|

|

Post by sd on Sept 12, 2016 5:06:29 GMT -5

Wow- What patience! When Did you change your approach from holding a losing trade as a position?

|

|

|

|

Post by blygh on Nov 3, 2016 20:44:31 GMT -5

Shorting real estate with SRS, housing with XLB short, long steel SCHN, short Biotech with BIS and RXD - short Brazil with BZQ

Tight stops all around - covered my short of TLC

I do not see much to drive the market higher -

Blygh

|

|

|

|

Post by sd on Nov 4, 2016 5:52:18 GMT -5

I took some of your short picks-definitely look trending strong-

Why long SCHN - why would you think it has added upside from here-I expect the reason is stock specific ? and not the industry group.?

prefer the ultra picks- I took a position in TZA thinking small caps have been breaking down ahead of the other indexes.

Jobs report today may have a big impact on how it is interpreted- Employers are reportedly seeming some wage pressure- Hard to believe that though....

Also a buy-stop in SLV $17.80 entry-$17.95 limit.

|

|

|

|

Post by blygh on Mar 19, 2017 11:45:34 GMT -5

This week I took positions in IR, ITW - added to positions on high dividend payers NLY AHN

Blygh

|

|

|

|

Post by blygh on Mar 21, 2017 7:10:20 GMT -5

Finally made a buck on NKTR and ESPR - tight stops in place

Holding SOXL short term - Today I am going to day trade MU

Blygh

|

|

|

|

Post by blygh on Apr 24, 2017 16:55:36 GMT -5

Took profits on ITW (stop at 140.00) - invested in MTN - sold it years ago and forgot about it - missed a BIG rise - back into LMT - new position in RMCF -

Defense and aerospace stocks doing well - ITA HEI HII MLM BA GD LMT NOC UTX - ITA looks like a good ETF. Putting tight stops on NLY ANH - took small profit on IR

Blygh

|

|

|

|

Post by sd on Apr 25, 2017 12:10:27 GMT -5

ITA seems a good way to hold the aerospace/defense basket -Theme play for Trump's promises as well. New breakout today- I'll be buying some- with a 145 stop-loss- the low side of the recent pullback- (Still holding TQQQ- , and XBI may finally get going)and, reentered botz,robo ,aaon, today-

|

|

|

|

Post by blygh on Jul 2, 2017 20:44:17 GMT -5

Well I finally made a buck on SCHN - VICL is on a slow rise - hit YTD high. I will continue to hold it- I sold NLY and ANH. I think energy and materials (XME X FXC ) will rebound XOM COP CVX all seem safe bets. I like energy services - always have - Frequently to my detriment - small positions in MDR TRN IEZ. Holding CRUS.

Blygh

|

|

|

|

Post by blygh on Jul 25, 2017 8:21:50 GMT -5

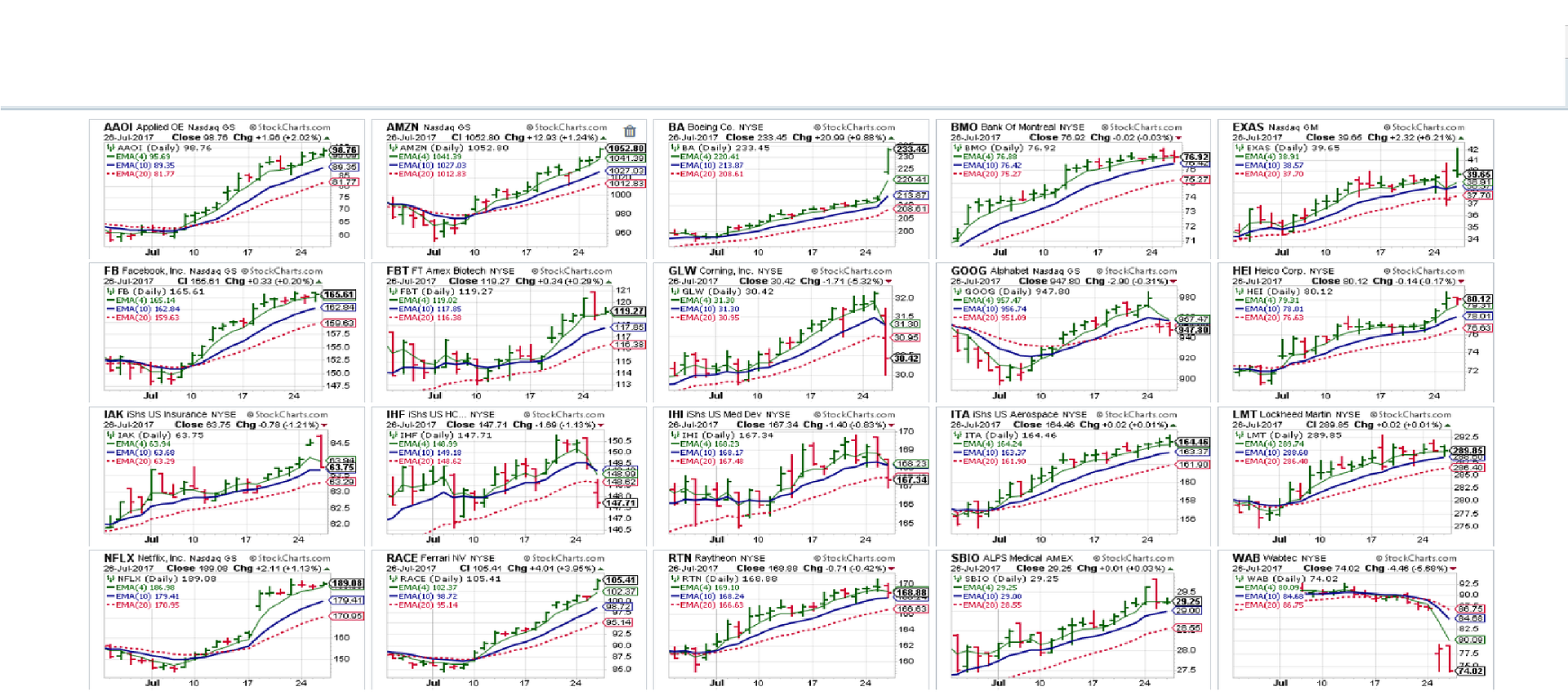

I am clearing out the non-performers today and going with/staying with steady growers - Defense and aerospace (ITA - BA- LMT- HEI- RTN) - Canadian Banks (BNS RY NTIOF BMO) - - FANG (FM- AMZN- NFLX - GOOG ) - HEALTH CARE (IHI IHF FBT PCPT SBIO )- INSURANCE (IAK) - Others RACE WAB GLW

STill holding AAOI EXAS

Blygh

|

|

|

|

Post by sd on Jul 26, 2017 19:21:46 GMT -5

Interesting - Canadian Banks??? There is a reason to hold financials - contained therein I suspect- i could not include/find PCPT, NBIOF as tickers... Posting a candle glance chart of your listed stocks- Hope you don't mind- I will be posting a similar candleglance snapshot in my thread ....

Like you, I'm going to be culling the laggards- And focus more on those that have sector / uptrends in place....and trending-

![]() i1307.photobucket.com/albums/s598/ksowter101/BLYGHS%20POSITIONS%20%207.26.17industry i1307.photobucket.com/albums/s598/ksowter101/BLYGHS%20POSITIONS%20%207.26.17industry groups _zpskwhkdi5x.png[/IMG] |

|

|

|

Post by blygh on Aug 15, 2017 11:33:51 GMT -5

I have been doing a lot of trading lately- term mainly for short term profits but today 8/15 I BOUGHT OR added to positions to MTN RACE LTM and BA for their steady grower pattern

|

|

|

|

Post by blygh on Oct 3, 2017 8:34:26 GMT -5

VICL up 40% this AM - awaiting news to see why - may be take over target - I am taking positions in energy services MDR MTW SLB RIG - liking some autos F GM TM - still holding chemicals CE EMN Mon. Transports should be doing better - shopping around for something with good growth at a reasonable price (NSC??) . Riding healthcare with IHF IHI FBT - wish I had the guts to short TESLA - down to 334 as I write.

Bllygh

|

|

|

|

Post by blygh on Nov 20, 2017 8:05:58 GMT -5

Well I am now looking for trades for next year - the short term trends with the expected Santa Claus rally, tax loss selling and 30 day repurchases make it difficult to see any long term trends. I am taking positions in energy services - RIG SLB MDR - Home builders-etf NAIL has the right mix. Health Care is on the rebound I use IHI IHE and IHF. I play the robotics trend with software XSW which is also good for cyber security. I don't see much internationally - a few Chinese stocks EDU BABA JD. Holding chemicals, railroad services WAB GBX. Holding SOXL for tech and BRK.B for insurance plus, NTRI MED for the weight loss trend (sold WTW for profits).

Blygh

|

|

|

|

Post by sd on Nov 21, 2017 8:52:39 GMT -5

services - RIG SLB MDR - Home builders-etf NAIL has the right mix. Health Care is on the rebound I use IHI IHE and IHF. I play the robotics trend with software XSW which is also good for cyber security. I don't see much internationally - a few Chinese stocks EDU BABA JD. Holding chemicals, railroad services WAB GBX. Holding SOXL for tech and BRK.B for insurance plus, NTRI MED for the weight loss trend (sold WTW for profits).

Interesting mix! I like the XSW- component - I'm long/overweight both ROBO and BABA in that robotics sector - I hope Biotech bottomed here- just added to a losing IBB last week.

Traded in and out of BABA instead of holding- Bought some JD last week as it looked better

IHI trending well- -Device makers uptrending.

and Nail 3x- solid trend as well- thanks for pointing it out- Home builders, industry doing good.Chart looks very steady-

SOXL 3x Also nice trend - I've been leery on the leveraged ETFs- but if you stand the extra volatility swing - the reward vs SMH is substantial-

Thanks for Sharing!

|

|

|

|

Post by blygh on Dec 17, 2017 21:41:15 GMT -5

THINKING ABOUT COUNTRY FUNDS - I have just about given up on South America, Mexico and Canada. Germany has been strong -not impressed with rest of Europe although I expect the Euro to appreciate against the dollar - Russia is interesting and - I think - worth a small position. India, Japan, China, I'm not feeling any love

|

|