|

|

Post by sd on Aug 23, 2009 14:47:43 GMT -5

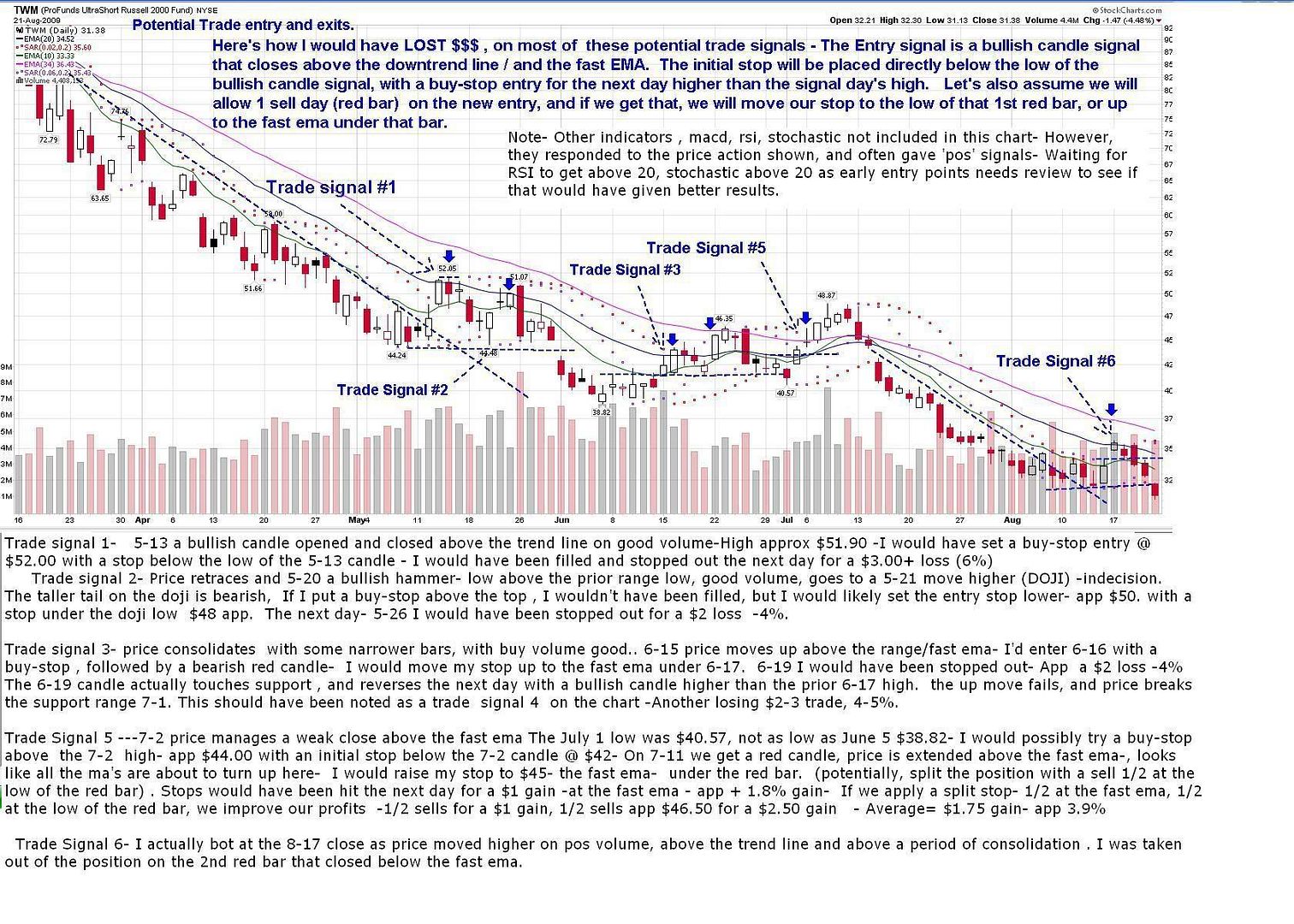

As a follow up to the prior post, I reviewed which entries I would have likely taken on TWM as potential downttrend reversals. I would have employed a buy-stop entry for the next market day after a bullish signal in price action had occurred. Stops would initially be set at the low of the bullish candle, the buy-stop slightly higher than the intraday high. Stops would be moved at the first red bar to either the low of the red bar if it penetrates the fast ema (Bullish entry candle has to close above the fast ema), or to the fast ema under that bar. A quick analysis shows that 5 of 6 trades would have been losers -totaling about -20% with 1 -4% winning trade- Not a very inspiring record. SD  |

|

|

|

Post by sd on Aug 26, 2009 20:36:21 GMT -5

8-26 Note

I'm holding 4 financials -RF, C, BAC, AXP , market is flat here.

Other positions are squeaking out gains.

Put in a couple of biotech orders- OREX and NVAX -H1N1 around the corner- sector is moving.

Tightening stops a bit here .It seems everyone is talking about how overbought the market is- When "Everyone" is saying it's going to happen , and that buyer sentiment is still high, we've got to correct- Just don't know when.

For a trade- URE on a $5.50 breakout with a $5.20 stop-loss

Partial position to keep my hand in here-SD

|

|

|

|

Post by sd on Aug 28, 2009 18:32:39 GMT -5

I know this market is oversold- Everyone proclaims it so when I turn on the TV, even the usual bulls are hesitant.. It's the "Cash for Trash" momentum move, where the market is bidding up a lot of lesser stocks that don't deserve to be

I'm skittish about the market, but still trying to trade it with the intent of selling a stock if it weakens appreciably. I'm allowing my stop to lag price, wary of any close under the fast ema as reason enough to put that stop under that day's low. I want to see a position move up enough beyond my entry where that makes sense to try to do.

Being wary, I'm also taking smaller positions, with the intent to add to them if the trade warrants. And a correction- I took in V and did not take AXP in the financials.

Nat gas futures had turned up from a multi-year low, and the UNG is a broken ETF waiting on a decision that will allow it to issue more shares- I caught part of an interview today, and frankly did not totally comprehend the issue- or hear the entire interview.- The downside of the ETF is that if it is decided it cannot issue additional shares, one commentator said the premium could collapse? Conversely , I looked at FCG which Banked out had pointed out- this ETF doesn't seem to have the same issues, and is trading up. FCG is at the near term recent high, with a price 14.88 and the most recent swing low $13.90 +/-

This is about $1 or 7%.

I looked at several Nat Gas stocks- ECA, CHK, UPL,DVN, and chose UPL and DVN as very close to the recent low in the present range- Limited loss here is the driver , and took partial positions, with less than 5% at risk at the stop. Will Nat gas go higher ? Oversupply is at hand. But there's a lot of Talk abount Nat gas as the transition fuel. This market swings, looking for new areas to justify momentum- I'm taking a small risk here, by thinking this is a good low-risk level to take a small position, and with a turn up in Nat gas pricing, -and possibly the threat of some supply 'disruption"- Hurricane in the Gulf- Let me point out, that this is a trade based on "expectation" of what the market might do- and not on technical movement higher. That expectation hypothesis hasn't worked well for me in the past in guiding my entries and exits. But I'm trying to modify my trading in several ways to be in this rarified market, .

The one key ingredient here, is that these positions are all moving higher. When Price action proclaims it's rolling over, I'll have to stop out.

I had a pending order on 2 biotechs- NVAX- orex. I decided to glance at the company profile, report- It had total revenue of $50,000 and was laying off employess- Go figure- Cancelled that order LOL! I better not look at any fundamentals if I want to keep trading.....

2 spec trades CHU- moved up from the range and has some tie in with the I phone, and ETFC, pop up higher today - both smaller positions.

Carrying a mix of positions has a plus-of diversification . My financials are in the green (slightly) plus I have a mix of others that Have moved up- CIEN, STD, LOGI ,Meas , where I will be net profitable.

NJ stopped out for a loss, ABCO stopped out this week for a small gain- Held that one for weeks waiting for an up move.

i need to get caught up on some charts - hopefully this weekend if time permits-

SD

|

|

|

|

Post by sd on Aug 29, 2009 9:27:07 GMT -5

Taking a small position in CHU - China Unicom Where the FXI is in decline, Chu has held up decently,-There was some blurb about CHU and AAPL-which caused me to look at the stock to begin with. Since it has held up well despite the China sell, still in a gradual uptrend on the daily, and it's attempted move Friday got it above all moving averages, I decided to buy some near the close , even though price was weakening. These ADR's gap around a lot, and so I'm falling back on just some basic TA, the most noteable being the recent swing -low $13.51 8-17, 8-19 as a logical stop level. As I see by this chart, price has not seen support at the 50 ema , easily falling beneath it in the past months- and it appears we may be going more sideways here, but I like the convergence of the ema's as long as the potential turn may be up - Price closed higher, and if it can hold above, the ema's will of course follow. I look at the convergence as an opportunity for price to go higher, or to fail and assume a downtrend- Weakness in the FXI has me concerned, but this seems to have some strength despite the larger weakness. Because of the whippiness of the price action, I'm selecting the lower stop- not the trend line, but the swing low $13.50. as my initial stop- This trade has resistance $1 overhead and so is not a "good" trade being a 1:1 probable. Only a 1/2 position taken here, , Usual technique for me on a buy-stop entry- with momentem move up would be to use a day that loses momentum and drops beneath the fast ema (red bar) is a warning and time to raise the stop to the low of that bar. Because of the potential sideways action here, and only gradual up-trend, I'll be leaving my stop @ $13.50, possibly cutting the position in 1/2 on weakness. If we get further signs of the expected correction this week, That red bar close below the fast ema is the warning shot. SD  |

|

|

|

Post by sd on Aug 30, 2009 19:27:53 GMT -5

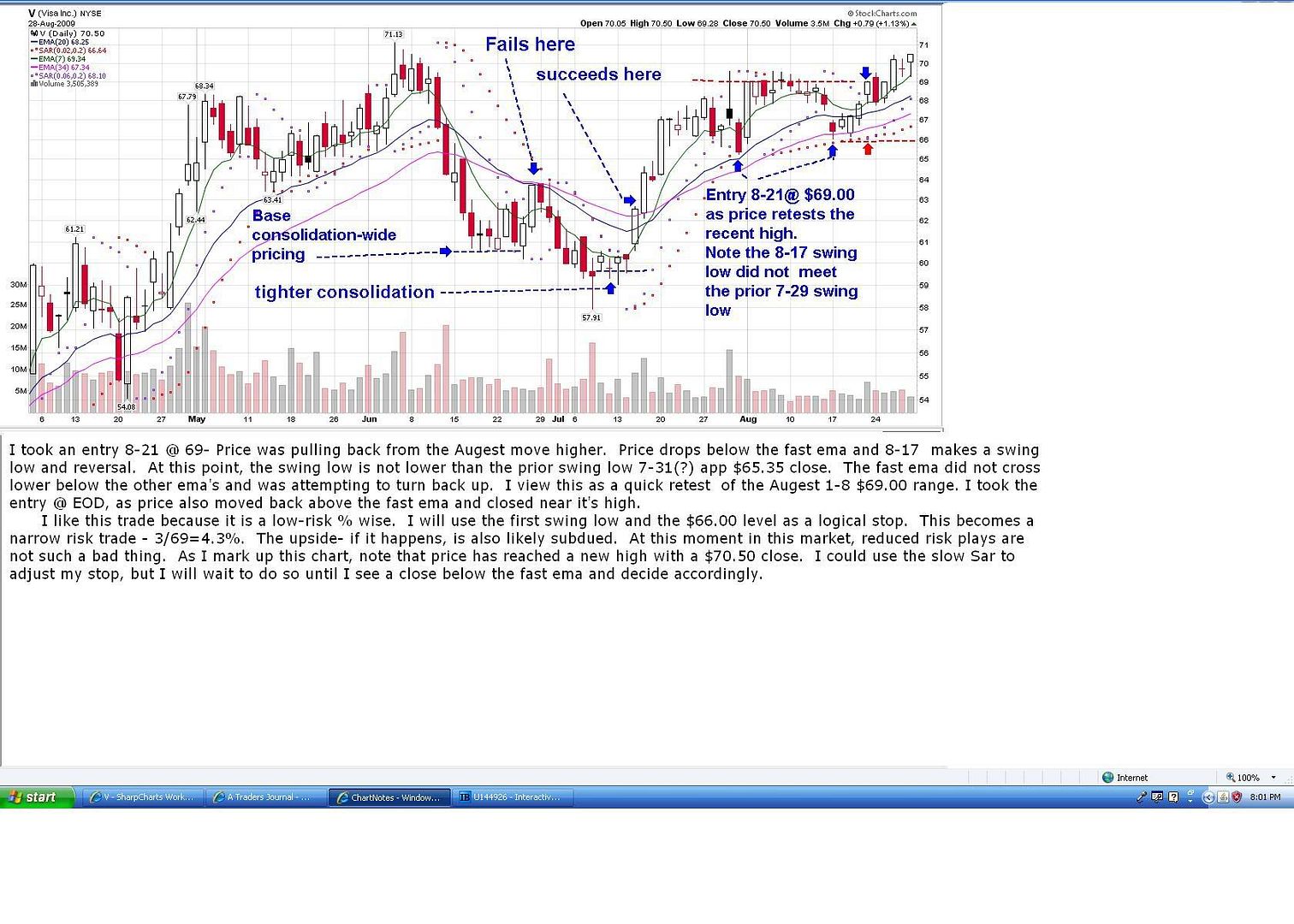

I'm taking a variety of different entries these days, with the idea of controlling downside risk a priority- That means on more speculative and cheaper plays to limit the position size- There's some truth that to make money you have to risk money- I took a position in V last week, as it moved higher and retested a recent attempt to break through prior resistance. I like the low level of risk this trade offers- just a tad over 4%, and like the price action and attempted retest. It did succeed, and price has closed higher- If the overall market tanks this week, it will sell off with everything else, but I'm not waiting for that to happen. The chart is simple- some price action and moving averages, SD  |

|

|

|

Post by sd on Aug 31, 2009 19:20:52 GMT -5

Anyone hear the news? China has been pulling back for weeks, and now there's speculation it might affect the US recovery- Go Figure........$SSEC Why hadn't the market locked onto this last weeK when I went short?  ? Today started off looking ugly, and gained about 1/2 of it back at the close. I didn't have any positions hit stops today, but one more day and I'm sure that won't be the case. I actually had 2 positions- V, and ETFC gain a little. I still have some positions profitable, but the gains seemed to be halved. We'll see if they all go into the red, or we get a bounce back tomorrow on expected good news- I haven't moved any stops higher tonight, although I did make some adjustments Sunday pm, going to see how this plays out-SD |

|

|

|

Post by sd on Sept 1, 2009 19:15:25 GMT -5

And 2 down days in a row! This one had teeth! OUCH!!!

EVERY position I had on lost money today, and 1/2 of my positions stopped out. What were winning positions went red except 3- Cien stopped out for a 1/3 of the gain I had, and only 2 positions remain profitable.

Of course, these are shorter term trades, and relatively recent entries- and so there is not much meat between the bone .

I knew- and somewhat expected the Risk in these trades at this time, and so I have to be somewhat resigned and take my medicine. I fully expect there to be additional downside tomorrow- When the market sells off on good news, the ISM-mfg report - and could go up on hot air and disregard all the prior "issues"....... It's September after all.

I've moved all stops on remaining positions to the low of today-

I could simply sell all at the open, but that would be my bias directing me. I don't really know what the market will do, just what I expect.In the past , my preconceived notions have limited my upside and snatrched profits too quickly. The evidence tonight is now is a different level of market risk, and it's time to protect $$$ and profits. Sell-off for 2 days in a row, disregarding the 'good' news tells me the market's bias is to take profits and head lower. Saw Sheila Blair-head of the FDIC acknowledge tonight on Kudlow that while the residential market risk has been greatly accounted for , the commercial market (the other shoe to drop) will indeed be the other impetus to toss several hundred (200-400) banks into insolvency in the next 6 months to 18 months.

As I am now just focused on the EOD information, and adjusting/making trades in the pm hours, I have to take a tactical stand on where I think the market may go in the near term- At present, I think we have all the basis for a more significant correction to occur, and thus I will be decidedly more defensive.

SD

|

|

|

|

Post by sd on Sept 2, 2009 22:23:29 GMT -5

and then there was one- V is my sole remaining position- everything else got wiped out at the open - Tough days , time to get into a faster -quick trade mode-SD

|

|

|

|

Post by sd on Sept 4, 2009 19:54:52 GMT -5

Was the market's action Tues and Wed the first real notice that things are not what they seem in OZ? It got my attention, by liberating most of my trading capitol, for a price of course.

I'm trying to figure out how best to trade going forward, and I believe I will try to both get in a trade a little bit sooner, and out sooner. I seem to have a bad sense of rythmn- just ask the wife about the last time we tried to Texas 2 step.

China has been selling off for weeks, and I truly expected it to have affected the US markets long before now. I was expecting the sell-off in the US markets, but thought it would have substantial follow through once started. My horse race pick had seemed to hold up over the prior weeks- Guess my timing was wrong once again!

Although I had adjusted my stop positions prior to this week, I still gave some additional lee-way - so as to not be stopped out on a single pullback. @ days of market sell-off took it's toll.

Thursday I decided to apply a slightly different approach, and took some oversold entries on price signals that were essentially 1 day early on some China related stocks. The catalyst for this trade was stocks and a market that had been downtrending , and appeared to reverse with the larger index. $ssec.

However, while it appears that China and the Us markets have disconnected on day to day trading , I think the market in general is suspect, and that the bears will win the day the next month.

So, I've taken 4 new trades using my available freed cash- glad i didn't lock it all up earlier this week.....

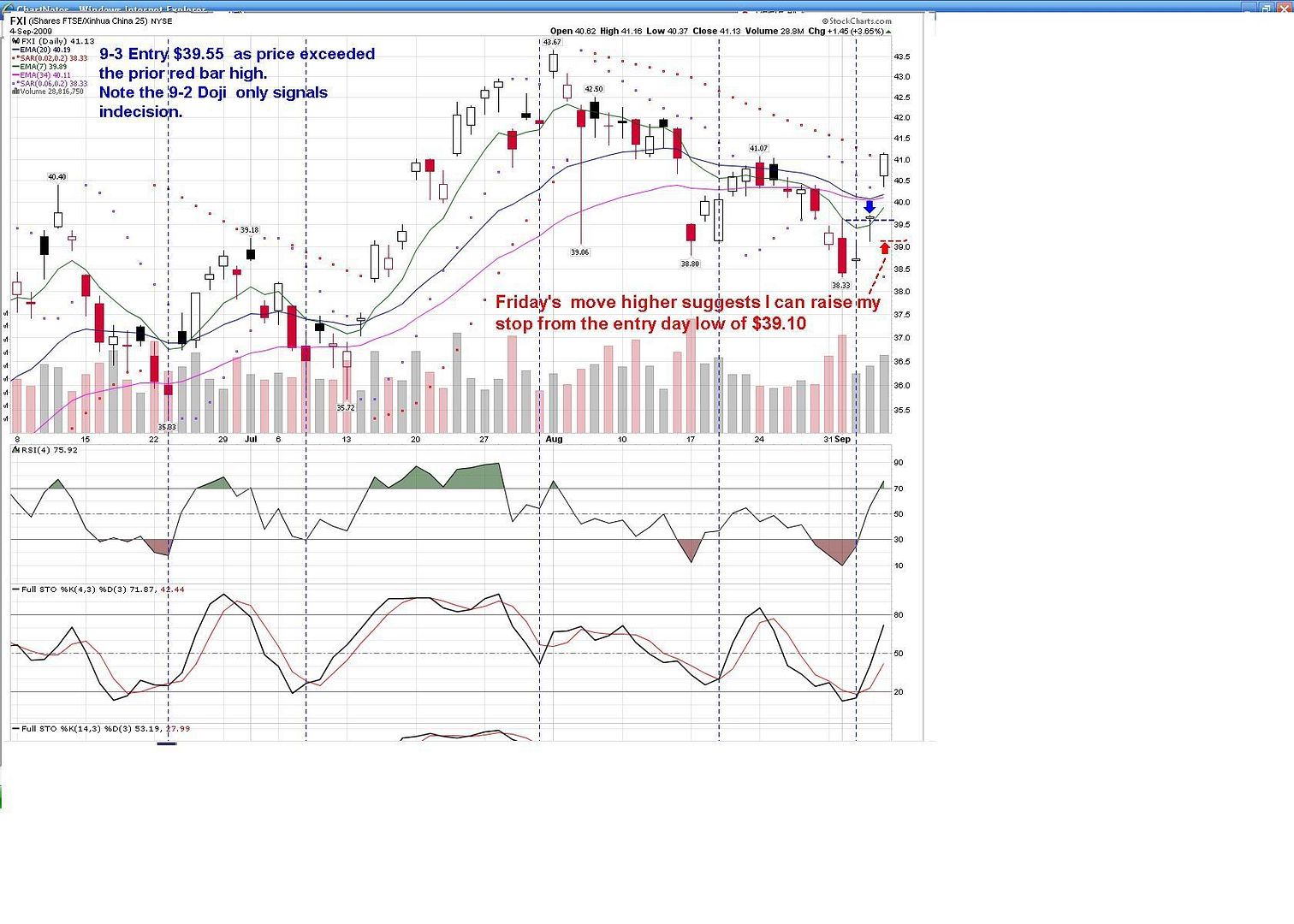

I entered into China as a theme play that appears underway and an oversold bounce at the least. CHL, CHU, and FXI on Thursday.

Today, Friday, I took a $51.19 entry on TEVA.

Technically, most of these trades are "early entries" , and the first advantage to them is the narrower stop-loss required to determine when the trade has failed. This will require a "faster" and more aggresive approach.

Initially I feel I at least got the quick term right when I went long these positions yesterday. I jumped in only on the China stocks because they are definitely oversold in the short term.

There was follow-through to the upside today, and I added a position in TEVA, having a bullish day in an oversold market-

What I'm trying to do is modify my "usual" approach, and experiment with a more aggressive entry and exit approach. i'm not at all sure how this will work out over time, but it feels right at this time-

The market has given me a large # of stocks that have pulled back and may be trying to rally higher. If I had more freed cash, I would have taken additional trades.

This is a test for me, whether I can adapt my trading in a weakening market, i was able to glance at some charts and take some positions near the EOD on Thursday. Friday-today - there was upside follow-through, and all positons are profitable at the close-

All of this can change by Tuesday when the market reopens.

SD

|

|

|

|

Post by blygh on Sept 4, 2009 20:52:35 GMT -5

I want to thank you for the tip on NVAX - I dumped 2/3 rds of my position at 7.09 and the last 1/3 at 6.8 for a fat profit. My favorite Chinese stocks are TK TOO EDU AOB CEO PTR and for a closed end CAF. TEVA is a good core holding

Blygh

|

|

|

|

Post by sd on Sept 5, 2009 8:40:49 GMT -5

Hi Blygh

I'm glad it worked out well on NVAX- I don't usually check company profiles etc- something I should likely do more often, but it seems the market will run something up regardless of the facts, -Just look at AIG, FNM, FRE -

and also thanks for sharing your China Picks. Do they pass fundamental scrutiny? If you don't mind my asking, What process do you apply in making your selections ?

As you likely know, I just try to find a chart-and hopefully something in a sector that has some upside momentum.

Teva makes sense because it seems to be in a sweet spot with generics likely being the beneficiary of any health care "reform"- I have no idea how well the company is doing business wise-

Thanks again, and have a good weekend- I hope the $ssec doesn't resume it's sell-off Monday!

SD

|

|

|

|

Post by sd on Sept 5, 2009 9:18:34 GMT -5

I've decided if we're going to get whippy, I'm going to try my hand at some faster trading, using a fast and slower stochastic 4; 14, and a fast (4) RSI, and just try to capture some quick gains, and will get really aggressive on stops- at least on trying to catch an entry where price has dropped below- Not trying to catch the proverbial falling knife, I'll also not put a lot of hope for the up moves to be the start of something bigger- If price manages to get above the fast ema , I'll look for the fast stochastic cross and drop to signal weakness as well as the fast RSI. Realistically this earlier entry will provide more gains on a move higher, but also more whipsaws- I'll be using a smaller position size as I experiment around with this approach, with an eye to getting my stop to BE asap. I'm going to apply price action below the fast ema with indicators declining, looking for a reversal in price with confirmation by indicators- fast line up turning and a an impending cross of the slower, RSI-4- upturned . I'll also continue to apply some of the other entries I commonly use, but with stops readily ratched higher on weakness. There was a turn in the China Market $ssec, which has been selling off for weeks, and that was my reason - these 3 all were giving oversold potential reversals. I entered as price looked solid on Thursday, and the following move Friday was higher, so I'm starting off in the right direction. China stocks jump around and gap daily- both up and down, so they may give little warning ..... I also entered TEVA on Friday- Similar play.I'll forward a chart -  |

|

|

|

Post by sd on Sept 9, 2009 20:09:19 GMT -5

I had 6 positions last week and added 7 more this-

V,CHU,CHL,FXI- Teva, the 3 china stocks were bot near the close of business on the reversal day.

This week I added mpw, aer,swks,adct, meas

Thanks to a beneficial market, these trades are higher-

I had my first stop today- CHU @ $13.80 on the raised stop.-I believe my entry cost $13.49 , so a small 2 % gain.

Also 1`/2 of the CHL position stopped out @ $50.58 with my entry cost $2 lower @ $48.58 for a 4+% gain on that portion- I adjusted the stop intraday, and decided to split the stop with 1/2 under a drop below the fast ema, and the other 1/2 just under the 50 ema (All based on an hourly chart.-looked at intraday)

Presently, all remaining positions are in the money, with the china related stocks lower today than yesterday. That's 3 days of an up market to thank for it- encouraging when trying a new approach.

My initial thinking is that on a daily chart of an uptrending stock where price usually stays above the fast ema, a close that drops below the fast ema is the place to raise the stop up to.

On the hourly chart, the signals will come too fast on moderate price drops causing an early exit and likely whipsaw as price rebounds higher. This is true, if we are in a bullish trend- If we are in a sideways market , this may be the right approach .It reduces losses and locks in a profit if price weakens. I will have to compare perceived weakness on the hourly chart with the price action on the daily, and find the balance where I can allow profits to run and not nip them in the bud. Thus experimenting with splitting the stops, so I can hopefully determine over a number of trades, which approach yields greater promise.

I should also try to compare this approach with an approach based solely on the daily chart--

Which will perform better if we go up for 3 days, down for 2, back up for 4, down for 3?

Rhetorical question at this point-

But- 2 down days last week took out most of my positions for an overall loss- Stops were not too tight in my opinion. In fact, I feel I had stretched my normal stop ratio so as to not get a quick whipsaw-

Thinking "if you had wider stops, you wouldn't have been taken out in 2 days?" Possibly true, but at what cost had the trend continued down for a 3rd or 4th day- ?

Can't get access to stockcharts tonight to upload a chart.

Will hope to post some in the day's ahead-

I also think this approach is far better suited to taking entries on pullbacks in stocks in primary uptrends, and not downtrends.

It is designed to identify potential price reversals on pullbacks that offer an improved entry.

SD

|

|

|

|

Post by sd on Sept 10, 2009 19:30:19 GMT -5

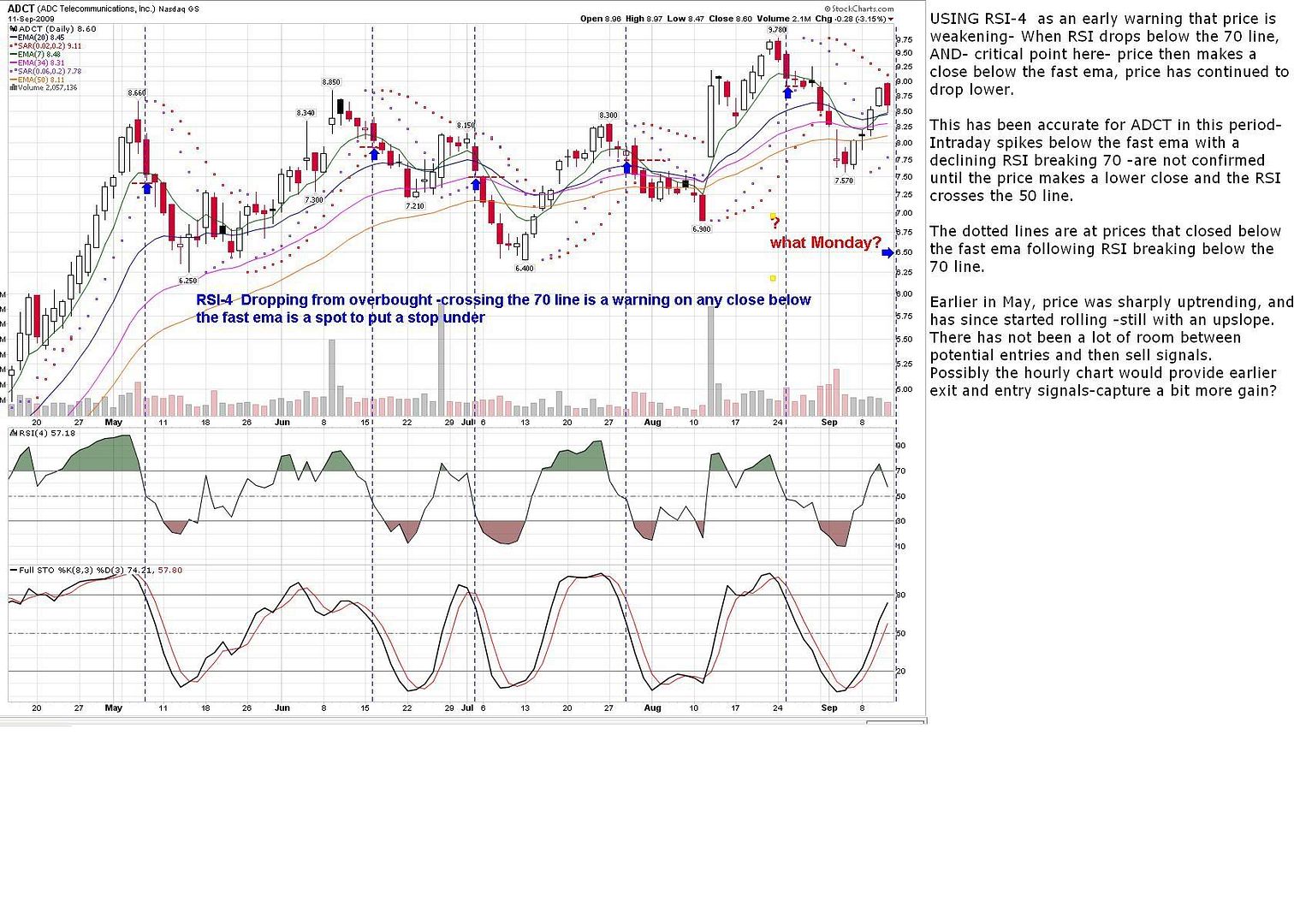

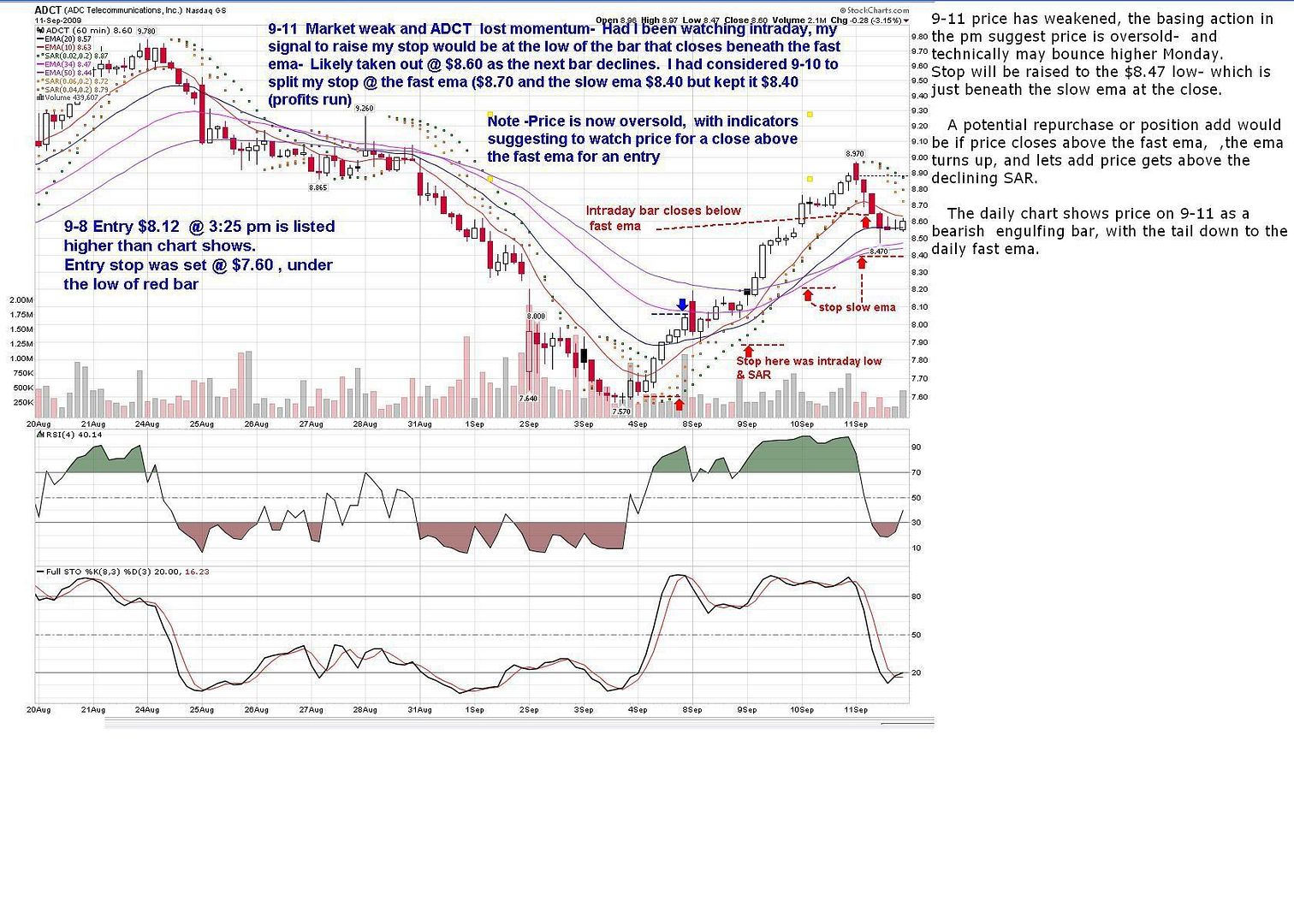

Just enough time tonight to illustrate a chart- I entered this trade late on the 2nd day, and it has moved nicely with the market rally. I tried to illustrate this daily chart- the consolidation range will give numerous false signals, Where i I feel this approach will do best is guaging stocks that have had a minor correction in an uptrend, and using this as a lower cost point of entry. I still have to figure out if my stop adjustments are too aggressive, but I still feel that in this potential market being extended, it's the smarter approach . Yesterday I sold 1/2 CHL at the higher stop, and today the remainder @ $50.50 FXI stop was not hit. I also Bot TKLC today - I had looked at a chart intraday and it was declining- I set a buy-stop if it reversed and moved higher and was filled @ $15.86. Hourly Chart attached-ADCT- SD  |

|

|

|

Post by sd on Sept 12, 2009 10:22:00 GMT -5

I had 2 trades entered and stopped out yesterday- TSRA, CY for losses, and a MEAS position that had been up nicely sold off at BE on a raised stop. Market was down slightly after 4 up days, but the market trend is still up. As a follow up on ADCT- It declined Friday, and I have both an hourly and a daily chart to attach here. It came close to hittling my stop at the hourly 50 ema, and it had a number of sell bars below the fast ema Friday, with a possible early sign in the pm bars that selling was abating and buyers stepped in . The 50 ema closed @ 8.44, the low was 8.47 and stop was @ 8.40 to start the day- I will raise my stop to the 50 ema-$8.44 which is $.03 under the intraday low- The daily chart suggests price is weakening, but it has not closed below the daily fast ema. As I tried to look back using RSI breakdowns of 70 on the daily, viable signals were given only when the breakdown was confirmed by a close beneath the fast ema. During This 5 month period , using this as a "sell signal" would have been timely for a day trader- There was 5 valid signals on a daily using that criteria. This also coincides with a general approach of setting a stop beneath the low of a bar that closes beneath the fast ema. While this would have been the "right" approach to sell and protect profits in this particular rolling price action for a swing trader , when one considers the next likely reentry signal, there is not a lot between the entry and the sell. A look at the hourly would likely suggest faster rentries and faster sells. (and likely more whipsaws.) I think the advantage is identifying an oversold condition with seeing a daily price signal, and confirm with the hourly for a potential entry. Caveat Emptor of course, While I have enthusiasm for trying to apply this faster time-frame viewpoint, I'll only know if this works out over numerous trades in different charts and market conditions,. While it limits risk, there is a higher potential loss of profits by not having a plan in place to take a reentry, or adding to the position as it moves up. There should also likely be a consideration of "market conditions" -i.e. -reduced position size or increased position size. And, at what point does one allow the trade to "run" to try to make a profitable position become a larger gain? drop the hourly signals in favor of daily etc. Obviously, One can and should look back over time in the charts to see if any aspect of this is beneficial or not- . Sounds like I'm in need of defining a trading plan with an eye to different entries, conditions, etc. Don't know how far I'll get on that this weekend- Too many chores to attend to, and too many charts from this week to annotate . SD   |

|