|

|

Post by blygh on Jun 25, 2017 17:43:48 GMT -5

Monday June 26 The morning line

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | TSLA | 386.69 |

|

|

| 370 |

|

| | 2 Ira | AAOI | 63.20 |

|

|

| 60 |

|

| | Spiderman | SYRS | 17.27 |

|

|

|

|

|

| | 4 SD | GLYC | 13.41@fc |

|

|

| 11.60 |

|

| | 5 RealDeal | CREEDFLT | 25.37 |

|

|

|

|

|

| 6 Blygh

| FSLR | 39.74@fc |

|

|

| 37.75 | 41.00 |

| | Market | SPY | 243.90 |

|

|

|

|

|

| | 8 | QQQ | 142.00 |

|

|

|

|

|

|

|

|

|

|

Post by sd on Jun 25, 2017 19:54:31 GMT -5

Blygh,

i'd like to add a stop-loss at $11.60 Thanks! 8:54 pm

|

|

|

|

Post by blygh on Jun 25, 2017 21:19:54 GMT -5

I got mixed up on my days last week and made my pick - FSLR on Thursday - with a 41 limit. It was up 1.32 on Friday to a 39.74 which limits me to a potential gain of 3.2% . There are just no upsides to this aging crap.

Blygh

|

|

|

|

Post by sd on Jun 26, 2017 7:49:55 GMT -5

I'll second that! 'Golden Years'just means that i have to pee more often!

|

|

|

|

Post by sd on Jun 26, 2017 9:18:13 GMT -5

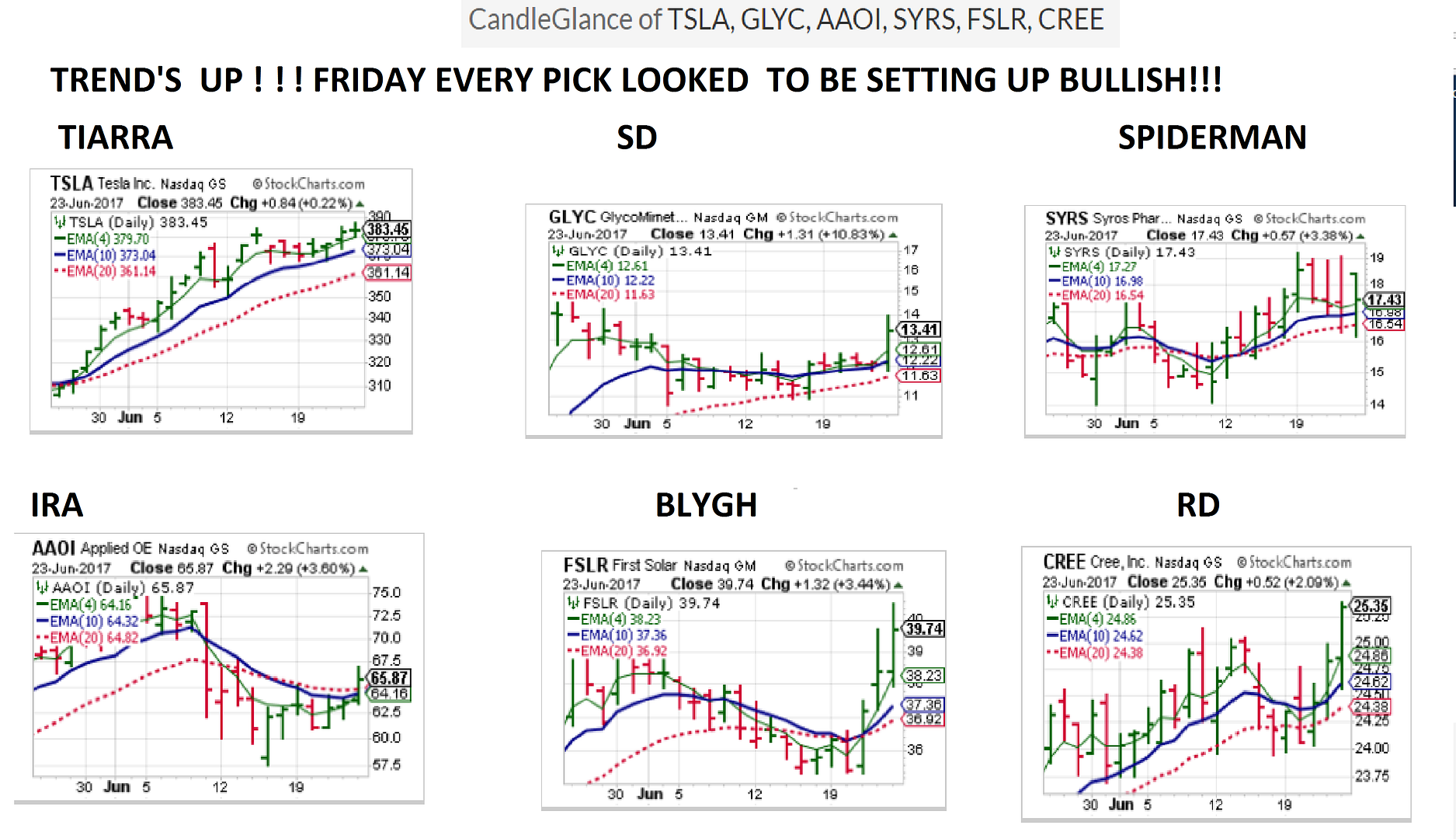

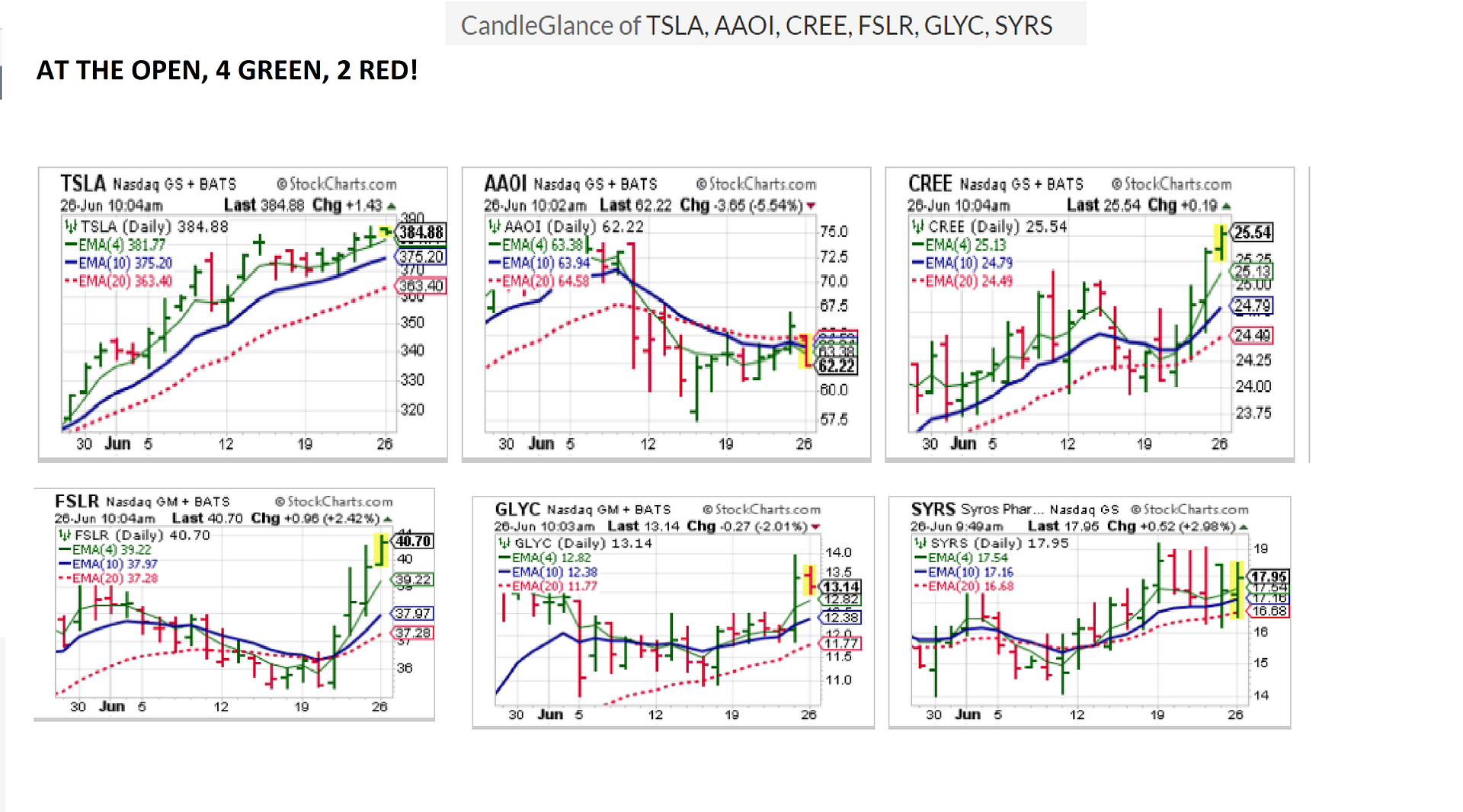

hOW THEY LOOKED AT fRIDAY'S CLOSE, AND THEN mONDAY'S OPEN

|

|

|

|

Post by blygh on Jun 26, 2017 15:08:01 GMT -5

Monday June 26 THEY'RE OFF!!!

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | TSLA | 386.69 | 377.49 | -9.20 | -2.38% | 370 |

| 5 | | 2 Ira | AAOI | 63.20 | 61.59 | -1.61 | -2.55% | 60 |

| 6 | | Spiderman | SYRS | 17.27 | 18.04 | +0.77 | +4.46% |

|

| 1 | | 4 SD | GLYC | 13.41@fc | 12.61 | -0.80 | -6.0% | 11.60 |

| 7 | | 5 RealDeal | CREEDFLT | 25.37 | 25.29 | -0.08 | -0.32% |

|

| 4 | 6 Blygh

| FSLR | 39.74@fc | 40.17 | +0.43 | +1.08% | 37.75 | 41.00 | 2 | | Market | SPY | 243.90 | 243.26 | -0.64 | -0.26% |

|

| 3 | | 8 | QQQ | 142.00 | 140.58 | -1.42 | -1% |

|

|

|

|

|

|

|

Post by blygh on Jun 27, 2017 15:40:00 GMT -5

TUES June 27 Out of the far turn

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | TSLA | 386.69 | 362.49 stopped at 370 | -18.69 | -4.32% | 370 |

| 5 | | 2 Ira | AAOI | 63.20 | 58.45 stopped at 60 | -3.20 | -5.06% | 60 |

| 6 | | Spiderman | SYRS | 17.27 | 17.23 | -0.04 | -0.23% |

|

| 2 | | 4 SD | GLYC | 13.41@fc | 11.55 stopped at 11.60 | -1.81 | -13.5% | 11.60 |

| 7 | | 5 RealDeal | CREEDFLT | 25.37 | 24.70 | -0.67 | -2.64% |

|

| 4 | 6 Blygh

| FSLR | 39.74@fc | 40.05 | +0.31 | +0.78% | 37.75 | 41.00 | 1 | | Market | SPY | 243.90 | 241.34 | -2.56 | -1.05% |

|

| 3 | | 8 | QQQ | 142.00 | 138.03 | -3.97 | -2.8% |

|

|

|

|

|

|

|

Post by blygh on Jun 28, 2017 15:31:06 GMT -5

Wednesday June 28 Out of the back stretch

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | TSLA | 386.69 | 371.24 stopped at 370 | -18.69 | -4.32% | 370 |

| 5 | | 2 Ira | AAOI | 63.20 | 60.00 stopped at 60 | -3.20 | -5.06% | 60 |

| 6 | | Spiderman | SYRS | 17.27 | 17.71 | +0.44 | +2.55% |

|

| 2 | | 4 SD | GLYC | 13.41@fc | 11.72 stopped at 11.60 | -1.81 | -13.5% | 11.60 |

| 7 | | 5 RealDeal | CREEDFLT | 25.37 | 25.25 | -0.12 | -0.47% |

|

| 4 | 6 Blygh

| FSLR | 39.74@fc | 40.49 stopped at 41 limit | +1.26 | +3.17% | 37.75 | 41.00 | 1 | | Market | SPY | 243.90 | 243.47 | -0.43 | -0.18% |

|

| 3 | | 8 | QQQ | 142.00 | 140.02 | -1.98 | -1.39% |

|

|

|

|

|

|

|

Post by Spiderman on Jun 28, 2017 16:22:35 GMT -5

Wow.

I just logged in and only Real Deal and I are left to continue the race. All the rest of you are stopped out.

It doesn't seem to be a race if everyone can stops out.

The race should be for the week. We're not betting real money.

Thoughts???

|

|

|

|

Post by blygh on Jun 28, 2017 17:36:52 GMT -5

I guess my view is that the "race" is a competition of investment acumen. I think the competition should reflect the potential strategies available to a swing trader. Stops (including buy stops) and limits and among the basic tools I use. I also use options but I am not willing to do the kind of calculations that would involve them. Any volunteers? To my best memory, this is the first time that more than one rider has hit a stop. If it gets to be a chronic problem we could consider a modification of the rules e.g. requiring stops at least 10% below the last price and limits 10% above. In the meantime, the track is yours and Real Deal's. I will wait for you at the finish line. Good luck

Blygh

|

|

|

|

Post by sd on Jun 28, 2017 20:52:03 GMT -5

It's been an interesting week to say the least-!

My vote concerning stops is exactly as it is in the real world - It is entirely up to the individual racer to use stops or limits or not- and they should be able to choose how tight or how wide they want to set them at-

I certainly wouldn't want anyone setting arbitrary stops for me in the real world or in the horse race- on stops or limiting my upside...

And, while it's not "Real Money" we are betting on, it can reflect how we may actually choose to trade with real money- None of us likely follows the same criteria when it comes to stops or taking proffits- No need to regulate it in the horse race-

And i think there are "lessons" to be learned- from even our modest Horse Race..

One could argue the point that since everyone that had stops in place got stopped out- Stops shouldn't be allowed at all....But what if the market tanked 30%? And someone stopped out at a 10% stop, while everyone else took a 30% loss?

Stops reflect the real world for most of us- If we set tight stops- we have a greater probability to get whipsawed on minor volatility- Tight stops work well when the market is trending in our favor- But when things change - the tight stops get hit when volatility increases- What might have been a successful approach during one market period of Trending, fails when the market goes flat and undecided. The trader learns that his or her approach has to be modified to match the change in the market tenor. Or to not trade- Or to reduce position size etc...

And we learn another lesson perhaps- That what we had been accustomed to as our go-to- trades may be falling out off favor as sector rotation is taking the wind out of the once strong horses ....

It's coincidental- that I have recently widened my stops in my actual trading - The goal being able to stay just an arm's length out of volatility- The Tech pullback on the 12th started and set a few down days with significant swing lows in the sectors. These swing lows should not be violated -IMO- with a lower close - or we are perhaps 'rolling over

AAOI is a good TA textbook example- of price hitting the recent low and rebounding- from $58.00 Better hold IMO - and try to move up from here....

My vote is don't set my choice as to whether i can use a stop or where i set it -please....

|

|

|

|

Post by Spiderman on Jun 29, 2017 6:35:46 GMT -5

I agree with both of you for real investing.

BUT this is a horse race for the week as designed by DG.

In a real horse race there's no stops they all run to the finish line.

Just my opinion.

|

|

|

|

Post by blygh on Jun 29, 2017 15:26:32 GMT -5

Thursday June 29 Into the home stretch . .

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | TSLA | 386.69 | 360.75 stopped at 370 | -18.69 | -4.32% | 370 |

| 5 | | 2 Ira | AAOI | 63.20 | 60.00 stopped at 60 | -3.20 | -5.06% | 60 |

| 6 | | Spiderman | SYRS | 17.27 | 17.07 | -0.20 | -1.16% |

|

| 3 | | 4 SD | GLYC | 13.41@fc | 11.68 stopped at 11.60 | -1.81 | -13.5% | 11.60 |

| 7 | | 5 RealDeal | CREEDFLT | 25.37 | 24.79 | -0.58 | -2.29% |

|

| 4 | 6 Blygh

| FSLR | 39.74@fc | 40.08 stopped at 41 limit | +1.26 | +3.17% | 37.75 | 41.00 | 1 | | Market | SPY | 243.90 | 241.39 | -2.51 | -1.03% |

|

| 2 | | 8 | QQQ | 142.00 | 137.60 | -4.40 | -3.01% |

|

|

|

|

|

|

|

Post by blygh on Jun 29, 2017 15:39:46 GMT -5

I remain sympathetic to Spiderman's point. This is why I continue to post a stock's closing price despite it's being stopped/limited at a different price. I can post the weekly gain on stopped/limited stocks although it would be too much trouble to do it on a daily basis. In other words I will post how the rider did AND how the stock did on a weekly basis.

Blygh

|

|

|

|

Post by blygh on Jun 30, 2017 6:32:14 GMT -5

From James B Stewart on June 30 2017 NYTimes

But as the bull market rolls on, some see storm clouds on the horizon. “Valuations are high and it’s one of the longest and largest bull markets in history,” said James Stack, president of InvesTech Research. “Bull markets don’t last forever. So the question is, when will the music stop.

I agree

Blygh

|

|