|

|

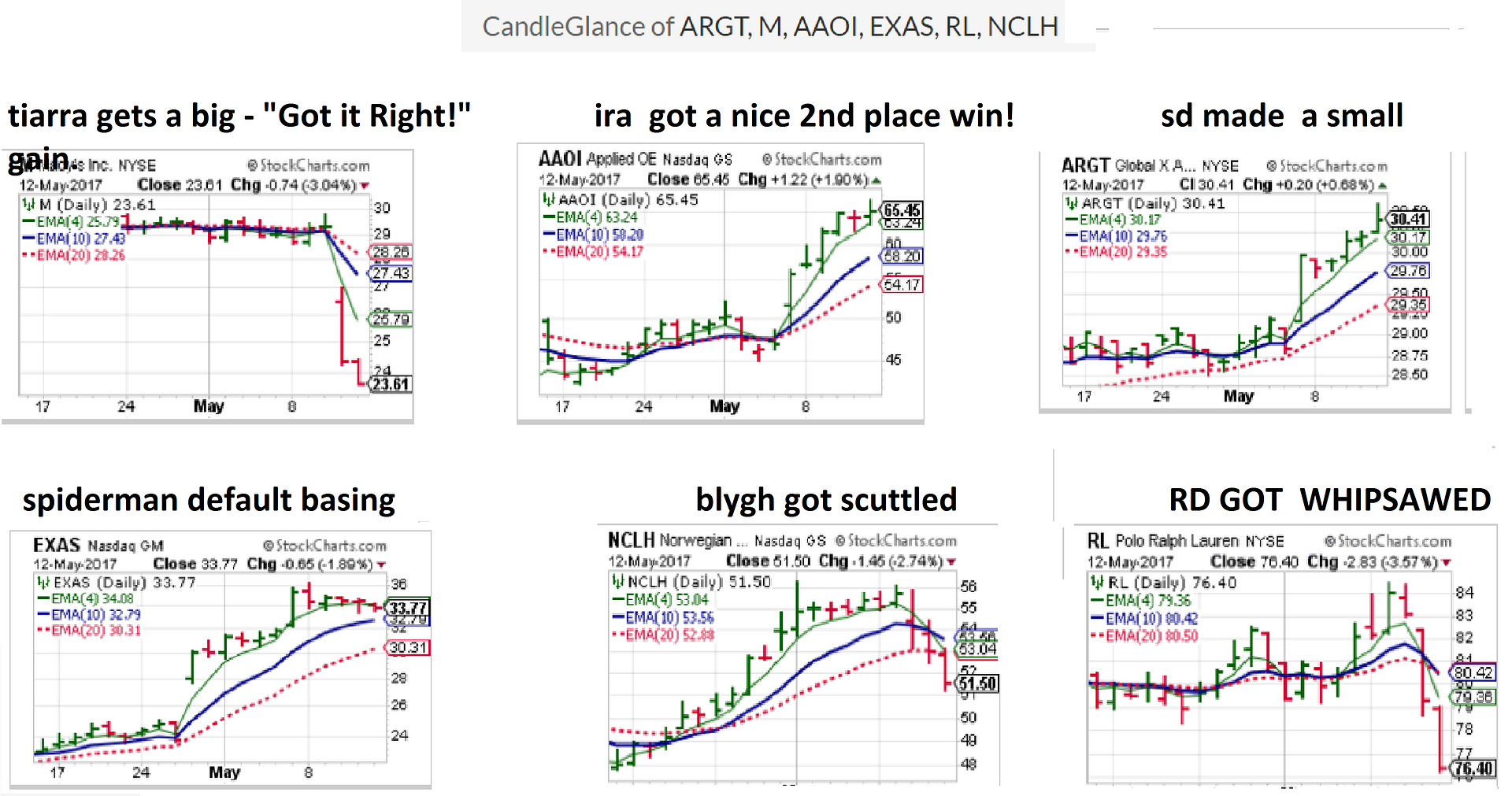

Post by sd on May 12, 2017 17:54:33 GMT -5

Here's the pics

|

|

|

|

Post by blygh on May 12, 2017 18:53:08 GMT -5

CONGRATS Tiarra and a nod to Ira - The Trump rally is stalled - energy prices down - retail falling. Infrastructure stalled - I try to think - what are people spending money on? Travel and Leisure? BJK MMYT PCLN TRIP?? Airlines - fully priced - Automobiles all down on sales - Health Care? On hold pending the Senate Health Care plan- Maybe time to follow SD's example and look to foreign markets - AMX long (Stop loss at 13- Limit=18)

Blygh

|

|

|

|

Post by sd on May 13, 2017 8:21:15 GMT -5

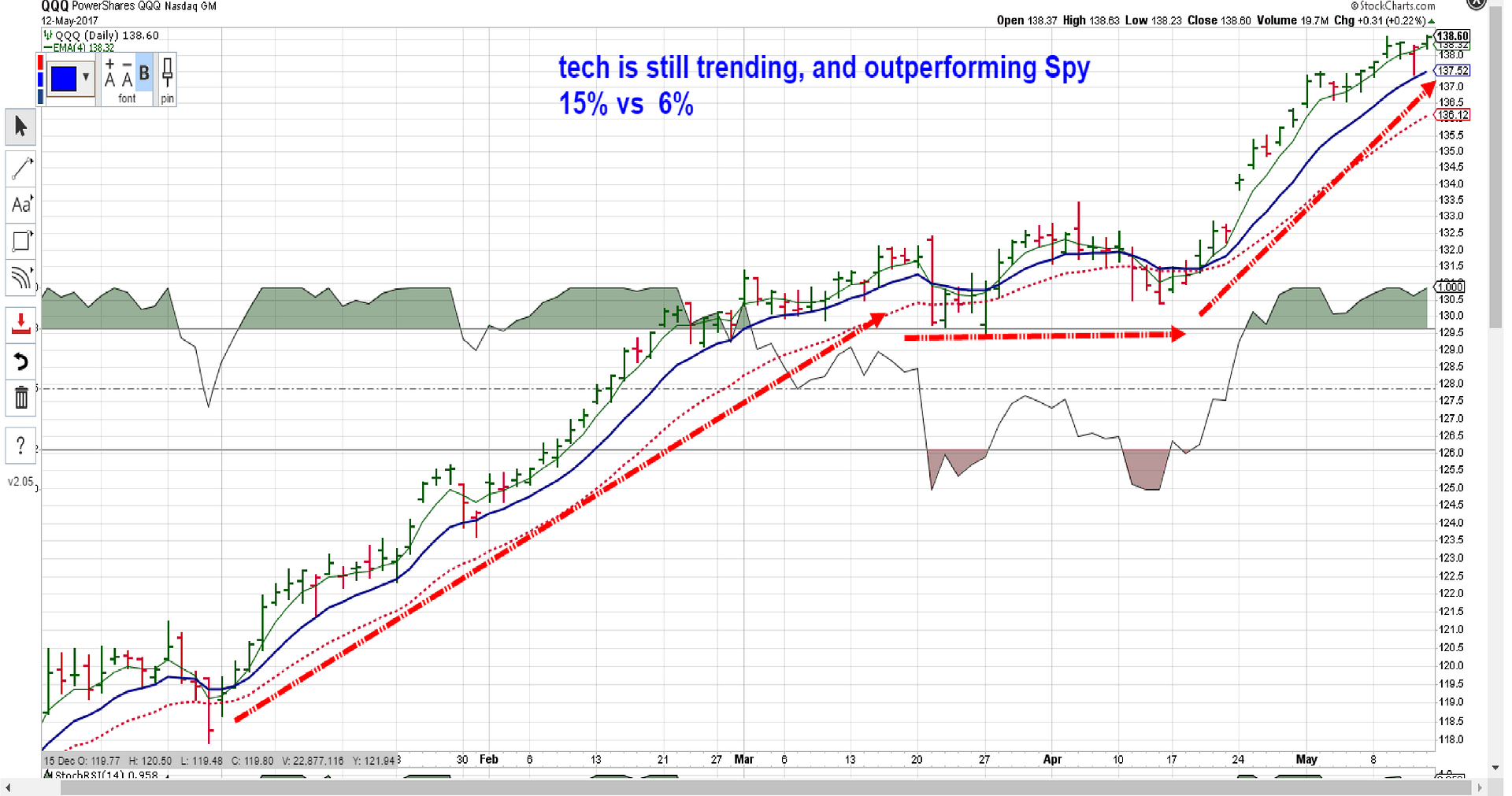

It certainly seems that there is no broad based market rally - the Spy is up 6% on the year, and is in a higher sideways channel following the March pullback.

"Stockpickers market" I think is the term that applies as the field narrows of trending stocks. drilling down into those sectors that show upside momentum makes sense to narrow the field where there is still an upside tide at work.

Tech as illustrated by the QQQ's is a broad sector-that is outperforming spy by 2x+ and is clearly trending higher.

To Blygh's note- there is an entire other market outside of the US that may not be as high priced and have opportunities for good growth that one would want to have exposure to in a portfolio, particularly if US stalls ...I have a position in TQQQ - 2x the qqq's applying the approach of only raising the stop After price CLOSES below the fast ema ...

By having a rule to not react on price intraday, one doesn't make a kneejerk reaction on volatility alone- only to find price went low, you sold out, but it closed higher- This happens to all of us- Try reviewing your trades ignoring a red bar day-That's normal,that's not necessarily a sell signal- that's volatility-

For aggressive traders- a fast ema could be your signal -4 ,5,6,10 ema....for others, a slower ema or a moving average cross is a good reference-

Look at the 2 charts and notice how much of the trending periods that approach of waiting to set a stop under the low of a bar that closed below the ema works-

Yes, it's not 100%- nothing is- and there are reentry rules / guidelines if stopped out to get back in- Check it out against past trades you've made when price is trending...

Anyone care to share your favorite entry exit guidelines? Favorite trade signals?

I'll post more on the EMA approach in the future in the Strategies thread. I know it's improved my results.

|

|

|

|

Post by realdeal on May 14, 2017 2:13:06 GMT -5

Congrats Tiarra you crushed it this week.

SD Congrats some week indeed. Thanks to IRA as well from me, I banked some coin on AAOI when it took out resistance of 60.

I'll go this week with ITUB (LONG)

-rd

|

|

|

|

Post by tiarra on May 14, 2017 15:26:43 GMT -5

BABA long stop at 117.90.

|

|

|

|

Post by blygh on May 14, 2017 16:12:13 GMT -5

INTERESTING SELECTIONS - so far 4 riders heading off-shore. Tiarra to China (BABA) - SD to Argentina (ARGT) - RD to Argentina (ITUB) - Blygh to Mexico (AMX) . I have had positions in Chile for a long time - CH. Other South American positions I hold are VIV, TEO and GGAL and ILF for an ETF. I have owned banks BBVA BMA in the past. In China, I hold CEO and EDU just sold CHL.

|

|

|

|

Post by sd on May 14, 2017 20:02:41 GMT -5

Interesting! Besides ARGT, Last week I also picked up some OEUH- a Europe value dividend fund. Kudos to you to be viewing the bigger picture and taking action!

Also, holding positions that are not directly correlated with the US market is smart from a diversification aspect- And when the US Market is as potentially extended as it appears to be now, Foreign investments are likely a better value in terms of EPS, and growth potential. With the US mkt stalling on many fronts....it is no longer a broad based market rally.... I'm gradually making some shifts in my focus- and now in my allocation. I made these trades in my trading account, but it's a 1st step in considering a more diverse Investment portfolio .

|

|