|

|

Post by blygh on Dec 26, 2016 23:36:00 GMT -5

| Rider | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ESTY | 12.00 | 12.18 | +0.18 | +1.5% |

|

| 2 | | 2 Ira | URA | 13.70 | 13.70 | 0 | 0% |

|

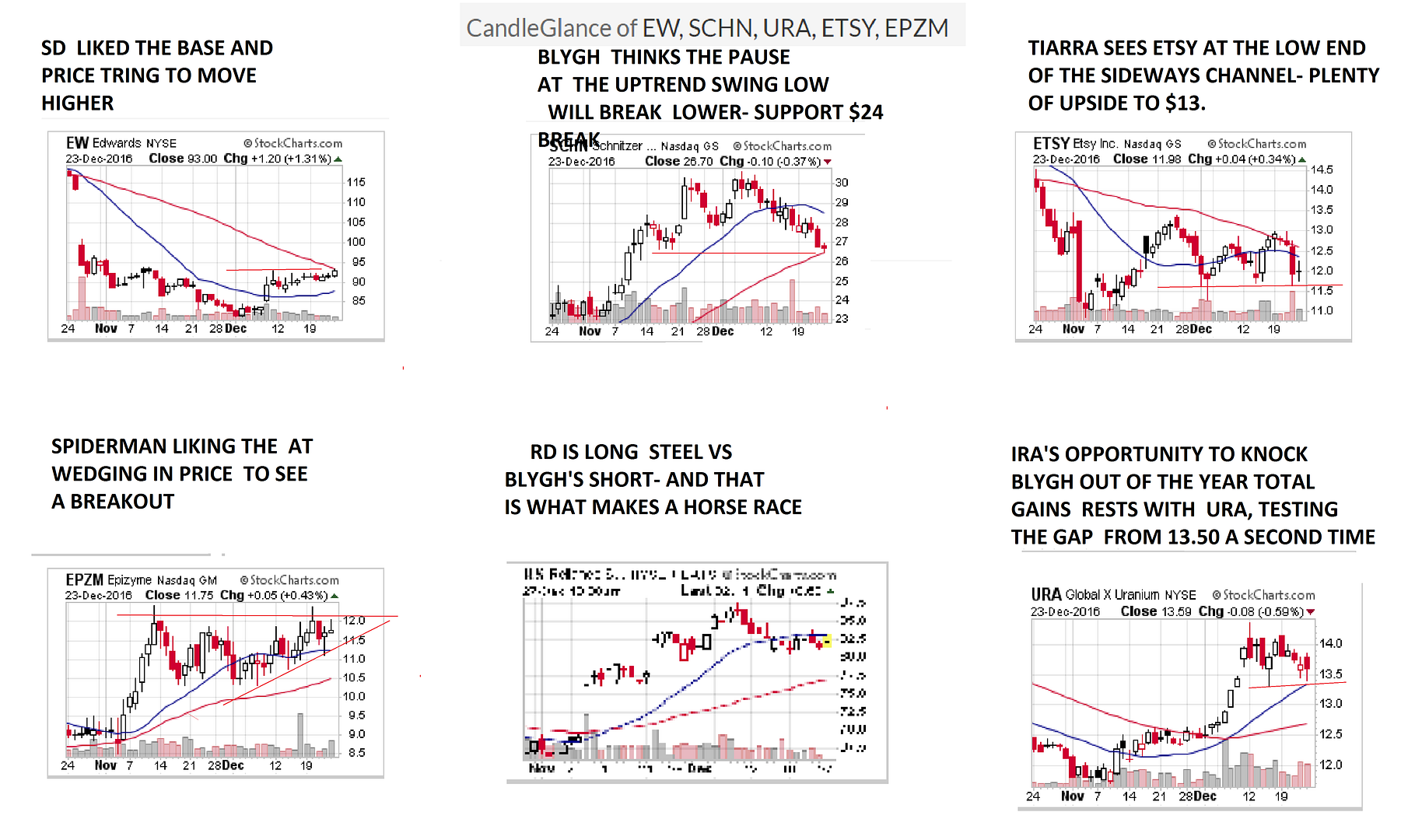

| 6 | | Spiderman | EPZM | 11.90 | 11.75 | -0.15 | +1.26% |

|

| 3 | | 4 SD | EW@fri CL | 91.48 | 93.35 | +1.83 | +2.11% |

|

| 1 | | 5 RealDeal | RS | 82.09 | 82.24 | +.15 | +0.18% |

|

| 4 | 6 Blygh

| SCHNshort | 25.55 | 27.35 | +1.80 | -7.05% | 29.00 | 24.00 | 7 | | Market | SPY | 226.02 | 226.27 | +0.25 | 0.11% |

|

| 5 | | 8 | QQQ | 120.44 | 120.82 | +0.38 | 0.32% |

|

|

|

|

|

|

|

Post by sd on Dec 27, 2016 10:16:46 GMT -5

PRE OPEN...THE LINE UP- RD'S PIC WAS AT MONDAY AM

|

|

|

|

Post by blygh on Dec 28, 2016 16:59:06 GMT -5

Out of the far turn into the back stretch

| Rider | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSY | 12.00 | 11.87 | -0.13 | -1.1% |

|

| 4 | | 2 Ira | URA | 13.70 | 12.67 | -1.03 | -7.52% |

|

| 7 | | Spiderman | EPZM | 11.90 | 12.15 | +0.25 | +2.10% |

|

| 1 | | 4 SD | EW@fri CL | 91.48 | 92.71 | +1.23 | +1.35% |

|

| 2 | | 5 RealDeal | RS | 82.09 | 81.03 | -1.06 | -1.29% |

|

| 5 | 6 Blygh

| SCHNshort | 25.55 | 26.70 | +1.15 | -4.50% | 29.00 | 24.00 | 6 | | Market | SPY | 226.02 | 224.40 | -1.62 | -.048% |

|

| 3 | | 8 | QQQ | 120.44 | 119.88 | -0.56 | -0.46% |

|

|

|

|

|

|

|

Post by blygh on Dec 29, 2016 17:01:28 GMT -5

Into the home stretch

| Rider | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSY | 12.00 | 11.76 | -0.24 | -2.00% |

|

| 5 | | 2 Ira | URA | 13.70 | 12.81 | -0.89 | -6.50% |

|

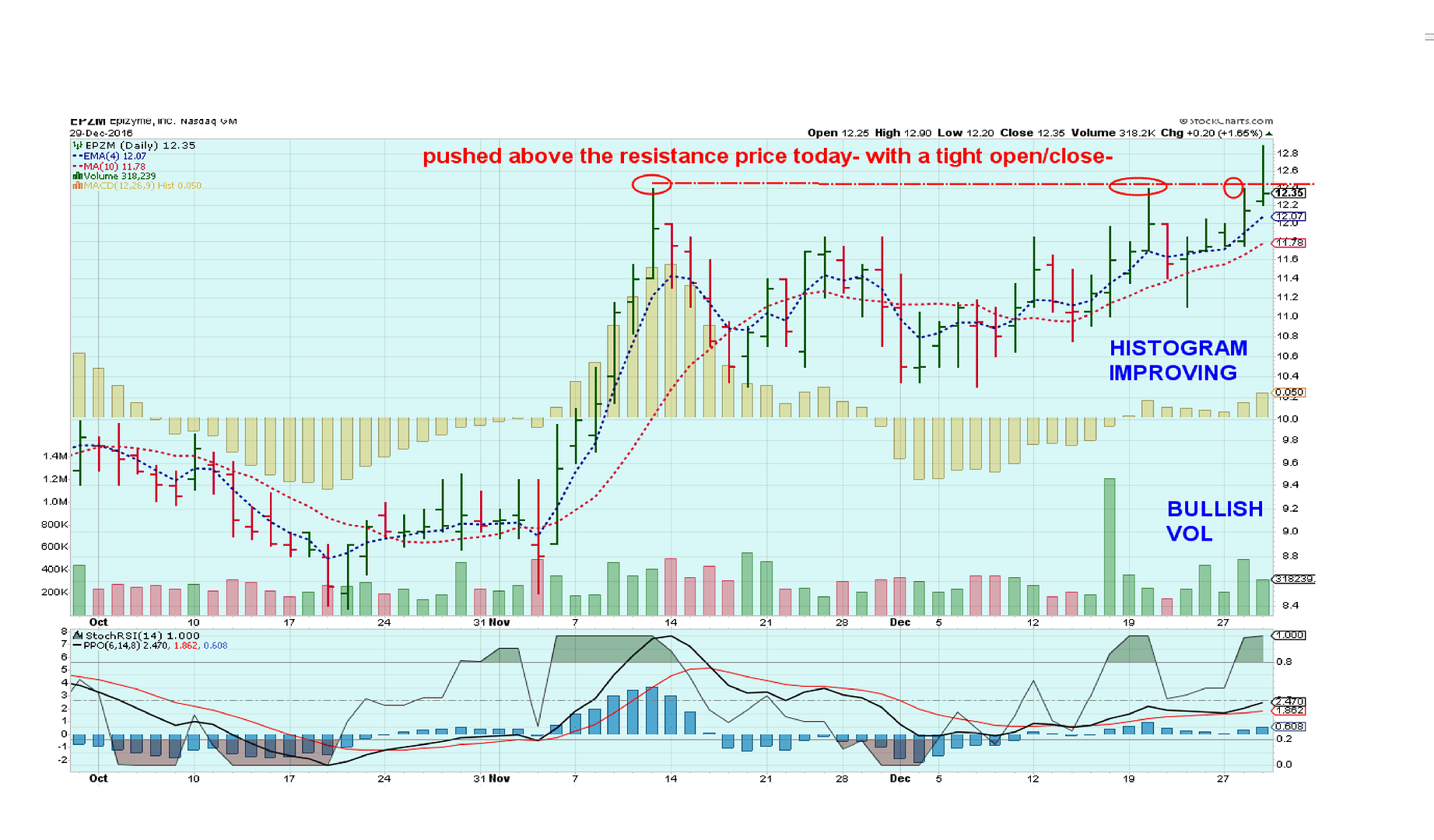

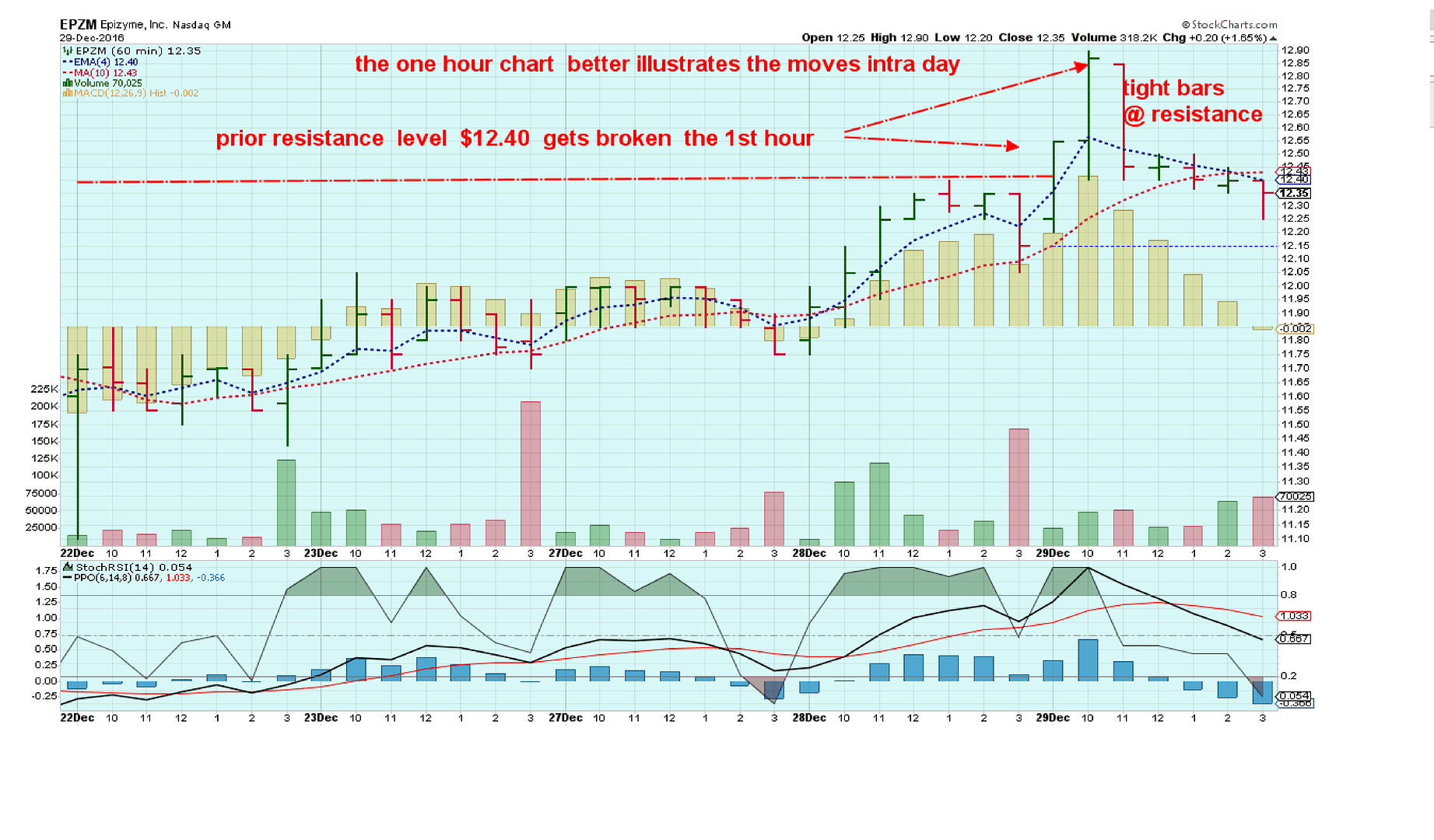

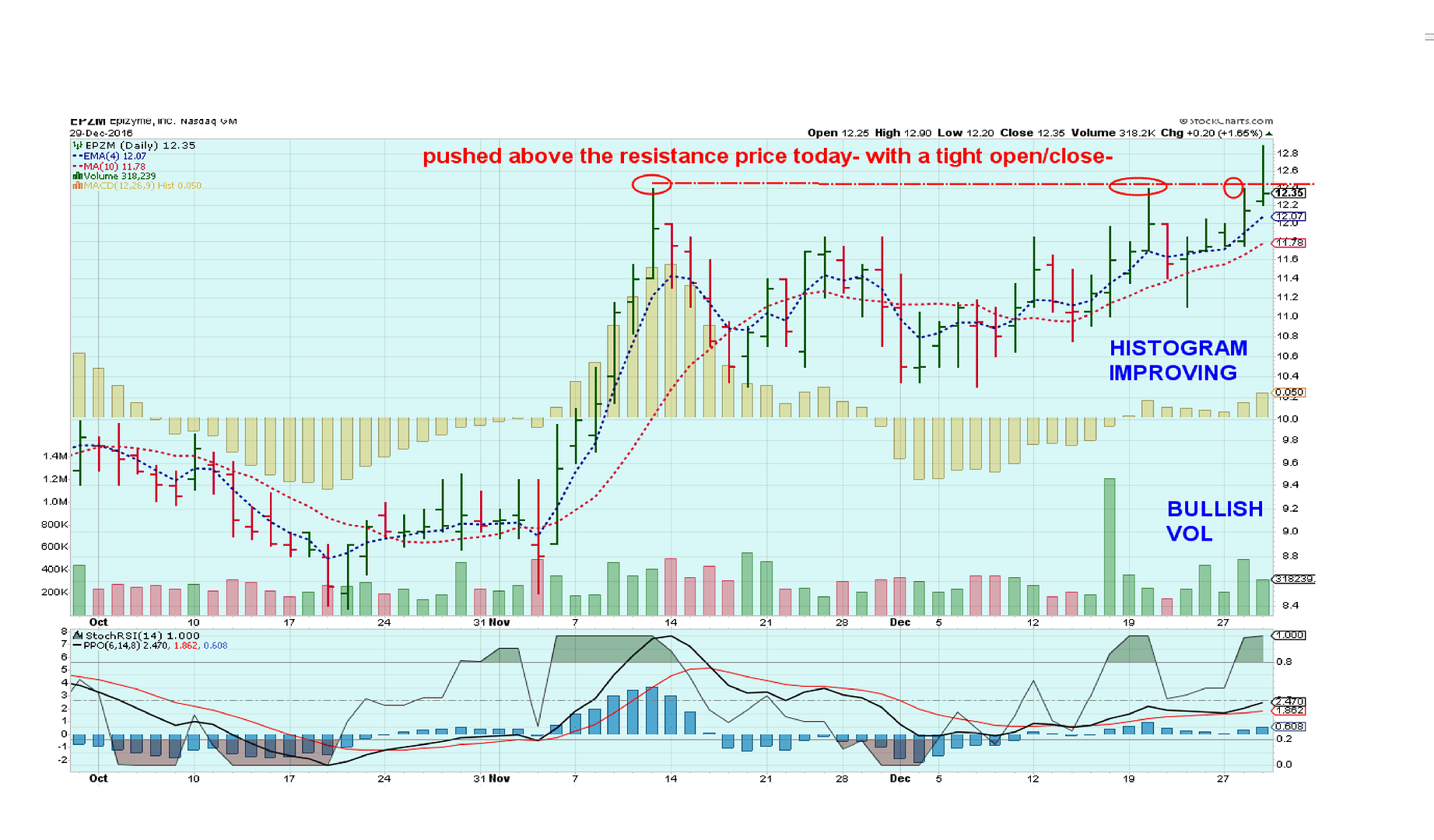

| 7 | | Spiderman | EPZM | 11.90 | 12.35 | +0.45 | +3.78% |

|

| 1 | | 4 SD | EW@fri CL | 91.48 | 93.71 | +2.23 | +2.44% |

|

| 2 | | 5 RealDeal | RS | 82.09 | 80.75 | -1.34 | -1.63% |

|

| 4 | 6 Blygh

| SCHNshort | 25.55 | 26.46 | +0.91 | -3.56% | 29.00 | 24.00 | 6 | | Market | SPY | 226.02 | 224.40 | -1.62 | -0.72% |

|

| 3 | | 8 | QQQ | 120.44 | 119.88 | -0.56 | -0.47% |

|

|

|

|

|

|

|

Post by sd on Dec 29, 2016 19:41:09 GMT -5

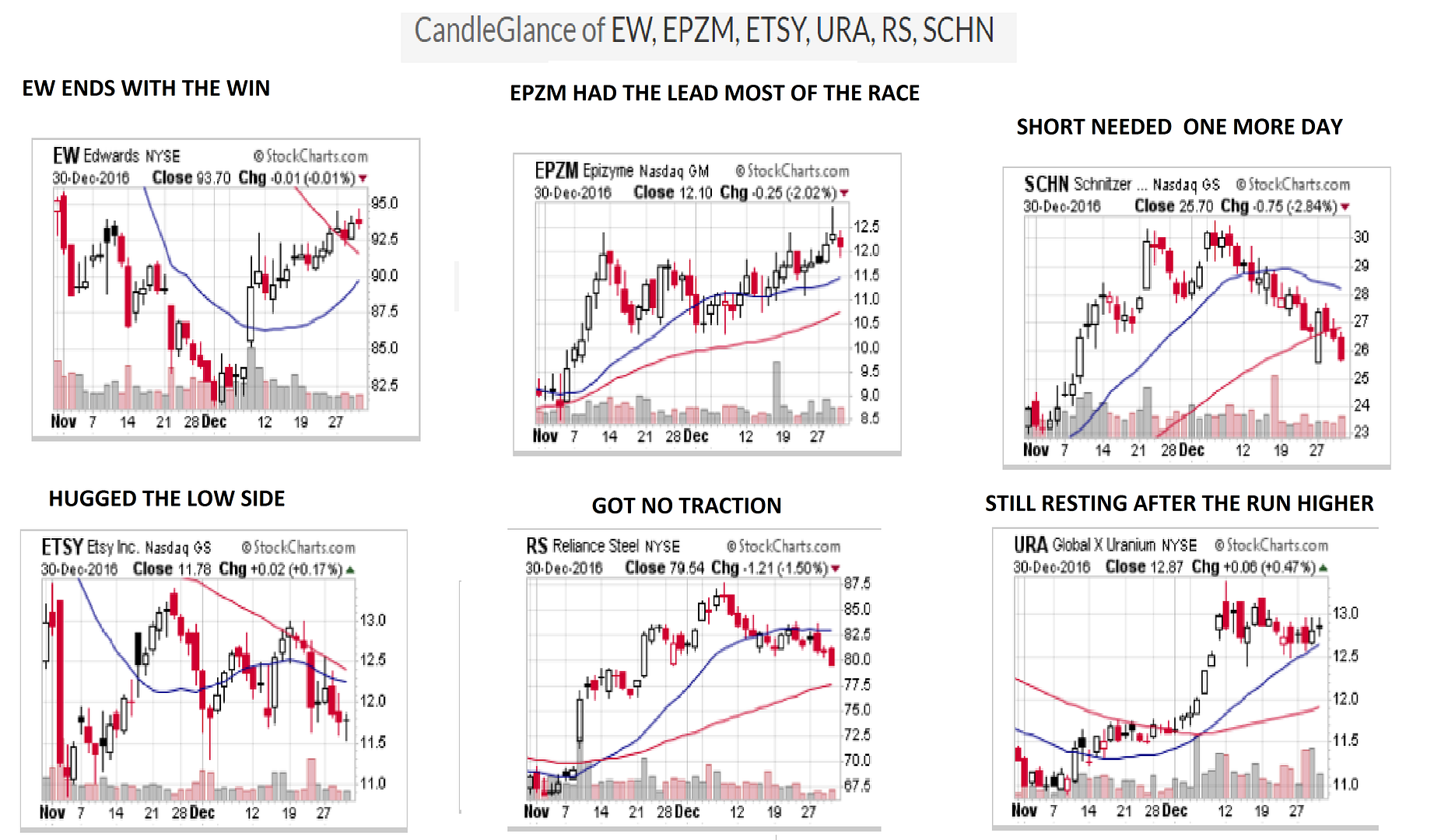

Both EW and EPZM are sitting at a prior resistance level. EPZM is pushing hard to break through, while EW is just grazing, enjoying the day!

EPZM closed just above where it opened- after having made a hard push higher-

I think today's push through resistance- although it didn't hold - looks very promising for another move higher- Looking at the 1 hour chart breaks the story down- a strong move in the 1st 1.5 hours, a sell-off-profit taking likely- and things tightened up as price came back to the resistance level, with the Close very tight to that resistance- Since Resistance is not a specific line, but a range- the Closing bar had pushed lower- but finished higher- looks positive to me- Tomorrow may be the day! Of course, I'm rooting for EW to get back on the track and show some of the same enthusiasm!   How about The Investment Race Guys ? Any interest? Just pick 5 and it will offer a different -long term focus, and perhaps some insights over time with position investing vs short term trading. As we are wrapping up the end of another year, and perhaps setting goals for the year ahead, One of mine is to develop an approach appropriate for position investing- with a wider exit strategy than viewing daily charts. For myself, the investment positions will be monitored with a weekly chart basis. Potentially, I will be focusing on ETF's rather than individual stocks-I don't know how Blygh will be positioned- Some of us hold positions in a company sponsored IRA - which may be stocks- or mutual funds- Those might be interesting candidates>

|

|

|

|

Post by tiarra on Dec 30, 2016 10:35:11 GMT -5

Will the 5 race for the year?

That is the general idea - Jan 3 2017 9 to the end of the last day of trading - You can change one stock per quarter on the last day of the quarter - Stops and limits allowed- dividends added to compute total return

|

|

|

|

Post by sd on Dec 30, 2016 12:12:23 GMT -5

Yes, it's 1 year, and Blygh discussed that once every quarter we could adjust the 5 positions- and use stops and limit buys along the way as well- go short- etc. We can work out the final details- but this would be similar to managing a retirement portfolio- or a long term investment portfolio. It could prove quite interesting- Stocks or unleveraged ETF's should be acceptable- I'm thinking ETF's for myself-

The mindset in Investing requires a different approach from short term swing trading, particularly in stop placement, should one decide to apply them- The issue might be if one is stopped out mid quarter- they cannot reenter until the end of the quarter- I am open to suggestions, and Blygh is likely as well, although he's got the tracking and adjustments to attend to-I would defer to him .

I'll update the Weekly charts- perhaps on a Monthly basis- open for your suggestions!

Hope to see you and others join in !

SD

|

|

|

|

Post by sd on Dec 30, 2016 12:46:33 GMT -5

To start the year's Horse race. I was considering staying with EW - it's one green spot in my trading account making gains today-

Instead, I will start the year with what i intend to be one of my Investment race picks- HEDJ long.SD

|

|

|

|

Post by blygh on Dec 30, 2016 17:22:45 GMT -5

And across the finish line

| Rider | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSY | 12.00 | 11.78 | -0.22 | -1.83% |

|

| 5 | | 2 Ira | URA | 13.70 | 12.87 | -0.83 | -6.06% |

|

| 7 | | Spiderman | EPZM | 11.90 | 12.10 | +0.20 | +1.68% |

|

| 2 | | 4 SD | EW@fri CL | 91.48 | 93.70 | +2.22 | +2.43% |

|

| 1 | | 5 RealDeal | RS | 82.09 | 79.54 | -2.55 | -3.11% |

|

| 6 | 6 Blygh

| SCHNshort | 25.55 | 25.70 | +0.15 | -0.59% | 29.00 | 24.00 | 3 | | Market | SPY | 226.02 | 223.53 | -2.49 | -1.10% |

|

| 4 | | 8 | QQQ | 120.44 | 118.48 | -1.96 | -1.63% |

|

|

|

|

|

|

|

Post by blygh on Dec 30, 2016 17:39:56 GMT -5

Total gains/losses since 7/16/16 - wins for 2016

As of 12/29/2016

| Ride | Gain/Loss% | Wins | Default pick | Long - short | Tiarra

| -51.76% | 6 | ESTY | long | | Joe | +2.83% | 4 | none |

| | Ira | +10.65% | 10 | LMT | long | | Spiderman | -24.69% | 9 | EXAS | long | | RealDeal | +3.94% | 1 | UGAZ/3 |

| | SD | +6.61% | 7 | CURE | long | | Blygh | +21.41%  | 9 | ISRG | long | | SPY | +3.67% |

|

|

| | QQQ | +5.98% |

|

|

|

|

|

|

|

Post by sd on Dec 30, 2016 18:38:00 GMT -5

Nice Way to End the year with a win-albeit modest, I'll take it-

I'm looking forward to 2017. Blygh has done an outstanding job of keeping up with -and updating the Race- and Thanks to Him for taking the time to do so! i wish all of the members a safe and merry New Years, and prosperity in 2017! Best- SD  |

|

|

|

Post by blygh on Dec 31, 2016 13:10:36 GMT -5

Thanks and congrats SD. Next week AMD short (stop at 12 Limit at 10.50)

I will create a 2017 1 year investment board - from the feedback I am assuming the following rules apply - minimum price $8.00/share (lower priced stocks are corrected to the $8. No leveraged ETFs. Long or short with buy stops, stops and limits are acceptable. Total return will be inclusive of dividends. The 5 stock portfolio can be rebalanced on the first day of each new quarter - Not sure how to handle cash from stops - just pick a new stock or does it stay in cash or does it go into 90 day Treasuries (the risk free return) ?

Blygh

|

|

|

|

Post by sd on Dec 31, 2016 18:07:48 GMT -5

HMMM-Good question-brings up some more though- I like the idea of flexibility-and including dividends. but as an "investment" portfolio- and for the purposes of not having to track daily- i would think that a change could be made in a new stock, replacing an existing one- just at the start of a new quarter.

I would assume it would be easier tracking to say a position that stopped out would remain in cash for the duration of the quarter.

Regarding stops- Assume that a position shoots up 30% , and then declines-before the end of the quarter. Other than fixed stops on the entry price- it would seem that a trailing % stop -loss would be one way to allow a position to capture some gains before it rolls over and goes into a decline- Or setting a limit % sell to lock in the gain, along with a stop-loss. Are we allowing partial position stops? Might be adding too much complexity.

Some other methods involving TA I am personally interested in , but may -or may not- be appropriate -Other members may not particularly be interested in those...

Those TA methods could be a sell when price closes below a certain moving average; when 2 moving averages cross; Parabolic Psar-; Chandelier exits(based on ATR)- While i'd like to apply a TA method-I'm open for discussion....

Any other ideas guys?

Blygh, If you want to open that other thread, it might be useful to consolidate the ideas in there.

Happy new year All!

|

|

|

|

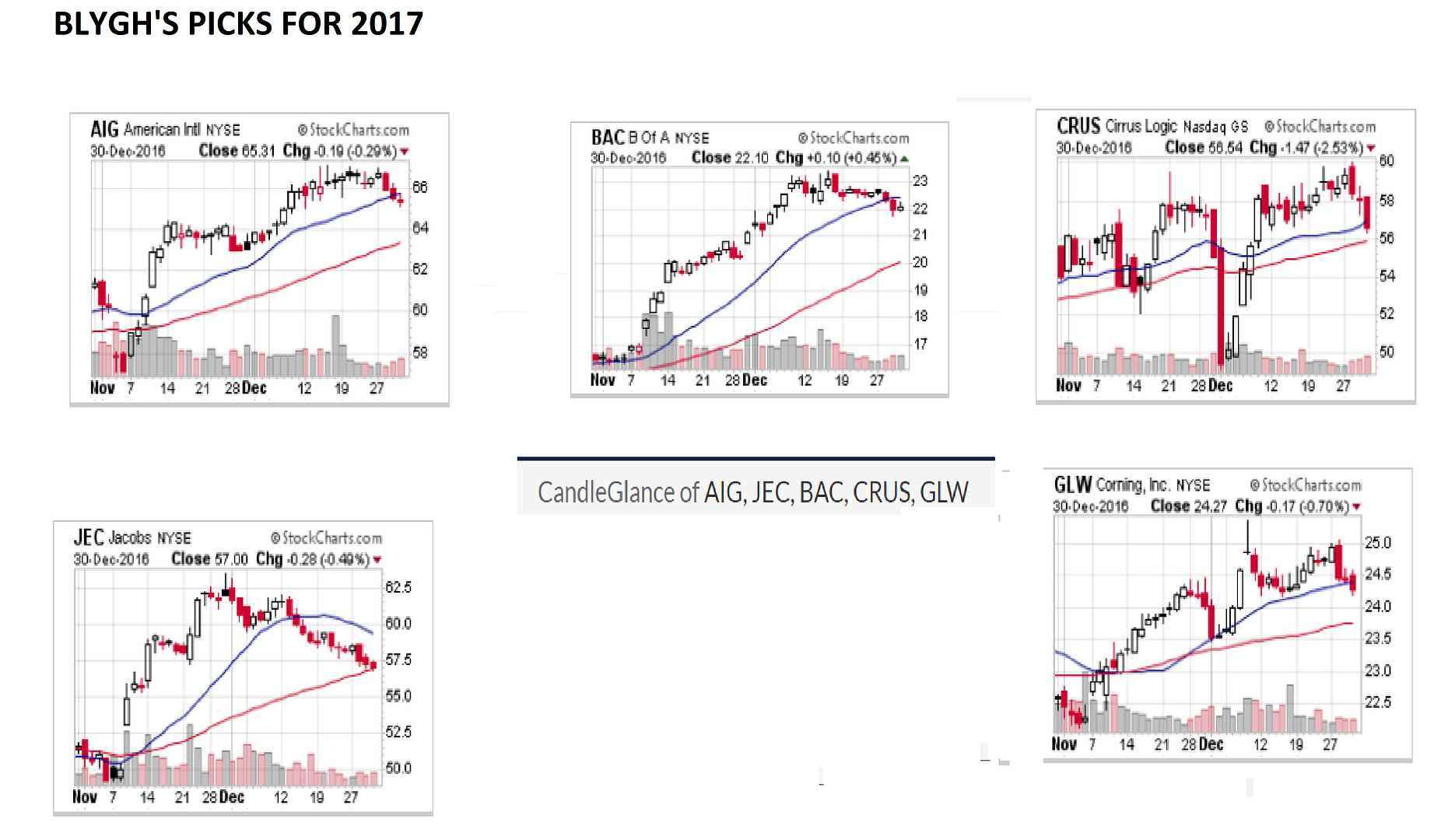

Post by blygh on Dec 31, 2016 22:57:36 GMT -5

It is getting a little complicated, For trailing stops we would have to constantly monitor every price to know what would be 30% less. Too much trouble for me given keeping up with the daly results. How about we keep it simple - 5 stocks - long or short - stops and limits - - stopped out/limited out stocks go to money market return for the duration of the quarter at which time new replacement stocks may be chosen. That's it. We are looking for average one year returns on the portfolio. This game is a side show vis-a-vis the weekly horse race

My five stocks are AIG JEC BAC CRUS GLW

|

|

|

|

Post by sd on Jan 1, 2017 8:41:47 GMT -5

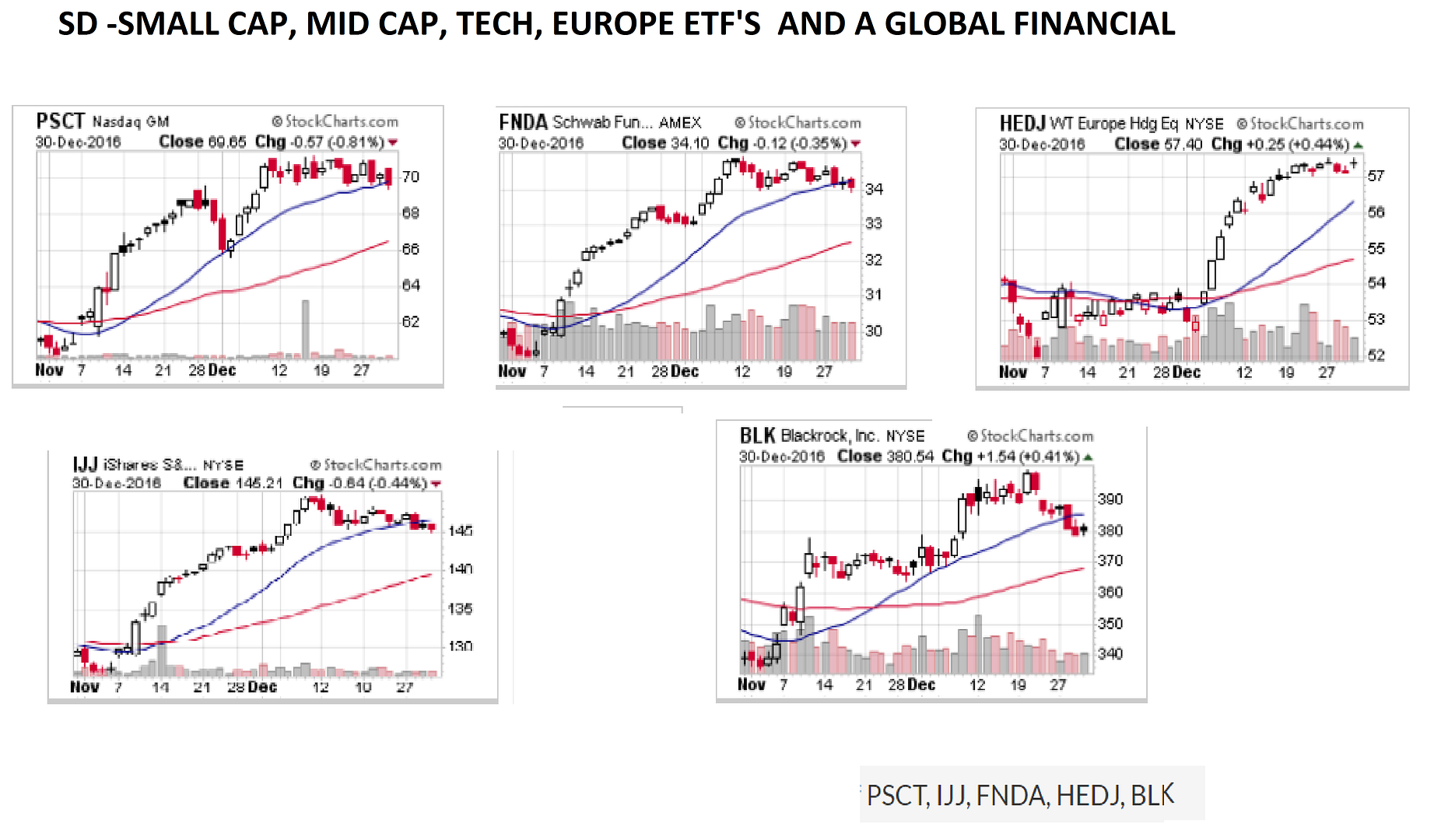

I agree-Keep it straight forward - I'm reviewing my picks this Sunday am-, will get them posted in a bit- BLYGH'S LINE UP IN THE INVESTMENT RACE- SD's INVESTMENT PICKS: I selected from some ETFs that have a narrower focus approach to the US market vs the broader ETF that covers that segment . FNDA small cap weighted based on fundamentals; IJJ mid cap 400 value; PSCT has overlap -but a narrowed tech focus within small cap companies. SD's INVESTMENT PICKS: I selected from some ETFs that have a narrower focus approach to the US market vs the broader ETF that covers that segment . FNDA small cap weighted based on fundamentals; IJJ mid cap 400 value; PSCT has overlap -but a narrowed tech focus within small cap companies.

HEDJ should give broad exposure to Europe without the currency risk-It has a PE ratio of 17 focused on established dividend paying large cap European companies

BLK -stock- is a global financial.

|

|