|

|

Post by blygh on Aug 6, 2016 12:24:49 GMT -5

For next week AMH long - rationale - housing shortage persists - lots of insider buying - great earnings growth - breakout last Friday

Blygh

|

|

|

|

Post by sd on Aug 7, 2016 6:54:57 GMT -5

I'm swapping horses ALNY- biotech-pharma stock just pushing higher through the recent double resistance.

good luck!

|

|

|

|

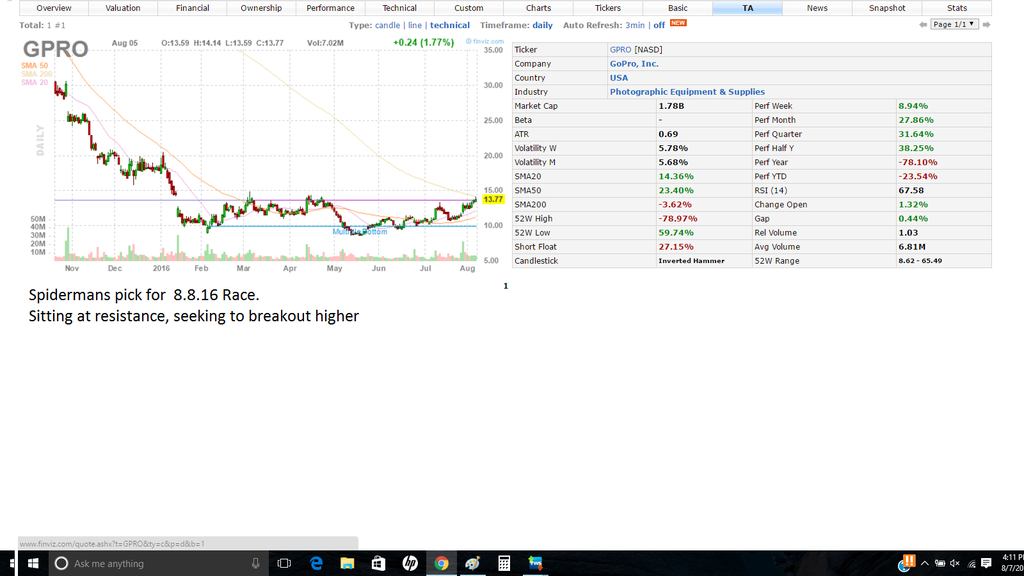

Post by Spiderman on Aug 7, 2016 7:45:05 GMT -5

I'll ride GPRO long this week.

Spiderman

|

|

|

|

Post by sd on Aug 7, 2016 15:06:38 GMT -5

BLYGH'S PICK AMH-

|

|

|

|

Post by sd on Aug 7, 2016 15:17:24 GMT -5

GPRO Spiderman's horse 8.8.16 Race |

|

ira85

New Member

Posts: 837

|

Post by ira85 on Aug 7, 2016 15:27:50 GMT -5

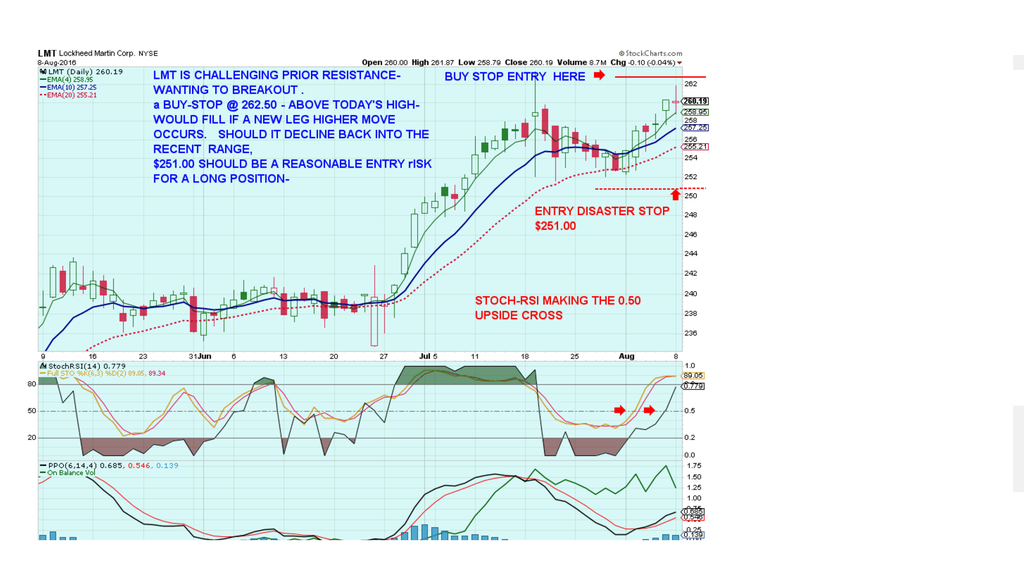

For next week and until further notice I'll ride LMT.

Thanks to blygh and SD for all the work you are doing!

I'm going to try a different strategy. It may be better suited for a very long term contest but I'll try it here. I'm trying to pick a stock or ETF that is a steady grower with very limited downside action. Participates in market up moves and doesn't go down much when the market is down. Two of my old favorites have been like this for the past few years, MO and LMT. LMT seems to lose less and less often. LMT will be my default weekly pick. While the rest of you are winning the weekly races I'm hoping to win the cumulative race by imitating the tortoise while you guys play the hare.

Good luck! -ira

|

|

|

|

Post by tiarra on Aug 7, 2016 18:48:57 GMT -5

NCLH long

|

|

|

|

Post by tiarra on Aug 7, 2016 18:49:34 GMT -5

Congrats Spiderman!

|

|

|

|

Post by sd on Aug 8, 2016 17:53:10 GMT -5

Ira's pick - LMT is testing a recent high- TA traders would consider this prior high a resistance level to be overcome, and the price action today

saw that level penetrated with a bullish close on Friday, but not closed above higher today- One method to approach this as a trade is - if it "breakouts" above today's price action, it has a greater chance of succeeding as prior resistance -overcome- would then become a "support" - as long as there are additional Buyers interested in purchasing the stock above this level. Setting a Buy-stop entry order on a higher up move is one method of reducing whipsaw failed breakouts- Costs you a little bit with the higher entry, but it saves you some pain if you simply Buy expecting a breakout and price retraces lower.

Good LUCK IRA!

|

|

|

|

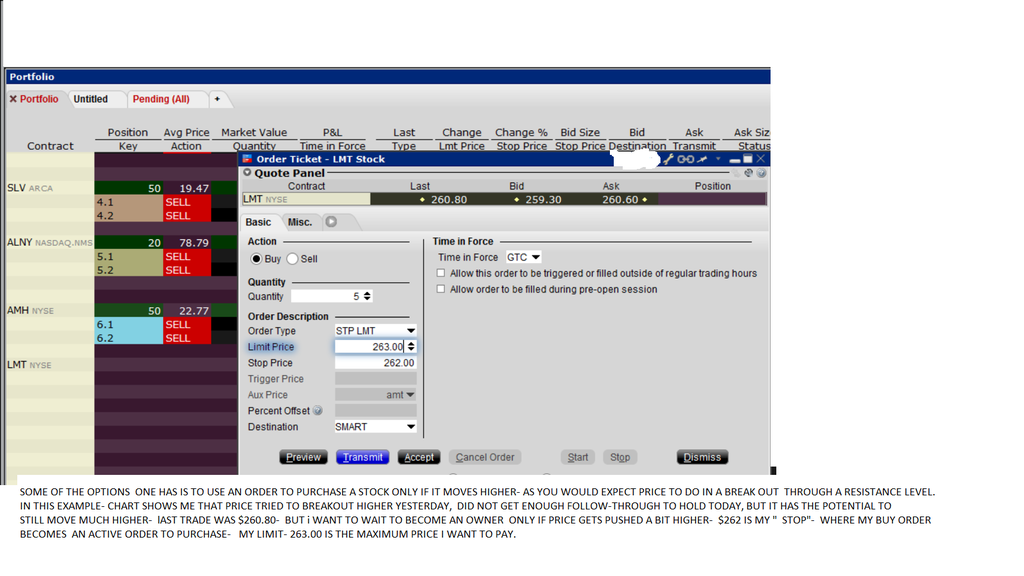

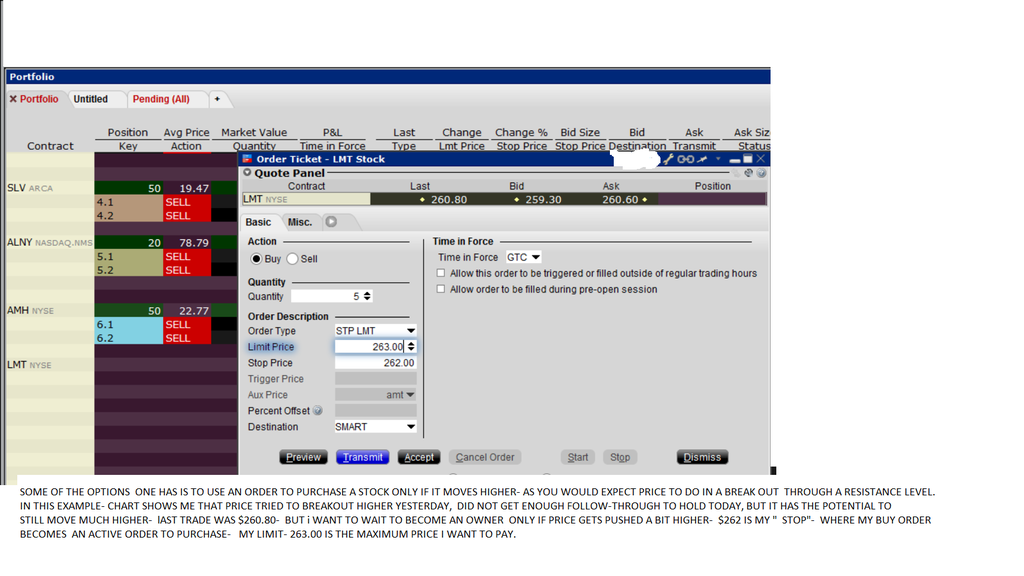

Post by sd on Aug 8, 2016 18:28:33 GMT -5

EXPLAINING MY application of a Buy-Stop Entry

Price is at resistance, potentially will break out higher- the Buy-Stop order does not become a Buy order until price exceeds a certain higher price.

In this example- the Buy-stop ((Stop) is set at 262.00 and the Limit is $263.00 . Always include a limit - because breakouts can gap high and your order is filled at the very high from the open.

I will use this order to enter a position for just 5 shares to see where this goes.

|

|

|

|

Post by sd on Aug 8, 2016 18:30:02 GMT -5

EXPLAINING MY application of a Buy-Stop Entry

Price is at resistance, potentially will break out higher- the Buy-Stop order does not become a Buy order until price exceeds a certain higher price.

In this example- the Buy-stop ((Stop) is set at 262.00 and the Limit is $263.00 . Always include a limit - because breakouts can gap high and your order is filled at the very high from the open.

I will use this order to enter a position for just 5 shares to see where this goes.

|

|

|

|

Post by sd on Aug 8, 2016 18:56:35 GMT -5

NCLH- Tiarra's horse is testing the recent attempt to move higher. Substantial Basing action, following a prior period of downtrend.

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Aug 8, 2016 19:56:40 GMT -5

Thanks for the analysis of LMT SD. I know very little about the technical aspects of trading. I took to heart the old advice that frequent trading was generally responsible for under performance and one was better off trading infrequently. So I'm testing that idea with LMT. If I have the patience that is.

Yesterday evening I got to thinking ... My strategy is to pick a stock that goes up but doesn't go down. I'm also looking for the Holy Grail, so let me know if you get a hot tip on it. -ira

|

|

|

|

Post by sd on Aug 9, 2016 3:39:03 GMT -5

We're all searching for that stock that only goes up, and never Down! LOL!

I thought it might be interesting- when time allows, to post the charts of individual entries. and possibly take some trades if they set up according to my approach.

You are correct in that- the large majority of retail traders underperform Buy and Hold because they react late- They Exit when the price has a large pullback, shaking them out, and get back in late- when price is higher, after it has shown that it's recovering.

Of course, major Bear markets 2008 -took stock values down over 40%- and 2003....

Understanding some basic TA, and Weekly charts for long term positions is useful. Daily charts for long term positions will only make you nervous.

I have an order to purchase some LMT at 262-limit 263=

Good Luck!

|

|

|

|

Post by tiarra on Aug 9, 2016 15:26:44 GMT -5

I forgot to put in a stop loss...

|

|