|

|

Post by sd on Feb 17, 2017 18:03:29 GMT -5

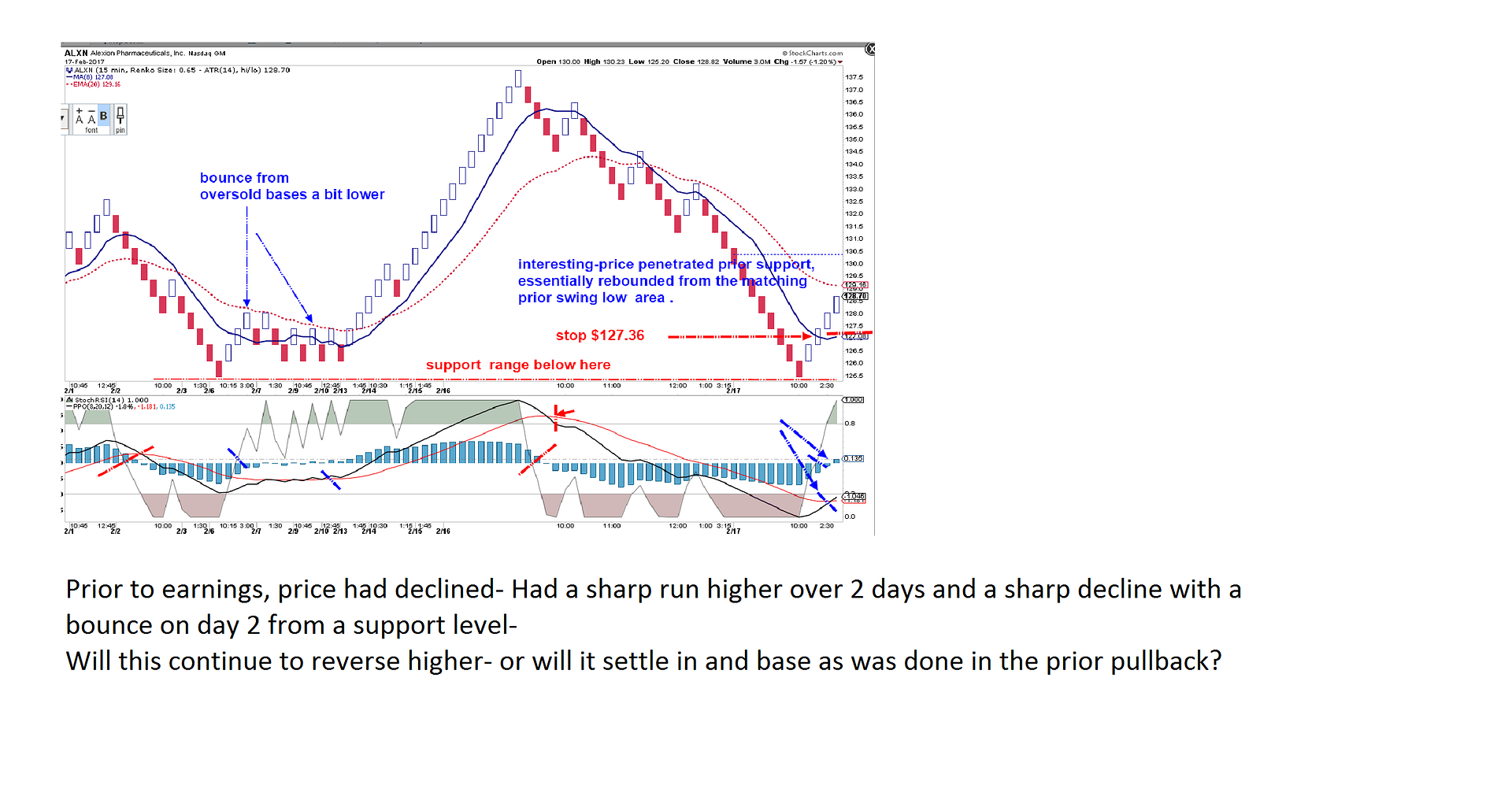

Another way to view ALXN chart- attached- This is a 15 min Renko chart-

Notice the prior low Renko bar in the prior decline- and also the way price moved up and down a bit prior to moving sharply higher-

Following the decline , price reached past the prior "support- and penetrated to the low end of that support range- (Note that Renko bars in this time frame represent a $.65 range.)

Will price make a V recovery higher off today's bounce from the low? OR, will it pullback and base higher than the low Renko bar as it did previously?

Stops are prudent- and up to one's comfort level and goals . Good luck!

|

|

|

|

Post by sd on Feb 17, 2017 18:07:57 GMT -5

duplicate

|

|

|

|

Post by sd on Feb 17, 2017 18:36:30 GMT -5

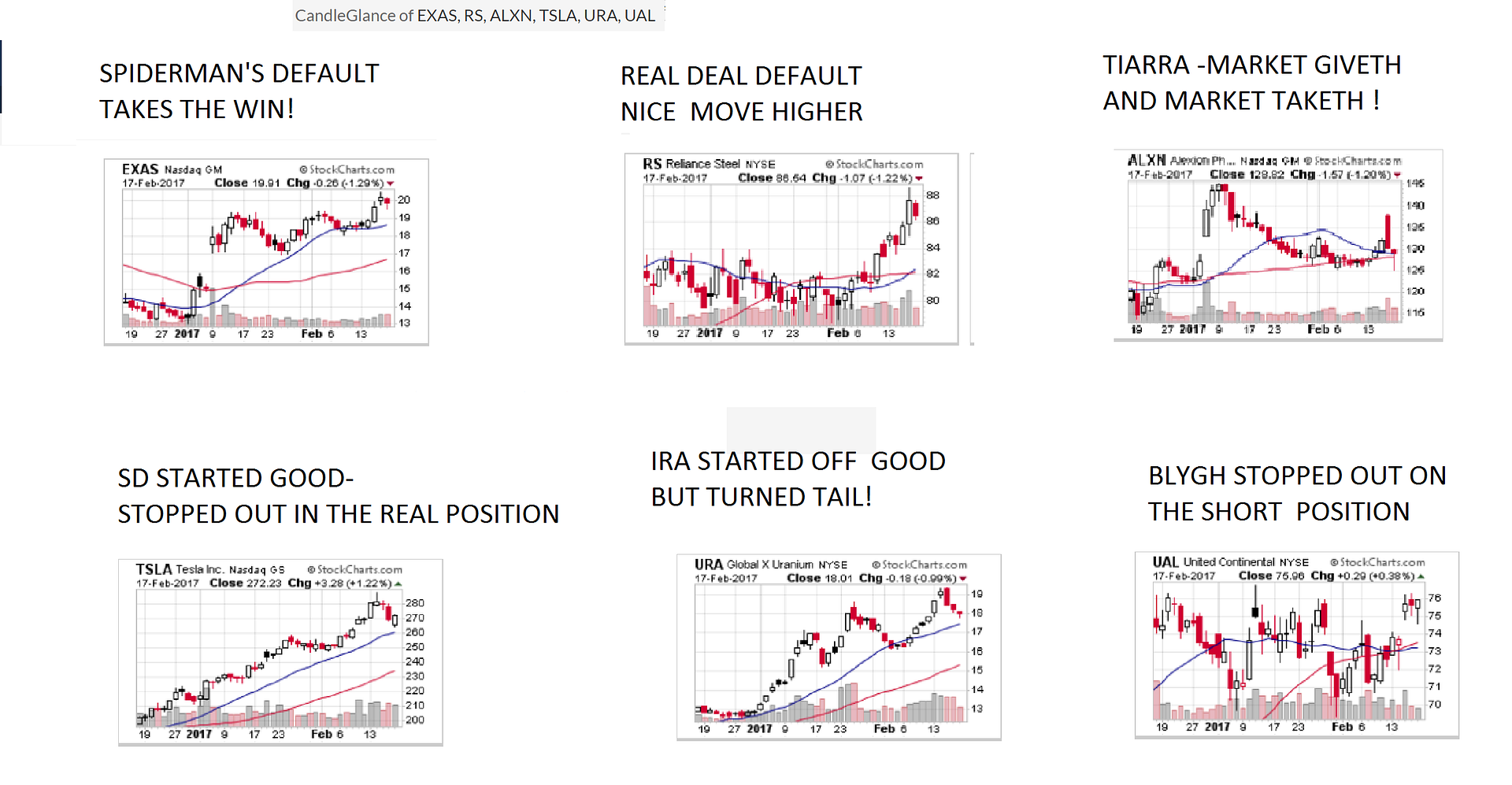

hmmm dEFAULT PICKS TAKING BOTH THE WIN, PLACE- sOUNDS ROBOTIC! RALLY PEOPLE!

|

|

|

|

Post by blygh on Feb 17, 2017 18:37:40 GMT -5

Total Return in 2017 as of 2/17/2015| Rider | Win | Place | Show | Total Return | Default pick | | Tiarra | 3 |

| 1 | +12.312% | ETSY | | Ira |

| 2 | 1 | +1.551% | VIXY short

| | Spiderman | 1 | 1 | 1 | -15.515% | EXAS | | Real Deal |

| 1 |

| -7.973% | RS | | SD | 1 | 2 |

| +9.791% | CURE | | Blygh | 2 |

|

| -1.751% | ISRG | | Market (SPY) |

| 1 | 4 | +4.673%* |

|

|

|

|

|

Post by tiarra on Feb 18, 2017 8:44:24 GMT -5

BLYGH, I got out at 127.36, so you need to adjust my earnings down.

|

|

|

|

Post by blygh on Feb 18, 2017 15:21:07 GMT -5

How do you figure Tiarra? I checked last week's entries. You had a 125 stop (which I neglected to put on the Tot board - my bad). According to the rules I do not think that you can change your stop to a different price while the contest is on (If we could, I would have dropped UAL like a hot potato). The WSJ reported the low for Friday as 125.20 - So as far as I can see you never hit your stop - consequently you got Friday's closing price. Am I not getting this right?? SD, - or anyone else - want to weigh in? I do admire your honesty though.

Changed my mind on my pick - now HII - stop 206

Blygh

|

|

|

|

Post by sd on Feb 18, 2017 16:43:46 GMT -5

Blygh is correct IMO- Tiarra, I also see the price low as $125.20 on stockcharts- so the stop was never hit- and , I agree, we cannot modify our stop -or add one -after the Sunday pm deadline- So Congratulations On the higher gain!I posted the Renko chart thinking your stop might have reflected a real position reaction....

|

|

|

|

Post by realdeal on Feb 18, 2017 20:13:09 GMT -5

Congrats SpiderMan

I'll go with XLNX (long)

|

|

|

|

Post by Spiderman on Feb 19, 2017 8:06:42 GMT -5

Thanks.

I'll ride NLNK long this week.

Spiderman

|

|

|

|

Post by tiarra on Feb 19, 2017 17:40:46 GMT -5

I won't argue, it gives me more of an advantage! LOL! I will put in my next week's pick in a little while. Edited to tell SD, I posted during the trading day Friday that I wanted out. I cried "Uncle" That is the stop I am referring to.

congrats on your win, Spiderman

|

|

|

|

Post by tiarra on Feb 19, 2017 20:45:51 GMT -5

IDCC long stop at 95

|

|