|

|

Post by sd on Jun 10, 2017 7:48:03 GMT -5

Don't know if they are having security issues- That would be huge if hackers could get past their firewalls-

If they put additional log-in/passwords and procedures in , it's for your protection- just have to go with the extra procedures-

While several of the online trading platforms- Scottrade, TDAmeritrade allow you a simple log in with user name and a password-

Interactive Brokers also requires the extra step of log in after you match a numeric sequence that changes on every log in and matches the card they send you with 224 different combinations.

In today's world , the new reality is the need for extra security- both in the real world as well as cyber space.

AMZN is an amazing company- Prime service is outstanding - If anyone can do security right- it will be them IMO

|

|

|

|

Post by sd on Jun 10, 2017 8:13:32 GMT -5

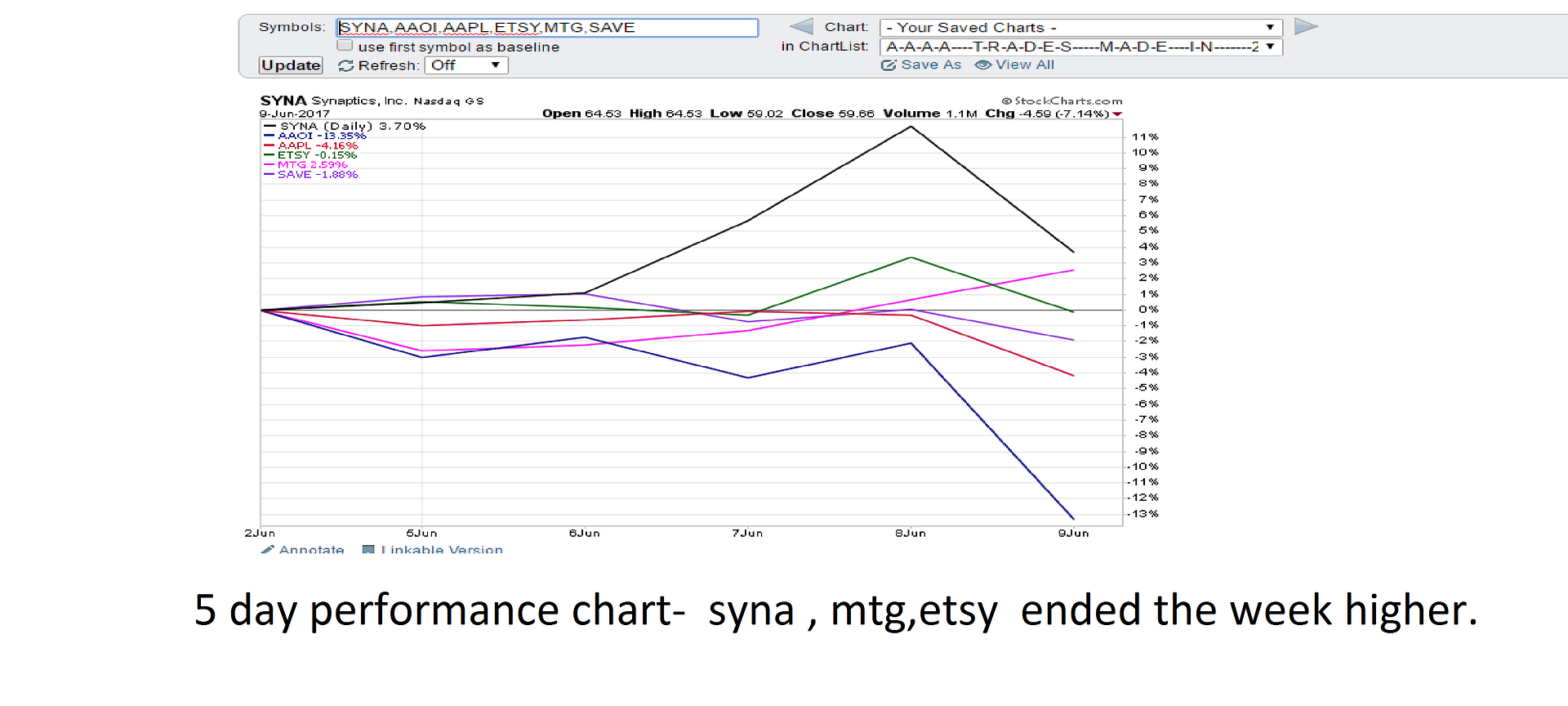

And what a week! Here's the Pic's

1st one is the 5 day performance chart

|

|

|

|

Post by blygh on Jun 10, 2017 18:54:48 GMT -5

WHAT A week - presents a major challenge to next week's pick - the obvious choice is between long financials and short tech - assuming Friday's sell off continues. Or is the tech sell off a mini flash crash?? I am really tempted to go long in GS - Goldman Sachs - I assume they have shorted the hell out of the techs before they went public that tech is over bought. They are pretty sharp investors. But I am going to short PBYI - up from 30 to 80 on the last 6 weeks - on drug discovery BUT 26% of the stock is shorted and insider selling is 5 times insider buying. Good enough for me

PBYI short - stop loss 83

Blygh

|

|

|

|

Post by Spiderman on Jun 11, 2017 5:46:54 GMT -5

Congrats SD,

I'll ride YRCW long.

Spiderman

|

|

|

|

Post by sd on Jun 11, 2017 8:52:29 GMT -5

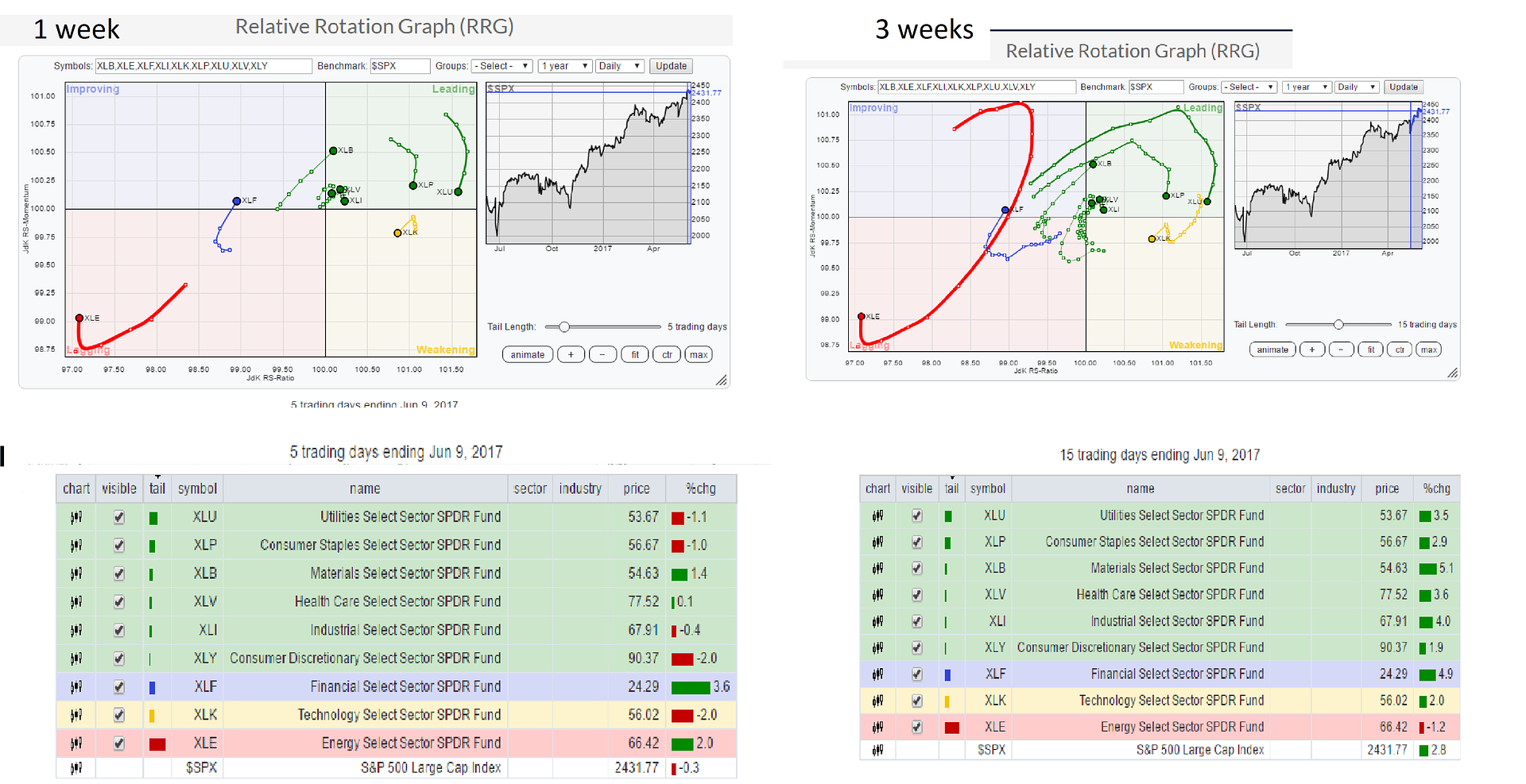

Sector rotation illustrated in graph form - relative performance to the $SPX

notice that the financials - XLF is now showing relative strength improving- The upper right box is where you want to see the sector direction heading

xlb has been showing 3 weeks outperformance, while the xlf is showing higher momentum this past week. TECH -XLK- is in the weakening box for 3 weeks, and energy IS STILL in the lower left quadrant .

seeing sector rotation in a graphic form is something to consider when making a trade decision- Is the sector Tide/direction favoring the trade direction?

available on stockcharts.com

stockcharts.com/docs/doku.php?id=other-tools:rrg-charts

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Jun 11, 2017 11:39:07 GMT -5

I'll ride AAOI short this week. Stop at 70.

The last time AAOI sold off it went from 60 to 40 in 12 market days. If this Friday selloff is just a couple of days correction this short will whipsaw me. I'll gamble it will be more like the March-April correction.

Thanks so much Blygh and SD for the commentary. The Goldman and Puma observations sound very well reasoned. Thanks!

I'm concerned we may be getting close to a turning point. Fed "normalizing" higher interest rates, lots of complacency. I hear people at work talking about how great their retirement accounts are doing and how they plan to keep on track for another year or two, let their account grow another 20%, and then retire. Seems like some folks think this is on auto-pilot with no place to go but up. The craze for index investing seems to stoke that fire. I wonder if one day we'll look back on the S&P 500 ETF's in 2017 and see it more like the 2000 tech bubble or the nifty-50. People who think a passively managed broad market index won't go down and stay down for an extended time haven't looked at history. In the late 80's I invested in a Japan growth mutual fund. Nuff said. -ira

|

|

|

|

Post by realdeal on Jun 11, 2017 12:20:57 GMT -5

Big Congrats to SD! After Friday's sell-off I thought it be a race to the bottom.

I'll go with MD long, it's in a trading range and close to a Breakout, has a gap to fill around the 59+ level.

-rd

|

|

|

|

Post by realdeal on Jun 11, 2017 12:43:54 GMT -5

Hi Tiarra,

I have learned in my days and from a good number of books nothing is 100% secure. I don't sell on AMZN but I was ordering a father's day gift and forced to reset my password the other day. You should look into a VPN and a Tor browser. Also not sure if anyone keeps on this stuff but a bill passed a few months back were anyone can buy your browser history. Whoever you pay to provide you with internet access – Comcast, AT&T, Time Warner Cable, etc will be able to sell everything they know about your use of the internet to third parties without requiring your approval and without even informing you.

Good Luck

-rd

|

|

|

|

Post by sd on Jun 11, 2017 13:43:19 GMT -5

Like the market participant cycle RD!

|

|

|

|

Post by tiarra on Jun 11, 2017 15:21:33 GMT -5

Congrats, SD!

Long FNSR stop at 24.66

I placed an order from Amazon and it wasn't shipped. I am assuming for the same reason I couldn't ship my orders. The accounts are too hard to get into right now. I had to have them text and call me pass codes. I would short AMZN, but it fell so much Friday, I decided not to.

realdeal, I hate to think of a company buying my search history only to discover how boring of a person I am! lol

|

|