|

|

Post by blygh on Dec 11, 2016 17:54:46 GMT -5

The morning line

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 |

|

|

|

|

|

| | 2 Ira | GDXshort | 11.90 |

|

|

|

|

|

| | Spiderman | YRCW | 16.18 |

|

|

|

|

|

| | 4 SD | TWTR | 19.48 |

|

|

| 18.65 |

|

| | 5 RealDeal | TWLOshort | 29.04 |

|

|

|

|

|

| 6 Blygh

| MDR | 8.15 |

|

|

| 6.80 | 9.00 |

| | Market | SPY | 226.40 |

|

|

|

|

|

| | 8 | QQQ | 118.95 |

|

|

|

|

|

|

|

|

|

|

Post by sd on Dec 11, 2016 20:47:45 GMT -5

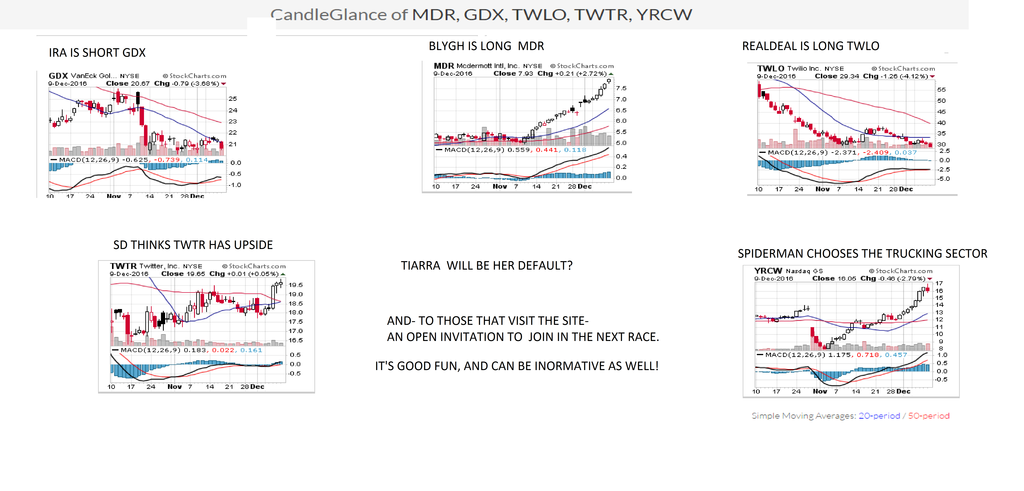

THE LINE UP THIS SUNDAY PM HAS VARIOUS SECTORS IN PLAY- SOME SHORTS, SOME LONGS .

BLYGH IS LONG ENERGY, SPIDERMAN LONG TRUCKING, IRA SHORT GOLD, REALDEAL OPTIMISTIC ON SOFTWARE, AND SD IS TRYING TO PULL A BUNNY OUT OF THE HAT WITH

TRUMP'S FAVORITE COMMUNICATION MEDIA-TWTR. TIARRA MAY BE POSITIONED WITH HER DEFAULT PICK- AS SHE IS LIKELY BURNING THE NIGHT LIFE UP IN HER HOME TOWN!

tHERE ARE A LOT OF 'GUESTS' VISITING THIS SITE - OR SOMEONE IS LOGGING IN AS A GUEST 30-40 TIMES A DAY-

IF YOU ARE JUST VISITING- FEEL FREE TO JOIN IN - tHE MORE-THE MERRIER- AND - AS SOME GYM'S PROMOTE- "THIS IS A JUDGEMENT FREE ZONE-"

|

|

|

|

Post by blygh on Dec 11, 2016 21:26:10 GMT -5

I gave Tiarra her default pick . I am soliciting comments about rule changes for 2017

(1) I would support the entry deadline being moved to 9:00pm (21:00) eastern time - before the Japan starts trading.

(2) Shall we allow buy stops and, if we do, would a rider only start the race when his/her pick hit the stop and scratched if it never hits the stop.

(3) Just as an aside we could do what Louis Rukeyser used to do on the old Wall St. Week. At the beginning of the year every one picks five investments - long or short - and we evaluate after the last trading day of the year. This would require us to take a longer term view -

(4) Other ideas??

Blygh

|

|

|

|

Post by realdeal on Dec 12, 2016 9:19:33 GMT -5

Hey SD, I'm actually short TWLO, not long. I usually have log in problems, so some of 30-40 times as a guest maybe me, I'm more of checking in twice at the most a day but mostly once.

Have a good one

-rd

|

|

|

|

Post by realdeal on Dec 12, 2016 9:30:39 GMT -5

Blygh,

1) I'm all for the deadline being moved.

2) Sure...

3) That's interesting, if we decided to do that, maybe there is website out there, that can track the stocks for you, I can look into it more when I get some time.

Market is open, have to run for now.

-rd

|

|

|

|

Post by blygh on Dec 12, 2016 16:36:11 GMT -5

Ira tiptoes out of the gate to lead

Errors corrected -forgot RD and Ira were short

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 | 12.18 | -0.24 | -1.93% |

|

| 4 | | 2 Ira | GDXshort | 20.90 | 20.72 | -0.18 | +0.86% |

|

| 1 | | Spiderman | YRCW | 16.18 | 15.61 | -0.57 | -3.52% |

|

| 7 | | 4 SD | TWTR | 19.48 | 18.93 | -0.55 | -2.82% | 18.65 |

| 6 | | 5 RealDeal | TWLOshort | 29.04 | 29.22 | +0.18 | -0.62% |

|

| 3 | 6 Blygh

| MDR | 8.15 | 7.93 | -0.22 | -2.70% | 6.80 | 9.00 | 5 | | Market | SPY | 226.40 | 226.25 | -0.15 | -0.06% |

|

| 2 | | 8 | QQQ | 118.95 | 118.96 | +0.01 | 0.00% |

|

|

|

|

|

|

|

Post by sd on Dec 12, 2016 18:59:33 GMT -5

Sorry about that RD! I was pushing it to get the charts in at that time-had started the chart list before Blygh posted the line up- and it got late. Since it had broken below the prior low, kinda wondered,

And i didn't get Tiarra's default in-= ETSY

|

|

|

|

Post by sd on Dec 12, 2016 20:11:51 GMT -5

"(1) I would support the entry deadline being moved to 9:00pm (21:00) eastern time - before the Japan starts trading.

(2) Shall we allow buy stops and, if we do, would a rider only start the race when his/her pick hit the stop and scratched if it never hits the stop.

(3) Just as an aside we could do what Louis Rukeyser used to do on the old Wall St. Week. At the beginning of the year every one picks five investments - long or short - and we evaluate after the last trading day of the year. This would require us to take a longer term view -

(4) Other ideas??

1. I'm good on moving the deadline- I'll catch up what charts i can Sunday before it's sack time (relatively early for me)

2. Yes to allowing the use of Buy-Stops. Or limit entries- as well. If not hit- the trade is a scratch- 0- makes sense

3. I like that idea- and also expanding to consider the longer term view.

4. Several other ideas- that may be worth discussion-

In an actual Investment portfolio, you would not put all of your eggs into one basket- This is likely a take on Cramer's diversified portfolio- or most any conservative investment advisor- for that matter-

Do we get to select any 5 individual stocks, or do we have to select 5 from different sectors- or just 5 from different industry groups-? The FANG stocks would all be considered diversified as an example.

If it is a longer term approach, I would suggest that a weekly chart would be the norm. The most straightforward approach would be to Buy and hold Jan 1.

Or do we get more involved with allowing stops - or go the whole gamut with offering the Investor an opportunity to stay with the status quo- or to reallocate? a rebalancing every one quarter- ? If one stock has been a big outperformer, or a big loser- I would think it would be instructive to consider a rebalancing allowed within the 5 stocks selected every quarter? This would also initiate a reason for a quarterly review of the investments

I also think that having each Investor list a few reasons for the rationale for their Initial Investment- and then revisit that thesis every quarter- would be informative-to the individual Investor and the others as well. Doesn't have to be an involved analysis- it could be as simple as

"-I'm Buying fB for the long term because it is a leader in social media. " "I'm buying AMZN because it is a leader in online selling " etc.

I'm buying Netflix because they will continue to expand content and world wide subscribers. I'm buying Goog, because it owns the internet

I'm buying PJP because i think Healthcare is oversold and will rebound in late 2017. I don't want to risk buying an individual healthcare company- so i would choose the etf.

This would outline my possible picks- heavily tech weighted- i would want to set stops- and reentry points- Since i think TA is functional, i would likely select something as simple as selling the position on a moving average decline over another moving average- and a reentry when that same moving average makes the upcross . Or- Investors could choose a trailing % stop-loss to exit and then a reason to reenter....

Lots to discuss - I will follow what the other members may decide and their approach- If the consensus is to Buy and Hold- I'm in.

i really like the idea- ! because i will be doing this exact thing this coming year outside of the trading account.

|

|

|

|

Post by blygh on Dec 13, 2016 17:41:18 GMT -5

The Market leads all -I am unsure as to what happened with GDX - it looks like a reverse split but the value of the Monday open according to the WSJ was 20.75-while doubling the original price would have been 23.80 (2 x 11.90)

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 | 12.24 | -0.18 | -1.45% |

|

| 5 | | 2 Ira | GDXshort | 20.75revsplit | 20.72 | -0.03 | +0.145% |

|

| 2 | | Spiderman | YRCW | 16.18 | 15.55 | -0.18 | -3.89% |

|

| 7 | | 4 SD | TWTR | 19.48 | 19.37 | -0.11 | -0.57% | 18.65 |

| 3 | | 5 RealDeal | TWLOshort | 29.04 | 29.27 | +0.23 | -0.79% |

|

| 4 | 6 Blygh

| MDR | 8.15 | 7.87 | -0.28 | -3.44% | 6.80 | 9.00 | 6 | | Market | SPY | 226.40 | 227.76 | +1.36 | +0.60% |

|

| 1 | | 8 | QQQ | 118.95 | 120.46 | +1.51 | +1.27% |

|

|

|

|

|

|

|

Post by sd on Dec 13, 2016 19:34:01 GMT -5

Going through the Finviz screener, and Tiarra's pick from last week made a showing-COO keeping on higherrrrrr....

|

|

|

|

Post by blygh on Dec 14, 2016 16:43:45 GMT -5

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 | 11.84 | -0.58 | -4.67% |

|

| 5 | | 2 Ira | GDXshort | 20.75revsplit | 19.89 | -0.86 | +4.15% |

|

| 1 | | Spiderman | YRCW | 16.18 | 15.15 | -1.03 | -6.37% |

|

| 6 | | 4 SD | TWTR | 19.48 | 18.93 | -0.55 | -2.82% | 18.65 |

| 4 | | 5 RealDeal | TWLOshort | 29.04 | 29.51 | +0.47 | -1.62% |

|

| 3 | 6 Blygh

| MDR | 8.15 | 7.63 | -0.52 | -6.38% | 6.80 | 9.00 | 7 | | Market | SPY | 226.40 | 225.88 | -0.52 | +0.23% |

|

| 2 | | 8 | QQQ | 118.95 | 120.21 | +1.26 | +1.06% |

|

| |

I had to correct GDX again - my Apple dashboard says close at 20.72 while WSJ says 19.89

|

|

|

|

Post by tiarra on Dec 14, 2016 17:16:59 GMT -5

Please do change the deadline time. It was after 8 when I remembered I had not put my pick in.

|

|

|

|

Post by blygh on Dec 14, 2016 22:52:14 GMT -5

Figured out the GDX prices. There are two classes of stock - GDX and GDX.A - when I entered GDX into the Dashboard stock tracker - I got a drop down box that only listed GDX.A - I assumed that was Ira's pick - the tote board is now correct.

Blygh

|

|

|

|

Post by blygh on Dec 15, 2016 16:32:19 GMT -5

Out of the backstretch

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 | 12.55 | +0.13 | +1.05% |

|

| 2 | | 2 Ira | GDXshort | 20.75revsplit | 18.99 | -1.76 | +8.48% |

|

| 1 | | Spiderman | YRCW | 16.18 | 15.12 | -1.06 | -6.55% |

|

| 7 | | 4 SD | TWTR | 19.48 | 18.79 | -0.69 | -3.54% | 18.65 |

| 5 | | 5 RealDeal | TWLOshort | 29.04 | 29.65 | +0.69 | -2.38% |

|

| 4 | 6 Blygh

| MDR | 8.15 | 7.71 | -0.44 | -5.40% | 6.80 | 9.00 | 6 | | Market | SPY | 226.40 | 226.81 | +0.41 | +0.18% |

|

| 3 | | 8 | QQQ | 118.95 | 120.40 | +1.45 | +1.22% |

|

| |

|

|

|

|

Post by blygh on Dec 16, 2016 17:27:15 GMT -5

At the finish

| Riderort | Horse | Open | Latest | G/L | % | Stop | Limit | Rank | | 1 Tiarra | ETSYdefault | 12.42 | 12.78 | +0.36 | +2.9% |

|

| 2 | | 2 Ira | GDXshort | 20.75 | 19.08 | -1.67 | +8.05% |

|

| 1  | | Spiderman | YRCW | 16.18 | 14.72 | -1.46 | -9.02% |

|

| 7 | | 4 SDstopped | TWTR | 19.48 | 18.65 | -0.83 | -4.26% | 18.65 | STOPPED | 4 | | 5 RealDeal | TWLOshort | 29.04 | 29.25 | +0.21 | -0.72% |

|

| 5 | 6 Blygh

| MDR | 8.15 | 7.51 | -0.64 | -7.85% | 6.80 | 9.00 | 6 | | Market | SPY | 226.40 | 225.04 | -1.36 | -0.60% |

|

| 3 | | 8 | QQQ | 118.95 | 119.60 | 0.65 | +0.55% |

|

|

|

|

|