|

|

Post by sd on May 5, 2017 19:08:42 GMT -5

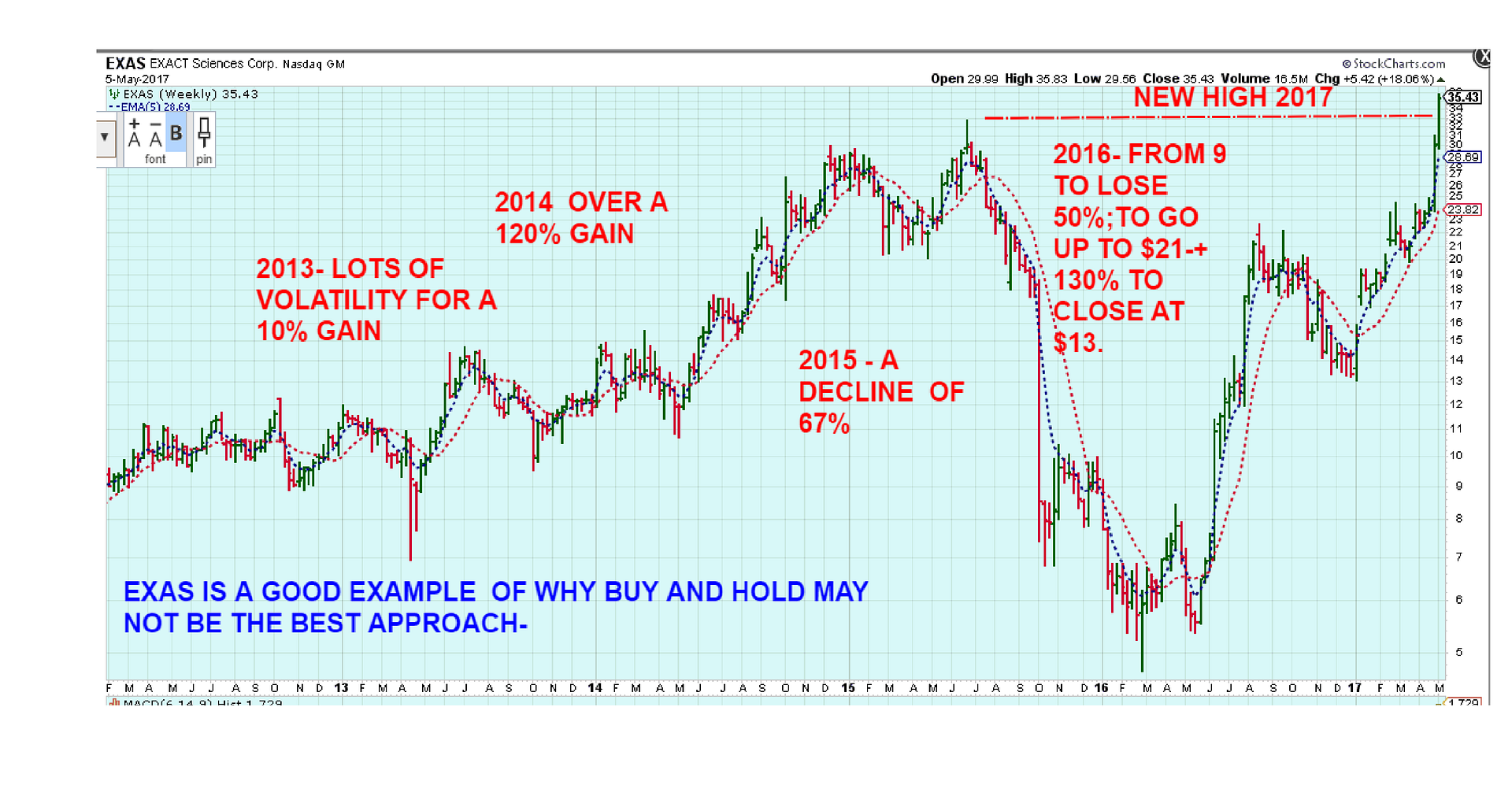

The Impressive gains of some of the YTD default pics would initially make one think that Buy and Hold is indeed perhaps the best way to go- But with outsized gains comes outsized Risk.

With individual stocks also comes opportunity- for such impressive gains- and also potentially outsized losses. EXAS weekly chart is a good example of why one needs to have a plan in place to not simply be a passive investor- but needs to have some rules for entry and exits when the trend is no longer in your favor--

|

|

|

|

Post by blygh on May 6, 2017 11:32:16 GMT -5

Congrats to Spiderman with nods to Ira and Real Deal. Next week I will ride NCLH long (again) - stop at 52, limit at 62.

Blygh

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on May 7, 2017 12:06:34 GMT -5

I'll ride AAOI long again.

Thursday evening I was in 7th place and deep in the red. Then AAOI reported blowout earnings. Revenues up 91% year over year. Earnings were $1.10 a share. First quarter last year was a 4 cent loss. What a relief! I don't have any real money in AAOI. Sure glad to see SD didn't get stopped out and was in it Friday. -ira

|

|

|

|

Post by Spiderman on May 7, 2017 12:30:06 GMT -5

HI Blygh,

My YTD at the beginning of the week was -28.888% and I had a gain of 18.14% this week, how can my YTD be -16%?

Just curious.

Thanks,

Spiderman

If you were down 28.888% then your stake was (1-0.28888) =.71112 which when multiplied by 1.1814 yields 0.84012 which is .16 - down from break even (=1). Hence you are down 16% YTD. Every week I take a rider's previous week's YTD accumulated stake and multiply it by the week's gain/loss %. Example

Lets say you made 10% on week 1 - your stake is now 1.1 (hundred, thousand, - the size of the wager is irrelevant to the gain/loss ratio. If in the second week, you are down 3% I take the 1.1 x (1-.03) =1.067 or a 6.7% YTD. If the next week you are down 7% the 1.067 x (1-.07) = .9923. I express this as loss of 0.769% =(1-.9923). I think that this reflects real weekly investment measurement. We could, I suppose, just average weekly gains/losses but that presumes investing the same amount each week instead of betting the accumulated stake. Make sense?? Comments ??

Blygh

|

|

|

|

Post by realdeal on May 7, 2017 13:06:07 GMT -5

Thanks and Congrats to Spiderman! WOW!

I was thinking DUK long but I'll go with RL (long) for this week. Diamond Bottom on the daily and weekly

-rd

|

|

|

|

Post by tiarra on May 7, 2017 17:58:56 GMT -5

Congrats, gentlemen for your impressive gains this week! Especially Spiderman.

M short stop at 30.25. Hopefully I am not catching the bottom like I did with Kohls last week!

|

|