|

|

Post by bankedout on Oct 4, 2012 11:25:18 GMT -5

My concern with BIOS at the current price is that it might need to deal with a bunch of shareholders who saw their stock go under water from this price level in the past. However, you never know for sure if resistance will re-materialize. If/when you see it stall, it might be time to hit the exits. That is my opinion.  |

|

|

|

Post by sd on Oct 4, 2012 18:49:17 GMT -5

I appreciate the Heads Up Bankedout-

You are correct- Historically, BIOS is at the 9-$10 resistance range viewed on the monthly chart- The one positive, is that price has actually closed higher in September than the prior closes -

I am inadvertently overweight the position- My initial entry cost basis was just below $8 ., with my overweight cost now $8.55.

I periodically adjust stops higher-

Thanks for the input- I've decided to apply stops with the RENKO charts on positions that are trending and are above the breakeven status-

Thanks for taking the time to post a chart!

Stops are adjusted higher- SD

|

|

|

|

Post by sd on Oct 17, 2012 18:32:48 GMT -5

I'm not keeping up with updating my trades very well-

BIOS did stop out over several days on split stops levels.

HDGE stopped out Tuesday, and VIXY stopped out today-

I had an open Buy-stop order for DSCI which was filled on the breakout higher today

DSCI

PDLI biopharma position is doing well-

Along with the rising housing recovery, I had taken a position in SLM, and that position is now below break even, but not at my stop.

Acct value has lost 2% in the past week or so $9198 was an improvement over earlier this week.

With the FED backstopping the markets, and perhaps the markets think Romney will succeed, or at least his standings in the polls have improved- I will focus on areas that are showing strength.-SD

|

|

|

|

Post by sd on Oct 22, 2012 18:52:12 GMT -5

On vacation this week, but instead of spending time on the computor, and trading, I'm working on the house- adding new windows, siding, and an R7 rigid insulation to the exterior. Should pay dividends in energy savings/comfort for years to come. (doing some Bow hunting as well in the early am and later pm) Although we saw a bit of a late day rally, the market has been weak- and I've seen my most recent winning trades rolling over- and losing trades hit my stops. I simply sold everything today, closed all positions, and will look to tip toe back in when there is a sense of directional movement to the upside. My trading decision will likely mimic yeserday's hunt- I went into a stand , and saw nothing, and gave it a few extra minutes- I lowered my bow down on a rope to near ground level, I then untied my lanyard from my safety harness, and removed it from the tree- I'm about 20' above the ground- The metal roller on the lanyard made a mettalic clicking noise as the nylon strap was pulled through the buckle. Immediately, I hear a very loud "Snort" and the 6 point buck that was standing 20 feet away strolls away!- Timing does count- both in Hunting and the Markets. When i resume taking new trades, it will be with the more tactical hourly chart approach vs the wider stop approach I have adopted in recent months. I'm down several percent as I go to CASH and a wait and see attitude. On the IRA accounts, I have a large bond exposure, in various bond funds, Today I shifted monies out of the "growth" funds into a money market as we wait to see how things look going forward. SD  |

|

|

|

Post by bankedout on Oct 23, 2012 9:29:43 GMT -5

I think it is a good idea to step aside when you see your ideas not working as well as planned. The RENKO idea is a good one, however I think it needs to be implemented earlier in a bull market.  The problem, of course, is that in real time, we never know for sure if the bull market will materialize and have a couple of months worth of upside to make it all worthwhile. If/when the up leg doesn't keep going or materialize, the account gets ground down. It may be wise to do both longer and shorter term trading always. Have a couple longer term positions going in hopes of capturing a nice upwards trend, but trading for shorter term profits along the way. |

|

|

|

Post by sd on Oct 27, 2012 18:39:45 GMT -5

"I think it is a good idea to step aside when you see your ideas not working as well as planned.

The RENKO idea is a good one, however I think it needs to be implemented earlier in a bull market.

The problem, of course, is that in real time, we never know for sure if the bull market will materialize and have a couple of months worth of upside to make it all worthwhile. If/when the up leg doesn't keep going or materialize, the account gets ground down.

It may be wise to do both longer and shorter term trading always. Have a couple longer term positions going in hopes of capturing a nice upwards trend, but trading for shorter term profits along the way. "

Stepping aside as the market got choppy was prudent for me.

My last week saw some initial entries hitting the stops the same day,- the market clearly was not pushing many stocks to new 52 week highs- Therefore - My "edge" universe dealt me a few whacks-

I had been surprising myself with the ability to stay in the trades as long as I did on some-

Should I seek to reenter in abscence of a trending market, it will be with the hourly chart on entries, and reduced position-

RENKO- can also be used on any time frame chart- My application was to try to stay long in trades while the market was trending- I think the RENKO chart- telling the trader what the ATR (Average True Range) is quite useful-in setting trailing stops- I switched between both the RENKO as a reference and the daily/ hourly charts- I'll refer to Renko in the future, as I think it simplifies the "Picture" Possibly on an hourly chart .

Food for thought & follow up down the road-

"It may be wise to do both longer and shorter term trading always. Have a couple longer term positions going in hopes of capturing a nice upwards trend, but trading for shorter term profits along the way. "

GOOD POINT-

I have been doing some self analysis , and find that I am not very Risk tolerant- Since trading is about taking RISK, I tend to take positions that I perceive as less Risky- although I may try a small biotech position once in a while-

My time I have for "trading" - and my analysis of the market forces at work- is also quite limited. And perhaps that is simply a matter of priorities these days.

Back in APRIL I funded 2 separate ROTH accounts - one for my wife and one for myself- Both are ROTHs. We had maxed out our IRA contributions through the employer-

The goal of these accounts was to initiate a trading/investment approach- and through books such as "The Ivy Portfolio", and sites like Seeking Alpha,

There are a number of developed ways to invest , that should reduce market volatility with lower drawdowns, and potentially larger gains-

At my age, (62) Portfolio Risk is indeed a factor-But we also need to try to get some added $$$$ -

So an "investing" approach vs a swing trading approach is appropriate. But which approach?

I'll follow up in the next post.

SD

|

|

|

|

Post by sd on Oct 27, 2012 19:46:38 GMT -5

As the prior post indicated, I have been contemplating a trading/investing approach that has a longer term view-

In my company IRA, My wife and I are fully funded and make periodic adjustments to the allocations- I have reduced the growth %, maintained a large bond complement, and increased the cash. It is likely that once the election has occurred, the market will come to a sense of direction- Certainly by January- and the "fiscal Cliff"

The nice thing about the ira account is that I don't have to look at it daily- and don't want to- I may look at it weekly- or perhaps not if the market is not volatile-

I increase the bond allocation and the cash - and simply watch the charts since i'm stuck with mutual funds in that account.

The bond funds have done extremely well this past year, continuing a 3 year uptrend- despite Meredith Whitney's proclamation last year that Bonds were about to implode- the next "bubble" to burst- That will happen one day- but the tell will be in the charts I suspect.

Outside of the employer's sponsored IRA, I have opened a separate Roth IRA for both my Wife and myself- funded through Scottrade because it was convenient- and they had a local office in Raleigh.

I have done nothing with those accounts to date, because I had a 'good idea' but didn't have the homework done to back up that 'good idea'.

Frankly, I didn't have a well-researched plan to invest those monies- and so I have done nothing to date-I just knew I needed to take the opportunity to fund the accounts-

Didn't want to Rush in-

My desire in these separate Roth IRA accounts is to employ an investment approach that should have less volatility than the market, but achieve comparable or better returns.

Unfortunately, I am underfunded with these initial accounts - A $100,000.00 account would be a good start- but I will see what the initial $5000.00 starting Roth account will allow-

In reading "The Ivy Portfolio" by Mebane Faber there was an analysis of work done by Swenson on an investment approach that was largely initiated by the large endowment funds of Harvard/ Yale - The components were diversification, asset allocation, and periodic rebalancing-

One could say that is fine for these lofty well funded institutions- and not think that an individual could perhaps benefit from their expertise- They all took a beating in 2008 btw-

The components of the strategy are:

Have a diversified approach to the markets-

Adjust the % allocation of the investments with a regular rebalancing.

Time the investments based on relative strength and technical strength-

The Ivy Portfolio 'backtests these historical models and reportedly finds that an entry and an exit on a break of the 195 sma over decades provides a lower volatility and higher reward-

and it suggests focusing on ETF's to accomplish this-

In our new and expanded universe of ETF's, there are some new ETF's that automatically rebalance at set intervals-

They also apply the high relative strength ingredient, and this aspect would seem to make them very momentum focused . These are not leveraged ETF's to my knowledge-

This is the path I am on in the "investing" aspect- of these accounts.

The work to be done is to decide which ETF's give the market exposure and non-correlation, and to choose the alternative investment,.

One example investment might be SDOG- which takes the 5 highest dividend producers in each of the 10 market sectors- and rebalances quarterly- This strikes me as a core position in an investment strategy- It is automatically momentum based , and if the fund rolls over, it means the entire market is likely in decline-

There are other new products on the market that use a relative strength component - the DWA technical leaders- PDP,PIZ,PIE, DWAS.

Flex Shares has also come out with "TILT" TLTD,TLTE that also periodically rebalance-

As the investing markets get more sophisticated, these offerings that are more specific to an approach may indeed be the semi-active investor's way to go- taking out a lot of the legwork for the individual investor-

SD

|

|

|

|

Post by bankedout on Oct 28, 2012 8:40:55 GMT -5

My thoughts are: There will never be an ETF that is a buy and hold forever, beat the market always product. In my opinion, one should not even bother looking for an ETF like that. For long term investing, set your charts on long term. In the chart of SPY below, each bar represents 3 months of trading activity.  I'm confident you can figure out a way to have your money invested while the market is trending upwards in the long term, and remove your investment money when it is not in your favor. This is not the complicated part. The complication is within ourselves. Can you really develop the discipline to sit tight on a position for 5 years? You must. In the meantime, have another account where you trade in shorter time periods. Grind it down, if you want or need to. However leave the long term account alone! In the longer account limit yourself to a few products. How about SPY, EEM, TLT, & GLD? There is no need to seek out a magic bullet ETF, in my opinion. Best of luck, as always. |

|

|

|

Post by sd on Oct 28, 2012 20:51:34 GMT -5

I'm confident you can figure out a way to have your money invested while the market is trending upwards in the long term, and remove your investment money when it is not in your favor. This is not the complicated part.

The complication is within ourselves. Can you really develop the discipline to sit tight on a position for 5 years?

You must.

In the meantime, have another account where you trade in shorter time periods. Grind it down, if you want or need to. However leave the long term account alone!

In the longer account limit yourself to a few products. How about SPY, EEM, TLT, & GLD? There is no need to seek out a magic bullet ETF, in my opinion.

Thanks for the input Bankedout- I also do not think there is a magic bullet ETF- However, some of these products offered today incorporate a rebalancing feature that seems to be a recurring theme across the investment articles I have read-

As your chart illustrates, there is a serious case to invest for the longer term bull cycles, and to exit when the longer term trend changes and rolls over- The "Timing" of that trend change is something that would have an important result in the longer term.

I stopped at a local Barnes & Noble book store today , and

picked up a copy of "All About Market Timing" by Leslie Masonson., along with "Trend Following" by Covel

In a cursorary scan of "All About Market Timing" , I see that the various timing entry/exit signals have made a huge improvements in results for the long term vs a straight investment approach- The book deals with a lot of back testing results, and i am anxious to do some in depth reading -

Since the premise of timing is to stay in a trend until it weakens, and then exit and the choices become- preserve monies in a cash account, or have an altrernative investment to take advantage of a major change in trend-

Your 4 suggestions have merit- a narrow and focused universe to deal with- That perhaps is all an investor would need to focus on-

I'm going to study the subject further, and will post periodic updates as I learn more-

Thanks for taking the time and sharing your Input! Sd

|

|

|

|

Post by bankedout on Oct 28, 2012 22:22:00 GMT -5

One nice thing about trading in the long term is that you have so much time to enter and exit a position. Even if you are late on entry by a few months and late on exit by a few months, you still captured a giant trend of perhaps 4 years.

Please keep us updated on your progress.

|

|

|

|

Post by sd on Oct 30, 2012 20:32:18 GMT -5

I picked up several books this weekend- Trend Following by Covel, and "All About Market Timing" by Leslie Masonson. I have skimmed through the Masonson book- and find it reinforces the idea that one should not simply employ a "Buy and Hold investment approach- Masononson also has a website that I just visited and will post the link here: www.buydonthold.com/2012/dashboard-remains-on-2-neutral-signal-as-200-dma-holds/ The book discusses various timing strategies- Not all masonson's - that were done over extensive market periods- There are different methods of market timing, and a number of researchers did studies- Dow, S & P, Nas- Seasonality was a major study- "Go Away in May" is certainly one componet - Where investments were studied across the market's historical database . If you go to your investment Broker, he will correctly tell you that if you miss being invested in the market for the 10 biggest days of the year, you will miss out on the majority of the gains- What the Broker fails to tell you, If you are out of the market for the 10 worst losing days of the year, you will seriously outperform missing the 10 big days-- The down days take your account down harder and further- Which gets into seasonality- It's not just the "Go Away in May" but the different researchers found compelling statistical results that suggest that being out of the market during certain periods, can seriously improve the results of one's returns. The results are quite impressive- - and seem to be fairly consistent with a very few non conforming years- over 100+ but the results are a greatly improved return with lesser drawdowns. and Masonson suggests that one can and should have an awareness of the seasonality factor in one's trading. He also cites the research concerning investing with an eye to the Presedential cycle- And there seems to be a higher probability for gains going into the election cycle than after- After it is all said and done- Masonson recognizes there are years that do not conform to the statistical "norm" and suggest trading/investing with an eye to some major market sentiment indicators as well as technical charts - I liked the book; I did a 'Fast read" and need to go back and spend more time on a reread- This is the updated version of the first edition- and so it added in some research through 2010- The author clearly tries to encourage one not to be a passive holder of investments- and that by taking action at the right time, one can protect a substantial % from loss and greatly improve the net long term gains- He cites several market sentiment indicators, advocates stop-losses - although he does not do a very good job of suggesting how to deal with the sideways markets- potential whipsaws- - There was a lot of good historical analysis of applying different timing approaches, when to add leverage, and when to go to safe ground, and when to go short should one choose to- Masonson's approach is designed to get the investor positioned to increase his returns when market conditions are favorable, and to ultimately reduce the Portfolio Risk - For a net larger return with a lesser drawdown . The book is worth the $22 IMO, if it only makes the reader more conscious that taking action is historically warranted- This was the weekend of the "Sandy" storm, which gave the Northern Atlantic States- and NYC the most of her fury- The stock exchange was reportedly under water, and closed Monday and Tuesday, but will reopen Wednesday (tomorrow) I am still in cash in my trading account- The impact this late weekend storm will have on those with open positions on Friday-,,, Could be substantial as the market opens Wednesday it should be quite volatile - On Friday, it was doubtful that anyone would have predicted the stock exchange would be closed for 2 days- Where prices will open- I would expect down as the market will expect a big hit to insurers, retailers, etc. IS This the time to be defensive on an emotional market response that may be short lived- but could be surprisingly volatile- Or Not? SD |

|

ira85

New Member

Posts: 837

|

Post by ira85 on Oct 30, 2012 21:07:30 GMT -5

I appreciate the book review. I've been checking Masonson's website regularly since you mentioned it some months ago. As you know, he's currently neutral. You note Masonson's book finds there is validity to trading on seasonality and the Presidential election cycle. I was first introduced to both of those issues by Sy Harding. He has followed those cycles for quite some time. Sy Harding StreetSmart Report www.streetsmartreport.com/index.phpThanks for the good info. -ira |

|

|

|

Post by sd on Oct 31, 2012 10:13:57 GMT -5

Thanks Ira, I see that the site has the same theme- and that he also has an updated blog, discussing market conditions- Thanks for the link! Some statistics from the site: on a seasonality factor that seems to affect most markets/ countries - www.streetsmartreport.com/comm4And an article on the fool hardiness of Buy and Hold investing www.streetsmartreport.com/comm4a updated from the late 1999 original- Other articles on the site for "free" as well. Thanks for sending! Sd |

|

|

|

Post by sd on Nov 1, 2012 10:39:37 GMT -5

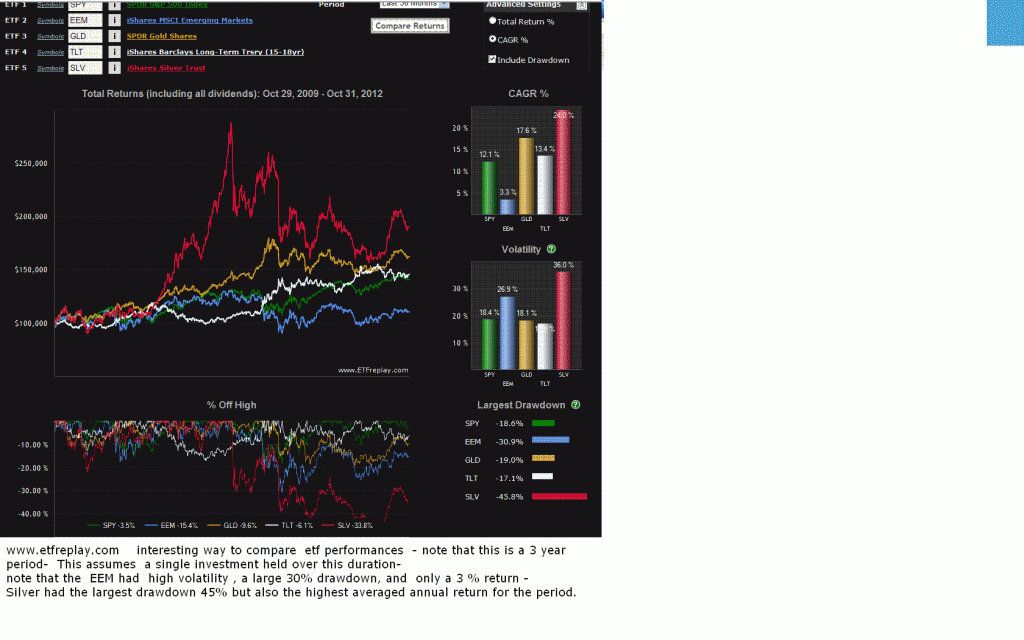

WWW.ETFREPLAY.COMLots of features available there- Attached is a screenshot of the etf compare/backtest results- This shows how an investment of $100,000 in each of 5 funds would have performed over 3 years.

|

|

|

|

Post by sd on Nov 1, 2012 16:42:59 GMT -5

I've spent a vacation day at the house, and spent a lot of the day trying to learn more about different ETF rotation strategies-

Towards the end of the day with all of the major indexes up 1%, I took some positions for short term trades-in stocks- not ETF's

Due to the damage from Sandy, I took a position in MAN $39.09; expecting that this will be a windfall for temporary labor working through the reconstruction. Up to $50 BLN in damages-

BAC $9.70, C $37.97,- Both moving higher

FLR $57.78 (which sold off hard after hrs) - Is also an infrastructure play- I may have really missed the target with this one-

and I bot some MSFT @ $29.53- New operating system, new tablet release, something NEW with this company after all-

I was waiting to see if AAPL will drop below $580- although I view the $540-$550 as the final support line.

In the past 2 years, November has not been a seasonal winner for the markets-With this also being an election year,

This storm 'paused' the election news rhetoric, and Obama looked Presidential traveling to New jersey and meeting with Gov Christie- a staunch Republican- So far, it looks as though the storm may be a positive for Obama.

I'm expecting a positive jobs report tomorrow, and that may have a slight positive for the markets-

With the impending election just around the corner, the attitude of the market is likely a "wait and See" - and today's market rally was something of a surprise .

Either Way, I will be trading these moves with the hourly chart-SD

There was better than expected report from China, and among the articles I read today was the suggestion that it is important to look outside of the USA for growth- and that would be

|

|