|

|

Post by sd on Oct 7, 2016 13:03:47 GMT -5

Hey Tiarra!Thanks-

Do you really think the market is Oversold? HMMM Typo? PE's are high, earnings are not growing, and the Fed will Raise in December.

A question for You and/ Joe - How much do fundamentals come into play when making a short term trade?

It would be fun and instructive to have joe's teaching input and some students as well! Should they decide to join in....

And your friend - Yes, it IS going to be an interesting time in the next Month or so to get her toes 'wet' -or bit by the shark!LOL!

Have a great day!

|

|

|

|

Post by sd on Oct 7, 2016 13:04:55 GMT -5

For next week's race, I will have to go with a position i own- RDCM finally is moving higher- even on a bad day-

RDCM long please!

|

|

|

|

Post by blygh on Oct 7, 2016 15:57:12 GMT -5

And across the line | Rider | Horse | Open | Latest | Gain/Loss | Percent | Stop | Limit | Rank | | Tiarra | AA short deflt pick | 30.42 | 31.37 | +0.95 | -3.12% |

|

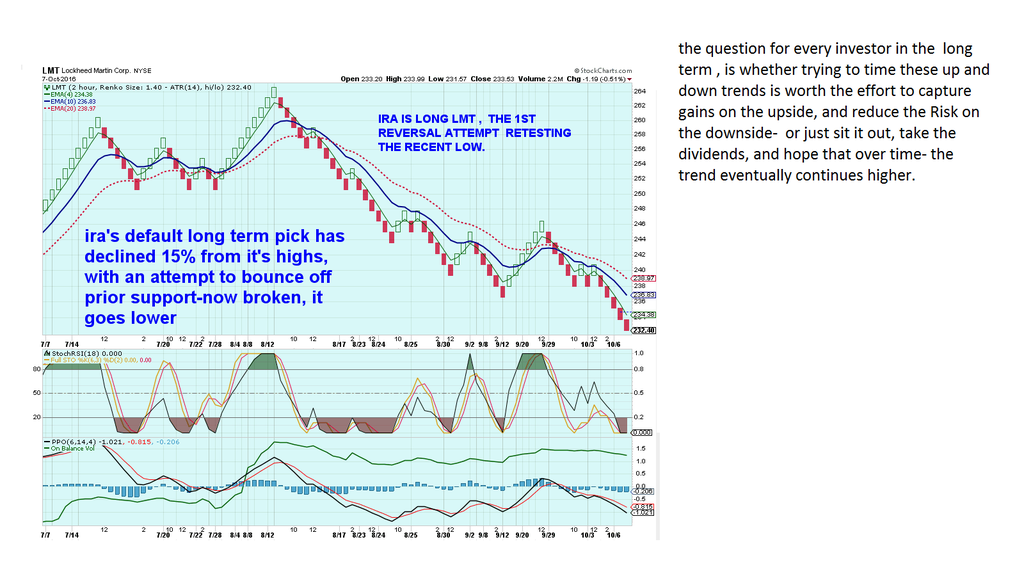

| 6 | | Ira | LMT | 238.71 | 233.53 | -5.18 | -2.17% |

|

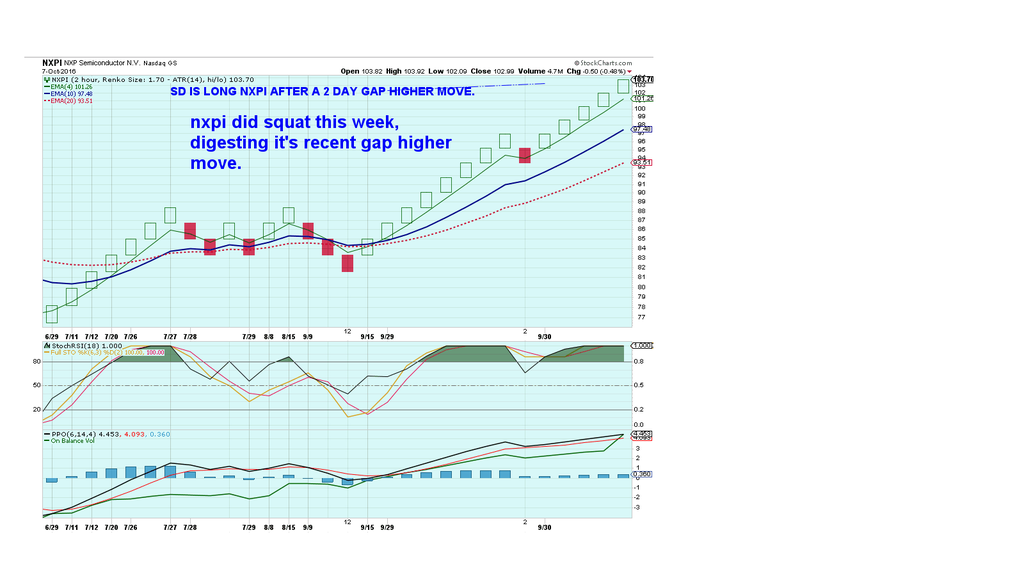

| 5 | | SD | NXPI | 102.98 | 102.99 | +0.01 | +0.01% |

|

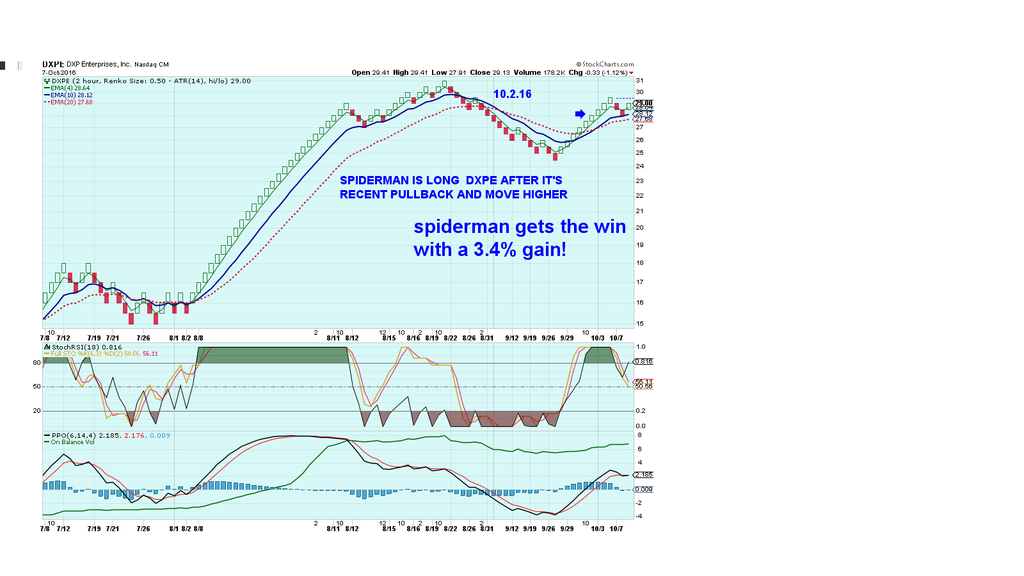

| 3 | | Spiderman | DXPE | 28.17 | 29.13 | +0.96 | +3.4% |

|

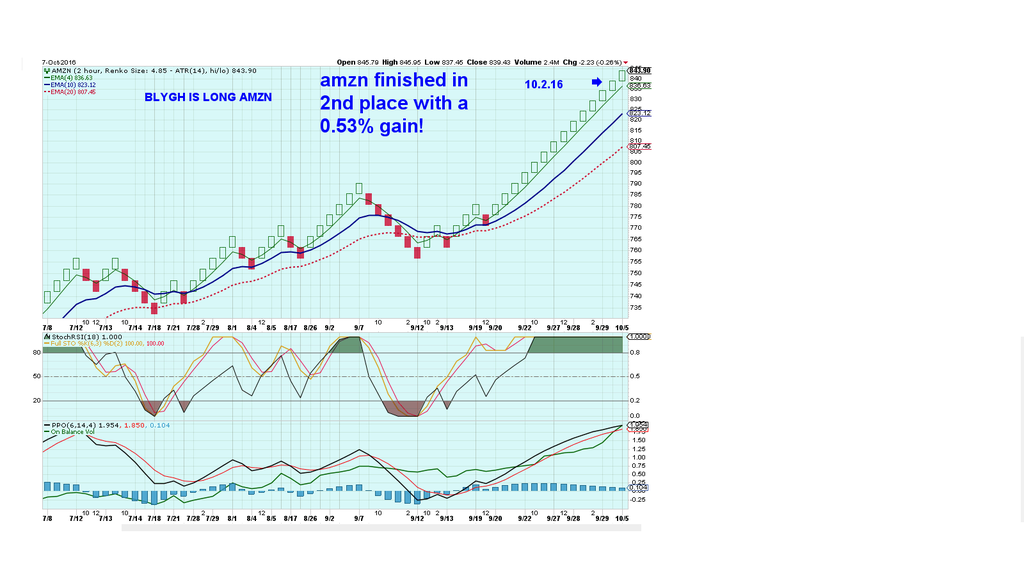

| 1 | | Blygh | AMZN | 835.01 | 839.43 | +4.42 | +0.53% |

|

| 2 | | Market | SPY

| 216.30 | 215.04 | -1.26 | -0.58% |

|

| 4 |

Spiderman for the going-away win

[/div] [/div][/font] |

|

|

|

Post by blygh on Oct 7, 2016 16:00:03 GMT -5

Gains/losses since 7/16/16 | Rider | % gain/loss | Wins | Default pick | | Tiarra | -32.21% | 5 | ETSY long | | SD | -6.91% | 4 | CURE long | | Ira | +6.06% | 8 | LMT long | | Spiderman | +41.00% | 8 | EXAS long | | Blygh | +15.75 | 6 | ISRG long |

|

|

|

|

Post by tiarra on Oct 7, 2016 18:36:58 GMT -5

Yes, that was a typo! LOL! Sorry! It seems no matter how bad earnings are stocks just keep going up. I am sure if Trump wins the election, the interest rate will be manipulated in such a way as to be able to blame him for the big corrective dive, which is bound to happen eventually.

Congrats to Spiderman for the win

|

|

|

|

Post by Spiderman on Oct 8, 2016 8:35:14 GMT -5

Hey Tiarra,

I normally don't comment on other players stock selections but you own RDCM.

In my opinion, RDCM is almost at an all time high and it's P/E ratio is at a whopping 273.

The trend lines are flattening and it's up 79% over the past 3 months.

Keep a close watch on it. I don't know how much higher it can go.

Short term indicators seem to favor it.

Again just my opinion.

Spiderman

|

|

|

|

Post by sd on Oct 8, 2016 9:18:51 GMT -5

Congratulations Spiderman! another one in your quiver!

I appreciate the caution on RDCM, and commentary is always welcome- I think we need more of that to spice up things as well as sharing our different perspectives. RDCM was one of a few stocks i purchased based on upside Momentum in the Finviz screener a few weeks ago. It was an interesting purchase, because it had "broke out higher" Sept 6 I think, and I didn't chase it but placed a limit order -which was filled on the retracement-which gave me a lower cost entry. More of a position trade/ experiment. I will post a chart in the Strategies thread later, after i post the charts here of the Horse Race-

As for fundamentals and PE ratios- It seems that eventually PE ratios do Matter, but it may take months or years for expected earnings and investors paying up for what they think is on going growth to get challenged and investors quit paying up . I think CMG was a good example -in the restaurant business, with a very high flying PE relative to the group . As a trade, a trailing stop-loss is in order, gradually moving up if price continues to move-The question becomes what method determines the appropriate stop. Hope to get the horse race results in before the grandkids arrive!

Thanks again for taking the time to post a commentary!

|

|

|

|

Post by sd on Oct 8, 2016 9:23:40 GMT -5

I agree Tiarra- No matter who gets elected, during their presidency the market will have to substantially correct. I think it starts with a rate increase coming in December- putting a stall on this stop and go market- increasing volatility- and shaking the trees.

While the Fed declares itself to not be aligned in a "political" manner- you have to wonder where policy and politics diverge.

|

|

|

|

Post by sd on Oct 8, 2016 10:37:35 GMT -5

and the pictures of how they finished the race:Tiarra's default AA  Blygh 2nd place with AMZN  Spiderman gets the win with DXPE!  IRA's default Long term LMT continues to trend lower  SD took a gamble that NXPI would find more momentum-

|

|

|

|

Post by Spiderman on Oct 8, 2016 12:25:10 GMT -5

Hey SD,

Good luck with RDCM. If you place a trailing stop-loss don't you think the market makers will make sure it's met?

Every time I place a stop-loss it seems those market makers always drop the price and a few minutes later the stock rebounds. It's so frustrating. LOL

Spiderman

|

|

|

|

Post by sd on Oct 8, 2016 14:12:50 GMT -5

Hi Spiderman,

For my personal situation, I have to be an End of Day trader- seldom being able to view or access the markets in real time . This can be an advantage- as i am not focused on the markets and the volatile price movements. And, in this market, I have been trying to see if i can develop and hold positions for a longer duration- which means the stops I use are now wider and likely outside of what a day trader would apply. This is an experiment of sorts, and it is also a change for me personally. I'll expand on this thinking in the Strategies thread -hopefully later today.

To answer your specific question- I would say it is likely accurate that market makers- and large funds desiring to add to a position will definitely manipulate price to allow them to accumulate shares at the lowest levels- including pushing price down to where there are a lot of stops waiting.

I think you can see the evidence of that type of accumulation when you have price in a sideways consolidation, and larger institutions want to add to their positions, they can drop price lower by selling some shares on the cheap , showing a break below what traders -would call temporary support-

and as selling gives way to more selling- perhaps in just a few hours, the traders with stops under the range give up their shares in the fear that they are on the start of a larger decline- Since the pro's know that retail traders all essentially fall in a certain range, it's likely they consider it easy pickings to add to a position this way. The trader watching his position going lower in real time has to make a choice- and as the price exchange goes lower on the bid/ask , they don't know how much lower it may drop- or necessarily ' Why' it is declining- particularly if there is no negative news release.

This type of price action - dropping below support and with a quick move back up into the support range- is worth watching for a further movement to break out higher- IMO- If institutional accumulation is building a position, the breakout from there may prove to have substantial follow-through momentum. Or so the logic goes-

I think many retail traders- and I ARGH one- have experienced whipsaws- stops getting hit on a volatility move lower, only to see the position immediately close higher, and make a larger up move- all without the trader whose stop got taken out.

That may become the cause of the rationale to trade without a stop altogether- thinking one will exit the position if it really goes lower- and then one finds themselves becoming a long term holder as price declined even lower, and the trader believing it will certainly bounce higher- any day now- and make the trade a break-even- or lesser loss.

There may be some short term merit to this approach- as - an ongoing bull market eventually sees the majority of quality companies stock also climbing gradually higher- as long as you are patient enough!

|

|

|

|

Post by Spiderman on Oct 9, 2016 11:32:15 GMT -5

Thanks all,

I'll ride TRIL long this week.

I had a difficult time making this weeks selection. Nothing really looked good.

Spiderman

|

|

|

|

Post by tiarra on Oct 9, 2016 15:52:43 GMT -5

I had a hard time finding a stock. Most of the charts I pulled up seemed to be going into a sideways pattern

I want to make ETSY long my default stock. Let me know if I need to post that elsewhere.

For this week MYCC long. I don't trade stocks with low volume like this one, but it's an entry!

|

|

|

|

Post by blygh on Oct 9, 2016 18:52:25 GMT -5

I really can't get excited about anything this coming week. Semi-conductors, telecommunication equipment, and Brazil are my sectors of interest - After much consideration I am going with QCOM long stop loss at 64 Limit 75. Tierra, I will change your default pick. Good luck all - it could be a volatile week -

Blygh

|

|

|

|

Post by tiarra on Oct 9, 2016 19:44:39 GMT -5

This is Joe. Short AMZN

|

|