|

|

Post by blygh on May 26, 2017 16:11:08 GMT -5

YTD for 2017 as of 5/26/17

| Rider | Wins | Place | Show | YTD | Default | YTD default | Tiarra

| 5 | 1 | 3 | +22.053% | ETSY | +12.36% | | Ira | 3 | 4 | 2 | +8.731% | VIXY short | +70.08% | | Spiderman | 3 | 1 | 4 | -33.601% | EXAS | +248.47% | | SD | 1 | 3 | 6 | -2.335% | XBI | +15.325% | | Real Deal | 1 | 6 |

| -24.309% | CREESINCE 4/28 | +9.519% | | Blygh | 7 | 2 |

| +10.267% | ISRG | +41.85% | | Market |

| 3 | 5 | +5.654% |

|

|

Tiarra continues to lead in Yield to Date

(I may put a portfolio together consisting of our default picks) z |

|

|

|

Post by sd on May 26, 2017 20:58:29 GMT -5

That would be a rewarding portfolio if the market continues to reward those picks going forward! Consider that the market is around 8% YTD.

The outsized performance of the picks vs the market also suggests that we tend to limit ourselves feeling that stock xyz has made too much of a move- gaining 20% in a short period. or 30%, or 40%- or 100% + . All of the default picks have more momentum judged by performance than the market.

Consider that all 6 picks YTD yielded an average return of 66%. That is 8X the market return (800%)

Lose the best YTD performer- EXAS out of the average-248% The next 5 default combo gives a return of 29%- more than 300% better than the market.

Lose the Vixy Short 70% , and the remaining 4 positions yield 19.25%

Lose the 3rd best performer ISRG, and the 3 remaining picks yield a 12% return- or 50% higher than the market.

That type of performance is outstanding , even if one loses the top 3 performers, beating the 'benchmark SPY by 50%. (12% vs 8%) That is Huge in an investment portfolio.

The other aspect of the equation is What is the volatility to achieve these larger gains? SPY on average had a decline this past year less than 5% - something an Investor should be comfortable with and not lose sleep over-

Higher volatility and wider price swings are often associated with high flying stocks- So, to get the extra sizzle and gains, one has to be able to stomach the added potential wider downside. Is that true of each of the default picks?

When RISK enters, the average investor is truly Risk adverse- Thus , a more stable (lower) return with lower volatility allows the invester to sleep better-

Your financial adviser asks you to fill out one of those Risk vs gains questionaires.

With the greater volatility expected seeking market outperformers, i would think one needs to have a wider exit plan than normal to stay outside the potential swings and greater downside declines- Any thoughts to that aspect of the approach?

|

|

|

|

Post by blygh on May 27, 2017 8:59:19 GMT -5

A WIDER EXIT PLAN - I think you are right SD. Will the Trump bump fall flat due to political risk? If he is successful in cutting the budget - hundreds of billions of dollars will not be spent. This money circulates through the economy putting millions to work. If the Fed raises interest rates - as widely expected - there will be less borrowing and hence less money circulating through the economy. No one I have read thinks we can grow the economy at 3%/yr except for a few Trump staffers (and I don't think that even they really believe it).

My present market strategy is to look for slow steady growers - liberal use of tight stop loses - (Put option are very expensive and probably not worth it - I would rather go short against a call- less profitable but much safer) - I have made my target gain for the year. I am not willing to take much risk. I do not see much that can drive the market as a whole. I think it is a stock pickers market but I am selling before earnings announcements - just too d**n volatile.

Blygh

|

|

|

|

Post by sd on May 27, 2017 21:56:58 GMT -5

You are right to be prudent IMO... I also don't see how Trumps initiatives will manage to push through, and it would take 12- 18 months to see the results.

Earnings have been good -but we are at a rich valuation- Dollar has been dropping since the start of the year, so that should keep multinationals happy .

I think Europe has outperformed the US mkt and is at a better valuation-

However, the markets often will outperform (already have) and recover quickly- until the psychology

I am holding OEUH as a conservative way to get exposure to Europe - It was a quick selection, and there are likely better - but it is a factor driven etf- www.etf.com/OEUH

that incorporates "higher quality, lower volatility, dividends. and has a 1 year return of 15%- PE ratio was 22.83- bit high it would seem- Perhaps the Europe run has caught up too quickly.....

When we consider faster momentum, faster gains- AAOI, EXAS, ISRG, There are several ways to get some of the sizzle and moderating the Risk - and still take a fling with the high flyers...

Reduce the position size to a smaller allocation-; an approach that employs stops- trailing, and a method to tighten them as necessary in response to price or market action.

OR- As you have met your goal- relax, unwind, reduce position size and carry a larger cash for the someday correction -

I am still intrigued-somewhat as a moth to a flame- to want to incorporate a smaller portion of a portfolio to hold a few more aggressive positions- while the larger portion is more conservatively held.

Stops should take care of the feared sell-off- To be tradinjg- or even investing- without stops at these levels would seem to be overly optimistic- Of Course, stops can be as wide as one can stand....

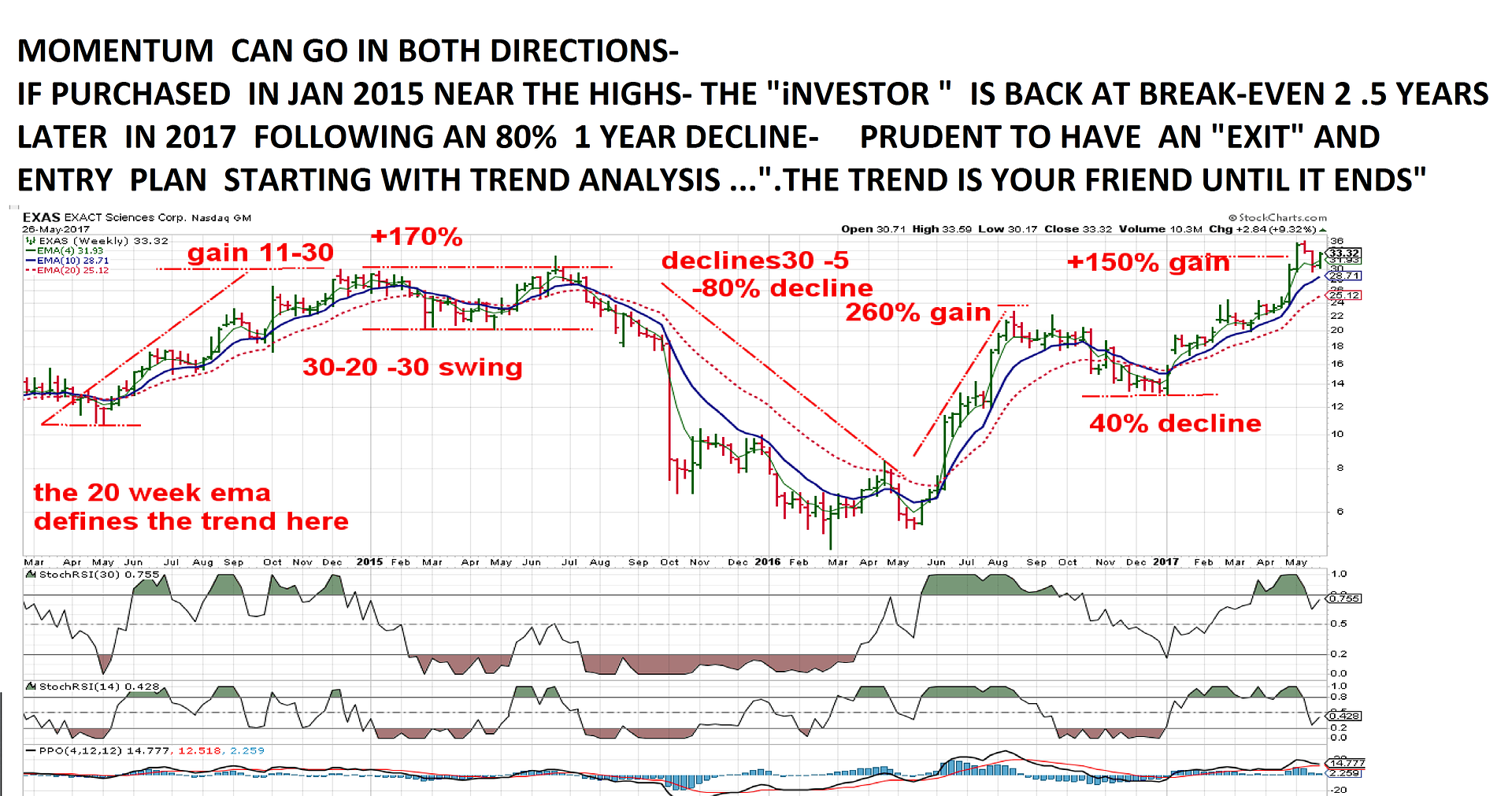

EDIT-ADD CHART EXAS

EXAS weekly chart is a good example of volatility, and a good poster child for taking WITH Trend Trades-

A 3 YEAR LOOK

|

|