|

|

Post by blygh on Jul 23, 2016 20:16:31 GMT -5

Congrats Ira - and a nod to Tiarra - Next week MMSI long - I think Biotechs are in a rebound and that there will be a lot of takeovers of niche companies

Blygh

|

|

|

|

Post by blygh on Jul 23, 2016 20:19:20 GMT -5

|

|

|

|

Post by tiarra on Jul 24, 2016 13:38:44 GMT -5

Great win IRA

HOG Long Stop loss at 48

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Jul 24, 2016 15:02:25 GMT -5

I'm okay with eliminating the leveraged ETF's. If we just record wins and losses for each week without tracking the cumulative gains and losses, then the leveraged ETF's have an unfair advantage. But over time their volatility erodes cumulative gains, e.g. you win with a 20% gain one week and lose with a 20% loss the next week, over and over. That pattern will result in a winning pick most weeks, but a loss on the cumulative record.

Are we going to track weekly winners and cumulative gains/losses? It's a relevant question because you look for different stocks for weekly winners than you do for long term gains. I think for good cumulative records one would look for steady growers with few losses. But weekly winners need to be more volatile.

Also, if we have stop loss prices, then we will sell during the trading week. But we will still only add new buys on the weekend. Too much work to allow buys during the week. And if we are going to track cumulative gains/losses for our portfolio, might we hold more than one at a time? Having more than one security at a time is more like real world. But also more work to track and update. We need to keep this manageable.

For next week I'll switch to MSFT short. MSFT had a big move up last week leaving a big gap in the chart. I'm betting there will be some profit taking to fill some of that gap. Also, August and September are the 2 weakest months historically. So I'd be looking for shorts. MSFT is an example of a company one might hold for cumulative record, but it's not volatile enough to win a weekly race very often. -ira

|

|

|

|

Post by sd on Jul 24, 2016 15:55:14 GMT -5

Hi IRA-

Hope you are wrong on MSFT- as I hold a position pre gap higher-LOL!But i have a stop-loss in place. Hope it doesn't get taken out.

On what you brought up- Just my understanding- I think the use of stop-losses and limit sells are up to the individual racer- I personally like the idea, because i use stops in my actual trading.

It also potentially limits the damage to your score should the trade go South on you. Of course, It could also stop you out on a tight stop and intraday volatility and then move higher and perhaps be the week's winner. and - you would only receive the score your stop-loss would have exited you at. More real world IMO.

If one chooses to set a limit sell at a target, the potential is there to have the target hit during the day, but price goes down and closes lower-

I think it also makes sense that the gains and losses would be recorded weekly - and eventually the cumulative totals would determine the top racers over the longer term.

Each racer can choose a different horse each week- so any cumulative total would be based on the net % score- gain or loss- and not track the actual horse used.

Keeping it to a single entry for each race keeps it simple-

Since Blygh is taking care of tracking the Race, What methods work best for him are fine with me. I'm just putting in my understanding of the outline- Blygh can summarize the final conditions once he gets everyone's feedback- Regards- SD

|

|

|

|

Post by sd on Jul 24, 2016 16:25:37 GMT -5

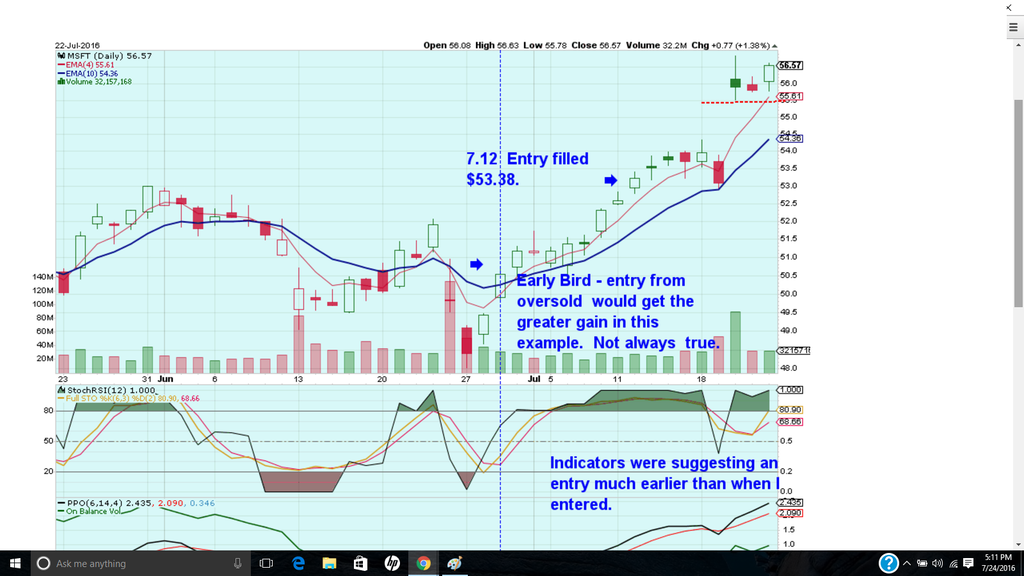

It's been a while- see if i got this right on posting images- from Photobucket I'm trying to post a MSFT chart- IRA's Short MSFT, and i am using a stop-loss to actually try to keep some of the profits.  will see if this works- OK, that was simple. I took the initial entry because Tech was lagging the market rally after the Brexit sell-off. I felt MSFt offered some relatively "safe" price action and stability. I also took other positions- Goog, Hack, FB, Notice on the chart, my entry was not the most opportune place to enter-But it's where Time allowed me to check in on stocks and make a selection. Notice that the "Best" entry in the past weeks would have been on a rebound from an oversold condition- and - also the best Risk to Reward ratio- I will pursue this application in a separate new thread. SD |

|

|

|

Post by blygh on Jul 24, 2016 16:32:22 GMT -5

|

|

|

|

Post by tiarra on Jul 24, 2016 16:49:09 GMT -5

On a side note, I wanted to say HOG will have earnings coming out Thursday. I anticipate a fairly decent move, which is why I picked it. If it starts moving downward, I think it will go around $46, then possible $40. I like to get out before actually earning announcements to avoid surprises, but you can usually have a nice gain before hand.

|

|

|

|

Post by sd on Jul 25, 2016 4:54:52 GMT -5

I'm placing small orders on both Blygh's and Tiarra's Horse's. Thought it would be interesting- and possibly profitable! The trade commission at IB is just $1, allowing me to try this-

My entry orders are not duplicating the racer's entry. I will be using Buy-stops on a move higher to enter into the trade , _with limit sells, and a fixed entry stop-loss I would potentially move up trailing price. This was a spur of the moment idea I had when I awoke this am-

So not a lot of study went into this- I'll try to get the charts posted tonight-

MMSI has had a nice move up, break higher last week. HOG has been sideways since the large up-move in july, and pullback- but is pushing up higher

HOG-10 sh BS $50.80 lmt $51 stop $49.80 MMSI 20 sh BS $22.00, lmt $22.20 stop 21.50

|

|