|

|

Post by blygh on Jul 9, 2017 14:34:59 GMT -5

Week 27 Monday July 10 The morning line

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | CBSH | 57.12 |

|

|

| 56 |

|

| | 2 Ira | AAOI | 67.39 |

|

|

|

|

|

| | Spiderman | BLCM | 11.64 |

|

|

|

|

|

| | 4 SD | PBYI | 88.70 |

|

|

|

|

|

| | 5 RealDeal | PIXY | 10.65 |

|

|

|

|

|

| 6 Blygh

| JETS | 32.51 |

|

|

| 31.25 |

|

| | Market | SPY | 241.95 |

|

|

|

|

|

| | 8 | QQQ | 137.84 |

|

|

|

|

|

|

|

|

|

|

Post by sd on Jul 9, 2017 19:23:56 GMT -5

Here's the updated Chart List for the horse race:

stockcharts.com/public/1675108/tenpp.

I post Tiarra with her default ETSY (Doesn't look bad btw..) If she makes her pick prior to the deadline, i will update

I stayed with PBYI- An actual position I am still holding from $82- Hoping it gets a spark to move higher this week - I'm trying to apply Blygh's "Patience".

I did take an Entry last week back into AAOI- i simply liked that while Tech still looked weak, it held the pullback swing instead of breaking lower. The Entry was close to a well defined bottom of the base- The Point of Failure... and so I went long both AAOI and AMD at the same day- nice to see the Tech make a rally- hope it provides some added momentum higher this week-

I do think it is time to be more tactical - So i will look to sell a portion of the AAOI and lock in the + 10% on a partial- I did not get a chance to view the market close on Friday- or would have done so then. Logical target for AAOI would be just below the prior recent high- 72.00 area.

MRAM - looks interesting - It's at resistance, but can it push through? I was lucky previously with MRAM - so 'll approach this with a limit that price may struggle here-with some volatility - and a limit now at $20.50 may see a pullback fill- closer to the P.O.F. SD

|

|

|

|

Post by realdeal on Jul 10, 2017 8:08:14 GMT -5

I had PIXY at Friday's Close.. Thanks

Attachments:

|

|

|

|

Post by realdeal on Jul 10, 2017 8:11:09 GMT -5

SD, I'll sell PBYI and try to re-enter, should take off for the week LOL. Good Luck buddy =)

|

|

|

|

Post by blygh on Jul 10, 2017 13:54:03 GMT -5

Re: Real Deal - your entry - "PIXY at the Friday close" was entered Saturday at 11:06. My understanding of the rules is that if you want the Friday close - you must post your stock before the Friday close. Retroactive entry points could make a lot of money - but it would be silly for any counter party to sell you their stock at a price lower than the on going market price. Opinions, riders?

Blygh

|

|

|

|

Post by blygh on Jul 10, 2017 16:49:57 GMT -5

Week 27  Monday July 10 OFF (?) AND RUNNING (?)

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | CBSH | 57.12 | 56.88 | -0.24 | -0.42% | 56 |

| 3 | | 2 Ira | AAOI | 67.39 | 68.64 | +1.25 | +1.86% |

|

| 1 | | Spiderman | BLCM | 11.64 | 11.39 | -0.25 | -2.15% |

|

| 5 | | 4 SD | PBYI | 88.70 | 85.85 | -2.85 | -3.21% |

|

| 6 | | 5 RealDeal | PIXY | 10.65 | 9.76 | -0.89 | -8.36% |

|

| 7 | 6 Blygh

| JETS | 32.51 | 32.37 | -0.14 | -0.43% | 31.25 |

| 4 | | Market | SPY | 241.95 | 242.37 | +0.42 | +0.17% |

|

| 2 | | 8 | QQQ | 137.84 | 138.66 | +0.82 | +0.6% |

|

|

|

|

|

|

|

Post by sd on Jul 10, 2017 19:15:07 GMT -5

Yes, my understanding of the rules are that to get the Friday Close, that pick must happen during the week prior to the close on Friday. Sorry RD. Blygh is correct.I think that was agreed on as we got our feet started earlier this year.....And you have to declare that you want the FC -even if you post the pick prior to the close.....

I'm still waiting, RD , on PBYI- crept up at the open today but closed low- My entry was $82-6-19 and that's been 3 weeks of patience- Same with ALGN- getting moldy with those 2 .

Small profit to be had in PBYI, small loss in ALGN if executed tomorrow-

XBI- made a recent new swing low today-on the recent pullback from the highs, so the biotech sector isn't feelin the love to make it jump higher- I have a position in XBI that today's action will prompt me to set a stop at $76.75 - on a $73.95 entry- The 1st pullback was "normal", but a dbl bottom doesn't bode well- So, I'm tightening stops to retain some small profits.

Like you, I also expect it pop just after i sell..... but there's a time factor in tying up cash in a position that doesn't move well. I still like the relative low Risk that's involved when you have such a tight range base- Well defined line in the sand ..... I might leave a small % -

Did sell 1/3 in AAOI today- I had to drop my limit 3x to get a fill- and it closed higher-

Edit- I forgot that I only have a small position to begin with- so stop will be $85.25

|

|

|

|

Post by blygh on Jul 11, 2017 15:39:59 GMT -5

Week 27 Tuesday July 11 Into the far turn

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | CBSH | 57.12 | 56.41 | -0.71 | -1.24% | 56 |

| 4 | | 2 Ira | AAOI | 67.39 | 70.04 | +2.65 | +3.93% |

|

| 1 | | Spiderman | BLCM | 11.64 | 11.37 | -0.27 | -2.32% |

|

| 6 | | 4 SD | PBYI | 88.70 | 86.90 | -1.80 | -2.03% |

|

| 5 | | 5 RealDeal | PIXY | 10.65 | 9.51 | -1.14 | -10.70% |

|

| 7 | 6 Blygh

| JETS | 32.51 | 32.17 | -0.34 | -1.05% | 31.25 |

| 3 | | Market | SPY | 241.95 | 242.18 | -0.23 | -0.1% |

|

| 2 | | 8 | QQQ | 137.84 | 139.05 | +1.21 | +0.88% |

|

|

|

|

|

|

|

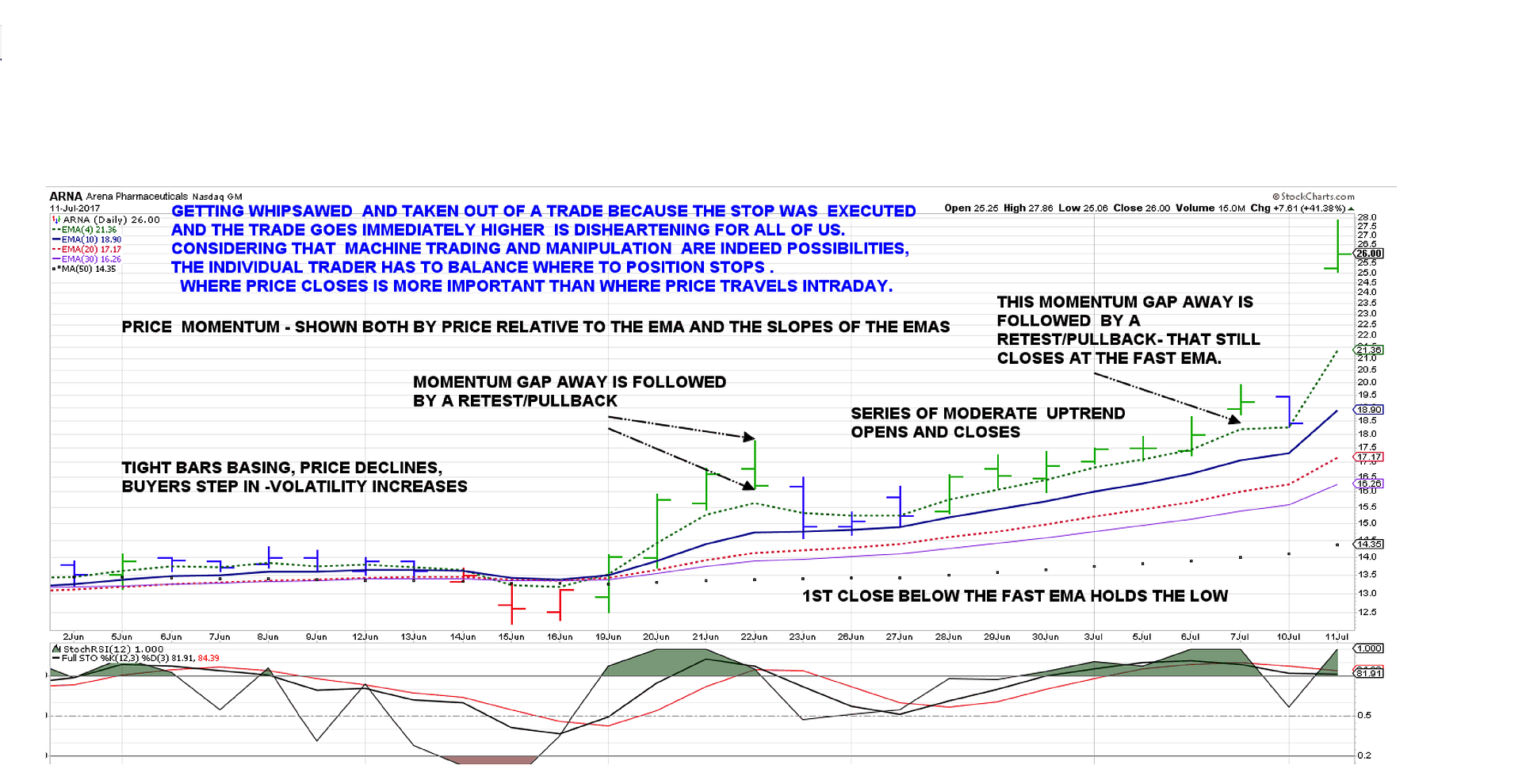

Post by blygh on Jul 11, 2017 16:41:32 GMT -5

From James B. Stewart - Den of Thieves "When insider traders gain windfall stock profits because they have bribed someone to leak confidential information -when prices are manipulated and blocks of stock secretly accumulated - our confidence in the underlying fairness of the markets is shattered

My investment in Arena pharmaceuticals fell 4.2% yesterday. I was stopped out - Arena was up 40% today. Why does this make me think that price manipulation may be an issue? Stocks like PBYI and TSLA that swing wildly in price - to my mind - are just subject to forces beyond my ability to assess rationally.

Blygh

|

|

|

|

Post by sd on Jul 11, 2017 20:12:24 GMT -5

i EMPATHIZE!

tHAT WAS A HUGE MOVE UP 40% ON ONE DAY!

To specifically respond to your statement- I would say YES- Both Manipulation and Machine Trading are integral to the stock market we now trade in.

They can take advantage of retail traders and can move price both up and down.

Just some thoughts..... While we would like to trade with a systematic approach- when volatility increases, what works during periods of lesser volatility may not work in greater volatility . I have come to be of the opinion that tighter stops can be a detriment- as long as price is behaving as one might expect- if the goal is to hold a stock that is trending for a longer duration than a few days price bars, one can see that volatility often is less if one only considers the space between the open and the Close- everything else is just Noise - While that Noise can be meaningful, for me, as a Swing trader- i am trying to give adequate leeway to anticipate some volatility spikes .

I focus on Price and how it performs to some moving averages-

Here's my thoughts - If you had an automatic trailing stop-loss set at -4%- the movement was measured from the high that price probed, well away from the Ema and was followed by a pullback and close at the ema- The Trend was still to the upside. By gapping higher on 7-7, Arna was probing a higher momentum move. The 7-10 pullback was a retest of that momentum, also taking out any tighter trailing stop-losses...

The retest closed at the low and at the fast ema. Did somebody know something was about to happen? It certainly would appear to be the case-

What motivated the stock to jump 40%+ ? Perhaps an earnings release? Doesn't matter What - the question is - How does a retail trader compete with those that can manipulate price or get insider information? You can't . You can only trust that the system you apply and interpret, "fits" what is occurring in the market or your sector at that time...

instead of average volatility multiples- or ATR values- perhaps including a view of price as it fits the ema's is also a good combination- For example- if price had gapped away for 1 or 2 days from the ema, it would be time to take some profits off the table- as the rubber band stretches, it always pulls price back in alignment.Eventually.

Price did not trend strongly here- the gradual slope up was relatively slight- So, My premise is that when price is trending- (Price higher and moving up and all emas sloping up and in proper order) If i want to hold for a longer duration, I only raise a stop-loss to a low of a bar that closes below the fast ema- This is somewhat aqggressive- and i have relaxed that somewhat- but note that would have "worked" here-

Also, a stop-loss at the trailing 20 ema never got touched, and could have been tightened on signs of weakness- These are all variables and hindsight 20-20.

But, that's me and not you. We all have different approaches to the market- Some will seem to work better than others- at diffferent times- What works best is what works for you.

The final question is hard to reconcile because of the large gain that was stopped out prior to...

Why did i set the stop-loss where it was? And, do i widen stops just because this one trade moved so much?

It really boils down to what works best for you- not on one missed large gain trade, but on a series of multiple trades that you ultimately have experienced.

It's not about the One trade we made or lost monies on- It's about the many.......

A 40% gain in one day is very unusual, but the majority of your trades- and mine- will likely not come close to that - and so our trading needs to reinforce what we believe will be successful and psychologically we can accept regarding Risk.

I have also been splitting my positions- some with wider stops- and taking a portion of profits-on an early gain- i find this psychologically and financially beneficial. I don't know where the trade may go, but if the Trend is intact, I hope to ride it for a larger gain...

I think i would have trouble to watch price move against me 5% intraday, so it's best i have the day job and only focus on Closing prices!

my feedback is perhaps just a different perspective - SD

|

|

|

|

Post by blygh on Jul 12, 2017 15:13:35 GMT -5

Week 27  Wednesday July 12 In to the back stretch

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | CBSH | 57.12 | 56.24 | -0.88 | -1.54% | 56 |

| 6 | | 2 Ira | AAOI | 67.39 | 72.64 | +5.25 | +7.80% |

|

| 1 | | Spiderman | BLCM | 11.64 | 11.75 | +0.09 | +0.77% |

|

| 3 | | 4 SD | PBYI | 88.70 | 89.05 | +0.35 | +0.4% |

|

| 5 | | 5 RealDeal | PIXY | 10.65 | 9.27 | -1.38 | -13.0% |

|

| 7 | 6 Blygh

| JETS | 32.51 | 32.70 | +0.19 | +0.58% | 31.25 |

| 4 | | Market | SPY | 241.95 | 243.94 | +1.99 | +0.82% |

|

| 2 | | 8 | QQQ | 137.84 | 140.70 | +2.86 | +2.08% |

|

|

|

|

|

|

|

Post by blygh on Jul 13, 2017 15:31:21 GMT -5

Week 27 Thursday Into the home stretch

@fc = "At Friday close | Rider | Horse | Open | Latest | G/L | % | Stop |

| Rank | | 1 Tiarra | CBSH | 57.12 | 58.72 | +1.60 | +2.80 | 56 |

| 3 | | 2 Ira | AAOI | 67.39 | 78.04 | +10.65 | +15.8% |

|

| 1 | | Spiderman | BLCM | 11.64 | 12.26 | +0.62 | +5.33% |

|

| 2 | | 4 SD | PBYI | 88.70 | 90.95 | +2.25 | +2.54% |

|

| 4 | | 5 RealDeal | PIXY | 10.65 | 10.32 | -0.33 | -3.01% |

|

| 7 | 6 Blygh

| JETS | 32.51 | 32.59 | +0.08 | +0.25% | 31.25 |

| 6 | | Market | SPY | 241.95 | 244.42 | +2.47 | +1.02% |

|

| 5 | | 8 | QQQ | 137.84 | 141.01 | +3.17 | +2.3% |

|

|

|

|

|

|

|

Post by sd on Jul 13, 2017 19:45:28 GMT -5

IRA, you're capturing the dbl digits i was hoping you'd see! There's still 1 day to go Though! Nice 1 week gain so far!

|

|

|

|

Post by blygh on Jul 14, 2017 8:02:57 GMT -5

Fri AM - Needham & Co. just raised its price target on AAOI to 100 from 85

BUT Columbine Capital Services downgraded AAOI from Neutral to Unfavorable (but if they had rated it "Neutral" what do they know?)

Blygh

|

|

|

|

Post by sd on Jul 14, 2017 11:39:45 GMT -5

Up another 7% today- Hard to think about chasing it up here...

What else will be moving the markets? Chips? Biotech? Financials -xlf- are heading lower today-

Although I've had PBYI as a horse- I'm out of the position now- and will change horses . I'll select TVTY- a health care sector play and a position I've been patient in. Finally trying to make a move higher today- I'll take it at the FC, with a stop @ $38.91.

|

|