|

|

Post by blygh on Apr 23, 2017 18:12:32 GMT -5

And they are off and running

| Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | SBUXsht | 60.97 | 61.11 | +0.14 | -0.23% |

|

| 5 | | 2 Ira | AAOI | 46.83 | 48.78 | +1.95 | +4.16% |

|

| 1 | | Spiderman | AAON | 36.85 | 36.75 | -0.10 | -0.27% |

|

| 6 | | 4 SD | TSLA | 309.22 | 308.03 | -1.19 | -0.39% |

|

| 7 | | 5 RealDeal | BA | 181.75 | 182.06 | +0.31 | +0.17% |

|

| 3 | 6 Blygh

| GMsht | 34.66 | 33.91 | -0.75 | +2.16% |

|

| 2 | | Market | SPY | 237.18 | 237.17 | -0.01 | 0.00 |

|

| 4 | | 8 | QQQ | 134.02 | 134.16 | +0.14 | +0.01% |

|

|

|

|

|

|

|

Post by sd on Apr 24, 2017 15:15:08 GMT -5

This am I heard the market rallied on news about the direction of the French election- Cest La Vie!

|

|

|

|

Post by tiarra on Apr 24, 2017 17:44:54 GMT -5

I have Starbucks opening at 61?

FROM 4/23 6:56

"I am going to be risky and go SBUX short. Right now the stock is really up due to the new Unicorn drink and high expectations for earnings. While I think their sells will be up next quarter, I am thinking it will actually be down when the earnings come out Thursday. On a side note, I have NEVER had anything from there. Stop is at 64" Yahoo gave the opening price as 60.61 The WSJ now says 60.97 now for 9:30. I think the 60.61 may have been an offer price. The first trade was 60.97 - I will correct the Totboard.

Blygh

|

|

|

|

Post by blygh on Apr 25, 2017 15:27:57 GMT -5

Rounding the far turn

| Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | SBUXsht | 60.97 | 60.96 | -0.01 | +0.0165% | 64 |

| 7 | | 2 Ira | AAOI | 46.83 | 49.40 | +2.57 | +5.49% |

|

| 1 | | Spiderman | AAON | 36.85 | 37.00 | +0.15 | +0.407% |

|

| 6 | | 4 SD | TSLA | 309.22 | 313.79 | +4.57 | +1.48% |

|

| 3 | | 5 RealDeal | BA | 181.75 | 183.51 | +1.76 | +0.968% |

|

| 4 | 6 Blygh

| GMsht | 34.66 | 33.99 | -0.67 | +1.93% | 35 |

| 2 | | Market | SPY | 237.18 | 238.55 | +1.37 | +0.578% |

|

| 5 | | 8 | QQQ | 134.02 | 135.13 | +1.11 | +0.828% |

|

|

|

[/div |

|

|

|

Post by blygh on Apr 26, 2017 15:43:51 GMT -5

Into the backstretch| Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | SBUXsht | 60.97 | 61.56 | +0.59 | -0.97% | 64 |

| 6 | | 2 Ira | AAOI | 46.83 | 47.47 | +0.64 | +1.37% |

|

| 1 | | Spiderman | AAON | 36.85 | 37.25 | +0.40 | +1.09% |

|

| 2 | | 4 SD | TSLA | 309.22 | 310.17 | +0.95 | +0.31% |

|

| 5 | | 5 RealDeal | BA | 181.75 | 181.71 | -0.04 | -0.022% |

|

| 7 | 6 Blygh

| GMsht | 34.66 | 34.38 | -0.28 | +0.81% | 35 |

| 3 | | Market | SPY | 237.18 | 238.40 | +1.22 | +0.51% |

|

| 4 | | 8 | QQQ | 134.02 | 134.94 | +0.92 | +0.69% |

|

|

|

[/div |

|

|

|

Post by blygh on Apr 27, 2017 15:55:37 GMT -5

Into the home stretch| Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | SBUXsht | 60.97 | 61.30 | +0.33 | -0.54% |

|

| 7 | | Spiderman | AAON | 36.85 | 37.30 | +0.45 | +1.22% |

|

| 2 | | 4 SD | TSLA | 309.22 | 308.63 | -0.59 | -0.19% |

|

| 6 | | 5 RealDeal | BA | 181.75 | 183.22 | +1.47 | +0.81% |

|

| 3 | 6 Blygh

| GMsht | 34.66 | 34.54 | -0.12 | +0.35% |

|

| 5 |

| SPY | 237.18 | 238.60 | +1.42 | +0.6% |

|

| 4 | | IRA | AAOI | 46.83 | 49.36 | +2.53 | +5.40% |

|

| 1 |

Just an FYI - Spiderman's default pick - EXAS - Exact sciences - was up 26.6% today for a YTD gain of 124% - And it looks like Tiarra was right about SBUX - Starbucks - down 3.6% after earnings report

[/div |

|

|

|

Post by sd on Apr 27, 2017 19:33:02 GMT -5

Good perception Tiarra, And WOW on EXAS!

|

|

|

|

Post by blygh on Apr 28, 2017 17:17:30 GMT -5

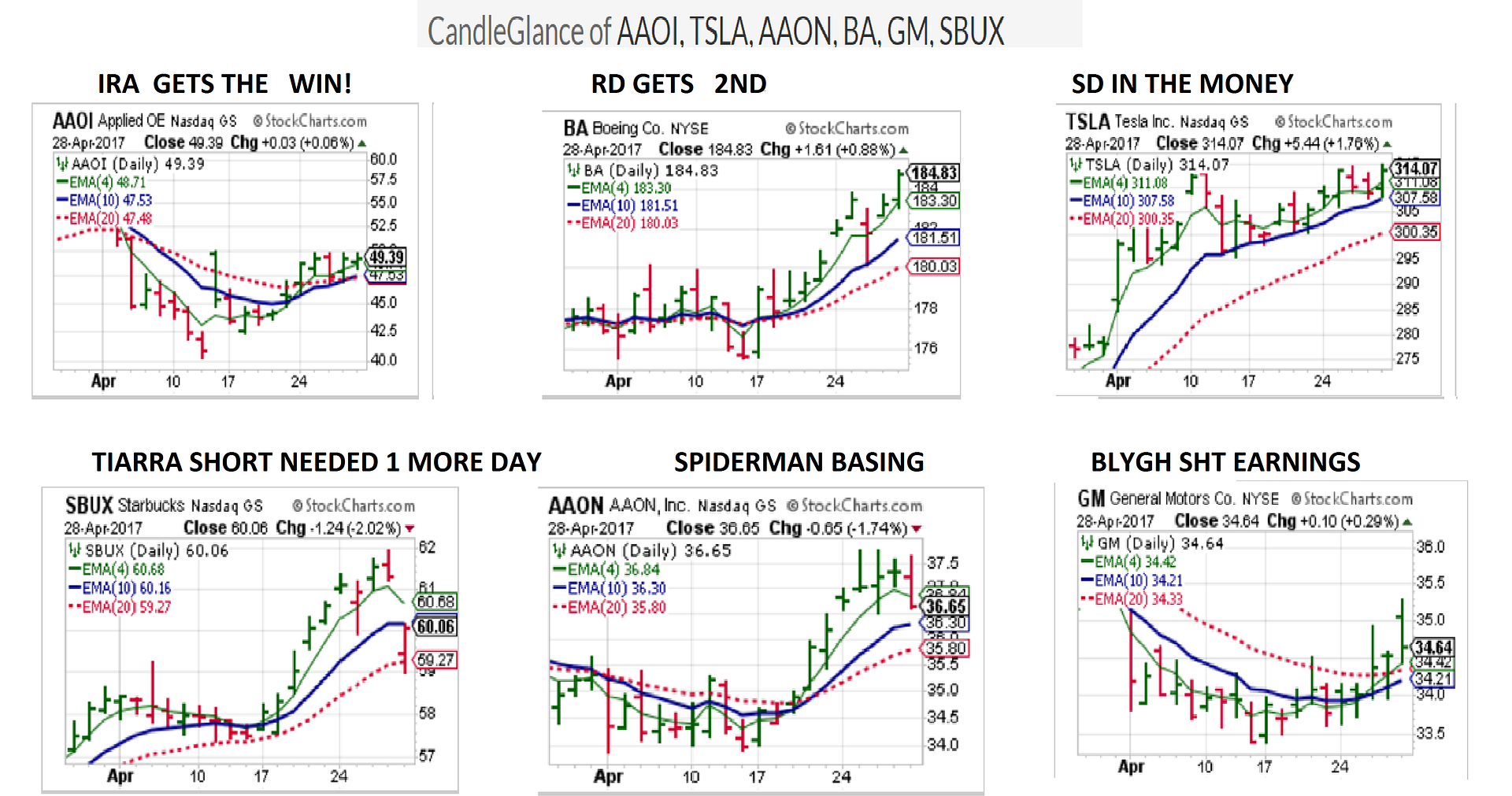

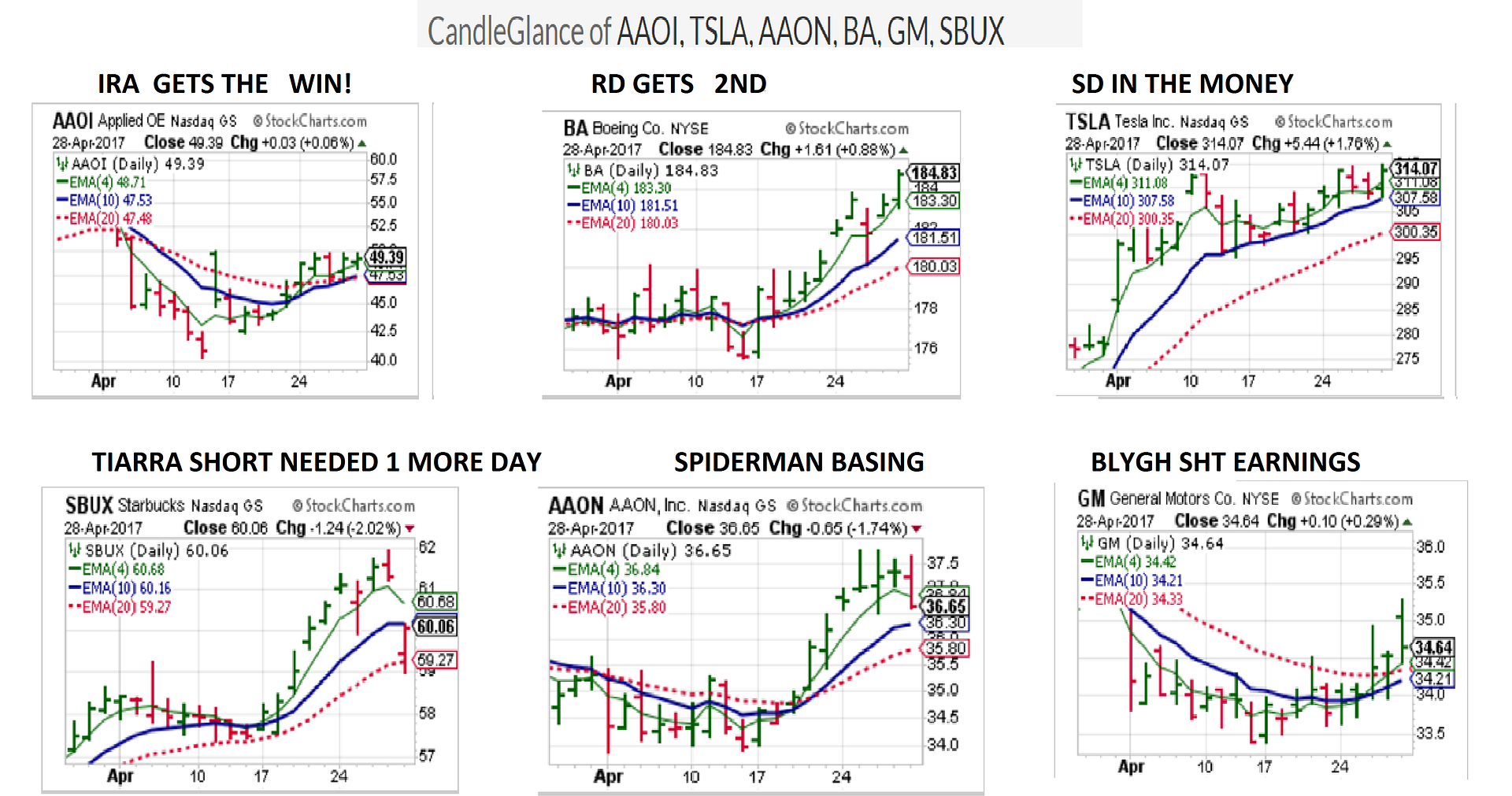

AT THE FINISH !!!!

| Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | SBUXsht | 60.97 | 60.06 | -0.91 | +1.49% | 64 |

| 4 | | 2 Ira | AAOI | 46.83 | 49.39 | +2.56 | +5.46% |

|

| 1 | | Spiderman | AAON | 36.85 | 36.65 | -0.20 | -0.54% |

|

| 6 | | 4 SD | TSLA | 309.22 | 314.07 | +4.85 | +1.57% |

|

| 3 | | 5 RealDeal | BA | 181.75 | 184.83 | +3.08 | +1.70% |

|

| 2 | 6 Blygh

| GMsht | 34.66 | 34,64 bit stopped wt 65.02 | +0.36 | -1.04% | 35 |

| 7 | | Market | SPY | 237.18 | 238.06 | +0.88 | +0.37% |

|

| 5 | | 8 | QQQ | 134.02 | 136.00 | +1.98 | +1.48% |

|

|

|

|

|

|

|

Post by blygh on Apr 28, 2017 18:54:52 GMT -5

YTD for 2017 as of 4/28/17

| Rider | Wins | Place | Show | YTD | Default | YTD default | Tiarra

| 4 | 1 | 2 | +6.243% | ETSY | -9.428% | | Ira | 2 | 3 | 1 | -15.393% | VIXY short | +36.626% | | Spiderman | 2 | 1 | 4 | -28.888% | EXAS | +123.79% | | SD | 1 | 3 | 4 | -2.535% | XBI | +19.89% | | Real Deal | 1 | 5 |

| -5.598% | RS | -2.972% | | Blygh | 6 | 1 |

| +6.303% | ISRG | +30.24 | | Market |

| 2 | 5 | +4.802% |

|

|

Blygh has a slight edge over Tiarra on the YTD -I added a column to show the YTD on our default picks - It looks like Buy-and-hold is a better idea than market timing |

|

|

|

Post by sd on Apr 29, 2017 7:51:37 GMT -5

Congrats IRA! Nice win! RD for 2nd !

That YTD for the default is interesting!

I would submit that while that does seem to "support" Buy and Hold- with the caveat that you would never pick just 1 stock- and some would obviously not be great performers-indeed- potential losers that you still would need to have some criteria that exits your position on a wider decline-

I think it is important to have a reason to Exit a trade - that one could follow unemotionally. And then a criteria to reenter the position.

Also, how much volatility can one stomach, seeing a big move pullback giving up potential "Profits"- Exas for example had a 20% high to low in March.

but didn't close below the 50 ema.

AAOI (Ira's present pick) had gained 24 to 60 -a 150% gain through march, but then declined to 40- In the process of giving up $20 of profits , it dropped through the 20,30,50 down to a 70 sma.

Note that a stop using the 30 ema worked well with AAOI, and would have captured a large portion of the gain, Exas would have also stopped out , as it declined about 20% from the high- A reentry back into both would be based on a close above a higher ema-crossover- for example, the 10 closing above the 20, and price closing above the 10 .

For example- an exit signal on any CLOSE (not penetration) below a slower moving average-Stop to be set exactly at the low of that bar that closed below the ema.... choose your average - 30, 50, 100, 150,200 and a reentry on a move higher, once price closes above the faster moving average.

Add in a momentum criteria- for example- RSI above and below the 50 to validate signals and reduce whipsaws.

And perhaps a slope criteria as moving averages all converge tightly during periods of longer consolidations.

I think results definitely improve with fewer trades and holding as long as the Trend is intact- Many of us (self included) get too impatient- wanting that faster action- or locking in small profits. I think the traders solution there would be to follow an approach to split the position-

Take a faster approach, quicker sell to lock in some gains, and a slower approach on the remaining, with a stop moved up to break-even initially .

Using the 6 Default picks would be interesting to compare -or the investment picks- at the end of this year- One of these days, we will wake up and find that the Bull market does indeed have a Bearish side- Perma bulls in 2008-09 saw an extended decline and loss of their market gains, taking years to get back to breakeven. I think the Tech sector took 17 years to get back to breakeven- That's not considering the added expense of Inflation over those years.

Something to work on this Fall/winter- Meantime- if the Trend is intact- stay the course if you are long term focused-Is that 50 ema sloping upwards to the right?

And here's the pic's from this week!

|

|

|

|

Post by realdeal on Apr 30, 2017 8:58:24 GMT -5

Congrats IRA! Thanks SD

I'll go with SHOP (long) my earnings crapshoot of the week LOL

Also like to change my default horse to CREE (LONG)

-rd

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Apr 30, 2017 10:37:30 GMT -5

I'll ride AAOI long again next week.

Thanks blygh for the YTD default. Congrats Tiarra, the only one with weekly picks beating the default. And did you notice 3 or us are handily beating the Market with our default.

And thanks SD for the discussion of making buy/sell decisions systematically. I made some notes to try your suggestions in coming weeks. Thanks. -ira

|

|

|

|

Post by blygh on Apr 30, 2017 11:09:59 GMT -5

Congrats Ira - and thanks for bring AAOI to my attention (I made a buck on it)

Next week - what to do? What to do? Do I go away in May or ride the wave? ?? CDE short - stop loss at 9.50

Blygh

|

|

|

|

Post by tiarra on Apr 30, 2017 18:35:42 GMT -5

KSS short stop at 40.25

Congrats, IRA

I am thinking I need to change my default or at least the direction! lol

Good luck, fellow!

|

|

|

|

Post by sd on Apr 30, 2017 19:38:13 GMT -5

Ride the Wave Blygh- At least until it flattens out! Follow the trend and see where it leads-

I'll stay with TSLA long- it's basing, but if the market stays strong, it might move yet higher- We'll see! Stop at the 20 ema $300.00

AAOI looks poised to move higher- potentially a good buy-stop at the 50 with a limit $50.50. I'd have to use $47 as a tight stop-loss .

I would take this as a smaller position size- not knowing what caused the recent larger breakdown of the initial strong trend.

AAON put in a sell bar Friday, i'll be setting a stop at AAON's low for Monday.

IRA- I'm basically a trend follower- and a believer in viewing price relative to a series of moving averages- I think you do better to stay with the trend until it stalls, shows an exhaustion climax move, or "rolls over" and starts to exhibit weakness. You can elect to be more or less aggressive depending on what you reference in moving averages- Faster moving averages, or slower moving averages. Ultimately, it is best to trade "with" the trend- so learning trend with moving averages as a reference is start #1.

RD had recommended Stan Weinstein -years ago- and i think Dave Landry also has a good primer -

A good friend had some trades in GOOG that had him somewhat underwater, He held through the decline, and i encouraged him to realize that GOOG was now technically still in a viable uptrend- a simple evaluation with the moving averages in alignment moving higher to the upper right and price above-

My friend sold this week at $852 as price broke out - It was a relief sell for him- and a small % gain- But it never gave any indication of weakness-

relative to the moving averages. Goog then went to $870 and gapped up to $905-

At this point, as with most gaps, It could possibly gap again, or decline- I would set a stop-loss now- not at the moving average- but at the low of Friday's bar for 2/3 of the position- and possibly leave 1/3 with a higher stop at the fast 4 ema. $883.00.

Before adopting anyone's Cliff notes -including mine- - look back over a few years of a trade prospect to see if the approach as you interpret it would assist or hinder- Also, note that 'Trending' is not the 'norm' most of the time for most stocks- So evaluating when a trend may be starting- or ending- takes time to learn- When the moving averages are all spaced apart and rising and price is above the fast- That's a trend- that's easy....It's how to handle what comes next becomes the challenge in the decision making process.

SD

|

|