|

|

Post by sd on Jun 30, 2017 9:13:39 GMT -5

For TECH, it certainly seems the band has gone on break -

MU reported a beat on earnings, and is down -4% at 10 am...."[Shares of Micron Technology ticked up more than 2 percent in extended trading before giving back some gains after the memory technology company reported third quarter EPS of $1.62 and revenue of $5.57 billion. Those numbers exceeding analysts' consensus expectations of $1.51 in EPS and $5.41 billion in revenue, according to Thomson Reuters."

Ed Seykota ...Time for another listen... www.youtube.com/watch?v=LiE1VgWdcQM Got to find some music...

/font]

|

|

|

|

Post by realdeal on Jun 30, 2017 13:30:47 GMT -5

I'm not trying to come off snippy, if so it's due to my mouth "dentist" no anyone here. It's a horserace if someone gains 18% 20% whatever it's not actual bank. If the stock tanks... again you're not losing. I think stops are a waste. What really is the intention of the game now? I was a member of this board when it first started "I made that graphic you see above" granted I have not posted for many years but I recall a time when you had to post why Technically/Fundamentally or both. What is anyone learning if one just picks a stock long or short because of earning coming up or something like that? Then again maybe everyone here has been trading/investing as long as me and the horserace is purely for entertainment. Why are we competing with the SPY and QQQ again? I thought it's just between members?

If you're playing around with a new method/strategy fine, but anything done on paper from my experience you lack the emotion, trust me it's a whole different ballgame when you actually own a stock.

-rd

|

|

|

|

Post by sd on Jun 30, 2017 14:31:21 GMT -5

When it looks bad.... buying AAOI now because it is close to a P>O>F> - Small position filled $61.95 Point of failure- definite stop below $58.00 dbl bottom- identifies the risk

|

|

|

|

Post by sd on Jun 30, 2017 14:41:31 GMT -5

I'll take PBYI at todays close- Actual position - RD had brought to my attention prior week. Stop a wide $79.00.

MD a prior horse is still hearing the music- added to the position

|

|

|

|

Post by blygh on Jun 30, 2017 16:02:56 GMT -5

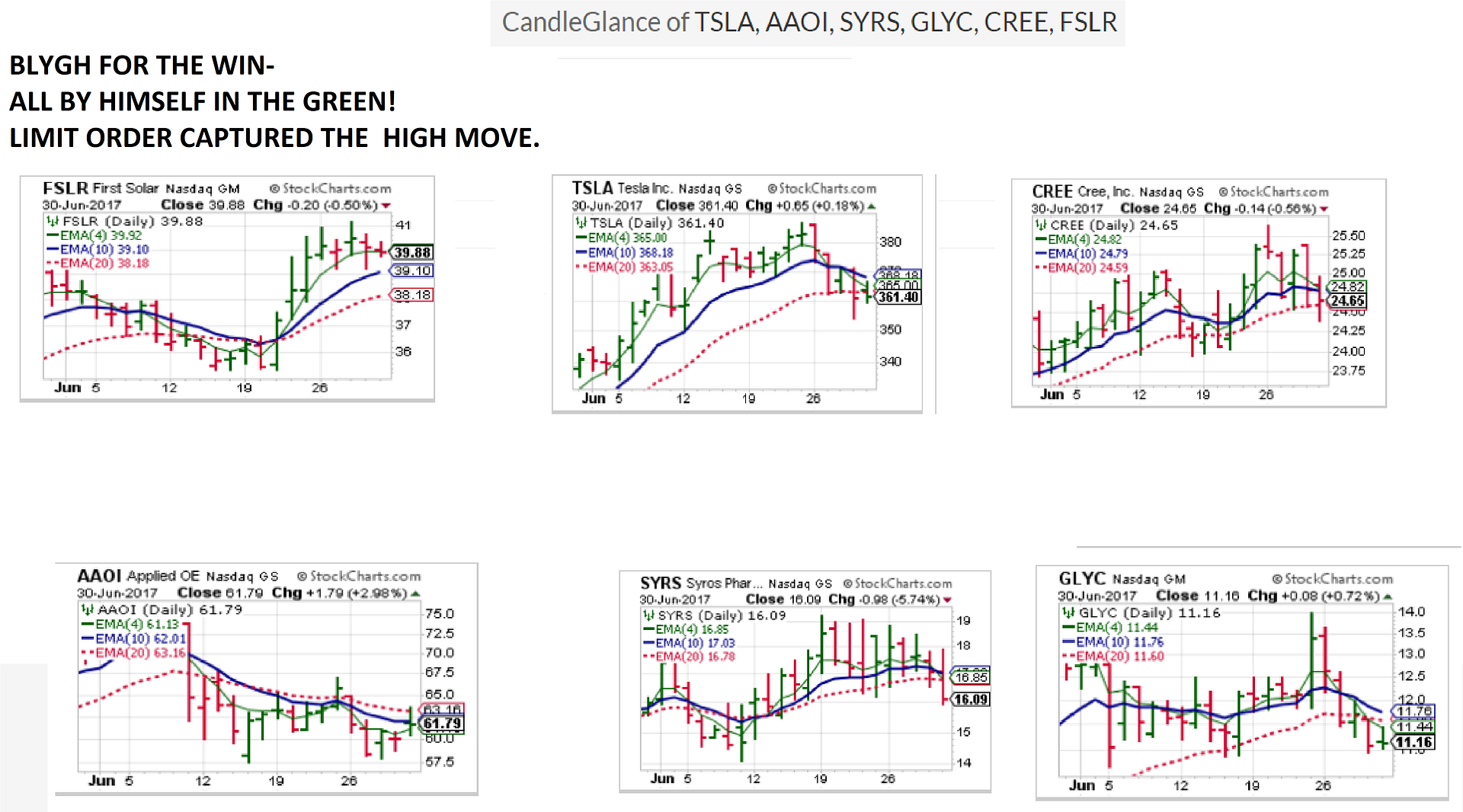

Friday June 30 Across the finish line

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | rider% | Stop | Stock | Rank | | 1 Tiarra | TSLA | 386.69 | 361.61 stopped at 370 | -18.69 | -4.32% | 370 | -6.49% | 4 | | 2 Ira | AAOI | 63.20 | 61.79 stopped at 60 | -3.20 | -5.06% | 60 | -2.23% | 5 | | Spiderman | SYRS | 17.27 | 16.09 | -1.18 | -6.83% |

| -6.83% | 6 | | 4 SD | GLYC | 13.41@fc | 11.16 stopped at 11.60 | -1.81 | -13.5% | 11.60 | -16.78% | 7 | | 5 RealDeal | CREEDFLT | 25.37 | 24.65 | -0.72 | -2.84% |

| -2.84% | 3 | 6 Blygh

| FSLR | 39.74@fc | 39.88 stopped at 41 limit | +1.26 | +3.17% | 37.75 | +0.35% | 1 | | Market | SPY | 243.90 | 241.80 | -2.10 | -0.86% |

| -0.86% | 2 | | 8 | QQQ | 142.00 | 137.64 | -4.36 | -3.07% |

| -3.07% |

|

|

|

|

|

Post by blygh on Jun 30, 2017 16:22:44 GMT -5

YTD for 2017 as of 6/30/17

| Rider | Wins | Place | Show | YTD | Default | YTD default | Tiarra

| 5 | 1 | 4 | +12.961% | ETSY |

| | Ira | 4 | 4 | 4 | -2.018% | VIXY short |

| | Spiderman | 4 | 3 | 4 | -31.978% | EXAS |

| | SD | 2 | 4 | 6 | +6.755% | XBI |

| | Real Deal | 1 | 7 | 1 | -27.694% | CREESINCE 3/28 |

| | Blygh | 9 | 3 |

| +15.895% | ISRG |

| | Market |

| 3 | 6 | +5.833% |

|

|

With a small gain vs SD's loss moves Blygh into first place in the YTD race

|

|

|

|

Post by sd on Jun 30, 2017 16:53:32 GMT -5

Congrats Blygh! The only one finishing in the money!

Discussing the merits of Stops, Limits-

Blygh captured a nice 3.17% gain with the limit, while the stock finished with a modest +.35%!

On the stop side,

Tiarra reduced her potential loss by 2% by stopping out higher.

Ira's stop took him out ffor -5% while the stock still lost- but by -2.25%

SD took the worst hit- with his wide stop losing -13.5% but the stock losing more , -16.78%

BLYGH Holds the Largest # of Wins, as Well as the YTD Congrats!

Tiarra Holds 2nd place - wins and YTD. Also Congrats!

Since this is the End of June- 2nd quarter - The Book offer is still there-but RD has contributed some books as well- so I need to update the list. I'll try to get that done this weekend...

|

|

|

|

Post by sd on Jun 30, 2017 17:39:59 GMT -5

AND THE FINISH IN PICTURES

|

|

|

|

Post by blygh on Jun 30, 2017 18:39:06 GMT -5

In the year long 5 stock portfolio competition

| RIDER | 6 MONTH GAIN | | SD | +0.6473% | | BLYGH | +5.9268 | | TIARRA | +6.98% | | SPIDERMAN | +12.476% | | IRA | -2.87% | | REAL DEAL | NO ENTRY | | SPY | +8.48% | | QQQQ |

+19.50 |

|

|

|

|

|

|

|

|

|

|

Post by sd on Jun 30, 2017 19:03:28 GMT -5

Congrats Spiderman! Something to be said for "Buy and Hold!"

That should also merit a book selection! Hope there is one that interests you!

HMMM , my selections are serious underperformers, and i changed last quarter! If this was an actual Portolio return, i'd be stressed out! i'd do better with a dividend focused

portfolio!

|

|

|

|

Post by sd on Jul 1, 2017 9:20:17 GMT -5

Books & Video List-

BOOKS: Thanks RD for the adds.

Reminiscences of a stock operator- Edwin L Lefevre- classic

Options as a Strategic investment- McMillan

Money- master the game-Robbins

Getting started in Options-Thomsett

Tools 7 Tactics of the master Day Trader- Velez, Capra

Super Trader- Van Tharp

ethods of a Wall Street Master- Trader Vic- Tiarra

Elliot Wave Principles- Prechter

Swing Trading- Jon markman

Electronic swing trading- Sarkovich

Sell and Sell Short- ELDER

Exchange traded Funds-

Power Trading, Power living- Parness

Swing Trading- Velez

Short term trading- Toni Turner

Real money- Cramer

New market Wizards-Schwager

Getting Started in Technical Analysis- Schwager

Elliot Waves-simplified- Droke

Elliot Wave principle- Frost,Prechter

TA Study Guide- John Murphy

Mindful Trading-Howell

Videos

Profit from Candlesticks-Steve Nison

Elliot Waves-Prechter

Timing models- Freeburg

Swing Trading Tactics - Velez

Becoming a Disciplined Trader- KIEV

Discipline, Discipline, Discipline- Toghrarie

Sector Trading Strategies- Wagner

Intraday trading- Capra

Trading the moves- Downs

Swing trading Essentials- Markman

12 Simple TA indicators Larsen

Guerilla Trading- Tactics- Velez

Screening the markets-Gerstein

Core Trading Tactics- Velez

Guppy Moving averages- Guppy

Options 101 Trend Trading- Parnell

Trading Survival 101 Kezali

Winners: send me an e-mail with your selection-and a return address- i will try to get that in the mail within 1 week=

My E-mail:

Ksowter101@gmail.com'

Congratulations!

|

|

|

|

Post by blygh on Jul 1, 2017 21:02:36 GMT -5

Thanks for your efforts and book/tape offers, SD. I would like to hear from Tiarra and Ira on their views on the use of stops and limits. In the absence of a majority opposing stops/limits I think we should continue as we have.

Next week ?? difficult decision - looks like energy and energy services has bottomed out and started turning higher. I like MDR but at 7.14 I would have to take it at 8 to abide by the DG minimum rule. July is usually a bad month as senior traders head out to the Hamptons for the summer so I would be more comfortable going short. Looking at downward trends. I am going to short SNAP limit at 14 - stop loss 19.

Blygh

|

|

|

|

Post by Spiderman on Jul 2, 2017 6:11:53 GMT -5

Congrats Blygh,

I'll ride BLCM long this week.

Spiderman

|

|

|

|

Post by realdeal on Jul 2, 2017 10:03:30 GMT -5

Congrats Blygh!

I'll go with YUMC (long)

-rd

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Jul 2, 2017 15:24:32 GMT -5

Congrats blygh!

I'll ride MRCY long. -ira

|

|