|

|

Post by sd on Jan 2, 2011 19:38:08 GMT -5

Thoughts for 2011-

What's with the GOD listing? Pretty prentious - Is it because one is semi-compelled to shake out laundry in public in numerous posts?

Where did the music come from on my last post? Jazzy instrumental- strange ......Kind of a Pavlovian promo? Or have I been too long behind the keyboard? LOL!

All in stride-

For Christmas, I ordered a book by Dave Landry .

"The Layman's Guide to Trading Stocks" and read it over the weekend.

I liked the book- It was written both for the Novice investor /trader just starting, as well as other traders that want to learn to trade based on price action only. Landry is a purist, no indicators, some moving averages and trend lines. He keeps it extremely simple.

He covers several entry techniques he uses, as well as how he sets and trails stops, takes partial profits, and allows the remainder to run with progressively wider trailing stops.

Landry also goes into some detail as to his scanning methods, how he narrows his stock picking universe from thousands of stocks to within sectors gaining in strength and picking the better trades from those sectors. Quick summary is check the direction of the larger markets, sectors, and your stock to see they are in alignment. Nothing surprising there, but it establishes a solid foundation- and perhaps that's one of the basics.

Interestingly, the multiple moving averages/crossover I use in my charts are something he talked about in prior books some 10 years earlier. He doesn't rush to get into a trade on that MA cross, but waits for price to uptrend, and only then sets a buy-stop entry above a pullback .

He also uses wider stops, and tends to cut 1/2 the position to lock in profits early, letting the remainder ride.

The "trend is your Friend " and "A rising tide floats all boats" is the theme, and being able to sit on your hands when conditions don't warrant the risk of a trade is another.

He also has some more aggressive methods dictated in his earlier works for more advanced traders.

He also offers a conservative Risk/Reward position sizing method.

I need to re-read the book again , I think I would take exception with the way he sells 1/2 the position on a target that matches his wider stop-loss.

All in all, I think this book is a good read for swing traders.

I like that it doesn't focus on a lot of lagging indicators, exotic interpretations of the market - Trin, Vix etc. I think it's especially important for newer traders that 'believe' in their stocks that have risen so well the past 2 years

The book actually brings home something I will be following this year-

Sector strength-Or sector themes. Taking trades in the direction of a sector that is gaining in strength makes strength. There's some sector rotation ongoing in the markets .

It makes sense to match the trade with a sector that is growing. I Call it a 'theme' play-

Regardless, the book focuses on the essentials that I think are applicable for swing traders and particularly fundamental investors - and well worth the $59 price.

SD

|

|

|

|

Post by dg on Jan 2, 2011 21:09:01 GMT -5

sd:

The website apparently categorizes us by how many posts we generate. Kind of stupid, I think.

I found the ranking system and eliminated it.

|

|

|

|

Post by sd on Jan 2, 2011 21:14:39 GMT -5

And in an absolute attempt to refute (HUMOR) Landry's book, I set an example of the second TWM trade. I find I use a 60 minute chart for trade insight intraday, but the daily chart closes some of those gaps. This next chart shows the daily in it's recent 6 month downtrend and the few rally attempts. It's important to define rally as price moves back and closing above the declining ema's, as well as an eye to the declining par Sar. Note that price ever closed above the declining emas and closed above the prior Sar level. This latest market consolidation has price in NRB's and the emas haven't upturned. There is potential here, but I'm not sure the risk is close to the reward. Time will tell, but my 60 minute chart encouraged jumping in here when the daily doesn't even suggest the consideration.  |

|

|

|

Post by sd on Jan 4, 2011 20:37:21 GMT -5

"sd:

The website apparently categorizes us by how many posts we generate. Kind of stupid, I think.

I found the ranking system and eliminated "

Thank you.

|

|

|

|

Post by sd on Jan 4, 2011 20:52:15 GMT -5

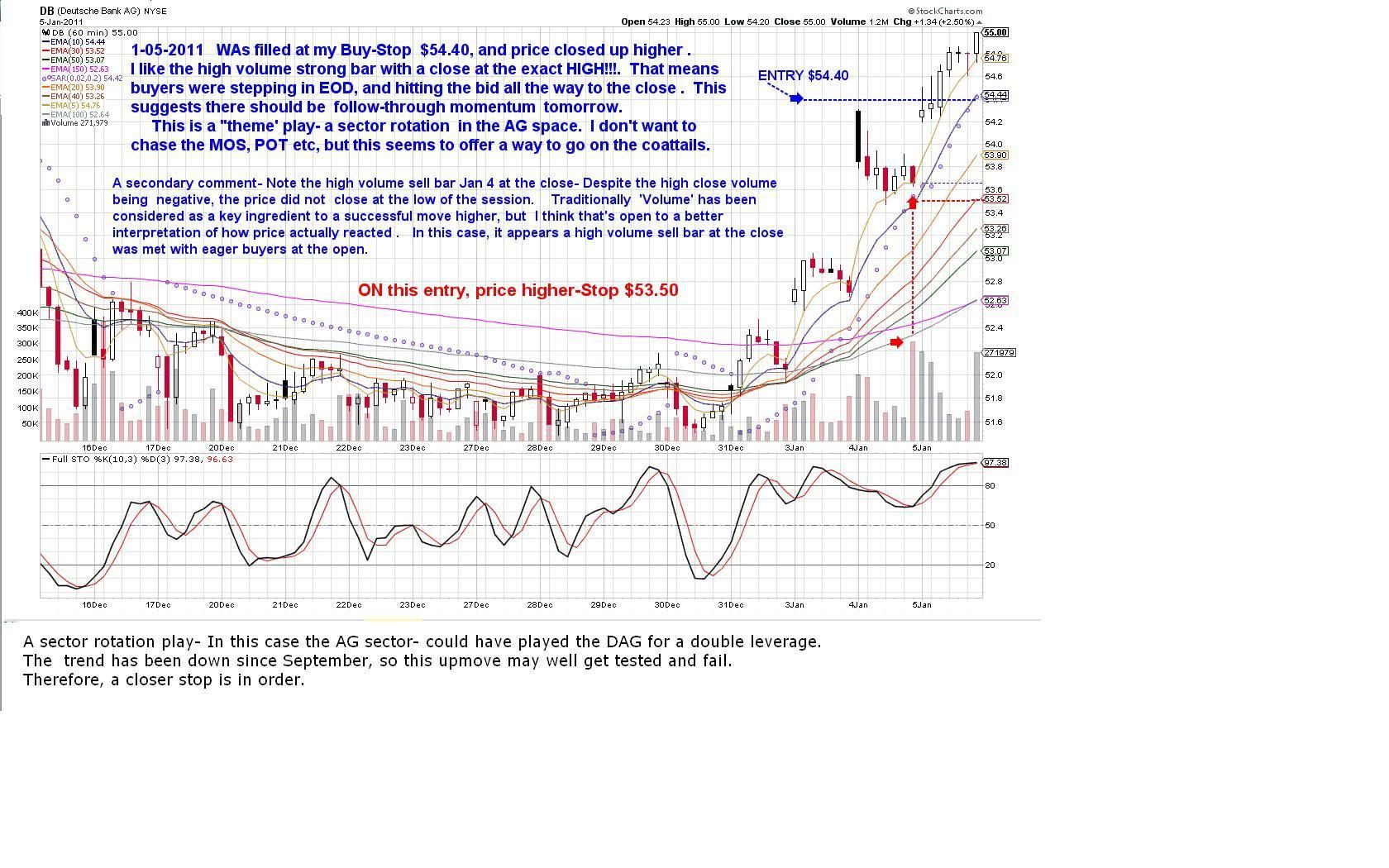

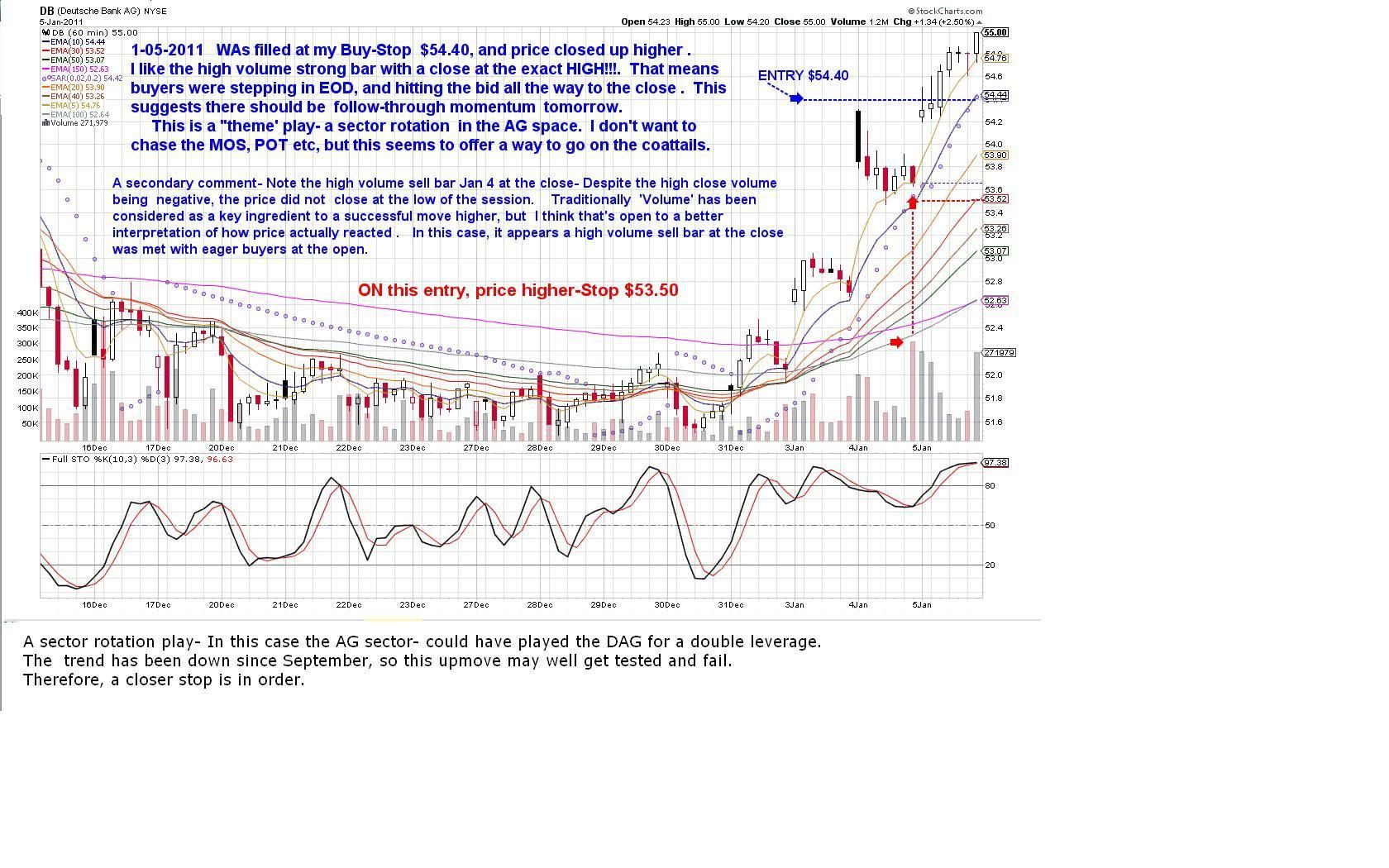

Tues-1-04-2011

DWSN- a play on oil was down slightly today as the market closed a bit down.

Banks up, RSX up, MDRX up.

Cree had pushed above 68 but didn't hold, and I'm waiting to see a better move- higher.

With some cash in the wings and some freed cash-Trying 2 plays tomorrow-

The FXI is rallying the last 2 days, and I'm trying a secondary play with BIDU. BS 101.50, Limit 102 stop 99.00 as opposed to a 96 stop below the recent lows.

The second play is in the AG space. With Mos reporting better-than expected earnings, I'm looking at the AG ETN DB.

Price frequently gaps on this , and on today's gap higher it closed near the low. I'm giving this a bit of room , with a stop below the recent low range on my initial entry.

If the buy-stop trade fills, I will adjust the stops.

DB 54.40 stop -Limit 54.80 stop $51.00

No time for a chart tonight. SD

|

|

|

|

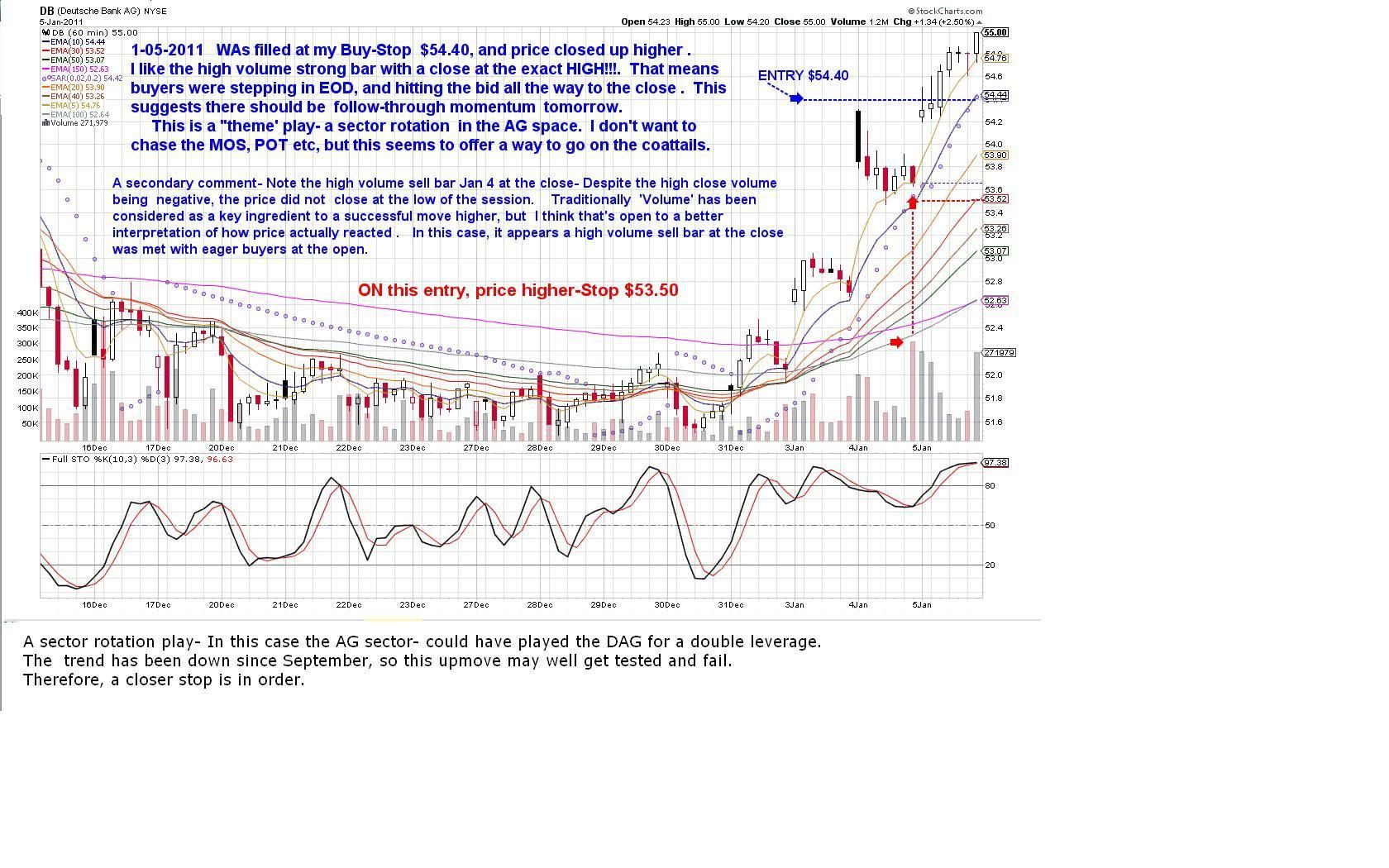

Post by sd on Jan 5, 2011 20:35:27 GMT -5

What a nice day,! I come home and log onto my trading account and see nothing but blue- got to be my favorite color! When every position is up, it's only a matter of a few days...... My DB Ag play worked out in my favor. I was filled at the buy-stop low and the stock closed strongly @ the $55.00 high EOD. This suggests that unless a meteor strikes tomorrow, the stock should try to go yet higher. Bidu also acted as I expected, and I am unclear as to why my trade was never filled- Perhaps I spent too much time 'posting' the trade without filling in the final trade on the broker's program. Bottom line- both trades went in the right direction, along with the market. I only have positions in the DB, but like the Bidu play and will reenter tomorrow- albeit a bit higher.   |

|

|

|

Post by sd on Jan 6, 2011 21:26:15 GMT -5

I'm adding several trades, and going over weight financials .

I was filled on BIDU today .

As part of a sector play, the financials have been gaining, and I'm pleased with my C and WFC positions. Note that both of these have had some volatility and challenges, but are moving higher .

For tomorrow, ,I'm going ahead with adding to my financial weighting.

However, I'm adding 2 new financials that haven't struggled as much as my others-

These trades have been uptrending for many months, and in the context of being in the "financial sector" , they have trended while the GS, C, BAC, JPM have struggled in stops and spurts.

AMP bs-60.00 Lmt 60.10 stp $57.00

KKR bs-15.30 -15.35 stp $14.00

Both uptrending , trade is on the expectation of the trend will go higher.

FFIV- Pullback from a recent high, basing period, atempt to go higher. Buy-stop entry $138.55

SD- Energy play- Actually had planned to place a buy-stop on this prior - It has made the 1st move up, will see if it has more to the upside- $7.90 Bs Stp $7.50

|

|

|

|

Post by sd on Jan 8, 2011 17:23:50 GMT -5

What the heck does the Ma Supreme Court think it's doing in trashing a perfectly good uptrend in the financials? And, me just adding AMP & KKR ! We'll see if this has further downside momentum or gets shrugged off by the market. It caused my WFC position to stop out for a small gain- about 1/4 of what it was at the prior day. The DB trade - thought it was a good play on the Ag business- it actually may not be related as I thought. It had been downtrending and POT, MON, MOS, etc had been higher for a while. I'm posting 4 charts here, the early entry and snapshots of the 60 minute and the daily, and also the stopped out shots. In that the primary trend was down, I'm pleased I didn't allow a wider stop. SD     |

|

|

|

Post by sd on Jan 10, 2011 20:20:06 GMT -5

My RSX position hit both layered stops today. This is a defensive approach I am taking- If price action doesn't look like it's going in my direction, I set 1/2 the position stop higher, and 1/2 at the lower level that a normal price swing should not hit. This will require additional work, but I think it's a good approach in reducing loss. I also added to my FFIV position today as cash had freed up. Fortunately , FFIV moved higher above the recent pullback range.  |

|

|

|

Post by sd on Jan 14, 2011 18:10:38 GMT -5

Friday Afternoon Ramblings:1-12-2011

I have been gradually modifying my trading since I got back into the market some weeksmonths ago. I still only have time to view the market evenings, weekend, and occaisionally Friday afternoons.

It certainly doesn't hurt to find yourself in an ongoing rally to think " Man, This Works!"

Usually what happens when there's this much blue, is the market takes a chunk of it away. Often the reason is something the market disregarded previously, but suddenly and without much warning, the Market reacts and pushes almost everything down.

The market pundits all agree we've come up quite a bit in a short period of time, but many also believe we'll continue to move higher because of the Fed, Bonds, (inflows to stocks) and companies meeting and exceeding profit expectations.etc.

I think it's important to adapt to the market environment one is trading in. This market is trending higher, with some sector rotation ongoing.

I'm looking for stocks with sector stories that suggest strength and expected moves higher. Today, I own some financials, C $4.74; , BAC $15.01 (today) , AMP $60.20

Energy- DWSN $ 31.89, SWN $39.38 (today) , SD $7.90

Medical- MDRX $19.35

MFG- F $18.86 (today) (will LTH! ) Weekly chart?

Tech FFIV $139.24 ATML $13.91 (today) and

BIDU $105.11

These may not have been the best plays within each sector, and each one was selected for somewhat different reasons.

I am hoping that BIDU, SWN, F will actually become a longer term -position, and I will use a daily chart on these for selection of stops.

My mindset is to hold for days/hopefully weeks until the stock rolls over on weakness. Often I get stopped out on entry because I have a very close stop % wise- due to levels I see when using a 60 minute chart. The trade-off , is that with smaller losses, I can afford to attempt the trade several times, and can potentially reenter soon after being stopped out.

I started giving a bit more room -particularly if the position is going in my favor. Still tight by swing trading standards.

That has worked in this relatively low volatility market.

Conditions will change for some reason in the days or weeks ahead, and I want to position myself to withstand some market specific volatility, but not see winning positions become losers.

Therefore, I'll take an approach I've used previously; On break of trend, I'll raise a stop beneath the low of the bar that closes below the ema I consider significant. If I've been in the position for a while and have a 5% + gain, I'll raise 1/2 the position to that level and leave the remaining stop @ BE.

If price moves higher, that first pullback becomes a possible support level. At some point as the trade is held longer, I will refer to the daily chart for stop-levels .

As i post charts, I will try to annotate them with the rationale I have for the action- I'll try to do a follow up recap on the trade , including where i should have reentered, or -"Whew, glad I got out!" SD

|

|

|

|

Post by sd on Jan 14, 2011 19:04:37 GMT -5

AMP- Financial- I went ahead and just Bought into the uptrending stock. AMP, KKR have been uptrending for months -since Augest- Conventional wisdom says to buy the pullback- when and if it occurs. Ive stepped in and just bought in this trending market with adjustable stops as price dictates. SD  |

|

|

|

Post by sd on Jan 16, 2011 11:42:46 GMT -5

Sunday morning musings-

As long as the market continues to Trend, I'll adapt my stops to allow more room for normal volatility. I'll try to stay in the trade as long as the "Trend is my Friend".

Ideally i can make better entries on pullbacks and resumption of trend.

i'll use a modified Landry approach- He advocates locking in gains on 1/2 the position when the gain is equal to the Risk

R:R = 1:1 and then let the remaining shares have a stop near Break even and ideally ride the trend for a longer term gain.

My stops are usually set too close- Fear of Loss- and often get taken out on what is normal volatility . I think this is a good approach when you're betting on a reversal of trend, but when the trend is up and you're betting on a resumption of the uptrend, a wider stop based on potential normal volatility should be the case. I get too focused on a 60 minute chart , and a "normal" pullback on a daily looks like price is taking a crater on the 60 minute. Since I don't trade intraday, I'm out of sync with my charts and need to have a wider perspective.

The first thing I want to do is adjust my stops on all positions where I have some decent gains, splitting the stops to keep some wider , and some ready to close in on weakness.

I'm also a believer in reentering a stock once I've been stopped out once price shows it's direction.

I may set stops based more on the Daily chart on positions that are in the blue, and not use the 60 minute on established trades.

I will still use a look at the 60 minute chart & daily to consider entries and also stops on new positions, but the stop will be placed a bit wider initially unless price action leads me to think I got in too early- Then, I may split the position stops on entry. I've done this in the past, and usually both stops get taken out. I'll have to work through this

It would be nice to have enough profit in a position, you could simply back away from the daily and only look at the weekly price action and trend. I have to get this mindset when it comes to my IRA-

I decided I'd take a Long Term Position in F yesterday and Bought @ $18.86. I'm going to determine a stop-loss based on the weekly charts. Experiment for myself, to see if I can stand it when price ultimately has a pullback- and since i bought as it's near it's high, that won't take long .

In the event of a market wide correction/weakness that hasn't occurred yet, I have to keep in mind I'm buying at a level where most things have been up for some time. Market is extended-on many fronts and sector rotation continues.

When sector rotation hits my positions and stops me out, hopefully i'll have had the opportunity to net some larger gains.

SD

|

|

|

|

Post by sd on Jan 16, 2011 18:45:54 GMT -5

Sunday pm, -1-16-2011

I've added daily charts on my stockcharts lists for each of my positions.. I went through those charts and established stop levels that are much wider than I use on the 60 minute charts.

I then adjusted each position with the appropriate stops

IT FELT VERY UNCOMFORTABLE TO DO SO.

Some of my most recent trades were taken with the view through a 60 minute chart and a tighter exit was the norm.

IF THE MARKET WAS TO REVERSE COURSE tomorrow and take out all my stops, I would see a 5% hit to my portfolio-

If I left the stops exactly as they are.

I will be adjusting stops as the trades progress.

I also put in limit order sells on a portion of each position 20% above my entry- That may be a lofty goal to lock in partial profits, hoping to catch some spike highs that sell.

SD

|

|

|

|

Post by sd on Jan 18, 2011 21:24:34 GMT -5

OK! HERE WE GO! 1-18-2011 My first "stop" out to lock in gain occurs today 1/2 of my DWSN position sold for 5% above my entry. My stop was higher - likely 7% , but slippage in the execution knocked it down. The remaining 1/2 position is at B.E. I'm watching some of my other profitable positions roll over, and if I had used the 60 minute chart, would have been stopped out -and locked in some higher gains. I will try this out for a while-  |

|

|

|

Post by sd on Jan 19, 2011 21:50:50 GMT -5

WELL!, while the market was down 1%, my positions have found me down much further than I anticipated- I am down approx 4%, and still hold most of my positions. Most of my profititable trades have given up the majority of their gains.

Financials - GS disappointed, and my C position is just above my BE stop. My recent BAC entry is in the red and 1/2 sold off.

FFIV not in my calculations to gap down so sharply-

This appears to be a situation not specific to a single sector today- MOS, Financials, TECH and the 'cloud space' all got torpedoed. Oil down and my SD position and DWSN all went lower-SD hit both stops for a loss.

At this moment, it feels that more than a sector correction may be underway- it's about time for this to happen, unfortunately, I just attempted this wider stop approach, but it's time to get defensive and raise stops higher and minimize loss-

SD

|

|