining positions - MAN are vulnerable to the same personal Assumption- and I will adjust my stop-loss accordingly-

The GOLD short trade (DZZ) is a different component however- I see the GLD as holding long term hard support at 148, and so we have some downside from here (162) . As the dollar is moving higher, Gold is weakening as the reserve currency trade-

I will treat this Gold Short trade with an eye to the dollar-

I'm not sure how the outcome of the election would affect this trade?

I'm reading the updated version of Covel's "Trend Following" and have just started it essentially- Interesting so far-

Masonson's book lists November as historically yielding a 2% upmove- but the past 2 novembers have been losers- So seasonal Buyers beware! With an election on the cusp- there will likely be a substantial market reaction- Cash might be the prudent place to be-SD

|

|

|

|

Post by sd on Nov 6, 2012 16:48:32 GMT -5

Markets all closed up- with commodities, materials, energy all up 1%+

Gold rallied as well-closing back above $1700- putting my DZZ trade well into losing territory- although not yet hitting my stop-loss- I considered trimming the position by 1/2 but thought I'd see how the market reacts to whoever wins or loses tomorrow-

I added to both the C and BAC positions this afternoon near the close-both are pushing higher, along with the other financials.

I decided I'd sell AAPL - With the markets rallying, AAPL opened higher @ $590- but then sold off the remainder of the day- I was expecting a bounce off what I perceived as a support level, and clearly some others thought so as well with the gap higher openbut it clearly did not have buyer's support-

After the extended downturn, and with the markets in rally mode, I anticipated that AAPL would have a better showing-

and not close as weakly -

During the day, the talking heads were all trying to put a spin on WHY the markets were rallying and for Whom -

The spin on an Obama win favoring Gold is that QE3 and Bernake will continue to support a weak dollar-- and I assume a Romney win would have a different market perspective.

|

|

|

|

Post by sd on Nov 7, 2012 9:27:03 GMT -5

Post election-

Futures lower- Obama wins- fiscal cliff an ongoing US concern-Germany is reportedly weak- fueling ongoing weakness in Europe-

Bernake & QE#3+ should keep a weak dollar - Should cause Gold to continue to move higher -

More Regulations for the banks-

I'm on the wrong side of the market with my trades- with yesterday's greens now showing red across the board.-

Particularly C & BAC- I'm going to watch the market (vacation day) and see if I sell and take the loss, or ride the open lower-SD

|

|

|

|

Post by bankedout on Nov 7, 2012 11:37:02 GMT -5

You were right sd, that the markets would choose their direction post election. Today's selling appears pretty convincing to me.

|

|

|

|

Post by sd on Nov 7, 2012 13:21:47 GMT -5

Convinced me by Golly!

ODDLY enough my Gold short is gaining a bit- doesn't make sense to me- I did sell 1/2 BAC & C - but chose to keep the remainder- I may regret that choice-

My remaining positions hit their raised stops in MSFT & MAN

|

|

|

|

Post by sd on Nov 7, 2012 15:00:01 GMT -5

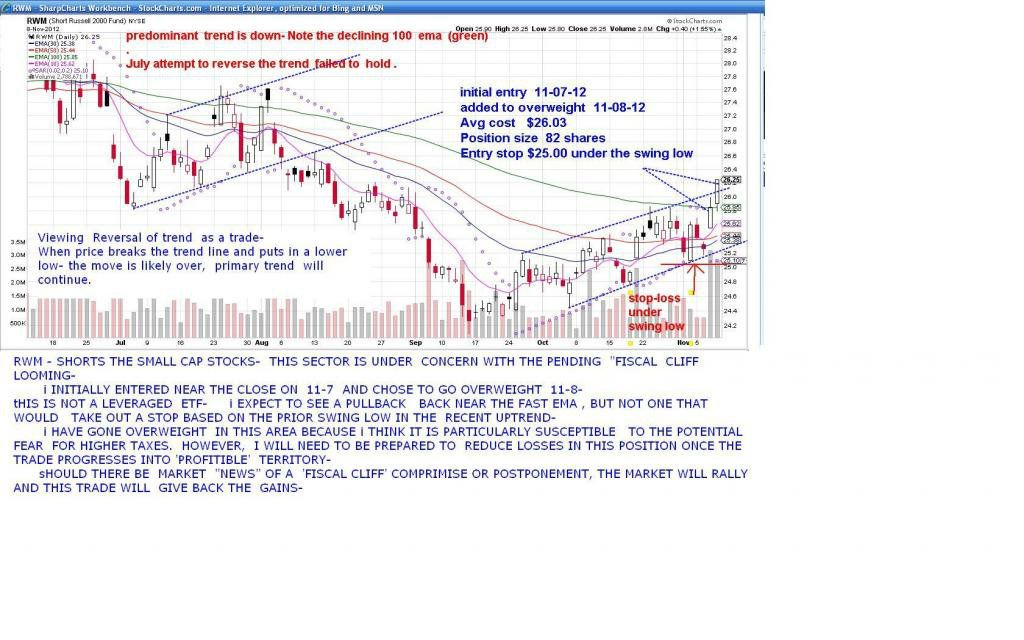

With the steam out of my sails , I followed Bankedout's lead and took a position in RWM- it's an inverse of the small cap 2000-

It is not leveraged-but it does rebalance and so may not yield a 1:1 This may not have been a good inverse to select from .

I don't have the wherewithall (stomach) to step into the 3x leveraged markets-. I'm hoping the lower volatility of this will allow me to stay with this one as long as it's trending higher- SD

|

|

|

|

Post by sd on Nov 7, 2012 15:22:32 GMT -5

I have also taken the time to transfer monies in my IRA- That is limited largely to mutual funds-

I have a large bond component already, and today I took monies out of several income & dividend focused funds- I put some into more municipal bonds, and some into cash. Reportedly dividends may be viewed by the Obama admin as a source for higher taxes- I'm expecting these funds to sell off sharply with the market over the next few days.

The Bond components- particularly the muni- should be the beneficiary of the sell-off-

SD

|

|

|

|

Post by bankedout on Nov 7, 2012 17:56:01 GMT -5

Everyone has their own level of risk tolerance.

Remember I am playing with just profits (I withdrew all of my contributions previously).

Good luck to you.

|

|

|

|

Post by sd on Nov 8, 2012 21:06:57 GMT -5

RISK Tolerance is a Big determination of one's end results-

Without RISK there is also not the opportunity for substantial Gain. Most of us -self included- view limiting our Risk as a prudent approach- Studies indeed show that most are inclined to not be willing to take the larger Risk - with the net possible large gain- once the potential Loss is factored in- We tend to be first Risk adverse- to maintain the present status quo- SLOW and Steady wins the race said the tortoise to the Hare! We have been taught that from childhood!

Society tends to teach us to be Risk Adverse vs Risk takers- and perhaps this applies to our work, our relationships, our trading- Some of those big Risk Takers- achieve the higher rewards- where those that fail go down into anonimity-Those are the people that did not follow the norm- They were willing to try to outperform , some had failures, and continued to try - and eventually persevered- Those are the people that we look up to-

History rewards those Risk takers that succeed- and ignores those that fail-Business and Investing Success embrace those that "succeeded"- and most did so by taking larger Risks Along the way- Many are forgotten- who took larger Risks but failed for any number of reasons-

reading Covel on 'Trend Following"- those outstanding traders continued to apply their methodology - in spite of drawdowns-- and became famous for their outstanding long term performance results- not withstanding periods in which their performance was considered to be terrible- but they persevered and ultimately saw outsized gains that made the previous losses insignificant-

What they had in common was a belief in their system- and their continued application of that system -

Those that are here don't have a well developed computerized system with a financial account that can withstand periods of extensive drawdowns to ultimately be proven right-

Bankedout's aggressive 3x trades have caused me to reevaluate my relatively 'safe' trading approach- The net result of the past year was minor gains and minor loss and managing the relatively small swings.

I have realized that I am not very tolerant of RISK-

I act defensively in my IRA to protect present gains and shield myself from losses- This is prudent considering my time horizon is relatively close- within 5 years-

What about this original thought- ?

Should my trading account be managed as 'safely' and conservatively as my retirement account?

The answer is - "only if I want to see the same results"

If I want to see the same results, I should simply 'Rollover" my monies into my IRA account-

I added to the RWM trade today- An unleveraged short of the Russell 2000- to an overweight position-

This is not simply a chart trade- It's success depends on the politicians- Already, there is a "news conference" where both the Republicans and the president will speak at different times tomorrow trying to say how this 'fiscal cliff overhang ' will be resolved-

As we know by history- Reversal of trend trades fail until they succeed- My goodness, there is some profound trading truth buried in that Yogi Berra statement-

The truth is, we tend to believe what makes sense to us, and to think that the rest of the world views it the same- and we are often misled by political statements and momentary resolutions that have no meaning but to passify the markets in the short term-

We should all likely learn to trade only on Monthly charts- because the truth is more likely to be found there-As well as the prevailing trend-

SD

|

|

|

|

Post by sd on Nov 8, 2012 21:21:47 GMT -5

Photobucket has changed their format- I am not sure this will be a "proper" size chart  |

|

|

|

Post by sd on Nov 15, 2012 21:38:38 GMT -5

Short update-

Still holding RWM- tried to add to the position today but price never stepped back as anticipated-

Stop was not executed in BAC today as anticipated- went up $.15.

Working more and enjoying it less- Traveling almost 4 hrs/ day-

I like Bankedout's idea of more focused & narrowed trading- I was hoping to hold the BAC as a core position, but it is pushing my limits based on a weekly hold-

I expect the news one day will give rise to a big market rally-as the financial cliff will be deemed to be postponed by some words of agreement-

In the IRA, the bond accounts continue to go higher- SD

|

|

|

|

Post by sd on Nov 17, 2012 19:23:49 GMT -5

I cannot access any library files in photobucket- Testing a photobucket img file I had linked to- brings me to photobucket without a visible photo- Copied the img link to see what gets posted  |

|

|

|

Post by sd on Nov 17, 2012 19:30:14 GMT -5

OK, The photo link works- so the picture is hosted-

I had recently "upgraded' to a new photobucket format-

There is nothing shown in the library or under albums, yet the photos are still hosted - I cannot get the browse button to do anything- I have tried to click to revert back and nothing happens-Annoying indeed-

I am getting quite frustrated with photobucket-Last week I had downloaded the desktop application, as well as going to their newer format- Now I am unable to go back or access any library files- I am unsure that I did not somehow open a "new" photobucket account - and that is why I do not see any existing files- Photobucket recognizes my access from this computor-and brings me to the same start page-

I will try to access Photobucket from a different computor.

Any suggestions or similar issues?

|

|