|

|

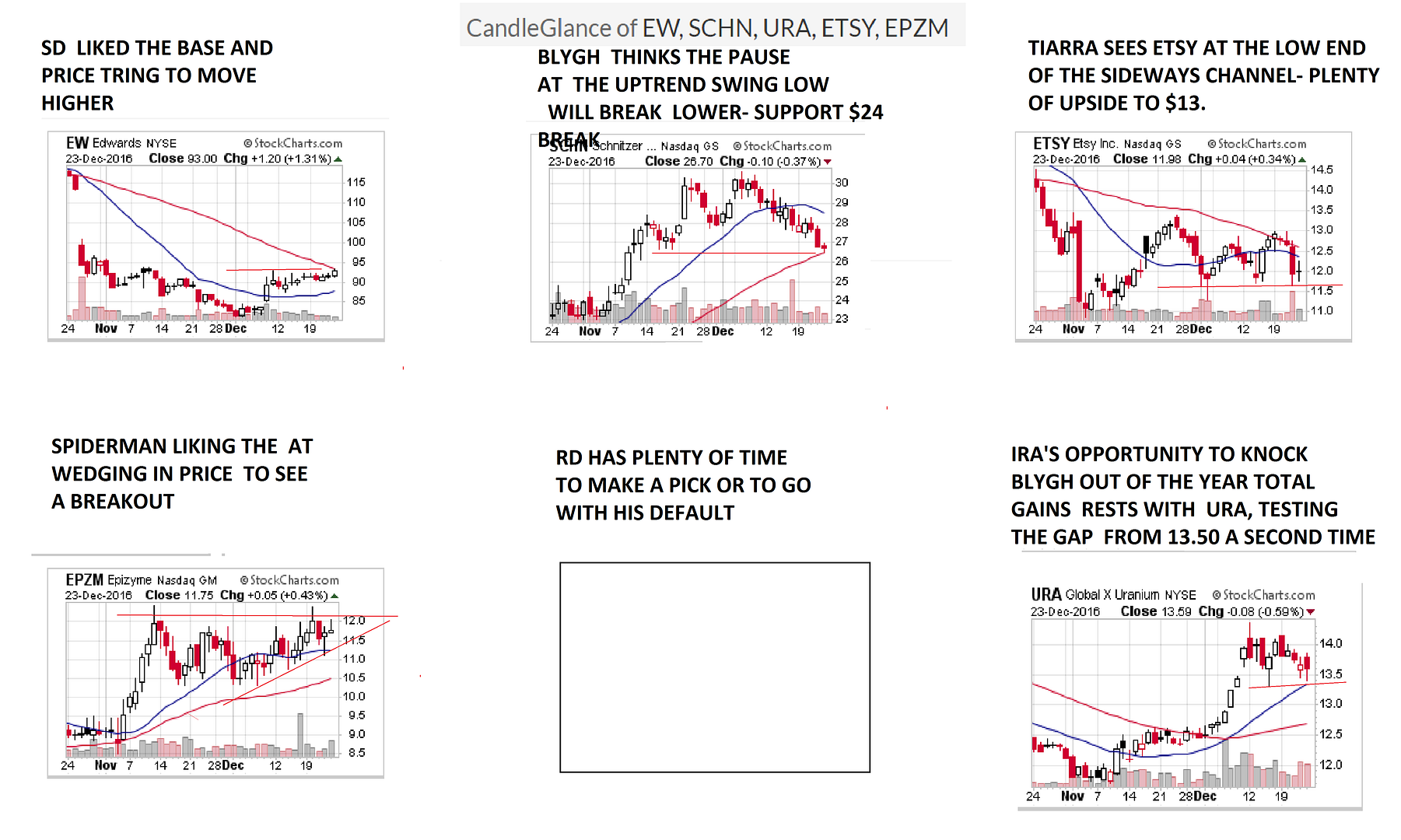

Post by blygh on Dec 23, 2016 21:16:12 GMT -5

Total gains/losses since 7/16/16 - wins for 2016

As of 12/23/2016

| Ride | Gain/Loss% | Wins | Default pick | Long - short | Tiarra

| -50.86% | 6 | ESTY | long | | Joe | +2.83% | 4 | none |

| | Ira | +17.79% | 10 | LMT | long | | Spiderman | -25.93% | 9 | EXAS | long | | RealDeal | +7.28% | 1 | UGAZ/3 |

| | SD | +4.08% | 6 | CURE | long | | Blygh | +22.13%  | 9 | ISRG | long |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post by blygh on Dec 23, 2016 21:39:41 GMT -5

Proposed rules for the long term investment competition.

During the nest week players should pick 5 stocks (no leveraged ETFs) long or short with the idea of holding them for one year. I will record the opening price for Jan 2 2017, the prices at the end of each quarter and the price on the last day of trading 2017. Stops and limits including buy limits are acceptable. In the case of a buy limit below where a stock is trading, the player only gets that security in his portfolio when it hits the buy stop. The same rule applies with a short limit.

OK SD?

|

|

ira85

New Member

Posts: 837

|

Post by ira85 on Dec 23, 2016 22:51:23 GMT -5

Congrats Blygh!

This is probably a dumb idea, but I'll ride URA long next week. My default LMT has been getting whacked by Trump tweets. So I'll try to catch a lift on other Trump tweets. Again, I apologize for such a rationale. Traveling this weekend with no time to prepare. Merry Christmas to all!! -ira

|

|

|

|

Post by sd on Dec 24, 2016 14:09:11 GMT -5

"Proposed rules for the long term investment competition.

During the nest week players should pick 5 stocks (no leveraged ETFs) long or short with the idea of holding them for one year. I will record the opening price for Jan 2 2017, the prices at the end of each quarter and the price on the last day of trading 2017. Stops and limits including buy limits are acceptable. In the case of a buy limit below where a stock is trading, the player only gets that security in his portfolio when it hits the buy stop. The same rule applies with a short limit. "

I'm good with that Blygh- and Congratulations on your overall gains- Looks like you are sitting strong to Win the year! -and Ira did well also!

How about opening another separate thread dedicated just to this longer term Race?

I look forward to the members best ideas for a 5 position investment portfolio- What happens if a position OR TWO gets stopped out in -say- the 1st quarter by a stop-loss? Not to make it more complicated than necessary,and keeping the original 5 picks for better or worse-

instead of making the position stay in cash for the rest of the year, what if - only at the end of each quarter- the stopped out cash was allowed to be put back into the game by a reentry into the same position? Or, a cash position that never filled in the 1st quarter could be adjusted at the end of the quarter? Perhaps the rentry could be changed from a long position to a short position in the original stock only?

By making adjustments available to the portfolio only once a quarter, would indeed be some extra work on your end, but would give some flexibility to manage the portfolio 3 times in the coming year.

Your Thoughts?

I'll keep up with supplying the charts- Perhaps posting them Monthly if time allows....- and I'll be using the Weekly chart to track performance, rather than the daily.

Tracking Ira's prior default pick LMT over the course of the horse race- and it's Up and down swings- prompts me to suggest that I will

test how a moving average crossover exit and entry performs in the various portfolios- and compare the results of that approach with the longer term investment choice approach.

I know everyone is busy this time of year, but I hope we can get good participation for the Investment Race-Guests as well-

Just 5 picks and a post gets you skin in the game! Join in, the more the Merrier!

|

|

|

|

Post by blygh on Dec 24, 2016 17:17:44 GMT -5

I like the idea of being allowed to reinvest stopped out cash quarterly - How about allowing stopped out cash to be invested in any of the rider's five securities (or even a sixth one) in the first week of a new quarter? Should we maintain the $8.00 minimum? Should we allow leveraged ETFs - holding a leverage ETF for the long term is a path fraught with peril - not for the faint hearted but if someone wants to choose it . . . so be it?

The Feast of Saturnalia was a Roman pagan festival from Dec 11 to Dec 23 - It was so popular with eating drinking and gift giving that the Christians rebranded it as "Christmas"

BTW for the regular weekly race YTD gains will be zeroed out - everyone will start on Jan 3 with 0% gains/losses so we can start fresh. I will see how much trouble it is to track win, place and show

Next week SCHN short Stop loss at 29 limit (on the downside) of 24

Merry Christmas

Blygh

|

|

|

|

Post by sd on Dec 24, 2016 21:04:35 GMT -5

I also like the idea of being able to "rebalance " the portfolio on a quarterly basis-

This is what is actually done if you have a portfolio that is actively managed- I would think we would have to stay within the initial 5 picks, but could shift the weightings (rebalance) with the ability to concentrate the portfolio with what is working- HMMM - does that mean one could choose or shift to just 1 position for the entire portfolio?

I think it is fair to limit the paperwork on your end- so what you think will not be too much trouble is fine with me-

I also like allowing the trader the option to rebalance the portfolio -only on a quarterly basis- within the same group of stocks or ETF's they started out with.

My Vote would be - I won't use Leveraged ETF's - but if others want to try that route- I'll go along-If leveraged ETFs are used, it will be a lesson in Decay over time-as they will be locked in that position quarter to quarter-

Price adjustment? perhaps down to $5 would be still out of pink sheets -

I'll be going with ETF's- My present portfolio would be :

My 1st portfolio considerations- for myself is not to use stocks- would be using ETF's - spreads the risk and adds greater diversity within each group.

QQQ- Tech sector- Up for the year, but not in favor. There has been a lot of selling in Tech-

IJJ -US Mid cap value-

FNDA- US SMALL CAP

HEDJ - I want exposure to Europe and hedge the currency differential.

TDIV- GLOBAL Technology- If global growth improves, this should benefit.

|

|

|

|

Post by tiarra on Dec 25, 2016 20:07:41 GMT -5

Nice win, Blygh

I will go with my default this week. ETSY long.

Hope you all had a merry Christmas

|

|

|

|

Post by Spiderman on Dec 26, 2016 11:14:23 GMT -5

Congrats Blygh.

I'll stay on EPZM long.

Happy New Year to all !!!

Spiderman

|

|

|

|

Post by sd on Dec 26, 2016 18:43:23 GMT -5

GOT 5 OF 6 WITH PICKS. RD has time to make a pick, or go with his default- I'm posting this chart early, 'cause i won't be able to at 9 pm.

|

|