|

|

Post by sd on Jul 29, 2009 14:03:27 GMT -5

On vacation this week, took a few trades on the long side this week , most were moving up despite the market bearish.

Not able-or wanting- to spend all day watching the screen, Posting this @ 2pm as I got rained out from cutting up a dump truck load of oak logs that got dropped off yesterday.

I had profits going on to start, and then progressively things weakened particularly today. I took several small spec positions, think they were biotech related, and made a nice gain on a raised stop in DCGN- lost on XOMA.

Went into C @ $2.80 and it's still profitable today. Have already moved the stop to my entry level today, it's up as is BAC (don't own it)-still holding UYG with a $4.25 stop

URE I had a 1/2 position on @ 4.04 and then the announcement came out that housing looked much better than expected and I immediately added another 1/2 position to $1600 range. It was up nicely intraday , and then weakened, and I debated about selling 1/2 the position today- which is what I should have done recognizing the market and stock weakness.

I stopped out @ 3.99, 3.98 for a $38.00 loss on the trade-2.3%

The majority of the trades the past 3 days have simply withered away- I'm down about 100.00 at present. It was interesting

I also decided to take 2 short positions earlier today after 10 am watching price action for signs the market might rally-

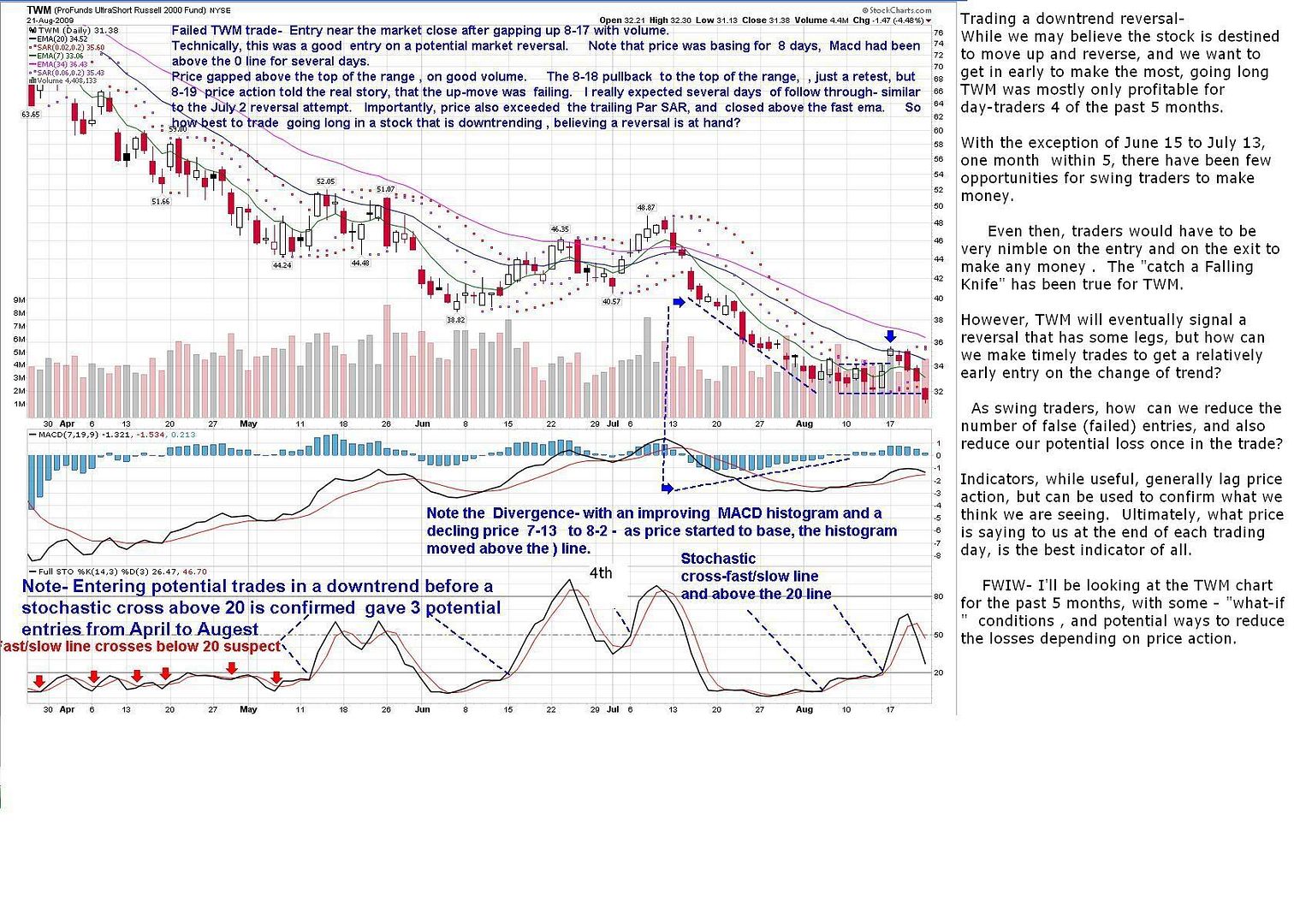

I went long TWM-$35.79 -with a 34.74 initial stop (2.8%) it seems a compelling entry here, what with the market obviously pausing in it's run higher.-which puts it below the most recent low. and SMN $15.72 , I'm going to set my initial stop @ 14.42 which also puts it lower than the prior low 2 days ago. This is risking 8% initially, but I intend to close that gap if price weakens.

Market is choppy, the $vix is moving higher, and both smn and twm are in the green presently.

Technically ,on the daily- both of these trades are too early. The hourly suggests this may be a good time- these stocks will likely gap higher on the open if the market decides to actually have more of a move down this week.

Some blue skies showing - back to the woodpile-SD

|

|

|

|

Post by sd on Jul 30, 2009 20:40:44 GMT -5

Forget going back to the woodpile! It's straight to the wood shed for me! My TWM position stopped out on this strong market day today, and my materials short- smn came very close to hitting my stop loss. One more rally day and it will be toast.

My 2 remaining prior positions- C and UYG (financials long) are both still positive and helping to offset my losses there.

Yes, the street is beating the pants off of reduced estimates, and undoubtedly there will be higher revisions of earnings for the next quarter- maybe that's when those with a bearish stance will find some footing. I'm simply wrong in my thought process- or at least the timing of it, and it seems I have been consistantly wrong, mostly missing out on the rally higher from March.

as I listen to the market whiz's,tonight, a good portion of this markets upsurge is short covering and managers that wanted to stay on the side lines having to jump on the band wagon-

Regardless of what moves this market, I've been more inclined to believe that the market will wake up and say - time to retest, we still have major issues for business and the consumer- and prior 3 days of a flat market - I keep thinking back to the mantra the market is looking ahead 6 months means the market is way optimistic- and I don't see it reflected in my world-

The dow was up strong today, but weakened by 1/2 at the close-=Was I early? Disney is down and uncertain looking forward. Is that enough to derail the markets upward move? I doubt it.

In retrospect, I did mention that these trades were indeed early by most TA measures- a bit of self indulgencence on my part - and a smattering of greed to be on board early instead of a day late..a dangerous combination, but it was controlled by my position sizing .

I didn't spend more than 15 minutes looking at the market today- and let things roll as I had set them with the previous stops, and went about my business.

I'm down to C, smn, and uyg and no free cash- a blessing in disguise there .

BAC and AAPL continue on?

I still have to believe a short term trading approach is the best way here-SD

|

|

|

|

Post by sd on Aug 3, 2009 19:05:25 GMT -5

Aug- 03 Market continued to move higher- I had some buy-stops filled early on ,on price breakouts with limit orders. Several stocks just blew past my limits and near the EOD I went ahead, held my nose and Bot some of those.

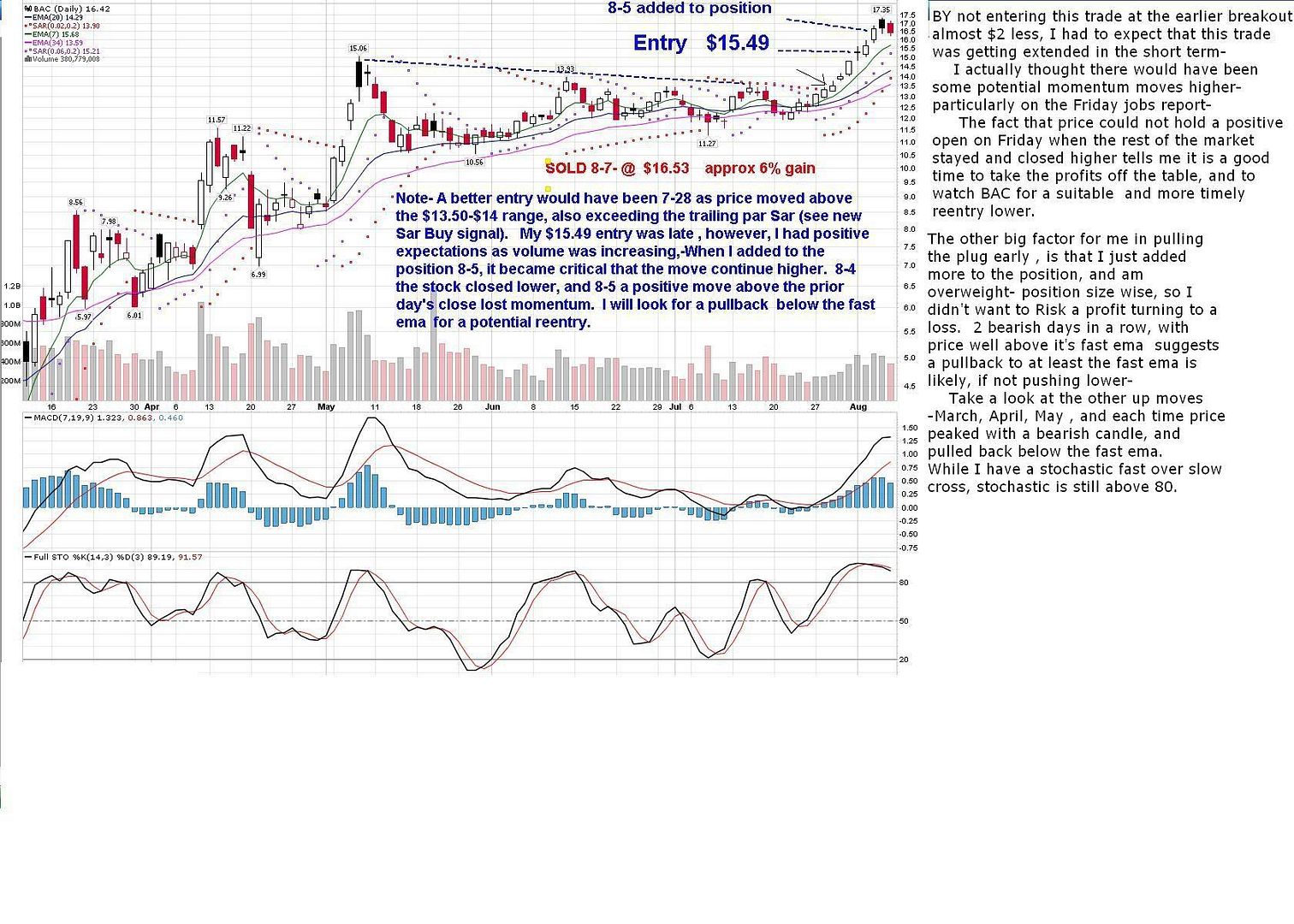

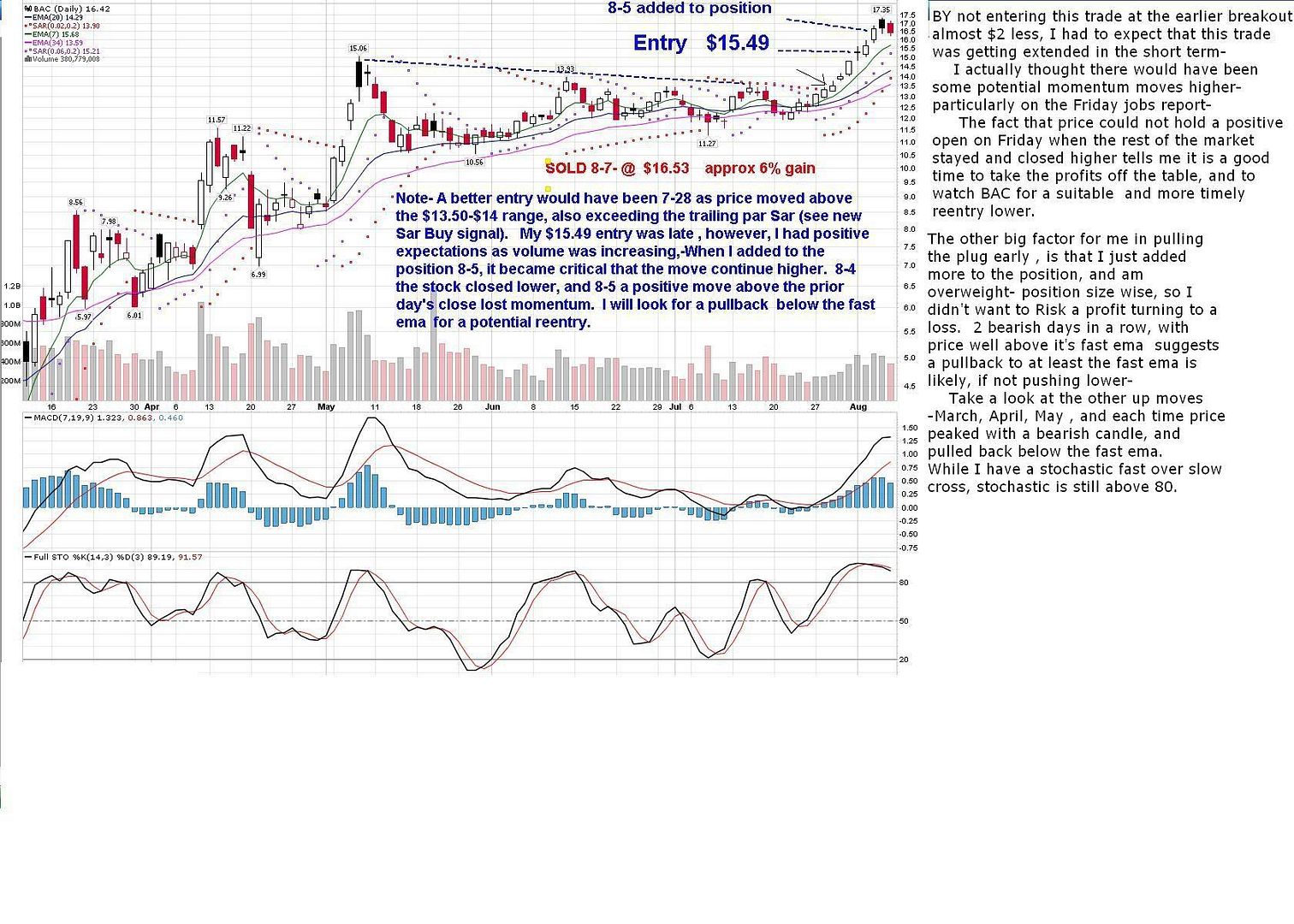

BAC was one of those- Apparently there was some "bad news" with BAC, about deceptive bonuses etc, SEC charges, and then it was resolved, and some management changes-and the stock moved higher.-

I can't help but wonder what/when will derail this market?Likely just when all us bearish folks concede, the market will draw us in and then the smart money knows to sell.

Well, the market certainly climbed a "wall of Worry" to get where it is today-

and now, are we almost at the top? S&P closed over 1000 today! How many large funds will be pouring in here?

Some good production news today spurring the world-wide recovery theme-

I still hold C and UYG from the prior week, and they're making respectable % gains . Both were smaller sized positions, and I may add more- I have a buy-stop to add more C - presently @ $3.28 , but I may adjust that lower following price action.

I can't take the hit on some of these stocks for a technically appropriate stop-loss, although I have moderated my position size. I'm looking for some follow-through tomorrow, and plan to adjust stops daily. SD

|

|

|

|

Post by sd on Aug 3, 2009 20:36:27 GMT -5

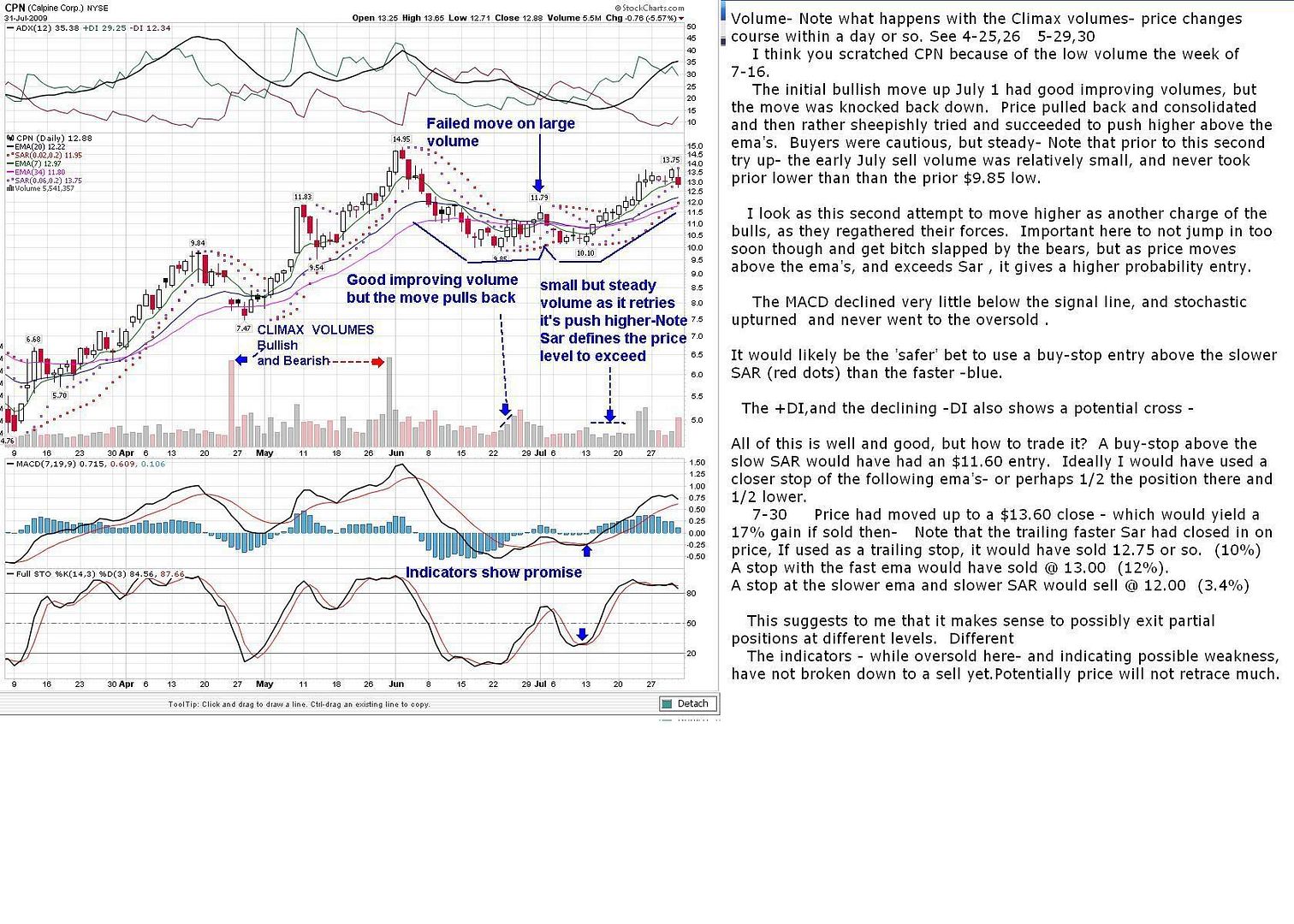

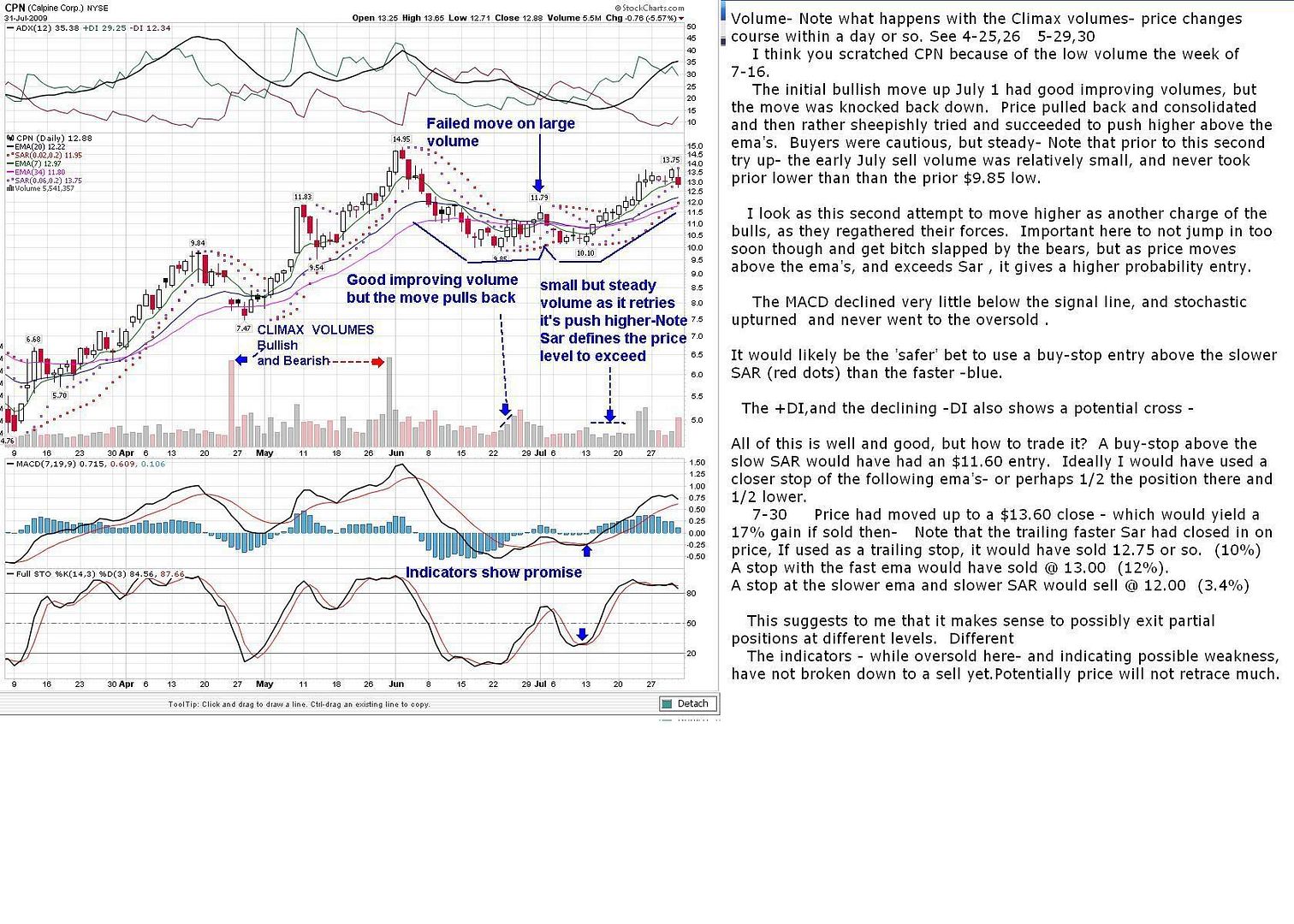

For my fellow traders: One Approach for a short term trade entry: Trading a failed breakout 's second attempt- on a retracement- I like to go for a pullback where price has dropped out of an uptrend, has retraced some- not too extremely- perhaps a rounding bottom suits me best- By this time price is below all it's moving averages, a few indicators suggest price is stabilizing, and then price tries to push higher. In improving the probability of success, it's important to not jump into the trade too soon. I actually look at price action and a faster ema , along with a couple of indicators, to try to judge when a reversal may succeed. A number of times, the first attempted move higher gets knocked back down by sellers, and price licks it's wounds and tries to regather it's wits. Bear with me, this is my attempt at imagery...Consider a bull running with the herd, transformed into a skittish lone wolf? OK, a bit overdone..... Using TA and some thought to the psychology of what price action is saying, When the bullish trend line has been broken, and price falls back and then once again attempts to regain it's momentum at moving higher- That is a potential BUY opportunity.(within the right parameters) Ideally , all the fast sellers are out of the stock, and the rest are holding their breath to see which way price will go. Price has fallen, and ideally is gradually moving up - I personally like using faster moving averages and also somewhat faster indicators than standard. Potentially , this will give more whipsaw signals, particularly for longer term traders, but provides earlier indications of changes for shorter term traders- This potentially is less risk- and also less reward- i.e. whipsaws. Standard Indicators: I only rely on 2- a fast macd and a full stochastic. Here's the premise- Stock ABC has been uptrending and loses it's momentum, pulls back - and then tries to move higher- The macd histogram is improving towards the 0 line, stochastic fast line is starting to upturn and cross over the slow line, ideally both are near their base lines, and price turns back up. Price then moves above the declining ema's, and ideally we see a fast ema cross over the slower ema's all at the same time. AS price closes above the fast ema, it presents a potential buy opportunity , IF it exceeds the trailing parabolic Sar- Parabolic Sar can be adjusted to a fast and a slower range- it measures volatility within a price range- A slower SAR will give later entries, and a faster SAR will give more whipsaws. A slower trailing SAR 0.06 vs 0.02 gives a wider move required to be exceeded.- Gives fewer false entry signals, albeit at a higher price. I often use the trailing SAR as a price level for a buy-stop entry on a break up higher. In the chart of CPN, price indeed moved above the ema's and SAR and I would have been a buyer on the up move- and the trade would have failed, as price then pulled back and dropped lower below the ema's , before trying to climb higher a second time. It would have been a losing trade the first time I tried it, but would have succeeded the second time. What I think may make a difference in this second attempt to move higer: On the second pullback, price never exceeded the 1st pullback's lows. and in the second attempt - volume was actually smaller, but steady, and lead into an upside gain. The fact that price made a second attempt to exceed the first up move held promise, and offered a good entry level using a buy-stop above SAR. SD  |

|

|

|

Post by sd on Aug 4, 2009 19:32:01 GMT -5

Today the market started off down, and made a turn-a-round and closed higher. Again the S&P closed over the 1000 mark, which psychologically is a positive for the bulls.-

I understand this week is the report of unemployment claims,which better come in substantially better, since the street seems to expect an improvement . A bad number there may be enough to cause a big sell- but the pundits point out that there is still a lot of money on the sidelines that has missed this rally and needs to join in or they will simply look bad .

This past week's rabbit-out of the largess of the gov't to keep things moving: the Cash for Clunkers program got a second chance-more stimulus money to be released it appears- This may indeed prove to be a good thing in the short term, just as the better earnings were perceived to be a positive.

Even the news that GE falsified it's past earnings didn't derail the market. Was that covered on CNBC tonight? I guess I missed their comments on it-

The commercial real estate market may be improving- despite the thinking it was "the next shoe to drop".

5 months improvement- I guess it's time to concede -things are better. and that benefits BAC.

In my gut, I continue to anticipate the correction- and that anticipation will eventually become a reality- but that has also constrained my trading - and investing. I've had smaller losses but also smaller profits, and have

If financials are the ultimate beneficiary of an improving market, perhaps I should get overweight BAC , C, V, MA.

V on a break higher above $70.?

Just some musings here. and regurgitating the analysis of the pundits on TV.

How about URE, IYR or the builders themselves?

SD

|

|

|

|

Post by sd on Aug 5, 2009 20:06:03 GMT -5

8-5 update-

I had added a number of new positions Monday, most were weaker today as the market was down-

What was surprising is my financial positions were moving up, and so I brought C up to a full position , BAC went overweight, and paused on UYG- but I'll add to it tomorrow if it continues to move higher.

Of my newer entries- I'm not giving much leeway-Since these were mostly break-outs higher...... Those that today spiked lower, below the fast ema, I've raised the stop to the low of the day- Well above SAR and recent swing lows. Those that remain above the fast ema, I've looked to the fast SAR. I'm crowding these trades, But as the market seems to be digesting negative news- CSCO, possibly the jobs, I can't help but feel that limiting the downside is particularly appropriate here.

SD

|

|

|

|

Post by sd on Aug 5, 2009 20:33:23 GMT -5

As I review the UYG chart- up very smartly the past 3 days, Price seems extended beyond it's MA, and a look at the shorter term charts and the EOD price action suggest some bearish price action going into the close with volume on the sell side.

Price hit a 5.37 high, with a 5.30 close, and I'm going to do an untypical trade- I'm setting a limit buy for $5.07 for Aug 6, thinking that I may get a move lower as the market reacts in the am, and possibly an upside move later in the day. This can be the "catch a falling knife" scenario, but I'll have a stop in place as well. I'll try to monitor the open on am break and see if I need to adjust the trade-SD

|

|

|

|

Post by sd on Aug 6, 2009 19:22:17 GMT -5

UYG gapped up higher, and I went ahead and added to my position on what was a bullish move higher in the am- later in the day , the mood waned.

The trades all hinge on tomorrow's job's report- and here is why I think it's prudent to set stops at today's trading lows- Cash preservation on a weak number and market sell-off.

....................................................................................

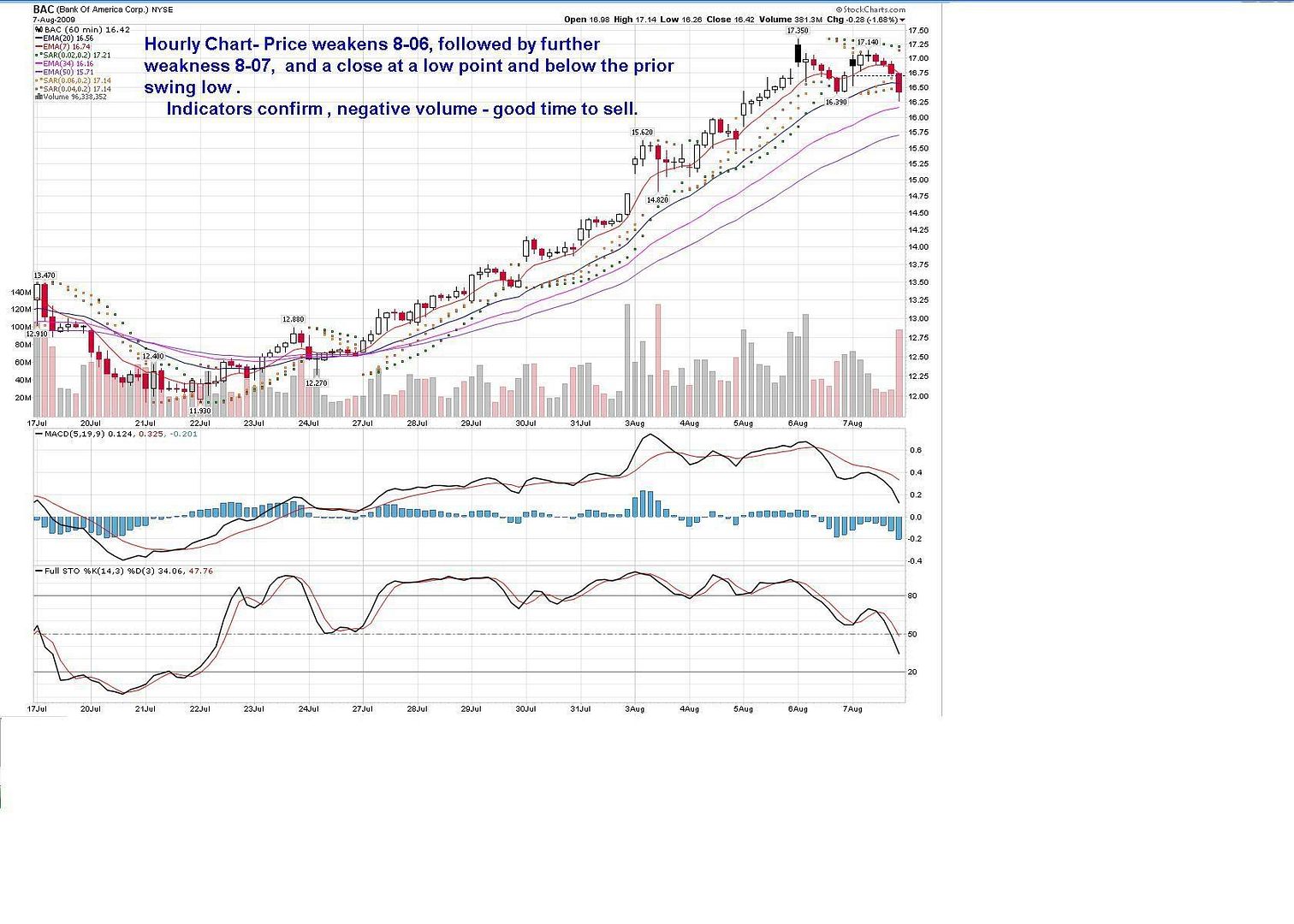

BAC lost momentum today, as did UYG- and get this:

after yesterday's positive mention where Cramer said to a caller- Yes he'd buy C, he opens tonight's show with a BUY!BUY!BUY!

I should send him a big Thank You Jim for the pump up-Up over the $4.00 in afterhours--I should sell into the open!

Actually C had run up 5% today during normal trading -about $.23 , and with Cramer's pump, it's my largest gainer, followed by UYG and then BAC-

Everything else i own is borderline or losing slightly-

A lot hinges tomorrow on the jobs report. 8:30 am - Virtually every stock will likely react -one way or the other. If the jobs report isn't outstandingly positive, we'll finally go down and see some correction I believe.GS is predicting a positive report- but many others are hedging.

The market has been flat this week, and I think it'sbeen positioning for a correction- Other than my financial positions- most of my other trades are flat or declining, and I'm applying tight stops to all. With the exception of C, the financials started off strong and then sold off. BAC closed down.

As of this week, I have squeaked out a new port high thanks to the financials, and I think to aggressively setting tight stops on weakness and limiting my downside.

I think my stop set-up is simple - The jobs report will be out before the market open- A bad jobs report the market will open sharply down, and take every position I have with it. If the report is positive, the market will open higher.

I see this jobs report as THE single item the market is hanging on, and so I believe a positive jobs report will see a lot of stocks gapping higher, and if not, gapping lower.

My financial positions have moved up very aggressively, and I desire to protect myself from a bigger downside gap- All the prices are well above the fast ema, and so I will set my stops- across the board, at today's low for all positions, including financials. This is comparable to putting it on black or white at Vegas.-A line has been drawn and stocks will react accordingly.

If the report is beneficial, stocks will likely open higher, and if not, will gap lower.

The opportunity of a pullback is to be ready to get back into financials at a lowercost.

I may have mentioned this previously as we discussed where to set stops- Since most of my positions are breakouts higher, and were already above the fast ema when initiated, if the price drops below the fast ema intraday, I take that as my signal swing low, and raise my stop to that level.

Feeling I missed out on much of this market move since March, I was skimming back through Stan Weinstein's book, but realize my mindset is that while we didn't get the big correction, we are none-the-less overdue for a correction. That is why I believe maintaining a shorter term and more defensive approach is appropriate- particularly considering some of my entries were on moves higher.

Tomorrow should be interesting to say the least- If the market goes higher, I'm going heavy financials and real estate, commodities, and emerging markets.

SD

|

|

|

|

Post by sd on Aug 6, 2009 19:42:31 GMT -5

As a follow up to my prior post, a mention on setting stops- ideally, to stay in a position longer, one would either select a break of the trend line, or a break below a prior swing low. or something similar.

If one enters later in a trend, it is likely realistic to expect that a turn in the trend may be ready to occur- and to limit losses accordingly.

On a continuation of the trend however, one needs to have the gumptions to reenter. SD

|

|

|

|

Post by sd on Aug 7, 2009 17:13:17 GMT -5

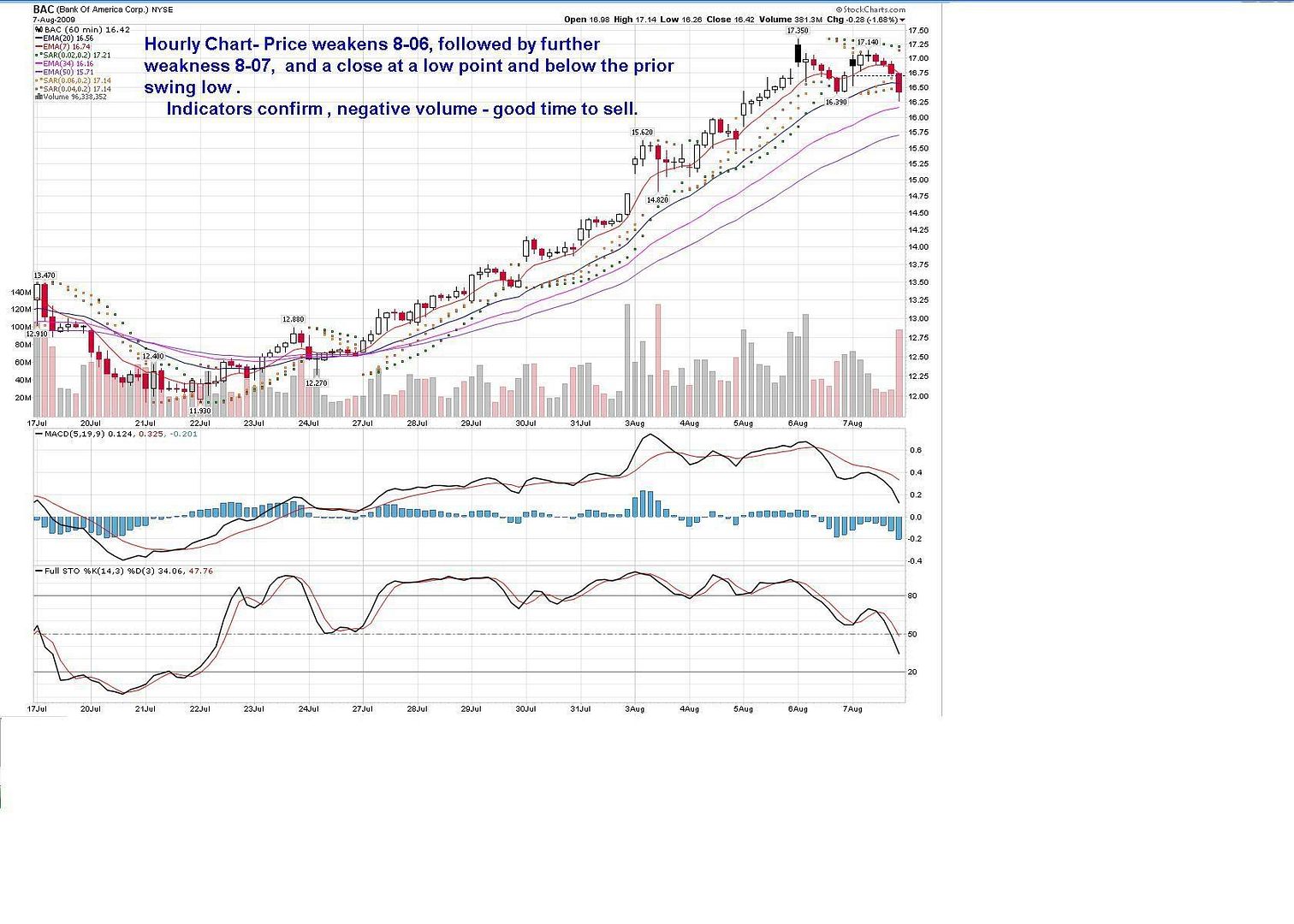

Today- Friday was an interesting day- Stops on all positions were all raised to the prior day's low. When I saw there was a positive jobs report this am, I scrambled @ 9:30 am to cancel all raised stops. All trades opened higher. C moving up well- When I checked at lunch time,Only a 1/2 work day - trades were still doing well, and when I returned to look @3 pm the outstanding gains I had been viewing previously were significantly diminished -as BAC actually was going in the red and closing lower than yesterday- C was also in decline-the candlestick was a bearish 'shooting star' - tall tail up, and then declining- It also closed lower than it opened. I kept the UYG (Financial ETF) position open,as it had moved higher and gained on the day. Both C and BAC have made substantial moves this week, and I expect both stocks will indeed move higher, and I will plan to reenter- hopefully at a lower cost basis- 3 charts- BAC daily, BAC hourly, and C daily-SD    |

|

|

|

Post by sd on Aug 10, 2009 19:34:10 GMT -5

Just a short note, as I follow up on BAC, C , and UYG- The overall market was lower today, but C and BAC both improved, but not exceeding the prior highs- and UYG was down-

These stocks previously moved higher against a weak market, and when the market rallies, they weaken- So go figure......

At this point, I'm waiting to see how the next days/week work out with the market, and these financials specifically- Will the impending correction actually show itself?

I still look at C and BAC as likely reentries, but felt that the weak price action when the market showed signs of strength , just as I felt positive when the stocks showed strength in a weak market- Got to go with what works, and limit the risk.

SD

|

|

|

|

Post by sd on Aug 11, 2009 18:50:48 GMT -5

Today there was a pullback in financials across the board, and analyst thingy Bove also stated that financials have gotten ahead of themselves.- Both C, BAC, and UYG moved lower today, and so I feel somewhat justified by my early exits. Now it will be a matter of watching price action and determining a good spot for a reentry.

I also went through tonight and tightened stops on my remaining positions- it certainly "feels" like this is indeed the market rolling over , and protecting profits and minimising losses is only sensible. On the other hand, my timing of what the market will do in reaction to news, earnings and woulda-coulda is noteably out of step with the reality-

Cudos to those investors/traders that have/had the foresight to follow market themes and get on board early and reap the benefits- , I also want to find a trade that has a market theme and momentum behind it.

The bank trade- with gov't intervention, is a good example-

I'm working off memory here, so bear with me, but I had a nice earlier trade in BAC earlier this year and netted a one time gain and didn't revisit the trade as it had then moved higher- While I made a nice quick profit, perhaps 30% , I missed out on the 400% run-up the stock actually has had. and many other financials have done very well!

How about the Nat Gas plays-? there is a tremendous push for Nat gas to be the salvation for future reductions of oil.

Look at some mortgage plays, and a market rebound this week with FNM, and FRE-The long awaited 'commercial real estate' shoe may drop without so much as a small thump on the carpet-

I've been here before- that sense of de-ja-vu? sp? Is this the long awaited correction starting, or just a small pullback and a good reentry opportunity? For trend traders, a new lower -low, or break of the trend line should be a time to lock in some profits. Waiting to see where this goes- SD

|

|

|

|

Post by sd on Aug 18, 2009 20:32:33 GMT -5

This weekend I spent some time scanning stocks and came up with a group of prospective break -up-higher candidates that I put in buy-stops for Monday am-

I saw the market futures were down 190 pts , and thought about canceling the buy-stops but left them in place on the unlikely chance that some of my picks would soar higher despite the market's bias lower.

I was off of work on personal business this Monay, returning home @ 3pm and checked out the charts- Market had not rebounded much, and the impetus for the sell-off was perceived weakness in China. I went short the market going into the close through a number of ETF's that had made substantial % gaps higher that am- SMN, TWM, DUG, FXP,EEV, EFU

I really expected to see a few day's weakness-some continued follow through lower , but this market continues to push aside what should derail the continued move higher.

I expect these positions will all be stopped out on one additional upside day-

Remeber the voice of EEyore in Winnie the Pooh ?

It looks like I'm wrong again........... SD

|

|

|

|

Post by sd on Aug 20, 2009 20:59:16 GMT -5

I definitely had to cry "UNCLE!!!" with my short focused positions- While not yet stopped out of 2 - EEV and smn, I've raised the stops on those to the intraday lows made today on the unlikely chance the market will find some indigestion overnight and these 2 positions will go a bit higher- My losses on those that have stopped out were substantial -% 2x compared to my usual tighter stops. I was trying to give the trades some breathing room, and it turns out it was a one day wonder/correction. I'll try to post these later, but while I hate losing money, I was able to not just knee-jerk react to these trades as they turned against me- Perhaps I should have- because Rule #1 should be - protect the account- I intentionally gave these trades a bit more room than normal, and I will have to say that I feel I did this because I in fact feel that I've tended to jump out of trades early defensively, often to see the stocks turn up higher- Last week, I had 2 positions stop out where my stops were within $.02 of the price low- and that indeed is painful when you're that close ........ However, the answer is to not just go significantly wider with stops- Why say that? I have some prior lists of potential buys over the past few months, and a minority of the stocks on those lists have actually moved higher. An effort to stay in those positions with wider stops would have resulted in greater losses. I was filled in CIEN Monday- the prior week it had broken out of a range and I had placed a limit order to buy if it rertraced and I have an entry @ 12.16 and today it closed up $13.05. I also had a buy-stop on LOGI and it was filled @ $17.54 today- I cancelled the remaining pending trades- LOGI was loaded and waiting . C and BAC both moved up higher, but the bank index seems stalled here- I can use C as a poster child for trying to stay in a momentum trade. Looking to buy STD with a buy-stop $14.90. The MACD tells me it is early yet, but price has moved back above the fast ema, and is retesting the recent high- Bank stock- ADR. I may also try C with a limit order on a pullback to today's lows-$4.20. Big move up today, looking to see a pullback for a reentry. IBM looks very interesting here simply as a very narrow consolidation range, with a potential buy-stop @ 120 with a stop-loss at 116. It doesn't get much better than that with a very limited downside risk. of 3-4% with an international company. It looks a bit early, as it recently gapped higher, and the macd suggests a few more days consolidation- still well below the 0 line. The gap moved the stock 10% higher, and it may take some time for it to push more. Well worth watching and taking an entry if 120 is filled. CXW- Price action has pushed this higher- potential buystop entry @ $20.90 with a 19.50 initial stop . Price action seems to be going more parabolic this month and is not sustainable over the long term - I think this company handles corrections facilities, and don't know how this can be improving as a business in today's state's budgets- We're closing 7 prisons here in NC - I heard today- Note , while Nat gas is selling off hard as a commodity, it is likely one to watch this fall- The UNG is not the viable vehicle to trade- FCG as Banked out pointed out a while back is a better play, Also , APC, CHK, CHK ,DVN? The HYPE is that Nat gas will be a short term- decade or two replacement for oil/gasoline energies- and it appears we have a lot of it available here in the US. Maybe the gov't will subsidize the gas companies as more folks are unemployed going into the winter months?  Time to shut the lights down if I'm getting negative- Good Luck- SD |

|

|

|

Post by sd on Aug 22, 2009 20:47:48 GMT -5

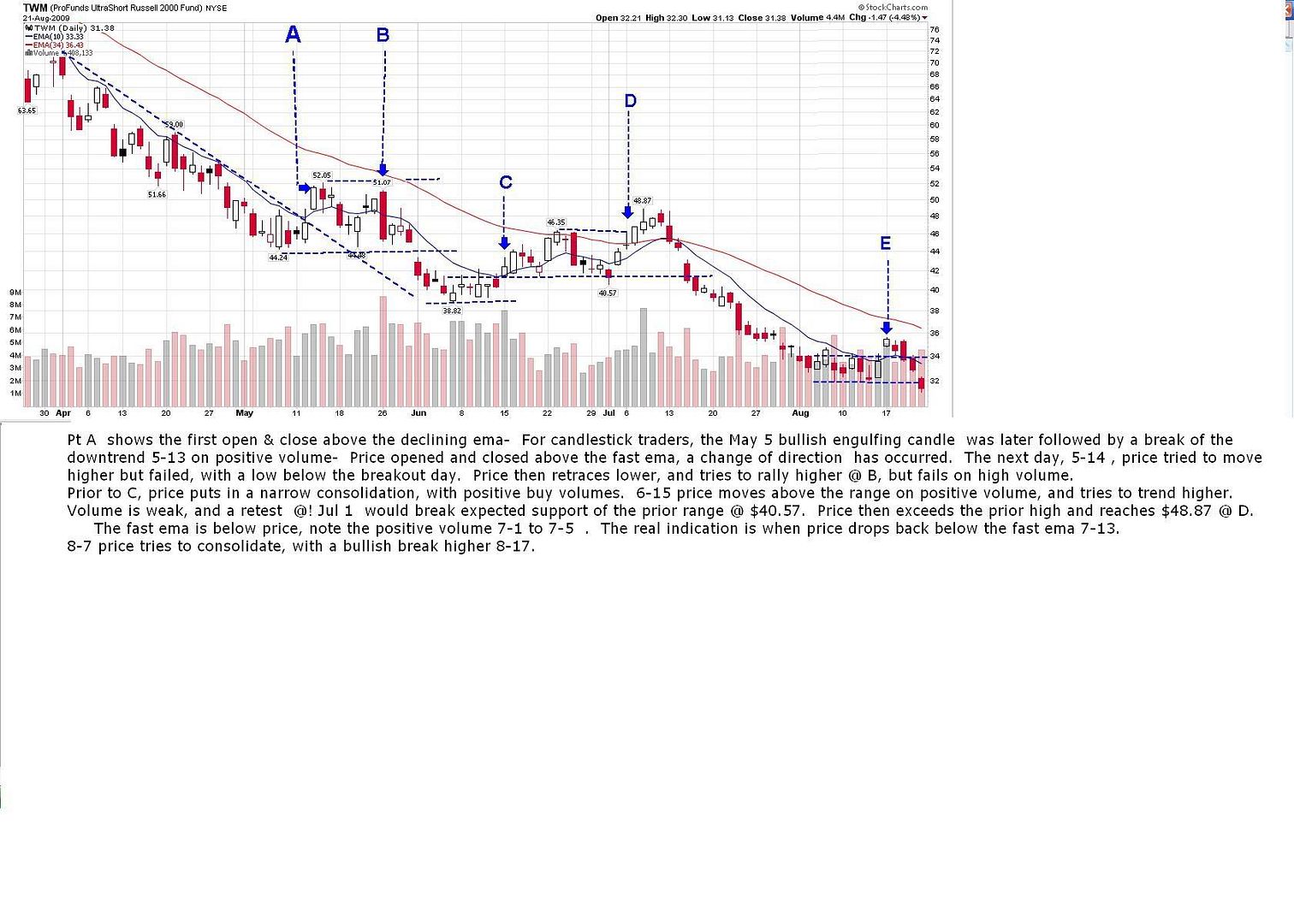

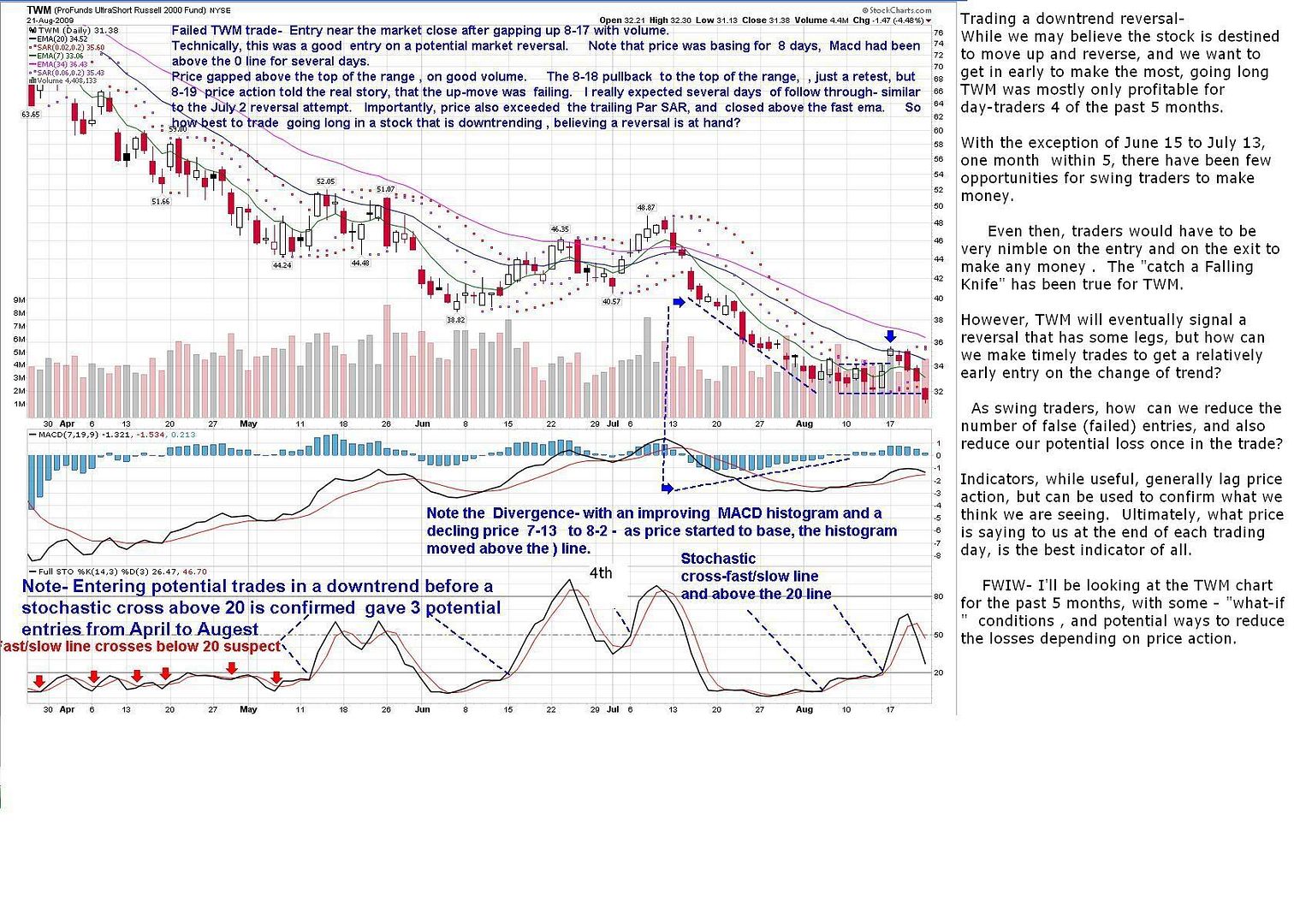

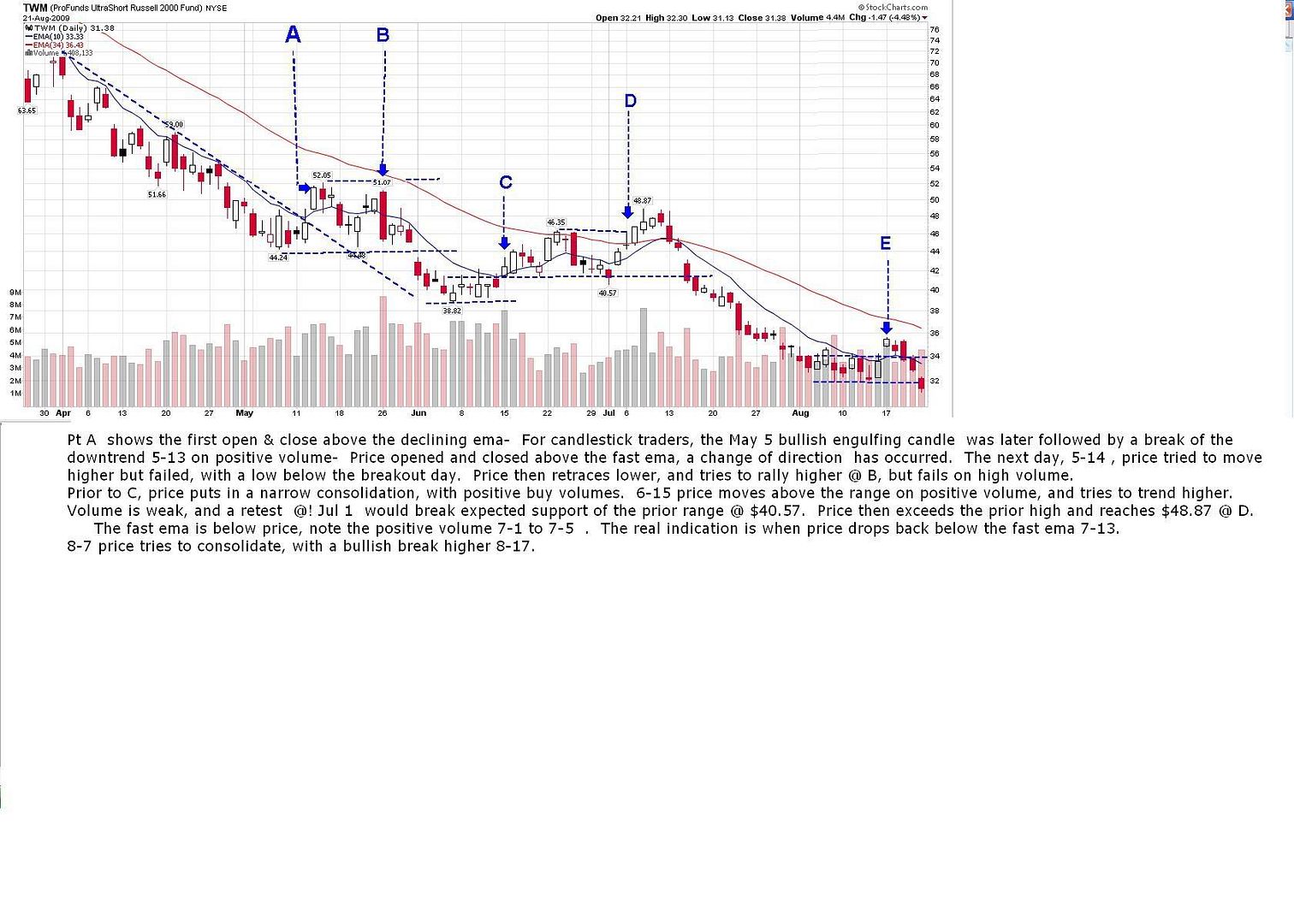

Trying to jump in on a reversal of a downtrending stock or index is indeed risky business. To begin with, downtrends usually have more momentum than uptrends, easier to fall further, than it is to climb higher. My recent trades this week were based on an assumption of a significant change in market sentiment was about to occur, with an expected sell-off of the markets- for a few days at least. The fundamental rationale was that China has been pulling back sharply for the past few weeks, affecting the commodities and - it should have affected the US markets IMO, because a lot of the big multinational companies are dependant on growth from the East and China. China's market selling off in a correction should have spurred a similar correction here, but other than a few days of indecision, this market ignored it. I traded the TWM move higher - It was a break higher from a week's consolidation, and appeared to have legs. It did not . I also went long 5 or so other short etf plays, all of which had similar chart patterns and indications, and got stopped out for losses on all. More substantial losses than I usually permit - A note here on allowing your personal bias to influence you- I will take a potential long trade much quicker than a short trade- I allowed my personal expectations of what the market would/could/should do , to allow me to jump into these trades. I was confident I was catching the first day of a multi-day rally in these positions, that fear would flood the market, and some hard and fast selling would drive these higher., The charts are essentially similar, and so I'll just focus on the TWM trade. I wanted to take some time , look in the rear view mirror,post a couple of charts for thought.......... The lure of catching a reversal is strong, and TWM has given several reversal signals the past 5 months that would have likely proven costly to most swing traders (and have to me several times)  Looking at a chart without indicators: Just a view of price action with a couple of trend lines and expected support/resistance  |

|